Canoe Financial Renews At-The-Market Equity Program for Canoe EIT Income Fund

01 December 2020 - 3:53AM

Canoe EIT Income Fund (the “Fund”) (TSX: EIT.UN) (TSX: EIT.PR.A)

(TSX: EIT.PR.B) is pleased to announce that it is renewing its

at-the-market equity program (the “ATM Program”) that currently

allows the Fund to issue up to $200,000,000 of units of the Fund

(the “Units”) to the public from time to time, at the discretion of

Canoe Financial LP (the “Manager”). Any ATM Program Units issued

will be sold at the prevailing market price at the time of sale

through the Toronto Stock Exchange (the “TSX”) or any other

marketplace in Canada on which the Units are listed, quoted or

otherwise traded.

The volume and timing of distributions under the

ATM Program, if any, will be determined at the Manager’s sole

discretion. The ATM Program will be effective until December 25,

2022 unless terminated prior to such date by the Fund. The Fund

intends to use the proceeds from the ATM Program in accordance with

the Fund’s investment objectives and strategies, subject to the

Fund’s investment restrictions.

The Fund’s regular monthly distribution of $0.10

per Unit remains unchanged. The Fund has maintained the $0.10 per

Unit monthly distribution since August 2009, through varying market

conditions. The Fund’s annual voluntary redemption feature for

unitholders also remains unchanged.

Sales of the Units through the ATM Program will

be made pursuant to the terms of an equity distribution agreement

dated November 27, 2020 with National Bank Financial Inc. (the

“Agent”).

Sales of Units will be made by way of

“at-the-market distributions” as defined in National Instrument

44-102 Shelf Distributions on the TSX or on any marketplace for the

Units in Canada. Since the Units will be distributed at prevailing

market prices at the time of the sale, prices may vary among

purchasers during the period of distribution. In order to ensure

that the price at which the Units are sold under the ATM Program is

at least equal to the most recent net asset value per Unit, the

Manager may make voluntary cash contributions per Unit to the Fund

depending on the price at which Units are sold during the period of

any distribution. The ATM Program is being offered pursuant to a

prospectus supplement dated November 27, 2020 to the Fund’s short

form base shelf prospectus dated November 25, 2020. Copies of the

prospectus supplement and the short form base shelf prospectus may

be obtained from your registered financial advisor using the

contact information for such advisor, or from representatives of

the Agent, and are available on SEDAR at www.sedar.com.

The Units have not been, nor will be, registered

under the United States Securities Act of 1933, as amended, or any

state securities laws and may not be offered or sold in the United

States or to U.S. persons absent registration or applicable

exemption from the registration requirement of such Act and

applicable state securities laws. This news release shall not

constitute an offer to sell, or the solicitation of an offer to

buy, nor shall there be any sale of these securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to qualification under the securities laws of any

such jurisdiction.

About Canoe EIT

Income Fund

Canoe EIT Income Fund is one of Canada’s largest

closed-end investment funds, designed to maximize monthly

distributions and capital appreciation by investing in a broadly

diversified portfolio of high quality securities. The Fund is

listed on the TSX under the symbols EIT.UN, EIT.PR.A and EIT.PR.B,

and is actively managed by Robert Taylor, Senior Vice President and

Portfolio Manager, Canoe Financial.

About Canoe Financial

Canoe Financial is one of Canada’s fastest

growing independent mutual fund companies managing over $8.5

billion in assets across a diversified range of award-winning

investment solutions. Founded in 2008, Canoe Financial is an

employee-owned investment management firm focused on building

financial wealth for Canadians. Canoe Financial has a significant

presence across Canada, including offices in Calgary, Toronto and

Montreal.

For further information, please

contact:Investor Relations

1-877-434-2796www.canoefinancial.cominfo@canoefinancial.com

Forward Looking Statement:

Certain statements included in this news release constitute forward

looking statements which reflect Canoe Financial LP’s current

expectations regarding future results or events. Words such as

“may,” “will,” “should,” “could,” “anticipate,” “believe,”

“expect,” “intend,” “plan,” “potential,” “continue” and similar

expressions have been used to identify these forward-looking

statements. In addition, any statement regarding future

performance, strategies, prospects, action or plans is also a

forward-looking statement. Market predictions and forward-looking

statements are subject to known and unknown risks and uncertainties

and other factors that may cause actual results, performance,

events, activity and achievements to differ materially from those

expressed or implied by such statements. Forward looking statements

involve significant risks and uncertainties and a number of factors

could cause actual results to materially differ from expectations

discussed in the forward looking statements including, but not

limited to, changes in general economic and market conditions and

other risk factors. Although the forward-looking statements are

based on what Canoe Financial LP believes to be reasonable

assumptions, we cannot assure that actual results will be

consistent with these forward-looking statements. Investors should

not place undue reliance on forward-looking statements. These

forward-looking statements are made as of the current date and we

assume no obligation to update or revise them to reflect new events

or circumstances.

The Fund makes monthly distributions of an

amount comprised in whole or in part of return of capital (ROC) of

the net asset value per Unit. A ROC reduces the amount of your

original investment and may result in the return to you of the

entire amount of your original investment. ROC that is not

reinvested will reduce the net asset value of the Fund, which could

reduce the Fund’s ability to generate future income. You should not

draw any conclusions about the Fund’s investment performance from

the amount of this distribution.

Commissions, trailing commissions, management

fees and expenses all may be associated with investment funds.

Please read the information filed about the Fund on www.sedar.com

before investing. Investment funds are not guaranteed and past

performance may not be repeated.

This communication is not to be construed as a

public offering to sell, or a solicitation of an offer to buy

securities. Such an offer can only be made by way of a prospectus

or other applicable offering document and should be read carefully

before making any investment. This release is for information

purposes only. Investors should consult their Investment Advisor

for details and risk factors regarding specific strategies and

various investment products.

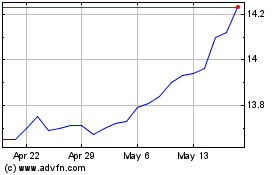

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024