Canadian Life Companies Split Corp. Announces TSX Acceptance of Normal Course Issuer Bid

13 March 2014 - 2:25AM

Marketwired Canada

Canadian Life Companies Split Corp. (the "Company") announced today that the

Toronto Stock Exchange (the "TSX") has accepted its notice of intention to make

a Normal Course Issuer Bid (the "NCIB") to purchase its Preferred Shares and

Class A Shares through the facilities of the TSX. The NCIB will commence on

March 14, 2014 and terminate on March 13, 2015.

Pursuant to the NCIB, the Company proposes to purchase, from time to time, if it

is considered advisable, up to 1,337,210 Preferred Shares and 1,337,210 Class A

Shares of the Company, representing approximately 10% of the public float of

13,372,107 Class A Shares. As of March 6, 2014, there were 13,594,440 Preferred

Shares and 13,594,440 Class A Shares issued and outstanding. The Company will

not purchase, in any given 30-day period, in the aggregate, more than 271,888

Preferred Shares or more than 271,888 Class A Shares, being 2% of the issued and

outstanding Preferred Shares and Class A Shares as of March 6, 2014. Under a

normal course issuer bid that commenced on January 14, 2013 and terminated on

January 13, 2014, the Company purchased 370,100 Preferred Shares at a weighted

average price per Preferred Share of $10.12, and 370,100 Class A Shares at a

weighted average price per Class A Share of $2.51.

The Board of Directors of the Company, on the advice of Quadravest Capital

Management Inc., the Company's investment manager, believes that such purchases

are in the best interests of the Company and are a desirable use of its funds.

All purchases will be made through the facilities and in accordance with the

rules and policies of the TSX. All Preferred Shares or Class A Shares purchased

by the Company pursuant to the NCIB will be cancelled.

Canadian Life Companies Split Corp. is an investment fund managed and advised by

Quadravest Capital Management Inc. The Preferred Shares and Class A Shares of

the Company are listed in the Toronto Stock Exchange under the symbols LFE.PR.B

and LFE respectively.

Certain statements included in this news release constitute forward-looking

statements, including, but not limited to, those identified by the expressions

"expect", "intend", "will" and similar expressions to the extent they relate to

the Company. The forward-looking statements are not historical facts but reflect

the Company's current expectations regarding future results or events. These

forward- looking statements are subject to a number of risks and uncertainties

that could cause actual results or events to differ materially from current

expectations. Although the Company believes that the assumptions inherent in the

forward-looking statements are reasonable, forward-looking statements are not

guarantees of future performance and, accordingly, readers are cautioned not to

place undue reliance on such statements due to the inherent uncertainty therein.

The Company undertakes no obligation to update publicly or otherwise revise any

forward-looking statement or information whether as a result of new information,

future events or other such factors which affect this information, except as

required by law.

FOR FURTHER INFORMATION PLEASE CONTACT:

Canadian Life Companies Split Corp.

Investor Relations

416-304-4443

Toll Free: 1-877-4-Quadra (1-877-478-2372)

www.lifesplit.com

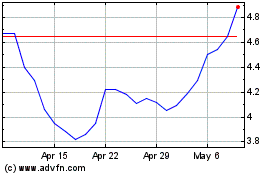

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

From Nov 2024 to Dec 2024

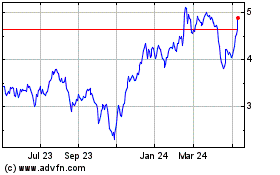

Canadian Life Companies ... (TSX:LFE)

Historical Stock Chart

From Dec 2023 to Dec 2024