Canadian Energy Exploration Inc. (formerly named TALON International Energy, Ltd.) Announces Closing of Amalgamation and Private

20 January 2010 - 11:53AM

Marketwired Canada

Canadian Energy Exploration Inc. ("CEE") (TSX Venture: XPL) (formerly named

TALON International Energy, Ltd.) ("TALON") (TSX VENTURE:TAR) is pleased to

announce that, further to press releases dated July 23, 2009 and October 16,

2009, and pursuant to an amalgamation agreement (the "Agreement") with Fifth

Avenue Diversified Inc. ("Fifth Avenue") effective October 7, 2009, TALON and

Fifth Avenue continued into the province of Alberta (the "Continuances") and

amalgamated (the "Amalgamation") on January 1, 2010 to form CEE. In addition,

Fifth Avenue and CEE completed private placements (the "Private Placements") of

common shares and common shares issued on a flow-through tax basis (the

Amalgamation, the Continuances and the Private Placements are collectively

referred to herein as the "Transaction").

The Amalgamation

Under the Agreement, each of TALON and Fifth Avenue continued into the Province

of Alberta. TALON and Fifth Avenue then amalgamated to form CEE. Pursuant to the

Transaction, all of the outstanding TALON securities and Fifth Avenue securities

were exchanged for corresponding securities of CEE. In particular, CEE will

issue:

- One CEE common share ("CEE Share") for every ten TALON common shares

("TALON Shares") issued and outstanding on the effective date of the

Transaction; and

- One CEE Share for every two Fifth Avenue common shares ("Fifth Avenue

Shares") issued and outstanding on the effective date of the

Transaction.

Any fractional interest resulting from the foregoing transactions has been

rounded up or down to the nearest CEE security.

After completion of the Transaction there are 31,428,769 CEE Shares outstanding

which consist of 23,983,769 CEE Shares issued pursuant to the Amalgamation and

Private Placements and a further 7,445,000 CEE Shares were issued in order to

settle debts owed by Fifth Avenue (the "Fifth Avenue Debt Conversion"). In

addition, 2,250,000 CEE stock options have been issued in accordance with CEE's

stock option plan.

As a condition of the Transaction imposed by the TSX Venture Exchange Inc. (the

"Exchange"), the CEE Shares acquired by the directors and officers of CEE and

certain shareholders of Fifth Avenue, representing a total of 11,116,275 CEE

shares or 35.4% of the issued and outstanding CEE Shares, have been escrowed

(the "Escrowed Shares").

Pursuant to the terms of escrow, the Escrowed Shares will be releasable from

escrow as to 10% on the date the Exchange issues its final bulletin with respect

to the Transaction, with a further 15% being releasable every six months

thereafter.

Shareholder Approval

Each of TALON and Fifth Avenue held a shareholder meeting on November 9, 2009.

All resolutions that were considered by the TALON and Fifth Avenue shareholders

were approved at the TALON and Fifth Avenue shareholder meetings, respectively.

At the TALON shareholder meeting, the TALON shareholders who voted at the

meeting unanimously passed special resolutions approving the continuance into

the province of Alberta and approving the Amalgamation, as more particularly

described in the Joint Management Information Circular of TALON and Fifth Avenue

dated October 7, 2009.

Exchange Approval and Trading of CEE Shares

On December 29, 2009, the Exchange granted conditional approval to TALON to

proceed with the proposed Transaction. On January 18, 2010, the Exchange issued

a bulletin accepting the final documentation with respect to the Transaction.

Pursuant to the final Exchange bulletin, the CEE Shares will begin trading on

the Exchange under the symbol TSXV: XPL effective as of the opening of trading

on January 20, 2010.

Cease Trade Orders

The Alberta Securities Commission (the "ASC") and the British Columbia

Securities Commission (the "BCSC") have issued revocation orders dated October

14, 2009 and November 30, 2009, respectively (the "Revocation Orders") granting

full revocation of compliance-related cease trade orders issued by the ASC and

the BCSC in respect to TALON.

The Alberta cease trade order was issued on May 7, 2008 against TALON by the ASC

for the failure of TALON to file its audited annual financial statements and

management's discussion and analysis for the year ended December 31, 2007 (the

"2007 Annual Filings"). As a result of the Order, the Exchange suspended trading

in TALON's shares on May 7, 2008. The 2007 Annual Filings were filed on the

System for Electronic Document Analysis and Retrieval ("SEDAR") on May 8, 2008.

The British Columbia cease trade order was issued on June 4, 2009 against TALON

by the BCSC for the failure of TALON to file its audited annual financial

statements and management's discussion and analysis for the year ended December

31, 2008 (the "2008 Annual Filings") and its unaudited interim financial

statements and management's discussion and analysis for the three months ended

March 31, 2009 (the "2009 Interim Filings"). The 2008 Annual Filings and the

2009 Interim Filings were filed on SEDAR on October 9, 2009.

Private Placement

As previously announced (see TALON press releases dated July 23, 2009 and

October 16, 2009), Fifth Avenue and CEE have closed their respecting Private

Placements, which after completion of the Transaction consisted of the issuance

of 9,781,470 CEE shares, at a price of CDN.$0.05 per CEE Share; and 6,554,167

CEE Shares, issued on a "flow-through tax basis", at a price of CDN.$0.06 per

share, for total proceeds of $882,323.50. The Fifth Avenue Shares issued

pursuant to the Private Placement were exchanged upon the completion of the

Amalgamation for CEE Shares based on the Fifth Avenue exchange ratio.

The proceeds of the Private Placements will be used for exploring oil and gas

opportunities and for CEE's exploration program. Additional amounts have been

allocated for costs required to complete the Amalgamation, the Private

Placements and additional transactions and for unallocated working capital.

There may be circumstances where for sound business reasons, a reallocation of

funds may be necessary in order for CEE to achieve its stated business

objectives.

Fifth Avenue Debt Conversion

In connection with completion of the transaction and pursuant to the Agreement,

CEE has issued a total of 7,445,000 CEE Shares at a deemed price of $0.05 per

share to certain creditors of Fifth Avenue. The shares were issued in order to

settle debts owing in the aggregate amount of $372,250. These shares were issued

on the same terms as the common share Private Placements.

Stock Options

At the closing of the Transaction, CEE granted options to purchase up to

2,250,000 CEE Shares to officers, directors and consultants of CEE at an

exercise price of $0.10 per share exercisable for a period of five years from

the date of grant.

CEE's Board of Directors and Officers

In connection with the completion of the Transaction, the following individuals

have been appointed as directors and the management and key personnel of CEE:

Directors: Chris J. Bloomer, David Stadnyk, William S. Sudhaus, George Tsafalas

and John D. Wright.

Officers: William S. Sudhaus - President and Chief Executive Officer, George

Tsafalas, Chief Financial Officer, and Donald B. Edwards, Corporate Secretary.

Early Warning of Securityholders of CEE

In connection with the completion of the Transaction, David Stadnyk of Suite

#1220, 666 Burrard Street, Vancouver, British Columbia V6C 1X8 has acquired

direct ownership over 4,621,667 CEE Shares or approximately 14.7% of the issued

and outstanding CEE Shares, and 250,000 stock options to purchase CEE Shares

exercisable at a price of $0.10 per share for a period of five years from the

date of grant. Pursuant to the Transaction, Mr. Stadnyk received 2,491,666 CEE

Shares in exchange for the 4,983,333 Fifth Avenue Shares he held immediately

prior to the completion of the Transaction. In addition, Mr. Stadnyk received

2,130,000 CEE Shares at a deemed consideration of $0.05 per share pursuant to

the Fifth Avenue Debt Conversion. Assuming the full exercise of his stock

options, Mr. Stadnyk will directly own an aggregate of 4,871,666 CEE Shares or

15.4% of the then issued and outstanding CEE Shares.

In connection with the completion of the Transaction, George Tsafalas of Suite

#1220, 666 Burrard Street, Vancouver, British Columbia V6C 1X8 has acquired

direct ownership over 4,388,334 CEE Shares or approximately 14% of the issued

and outstanding CEE Shares, and 250,000 stock options to purchase CEE Shares

exercisable at a price of $0.10 per share for a period of five years from the

date of grant. Pursuant to the Transaction, Mr. Tsafalas received 933,334 CEE

Shares at a deemed consideration of $0.05 per share in exchange for the

1,866,668 Fifth Avenue Shares he held immediately prior to the completion of the

Transaction. In addition, Mr. Tsafalas received 3,455,000 CEE Shares pursuant to

the Fifth Avenue Debt Conversion. Assuming the full exercise of his stock

options, Mr. Tsafalas will directly own an aggregate of 4,638,334 CEE Shares or

14.6% of the then issued and outstanding CEE Shares.

CEE has been advised by Mr. Stadnyk and Mr. Tsafalas that each of them has

acquired the CEE Shares and stock options for investment purposes, and that each

of them may acquire additional securities in CEE in the future.

For further information or to obtain a copy of the early warning reports filed

in connection with the above can be found under CEE's profile on SEDAR at

www.sedar.com.

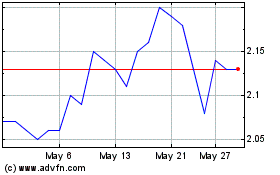

Centamin (TSX:CEE)

Historical Stock Chart

From Jun 2024 to Jul 2024

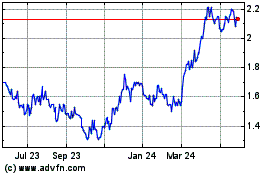

Centamin (TSX:CEE)

Historical Stock Chart

From Jul 2023 to Jul 2024