Engine Capital Sends Letter to Dye & Durham’s Board of Directors Regarding its Concerns About the Company’s Rising and Excessive Leverage

11 September 2024 - 9:00PM

Business Wire

Highlights How the Company’s Two Recently

Announced Acquisitions Totaling C$69.3 Million Go Against the Board

and Management’s Previous Commitment to Reducing the Debt Load

Pro-Forma Leverage Is Back to Approximately the

Same Level as It Was Prior to the February 2024 Dilutive Equity

Offering Despite Leadership’s Repeated Promises to Drive Leverage

Below 4x

Engine Capital LP (together with its affiliates, “Engine” or

“we”), which owns approximately 7.1% of Dye & Durham Limited’s

(TSX: DND) (“Dye & Durham” or the “Company”) outstanding

shares, today issued the below letter to the Company’s Board of

Directors (the “Board”).

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240911332531/en/

***

September 11, 2024

Dye & Durham Limited 1100-25 York Street Toronto, Canada M5J

2V5 Attention: Board of Directors

Members of the Board:

We were incredibly disappointed by the Company’s recent Q4 2024

earnings announcement on September 4, 2024, which included news of

two additional acquisitions for a total consideration of C$69.3

million.1 These acquisitions are significant, representing around

7.5% of the Company’s market capitalization. While the Company is

trying to minimize the size of these acquisitions by highlighting

that the upfront payment is “only” C$21 million, the reality is

that the total consideration is much larger and includes C$44

million in deferred consideration which is just another form of

leverage. We felt blindsided because for the last few months that

we have interacted with Chair Colleen Moorehead, she has repeatedly

assured us that “the Board has no appetite for M&A” and that

“the Board’s priority is to reduce debt.” The Company’s latest

announcement flies in the face of these statements and compounds

its credibility issues with shareholders.

These new acquisitions are even more disappointing considering

the Board has consistently received feedback from many shareholders

since at least 2022 that the Company should prioritize debt

reduction over M&A. We know this feedback has been shared with

the Board based on presentations filed as part of the ongoing

litigation between the Company and one of its significant

shareholders, OneMove Capital, in the Ontario Superior Court of

Justice in Toronto (the “Court”). We have included some of those

slides, all of which are publicly accessible in the Court file, in

Appendix A. These slides make clear shareholders’ concerns

regarding Dye & Durham’s level of debt, the need to rapidly

reduce debt, the leverage profile, and the pace of acquisitions. In

a section titled “Broad investor concern regarding CEO

communications,” the second slide cites an example where management

publicly indicated a focus on debt reduction (including telling the

market the TM Group proceeds would be used to pay down debt) only

to announce acquisitions shortly thereafter. The bottom line is

that the Board is well aware of shareholders’ concerns but simply

does not care.

The example mentioned in this slide is very similar to recent

actions taken by the Board. After repurchasing 14.7 million shares

for an average price of C$15.22 per share in fiscal year 2023

(including through two Substantial Issuer Bids), the Board just a

few months later completed a highly dilutive equity issuance of

11.96 million shares at C$12.10 per share in February 2024. The

stated reason for this dilutive financing was to reduce debt. In

reality, shareholders were diluted to allow the Board to continue

its M&A spree, as just months later in August 2024, the Company

used some of those proceeds for new acquisitions. As a result of

these acquisitions, the Company’s level of debt has increased, and

its leverage profile has worsened despite the Board and

management’s claims that they are focused on reducing debt and

leverage.2

We also want to highlight the Company’s leverage ratio over the

last few quarters. Incredibly, pro-forma leverage following these

two acquisitions is now back to around the same level as it was

prior to the February 2024 dilutive equity offering despite

management’s repeated commitment to drive leverage below 4x as

quickly as possible.3

This M&A is also irresponsible, in our opinion, given the

heightened turnover of the management team. Over the last few

months alone, the following senior executives have departed the

organization:

- David Nash – Chief Product Officer (hired in July 2023)

- Aaron Eichenlaub – Chief Revenue Officer (hired in July

2023)

- John Robinson – CEO Financial Solutions Business, formerly

Global COO

- Wojtek Dabrowski – Chief People and Communications Officer

(hired in June 2022)4

- Charlie MacCready – Chief Legal Officer

- John Sulja – Chief Information Officer (hired in June

2022)

We wonder how the Board can continue to approve acquisitions

when the management team is in such turmoil, no matter how

compelling the purchase opportunity may seem. These are just a few

reasons why the Company’s shares continue to trade at a significant

discount to other technology companies or technology

consolidators.5 We contend that meaningful changes are required to

close this valuation gap. Shareholders deserve a Board and

management team that are patient, disciplined, rational – and

receptive to their feedback.

We believe documents filed with the Court as part of the

litigation explain why it has been so difficult to reach an

agreement with the Company. In an email summarizing an interaction

with a shareholder, former Chair Brian Derksen explained that the

Company’s CEO, Matthew Proud, would not agree to increase the size

of the Board because he was concerned about “dilution of

influence.”6 Given this comment, it is ironic that the Board has

accused Engine of trying to “take control of the Board” without

paying a premium (despite the fact that if Engine’s principal were

to be elected, he would only be one out of seven directors).

Dye & Durham under the leadership of the Board has become a

laughingstock of the Canadian capital markets. We are surprised the

Company’s directors are not concerned about their own personal

reputation and potential personal liability, as they continue to

fund more acquisitions and frivolous litigation against Dye &

Durham’s own shareholders, instead of focusing on reducing

leverage, as shareholders have now been asking for a while. We urge

the independent directors (Ms. Moorehead, Mr. Derksen, Ted Prittie,

Peter Brimm, and Ronnie Wahi) to stop the shenanigans and set a

date for the Special Meeting as soon as practically possible so

that shareholders can have their say.

Sincerely,

Arnaud Ajdler Managing Partner

No Solicitation

This press release does not constitute a solicitation of a proxy

within the meaning of applicable laws, and accordingly, DND

shareholders are not being asked to give, withhold or revoke a

proxy.

About Engine Capital

Engine Capital LP is a value-oriented special situations fund

that invests both actively and passively in companies undergoing

change.

1 Includes C$4.5 million in contingent consideration. 2 This

analysis includes deferred payments that were part of the

consideration for these acquisitions since these deferred payments

are a liability for the Company. 3 Leverage includes convertible

debentures and deferred considerations. Assumes acquisitions were

made at 10x EBITDA, per management’s commentary. 4 Mr. Dabrowski

may still work with the Company as a consultant. 5 “DND shares

currently trade at 8.3x C2024E EBITDA vs. legal SaaS at 19.3x and

tech consolidators at 18.8x.” Canaccord Genuity report published by

Robert Young and Max Ingram on September 5, 2024. 6 Court

filings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240911332531/en/

For Investors:

Engine Capital LP 212-321-0048 info@enginecap.com

For Media:

Longacre Square Partners Charlotte Kiaie / Bela Kirpalani,

646-386-0091 ckiaie@longacresquare.com /

bkirpalani@longacresquare.com

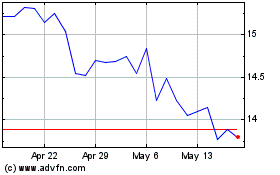

Dye and Durham (TSX:DND)

Historical Stock Chart

From Oct 2024 to Nov 2024

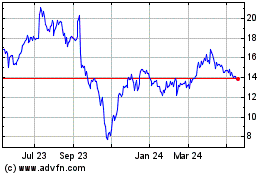

Dye and Durham (TSX:DND)

Historical Stock Chart

From Nov 2023 to Nov 2024