Lithium Americas Corp. (TSX: LAC) (NYSE: LAC)

(“

Lithium Americas” or the

“

Company”) today announced the retirement of

Eduard Epshtein and the appointment of Pablo Mercado as Executive

Vice President and Chief Financial Officer (“

CFO”)

to succeed Eduard as CFO of Lithium Americas.

Upon completion of the planned separation of the

Company’s Argentine and North American businesses into two

independent public companies (the “Separation”),

Pablo would become CFO of the North American business. Eduard will

continue to work with Lithium Americas as an advisor supporting the

Separation and the financial reporting needs of both

businesses.

“Eduard has been the CFO of Lithium Americas

since 2007, and has made significant contributions to the success

of our business,” said George Ireland, Chairman. “On behalf of the

Company, I would like to thank Eduard for his contributions and

wish him every success in his retirement. Eduard is leaving a

business that is in a strong financial position and well on track

to deliver on our long-term vision. We welcome Pablo to the Lithium

Americas team.”

“I am excited to announce Pablo’s appointment as

Lithium Americas’ new CFO,” said Jonathan Evans, President and CEO

of Lithium Americas. “Pablo is a seasoned CFO who brings a wealth

of experience in strategy, M&A and capital markets.”

Pablo Mercado has over 23 years of experience in

finance and corporate development in the energy industry. Most

recently he served as CFO of EnLink Midstream, LLC, and prior to

that, as CFO of Forum Energy Technologies, Inc., both US public

companies listed on the New York Stock Exchange. Pablo started his

professional career in 1998 as an investment banker at Bank of

America, UBS and Credit Suisse, until joining Forum in 2011. Pablo

holds a BBA from the Cox School of Business and a BA in Economics

from the Dedman College, both of Southern Methodist University, and

an MBA from the University of Chicago Booth School of Business.

ABOUT LITHIUM AMERICAS

Lithium Americas is focused on advancing lithium

projects in Argentina and the United States to production. In

Argentina, Caucharí-Olaroz is advancing towards first production

and Pastos Grandes represents regional growth. In the U.S., Thacker

Pass has received its Record of Decision and has commenced

construction. The Company trades on both the Toronto Stock Exchange

and on the New York Stock Exchange, under the ticker symbol

“LAC.”

For further information contact:Investor

RelationsTelephone: 778-656-5820Email:

ir@lithiumamericas.comWebsite: www.lithiumamericas.com

FORWARD-LOOKING INFORMATION

Certain statements in this release constitute

“forward-looking statements” within the meaning of applicable

United States securities legislation and “forward-looking

information” under applicable Canadian securities legislation

(collectively, “forward-looking statements”). Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the actual results, events, performance or

achievements of the proposed Separation and of the Company (Lithium

Americas (NewCo)’s / Lithium International’s), its projects, or

industry results, to be materially different from any future

results, events, performance or achievements expressed or implied

by such forward-looking statements. Such statements can be

identified by the use of words such as “may,” “would,” “could,”

“will,” “intend,” “expect,” “believe,” “plan,” “anticipate,”

“estimate,” “schedule,” “forecast,” “predict” and other similar

terminology, or state that certain actions, events or results

“may,” “could,” “would,” “might” or “will” be taken, occur or be

achieved. These statements reflect the Company’s current

expectations regarding future events, financial or operating

performance and results, and speak only as of the date of this

release. Such statements include without limitation, statements

with respect to the proposed Separation, the expected timetable for

completing the Separation (including timing of the CRA

application), the ability of the Company to complete the Separation

on the terms described herein, or at all, the receipt of Board of

Directors, shareholder and required third party, court, tax, stock

exchange and regulatory approvals required for the Separation

(including obtaining a CRA advance income tax ruling in respect

thereof), the expected holdings and assets of the entities

resulting from the Separation, the expected benefits of the

Separation for each business and to the Company’s shareholders and

other stakeholders, the strategic advantages, future opportunities

and focus of each business, expectations regarding the status of

development of the Company’s projects, the expected potential

benefits of the Thacker Pass project for creation of a battery

supply chain in the United States, the expected timing for a

decision by the court concerning the appeal of the ROD, and

expectations regarding the process of building the teams of Lithium

Americas (NewCo) and Lithium International and regarding the

intentions of Jonathan Evans and Pablo Mercado to remain as the CEO

and CFO, respectively, of Lithium Americas (NewCo).

Forward-looking statements involve significant

risks and uncertainties, should not be read as guarantees of future

performance, events or results and will not necessarily be accurate

indicators of whether or not such events or results will be

achieved. A number of factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements or information, including, but not limited to,

uncertainties with obtaining required approvals, rulings, court

orders and consents, or satisfying other requirements, necessary or

desirable to permit or facilitate completion of the Separation

(including CRA, regulatory and shareholder approvals); future

factors or events that may arise making it inadvisable to proceed

with, or advisable to delay or alter the structure of the

Separation; the performance, the operations and financial condition

of Lithium Americas (NewCo) and Lithium International as separately

traded public companies, including the reduced geographical and

property portfolio diversification resulting from the Separation;

the impact of the Separation on the trading prices for, and market

for trading in, the shares of the Company, Lithium Americas (NewCo)

and Lithium International (collectively the “Entities” and

individually, an “Entity”); the potential for significant tax

liability for a violation of the tax-deferred spinoff rules

applicable in Canada and the United States; uncertainties with

realizing the potential benefits of the Separation; risks

associated with mining project development, achieving anticipated

milestones and budgets as planned, and meeting expected timelines;

risks inherent in litigation that could result in additional

unanticipated delays or rulings that are adverse for an Entity or

its projects; maintaining local community support in the regions

where an Entity’s projects are located; changing social perceptions

and their impact on project development and litigation; ongoing

global supply chain disruptions and their impact on developing an

Entity’s projects; availability of personnel, supplies and

equipment; the impact of inflation or changing economic conditions

on an Entity, its projects and their feasibility; any impacts of

COVID-19 or an escalation thereof on the business of an Entity;

unanticipated changes in market price for an Entity’s shares;

changes to an Entity’s current and future business plans and the

strategic alternatives available to the Entity; industry and stock

market conditions generally; demand, supply and pricing for

lithium; and general economic and political conditions in Canada,

the United States, Argentina and other jurisdictions where an

Entity conducts business. Additional information about certain of

these assumptions and risks and uncertainties is contained in the

Company’s filings with securities regulators, including the

Company’s most recent annual information form and most recent

management’s discussion and analysis for the Company’s most

recently completed financial year and interim financial period,

which are available on SEDAR at www.sedar.com and EDGAR at

www.sec.gov.

Although the forward-looking statements

contained in this release are based upon what management of the

Company believes are reasonable assumptions as of the date hereof,

there can be no assurance that actual results will be consistent

with these forward-looking statements. These forward-looking

statements are made as of the date of this release and are

expressly qualified in their entirety by this cautionary statement.

Subject to applicable securities laws, the Company does not assume

any obligation to update or revise the forward-looking statements

contained herein to reflect events or circumstances occurring after

the date of this release.

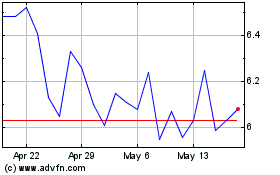

Lithium Americas (TSX:LAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Lithium Americas (TSX:LAC)

Historical Stock Chart

From Jan 2024 to Jan 2025