International Clean Power Dividend Fund Completes Conversion Into Infrastructure Dividend Split Corp.

06 May 2024 - 11:34PM

Infrastructure Dividend Split Corp. (“Infrastructure Split”) (TSX:

IS) is pleased to announce the successful completion of the

previously announced merger of International Clean Power Dividend

Fund (“CLP”) (TSX: CLP.UN), with Infrastructure Split being the

continuing fund. Each CLP unit has been automatically exchanged

into 0.46707742 Class A Shares of Infrastructure Split. This

exchange ratio was based on the net asset value per unit of CLP as

of the close of business on May 3, 2024, divided by $15.00.

Approximately 5,212,245 Class A shares of Infrastructure Split were

issued in connection with the merger.

CLP Units will be

delisted from the TSX at the end of business on May

7th. Class A Shares of

Infrastructure Split will begin trading on the TSX at the opening

of business on May 8th under the

symbol IS. Unitholders of CLP do not need to take any actions to

receive their Class A Shares of Infrastructure Split.

Infrastructure Split has been designed to

provide investors with a diversified, actively managed portfolio

comprised primarily of dividend paying securities of issuers

operating in the infrastructure sector. The investment strategy of

Infrastructure Split will be to initially invest in a portfolio of

approximately 15 dividend-paying issuers operating in the

infrastructure sector that Middlefield Capital Corporation (the

“Advisor”), the investment advisor of Infrastructure Split,

believes offers investors the potential for both income through

attractive dividend yields and capital appreciation and that it

believes are undervalued and well-positioned to benefit from the

Advisor’s outlook for a gradual reduction in interest rates, the

continuation of global decarbonization, and favourable demographics

(such as a growing middle class and urbanization).

The investment objectives for the Class A Shares

are to provide holders with non-cumulative monthly cash

distributions and to provide holders with the opportunity for

capital appreciation through exposure to the portfolio.The initial

target distribution yield for the Class A Shares will be 10% per

annum based on the $15 issue price (or $0.125 per month or $1.50

per annum). Former unitholders of CLP who wish to participate in

the Distribution Reinvestment Plan (the “DRIP”) of Infrastructure

Split Class A shares will need to enroll in the Infrastructure

Split’s DRIP. The first distribution of Infrastructure Split Class

A shares is not DRIP eligible and will be payable to holders of

record as at May 10th, 2024, and paid on May 15th, 2024.

Infrastructure Split has filed an amended and

restated Preliminary Prospectus for the offering of Preferred

Shares, which is expected to close on or about May 8th, 2024. The

Preferred Shares will be listed on the TSX under the symbol

IS.PR.A. The Preferred Shares have been provisionally rated Pfd-3

(high) by DBRS Limited. The investment objectives for the Preferred

Shares are to provide holders with fixed cumulative preferential

quarterly cash distributions and to return $10.00 to holders on

April 30, 2029 (the “Maturity Date”), subject to extension for

successive terms of up to five years each as determined by the

Company’s board of directors (the “Board of Directors”). The

quarterly cash distribution until April 30, 2029 will be $0.18 per

Preferred Share ($0.72 per annum), representing a yield of 7.2% per

annum on the issue price of $10.00 per Preferred Share.

The Merger was not effected on a tax-deferred

roll-over basis and, as such, will be considered a taxable event

for investors that may result in capital losses or gains becoming

realized. All costs of the mergers were paid by the manager,

Middlefield Limited.

For further information, please visit our

website at www.middlefield.com or contact Nancy Tham in our Sales

and Marketing Department at 1.888.890.1868.

Commissions, trailing commissions, management

fees and expenses all may be associated with owning units of an

investment fund or ETF investments. Please read the prospectus and

publicly filed documents before investing. You will usually pay

brokerage fees to your dealer if you purchase or sell units of an

investment fund on the Toronto Stock Exchange or alternative

Canadian trading platform (an “exchange”). If the units are

purchased or sold on an exchange, investors may pay more than the

current net asset value when buying units of an investment fund and

may receive less than the current net asset value when selling

them. There are ongoing fees and expenses associated with owning

units of an investment fund. An investment fund must prepare

disclosure documents that contain key information about CLP. You

can find more detailed information about CLP in the public filings

available at www.sedar.com. The indicated rates of return are the

historical annual compounded total returns including changes in

unit value and reinvestment of all distributions and do not take

into account: certain fees such as sales fees, redemption fees,

distributions or optional charges or income taxes payable by any

securityholder that would have reduced returns. Investment funds

and ETFs are not guaranteed, their values change frequently and

past performance may not be repeated.

Certain statements in this press release may be

viewed as forward-looking statements. Any statements that express

or involve discussions with respect to predictions, expectations,

beliefs, plans, intentions, projections, objectives, assumptions or

future events or performance (often, but not always, using words or

phrases such as "expects", "is expected", "anticipates", "plans",

"estimates" or "intends" (or negative or grammatical variations

thereof), or stating that certain actions, events or results "may",

"could", "would", "might" or "will" be taken, occur or be achieved)

are not statements of historical fact and may be forward-looking

statements. Statements which may constitute forward-looking

statements relate to: the proposed timing of the Merger and

completion thereof; the benefits of the Merger; the change in

investment objectives of CLP; the creation of Infrastructure Split

and the issuance of its preferred and Class A shares; and the

reduction in management fees. Forward-looking statements are

subject to a variety of risks and uncertainties which could cause

actual events or results to differ from those reflected in the

forward-looking statements including as a result of changes in the

general economic and political environment, changes in applicable

legislation, and the performance of each fund. There are no

assurances the Manager, the Advisor, CLP or Infrastructure Split

can fulfill such forward-looking statements and undertake no

obligation to update such statements. Such forward-looking

statements are only predictions; actual events or results may

differ materially as a result of risks facing one or more of the

Manager, the Advisor, CLP or Infrastructure Split, many of which

are beyond the control of the Manager, the Advisor, CLP or

Infrastructure Split.

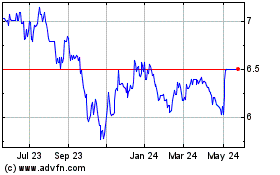

International Clean Powe... (TSX:CLP.UN)

Historical Stock Chart

From Dec 2024 to Jan 2025

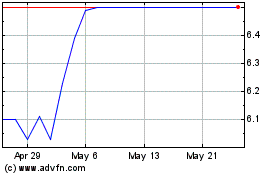

International Clean Powe... (TSX:CLP.UN)

Historical Stock Chart

From Jan 2024 to Jan 2025