Centamin Egypt Reports on Activities in the Quarter Ended December 31, 2009

13 February 2010 - 2:29AM

Marketwired Canada

Centamin Egypt Limited ("Centamin" or "the Company") (TSX:CEE)(LSE:CEY) is

providing the following report on its activities in the quarter ended December

31, 2009:

Highlights

Construction and Development

- Completion of Stage 1 commissioning activities with remaining Stage 2

construction activities well advanced

- Process Plant performing in accordance with design specifications

Operations

- Mill throughput commenced following completion of Stage 1 construction

activities

- Continued increase in open pit mine production in both material and ore

movement

- Underground decline development underway

- Sukari Resource upgraded to a Measured and Indicated Resource of 210.2Mt

@ 1.52g/t Au for 10.29Moz Au with an Inferred Resource of 66.3Mt @

1.6g/t Au for 3.4 Moz Au

- 15,337m of resource diamond drilling completed

- Eight drill rigs on site continuing resource definition drilling to

target Hapi, Amun Deeps and Pharaoh Zone

- Regional Exploration continues - drilling commenced at Quartz Ridge Main

Quartz Vein structure during the quarter with 16 holes holes for 1,436m

completed to date. Drilling confirms mineralised quartz vein shear zone

structure

- Significant intersections received for the quarter include:

D1470 - 20m @ 3.61g/t from 310m

D1471 - 19m @ 13.7g/t from 804m

D1479 - 16m @ 8.16g/t from 547m

D1482 - 21m @ 4.19g/t from 593m

D1490 - 45m @ 2.11g/t from 325m

D1494 - 24m @ 3.19g/t from 311m

Corporate

- Successfully migrated to the main board of the London Stock Exchange in

November 2009

Subsequent Events

- Commencement of gold exports to a nominated overseas gold refinery

- ASX delisting completed

- Total reserves increased to 7.1 million ounces

Commenting on the quarterly report Josef El-Raghy, Managing Director/CEO of

Centamin, stated:

"The quarter saw the maiden feed through our mills at Sukari. This follows the

successful completion of Stage 1 construction activities and the achievement of

design throughput from the Sukari processing facility. We have also seen the

first gold being exported and sold at spot prices from Sukari which represented

one of the last major milestones in project execution. From the rate of

production and the recovery rates reached so far, Centamin remains on track to

hit its production target of over 200,000 oz Au in the current calendar year.

Corporately, our move to the Main Market of the London Stock Exchange during the

quarter was another step in the Company's growth as the Company continues to

evolve from a junior explorer to a significant gold producer".

SUKARI GOLD PROJECT - CONSTRUCTION

Stage 1 (oxide circuit) commissioning activities were completed during the

December 2009 quarter, with regular and sustained ore throughput achieved late

in the quarter. Stage 2 (sulphide circuit) construction is well advanced with

completion scheduled for February / March. Workforce levels have reduced in line

with the completion of construction activities and transition into full

production from the Sukari Gold Project. Engineering works for expansion of

throughput to 8 - 10 mtpa will commence in quarter one of 2010.

SUKARI GOLD PROJECT - OPERATIONS

----------------------------------------------------------------------------

% Change

Unit Measure Dec 2009 Sept 2009 Dec vs. Sept

Quarter Quarter Quarter

----------------------------------------------------------------------------

Ore Mined '000 tonnes 894 904 (1)%

----------------------------------------------------------------------------

Total Material Movement '000 tonnes 3,914 3,458 13%

----------------------------------------------------------------------------

Ore Processed '000 tonnes 140 - n/a

----------------------------------------------------------------------------

Head Grade grams/tonne 1.11 - n/a

----------------------------------------------------------------------------

Gold Recovery % 70.6 - n/a

----------------------------------------------------------------------------

Gold Produced ounces 1,118 - n/a

----------------------------------------------------------------------------

Mine Production

Centamin conducts its open pit mining operations on an 'owner operator' basis.

Primary mining fleet includes ten CAT785C rear dump trucks and two O&K RH120E

excavators with additional mine support equipment in place. During the quarter,

a third O&K RH120E excavator was commissioned and commenced mining operations.

Additional trucking fleet is currently being shipped to Sukari and will be

commissioned during the June 2010 quarter.

During the quarter, ore was mined in Stage 1 from the 1136RL to 1112RL bench and

in Stage 2 from 1178RL to 1170RL. 37,023 grade control metres in Stage 1 and

Stage 2 were completed to the 1088RL and 1160RL respectively. For the December

quarter, a total of 893,694 tonnes of ore @ 0.82g/t Au was mined. Total waste

movement for the December quarter was 3.9M tonnes, with a resulting stripping

ratio of 4.4:1. Ore grades achieved during the December quarter are in line with

oxide ore forecasts and in accordance with mine development expectations. Access

to transitional ore areas, including the higher grade sulphide zones in Stage 2,

commenced during the December quarter. As the volume of higher grade zones

increases throughout 2010, the average mine grade is expected to increase in

accordance with current mine development plans.

Drilling and mapping has shown high grade gold is associated with strongly

sheared and sericite-hematite altered porphyry; with stock works of extensional

quartz veins and sheared contacts with the hangingwall rocks. Correlations

between the resource model and grade control continue to be satisfactory, with

mineralised controlling structures adequately appearing in the grade control and

mapping. To date, ore mined from Phase 1 and Phase 2 is 14% higher in gold

ounces compared to the reserve model. This is encouraging as we mine the top of

Sukari Hill where there is minimal resource drilling data coverage due to the

steepness of the topography.

Processing

Mill throughput commenced during the quarter, with 140,101 tonnes milled through

to the end of the quarter. Since the commencement of ore treatment, average mill

throughput rates and recoveries have increased steadily and have been

consistently achieving design capacity since the end of the December quarter. A

further 85,000 tonnes of crushed material has been transferred to dump leach

pads during the quarter. A total of 809,000 tonnes at 0.7 g/t have been

transferred to the dump leach pads since inception of leaching operations.

UNDERGROUND MINE DEVELOPMENT

Underground development at Sukari continues to progress well. The Amun decline

recorded a total advance of 147 metres through to the end of December.

The initial development has encountered variable ground conditions which were

expected in the footwall and close to surface. These have been managed with

simple ground support regimes, and have not affected the advance rates

anticipated. In the coming quarter, development rates will be increasing as more

personnel are mobilised. Planned development is expected to provide initial

access to the orebody towards the end of 2010. Stoping panels are scheduled to

commence production in early 2011.

The Company believes it has the opportunity to increase production by accessing

higher grade ore from an underground mine. The aim is to access this higher

grade ore earlier than otherwise would have been scheduled through surface

mining. As well as providing the haulage access for the planned underground

operation, the decline will also provide a platform from which to delineate

deeper targets which may form the basis of a larger underground operation

looking forward.

An initial underground mining rate of 500,000 tonnes per annum at a grade

between 5-10g/t Au is being targeted thus bringing higher grade ore feed into

production earlier than otherwise would have been scheduled through surface

mining averaging circa 2g/t.

RESOURCE DEFINITION

As previously reported in December 2009, the Sukari mineral resource was

upgraded to 10.29Moz Measured and Indicated, plus 3.4Moz Inferred. The total

Global Resource increased by 374,000 oz Au (4%) Measured and Indicated, and

175,000 oz Inferred (5%). Measured and Indicated resources account for 75% of

global resources.

Table 1 - Total Resource (December 2009)

----------------------------------------------------------------------------

Total

--------------------

Measured Indicated Measured + Indicated Inferred

- --------------------------------------------------------------------------

Cut-off Tonnes Grade Tonnes Grade Tonnes Grade Gold Tonnes Grade Gold

----------------------------------------------------------------------------

g/t (Mt) (g/t (Mt) (g/t (Mt) (g/t (Moz) (Mt) (g/t (Moz)

Au Au) Au) Au) Au)

----------------------------------------------------------------------------

0.5 78.26 1.48 131.93 1.55 210.19 1.52 10.29 66.3 1.6 3.4

----------------------------------------------------------------------------

0.7 56.25 1.82 95.75 1.91 152.00 1.88 9.18 47.2 2.0 3.1

----------------------------------------------------------------------------

1 36.65 2.35 63.59 2.45 100.24 2.42 7.78 31.2 2.6 2.7

----------------------------------------------------------------------------

Note to Table: Figures in table may not add correctly due to rounding

----------------------------------------------------------------------------

To view Figure 1, please visit the following link:

http://media3.marketwire.com/docs/sukariFig1.pdf

South of 11312.5N (ie southern half of the Sukari hill outcrop), the Measured

and Indicated resource is estimated at 8.94Moz, equal to approximately 87% of

the total Measured and Indicated resource. The resource increase is based on

additional assay results from approximately 23,274 metres of drilling.

On 01 February 2010, the Company announced that the total reserves had increased

to 7.1 million ounces from the previously reported 6.4 million ounces. The new

mineral reserves are based on drilling up to 01 November 2009 and a gold price

of US$700 per ounce. Details of the new reserves calculated for Sukari are

listed in the table below. The reserves have been marginally depleted using the

31 December 2009 topographic survey and exclude material mined between April and

December 2009.

----------------------------------------------------------------------------

Sukari Open Pit Mineral Reserve Estimate as at 31 December 2009

(reported at a cut-off grade of 0.4 g/t Au for oxide and sulphide

material and 0.5 g/t for transitional)

----------------------------------------------------------------------------

Proven Probable Mineral Reserve

----------------------------------------------------------------------------

Tonnes Au Tonnes Au Tonnes Au Cont Au

(Mt) (g/t) (Mt) (g/t) (Mt) (g/t) (Moz)

----------------------------------------------------------------------------

New Reserve 69.1 1.37 90.1 1.41 159.3 1.39 7.1

----------------------------------------------------------------------------

Previous Reserve 64 1.38 78 1.43 142 1.4 6.4

----------------------------------------------------------------------------

Note to Table: new reserve figure includes 1,167,798t @ 0.74g/t

for 27,762ozs in the proven category

The current reserve has been calculated from a Measured and Indicated resource

of 210Mt at 1.5g/t Au for 10.2 million ounces. A total Measured and Indicated

resource increase of 0.80 Million ounces has resulted in a 0.60 Million ounce

increase in total reserves.

The Sukari pit is being developed in a number of stages and the mining and

processing schedule developed for Sukari uses an elevated cutoff grade through

the early years to increase the head grade to the processing plant. It is

currently assumed that the material between this elevated cutoff grade and the

cutoff grade used for the Mineral Reserve estimate is stockpiled and treated at

the end of the project life.

EXPLORATION

During the quarter, resource definition drilling continued to be mainly

concentrated in the Pharaoh zone north of 11300N, following the high grade Hapi

Zone at depth, deeper Hapi zones at the basal porphyry contacts, the west

dipping high grade shear zone basal porphyry contact at the eastern margins and

other mineralised structures within the porphyry (Figure 2). Drilling also

occurred in the south of the Sukari porphyry from Wadi Fault testing the along

strike continuity of the Amun Deeps porphyry blocks and mineralisation, Hapi

Zone and Downthrust Zone from 10800N northwards.

Several encouraging high grade assay intersections have been returned from the

Pharaoh Zone in the targeted Hapi Zone, deeper Hapi and eastern basal porphyry

contact zones (Figure 2), and deep drilling in the Ra Zone between 10800N and

11000N intersected high grade porphyry blocks in the Amun Deeps and Downthrust

zones. Results have significantly increased the resource base and advanced

understanding of the complex controls on gold mineralisation along strike and at

depth.

The drilling continues to show the high grade Hapi and related zones extend from

the far south Amun Zone north to the area of current drilling in the Ra and

Pharaoh zones. These zones, along the entire strike length of the Sukari Hill

(2.5km), are the target of current infill and extension drilling with eight

diamond coring rigs.

To view Figure 2, please visit the following link:

http://media3.marketwire.com/docs/sukariFig2.pdf

REGIONAL EXPLORATION

Work continued on the Quartz Ridge prospect, with RC drilling having completed

16 holes for 1,436m. A further 10 holes for approximately 1400m remain.

Significant mineralisation has been intersected in north-south orientated

drilling intersecting the quartz reef at 10m to 60m below wadi level. As

predicted from the surface results, gold is focused in the quartz reef with

minor mineralisation occurring as a weak alteration geochemical halo in the

wallrock adjacent to the vein. Drilling is continuing.

CORPORATE

Following completion of due diligence during the quarter, the Company was

admitted to the Official List of the UK Listing Authority and commenced trading

on the London Stock Exchange's Main Market for listed securities on 06 November

2009.

The Company had earlier announced its intention to be removed from the

Australian Securities Exchange ("ASX") official list. The application for

removal from the ASX official list was announced in October 2009 in an effort to

streamline listing and compliance costs. Removal from the ASX official list

occurred on 29 January 2010.

At the Annual General Meeting on 27 November 2009, Mr Sami El-Raghy announced he

would be stepping down as the Chairman of Centamin and as a member of the Board

on 31 December 2009 to pursue new personal endeavours and challenges. Sami has

overseen a successful transformation of the Company from a mining exploration

company into a significant gold producer. Mr Gordon Brian Speechly also stepped

down from the Board on 31 December 2009 due to other work commitments. Mr

Speechly has been a director of the Company since 15 August 2000. Further

appointments to the Board are currently being considered.

The Company remains debt free, unhedged and able to aggressively pursue further

exploration and development activities, including the underground development of

the high grade Amun Deeps Zone.

On behalf of Centamin Egypt Limited

Josef El-Raghy, Managing Director/CEO

Quality Assurance and Control and Qualified Person

The information in this report that relates to ore reserves has been compiled by

Mr Andrew Pardey. Mr Pardey is a Member of the Australasian Institute of Mining

and Metallurgy and is a full time employee of the Company. He has sufficient

experience which is relevant to the style of mineralisation and type of deposit

under consideration and to the activity he is undertaking, to qualify as a

"Competent Person" as defined in the 2004 Edition of the "Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore Reserves" and is a

"Qualified Person" as defined in the "National Instrument 43-101 of the Canadian

Securities Administrators" and "CIM Definition Standards For Mineral Resources

and Mineral Reserves" of December 2005 as prepared by the CIM Standing Committee

on Reserve Definitions of the Canadian Institute of Mining. Mr Pardey's written

consent has been received by the Company for this information to be included in

this report in the form and context which it appears.

The information in this report that relates to ore reserves has also been

independently verified by Mr Pieter Doelman, an employee of Coffey Mining Pty

Ltd Perth. Mr Doelman is a Member of the Australasian Institute of Mining and

Metallurgy and has sufficient experience, relevant to the style of

mineralisation and type of deposit under consideration and to the activity he is

undertaking, to qualify as a "Competent Person" as defined in the 2004 Edition

of the "Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves" and is a "Qualified Person" as defined in the

"National Instrument 43-101 of the Canadian Securities Administrators" and the

"CIM Definition Standards For Mineral Resources and Mineral Reserves" of

December 2005 as prepared by the CIM Standing Committee on Reserve Definitions

of the Canadian Institute of Mining. Mr Doelman consents to the inclusion of

this estimate in reports.

The information in this report that relates to mineral resources is based on

work completed independently by Mr Nicolas Johnson, who is a Member of the

Australian Institute of Geoscientists. Mr Johnson is a full time employee of

Hellman and Schofield Pty Ltd and has sufficient experience which is relevant to

the style of mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify as a "Competent Person" as defined

in the 2004 edition of the "Australasian Code for Reporting of Exploration

Results, Mineral Resources and Ore Reserves" and is a "Qualified Person" as

defined in "National Instrument 43-101 of the Canadian Securities

Administrators". Mr Johnson consents to the inclusion in the report of the

matters based on his information in the form and context in which it appears.

Information in this report which relates to exploration, geology, sampling and

drilling is based on information compiled by geologist Mr Richard Osman who is a

full time employee of the Company, and is a member of the Australasian Institute

of Mining and Metallurgy with more than five years experience in the fields of

activity being reported on, and is a 'Competent Person' for this purpose and is

a "Qualified Person" as defined in "National Instrument 43-101 of the Canadian

Securities Administrators". His written consent has been received by the Company

for this information to be included in this report in the form and context which

it appears.

The assay samples were analysed by Ultra Trace Pty Ltd, Canning Vale, Western

Australia.

Refer to the updated Technical Report which was filed in May 2009 for further

discussion of the extent to which the estimate of mineral resources/reserves may

be materially affected by any known environmental, permitting, legal, title,

taxation, socio-political, marketing or other relevant issue.

Table 1 - Significant Intersections from the Sukari Gold Project

- December 2009 Quarter

---------------------------------------------------------------------------

HOLE NORTH EAST DIP AZI EOH FROM TO INTERVAL AUAR1

---------------------------------------------------------------------------

D1470 11300 10948 -85 270 584.8

---------------------------------------------------------------------------

incl. 326 327 1 16.1

---------------------------------------------------------------------------

incl. 530 531 1 19.0

---------------------------------------------------------------------------

---------------------------------------------------------------------------

D1471 10900 10945 -63 270 991.2 804 823 19 13.7

---------------------------------------------------------------------------

incl. 817 818 1.3 172.0

---------------------------------------------------------------------------

incl. 821 822 1 27.2

---------------------------------------------------------------------------

---------------------------------------------------------------------------

D1474 10850 10955 -67 270 899.2 359 361 2 11.8

---------------------------------------------------------------------------

---------------------------------------------------------------------------

D1475 11425 10890 -86 270 698.5

---------------------------------------------------------------------------

incl. 352 353 1 12.7

---------------------------------------------------------------------------

---------------------------------------------------------------------------

D1476 11750 10867 -84 270 623.8

---------------------------------------------------------------------------

incl. 578 579 1 18.0

---------------------------------------------------------------------------

---------------------------------------------------------------------------

D1479 10700 10827 -68 270 778.5

---------------------------------------------------------------------------

incl. 561 562 1 108.0

---------------------------------------------------------------------------

---------------------------------------------------------------------------

D1482 11750 10866 -63 270 653.8

---------------------------------------------------------------------------

incl. 40 41 1 10.3

---------------------------------------------------------------------------

incl. 612 614 2 26.9

---------------------------------------------------------------------------

---------------------------------------------------------------------------

D1485 10825 10791 -66 270 611.4

---------------------------------------------------------------------------

incl. 513 514 1 16.3

---------------------------------------------------------------------------

---------------------------------------------------------------------------

D1492 11675 10813 -85 270 658.3

---------------------------------------------------------------------------

incl. 647 648 1 51.5

---------------------------------------------------------------------------

---------------------------------------------------------------------------

D1494 11450 10913 -87 270 637.8

---------------------------------------------------------------------------

incl. 313 316 3 18.26

---------------------------------------------------------------------------

Note: Intervals shown in the table are down hole intercepts, drilled at

high angles relative to the internal mineralized structures and the Sukari

Porphyry; true widths do not apply or are not used in drilling the

stockwork style mineralization at Sukari

ABN 86 007 700 352

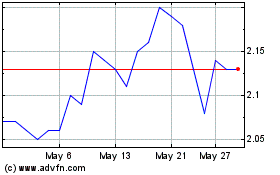

Centamin (TSX:CEE)

Historical Stock Chart

From Jun 2024 to Jul 2024

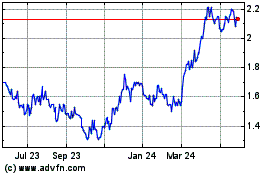

Centamin (TSX:CEE)

Historical Stock Chart

From Jul 2023 to Jul 2024