Financial 15 Split Corp.: Successful Overnight Offering Completed

11 January 2014 - 1:27AM

Marketwired

Financial 15 Split Corp.: Successful Overnight Offering Completed

TORONTO, ONTARIO--(Marketwired - Jan 10, 2014) - Financial 15

Split Corp. (the "Company") is pleased to announce it has completed

the overnight marketing of up to 1,531,000 Preferred Shares and up

to 1,531,000 Class A Shares. Total proceeds of the offering are

expected to be approximately $30 million. The Company has granted

the dealers an overallotment of 229,650 units if exercised,

bringing the total proceeds to $34.5 million. The offering was

co-led by National Bank Financial Inc., CIBC World Markets Inc. and

RBC Capital Markets and also included BMO Nesbitt Burns Inc., GMP

Securities L.P. and Canaccord Genuity Corp. The sales period of

this overnight offering has now ended.

The Preferred Shares

were offered at a price of $10.00 per Preferred Share to yield

5.25% and the Class A Shares were offered at a price of $9.60 per

Class A Share to yield 15.71%. The closing price of each of the

Preferred Shares and the Class A Shares on January 9, 2014 on the

TSX was $10.08 and $10.23, respectively.

The proceeds of the

secondary offering, net of expenses and the underwriters' fee, will

be used by the Company to invest in a high quality portfolio

consisting of 15 financial services companies made up of Canadian

and U.S. issuers as follows:

| Bank

of Montreal |

|

National Bank of Canada |

Bank

of America Corp. |

|

|

|

|

| The

Bank of Nova Scotia |

|

Manulife Financial Corporation |

Citigroup Inc. |

|

|

|

|

|

Canadian Imperial Bank of Commerce |

|

Sun

Life Financial Services of Canada Inc. |

Goldman Sachs Group Inc. |

|

|

|

|

| Royal

Bank of Canada |

|

Great-West Lifeco Inc. |

JP

Morgan Chase & Co. |

|

|

|

|

| The

Toronto-Dominion Bank |

|

CI

Financial Corp. |

Wells

Fargo & Co. |

The Company's

investment objectives are:

Preferred

Shares:

- to provide holders of the Preferred Shares with fixed,

cumulative preferential monthly cash dividends in the amount of

$0.04375 per Preferred Share to yield 5.25% per annum on the

original issue price; and

- on or about the termination date, currently December 1, 2015

(the "Termination Date"), to pay the holders of the Preferred

Shares $10.00 per Preferred Share, which was the original issue

price of the Preferred Shares.

Class A Shares:

- to provide holders of the Class A Shares with regular monthly

cash dividends initially targeted to be $0.10 per Class A Share to

yield 8.0% per annum on the original issue price of the Class A

Shares, and currently targeted to be $0.1257 per Class A

Share;

- on or about Termination Date, to pay the holders of Class A

Shares $15.00 per Class A Share, which was the original issue price

of the Class A Shares.

The Company will

today file an amended and restated short form preliminary

prospectus in each of the provinces of Canada with respect to the

offering. The offering is only made by prospectus. The prospectus

contains detailed information about securities being offered. A

copy of the amended and restated preliminary short form prospectus

is available from one of the syndicate members listed above.

Investors should read the prospectus before making an investment

decision.

Commissions,

trailing commissions, management fees and expenses all may be

associated with mutual fund investments. Investors should read the

prospectus before investing. Mutual funds are not guaranteed, their

values change frequently and past performance may not be

repeated.

Financial 15 Split Corp.Investor Relations416-304-4443 or Toll

free at 1-877-4-Quadra (1-877-478-2372)www.financial15.com

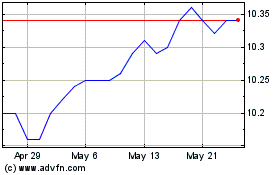

Financial 15 Split (TSX:FTN.PR.A)

Historical Stock Chart

From Oct 2024 to Nov 2024

Financial 15 Split (TSX:FTN.PR.A)

Historical Stock Chart

From Nov 2023 to Nov 2024