Gran Tierra Energy Inc.

(“

Gran Tierra”

or

the “

Company”

) (NYSE

American:GTE)(TSX:GTE)(LSE:GTE) today announced an

operational and financial update. All dollar amounts are in

United States dollars, and production amounts are on an average

working interest before royalties (“

WI”) basis

unless otherwise indicated. Per barrel (“

bbl”) and

bbl per day (“

BOPD”) amounts are based on WI sales

before royalties.

Message to Shareholders

Gary Guidry, President and Chief Executive

Officer of Gran Tierra, commented: “We are pleased to announce that

we started returning value to shareholders via share buybacks

during the third quarter of 2022 (“the Quarter”).

In addition to the share buybacks, we are equally as excited to

have started buying back some of our bonds in the open market to

strengthen our balance sheet.

During the Quarter, we commenced our enhanced

oil recovery (“EOR”) polymer injection project in

the Acordionero field. This pilot injection test is a milestone

after several years of laboratory and modeling indicated the

suitability of Acordionero for EOR. We continue to see strong

performance from our all of our waterfloods and development

drilling programs.

On the exploration front, we progressed on

several prospects during the Quarter. Our Gaitas-1 well in the

Middle Magdalena Valley is currently on production and a second,

deeper exploration well in the field is being planned for the

fourth quarter of 2022. In Ecuador, the Bocachico-1 exploration

well was cased and has commenced a 3-reservoir testing program. In

the Putumayo Basin of Colombia, our Rose-1 well showed encouraging

results while drilling and is currently being cased for

testing.”

Operations Update:

- Production

- Gran Tierra’s

total average production was approximately 30,391 BOPD during the

Quarter, which was 5% higher compared to the third quarter of 2021

and approximately flat with the second quarter of 2022.

- The Company’s

fourth quarter-to-date 2022 total average production(1) has been

approximately 32,000 BOPD.

-

Suroriente

- During the

Quarter, Suroriente experienced occasional disruptions due to

temporary localized blockades. The impact of these blockades

lowered the Company’s total average production for the Quarter by

approximately 920 BOPD.

- Ecuador

Exploration:

- Oriente

Basin: In the Chanangue Block, Gran Tierra has finished

drilling the Bocachico-1 exploration well and run production casing

to a total depth of 10,815 feet (“ft”) measured

depth. The Company plans to test three potential oil zones in the

Basal Tena, U Sand, and T Sand, over the next several weeks, as

identified by petrophysical log analysis. The T Sand was perforated

over 23.5 ft of reservoir and placed on jet pump. The well is still

cleaning up and over the last 24 hour flow period (October 9-10,

2022), it has produced at stabilized rates of 345 BOPD of 34 degree

API gravity oil, 141 bbl of water per day (“BWPD”)

and 133 thousand standard cubic feet of gas per day

(“MCFD”). The Company plans to complete a pressure

build up test to assess if there is any reservoir damage in the T

Sand and to then test the U Sand and Basal Tena immediately after

the pressure build up. After testing the U Sand and Basal Tena, the

Company plans on returning to the T Sand for further production

testing.

- Oriente

Basin: In the Charapa Block, the Company spud its second

2022 exploration well in Ecuador, the Charapa Norte-1 exploration

well, on October 5, 2022. This well is expected to reach its

planned total depth in approximately 28 days.

- Colombia

Exploration:

- Middle

Magdalena Valley Basin:

- Gran Tierra

drilled and completed the Gaitas-1 exploration well in July-August

2022, and the well has been on production test from the Lisama

Formation, which is the same producing formation at the Acordionero

oil field. Gaitas-1 is located approximately 7 kilometers south of

Acordionero’s Southwest Pad. During the last week, Gaitas-1 has

produced at stabilized average rates of 171 BOPD (17 degree API

gravity oil), 652 BWPD and 2 MCFD.

- Based on the

encouraging results of Gaitas-1, Gran Tierra plans to spud the

Gaitas-2 exploration well with a projected spud date later in the

fourth quarter 2022. The Company expects Gaitas-2 to target

multiple reservoir zones in a structurally higher location than the

Gaitas-1 well, in a planned effort to test the deeper Umir Sands

further away from possible oil-water contacts.

- Putumayo

Basin: In the ALEA-1848A Block, Gran Tierra has finished

drilling the Rose-1 exploration well and is currently running

production casing in order to test the well.

Financial Update:

- Share

Buybacks:

-

NCIB: On August 29, 2022, Gran Tierra announced

via press release that the Toronto Stock Exchange

(“TSX”) had approved its notice of intention to

make a normal course issuer bid (the “NCIB”) for

its shares of common stock (the “shares”).

Pursuant to the NCIB, the Company will be able to purchase up to

36,033,969 shares for cancellation, representing 10% of Gran

Tierra’s public float, for a one-year period commencing on

September 1, 2022, and ending on August 31, 2023. The aggregate

purchase price under the NCIB shall not exceed $37.5 million

without further consideration of and approval by Gran Tierra’s

board of directors.

- Share

Buybacks: Pursuant to the NCIB, as of September 30, 2022,

Gran Tierra had purchased approximately 10.8 million shares,

representing about 2.9% of shares outstanding, for a total purchase

price of $14.4 million at an average price of approximately $1.34

per share.

- Bond Buybacks:

- As part of Gran

Tierra’s ongoing commitment to reduce its net debt(2), during

September 2022, the Company bought back approximately $20.1 million

in face value of Gran Tierra’s 6.25% senior notes due February 2025

(the “2025 bonds”), representing approximately

6.7% of the outstanding 2025 bonds.

- The cost of the

2025 bonds’ buyback was approximately $17.3 million, representing a

discount of about 14% to the face value of the 2025 bonds.

- Gran Tierra

intends to hold the 2025 bonds which it has bought back on the

Company’s balance sheet.

- Purchasing the

bonds reflects a savings of $3.0 million in interest expense that

would have been paid over the remaining term to the maturity of the

2025 bonds.

- Cash and Net

Debt(2):

- As of September

30, 2022, Gran Tierra had approximately $118 million in cash on its

balance sheet and net debt(2) of approximately $462 million (net of

the buyback of 2025 bonds described above).

- Gran Tierra’s

new credit facility with Trafigura of up to $150 million remains

undrawn.

(1) Gran Tierra’s fourth quarter-to-date 2022

total Company average production is for the 9-day period of October

1-9, 2022.(2) Net debt is a non-GAAP measure and does not have

standardized meanings under generally accepted accounting

principles in the United States of America

(“GAAP”). Refer to “Non-GAAP Measures” in this

press release for descriptions of these non-GAAP measures and,

where applicable, reconciliations to the most directly comparable

measures calculated and presented in accordance with GAAP.

Corporate Presentation:

Gran Tierra’s Corporate Presentation has been

updated and is available on the Company website at

www.grantierra.com.

Contact Information

For investor and media inquiries please

contact:

Gary Guidry President & Chief Executive

Officer

Ryan Ellson Executive Vice President & Chief

Financial Officer

Rodger Trimble Vice President, Investor

Relations

+1-403-265-3221

info@grantierra.com

About Gran Tierra Energy

Inc.

Gran Tierra Energy Inc. together with its

subsidiaries is an independent international energy company

currently focused on oil and natural gas exploration and production

in Colombia and Ecuador. The Company is currently developing its

existing portfolio of assets in Colombia and Ecuador and will

continue to pursue additional growth opportunities that would

further strengthen the Company’s portfolio. The Company’s common

stock trades on the NYSE American, the Toronto Stock Exchange and

the London Stock Exchange under the ticker symbol GTE. Additional

information concerning Gran Tierra is available at

www.grantierra.com. Information on the Company’s website (including

the Corporate Presentation referenced above) does not constitute a

part of this press release. Investor inquiries may be directed to

info@grantierra.com or (403) 265-3221.

Gran Tierra’s U.S. Securities and Exchange

Commission (“SEC”) filings are available on the SEC website at

www.sec.gov. The Company’s Canadian securities regulatory filings

are available on SEDAR at www.sedar.com and UK regulatory filings

are available on the National Storage Mechanism (“the NSM”) website

at https://data.fca.org.uk/#/nsm/nationalstoragemechanism. Gran

Tierra's filings on the SEC, SEDAR and the NSM websites are not

incorporated by reference into this press release.

Forward Looking Statements and Legal

Advisories:

This press release contains opinions, forecasts,

projections, and other statements about future events or results

that constitute forward-looking statements within the meaning of

the United States Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, and

financial outlook and forward-looking information within the

meaning of applicable Canadian securities laws (collectively,

“forward-looking statements”). The use of the words “expect,”

“plan,” “can,” “will,” “should,” “guidance,” “forecast,” “signal,”

“progress,” and “believes,” derivations thereof and similar terms

identify forward-looking statements. In particular, but without

limiting the foregoing, this press release contains forward-looking

statements regarding: the Company’s expected future production

(including as a result of our testing results), the Company’s

drilling program, the Company’s potential debt repayments and share

repurchases, and its positioning for the remainder 2022. The

forward-looking statements contained in this press release reflect

several material factors and expectations and assumptions of Gran

Tierra including, without limitation, that Gran Tierra will

continue to conduct its operations in a manner consistent with its

current expectations, pricing and cost estimates (including with

respect to commodity pricing and exchange rates), and the general

continuance of assumed operational, regulatory and industry

conditions in Colombia and Ecuador, and the ability of Gran Tierra

to execute its business and operational plans in the manner

currently planned.

Among the important factors that could cause

actual results to differ materially from those indicated by the

forward-looking statements in this press release are: Gran Tierra’s

operations are located in South America and unexpected problems can

arise due to guerilla activity, strikes, local blockades or

protests; technical difficulties and operational difficulties may

arise which impact the production, transport or sale of our

products; other disruptions to local operations; global health

events (including the ongoing COVID-19 pandemic); global and

regional changes in the demand, supply, prices, differentials or

other market conditions affecting oil and gas, including inflation

and changes resulting from a global health crisis, the Russian

invasion of Ukraine, or from the imposition or lifting of crude oil

production quotas or other actions that might be imposed by OPEC,

such as its recent decision to cut production, and other producing

countries and the resulting company or third-party actions in

response to such changes; changes in commodity prices, including

volatility or a decline in these prices relative to historical or

future expected levels; the risk that current global economic and

credit conditions may impact oil prices and oil consumption more

than Gran Tierra currently predicts, which could cause Gran Tierra

to further modify its strategy and capital spending program; prices

and markets for oil and natural gas are unpredictable and volatile;

the accuracy of testing and production results and seismic data,

pricing and cost estimates (including with respect to commodity

pricing and exchange rates); the effect of hedges; the accuracy of

productive capacity of any particular field; geographic, political

and weather conditions can impact the production, transport or sale

of our products; the ability of Gran Tierra to execute its business

plan and realize expected benefits from current initiatives; the

risk that unexpected delays and difficulties in developing

currently owned properties may occur; the ability to replace

reserves and production and develop and manage reserves on an

economically viable basis; the risk profile of planned exploration

activities; the effects of drilling down-dip; the effects of

waterflood and multi-stage fracture stimulation operations; the

extent and effect of delivery disruptions, equipment performance

and costs; actions by third parties; the timely receipt of

regulatory or other required approvals for our operating

activities; the failure of exploratory drilling to result in

commercial wells; unexpected delays due to the limited availability

of drilling equipment and personnel; volatility or declines in the

trading price of our common stock or bonds; the risk that Gran

Tierra does not receive the anticipated benefits of government

programs, including government tax refunds; Gran Tierra’s ability

to obtain a new credit agreement and to comply with financial

covenants in its credit agreement and indentures and make

borrowings under any credit agreement; and the risk factors

detailed from time to time in Gran Tierra’s periodic reports filed

with the Securities and Exchange Commission, including, without

limitation, under the caption “Risk Factors” in Gran Tierra’s

Annual Report on Form 10-K for the year ended December 31, 2021 and

its other filings with the Securities and Exchange Commission.

These filings are available on the Securities and Exchange

Commission website at http://www.sec.gov and SEDAR at

www.sedar.com.

The forward-looking statements contained in this

press release are based on certain assumptions made by Gran Tierra

based on management’s experience and other factors believed to be

appropriate. Gran Tierra believes these assumptions to be

reasonable at this time, but the forward-looking statements are

subject to risk and uncertainties, many of which are beyond Gran

Tierra’s control, which may cause actual results to differ

materially from those implied or expressed by the forward-looking

statements. In particular, the unprecedented nature of the current

economic downturn, pandemic and industry decline may make it

particularly difficult to identify risks or predict the degree to

which identified risks will impact Gran Tierra’s business and

financial condition. All forward-looking statements are made as of

the date of this press release and the fact that this press release

remains available does not constitute a representation by Gran

Tierra that Gran Tierra believes these forward-looking statements

continue to be true as of any subsequent date. Actual results may

vary materially from the expected results expressed in

forward-looking statements. Gran Tierra disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as expressly required by applicable law.

Non-GAAP Measures

Net debt as of September 30, 2022, is defined as GAAP total debt

before deferred financing fees ($580 million) less cash ($118

million).

Presentation of Oil and Gas Information

References to a formation where evidence of

hydrocarbons has been encountered is not necessarily an indicator

that hydrocarbons will be recoverable in commercial quantities or

in any estimated volume. Gran Tierra’s reported production is a mix

of light crude oil and medium and heavy crude oil for which there

is not a precise breakdown since the Company’s oil sales volumes

typically represent blends of more than one type of crude oil. Well

test results should be considered as preliminary and not

necessarily indicative of long-term performance or of ultimate

recovery. Well log interpretations indicating oil and gas

accumulations are not necessarily indicative of future production

or ultimate recovery. If it is indicated that a pressure transient

analysis or well-test interpretation has not been carried out, any

data disclosed in that respect should be considered preliminary

until such analysis has been completed. References to thickness of

“oil pay” or of a formation where evidence of hydrocarbons has been

encountered is not necessarily an indicator that hydrocarbons will

be recoverable in commercial quantities or in any estimated

volume.

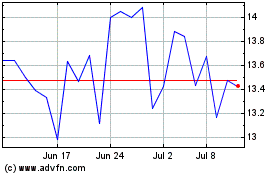

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Oct 2024 to Nov 2024

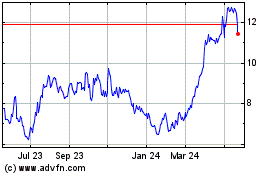

Gran Tierra Energy (TSX:GTE)

Historical Stock Chart

From Nov 2023 to Nov 2024