Canoe Financial LP announces approval of changes to certain mutual funds

11 June 2024 - 6:30AM

Canoe Financial LP (“Canoe Financial”) today announced unitholder

approval to proceed with changes to Canoe Premium Income Fund (the

“Fund”) as previously announced on March 28, 2024. Canoe Financial

also announced a change in sub-advisor for Canoe Global Income Fund

and Canoe Global Income Portfolio Class (collectively, “Global

Income Funds”).

Changes to Canoe Premium Income

Fund

Effective after the close of business on or about

June 20, 2024, the investment objective of Canoe Premium Income

Fund will be to generate income and long-term capital growth by

primarily writing put options, investing in equity securities,

and/or writing call options on these equities. The Fund will seek

to achieve its objectives by primarily writing cash covered put

options on North American equities, as well as investing in a

diversified portfolio of North American equities, writing covered

calls, and employing other options strategies.To better align with

the new investment objective:

- The Fund will be renamed Canoe Premium Yield Fund; and

- The Fund’s investment strategies will have a greater focus on

generating premiums from writing put options.

The Fund will continue to be managed by Steve

DiGregorio, Vice President & Portfolio Manager, and the Fund’s

risk rating will remain low/medium. Full details of changes to the

Fund can be found in a management information circular available on

www.sedarplus.ca.

Changes to Canoe Global Income Fund and

Canoe Global Income Portfolio Class

The Global Income Funds’ current sub-advisor Aegon

Asset Management, will be replaced with Reams Asset Management

(“Reams”) on or about August 1, 2024. Reams manages fixed income

assets for a broad group of institutional investors and is the

sub-advisor for Canoe Unconstrained Bond Fund and Canoe

Unconstrained Bond Portfolio Class. Reams was established in 1981

and is headquartered in Indianapolis. As of March 31, 2024, Reams

managed US $26.7 billion in assets.

About Canoe Financial

Canoe Financial is one of Canada’s fastest growing

independent mutual fund companies managing over $16 billion in

assets across a diversified range of award-winning investment

solutions. Founded in 2008, Canoe Financial is an employee-owned

investment management firm focused on building financial wealth for

Canadians. Canoe Financial has a significant presence across

Canada, including offices in Calgary, Toronto and Montreal.

About Reams Asset Management

Reams Asset Management, founded in 1981, is a fixed

income investment management firm whose mission is to provide

high-quality investment expertise and unmatched client service. We

apply our consistent investment process across a range of

strategies, seeking to take advantage of volatility and react

opportunistically to price and valuation dislocations in the bond

market. Reams offers clients customized solutions that seek to

maximize risk-adjusted total returns over a full market cycle and

across a range of fixed income strategies. Reams Asset Management

is a division of Scout Investments.

Further informationInvestor

RelationsCanoe Financial

LP1–877–434–2796info@canoefinancial.com

Commissions, trailing commissions, management fees

and expenses all may be associated with mutual fund investments.

Please read the prospectus before investing. The indicated rates of

return are the historical annual compounded total returns including

changes in unit value and reinvestment of all distributions and do

not take into account sales, redemption, distribution or optional

charges or income taxes payable by any unitholder that would have

reduced returns. Mutual funds are not guaranteed, their values

change frequently, and past performance may not be repeated.

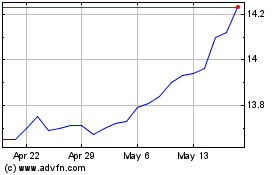

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Canoe EIT Income (TSX:EIT.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024