Hudbay Minerals Inc. (“Hudbay” or the “company”)

(TSX, NYSE: HBM) today announced that its

Board of Directors (“Board”) has approved an early works program at

its Rosemont project, and provided its annual mineral reserve and

resource update. All dollar amounts are in US dollars, unless

otherwise noted.

Summary

- Announced $122 million Rosemont early works program; this

amount is included in the $1,921 million capital cost estimate for

Rosemont.

- Rosemont minority joint venture process to commence

shortly.

- By proceeding with early works and financing activities in

parallel, Hudbay’s management expects to seek Board approval to

commence Rosemont construction by the end of 2019; this would

enable first production by the end of 2022.

- Lalor mine achieved production of 4,500 tonnes per day in the

first quarter of 2019.

- Filed updated technical report for Lalor reflecting increase in

reserves and resources and revised mine plan announced in February

2019.

- 777 mine life extended to second quarter of 2022.

- Continuing to advance community relations and technical

activities on properties near Constancia.

“We are pleased to be moving forward at Rosemont

and look forward to carrying out the early works in parallel with

financing activities for the project,” said Alan Hair, Hudbay’s

president and chief executive officer. “We continue to drive

momentum across our business with the Lalor mine’s successful ramp

up to 4,500 tonnes per day, extending 777’s mine life into 2022 and

moving Rosemont forward in a prudent manner.”

Rosemont Project

The permitting process at Rosemont concluded

with the receipt of the Section 404 Water Permit from the U.S. Army

Corps of Engineers and the Mine Plan of Operations from the U.S.

Forest Service in March 2019. Hudbay is now in a position to move

the project forward with development.

As previously disclosed, Hudbay’s agreement to

acquire United Copper & Moly LLC’s 7.95% interest in Rosemont

provides Hudbay with greater strategic flexibility with respect to

capital structure and project financing alternatives. Hudbay

intends to evaluate a variety of options, including the addition of

a new, committed joint venture partner for the development of

Rosemont. The company expects to carry out this process in parallel

with advancing the initial development of Rosemont, with the

objective to ultimately hold an approximate 70% interest in the

project while maintaining operatorship.

As part of the initial development plans,

Hudbay’s Board has approved an early works program with spending of

$122 million over and above the $20 million of Rosemont spending

previously included in 2019 growth capital expenditure guidance.

The early works program will be funded from cash on hand of $515

million as at December 31, 2018.

The $122 million early works program is part of

Rosemont’s total project capital cost estimate of $1,921 million as

disclosed in the National Instrument 43-101 technical report dated

March 30, 2017 (“2017 Technical Report”) for Rosemont and will fund

the following activities:

- Funding the construction of a water pipeline and power

transmission line to site, which are critical long-lead items that

are necessary to initiate heavy civil works at site.

- Advancing critical path engineering and geotechnical work to

support long-lead procurement and de-risk the project schedule and

cost estimate.

- Archaeological site work to prepare key areas for

construction.

- Spending on permit-related mitigation activities and owner’s

costs.

Hudbay plans to move ahead with early works and

financing activities in parallel in 2019 and expects to seek Board

approval to commence the construction of Rosemont by the end of the

year; this would enable first production by the end of 2022.

Rosemont, located in Arizona, is one of the

world’s best undeveloped copper projects delivering a 15.5%

after-tax unlevered IRR at a copper price of $3.00 per pound based

on the 2017 Technical Report. Rosemont is expected to produce

approximately 127,000 tonnes of copper annually at a cash cost of

$1.14 per pound, net of by-product credits, over the first 10 years

of operations.

Current mineral reserves and resources

(exclusive of reserves) for Rosemont are summarized below.

| Rosemont

Project Mineral Reserve and Resource Estimates1 |

Tonnes |

Cu

Grade(%) |

Mo

Grade(%) |

Ag

Grade(g/t) |

|

Mineral Reserves2,3 |

|

|

Proven |

426,100,000 |

0.48 |

0.012 |

4.96 |

|

Probable |

111,000,000 |

0.31 |

0.010 |

3.09 |

|

Total proven and probable |

537,100,000 |

0.45 |

0.012 |

4.58 |

|

Mineral Resources3 |

|

|

Measured |

161,300,000 |

0.38 |

0.009 |

2.72 |

|

Indicated |

374,900,000 |

0.25 |

0.011 |

2.60 |

|

Total measured and indicated |

536,200,000 |

0.29 |

0.011 |

2.64 |

|

Inferred |

62,300,000 |

0.30 |

0.010 |

1.58 |

Note: totals may not add up correctly due to

rounding.1 Based on 100% ownership of the Rosemont project.2 Blocks

were classified as Proven or Probable in accordance with CIM

Definition Standards 2014.3 Mineral reserves and resources

calculated using metal prices of $3.15 per pound copper, $11.00 per

pound molybdenum and $18.00 per ounce silver.

On March 27, 2019, opponents of the Rosemont

project filed a lawsuit against the U.S. Army Corps of Engineers

challenging, among other things, the issuance of the Section 404

Water Permit in respect of Rosemont. This lawsuit is one of many

challenges against the Rosemont permitting process and Hudbay is

confident the permits will continue to be upheld.

Constancia Mine

Current mineral reserves and resources

(exclusive of reserves) for Constancia as of January 1, 2019 are

summarized below.

| Constancia Mine Mineral Reserve and Resource

Estimates1 |

Tonnes |

Cu Grade(%) |

Mo Grade(g/t) |

Au Grade(g/t) |

Ag Grade(g/t) |

|

Constancia Reserves |

|

|

| Proven |

|

421,800,000 |

0.30 |

94 |

0.035 |

2.87 |

|

Probable |

|

72,000,000 |

0.23 |

72 |

0.035 |

3.06 |

|

Total proven and probable - Constancia |

|

493,800,000 |

0.29 |

91 |

0.035 |

2.90 |

|

Pampacancha Reserves |

|

|

|

Proven |

|

32,400,000 |

0.59 |

178 |

0.368 |

4.48 |

|

Probable |

|

7,500,000 |

0.62 |

173 |

0.325 |

5.75 |

|

Total proven and probable - Pampacancha |

|

39,900,000 |

0.60 |

177 |

0.360 |

4.72 |

|

Total proven and probable |

|

533,700,000 |

0.31 |

97 |

0.059 |

3.03 |

|

Constancia Resources |

|

|

|

Measured |

|

169,400,000 |

0.18 |

50 |

0.028 |

2.19 |

|

Indicated |

|

180,500,000 |

0.20 |

56 |

0.034 |

2.16 |

|

Inferred |

|

50,800,000 |

0.24 |

43 |

0.046 |

2.41 |

|

Pampacancha Resources |

|

|

|

Measured |

|

11,400,000 |

0.41 |

101 |

0.245 |

4.95 |

|

Indicated |

|

6,000,000 |

0.35 |

84 |

0.285 |

5.16 |

|

Inferred |

|

10,100,000 |

0.14 |

143 |

0.233 |

3.86 |

|

Total measured and indicated |

|

367,300,000 |

0.20 |

55 |

0.042 |

2.31 |

|

Total inferred |

|

60,900,000 |

0.22 |

60 |

0.077 |

2.65 |

Note: totals may not add up correctly due to

rounding.1 Mineral reserves and resources calculated using metal

prices of $3.00 per pound copper, $11.00 per pound molybdenum,

$18.00 per ounce silver and $1,260 per ounce gold.

In January 2018, Hudbay acquired control of a

large, contiguous block of mineral rights to explore for mineable

deposits within trucking distance of the Constancia processing

facility, including the past producing Caballito property and the

highly prospective Maria Reyna and Kusiorcco properties. Hudbay has

commenced permitting, community relations and technical activities

required to access and conduct drilling on these properties and has

been successful in reaching an agreement covering two of the

properties to date with plans to drill in the fourth quarter of

2019.

The Caballito property, located approximately

three kilometres northwest of Constancia, is a 120-hectare

(297-acre) concession block and is the site of the former Katanga

mine, which was operated by Mitsui Mining & Smelting Co., Ltd.

and Minera Katanga at different times between the late 1970s and

early 1990s. The deposit at Caballito is believed to consist of

narrow skarn bodies developed in the contact between limestone and

monzonite porphyries with copper, silver and gold mineralization in

hypogene sulfides.

The Maria Reyna property, located within ten

kilometres of Constancia, is a 5,850-hectare (14,456-acre)

concession block. In 2010, diamond drilling by a previous optionee

of the Maria Reyna property intersected copper skarn, breccias and

porphyry mineralization. Geophysical surveys and geological mapping

have also been conducted on the property and Hudbay believes that

the area remains very prospective for additional discoveries.

Negotiations with a local community to secure

surface rights over the Pampacancha deposit are progressing,

following the election of a new community council in the fourth

quarter of 2018. Hudbay continues to take a disciplined, measured

and patient approach to these negotiations, as this has proven to

be an effective way of engaging in previous instances and is

consistent with its proven long-term strategy for securing social

license and developing its business in Peru.

Lalor Mine

The Lalor mine achieved ore production of more

than 4,500 tonnes per day in February 2019 and production since

then has been in line with expectations.

In February 2019, Hudbay announced increased

mineral reserves and mineral resources for the Lalor mine and

nearby satellite deposits, and a new mine plan that includes the

processing of gold and copper-gold ore at the company’s New

Britannia mill. The company expects Lalor annual gold production to

more than double from current levels once the New Britannia mill is

refurbished in 2022. Average annual production of approximately

140,000 ounces is expected during the first five years, at a

sustaining cash cost, net of by-product credits, of $450 per

ounce1, positioning Lalor as one of the lowest-cost gold mines in

Canada.

Current mineral reserves and resources

(exclusive of reserves) for Lalor as of January 1, 2019 are

summarized below.

| Lalor Mine Mineral Reserve and Resource

Estimates1 |

Tonnes |

Cu Grade(%) |

Zn Grade(%) |

Au Grade(g/t) |

Ag Grade(g/t) |

|

Base Metal Zone Reserves |

|

|

| Proven |

|

5,137,000 |

0.76 |

7.13 |

2.37 |

26.31 |

|

Probable |

|

5,552,000 |

0.44 |

4.19 |

3.52 |

27.39 |

|

Gold Zone Reserves |

|

|

|

Proven |

|

58,000 |

0.80 |

2.65 |

5.46 |

39.09 |

|

Probable |

|

2,928,000 |

1.09 |

0.31 |

6.74 |

23.08 |

|

Total proven and probable |

|

13,675,000 |

0.70 |

4.46 |

3.78 |

26.11 |

|

Base Metal Zone Resources |

|

|

|

Inferred |

|

1,385,000 |

0.70 |

2.30 |

4.49 |

43.58 |

|

Gold Zone Resources |

|

|

|

Inferred |

|

4,516,000 |

1.08 |

0.35 |

4.38 |

20.42 |

|

Total inferred |

|

5,901,000 |

0.99 |

0.81 |

4.41 |

25.85 |

Note: totals may not add up correctly due to rounding.1 Mineral

reserves and resources calculated using metal prices of $1.17 per

pound zinc (includes premium), $1,260 per ounce gold, $3.10 per

pound copper, $18.00 per ounce of silver and using a C$/US$

exchange rate of 1.25.

The updated resource model at Lalor includes 5.9

million tonnes of inferred mineral resources, which have the

potential to extend the mine life beyond 10 years while feeding

both the Stall and New Britannia mills. In addition, the mineral

resources at Hudbay’s satellite deposits in the Snow Lake region,

including the copper-gold WIM deposit, the former gold producing

New Britannia mine and the zinc-rich Pen II deposit could provide

feed for the Stall and New Britannia processing facilities and

further extend the mine life.

The following table summarizes the current

mineral resource estimates for the Snow Lake regional deposits

(excluding Lalor).

| Snow Lake Regional Deposits (excl. Lalor)

Mineral Resource Estimates |

Tonnes |

Cu Grade(%) |

Zn Grade(%) |

Au Grade(g/t) |

Ag Grade(g/t) |

|

Indicated Resources |

|

|

| WIM1 |

|

3,900,000 |

1.71 |

0.26 |

1.57 |

6.68 |

|

Pen II2 |

|

500,000 |

0.49 |

8.89 |

0.35 |

6.81 |

|

Total indicated |

|

4,400,000 |

1.57 |

1.24 |

1.43 |

6.69 |

|

Inferred Resources |

|

|

|

WIM1 |

|

700,000 |

1.03 |

0.37 |

1.76 |

4.65 |

|

Pen II2 |

|

100,000 |

0.37 |

9.81 |

0.30 |

6.85 |

|

Total inferred (base metals) |

|

800,000 |

0.95 |

1.55 |

1.58 |

4.93 |

|

Birch & 3 Zone3 |

|

1,700,000 |

|

|

5.34 |

|

|

New Britannia3 |

|

2,800,000 |

|

|

4.51 |

|

|

Total inferred (gold) |

|

4,500,000 |

|

|

4.82 |

|

Note: totals may not add up correctly due to

rounding.1 WIM mineral resources reported based on a 1.3% CuEq

cut-off for the underground portion, and a 0.5% cut-off for the

open pit portion, assuming processing recoveries of 90% for copper

and zinc for gold and silver, and using long-term prices of $3.00

per pound copper, $1,200 per ounce gold, $1.00 per ounce zinc and

$15.00 per ounce of silver.2 Pen II mineral resources are estimated

at a minimum NSR cut-off of C$65 per tonne and assumed that the Pen

II mineral resources would be amenable to processing at the Stall

mill.3 New Britannia mineral resource estimates have been reported

at a minimal true width of 1.5 metres and with a cut-off grade

varying from 2 grams per tonne (at the 3 Zone and the lower part of

New Britannia) to 3.3 grams per tonne (at Birch and for the upper

part of New Britannia).

Hudbay continues to conduct drilling on the

recently announced new discovery in the Snow Lake region and is

encouraged by the mineralization intersected in the recent holes.

Assays are pending and the company expects to provide an update in

due course.

For additional details on the Lalor mine and the

company’s Snow Lake Operations, refer to the technical report

titled “NI 43-101 Technical Report, Lalor and Snow Lake Operations,

Manitoba, Canada”, effective January 1, 2019, which was filed on

Hudbay’s profile on SEDAR today at www.sedar.com and will be filed

on EDGAR at www.sec.gov.

777 Mine

The 777 mine life has been extended to the

second quarter of 2022, from the end of 2021, based on the most

recent estimate of mineral reserves.

Current mineral reserves and resources

(exclusive of reserves) for 777 as of January 1, 2019 are

summarized below.

| 777 Mine Mineral Reserve and Resource

Estimates1 |

Tonnes |

Cu Grade(%) |

Zn Grade(%) |

Au Grade(g/t) |

Ag Grade(g/t) |

|

Mineral Reserves |

|

|

| Proven |

|

2,169,000 |

1.80 |

4.44 |

1.77 |

26.45 |

|

Probable |

|

1,384,000 |

0.97 |

3.75 |

2.03 |

21.65 |

|

Total proven and probable |

|

3,552,000 |

1.48 |

4.17 |

1.87 |

24.58 |

|

Mineral Resources |

|

|

|

Indicated |

|

375,000 |

1.13 |

4.05 |

1.79 |

29.57 |

|

Inferred |

|

395,000 |

1.43 |

5.03 |

3.09 |

40.44 |

Note: totals may not add up correctly due to

rounding.1 Mineral reserves and resources calculated using metal

prices of $3.10 per pound copper, $1.24 per pound zinc (includes

premium), $1,283 per ounce gold, $17.50 per ounce silver and using

a C$/US$ exchange rate of 1.267.

Ann Mason

The following table sets forth the estimates of

the mineral resources at the Ann Mason project in Nevada.

| Ann Mason Project Mineral Resource

Estimates1 |

Tonnes |

Cu Grade(%) |

Mo Grade(%) |

Au Grade(g/t) |

Ag Grade(g/t) |

| Indicated |

|

1,400,000,000 |

0.32 |

0.006 |

0.03 |

0.65 |

|

Inferred |

|

623,000,000 |

0.29 |

0.007 |

0.03 |

0.66 |

Note: totals may not add up correctly due to rounding.1 For

additional details relating to the estimates of mineral resources

at the Ann Mason project, refer to the technical report dated March

3, 2017 and filed on SEDAR by Mason Resources Corp.

Hudbay is currently drilling on one of the

targets at Ann Mason and expects to continue exploration activities

throughout the remainder of 2019.

Non-IFRS Financial Performance

Measures

Cash cost, sustaining and all-in sustaining cash

cost per pound of copper produced are shown because the company

believes they help investors and management assess the anticipated

performance of its operations, including the margin generated by

the operations and the company. These measures do not have a

meaning prescribed by IFRS and are therefore unlikely to be

comparable to similar measures presented by other issuers. These

measures should not be considered in isolation or as a substitute

for measures prepared in accordance with IFRS and are not

necessarily indicative of operating profit or cash flow from

operations as determined under IFRS. Other companies may calculate

these measures differently. For further details on these measures,

including reconciliations to the most comparable IFRS measures,

please refer to page 45 of Hudbay’s management’s discussion and

analysis for the three months and year ended December 31, 2018

available on SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Qualified Person

The scientific and technical information

contained in this news release related to the Constancia mine and

Rosemont project has been approved by Cashel Meagher, P.Geo., our

Senior Vice President and Chief Operating Officer. The scientific

and technical information related to the Lalor and 777 mines

contained in this news release has been approved by Olivier

Tavchandjian, P.Geo., our Vice President, Exploration and Geology.

Messrs. Meagher and Tavchandjian are qualified persons pursuant to

NI 43-101. For a description of the key assumptions, parameters and

methods used to estimate mineral reserves and resources, as well as

data verification procedures and a general discussion of the extent

to which the estimates of scientific and technical information may

be affected by any known environmental, permitting, legal title,

taxation, sociopolitical, marketing or other relevant factors,

please refer to the NI 43-101 technical reports as filed by Hudbay

on SEDAR at www.sedar.com.

Additional details on the company’s material

properties, including a year-over-year reconciliation of reserves

and resources, is included in Hudbay's Annual Information Form for

the year ended December 31, 2018, which will be filed on SEDAR at

www.sedar.com.

Note to United States

Investors

This news release has been prepared in

accordance with the requirements of the securities laws in effect

in Canada, which differ from the requirements of United States

securities laws.

Canadian reporting requirements for disclosure

of mineral properties are governed by the Canadian Securities

Administrators’ National Instrument 43-101 Standards of Disclosure

for Mineral Projects (“NI 43-101”). Subject to the SEC

Modernization Rules described below, the United States reporting

requirements are currently governed by the United States Securities

and Exchange Commission ("SEC") Industry Guide 7 (“SEC Industry

Guide 7”) under the Securities Act of 1933, as amended.

The definitions used in NI 43-101 are

incorporated by reference from the Canadian Institute of Mining,

Metallurgy and Petroleum (“CIM”) – Definition Standards adopted by

CIM Council on May 10, 2014 (the “CIM Definition Standards”). For

example, the terms “mineral reserve”, “proven mineral reserve” and

“probable mineral reserve” are Canadian mining terms as defined in

NI 43-101, and these definitions differ from the definitions in SEC

Industry Guide 7. Furthermore, while the terms “mineral

resource”, “measured mineral resource”, “indicated mineral

resource” and “inferred mineral resource” are defined in and

required to be disclosed by NI 43-101, these terms are not defined

terms under SEC Industry Guide 7.

Under SEC Industry Guide 7 standards, a “final”

or “bankable” feasibility study is required to report reserves and

the primary environmental analysis or report must be filed with the

appropriate governmental authority. Further, under SEC Industry

Guide 7, mineralization may not be classified as a “reserve” unless

the determination has been made that the mineralization could be

economically and legally produced or extracted at the time the

reserve determination is made. Reserve estimates contained in this

news release may not qualify as “reserves” under SEC Industry Guide

7. Further, until recently, the SEC has not recognized the

reporting of mineral deposits which do not meet the SEC Industry

Guide 7 definition of “reserve”.

The SEC adopted amendments to its disclosure

rules to modernize the mineral property disclosure requirements for

issuers whose securities are registered with the SEC under the

Securities Exchange Act of 1934, as amended. These amendments

became effective February 25, 2019 (the “SEC Modernization Rules”)

with compliance required for the first fiscal year beginning on or

after January 1, 2021. The SEC Modernization Rules replace the

historical disclosure requirements for mining registrants that were

included in SEC Industry Guide 7, which will be rescinded from and

after the required compliance date of the SEC Modernization

Rules. As a result of the adoption of the SEC Modernization

Rules, the SEC now recognizes estimates of "measured mineral

resources", "indicated mineral resources" and "inferred mineral

resources". In addition, the SEC has amended its definitions of

"proven mineral reserves" and "probable mineral reserves" to be

“substantially similar” to the corresponding CIM Definition

Standards, incorporated by reference in NI 43-101.

United States investors are cautioned that while

the above terms are “substantially similar” to CIM definitions,

there are differences in the definitions under the SEC

Modernization Rules and the CIM Definition Standards. Accordingly,

there is no assurance any mineral reserves or mineral resources

that the Company may report as "proven mineral reserves", 'probable

mineral reserves", "measured mineral resources", "indicated mineral

resources" and "inferred mineral resources" under NI 43-101 would

be the same had the Company prepared the reserve or resource

estimates under the standards adopted under the SEC Modernization

Rules.

United States investors are also cautioned that

while the SEC will now recognize "measured mineral resources",

"indicated mineral resources" and "inferred mineral resources",

investors should not assume that any part or all of the

mineralization in these categories will ever be converted into a

higher category of mineral resources or into mineral reserves.

Mineralization described using these terms has a greater amount of

uncertainty as to their existence and feasibility than

mineralization that has been characterized as reserves.

Accordingly, investors are cautioned not to assume that any

"measured mineral resources", "indicated mineral resources", or

"inferred mineral resources" that the Company reports are or will

be economically or legally mineable.

Further, "inferred mineral resources" have a

greater amount of uncertainty as to their existence and as to

whether they can be mined legally or economically. Therefore,

United States investors are also cautioned not to assume that all

or any part of the "inferred mineral resources" exist. In

accordance with Canadian rules, estimates of "inferred mineral

resources" cannot form the basis of feasibility or other economic

studies, except in limited circumstances where permitted under NI

43-101.

For the above reasons, information contained in

this news release containing descriptions of the Company’s mineral

deposits may not be comparable to similar information made public

by United States companies subject to the reporting and disclosure

requirements under the United States federal securities laws and

the rules and regulations thereunder.

Forward-Looking Information

This news release contains “forward-looking

information” within the meaning of applicable Canadian securities

laws and “forward looking statements” within the meaning of the

“safe harbor” provisions of the U.S. Private Securities Litigation

Reform Act of 1995. We refer to such forward-looking statements and

forward-looking information together in this news release as

forward-looking information. All information contained in this news

release, other than statements of current and historical fact, is

forward-looking information. Often, but not always, forward-looking

information can be identified by the use of words such as “plans”,

“expects”, “budget”, “guidance”, “scheduled”, “estimates”,

“forecasts”, “strategy”, “target”, “intends”, “objective”, “goal”,

“understands”, “anticipates” and “believes” (and variations of

these or similar words) and statements that certain actions, events

or results “may”, “could”, “would”, “should”, “might” “occur” or

“be achieved” or “will be taken” (and variations of these or

similar expressions). All of the forward-looking information in

this news release is qualified by this cautionary note.

Forward-looking information includes, but is not

limited to, production, mineral reserve and resource estimates,

cost and capital and exploration expenditure guidance, anticipated

production at our mines and processing facilities, expectations

regarding the schedule for acquiring the Pampacancha surface rights

and mining the Pampacancha deposit, the anticipated timing, cost

and benefits of developing the Rosemont project, the outcome of

litigation challenging Rosemont’s permits, expectations regarding

the financing, sanctioning and schedule for developing the Rosemont

project, expectations regarding the Lalor gold strategy, including

the refurbishment of the New Britannia mill, the low costs of the

operation and the possibility of optimizing the value of our gold

resources in Manitoba, the possibility of converting inferred

mineral resource estimates to higher confidence categories, the

potential and our anticipated plans for advancing our mining

properties surrounding Constancia and the Ann Mason project,

anticipated mine plans, anticipated metals prices and the

anticipated sensitivity of our financial performance to metals

prices, events that may affect our operations and development

projects, anticipated cash flows from operations and related

liquidity requirements, the anticipated effect of external factors

on revenue, such as commodity prices, estimation of mineral

reserves and resources, mine life projections, reclamation costs,

economic outlook, government regulation of mining operations, and

business and acquisition strategies. Forward-looking information is

not, and cannot be, a guarantee of future results or events.

Forward-looking information is based on, among other things,

opinions, assumptions, estimates and analyses that, while

considered reasonable by us at the date the forward-looking

information is provided, inherently are subject to significant

risks, uncertainties, contingencies and other factors that may

cause actual results and events to be materially different from

those expressed or implied by the forward-looking information.

The material factors or assumptions that we

identified and were applied by us in drawing conclusions or making

forecasts or projections set out in the forward looking information

include, but are not limited to:

- the schedule for the refurbishment of the New Britannia mill

and the success of our Lalor gold strategy;

- the closing of the transaction to acquire the remaining 7.95%

interest in the Rosemont project and the likelihood of finding a

new minority joint venture partner;

- the ability to secure required land rights to develop and

commence mining the Pampacancha deposit;

- the success of mining, processing, exploration and development

activities;

- the scheduled maintenance and availability of our processing

facilities;

- the accuracy of geological, mining and metallurgical

estimates;

- anticipated metals prices and the costs of production;

- the supply and demand for metals we produce;

- the supply and availability of all forms of energy and fuels at

reasonable prices;

- no significant unanticipated operational or technical

difficulties;

- the execution of our business and growth strategies, including

the success of our strategic investments and initiatives;

- the availability of additional financing, if needed;

- the ability to complete project targets on time and on budget

and other events that may affect our ability to develop our

projects;

- the timing and receipt of various regulatory, governmental and

joint venture partner approvals;

- the availability of personnel for our exploration, development

and operational projects;

- maintaining good relations with the labour unions that

represent certain of our employees in Manitoba and Peru;

- maintaining good relations with the communities in which we

operate, including the communities surrounding the Constancia mine

and Rosemont project and First Nations communities surrounding the

Lalor mine;

- no significant unanticipated challenges with stakeholders at

our various projects;

- no significant unanticipated events or changes relating to

regulatory, environmental, health and safety matters;

- no contests over title to our properties, including as a result

of rights or claimed rights of aboriginal peoples;

- the timing and possible outcome of pending litigation and no

significant unanticipated litigation;

- certain tax matters, including, but not limited to current tax

laws and regulations and the refund of certain value added taxes

from the Canadian and Peruvian governments; and

- no significant and continuing adverse changes in general

economic conditions or conditions in the financial markets

(including commodity prices and foreign exchange rates).

The risks, uncertainties, contingencies and

other factors that may cause actual results to differ materially

from those expressed or implied by the forward-looking information

may include, but are not limited to, risks generally associated

with the mining industry, such as economic factors (including

future commodity prices, currency fluctuations, energy prices and

general cost escalation), uncertainties related to the development

and operation of our projects (including risks associated with the

permitting, financing, development and economics of the Rosemont

project and related legal challenges), risks related to the new

Lalor mine plan, including the schedule for the refurbishment of

the New Britannia mill and the ability to convert inferred mineral

resource estimates to higher confidence categories, risks related

to the schedule for mining the Pampacancha deposit (including the

timing and cost of acquiring the required surface rights and the

impact of any schedule delays), risks related to the maturing

nature of the 777 mine and its impact on the related Flin Flon

metallurgical complex, dependence on key personnel and employee and

union relations, risks related to political or social unrest or

change, risks in respect of aboriginal and community relations,

rights and title claims, operational risks and hazards, including

unanticipated environmental, industrial and geological events and

developments and the inability to insure against all risks, failure

of plant, equipment, processes, transportation and other

infrastructure to operate as anticipated, compliance with

government and environmental regulations, including permitting

requirements and anti-bribery legislation, depletion of our

reserves, volatile financial markets that may affect our ability to

obtain additional financing on acceptable terms, the failure to

obtain required approvals or clearances from government authorities

on a timely basis, uncertainties related to the geology,

continuity, grade and estimates of mineral reserves and resources,

and the potential for variations in grade and recovery rates,

uncertain costs of reclamation activities, our ability to comply

with our pension and other post-retirement obligations, our ability

to abide by the covenants in our debt instruments and other

material contracts, tax refunds, hedging transactions, as well as

the risks discussed under the heading “Risk Factors” in our most

recent annual information form filed on SEDAR at www.sedar.com.

Should one or more risk, uncertainty,

contingency or other factor materialize or should any factor or

assumption prove incorrect, actual results could vary materially

from those expressed or implied in the forward-looking information.

Accordingly, you should not place undue reliance on forward-looking

information. We do not assume any obligation to update or revise

any forward-looking information after the date of this news release

or to explain any material difference between subsequent actual

events and any forward-looking information, except as required by

applicable law.

About Hudbay

Hudbay (TSX, NYSE: HBM) is an integrated mining

company primarily producing copper concentrate (containing copper,

gold and silver), molybdenum concentrate and zinc metal. With

assets in North and South America, the company is focused on the

discovery, production and marketing of base and precious metals.

Directly and through its subsidiaries, Hudbay owns three

polymetallic mines, four ore concentrators and a zinc production

facility in northern Manitoba and Saskatchewan (Canada) and Cusco

(Peru), and copper projects in Arizona and Nevada (United States).

The company’s growth strategy is focused on the exploration and

development of properties it already controls, as well as other

mineral assets it may acquire that fit its strategic criteria.

Hudbay’s vision is to be a responsible, top-tier operator of

long-life, low-cost mines in the Americas. Hudbay’s mission is to

create sustainable value through the acquisition, development and

operation of high-quality, long-life deposits with exploration

potential in jurisdictions that support responsible mining, and to

see the regions and communities in which the company operates

benefit from its presence. The company is governed by the Canada

Business Corporations Act and its shares are listed under the

symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange

and Bolsa de Valores de Lima. Further information about Hudbay can

be found on www.hudbay.com.

For further information, please contact:

Candace BrûléDirector, Investor Relations(416)

814-4387candace.brule@hudbay.com

__________________________

1 Sustaining cash cost per ounce of gold

produced, net of by-product credits, is a non-IFRS financial

performance measure with no standardized definition under IFRS.

All-in sustaining cash cost includes all operating and sustaining

capital costs, including mining, milling and G&A, associated

with Lalor gold production and is reported net of by-product

credits. By-product credits are based on the following assumptions:

zinc price of $1.28 per pound in 2019, $1.27 per pound in 2020,

$1.17 per pound 2021 and long-term (includes premium); copper price

of $3.00 per pound in 2019, $3.10 per pound in 2020, $3.20 per

pound in 2021 and 2022, and $3.10 per pound long-term; silver price

of $16.50 per ounce in 2019, $18.00 per ounce in 2020 and

long-term; C$/US$ exchange rate of 1.30 in 2019 and 1.25 in 2020

and long-term.

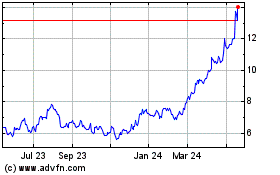

Hudbay Minerals (TSX:HBM)

Historical Stock Chart

From Oct 2024 to Nov 2024

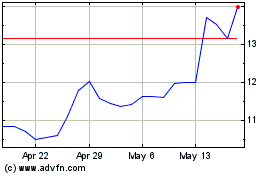

Hudbay Minerals (TSX:HBM)

Historical Stock Chart

From Nov 2023 to Nov 2024