Former steel fabrication plant with buildings

and facilities to materially reduce capital costs

Fortune Minerals Limited (TSX: FT) (OTCQB: FTMDF)

(“Fortune” or the “Company”)

(www.fortuneminerals.com) is pleased to announce that it has

entered into an option agreement with JFSL Field Services ULC

(“JFSL”), a wholly-owned subsidiary of a large international

engineering company, to purchase its former steel fabrication

plant, located in Lamont County within Alberta’s Industrial

Heartland northeast of Edmonton. Pursuant to the agreement, Fortune

will have six months to carry out additional due-diligence and

complete the purchase of the JFSL facility for C$5.5 million.

Fortune intends to acquire this brownfield site in order to

construct the hydrometallurgical refinery for the planned NICO

Cobalt-Gold-Bismuth-Copper mine in the Northwest Territories

(“NWT”). The proposed refinery would process concentrates

from the mine and produce cobalt sulphate for the rapidly expanding

lithium-ion rechargeable battery industry and their use in electric

vehicles (“EV’s”), portable electronic devices, and

stationary storage cells to make electricity use more efficient. In

addition to cobalt, the unique mineral assemblage of the NICO

deposit includes a highly liquid 1.1 million ounce in-situ gold

co-product, 12% of global bismuth reserves, and copper. The

vertically integrated NICO development (“NICO Project”)

would provide a reliable North American source of three Critical

Minerals produced responsibly with Canadian environmental-social

governance (“ESG”) values that are essential to support the

transformation to new technologies and the growing green

economy.

Like our news? Click-to-tweet.

"Cobalt, lithium and nickel are all minerals with huge demand in

the modern world. Fortune’s new refinery is exactly the type of job

creating, diversifying investment we envisioned with our mineral

strategy and action plan.” Jason Kenney, Premier of

Alberta

“Fortune Minerals’ new facility will add to Alberta’s mineral

refining capacity and will bring exciting economic opportunities to

the province. Alberta’s mineral strategy and action plan

capitalizes on our untapped potential and helps meet demand for the

critical and rare earth minerals which are essential to supporting

a low-carbon economy. Fortune Minerals’ investment announcement

demonstrates that our strategy is working. Our province has the

experienced workforce, and the necessary infrastructure to support

continued growth in the minerals sector, and there is no better

place for a new Critical Minerals refinery than Alberta’s

Industrial Heartland.” Sonya Savage, Minister of Energy,

Government of Alberta

“I am pleased to see continued investment and diversification in

the Industrial Heartland with Fortune Minerals’ plan to establish a

new cobalt refinery which will also have the future potential to

recycle metals from post-consumer batteries from across Alberta.

This project will create well-paid jobs for Albertans and continued

prosperity for my constituency.” Jackie Armstrong-Homeniuk, MLA

for Fort Saskatchewan-Vegreville

“The planned NICO Project in Alberta’s Industrial

Heartland supports our region’s robust diversification efforts and

highlights our value proposition for companies looking to execute

their capital growth strategies, develop new technologies and

advance their ESG priorities. Fortune Minerals’ innovative vision

and metallurgical process technology for the NICO Refinery will

promote further energy supply chain integration within North

America, solidifying Alberta and Alberta’s Industrial Heartland as

a critical jurisdiction for Canada’s energy future.” Mark

Plamondon, Executive Director of Alberta’s Industrial Heartland

Association

“More economic growth and diversification in Alberta’s energy

and tech sectors shows our competitive edge in action. This

includes access to highly skilled labour, resources, and

transportation links from Alberta’s globally recognized Industrial

Heartland and combined with our business-friendly environment

thanks to the Alberta tax advantage and a streamlined regulatory

framework.” Rick Christiaanse, CEO of Invest Alberta

Corporation

Refinery Site

The JFSL facility is situated on 76.78 acres of land adjacent to

the Canadian National Railway (“CN Rail”) in Alberta’s

Industrial Heartland, an association of five municipalities

northeast of Edmonton with planning approvals and tax incentives

designed to attract heavy industry. This former steel fabrication

plant includes site improvements and more than 40,000 square feet

of serviced shops and buildings that are anticipated to materially

reduce capital costs for the planned NICO Project development.

Key Site Attributes

- Brownfield location in the Edmonton area with geographic

synergies to the NICO mine in the NWT and existing facilities that

can be integrated into the planned refinery

- Aligns with key Canadian and Alberta government policy

objectives for western economic diversification, value-added

processing in Canada, and greater domestic participation in the

North American Critical Minerals supply chain for battery materials

and EV’s

- Complements the Alberta Government Mineral Resource Development

Act and the objectives identified in the new minerals strategy and

action plan

- Supports the Canada–U.S. Joint Action Plan on Critical Minerals

Collaboration

- Lowest combined federal and provincial tax rate in Canada

- Indicative interest from federal and provincial governments for

financial support

- Industrial Heartland planning approvals to attract heavy

industry and municipal tax incentives keyed to capital

investment

- Access to CN Rail and intermodal transportation hubs to receive

concentrate, reagents and other plant feeds, to ship products, and

facilitate future diversification into the recycling business

- Local services and utilities including power, natural gas,

process and potable water, and a third party-owned site to dispose

of the process residue

- Proximity to primary reagent suppliers including lime and

acid

- Commutable pool of engineers, trades and skilled labour to

construct and operate the refinery

- Proximity to other Critical Minerals sources and process

facilities to enable geographic vertical integration of the

Canadian battery materials supply chain and attract investment in

downstream industries

NICO Project

The NICO Project is comprised of a planned open pit and

underground mine and mill in Canada’s NWT and a related

hydrometallurgical refinery in Alberta. Fortune has expended more

than C$135 million to advance the NICO Project from an in-house

discovery to a near-term Critical Minerals producer. The Company

has received environmental assessment approval and the Type “A”

Water License to construct and operate the NICO mine and

concentrator. The recent completion of the Tlicho highway to the

community of Whati is a key enabler for the NICO development. This

C$213 million, 97-kilometre, public, all-season road, together with

the spur road Fortune plans to construct, will allow metal

concentrates to be trucked from the mine to the rail head at Hay

River or Enterprise, NWT for railway delivery to the Company’s

planned refinery in Alberta. An important economic attribute of

NICO ores is a high concentration ratio from simple flotation,

which allows the mill feed to be reduced to ~4% of the original

mass for lower cost transportation and downstream processing of a

homogeneous sulphide concentrate at the refinery.

The NICO Project was assessed in a positive Feasibility Study in

2014 by Micon International Limited that demonstrated an attractive

rate of return for the development. Key economic metrics at that

time were capital costs of ~C$600 million, including ~C$250 million

for the refinery, annual revenues of ~C$200 million, C$100 million

in EBITDA, 50% margins, and a negative cash cost for cobalt net of

by-product credits. These estimates will be updated to reflect

current costs, escalation, and revised commodity prices after

completion of the refinery site purchase and incorporation of other

project optimizations that Fortune has recognized to produce a more

financially robust project.

The NICO development is anticipated to have direct employment

for 250 workers at the mine and an additional 100 jobs at the

refinery. Indirect jobs are expected to be double the direct jobs

using a standard 2:1 industry employment multiplier. The economic

spinoffs for the refinery would be greater if the refinery

processes additional feed sources and recycled materials and/or the

region attracts investment from the battery and automotive

industries.

For more detailed information about the NICO Mineral Reserves

and certain technical information in this news release, please

refer to the Technical Report on the NICO Project, entitled

"Technical Report on the Feasibility Study for the

NICO-Gold-Cobalt-Bismuth-Copper Project, Northwest Territories,

Canada", dated April 2, 2014 and prepared by Micon International

Limited which has been filed on SEDAR and is available under the

Company's profile at www.sedar.com.

The disclosure of scientific and technical information contained

in this news release has been approved by Robin Goad, M.Sc.,

P.Geo., President and Chief Executive Officer of Fortune, who is a

"Qualified Person" under National Instrument 43-101.

Critical Minerals

The Canadian and United States governments have signed a Joint

Action Plan on Critical Mineral Collaboration to enable greater

North American production of minerals identified as critical to

economic and national security. Minerals considered critical for

this purpose have essential use in important industrial and defense

applications, cannot be easily substituted, and their supply chains

are threatened by geographic concentration of production and/or

geopolitical risks. Cobalt is an ‘Energy Metal’ and particularly

important Critical Mineral due to its consumption in lithium-ion

batteries. It is also consumed in aerospace, magnet and cutting

tool alloys, and pigments and catalysts needed in chemical

processes. The cobalt market is currently more than 150,000 tonnes

of refined metal, although analysts project that consumption will

grow to between 300,000 and 400,000 tonnes by the end of this

decade, primarily due to demand from EV’s. More than 70% of cobalt

mine production is currently sourced from the Democratic Republic

of the Congo, more than half of which is controlled by Chinese

state-owned corporations. China also controls 68% of refinery

production and 80% of cobalt chemical supply.

Bismuth is also identified as a Critical Mineral with unique

properties, including a low melting temperature, high density and

it expands when cooled, properties that are leveraged by the

automotive industry for glass frits, anti-corrosion coatings and

metallic paints and pigments. Bismuth is also non-toxic and has

anti-bacterial properties making it ideal for use in

pharmaceuticals such as Pepto-Bismol® and some medical devices. The

bismuth market is approximately 20,000 tonnes per annum, but has

growing demand as an ‘Eco-Metal’ and environmentally safe

replacement for lead - in solder, galvanizing and brass alloys,

free-machining steel and aluminum, paint, glass, ceramic glazes,

cosmetics, solar voltaics, ammunition and fishing sinkers. Many of

these applications have been developed because of legislation

banning or restricting the use of toxic metals including lead.

China controls approximately 75% of current bismuth mine and

refinery production although the NICO deposit contains the World’s

largest known Mineral Reserve.

Additional North American production is needed to diversify the

supply chains for both cobalt and bismuth. Governments are

therefore supporting potential near-term producers and processors

to ensure availability of the key raw materials needed to sustain

domestic industries. Identification of the new refinery site was

one of the few remaining milestones needed to complete the NICO

Project development and solidify Fortune’s participation in the

geographic vertical integration of the North American battery

materials supply chain.

About Fortune Minerals:

Fortune is a Canadian mining company focused on developing the

NICO Cobalt-Gold-Bismuth-Copper Project in the NWT and Alberta.

Fortune also owns the satellite Sue-Dianne Copper-Silver-Gold

Deposit located 25 km north of the NICO Deposit and is a potential

future source of incremental mill feed to extend the life of the

NICO mill and concentrator.

Follow Fortune Minerals: Click here to subscribe to

Fortune’s email list.

Click here to follow Fortune on LinkedIn.

@FortuneMineral on Twitter.

This press release contains forward-looking information and

forward-looking statements within the meaning of applicable

securities legislation. This forward-looking information includes

statements with respect to, among other things, the exercise of the

option by the Company and the purchase of the JSFL site, the

construction of the proposed hydrometallurgical refinery at the

JSFL site, the potential for expansion of the NICO Deposit and the

Company’s plans to develop the NICO Project. Forward-looking

information is based on the opinions and estimates of management as

well as certain assumptions at the date the information is given

(including, in respect of the forward-looking information contained

in this press release, assumptions regarding: the successful

completion of the Company’s due diligence investigations on the

JSFL site, the Company’s ability to secure the necessary financing

to fund the exercise of the option and complete the purchase of the

JSFL site, the Company’s ability to complete construction of a NICO

Project refinery; the Company’s ability to arrange the necessary

financing to continue operations and develop the NICO Project; the

receipt of all necessary regulatory approvals for the construction

and operation of the NICO Project and the related

hydrometallurgical refinery and the timing thereof; growth in the

demand for cobalt; the time required to construct the NICO Project;

and the economic environment in which the Company will operate in

the future, including the price of gold, cobalt and other

by-product metals, anticipated costs and the volumes of metals to

be produced at the NICO Project). However, such forward-looking

information is subject to a variety of risks and uncertainties and

other factors that could cause actual events or results to differ

materially from those projected in the forward-looking information.

These factors include the risks that the 2021 drill program may not

result in a meaningful expansion of the NICO Deposit, the COVID-19

pandemic may interfere with the Company’s ability to conduct the

drill program, the Company may not be able to complete the purchase

of the JSFL site and secure a site for the construction of a

refinery, the Company may not be able to finance and develop NICO

on favourable terms or at all, uncertainties with respect to the

receipt or timing of required permits, approvals and agreements for

the development of the NICO Project, including the related

hydrometallurgical refinery, the construction of the NICO Project

may take longer than anticipated, the Company may not be able to

secure offtake agreements for the metals to be produced at the NICO

Project, the Sue-Dianne Property may not be developed to the point

where it can provide mill feed to the NICO Project, the inherent

risks involved in the exploration and development of mineral

properties and in the mining industry in general, the market for

products that use cobalt or bismuth may not grow to the extent

anticipated, the future supply of cobalt and bismuth may not be as

limited as anticipated, the risk of decreases in the market prices

of cobalt, bismuth and other metals to be produced by the NICO

Project, discrepancies between actual and estimated Mineral

Resources or between actual and estimated metallurgical recoveries,

uncertainties associated with estimating Mineral Resources and

Reserves and the risk that even if such Mineral Resources prove

accurate the risk that such Mineral Resources may not be converted

into Mineral Reserves once economic conditions are applied, the

Company’s production of cobalt, bismuth and other metals may be

less than anticipated and other operational and development risks,

market risks and regulatory risks. Readers are cautioned to not

place undue reliance on forward-looking information because it is

possible that predictions, forecasts, projections and other forms

of forward-looking information will not be achieved by the Company.

The forward-looking information contained herein is made as of the

date hereof and the Company assumes no responsibility to update or

revise it to reflect new events or circumstances, except as

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220124005397/en/

For further information: Fortune Minerals Limited Troy

Nazarewicz Investor Relations Manager info@fortuneminerals.com Tel:

(519) 858-8188 www.fortuneminerals.com

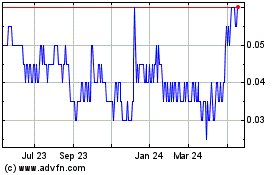

Fortune Minerals (TSX:FT)

Historical Stock Chart

From Dec 2024 to Jan 2025

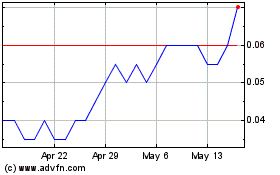

Fortune Minerals (TSX:FT)

Historical Stock Chart

From Jan 2024 to Jan 2025