Highlights That the Board is Wasting

Shareholder Resources in Its Baseless Attempt to Invalidate

Engine’s Director Nomination

Asserts the Board’s Efforts to Use Regulatory

Intervention to Retain Power Only Underscore the Urgent Need for

Significant Change at the Upcoming Annual Meeting

Engine Capital LP (together with its affiliates, "Engine" or

"we"), which owns approximately 7.1% of the issued and outstanding

common shares of Dye & Durham Limited (TSX: DND) ("Dye &

Durham" or the "Company"), today issued the following statement

regarding the Board of Directors’ (the “Board”) recent efforts to

entrench itself and disenfranchise shareholders, including by

raising frivolous concerns about Engine’s director nomination

notice as a potential prelude to invalidate the nomination:

“Chair Colleen Moorehead and her Board’s actions indicate that

they will go to great lengths to maintain power and prevent

shareholders from having their voices heard. After pursuing a

requisitioned shareholder meeting to refresh the Board for over

eight months, Engine received a letter from Company counsel late

Friday raising baseless concerns regarding our director nomination

notice for the upcoming Annual Meeting and seeking additional

superfluous information.1 Dye & Durham continues to baselessly

claim that Engine is part of a shareholder group – a false

assertion that’s been obsessively peddled by Ms. Moorehead and CEO

Matt Proud for months now.

Despite these transparent entrenchment efforts, Engine intends

to comply with the information requests and urges the Board to

immediately cease its gamesmanship and commit to providing

shareholders the opportunity to vote for our world-class slate at

the December Annual Meeting. If the Board invalidates our

nomination, Engine will be forced to take legal action against the

Company, which would only waste additional shareholder capital and

potentially delay the Annual Meeting. We suspect this is Ms.

Moorehead and Mr. Proud’s ultimate goal and cannot permit this

precedent of weaponizing the corporate machinery.

This latest defense tactic follows the Board’s attempts to use a

Competition Bureau investigation into Dye & Durham to convince

the Court that current management and the Board should stay in

power. Ironically, Mr. Proud and the Board’s own mismanagement – as

evidenced by the stunning admission in Court documents that eight

out of 11 direct reports of Mr. Proud recently departed – is what

seemingly put Dye & Durham in the crosshairs of the Competition

Bureau in the first place. Under the Board’s oversight, nearly the

entire senior management team reporting to Mr. Proud has exited the

Company, Canadian regulators have launched an investigation, two

deals in the U.K. and Australia were blocked by regulators,

shareholder feedback has been ignored for years and customers have

grown increasingly aggravated.

Finally, given Ms. Moorehead’s history of self-preservation

tactics, we caution the Board against resorting to further

entrenchment maneuvers before the upcoming shareholder vote,

including self-refreshment. The Company’s directors should not

hand-pick their successors given their track record of poor

performance and anti-shareholder governance. Shareholders have the

right to elect a new Board composed of independent and experienced

directors whose sole focus will be creating long-term shareholder

value.”

***

As a reminder, Engine is seeking to reconstitute Dye &

Durham’s Board with six highly qualified director

candidates – Arnaud Ajdler, Hans T. Gieskes, Tracey E.

Keates, Ritu Khanna, Anthony P. Kinnear and Sid Singh – at the

Company’s 2024 Annual Meeting of Shareholders scheduled for

December 17, 2024.

***

Information in Support of Public

Broadcast Exemption under Canadian Law

The information contained in this press release does not and is

not meant to constitute a solicitation of a proxy within the

meaning of applicable corporate and securities laws. Shareholders

of the Company are not being asked at this time to execute a proxy

in favour of Engine’s director nominees or in respect of any other

matter to be acted upon at the Annual Meeting. In connection with

the Annual Meeting, Engine intends to file a dissident information

circular in due course in compliance with applicable corporate and

securities laws. Notwithstanding the foregoing, Engine has

voluntarily provided in, or incorporated by reference into, this

press release the disclosure required under section 9.2(4) of NI

51-102 – Continuous Disclosure Obligations (“NI 51-102”) and has

filed a document (the “Document”) containing disclosure prescribed

by applicable corporate law and disclosure required under section

9.2(6) of NI 51-102 in respect of Engine’s director nominees, in

accordance with corporate and securities laws applicable to public

broadcast solicitations. The Document is hereby incorporated by

reference into this press release and is available under the

Company’s profile on SEDAR+ at www.sedarplus.ca. The registered

office of the Company is 25 York Street, Suite 1100 Toronto,

Ontario M5J 2V5.

None of Engine, any other “dissidents” within the meaning of the

Ont. Reg. 62 of the Business Corporations Act (Ontario) and any

partner, officer, director and control person of such “dissidents”

(collectively, the “Engine Group”) is requesting that Company

shareholders submit a proxy at this time. Once formal solicitation

of proxies in connection with the Annual Meeting has commenced,

proxies may be revoked in accordance with subsection 110(4) of the

Business Corporations Act (Ontario) by a registered holder of

Company shares: (a) by completing and signing a valid proxy bearing

a later date and returning it in accordance with the instructions

contained in the accompanying form of proxy; (b) by depositing an

instrument in writing that is signed by the shareholder or an

attorney who is authorized by a document that is signed in writing

or by electronic signature; (c) by transmitting by telephonic or

electronic means a revocation that is signed by electronic

signature in accordance with applicable law, as the case may be:

(i) at the registered office of the Company at any time up to and

including the last business day preceding the day the Annual

Meeting or any adjournment or postponement of the Annual Meeting is

to be held, or (ii) with the chair of the Annual Meeting on the day

of the Annual Meeting or any adjournment or postponement of the

Annual Meeting; or (d) in any other manner permitted by law. In

addition, proxies may be revoked by a non-registered holder of

Company shares at any time by written notice to the intermediary in

accordance with the instructions given to the non-registered holder

by its intermediary.

The costs incurred in the preparation and mailing of any

circular or proxy solicitation by Engine and any other participants

named herein will be borne directly and indirectly by the Engine

Group. However, to the extent permitted under applicable law, the

Engine Group intends to seek reimbursement from the Company of all

expenses incurred in connection with the solicitation of proxies

for the election of the Nominees at the Annual Meeting.

This press release and any solicitation made by Engine is, or

will be, as applicable, made by such parties, and not by or on

behalf of the management of the Company. Proxies may be solicited

by proxy circular, mail, telephone, email or other electronic

means, as well as by newspaper or other media advertising and in

person by managers, directors, officers and employees of Engine who

will not be specifically remunerated therefor. In addition, Engine

may solicit proxies by way of public broadcast, including press

release, speech or publication and any other manner permitted under

applicable Canadian laws, and may engage the services of one or

more agents and authorize other persons to assist it in soliciting

proxies on their behalf.

Engine Capital LP has entered into an agreement with Morrow

Sodali (Canada) Ltd. (“Sodali”) for solicitation and advisory

services in connection with the solicitation of proxies for the

Annual Meeting, for which Sodali will receive a fee not to exceed

US$175,000, together with reimbursement for reasonable and

out-of-pocket expenses, and will be indemnified against certain

liabilities and expenses, including certain liabilities under

securities laws.

No member of the Engine Group nor any of their associates or

affiliates has or has had any material interest, direct or

indirect, in any transaction since the beginning of the Company’s

last completed financial year or in any proposed transaction that

has materially affected or will or would materially affect the

Company or any of the Company’s affiliates. No member of the Engine

Group nor any of their associates or affiliates has any material

interest, direct or indirect, by way of beneficial ownership of

securities or otherwise, in any matter to be acted upon at the

Annual Meeting, other than the election of directors.

Disclaimer for Forward-Looking

Information

Statements contained herein that are not historical facts

constitute “forward-looking statements” and “forward-looking

information” (together, “forward-looking statements”) within the

meaning of applicable securities laws that reflect Engine’s current

expectations, assumptions, and estimates of future events,

performance and economic conditions. Such forward-looking

statements rely on the safe harbor provisions of applicable

securities laws. Because such statements are subject to risks and

uncertainties, actual results may differ materially from those

expressed or implied by such forward-looking statements and there

can be no assurance that the Company’s securities will trade at the

prices that may be implied herein, and there can be no assurance

that any opinion or assumption herein is, or will be proven,

correct. Words and phrases such as “anticipate,” “believe,”

“create,” “drive,” “expect,” “forecast,” “future,” “growth,”

“intend,” “hope,” “opportunity,” “plan,” “confident,” “restore,”

“reduce,” “potential,” “proposal,” “unlock,” “upside,” “will,”

“would,” and similar words and phrases are intended to identify

forward-looking statements. These forward-looking statements may

include, but are not limited to, statements concerning: the

anticipated financial and operating performance of Dye &

Durham; anticipated changes to Dye & Durham’s debt levels and

financial ratios; the outcome of the Annual Meeting; the release of

a transition plan and go-forward strategy; anticipated EBITDA; and

achieving organic growth, free cash flow generation and leverage

reduction. Such forward-looking statements are not guarantees of

future performance or actual results, and readers should not place

undue reliance on any forward-looking statement as actual results

may differ materially and adversely from forward-looking

statements. All forward-looking statements contained herein are

made only as of the date hereof, and Engine disclaims any intention

or obligation to update or revise any such forward-looking

statements to reflect events or circumstances that subsequently

occur, or of which Engine hereafter becomes aware, except as

required by applicable law.

About Engine Capital

Engine Capital LP is a value-oriented special situations fund

that invests both actively and passively in companies undergoing

change.

1 Engine requisitioned a special meeting on March 10, 2024,

which was later cancelled by the Company.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241111334086/en/

For Investors: Engine Capital LP 212-321-0048

info@enginecap.com For Media: Longacre Square Partners

Charlotte Kiaie / Bela Kirpalani, 646-386-0091

engine-DND@longacresquare.com

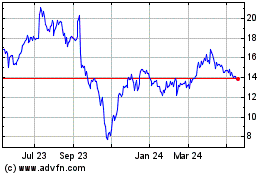

Dye and Durham (TSX:DND)

Historical Stock Chart

From Dec 2024 to Jan 2025

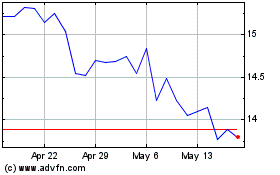

Dye and Durham (TSX:DND)

Historical Stock Chart

From Jan 2024 to Jan 2025