Goodfood Market Corp. (“

Goodfood” or the

“

Company”) (TSX: FOOD) is pleased to announce that

it has closed an offering (the “

Offering”) of

$12,675,000 aggregate principal amount of 12.5% convertible

unsecured subordinated debentures of the Company

(the “

Debentures”) due February 6, 2028

(the “

Maturity Date”), at a price of $1,000

per $1,000 principal amount of Debentures, by way of non-brokered

private placement. The total investment consists of $10 million

from Investissement Québec and $2.675 million from management,

Board members and existing shareholders.

“We are pleased to partner with Investissement

Québec to bolster Goodfood’s balance sheet and achieve our path to

profitability and positive cash flows. With the capital raised, we

will continue to execute the final steps of our profitable growth

plan and deliver more delicious Goodfood products to Canadians,”

said Jonathan Ferrari, Chief Executive Officer of Goodfood. “As our

target cost structure is now nearly in place, we are transitioning

our focus to growing the Goodfood brand in Quebec and across the

country and we are thrilled to count on a partner such as

Investissement Québec in our next growth phase. We are also proud

to highlight the commitment of our management team, board and

existing shareholders who are participating in this financing to

the tune of $2.675 million,” concluded Mr. Ferrari.

"Investissement Québec is proud to support

innovative Québec companies like Goodfood in order to propel their

growth," says Bicha Ngo, Senior Executive Vice-President, Private

Equity, Investissement Québec.

The Debentures will be convertible at the

holder’s option into Goodfood common shares (the “Common

Shares”) at a conversion price of $0.75 per Common Share.

The Debentures will bear interest at a rate of 12.5% per annum. The

interest portion for the period commencing on the issuance date and

ending in February 2025 will be capitalized semi-annually and

convertible at a price equal to the volume weighted average trading

price of the Common Shares on the TSX for the five (5) consecutive

trading days ending on the date on which such interest portion

becomes due, plus a premium of 50%. As of February 6 2025 and until

the Maturity Date, the interest portion will be payable

semi-annually in cash. As of February 6 2026, Goodfood may

repurchase the non-converted portion of a Debenture at an amount of

the principal and accrued interest plus an amount providing the

holder with an internal rate of return (IRR) equal to 18% for the

period during which such Debenture will have been outstanding. The

holders may require a repurchase on the same terms upon a change of

control of the Company.

The Debentures will be direct, subordinated

unsecured obligations of the Company, subordinated to any senior

indebtedness of the Company, including the Company's credit

facility, and ranking equally with one another and with all other

existing and future subordinated unsecured indebtedness of the

Company to the extent subordinated on the same terms. The Company

intends to use the net proceeds from the Offering to complete

Project Blue Ocean initiatives and for general corporate

purposes.

Jonathan Ferrari, Neil Cuggy, John Khabbaz and

Donald Olds, all directors and/or officers of the Company, have

purchased, indirectly, an aggregate of $2,425,000 principal amount

of Debentures under the Offering. Their participation is considered

to be a “related party transaction” as defined in Regulation 61-101

respecting Protection of Minority Security Holders in Special

Transactions (“MI 61-101”). The participation of

such insiders is exempt from the formal valuation and minority

shareholder approval requirements of MI 61-101 as neither the fair

market value of the securities issued to such insiders nor the

consideration for such securities exceeds 25% of the Company’s

market capitalization. The Company did not file a material change

report 21 days prior to closing of the Offering as the details of

the participation of insiders of the Company in the Offering had

not been confirmed at that time. The Offering, including the

insiders’ participation therein, has been approved by the board of

directors of the Company. Hamnett Hill, former director of the

Company, and President of edo Capital is also participating with an

investment of $250,000.

The Debentures offered, and the Common Shares

issuable on conversion, redemption or maturity thereof, have not

and will not be registered under the U.S. Securities Act of 1933,

as amended (the “1933 Act”), and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements under the

1933 Act. This press release does not constitute an offer to sell

or a solicitation of any offer to buy Debentures or Common Shares

in the United States.

About Goodfood

Goodfood (TSX: FOOD) is a leading digitally

native meal solutions brand in Canada, delivering fresh meals and

add-ons that make it easy for customers from across Canada to enjoy

delicious meals at home every day. The Goodfood team is building

Canada’s most loved millennial food brand, with the mission to

create experiences that spark joy and help our community live

longer on a healthier planet. Goodfood customers have access to

uniquely fresh and delicious products, as well as exclusive

pricing, made possible by its world class culinary team and

direct-to-consumer infrastructures and technology. We are

passionate about connecting our partner farms and suppliers to our

customers’ kitchens while eliminating food waste and costly retail

overhead. The Company’s administrative offices are based in

Montreal, Québec, with production facilities located in the

provinces of Quebec and Alberta.

About Investissement Québec

Investissement Quebec's mission is to play an

active role in Quebec's economic development by stimulating

business innovation, entrepreneurship and business acquisitions, as

well as growth in investment and exports. Operating in all of the

province's administrative regions, the Corporation supports the

creation and growth of businesses of all sizes with investments and

customized financial solutions. It also assists businesses by

providing consulting services and other support measures, including

technological assistance available from Investissement Québec –

CRIQ. In addition, through Investissement Québec International, the

Corporation prospects for talent and foreign investment, and

assists Quebec businesses with export activities.

|

FURTHER INFORMATION: |

|

|

Investors |

Media |

| Jonathan RoiterChief Financial

Officer (855) 515-5191 IR@makegoodfood.ca |

Roslane AouameurVice President,

Corporate Development(855) 515-5191media@makegoodfood.ca |

FORWARD-LOOKING STATEMENTS

This press release contains “forward-looking

information” within the meaning of applicable Canadian securities

legislation. Such forward-looking information includes, but is not

limited to, information with respect to our objectives and the

strategies to achieve these objectives, as well as information with

respect to our beliefs, plans, expectations, anticipations,

assumptions, estimates and intentions, including, without

limitation, statements concerning the anticipated use of net

proceeds from the Offering. This forward-looking information is

identified by the use of terms and phrases such as “may”, “would”,

“should”, “could”, “expect”, “intend”, “estimate”, “anticipate”,

“plan”, “foresee”, “believe”, and “continue”, as well as the

negative of these terms and similar terminology, including

references to assumptions, although not all forward-looking

information contains these terms and phrases. Forward-looking

information is provided for the purposes of assisting the reader in

understanding the Company and its business, operations, prospects,

and risks at a point in time in the context of historical trends,

current condition and possible future developments and therefore

the reader is cautioned that such information may not be

appropriate for other purposes. Forward-looking information is

based upon a number of assumptions and is subject to a number of

risks and uncertainties, many of which are beyond our control,

which could cause actual results to differ materially from those

that are disclosed in, or implied by, such forward-looking

information. These risks and uncertainties include, but are not

limited to, risks related to the Offering and the following risk

factors which are discussed in greater detail under “Risk Factors”

in the Company’s Annual Information Form for the 52 weeks ended

September 3, 2022 available on SEDAR at www.sedar.com: limited

operating history, negative operating cash flow and net losses,

going concern risk, food industry including current industry

inflation levels, COVID-19 pandemic impacts and the appearance of

COVID variants, quality control and health concerns, regulatory

compliance, regulation of the industry, public safety issues,

product recalls, damage to Goodfood’s reputation, transportation

disruptions, storage and delivery of perishable foods, product

liability, unionization activities, consolidation trends, ownership

and protection of intellectual property, evolving industry,

reliance on management, failure to attract or retain key employees

which may impact the Company’s ability to effectively operate and

meet its financial goals, factors which may prevent realization of

growth targets, inability to effectively react to changing consumer

trends, competition, availability and quality of raw materials,

environmental and employee health and safety regulations, the

inability of the Company’s IT infrastructure to support the

requirements of the Company’s business, online security breaches,

disruptions and denial of service attacks, reliance on data

centers, open source license compliance, future capital

requirements, operating risk and insurance coverage, management of

growth, limited number of products, conflicts of interest,

litigation, catastrophic events, risks associated with payments

from customers and third parties, being accused of infringing

intellectual property rights of others and, climate change and

environmental risks. This is not an exhaustive list of risks that

may affect the Company’s forward-looking statements. Other risks

not presently known to the Company or that the Company believes are

not significant could also cause actual results to differ

materially from those expressed in its forward-looking statements.

Although the forward-looking information contained herein is based

upon what we believe are reasonable assumptions, readers are

cautioned against placing undue reliance on this information since

actual results may vary from the forward-looking information.

Certain assumptions were made in preparing the forward-looking

information concerning the availability of capital resources,

business performance, market conditions, and customer demand. In

addition, net sales and operating results could be impacted by

changes in the overall economic condition in Canada and by the

continuing inflationary pressures and by the impact these

conditions could have on consumer discretionary spending. Fears of

a looming recession, increases in interest rates, uncertainty

surrounding the COVID-19 pandemic, continuing supply chain

disruptions, increased input costs are expected to have a

continuing significant impact on our economic condition that could

materially affect our financial condition, results of operations

and cash flows. Consequently, all of the forward-looking

information contained herein is qualified by the foregoing

cautionary statements, and there can be no guarantee that the

results or developments that we anticipate will be realized or,

even if substantially realized, that they will have the expected

consequences or effects on our business, financial condition or

results of operation. Unless otherwise noted or the context

otherwise indicates, the forward-looking information contained

herein is provided as of the date hereof, and we do not undertake

to update or amend such forward-looking information whether as a

result of new information, future events or otherwise, except as

may be required by applicable law.

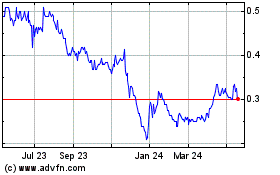

Goodfood Market (TSX:FOOD)

Historical Stock Chart

From Dec 2024 to Jan 2025

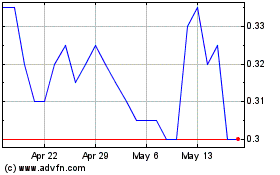

Goodfood Market (TSX:FOOD)

Historical Stock Chart

From Jan 2024 to Jan 2025