AM Best has affirmed the Financial Strength Rating (FSR)

of A+ (Superior) and the Long-Term Issuer Credit Ratings (Long-Term

ICRs) of “aa-” (Superior) of Intact Insurance Company, the lead

company of Intact Financial Corporation (IFC) [TSX: IFC], as well

as the other insurance subsidiaries of IFC. Concurrently, AM Best

has affirmed the Long-Term ICR of “a-” (Excellent) and the

Long-Term Issue Credit Ratings (Long-Term IRs) of IFC, the parent

holding company. In addition, AM Best has affirmed the Long-Term

ICR of “a-” (Excellent) of Intact U.S. Holdings Inc. (Delaware), an

intermediate holding company of IFC. The outlook of these Credit

Ratings (ratings) is stable. All companies are domiciled in

Ontario, Canada, unless otherwise specified. See below for a

complete listing of the members of Intact Financial Corporation’s

FSRs, Long-Term ICRs and Long-Term IRs.

The ratings reflect IFC’s consolidated balance sheet strength,

which AM Best assesses as very strong, as well as its strong

operating performance, favorable business profile and appropriate

enterprise risk management (ERM).

IFC’s balance sheet strength assessment is supported by its very

strong risk-adjusted capitalization, as measured by Best’s Capital

Adequacy Ratio (BCAR), a solid liquidity profile, and a prudent

reserving approach. The balance sheet also reflects substantial

surplus accumulation over the long term, which has been driven by

capital raises (both debt and stock offerings) in support of

acquisitions. IFC’s financial leverage ratios remain within AM Best

guidelines, despite an uptick for the full year ending 2023.

Nonetheless, financial leverage has improved through the first

quarter of 2024 driven by favorable net earnings. Overall, IFC

benefits from financial flexibility through access to Canadian and

U.S. capital markets.

AM Best notes that IFC has reported favorable operating results

over the long term, driven by consistent underwriting performance

in all geographic territories, which includes Canada, the United

States, the United Kingdom and Ireland (UK&I). Additionally,

overall net earnings also have benefited from increasing net

investment income due to rising interest rates. In 2023, IFC

continued to refine its business operations in the UK and Europe by

executing on multiple strategic initiatives, which include the exit

from the UK personal lines motor business, the acquisition of

Direct Line Insurance Group plc’s brokered commercial lines

operations, and the exit of the UK home and pet personal lines book

of business. AM Best expects these strategic actions to enhance

operating performance further in the organization’s UK&I book

of business.

AM Best assesses IFC’s business profile as favorable, reflecting

excellent geographic, product and channel diversification in the

independent broker channel and direct to consumer. IFC is the

largest provider of property/casualty insurance in Canada and

benefits from a strong brand name recognition through its operating

entities. Intact US provides the organization with further

diversification and a North America-based platform to write

specialty commercial lines. Canada is IFC’s largest market, where

it is a leading provider of personal auto, property and commercial

lines coverage.

AM Best views IFC’s ERM program as appropriate given the

enterprise’s comprehensive risk management framework with strong

internal controls and well-defined risk appetites, tolerances and

mitigation plans.

The FSR of A+ (Superior) and the Long-Term ICRs of “aa-”

(Superior) have been affirmed with stable outlooks for the

following members of the Intact Financial Corporation:

- Atlantic Specialty Insurance Company

- Belair Insurance Company Inc.

- Homeland Insurance Company of New York

- Homeland Insurance Company of Delaware

- Intact Insurance Company

- Jevco Insurance Company

- Novex Insurance Company

- OBI America Insurance Company

- OBI National Insurance Company

- Split Rock Insurance, Ltd.

- The Guarantee Company of North America USA

- The Nordic Insurance Company of Canada

- Trafalgar Insurance Company of Canada

The following Long-Term IR has been assigned with a stable

outlook:

Intact Financial Corporation— -- “a-”

(Excellent) on CAD 300 million, 4.653% senior unsecured medium-term

notes, due May 2034

The following Long-Term IRs have been affirmed with stable

outlooks:

Intact Financial Corporation— -- “a-”

(Excellent) on $500 million, 5.459% senior unsecured medium-term

notes, due 2032 -- “a-” (Excellent) on CAD 250 million, Series 2,

6.40% senior unsecured medium-term notes, due 2039 -- “a-”

(Excellent) on CAD 100 million, Series 3, 6.2% senior unsecured

medium-term notes, due 2061 -- “a-” (Excellent) on CAD 250 million,

Series 5, 5.16% senior unsecured medium-term notes, due 2042 --

“a-” (Excellent) on CAD 250 million, Series 6, 3.77% senior

unsecured medium-term notes, due 2026 -- “a-” (Excellent) on CAD

425 million, Series 7, 2.85% senior unsecured medium-term notes,

due 2027 -- “a-” (Excellent) on CAD 300 million, Series 8, 3.691%

senior unsecured medium-term notes, due 2025 -- “a-” (Excellent) on

CAD 300 million, Series 9, 1.928% senior unsecured medium-term

notes, due 2030 -- “a-” (Excellent) on CAD 300 million, Series 10,

2.954% senior unsecured medium-term notes, due 2050 -- “a-”

(Excellent) on CAD 375 million, Series 12, 2.179% senior unsecured

medium-term notes, due 2028 -- “a-” (Excellent) on CAD 250 million,

Series 13, 3.765% senior unsecured medium-term notes, due 2053 --

“a-” (Excellent) on CAD 400 million, Series 14, 5.276 % senior

unsecured medium-term notes, due 2054 -- “bbb” (Good) on CAD 150

million, 5.25% preferred shares -- “bbb+” (Good) on CAD 250

million, 4.125% subordinated debentures, due 2081 -- “bbb” (Good)

on CAD 300 million, 7.338% subordinated debentures, due June 30,

2083 -- “bbb” (Good) on CAD 250 million, 4.841% non-cumulative

five-year reset Class A Series 1 preferred shares -- “bbb” (Good)

on CAD 250 million, 3.457% non-cumulative five-year rate reset

Class A Series 3 preferred shares -- “bbb” (Good) on CAD 150

million, 5.2% non-cumulative fixed rate Class A Series 5 preferred

shares -- “bbb” (Good) on CAD 150 million, 5.3% non-cumulative

fixed rate Class A Series 6 preferred shares -- “bbb” (Good) on CAD

250 million, 4.9% non-cumulative five-year rate reset Class A

Series 7 preferred shares -- “bbb” (Good) on CAD 150 million, 5.4%

non-cumulative fixed rate shares Class A Series 9 preferred

shares

The following indicative Long-Term IRs under the shelf

registration have been affirmed with stable outlooks:

Intact Financial Corporation— -- “a-”

(Excellent) on senior unsecured notes -- “bbb+” (Good) on

subordinated unsecured notes -- “bbb” (Good) on Class A preferred

shares

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of Best’s

Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240604619575/en/

Cristian Sieira Financial Analyst +1 908 882

2315 cristian.sieira@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Rosemarie Mirabella Director +1 908 882

2125 rosemarie.mirabella@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

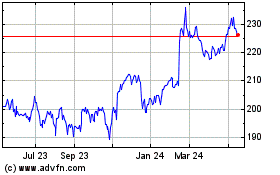

Intact Financial (TSX:IFC)

Historical Stock Chart

From Jan 2025 to Feb 2025

Intact Financial (TSX:IFC)

Historical Stock Chart

From Feb 2024 to Feb 2025