K92 Mining Inc. (“

K92” or the

“

Company”) (TSX

: KNT;

OTCQX

: KNTNF) announces production results for the

third quarter (“

Q3”) of 2023 at its Kainantu Gold

Mine in Papua New Guinea, of 26,225 oz AuEq or 22,227 oz gold,

1,784,009 lbs copper and 40,233 oz silver. Sales during the quarter

were 18,339 oz gold, 1,255,291 lbs copper and 30,484 oz silver.

Production for the quarter was impacted from the

safety incident on June 28 (see June 28, 2023 press release - K92

Mining Reports Mine Accident Resulting in Two Fatalities and July

6, 2023 press release – K92 Mining Resumes Mining Operations at

Kainantu Gold Mine), which resulted in the suspension of

underground mining for 9 days, delaying high-grade stoping tonnes

that was originally sequenced to be mined in September, to Q4, and

scheduled maintenance of the process plant for 4.5 days in

mid-July. Fourth quarter production is expected to be the strongest

for the year, driven by a higher grade stoping and ore development

mining sequence.

K92 is pleased to announce that in the second

half of September, the first ore tonnes were mined from the twin

incline, approximately 2 months earlier than expected, after thick

Judd mineralization was encountered while developing the first

waste pass access drive, in an area sparsely drilled and previously

interpreted to be waste. Two ore drives advanced ~7 metres to the

south and north, with multiple high-grade faces from channel

samples recorded, including: Southern Drive – 4.6 m at 14.89 g/t

AuEq (7.16 g/t Au, 161 g/t Ag, 3.56% Cu) and 6.8 m at 11.77 g/t

AuEq (6.53 g/t Au, 2.35% Cu, 117 g/t Ag), and; Northern Drive – 4.3

m at 7.19 g/t AuEq (2.77 g/t Au, 2.25% Cu, 64 g/t Ag) (see figures

6-7). A diamond drill rig is planned to commence drilling shortly

in this area to assess its potential and to determine which Judd

vein the drive corresponds to (i.e. J1, J2 or potentially a splay

of the J1 vein). Mining of Kora via the twin incline is expected to

commence in December, and as this second mining front is developed,

we anticipate a strong boost to mine flexibility and productivity,

leveraging the large and highly efficient twin incline

infrastructure.

During the quarter, the process plant set

multiple daily processing throughput records, including a new

monthly record in September of 1,542 tpd and a new daily record on

September 28 of 1,867 tonnes processed(3), representing rates that

are 13% and 36% above the Stage 2A Expansion annual average

run-rate of 1,370 tpd, respectively. Subsequent to quarter end, new

daily records of 1,902, 1,921 and 2,027 tonnes processed(3) were

achieved on October 6, 8 and 10, respectively, highlighting the

significant throughput potential of the Stage 2A process plant (see

figure 2). Quarterly ore processed was 121,201 tonnes, or an

average of 1,317 tpd, which is the second highest on record, even

with the 4.5 days of shutdown due to scheduled mill maintenance in

mid-July.

Following the commissioning of the Stage 2A

Plant Expansion in May, the process plant has continued to record a

significant increase in metallurgical recoveries for gold and

copper. Recoveries for Q3 averaged 92.0% for gold and 93.0% for

copper, significantly higher than the 2022 average of 90.4% for

gold and 90.5% for copper. In the month of September, a new

recovery record of 93.7% for copper was achieved. Optimization

efforts are ongoing, including to increase throughput that we

believe has the potential to be materially greater than its

nameplate design, as shown in the paragraph above.

In the third quarter, the mine delivered yet

another material movement record despite operations being impacted

in July due to the safety incident, with 124,236 tonnes of ore

mined and 305,506 tonnes of total material mined (ore plus waste).

During the quarter, 11 levels were mined, and the mill head grade

averaged 7.32 g/t AuEq or 6.20 g/t gold, 0.72% copper and 12.84 g/t

silver, head grade was impacted by significantly more than budgeted

processing of lower grade stockpiles following the safety incident

on June 28, that suspended mining operations for 9 days. Mining on

Kora was conducted on the 1110, 1130, 1150, 1170, 1185, 1265, 1285,

1305 and 1325 levels, and Judd on the 840, 1225, 1285, 1305 and

1325 levels.

Overall mine development totaled 2,227 metres,

an increase of 18% from Q3 2022, and significant advancement of the

twin incline in Q3, with incline #2 (6m x 6.5m) advanced to 2,639

metres and #3 (5m x 5.5m) advanced to 2,660 metres as of September

30, 2023. The twin incline is over 90% complete.

See Figure 1: Quarterly Total Ore Processed,

Development Metres Advanced and Total Mined Material ChartSee

Figure 2: Process Plant Throughput Performance and Daily RecordsSee

Figure 3: Overview of Mine Infrastructure UpgradesSee Figure 4:

Comparison of 800 Portal Incline and Twin Incline InfrastructureSee

Figure 5: Mining Front Location LongsectionSee Figure 6: Long

Section with Judd 840 Level Development LocationSee Figure 7: Judd

840 Level Southern Drive

Table 1 – Q3 2023 & 2022 Annual Production

Data

|

|

|

Q3 2022 |

Q4 2022 |

2022 |

Q1 2023 |

Q2 2023 |

Q3 2023 |

|

Tonnes Processed |

T |

117,938 |

121,686 |

448,087 |

117,903 |

112,471 |

121,201 |

|

Feed Grade Au |

g/t |

8.7 |

8.8 |

8.3 |

5.2 |

8.2 |

6.2 |

|

Feed Grade Cu |

% |

0.72% |

0.74% |

0.70% |

0.70% |

0.66% |

0.72% |

|

Recovery (%) Au |

% |

88.9% |

91.2% |

90.4% |

89.1% |

92.4% |

92.0% |

|

Recovery (%) Cu |

% |

88.4% |

91.8% |

90.5% |

91.3% |

92.8% |

93.0% |

|

Metal in Conc & Dore Prod Au |

Oz |

29,256 |

31,204 |

107,546 |

17,593 |

27,405 |

22,227 |

|

Metal in Conc Prod Cu |

T |

756 |

829 |

2,834 |

749 |

692 |

809 |

|

Metal in Conc Prod Ag |

Oz |

32,161 |

40,517 |

126,043 |

29,891 |

34,001 |

40,233 |

|

Gold Equivalent Production |

Oz |

32,995 |

35,538 |

122,806 |

21,488 |

30,794 |

26,225 |

Note – Gold equivalent for Q3 2023 is calculated

based on:

gold $1,928 per

ounce; silver $23.57 per ounce; and copper $3.79 per pound.

Gold equivalent for Q2 2023 is calculated based

on:

gold $1,976 per

ounce; silver $24.13 per ounce; and copper $3.85 per pound.

Gold equivalent for Q1 2023 is calculated based

on:

gold $1,890 per

ounce; silver $22.55 per ounce; and copper $4.05 per pound.

Gold equivalent for 2022 is calculated based

on:

gold $1,793 per

ounce; silver $22 per ounce; and copper $3.95 per pound.

Gold equivalent for Q4 2022 is calculated based

on:

gold $1,728 per

ounce; silver $21 per ounce; and copper $3.63 per pound.

Gold equivalent for Q3 2022 is calculated based

on:

gold $1,730 per

ounce; silver $19 per ounce; and copper $3.51 per pound.

Operational Guidance

As a result of the unexpectedly challenging

first quarter and the impacts of the safety incident on June 28,

2023, the Company is updating its production guidance to 111,000 to

116,000 oz AuEq (originally 120,000 to 140,000 oz). Cash cost and

all-in sustaining cost guidance remains unchanged at $620 to $680

per ounce gold and all-in sustaining costs at $1,180 to $1,300 per

ounce gold. Exploration, driven by the very promising results to

date from our vein and porphyry drill programs has been increased

to $20 million (originally $13 million to $16 million).

Looking ahead, we see multiple positive

near-term outcomes, including:

- Strong production forecasted for Q4, expected to be the

strongest of the year, driven by the mining sequence delivering

higher grades.

- Demonstrated additional process plant throughput capacity

following the Stage 2A Expansion, with September monthly throughput

exceeding the annual run-rate average throughput of 1,370 tpd, by

13%, and multiple daily records set in late-September and

early-October of between 1,867 to 2,027 tonnes processed(3).

- Transformation of underground mine productivity underway,

driven by significant investment in mine infrastructure (see

figures 3-4), including:

- Twin incline (>90% complete;

completion targeting year-end 2023).

- Ore and waste pass system

connecting the main mine with the twin incline (targeting

completion Q3 2024).

- Puma vent incline (targeting

completion mid-2024).

- Interim vent fan upgrade to

increase main mine flowrates by 30% (targeting completion year-end

2023).

- Stage 3 internal vent rise upgrade

(targeting completion mid-2024).

- Significant boost to mine

flexibility and production potential through tripling the number of

mining fronts in 2024 (from one currently at Kora and Judd in the

main mine area), with the twin incline mining front, supported by

large and highly-productive infrastructure beginning to come online

in Q4 2023, followed by mining between the twin incline and main

mine area in 2024 (see figure 5). These mining fronts will be

supported by significantly upgraded infrastructure as noted

above.

- Significant focus on resource

growth and expansion from vein field and porphyry exploration,

including an expanded exploration program in 2023 (increased to $20

million from $13 million to $16 million).

John Lewins, K92 Chief Executive Officer and

Director, stated, “Having just completed a site visit at the

Kainantu Gold Mine a few days ago, there is a tremendous amount of

enthusiasm within the Company for the near, medium and long-term,

while certainly taking on board lessons learned from the first nine

months of 2023 to make the operation stronger going forward.

On production, we expect the fourth quarter to

be the strongest of the year, benefitting from a higher grade

stoping sequence. Going forward, a major positive is the

significant demonstrated available capacity of the process plant,

which continues to exceed expectations and has provided the Company

with considerable optionality. In September, the mill set a new

monthly throughput record 13% greater than the 1,370 tpd annual

average throughput (500,000 tpa), and recently the mill delivered a

flurry of new daily records including 2,027 tonnes processed(3) on

October 10.

Progressively over the next 12 months, the

infrastructure upgrades made to the underground mine are expected

to be transformational, providing a significant boost to mine

flexibility and productivity, which in conjunction with a tripling

of mining fronts in 2024, is projected to materially boost the

production capacity of the underground mine. The Stage 3 Expansion

surface infrastructure upgrades including the new standalone 1.2

mtpa process plant, in conjunction with the underground

infrastructure upgrades, over the next 18 months, are expected to

fundamentally transform the business into a high-grade, low-cost

Tier 1 producer as outlined in the Integrated Development Plan

(“IDP”, see September 12, 2022 press release). Importantly, the

growth capital as outlined in the IDP is fully funded after

announcing the $100 million senior secured loan (see September 26,

2023 press release).

Given K92’s strong liquidity position for the

Stage 3 and 4 Expansions and the positive reported exploration

results to date, we are pleased to be increasing our exploration

expenditures for 2023 to $20 million from $13 to $16 million

originally planned. Exploration is significantly progressing at

both our vein and porphyry targets, and in addition to progressing

our existing programs, we expect to expand the number of

high-priority targets drilled concurrently in the near-term.”

Face Sampling Methodology, QA/QC and

Qualified Person

Face channel samples under geological control,

were taken across the full face of both the exposed lode system and

any waste rock, with sample intervals ranging from 0.1 to 1m in

width depending on the geologist’s interpretation. Two samples were

taken per interval at waist and knee height and the corresponding

widths recorded. Sample lengths are <1.5m, with samples

approximately 3.5 kg in size. Samples were separately assayed for

gold, copper and silver, and the results averaged out using length

weighting and channel orientation before entry into the database.

K92’s procedure includes the insertion standards, blanks and

duplicates for the face sampling. Gold assays are by the fire assay

method. Copper and silver assays are by three-acid-digestion method

(nitric, perchloric & hydrochloric mix).

K92 maintains an industry-standard analytical

quality assurance and quality control (QA/QC) and data verification

program to monitor laboratory performance and ensure high quality

assays. Results from this program confirm reliability of the assay

results. All sampling and analytical work for the mine exploration

program is performed by Intertek Testing Services (PNG) LTD, an

independent accredited laboratory that is located on site. External

check assays for QA/QC purposes are performed at SGS Australia Pty

Ltd in Cairns, Queensland, Australia.

The analytical QA/QC program is currently

overseen by Andrew Kohler, PGeo, Mine Geology Manager and Mine

Exploration Manager for K92. Andrew Kohler, a qualified person

under the meaning of Canadian National Instrument 43-101 –

Standards of Disclosure for Mineral Projects, has reviewed and is

responsible for the technical content of this news release.

About K92

K92 Mining Inc. is engaged in the production of

gold, copper and silver at the Kainantu Gold Mine in the Eastern

Highlands province of Papua New Guinea, as well as exploration and

development of mineral deposits in the immediate vicinity of the

mine. The Company declared commercial production from Kainantu in

February 2018, is in a strong financial position. A maiden resource

estimate on the Blue Lake porphyry project was completed in August

2022. K92 is operated by a team of mining company professionals

with extensive international mine-building and operational

experience.

On Behalf of the Company,

John Lewins, Chief Executive Officer and

Director

For further information, please contact David

Medilek, P.Eng., CFA, President at +1-604-416-4445

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION: This news release includes certain “forward-looking

information” within the meaning of applicable Canadian securities

legislation (“forward-looking statements”), including, but not

limited to, the impact of global supply chain and financial market

disruptions; projections of future financial and operational

performance; statements with respect to future events or future

performance; production estimates; anticipated operating and

production costs and revenue; estimates of capital expenditures;

future demand for and prices of commodities and currencies;

estimated mine life of our mine; estimated closure and reclamation

costs and statements regarding anticipated exploration,

development, construction, production, permitting and other

activities on the Company’s properties, including: expected gold,

silver and copper production and the Stage 3 Expansion and Stage 4

Expansion. Estimates of mineral reserves and mineral resources are

also forward-looking statements because they constitute

projections, based on certain estimates and assumptions, regarding

the amount of minerals that may be encountered in the future and/or

the anticipated economics of production. All statements in this

Annual Information Form that address events or developments that we

expect to occur in the future are forward-looking statements.

Forward-looking statements are statements that are not historical

facts and are generally, although not always, identified by words

such as “expect”, “plan”, “anticipate”, “project”, “target”,

“potential”, “schedule”, “forecast”, “budget”, “estimate”, “intend”

or “believe” and similar expressions or their negative

connotations, or that events or conditions “will”, “would”, “may”,

“could”, “should” or “might” occur. All such forward-looking

statements are based on the opinions and estimates of management as

of the date such statements are made.

Forward-looking statements are necessarily based

on estimates and assumptions that are inherently subject to known

and unknown risks, uncertainties and other factors, many of which

are beyond our ability to control, that may cause our actual

results, level of activity, performance or achievements to be

materially different from those expressed or implied by such

forward-looking information. Such factors include, without

limitation, Public Health Crises, including the COVID-19 Pandemic;

changes in the price of gold, silver, copper and other metals in

the world markets; fluctuations in the price and availability of

infrastructure and energy and other commodities; fluctuations in

foreign currency exchange rates; volatility in price of our common

shares; inherent risks associated with the mining industry,

including problems related to weather and climate in remote areas

in which certain of the Company’s operations are located; failure

to achieve production, cost and other estimates; risks and

uncertainties associated with exploration and development;

uncertainties relating to estimates of mineral resources including

uncertainty that mineral resources may never be converted into

mineral reserves; the Company’s ability to carry on current and

future operations, including development and exploration

activities; the timing, extent, duration and economic viability of

such operations, including any mineral resources or reserves

identified thereby; the accuracy and reliability of estimates,

projections, forecasts, studies and assessments; the Company’s

ability to meet or achieve estimates, projections and forecasts;

the availability and cost of inputs; the availability and costs of

achieving the Stage 3 Expansion or the Stage 4 Expansion; the

ability of the Company to achieve the inputs the price and market

for outputs, including gold, silver and copper; inability of the

Company to identify appropriate acquisition targets or complete

desirable acquisitions; failures of information systems or

information security threats; political, economic and other risks

associated with the Company’s foreign operations; geopolitical

events and other uncertainties, such as the conflict in Ukraine;

compliance with various laws and regulatory requirements to which

the Company is subject to, including taxation; the ability to

obtain timely financing on reasonable terms when required; the

current and future social, economic and political conditions,

including relationship with the communities in Papua New Guinea and

other jurisdictions it operates; other assumptions and factors

generally associated with the mining industry; and the risks,

uncertainties and other factors referred to in the Company’s Annual

Information Form under the heading “Risk Factors”.

Estimates of mineral resources are also

forward-looking statements because they constitute projections,

based on certain estimates and assumptions, regarding the amount of

minerals that may be encountered in the future and/or the

anticipated economics of production. The estimation of mineral

resources and mineral reserves is inherently uncertain and involves

subjective judgments about many relevant factors. Mineral resources

that are not mineral reserves do not have demonstrated economic

viability. The accuracy of any such estimates is a function of the

quantity and quality of available data, and of the assumptions made

and judgments used in engineering and geological interpretation,

Forward-looking statements are not a guarantee of future

performance, and actual results and future events could materially

differ from those anticipated in such statements. Although we have

attempted to identify important factors that could cause actual

results to differ materially from those contained in the

forward-looking statements, there may be other factors that cause

actual results to differ materially from those that are

anticipated, estimated, or intended. There can be no assurance that

such statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking statements. The Company disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

Figure 1: Quarterly Total Ore Processed,

Development Metres Advanced and Total Mined Material

Charthttps://www.globenewswire.com/NewsRoom/AttachmentNg/2f9a5b24-6777-47fe-9e63-ccbea2b5ce05

Figure 2: Process Plant Throughput Performance

and Daily

Recordshttps://www.globenewswire.com/NewsRoom/AttachmentNg/20966214-c39d-4999-b1ae-b0732f45b182

Figure 3: Overview of Mine Infrastructure

Upgradeshttps://www.globenewswire.com/NewsRoom/AttachmentNg/bd489058-b86b-4dcc-a3bf-59ef23c7bb0d

Figure 4: Comparison of 800 Portal Incline and Twin Incline

Infrastructurehttps://www.globenewswire.com/NewsRoom/AttachmentNg/8451d2df-d84f-4554-b6aa-c9245391cebe

Figure 5: Mining Front Location

Longsectionhttps://www.globenewswire.com/NewsRoom/AttachmentNg/281197c7-5582-4217-841f-d85e703927df

Figure 6: Long Section with Judd 840 Level Development Location.

Note: Drilling is planned to commence shortly to determine the

mineralization potential around the Judd 840 Level in addition to

which Judd vein the drive corresponds to (i.e. J1, J2 or

potentially a splay of the J1

vein).https://www.globenewswire.com/NewsRoom/AttachmentNg/3bd32e6e-bf07-49d6-a8eb-44a1b9889a33

Figure 7: Judd 840 Level Southern Drive. Face highlights from

this ~7 m drive include 4.6 m at 14.89 g/t AuEq (7.16 g/t Au, 161

g/t Ag, 3.56% Cu) and 6.8 m at 11.77 g/t AuEq (6.53 g/t Au, 2.35%

Cu, 117 g/t

Ag).https://www.globenewswire.com/NewsRoom/AttachmentNg/05c27953-d5bc-4f82-adf1-23f7ae3e9833

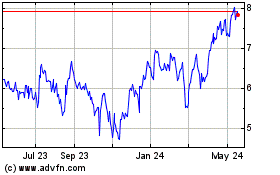

K92 Mining (TSX:KNT)

Historical Stock Chart

From Dec 2024 to Jan 2025

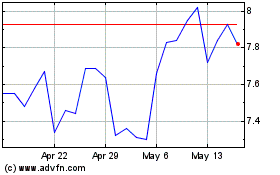

K92 Mining (TSX:KNT)

Historical Stock Chart

From Jan 2024 to Jan 2025