Intermap Technologies (TSX: IMP; OTCQB: ITMSF) (“Intermap” or the

“Company”), a global leader in 3D geospatial products and

intelligence solutions, today announced preliminary second quarter

results and a private placement offering.

Preliminary Second Quarter

Results

For the period ending June 30, 2023, the Company

reported revenue of $1.6 million, compared with $2.0 million for

the first quarter of 2023 and $2.4 million for the second quarter

of 2022. During the six months ended June 30, 2023, the Company

reported positive cash flow from operating activities of

$80,000.

The Company’s second quarter results were

affected by delays in government contracts. All of the contracts

relate to ongoing work that Intermap is confident will continue in

the latter half of this year. Some of these contracts are expected

to grow substantially this year. The contract delays were generated

by repeat customers on critical, funded domestic and foreign

government programs.

Intermap’s commercial business is continuing to

grow with new software and data subscriptions, especially in the

European insurance market. The Company’s software and solutions

revenue increased to $1.1 million compared with $0.8 million for

the second quarter of 2022. In the first half of 2023, software and

solutions revenue totaled $2.3 million compared with $1.7 million

for the same period in 2022. The Company’s European revenue

increased 75.6% in the second quarter of 2023 compared with the

same period in 2022. This increase is driven by the expansion of

its European insurance software and solutions through multi-license

subscription agreements with countrywide insurance

associations.

As the Company enters the second half of the

year, momentum remains high with a focus on execution of pending

government contracts and commercial opportunities.

The Company’s consolidated financial statements

for the quarter ended June 30, 2023, are available on SEDAR+ at

www.sedarplus.ca.

Private Placement

Intermap continues to explore strategic ways to

expand its shareholder base, allowing for broader investor

participation and greater liquidity in the publicly traded

stock.

On August 10, 2023, Intermap closed the first

tranche of an issuer private placement (the “Private Placement”) of

810,000 units ("Units"). Each Unit consists of one Class A common

share of the Company (a “Share”) and one transferable common share

purchase warrant (a "Warrant"). Each Warrant will entitle the

holder to purchase one additional Share at an exercise price equal

to the United States dollar (“USD”) equivalent of C$0.80 per Share,

which is exercisable for two years from the date of issuance. The

Units were issued at a price of C$0.55 per Unit for aggregate gross

proceeds of C$445,500. The Company intends to close a second

tranche of the Private Placement within the next week on the same

terms.

Capital raised in the Private Placement

strengthens Intermap’s balance sheet and enables the Company to

pursue strategic contracts, capitalize on new opportunities and

expand existing relationships with major clients. The Private

Placement included participation from longstanding investors and

new shareholders.

“We appreciate the continued support of our

investors,” said Patrick A. Blott, Intermap Chairman and CEO. “Our

commercial business continues its rapid growth with an increasing

percentage of recurring revenue. In our government business,

programs will continue and grow, and Intermap’s participation is

expected to increase. Our first half operating performance

highlights Intermap’s ability to manage operating leverage and

maintain cash flow by adjusting variable spending to accommodate

unexpected contract volatility. This infusion of capital will help

fund future growth and position us to execute on new and exciting

opportunities.”

Under the first tranche of the Private

Placement, Intermap also issued 48,600 warrants (“Finder Warrants”)

to certain finders. Each Finder Warrant under the first tranche is

exercisable for one Share at an exercise price of $0.48954 per

Share, being the USD equivalent of C$0.6575, at any time until

August 9, 2025. The exchange rate that is used to calculate the USD

equivalent exercise price for each the Warrants and the Finder

Warrants is the Bank of Canada’s latest published rate for the

business day immediately prior to the issuance of same.

All securities issued in connection with the

Private Placement are subject to a 4-month hold period, during

which time trading in the securities is restricted in accordance

with applicable securities laws.

The Private Placement and the listing of the

Shares issued under the Private Placement and the Shares issuable

upon exercise of the Warrants on the Toronto Stock Exchange (the

“TSX”) are subject to final approval of the TSX upon satisfaction

of customary closing conditions. The TSX has conditionally approved

the Private Placement and the listing of the Shares issued

thereunder and the Shares issuable upon exercise of the Warrants

and the Finder Warrants prior to closing of the first tranche of

the Private Placement.

Unless otherwise indicated, all dollar or “$”

references are expressed in USD.

To learn more about Intermap, visit

intermap.com/investors.

Intermap Reader AdvisoryCertain

information provided in this news release, including reference to

revenue growth, growth and continuation of government contracts,

pending government contracts and commercial opportunities, and

closing of the second tranche of the Private Placement, constitutes

forward-looking statements. The words “anticipate”, "expect",

“project”, “estimate”, “forecast”, “continue”, “focus”, “will”,

“intends” and similar expressions are intended to identify such

forward-looking statements. Although Intermap believes that these

statements are based on information and assumptions which are

current, reasonable and complete, these statements are necessarily

subject to a variety of known and unknown risks and uncertainties.

Intermap’s forward-looking statements are subject to risks and

uncertainties pertaining to, among other things, cash available to

fund operations, availability of capital, revenue fluctuations,

nature of government contracts, economic conditions, loss of key

customers, retention and availability of executive talent,

competing technologies, common share price volatility, loss of

proprietary information, software functionality, internet and

system infrastructure functionality, information technology

security, breakdown of strategic alliances, and international and

political considerations, as well as those risks and uncertainties

discussed Intermap’s Annual Information Form and other securities

filings. While the Company makes these forward-looking statements

in good faith, should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary significantly from those expected.

Accordingly, no assurances can be given that any of the events

anticipated by the forward-looking statements will transpire or

occur, or if any of them do so, what benefits that the Company will

derive therefrom. All subsequent forward-looking statements,

whether written or oral, attributable to Intermap or persons acting

on its behalf are expressly qualified in their entirety by these

cautionary statements. The forward-looking statements contained in

this news release are made as at the date of this news release and

the Company does not undertake any obligation to update publicly or

to revise any of the forward-looking statements made herein,

whether as a result of new information, future events or otherwise,

except as may be required by applicable securities law.

About Intermap

TechnologiesFounded in 1997 and headquartered in Denver,

Colorado, Intermap (TSX: IMP; OTCQB: ITMSF) is a global leader in

geospatial intelligence solutions, focusing on the creation and

analysis of 3D terrain data to produce high-resolution thematic

models. Through scientific analysis of geospatial information and

patented sensors and processing technology, the Company provisions

diverse, complementary, multi-source datasets to enable customers

to seamlessly integrate geospatial intelligence into their

workflows. Intermap’s 3D elevation data and software analytic

capabilities enable global geospatial analysis through artificial

intelligence and machine learning, providing customers with

critical information to understand their terrain environment. By

leveraging its proprietary archive of the world’s largest

collection of multi-sensor global elevation data, the Company’s

collection and processing capabilities provide multi-source 3D

datasets and analytics at mission speed, enabling governments and

companies to build and integrate geospatial foundation data with

actionable insights. Applications for Intermap’s products and

solutions include defense, aviation and UAV flight planning, flood

and wildfire insurance, disaster mitigation, base mapping,

environmental and renewable energy planning, telecommunications,

engineering, critical infrastructure monitoring, hydrology, land

management, oil and gas and transportation.

For more information, please

visit www.intermap.com or

contact:Jennifer BakkenExecutive Vice President and

CFOCFO@intermap.com +1 (303) 708-0955

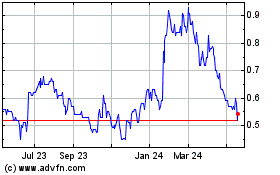

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Dec 2024 to Jan 2025

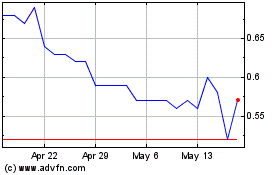

Intermap Technologies (TSX:IMP)

Historical Stock Chart

From Jan 2024 to Jan 2025