Coveo (TSX: CVO), a leading provider of enterprise AI platforms

that enable individualized, connected, and trusted digital

experiences at scale with semantic search, AI recommendations, and

GenAI answering, today announced financial results for its third

quarter of fiscal 2024 ended December 31, 2023.

“We had a strong third quarter and saw a broad resurgence in new

bookings with new and existing customers,” said Louis Têtu,

Chairman and CEO of Coveo. “We believe we are beginning to see the

strong early interest in generative AI turning into tangible

opportunities with customers, especially in situations with a

compelling ROI. Our leading AI platform is strategically positioned

to empower customers to leverage AI, helping them to drive higher

revenue and profitability and improve overall efficiency across

their operations. We believe the GA release of Relevance Generative

AnsweringTM in December will allow us to continue to build on this

momentum.”

Third Quarter Fiscal 2024 Financial

Highlights(All comparisons are relative to the

three-month period ended December 31, 2022, unless otherwise

stated)

- SaaS Subscription Revenue(1) of $29.9 million compared to $26.4

million, an increase of 13%.

- Total revenue was $31.8 million compared to $28.5 million, an

increase of 11%.

- Gross margin was 77% and product gross margin was 81%, both

consistent with last year.

- Operating loss was $6.5 million compared to $10.7 million, and

Adjusted Operating Loss(2) was $1.7 million compared to $3.9

million, both representing significant improvements.

- Net loss was $6.2 million compared to net loss of $10.0

million.

- Cash flows used in operating activities were $2.3 million for

the quarter and $0.4 million year-to-date.

- Cash and cash equivalents were $163.1 million as of December

31, 2023.

Third Quarter Fiscal 2024 Business

Highlights

- Net Expansion Rate(1) of 105% as of December 31, 2023. Net

Expansion Rate was 109% excluding customer attrition from customers

using certain deprioritized legacy Qubit product

capabilities(3).

- The company continues to see strong momentum with its

enterprise-ready Relevance Generative Answering™ solution, an

extension of its AI platform that combines Large Language Model

(“LLM”) technology with secure indexing and AI relevance

capabilities. Coveo signed agreements with customers such as SAP

Concur and Blackbaud in the quarter, and has completed expansion

transactions for Relevance Generative Answering™ in each of its

four solution areas (commerce, service, websites, and

workplace).

- Coveo announced the general availability of Relevance

Generative Answering™ on December 15, following successful beta

testing with a number of customers. Customers so far have seen

notable benefits, such as a reported 40% reduction in customer

search time and a 20% improvement in case deflection.

- The company introduced early access to Relevance Generative

Answering™ for B2B and B2C commerce, revolutionizing eCommerce by

providing scalable, secure, and traceable generative AI

question-answering capabilities to drive better online customer

experiences across product discovery and post-sales support.

- Coveo earned leadership recognition in The Forrester WaveTM:

Cognitive Search Platforms, 2023, excelling in the Intelligence,

Roadmap, Pricing, Flexibility, and Transparency criteria, with a

focus on its AI Search and Generative Experience platform. The

report highlights Coveo's evolving cognitive search capabilities,

advanced hybrid search, and strong integrations, making it a

compelling choice for firms seeking automated relevancy tuning and

impactful search experiences.

- Coveo was acknowledged as a Leader in the 2023 IDC MarketScape

for General-Purpose Knowledge Discovery Software, highlighting

strengths in pre-packaged solutions and content source integration

/ management, with recent advancements ensuring scalable,

intuitive, and technology-agnostic solutions for transforming

customer and employee interactions.

Financial Outlook

Following our strong third quarter of fiscal 2024, we are

improving our outlook for SaaS Subscription Revenue, Total Revenue,

and Adjusted Operating Loss for the full year. Coveo now

anticipates SaaS Subscription Revenue(1), Total Revenue, and

Adjusted Operating Loss(2) to be in the following ranges:

| |

Q4 FY’24 |

Full Year

FY’24 |

| SaaS Subscription Revenue(1) |

$30.2 – $30.7 million |

$118.0 – $118.5 million |

| Total Revenue |

$32.1 – $32.6 million |

$125.6 – $126.1 million |

| Adjusted Operating Loss(2) |

$2.0 – $3.0 million |

$7.5 – $8.5 million |

Cash flows used

in operating activities for the first nine months of fiscal 2024

were $0.4 million. As such, the company remains on track to achieve

positive operating cash flow in its next fiscal year (fiscal

2025).

These guidance ranges, including the timing to achieve positive

operating cash flow, are based on several assumptions, including

the following, in addition to those set forth under the

“Forward-Looking Information” section below:

- Achieving expected levels of sales of SaaS subscriptions to new

and existing customers, including timing of those sales, as well as

expected levels of renewals of SaaS subscriptions with existing

customers.

- Achieving expected levels of implementations and other sources

of professional services revenue.

- Maintaining planned levels of operating margin represented by

our Adjusted Gross Profit Measures(2) and Adjusted Gross Margin

Measures(4).

- Expected financial performance as measured by our Adjusted

Operating Expense Measures(2) and Adjusted Operating Expense (%)

Measures(4).

- Stabilization of ongoing headwinds, including those related to

economic and geopolitical factors, impacting sales cycles, pricing,

and the ability to generate new business.

- Our ability to attract and retain key personnel required to

achieve our plans.

- Similar foreign exchange rates, inflation rates, interest

rates, customer spending, and other macro-economic conditions.

- Our financial outlook does not include the impact of

acquisitions that may be announced or closed from time to

time.

These statements are forward-looking and actual results may

differ materially. Coveo’s outlook constitutes “financial outlook”

within the meaning of applicable securities laws and is provided

for the purpose of, among other things, assisting the reader in

understanding the company’s financial performance and measuring

progress toward management’s objectives, and the reader is

cautioned that it may not be appropriate for other purposes. Please

refer to the “Forward-Looking Information” section below for

additional information on the factors that could cause our actual

results to differ materially from these forward-looking statements

and a description of the assumptions thereof.

* * * * *

|

(1) |

|

SaaS Subscription Revenue and Net Expansion Rate are Key

Performance Indicators of Coveo. Please see the “Key Performance

Indicators” section below. |

| (2) |

|

The Adjusted Gross Profit

Measures, the Adjusted Operating Expense Measures, and Adjusted

Operating Loss are non-IFRS measures. Please see the “Non-IFRS

Measures and Ratios” section below and the reconciliation tables

within this release. |

| (3) |

|

Net Expansion Rate excluding

legacy Qubit-related attrition. This customer attrition represents

subscriptions of certain legacy Qubit customers using Qubit’s

product capabilities for non-core use cases that ultimately decided

to not renew their subscriptions. |

| (4) |

|

The Adjusted Gross Margin

Measures, the Adjusted Operating Expense (%) Measures, and Adjusted

Product Gross Margin are non-IFRS ratios. Please see the “Non-IFRS

Measures and Ratios” section below and the reconciliation tables

within this release. |

| |

|

|

Q3 Conference Call and Webcast Information

Coveo will host a conference call today at 5:00 p.m. Eastern

Time to discuss its financial results for its third quarter fiscal

year 2024. The call will be hosted by Louis Têtu, Chairman and CEO,

and other members of its senior leadership team.

| Conference Call: |

|

https://emportal.ink/3v6O5c0 |

| |

|

Use the link above to join the conference call without operator

assistance. If you prefer to have operator assistance, please dial:

1-888-664-6392 |

| Live Webcast: |

|

https://app.webinar.net/kyG796eaxJj |

| Webcast Replay: |

|

ir.coveo.com under the “News & Events”

section |

| |

|

|

Non-IFRS Measures and Ratios

Coveo’s unaudited condensed interim financial statements have

been prepared in accordance with IFRS as issued by the

International Accounting Standards Board. The information presented

in this press release includes non-IFRS financial measures and

ratios, namely (i) Adjusted Operating Loss; (ii) Adjusted

Gross Profit, Adjusted Product Gross Profit, and Adjusted

Professional Services Gross Profit (collectively referred to as our

“Adjusted Gross Profit Measures”); (iii) Adjusted Gross Margin,

Adjusted Product Gross Margin, and Adjusted Professional Services

Gross Margin (collectively referred to as our “Adjusted Gross

Margin Measures”); (iv) Adjusted Sales and Marketing Expenses,

Adjusted Research and Product Development Expenses, and Adjusted

General and Administrative Expenses (collectively referred to as

our “Adjusted Operating Expense Measures”); and (v) Adjusted Sales

and Marketing Expenses (%), Adjusted Research and Product

Development Expenses (%), and Adjusted General and Administrative

Expenses (%) (collectively referred to as our “Adjusted Operating

Expense (%) Measures”). These measures and ratios are not

recognized measures under IFRS and do not have standardized

meanings prescribed by IFRS and are therefore unlikely to be

comparable to similar measures presented by other companies.

Rather, these measures and ratios are provided as additional

information to complement IFRS measures by providing further

understanding of the company’s results of operations from

management’s perspective.

Accordingly, these measures and ratios should not be considered

in isolation nor as a substitute for analysis of the company’s

financial information reported under IFRS. Adjusted Operating Loss,

the Adjusted Gross Profit Measures, the Adjusted Gross Margin

Measures, the Adjusted Operating Expense Measures, and the Adjusted

Operating Expense (%) Measures are used to provide investors with

supplemental measures and ratios of the company’s operating

performance and thus highlight trends in Coveo’s core business that

may not otherwise be apparent when relying solely on IFRS measures

and ratios. The company’s management also believes that securities

analysts, investors, and other interested parties frequently use

non-IFRS measures and ratios in the evaluation of issuers. Coveo’s

management uses and intends to continue to use non-IFRS measures

and ratios in order to facilitate operating performance comparisons

from period to period, and to prepare annual operating budgets and

forecasts.

See the “Non-IFRS Measures” section of our latest MD&A,

which is available under our profile on SEDAR+ at www.sedarplus.ca

for a description of these measures. Please refer to the financial

tables appended to this press release for a description of such

measures and a reconciliation of (i) Adjusted Operating Loss to

operating loss; (ii) Adjusted Gross Profit to gross profit; (iii)

Adjusted Product Gross Profit to product gross profit; (iv)

Adjusted Professional Services Gross Profit to professional

services gross profit; (v) Adjusted Sales and Marketing Expenses to

sales and marketing expenses; (vi) Adjusted Research and Product

Development Expenses to research and product development expenses;

and (vii) Adjusted General and Administrative Expenses to general

and administrative expenses.

Key Performance Indicators

This press release refers to “SaaS Subscription Revenue” and

“Net Expansion Rate”, which are operating metrics used in Coveo’s

industry. We monitor such key performance indicators to help us

evaluate our business, measure our performance, identify trends,

formulate business plans, and make strategic decisions. These key

performance indicators provide investors with supplemental measures

of our operating performance and thus highlight trends in our core

business that may not otherwise be apparent when relying solely on

IFRS measures. We also believe that securities analysts, investors,

and other interested parties frequently use industry metrics in the

evaluation of issuers. Our key performance indicators may be

calculated in a manner different than similar key performance

indicators used by other companies.

“SaaS Subscription Revenue” means Coveo’s SaaS subscription

revenue, as presented in our financial statements in accordance

with IFRS.

“Net Expansion Rate” is calculated by considering a cohort of

customers at the end of the period 12 months prior to the end of

the period selected and dividing the SaaS Annualized Contract Value

(“SaaS ACV”, as defined below) attributable to that cohort at the

end of the current period selected, by the SaaS Annualized Contract

Value attributable to that cohort at the beginning of the period 12

months prior to the end of the period selected. Expressed as a

percentage, the ratio (i) excludes any SaaS ACV from new customers

added during the 12 months preceding the end of the period

selected; (ii) includes incremental SaaS ACV made to the cohort

over the 12 months preceding the end of the period selected; and

(iii) is net of the SaaS ACV from any customers whose subscriptions

terminated or decreased over the 12 months preceding the end of the

period selected.

“SaaS Annualized Contract Value” means the SaaS annualized

contract value of a customer’s commitments calculated based on the

terms of that customer’s subscriptions, and represents the

committed annualized subscription amount as of the measurement

date.

Please also refer to the “Key Performance Indicators” section of

our latest MD&A, which is available under our profile on SEDAR+

at www.sedarplus.ca, for additional details on the abovementioned

key performance indicators.

Forward-Looking Information

This press release contains “forward-looking information” and

“forward-looking statements” within the meaning of applicable

securities laws, including with respect to Coveo’s financial

outlook on SaaS Subscription Revenue, Total Revenue, and Adjusted

Operating Loss for the three months and the year ending March 31,

2024 and expectations and timing around achieving positive

operating cash flow, as well as statements regarding the benefits

and performance of Coveo Relevance Generative Answering

(collectively, “forward-looking information”). This forward-looking

information is identified by the use of terms and phrases such as

“may”, “would”, “should”, ”could”, “might”, “will”, “achieve”,

“occur”, “expect”, “intend”, “estimate”, “anticipate”, “plan”,

“foresee”, “believe”, “continue”, “target”, “opportunity”,

“strategy”, “scheduled”, “outlook”, “forecast”, “projection”, or

“prospect”, the negative of these terms and similar terminology,

including references to assumptions, although not all

forward-looking information contains these terms and phrases. In

addition, any statements that refer to expectations, intentions,

projections, or other characterizations of future events or

circumstances contain forward-looking information. Statements

containing forward-looking information are not historical facts but

instead represent management’s expectations, estimates, and

projections regarding future events or circumstances.

Coveo’s financial outlook on SaaS Subscription Revenue, Total

Revenue, and Adjusted Operating Loss also constitutes “financial

outlook” within the meaning of applicable securities laws and is

provided for the purposes of assisting the reader in understanding

the company’s financial performance and measuring progress toward

management’s objectives and the reader is cautioned that it may not

be appropriate for other purposes. Please refer to “Financial

Outlook” above for more information.

Forward-looking information is necessarily based on a number of

opinions, estimates, and assumptions (including those discussed

under “Financial Outlook” above and those discussed immediately

hereunder) that we considered appropriate and reasonable as of the

date such statements are made. Although the forward-looking

information contained herein is based upon what we believe are

reasonable assumptions, actual results may vary from the

forward-looking information contained herein. Certain assumptions

made in preparing the forward-looking information contained in

herein include, without limitation (and in addition to those

discussed under “Financial Outlook” above): our ability to

capitalize on growth opportunities and implement our growth

strategy; our ability to attract new customers, expand our

relationships with existing customers, and have existing customers

renew their subscriptions; our ability to maintain successful

strategic relationships with partners and other third parties;

market awareness and acceptance of enterprise AI solutions in

general and our products in particular; the market penetration of

our new generative AI solutions, both with new and existing

customers, and our ability to capture the generative AI

opportunity; our future capital requirements, and availability of

capital generally; the accuracy of our estimates of market

opportunity, growth forecasts, and expectations and timing around

achieving positive operating cash flow; our success in identifying

and evaluating, as well as financing and integrating, any

acquisitions, partnerships, or joint ventures; the significant

influence of our principal shareholders; and our ability to convert

pipeline into closed deals, and the timeframe thereof. Moreover,

forward-looking information is subject to known and unknown risks,

uncertainties, and other factors, many of which are beyond our

control, that may cause the actual results, level of activity,

performance, or achievements to be materially different from those

expressed or implied by such forward-looking information, including

but not limited to macro-economic uncertainties and the risk

factors described under “Risk Factors” in the company’s most

recently filed Annual Information Form and under “Key Factors

Affecting our Performance” in the company’s most recently filed

MD&A, both available under our profile on SEDAR+ at . There can

be no assurance that such forward-looking information will prove to

be accurate, as actual results and future events could differ

materially from those anticipated in such information. Accordingly,

prospective investors should not place undue reliance on

forward-looking information, which speaks only as of the date made.

Although we have attempted to identify important risk factors that

could cause actual results to differ materially from those

contained in forward-looking information, there may be other risk

factors not presently known to us or that we presently believe are

not material that could also cause actual results or future events

to differ materially from those expressed in such forward-looking

information.

You should not rely on this forward-looking information, as

actual outcomes and results may differ materially from those

contemplated by this forward-looking information as a result of

such risks and uncertainties. Additional information will also be

set forth in other public filings that we make available under our

profile on SEDAR+ at www.sedarplus.ca from time to time. The

forward-looking information provided in this press release relates

only to events or information as of the date hereof, and is

expressly qualified in their entirety by this cautionary statement.

Except as required by law, we do not assume any obligation to

update or revise any forward-looking information, whether as a

result of new information, future events, or otherwise, after the

date on which the statements are made or to reflect the occurrence

of unanticipated events.

About Coveo

Coveo powers the digital experiences of the world’s most

innovative brands serving millions of people and billions of

interactions across every digital experience. After a decade of

enriching our market-leading platform with forward-thinking global

enterprises, we know what it takes to gain a trusted AI-experience

advantage.

We strongly believe that the future is business-to-person, that

experience is today’s competitive front line, a make or break for

every business.

For enterprises to achieve this AI-experience advantage at

scale, it is imperative to have an Enterprise Spinal and composable

ability to deliver AI semantic search and generative experiences at

each customer and employee interaction.

Our single SaaS AI platform and robust suite of AI & GenAI

models are designed to transform the total experience from CX to EX

across websites, ecommerce, service, and workplace. Powering

individualized, trusted, and connected experiences across every

interaction to delight customers and augment employees, and drive

superior business outcomes.

Our platform is certified ISO 27001 certified, HIPAA compliant,

SOC2 compliant, and 99.999% SLA resilient. We are a Salesforce

Summit ISV Partner, an SAPⓇ Endorsed App, and an Adobe Gold

Partner.

Coveo is a trademark of Coveo Solutions, Inc.

Stay up to date on the latest Coveo news and content by

subscribing to the Coveo blog, and following Coveo

on LinkedIn and YouTube.

Contact Information

Paul MoonHead of Investor Relationsinvestors@coveo.com

Kiyomi HarringtonDirector, PR, Social and Corporate

Communicationskharrington@coveo.com

Condensed Interim Consolidated

Statements of Loss and Comprehensive Loss(expressed in

thousands of US dollars, except share and per share data,

unaudited)

|

|

Three months ended December 31, |

|

Nine months ended December 31, |

|

|

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

| |

$ |

|

$ |

|

|

$ |

|

$ |

|

| Revenue |

|

|

|

|

|

|

SaaS subscription |

29,901 |

|

26,389 |

|

|

87,842 |

|

75,861 |

|

|

Self-managed licenses and maintenance |

- |

|

298 |

|

|

- |

|

912 |

|

| Product

revenue |

29,901 |

|

26,687 |

|

|

87,842 |

|

76,773 |

|

|

Professional services |

1,860 |

|

1,810 |

|

|

5,670 |

|

6,119 |

|

| Total

revenue |

31,761 |

|

28,497 |

|

|

93,512 |

|

82,892 |

|

| |

|

|

|

|

|

| Cost of revenue |

|

|

|

|

|

|

Product |

5,731 |

|

4,948 |

|

|

16,182 |

|

14,455 |

|

|

Professional services |

1,439 |

|

1,656 |

|

|

4,467 |

|

5,455 |

|

| Total cost of

revenue |

7,170 |

|

6,604 |

|

|

20,649 |

|

19,910 |

|

| Gross

profit |

24,591 |

|

21,893 |

|

|

72,863 |

|

62,982 |

|

| |

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

Sales and marketing |

13,788 |

|

13,728 |

|

|

41,146 |

|

42,450 |

|

|

Research and product development |

9,153 |

|

8,705 |

|

|

27,035 |

|

26,800 |

|

|

General and administrative |

6,409 |

|

8,102 |

|

|

20,032 |

|

22,917 |

|

|

Depreciation of property and equipment |

605 |

|

599 |

|

|

1,777 |

|

1,951 |

|

|

Amortization and impairment of intangible assets |

721 |

|

1,072 |

|

|

5,926 |

|

3,337 |

|

|

Depreciation of right-of-use assets |

383 |

|

388 |

|

|

1,182 |

|

1,181 |

|

| Total operating

expenses |

31,059 |

|

32,594 |

|

|

97,098 |

|

98,636 |

|

| Operating

loss |

(6,468 |

) |

(10,701 |

) |

|

(24,235 |

) |

(35,654 |

) |

|

|

|

|

|

|

|

|

Net financial revenue |

(1,663 |

) |

(1,485 |

) |

|

(4,970 |

) |

(2,904 |

) |

|

Foreign exchange loss (gain) |

1,583 |

|

735 |

|

|

1,327 |

|

(581 |

) |

| Loss before income tax

expense (recovery) |

(6,388 |

) |

(9,951 |

) |

|

(20,592 |

) |

(32,169 |

) |

| Income tax expense

(recovery) |

(236 |

) |

96 |

|

|

(1,032 |

) |

330 |

|

| Net loss |

(6,152 |

) |

(10,047 |

) |

|

(19,560 |

) |

(32,499 |

) |

| |

|

|

|

|

|

| Net loss per share – Basic and

diluted |

(0.06 |

) |

(0.10 |

) |

|

(0.19 |

) |

(0.31 |

) |

| Weighted average number of

shares outstanding – Basic and diluted |

102,471,561 |

|

104,825,521 |

|

|

103,601,713 |

|

104,336,957 |

|

|

|

The following table presents share-based

payments and related expenses recognized by the company:

| |

Three months ended December 31, |

|

Nine months ended December 31, |

|

|

2023 |

2022 |

|

2023 |

2022 |

| |

$ |

$ |

|

$ |

$ |

| Share-based payments

and related expenses |

|

|

|

|

|

|

Product cost of revenue |

200 |

182 |

|

666 |

574 |

|

Professional services cost of revenue |

119 |

157 |

|

432 |

466 |

|

Sales and marketing |

810 |

1,375 |

|

1,747 |

4,445 |

|

Research and product development |

1,391 |

1,487 |

|

4,622 |

4,608 |

|

General and administrative |

1,518 |

2,163 |

|

5,334 |

5,406 |

| Share-based payments

and related expenses |

4,038 |

5,364 |

|

12,801 |

15,499 |

| |

Reconciliation of Adjusted Operating Loss to Operating

Loss(expressed in thousands of US dollars, unaudited)

|

|

Three months ended December 31, |

|

Nine months ended December 31, |

|

|

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

| |

|

|

|

|

|

| Operating

loss |

(6,468 |

) |

(10,701 |

) |

|

(24,235 |

) |

(35,654 |

) |

|

Share-based payments and related expenses (1) |

4,038 |

|

5,364 |

|

|

12,801 |

|

15,499 |

|

|

Amortization and impairment of acquired intangible assets (2) |

720 |

|

1,070 |

|

|

5,923 |

|

3,333 |

|

|

Acquisition-related compensation (3) |

- |

|

21 |

|

|

- |

|

407 |

|

|

Transaction-related expenses (4) |

- |

|

324 |

|

|

- |

|

324 |

|

| Adjusted Operating

Loss |

(1,710 |

) |

(3,922 |

) |

|

(5,511 |

) |

(16,091 |

) |

|

(1) |

|

These expenses relate to issued stock options and share-based

awards under our share-based plans to our employees and directors

as well as related payroll taxes that are directly attributable to

the share-based payments. These costs are included in product and

professional services cost of revenue, sales and marketing,

research and product development, and general and administrative

expenses. |

| (2) |

|

These expenses represent the

amortization and impairment of intangible assets acquired through

the acquisition of Qubit. These costs are included in amortization

and impairment of intangible assets. It includes an impairment of

customer relationships acquired through the business combination

with Qubit as described in note 5 of the condensed interim

consolidated financial statements for the three and nine months

ended December 31, 2023. |

| (3) |

|

These expenses relate to

non-recurring acquisition-related compensation in connection with

acquisitions. These costs are included in product and professional

services cost of revenue, and sales and marketing, research and

product development, and general and administrative expenses. |

| (4) |

|

These expenses relate to

professional, legal, consulting, accounting, advisory, and other

fees relating to transactions that would otherwise not have been

incurred. These costs are included in general and administrative

expenses. |

Reconciliation of Adjusted

Gross Profit Measures and Adjusted Gross Margin

Measures(expressed in thousands of US dollars,

unaudited)

|

|

Three months ended December 31, |

|

Nine months ended December 31, |

|

|

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

| |

$ |

|

$ |

|

|

$ |

|

$ |

|

| Total

revenue |

31,761 |

|

28,497 |

|

|

93,512 |

|

82,892 |

|

| Gross

profit |

24,591 |

|

21,893 |

|

|

72,863 |

|

62,982 |

|

| Gross margin |

77% |

|

77% |

|

|

78% |

|

76% |

|

|

Add: Share-based payments and related expenses |

319 |

|

339 |

|

|

1,098 |

|

1,040 |

|

| Add: Acquisition-related

compensation |

- |

|

6 |

|

|

- |

|

172 |

|

| Adjusted Gross

Profit |

24,910 |

|

22,238 |

|

|

73,961 |

|

64,194 |

|

| Adjusted Gross Margin |

78% |

|

78% |

|

|

79% |

|

77% |

|

| |

|

|

|

|

|

| Product

revenue |

29,901 |

|

26,687 |

|

|

87,842 |

|

76,773 |

|

| Product cost of

revenue |

5,731 |

|

4,948 |

|

|

16,182 |

|

14,455 |

|

| Product gross

profit |

24,170 |

|

21,739 |

|

|

71,660 |

|

62,318 |

|

| Product Gross margin |

81% |

|

81% |

|

|

82% |

|

81% |

|

| Add: Share-based payments and

related expenses |

200 |

|

182 |

|

|

666 |

|

574 |

|

| Add: Acquisition-related

compensation |

- |

|

4 |

|

|

- |

|

134 |

|

| Adjusted Product Gross

Profit |

24,370 |

|

21,925 |

|

|

72,326 |

|

63,026 |

|

| Adjusted Product Gross

Margin |

82% |

|

82% |

|

|

82% |

|

82% |

|

| |

|

|

|

|

|

| Professional services

revenue |

1,860 |

|

1,810 |

|

|

5,670 |

|

6,119 |

|

| Professional services

cost of revenue |

1,439 |

|

1,656 |

|

|

4,467 |

|

5,455 |

|

| Professional services

gross profit |

421 |

|

154 |

|

|

1,203 |

|

664 |

|

| Professional services gross

margin |

23% |

|

9% |

|

|

21% |

|

11% |

|

| Add: Share-based payments and

related expenses |

119 |

|

157 |

|

|

432 |

|

466 |

|

| Add: Acquisition-related

compensation |

- |

|

2 |

|

|

- |

|

38 |

|

| Adjusted Professional

Services Gross Profit |

540 |

|

313 |

|

|

1,635 |

|

1,168 |

|

| Adjusted Professional Services

Gross Margin |

29% |

|

17% |

|

|

29% |

|

19% |

|

| |

Reconciliation of Adjusted

Operating Expense Measures and Adjusted Operating Expense (%)

Measures(expressed in thousands of US dollars,

unaudited)

|

|

Three months ended December 31, |

|

Nine months ended December 31, |

|

|

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

| |

$ |

|

$ |

|

|

$ |

|

$ |

|

| Sales and marketing

expenses |

13,788 |

|

13,728 |

|

|

41,146 |

|

42,450 |

|

| Sales and marketing expenses

(%) |

43% |

|

48% |

|

|

44% |

|

51% |

|

| Less: Share-based payments and

related expenses |

810 |

|

1,375 |

|

|

1,747 |

|

4,445 |

|

| Less: Acquisition-related

compensation |

- |

|

6 |

|

|

- |

|

77 |

|

| Adjusted Sales and

Marketing Expenses |

12,978 |

|

12,347 |

|

|

39,399 |

|

37,928 |

|

| Adjusted Sales and Marketing

Expenses (%) |

41% |

|

43% |

|

|

42% |

|

46% |

|

| |

|

|

|

|

|

| Research and product

development expenses |

9,153 |

|

8,705 |

|

|

27,035 |

|

26,800 |

|

| Research and product

development expenses (%) |

29% |

|

31% |

|

|

29% |

|

32% |

|

| Less: Share-based payments and

related expenses |

1,391 |

|

1,487 |

|

|

4,622 |

|

4,608 |

|

| Less: Acquisition-related

compensation |

- |

|

8 |

|

|

- |

|

143 |

|

| Adjusted Research and

Product Development Expenses |

7,762 |

|

7,210 |

|

|

22,413 |

|

22,049 |

|

| Adjusted Research and Product

Development Expenses (%) |

24% |

|

25% |

|

|

24% |

|

27% |

|

| |

|

|

|

|

|

| General and

administrative expenses |

6,409 |

|

8,102 |

|

|

20,032 |

|

22,917 |

|

| General and administrative

expenses (%) |

20% |

|

28% |

|

|

21% |

|

28% |

|

| Less: Share-based payments and

related expenses |

1,518 |

|

2,163 |

|

|

5,334 |

|

5,406 |

|

| Less: Acquisition-related

compensation |

- |

|

1 |

|

|

- |

|

15 |

|

| Less: Transaction-related

expenses |

- |

|

324 |

|

|

- |

|

324 |

|

| Adjusted General and

Administrative Expenses |

4,891 |

|

5,614 |

|

|

14,698 |

|

17,172 |

|

| Adjusted General and

Administrative Expenses (%) |

15% |

|

20% |

|

|

16% |

|

21% |

|

| |

Condensed Interim Consolidated

Statements of Financial Position(expressed in thousands of

US dollars, unaudited)

|

|

December 31, 2023 |

|

March 31, 2023 |

|

| |

$ |

|

$ |

|

| Assets |

|

|

| Current

assets |

|

|

|

Cash and cash equivalents |

163,118 |

|

198,452 |

|

|

Trade and other receivables |

33,678 |

|

24,233 |

|

|

Government assistance |

11,413 |

|

7,142 |

|

|

Prepaid expenses |

6,957 |

|

8,707 |

|

| |

215,166 |

|

238,534 |

|

| Non-current

assets |

|

|

|

Contract acquisition costs |

10,541 |

|

11,148 |

|

|

Property and equipment |

6,170 |

|

6,846 |

|

|

Intangible assets |

9,502 |

|

15,107 |

|

|

Right-of-use assets |

6,557 |

|

7,645 |

|

|

Deferred tax assets |

3,817 |

|

3,896 |

|

|

Goodwill |

26,092 |

|

25,642 |

|

| Total

assets |

277,845 |

|

308,818 |

|

| |

|

|

|

Liabilities |

|

|

| Current

liabilities |

|

|

|

Trade payable and accrued liabilities |

21,917 |

|

21,435 |

|

|

Deferred revenue |

64,145 |

|

55,260 |

|

|

Current portion of lease obligations |

2,083 |

|

1,929 |

|

| |

88,145 |

|

78,624 |

|

| Non-current

liabilities |

|

|

|

Lease obligations |

7,604 |

|

8,940 |

|

|

Deferred tax liabilities |

1,723 |

|

2,721 |

|

|

Total liabilities |

97,472 |

|

90,285 |

|

| Shareholders'

equity |

|

|

|

Share capital |

834,370 |

|

868,409 |

|

|

Contributed surplus |

37,613 |

|

25,949 |

|

|

Deficit |

(651,548 |

) |

(631,988 |

) |

|

Accumulated other comprehensive loss |

(40,062 |

) |

(43,837 |

) |

|

Total shareholders' equity |

180,373 |

|

218,533 |

|

| Total liabilities and

shareholders' equity |

277,845 |

|

308,818 |

|

| |

|

|

|

Condensed Interim Consolidated

Statements of Cash Flows(expressed in thousands of US

dollars, unaudited)

|

|

Nine months ended December 31, |

|

|

2023 |

|

2022 |

|

| |

$ |

|

$ |

|

| Cash flows from

operating activities |

|

|

|

Net loss |

(19,560 |

) |

(32,499 |

) |

|

Items not affecting cash |

|

|

|

Amortization of contract acquisition costs |

3,337 |

|

3,302 |

|

|

Depreciation of property and equipment |

1,777 |

|

1,951 |

|

|

Amortization and impairment of intangible assets |

5,926 |

|

3,337 |

|

|

Depreciation of right-of-use assets |

1,182 |

|

1,181 |

|

|

Share-based payments |

11,759 |

|

15,628 |

|

|

Interest on lease obligations |

407 |

|

482 |

|

|

Variation of deferred tax assets and liabilities |

(987 |

) |

323 |

|

|

Unrealized foreign exchange loss (gain) |

1,113 |

|

(581 |

) |

|

|

|

|

|

Changes in non-cash working capital items |

(5,388 |

) |

7,728 |

|

|

|

(434 |

) |

852 |

|

| |

|

|

| Cash flows used in

investing activities |

|

|

|

Business combination, net of cash acquired |

- |

|

(475 |

) |

|

Additions to property and equipment |

(953 |

) |

(1,046 |

) |

|

Additions to intangible assets |

(23 |

) |

(5 |

) |

|

|

(976 |

) |

(1,526 |

) |

| |

|

|

| Cash flows used in

financing activities |

|

|

|

Proceeds from exercise of stock options |

1,392 |

|

1,579 |

|

|

Tax withholding for net share settlement |

(1,267 |

) |

(599 |

) |

|

Payments on lease obligations |

(1,750 |

) |

(1,889 |

) |

|

Shares repurchased and cancelled |

(29,649 |

) |

- |

|

|

Repurchase of stock options |

(4,553 |

) |

- |

|

| |

(35,827 |

) |

(909 |

) |

| |

|

|

| Effect of foreign exchange

rate changes on cash and cash equivalents |

1,903 |

|

(13,924 |

) |

| |

|

|

| Decrease in cash and

cash equivalents during the period |

(35,334 |

) |

(15,507 |

) |

| |

|

|

| Cash and cash equivalents –

beginning of period |

198,452 |

|

223,072 |

|

| |

|

|

| Cash and cash

equivalents – end of period |

163,118 |

|

207,565 |

|

| |

|

|

|

Cash |

21,854 |

|

51,170 |

|

|

Cash equivalents |

141,264 |

|

156,395 |

|

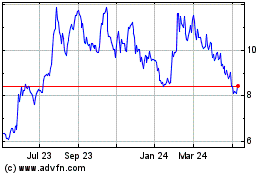

Coveo Solutions (TSX:CVO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Coveo Solutions (TSX:CVO)

Historical Stock Chart

From Mar 2024 to Mar 2025