Glass Lewis Recommends Shareholders Vote “FOR”

Engine Nominees Arnaud Ajdler, Hans T. Gieskes, Anthony Kinnear and

Sid Singh

Glass Lewis Also Recommends Shareholders

“WITHHOLD” on CEO Matthew Proud, Chair Colleen Moorehead,

Compensation Committee Chair Edward Prittie and Director Luke

McCormick

Glass Lewis States “Investors Would Be Well

Served Endorsing Substantive Change to the DND Board at This

Time”

Engine Reminds Shareholders to Vote for

ALL SIX of Its Directors on the BLUE

Proxy Card by 10:30am EST TODAY

Engine Capital LP (together with its affiliates, "Engine" or

"we"), which owns approximately 7.1% of the issued and outstanding

common shares of Dye & Durham Limited (TSX: DND) ("Dye &

Durham" or the "Company"), today announced that Glass, Lewis &

Co. (“Glass Lewis”) has recommended that Dye & Durham

shareholders support meaningful boardroom change by voting for four

of its six directors at the Company’s 2024 Annual Meeting of

Shareholders to be held on December 17, 2024. Glass Lewis

recommends that shareholders vote the BLUE proxy card to elect Arnaud Ajdler, Hans

T. Gieskes, Anthony Kinnear and Sid Singh to the Board of Directors

(the “Board”).

Glass Lewis also recommends that shareholders WITHHOLD votes for CEO Matt Proud, Board Chair

Colleen Moorehead, Chair of the Compensation Committee Edward

Prittie and director Luke McCormick.

Mr. Ajdler, Founder and Managing Partner of Engine,

commented:

“We appreciate the endorsement for meaningful boardroom change

at Dye & Durham from both leading independent proxy advisory

firms. In their reports, Glass Lewis and ISS rebuke the Board – led

by Chair Colleen Moorehead and CEO Matt Proud – for its failure to

generate value since the Company’s 2020 IPO and for its use of

several entrenchment tactics to prevent shareholders from having

their say. Notably, both Glass Lewis and ISS agree with our

concerns regarding the potential for Mr. Proud to disrupt progress

at the Company, including its search for a new CEO, if he were

reelected to the Board.”

In its full report, Glass Lewis highlighted its rationale in

recommending shareholders vote for meaningful boardroom

change:1

- “[…] we do not consider DND has, by its own benchmark,

convincingly established any particularly durable legacy of

consistent, competitive value creation since listing.”

- “[…] DND seems to take material analytical and/or narrative

liberties, including by failing to address key concerns which

otherwise serve to underscore doubts surrounding the efficacy of

the current board […] we believe adequate cause exists to

suggest investors would be well served endorsing substantive

change to the DND board at this time.”

- “DND's reported severance payment of C$10 million to Mr. Proud

— to which he was not entitled and about which DND has provided

investors no substantive commentary or transparency — is

decidedly disconcerting […]”

- “We do not find any of these steps to be indicative of a board

interested in the timely exercise of the shareholder franchise, and

instead consider these patterns to be much more consistent with

a board determined to employ a fairly wide range of stall tactics

and entrenchment mechanisms.”

- “The reasons to oppose Mr. Proud's candidacy are, in our

view, expansive. We are also concerned Mr. Proud appears to be

at the center of DND's overworked executive turnstile, a

circumstance which amplifies already significant uncertainty

regarding his prospective willingness to leverage the existing

investor rights agreement to appoint himself board chair

concurrent with the board's effort to identify and retain his

successor.”

- “[…] we believe [Ms. Moorehead’s] service as board chair

during DND's expansive efforts to blunt the shareholder franchise

hardly serves as a particularly auspicious indication of her

willingness or ability to effectively and reliably represent

unaffiliated investor interests.”

- “The issue of customer value add is also fraught for the board,

as Engine reasonably highlights consistently and pointedly

negative responses to material price increases (including at

least one lawsuit) and a failure to stick to messaged price

freezes, which developments the Dissident believes have

damaged DND's credibility and driven significant customer

losses.”

- “We believe the foregoing Engine candidates represent a

favorable cross-section of independence, executive service,

relevant industry expertise and prior public company board

experience, giving us a reasonable degree of confidence they

will be well situated to swiftly contribute to necessary

deliberations relating to myriad issues at DND.”

In its report recommending shareholders vote FOR three of Engine’s director candidates,

Institutional Shareholder Services Inc. (“ISS”) noted the

following:2

- “Various configurations of the board have been ineffective

at performing oversight over the company's founder, CEO, and

strategic architect, Matthew Proud.”

- “[…] there is unease regarding oversight and

accountability, and the ability of the incumbent board (with

Proud involved) to attract and retain a new high-caliber CEO.”

- “Shareholders would be right to wonder […] if Proud and the

management nominees endorsing his continued involvement in the

succession process should be trusted.”

- “At times, the board has engaged in questionable tactics to

stifle the dissident campaign under [Ms. Moorehead’s] tenure,

most notably by lobbying for the Competition Bureau investigation

to serve as rationale to preserve the incumbent board and

management.”

Shareholders are encouraged to vote FOR all six of

Engine’s nominees using only the BLUE proxy card. In order for your votes to be

counted, you must submit your BLUE proxy or voting instruction form

before 10:30 a.m. Eastern Time TODAY

Contact your broker to obtain the 16-digit control number

associated with your BLUE

voting instruction form. Once you have your control number, visit

www.LetsFixDND.com/how-to-vote to cast your vote. If you have

already voted using the GOLD Dye & Durham proxy, you can submit

a new vote using the BLUE

proxy. Only the later dated proxy will be counted at the Annual

Meeting. If you have questions or require assistance with voting

your shares, please contact the proxy solicitation agent, Sodali

& Co, at Toll Free: 1-888-777-2094, Outside North America

(collect calls accepted): 1-289-695-3075 or Email:

assistance@sodali.com.

For more information on how to vote for the entire Engine slate

on the BLUE Proxy Card, to

download a copy of the full presentation and to share feedback on

Dye & Durham, visit www.LetsFixDND.com. Visit SEDAR+

(www.sedarplus.ca) to review a copy of Engine’s Information Proxy

Circular, dated November 29, 2024.

Disclaimer for Forward-Looking

Information

Statements contained herein that are not historical facts

constitute “forward-looking statements” and “forward-looking

information” (together, “forward-looking statements”) within the

meaning of applicable securities laws that reflect Engine’s current

expectations, assumptions, and estimates of future events,

performance and economic conditions. Such forward-looking

statements rely on the safe harbor provisions of applicable

securities laws. Because such statements are subject to risks and

uncertainties, actual results may differ materially from those

expressed or implied by such forward-looking statements and there

can be no assurance that the Company’s securities will trade at the

prices that may be implied herein, and there can be no assurance

that any opinion or assumption herein is, or will be proven,

correct. Words and phrases such as “anticipate,” “believe,”

“create,” “drive,” “expect,” “forecast,” “future,” “growth,”

“intend,” “hope,” “opportunity,” “plan,” “confident,” “restore,”

“reduce,” “potential,” “proposal,” “unlock,” “upside,” “will,”

“would,” and similar words and phrases are intended to identify

forward-looking statements. These forward-looking statements may

include, but are not limited to, statements concerning: the

anticipated financial and operating performance of Dye &

Durham; anticipated changes to Dye & Durham’s debt levels and

financial ratios; the outcome of the Annual Meeting; the release of

a transition plan and go-forward strategy; anticipated EBITDA; and

achieving organic growth, free cash flow generation and leverage

reduction. Such forward-looking statements are not guarantees of

future performance or actual results, and readers should not place

undue reliance on any forward-looking statement as actual results

may differ materially and adversely from forward-looking

statements. All forward-looking statements contained herein are

made only as of the date hereof, and Engine disclaims any intention

or obligation to update or revise any such forward-looking

statements to reflect events or circumstances that subsequently

occur, or of which Engine hereafter becomes aware, except as

required by applicable law.

Non-IFRS Measures

This press release makes reference to certain non-IFRS financial

measures. These measures are not recognized measures under IFRS, do

not have a standardized meaning prescribed by IFRS and may not be

comparable to similar measures presented by other companies.

Rather, these measures are provided as additional information to

complement IFRS financial measures by providing further

understanding of the Company’s results of operations from the

Company’s perspective as disclosed by the Company in its public

disclosure, including in the Company’s Management Circular. The

Company’s definitions of non-IFRS measures may not be the same as

the definitions for such measures used by other companies or

investors in their reporting. Non-IFRS measures have limitations as

analytical tools and should not be considered in isolation nor as a

substitute for analysis of the Company’s financial information

reported under IFRS. The Company discloses that it uses non-IFRS

financial measures, including “EBITDA” and “Leveraged Free Cash

Flow”, to provide investors with supplemental measures of the

Company’s operating performance and to eliminate items that have

less bearing on operating performance or operating conditions and

thus highlight trends in the Company’s core business that may not

otherwise be apparent when relying solely on IFRS financial

measures. Engine believes that securities analysts, investors and

other interested parties frequently use non-IFRS financial measures

in the evaluation of issuers such as the Company. The Company also

discloses that it uses non-IFRS financial measures in order to

facilitate operating performance comparisons from period to period.

Please see “Cautionary Note Regarding Non-IFRS Measures” and

“Select Information and Reconciliation of Non-IFRS Measures” in the

Company’s most recent Management’s Discussion and Analysis, which

is available on the Company’s profile on SEDAR+ at

www.sedarplus.ca, for further details on these non-IFRS measures,

including (i) definitions of each non-IFRS measure and an

explanation of the composition of each non-IFRS financial measure,

and (ii) relevant reconciliations of each non-IFRS measure to its

most directly comparable IFRS measure, which information is

incorporated by reference herein. Engine believes that its

disclosure of non-IFRS measures in this press release is consistent

with the use of such measures by the Company.

About Engine Capital

Engine Capital LP is a value-oriented special situations fund

that invests both actively and passively in companies undergoing

change.

1 Permission to use quotations from Glass Lewis was neither

sought nor obtained.

2 Permission to use quotations from ISS was neither sought nor

obtained.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241212829096/en/

For Investors: Engine Capital LP 212-321-0048

info@enginecap.com

Sodali & Co. North American Toll-Free Number: 1-888-777-2094

Outside North America (collect calls accepted): 1-289-695-3075

assistance@sodali.com For Media: Longacre Square Partners

Charlotte Kiaie / Bela Kirpalani, 646-386-0091

engine-DND@longacresquare.com

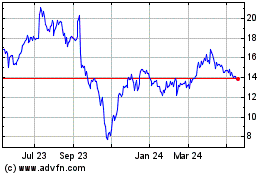

Dye and Durham (TSX:DND)

Historical Stock Chart

From Jan 2025 to Feb 2025

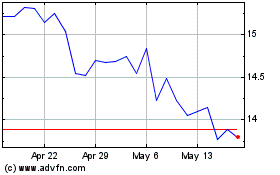

Dye and Durham (TSX:DND)

Historical Stock Chart

From Feb 2024 to Feb 2025