Marimaca Copper Corp. (“Marimaca Copper”, “Marimaca” or the

“Company”) (TSX: MARI) is pleased to announce a C$20

million equity investment by Mitsubishi Corporation (“Mitsubishi”)

by way of non-brokered private placement (the “Strategic

Investment”). Proceeds from the Strategic Investment will be used

to advance and accelerate the development of the Company’s flagship

Marimaca Copper Project located in the Antofagasta region, Chile.

Mitsubishi will subscribe for an aggregate

4,640,371 units (“Units”) consisting of one common share (a “Common

Share”) and one Common Share purchase warrant (a “Warrant”) at a

price of C$4.31 per Unit. Each Warrant will entitle Mitsubishi to

purchase one additional Common Share at an exercise price of C$5.60

for a period of 24 months following the closing of the Strategic

Investment. Following completion of the Strategic Investment,

Mitsubishi will own approximately 5.0% of Marimaca’s issued and

outstanding common shares on a non-diluted basis.

The Unit subscription price represents an 11%

premium to the 20-day volume weighted average price of the

Company’s common shares on the Toronto Stock Exchange (“TSX”) as of

June 19, 2023.

Mitsubishi is a major investor in the Latin

American copper industry with a portfolio of existing investments

including Escondida, Los Pelambres, Antamina, Los Bronces and

Quellaveco.

Hayden Locke, President & CEO of

Marimaca Copper, commented:

“We are pleased to welcome Mitsubishi

Corporation as a partner and shareholder in Marimaca. This

investment is a strong endorsement of the quality of the Marimaca

Project from an exceptionally well-respected and established

stakeholder in the Chilean copper industry.

“We are pleased that Mitsubishi shares our view

that the Marimaca Copper Project is a unique, very high quality,

development stage project. Its location affords it several

advantages including an expectation that it will be among the

lowest carbon intensity copper producers in the industry. It is one

of very few new copper projects that has the potential to deliver

near term production of meaningful scale.

“Mitsubishi’s investment significantly de-risks

our next phase of development and provides funding to accelerate

progress toward the Definitive Feasibility Study and permitting,

while minimizing dilution to our existing shareholders.”

Taro Abe, General Manager, Base Metals

Dept., Mitsubishi Corporation, commented:

“We are excited to be involved in the Marimaca

project, which has the potential to deliver a meaningful new supply

of copper in the near term. Of particular importance to us are the

sustainability credentials of the project, which we believe will be

a source of very low carbon intensity copper.

“We look forward to working together with the

Marimaca team as it moves into the next phase of studies and

permitting with the hope we can fully utilise our deep experience

in the Chilean copper industry to further enhance this

project.”

Marimaca intends to use the proceeds of the

Strategic Investment to progress the Definitive Feasibility Study

(“DFS”) and permitting workstreams on the Company's Marimaca Copper

Project, and for working capital and general corporate purposes.

The Strategic Investment is expected to close on or before July 11,

2023 and is subject to the approval of the TSX. The securities

issued pursuant to the Strategic Investment will be subject to a

statutory 4-month hold period in accordance with applicable

Canadian securities laws. No finder's fee is payable in connection

with the Strategic Investment.

In connection with the Strategic Investment,

Mitsubishi will be granted certain rights including:

- For so long as

Mitsubishi maintains an ownership interest of at least 2.5%,

Mitsubishi will be granted participation and top-up rights that

enable it to maintain its pro rata ownership interest in the

Company.

- The right to

nominate one member for election to the Company’s Board of

Directors should Mitsubishi’s ownership interest increase to 7.5%

or greater.

- The right to

appoint two members to an Environmental and Technical Committee

that will be formed.

In connection with the Strategic Investment,

Greenstone Resources L.P. and certain of its affiliates and

affiliates of Tembo Capital Mining GP Limited, including Ndovu

Capital XIV B.V., have agreed to waive their respective

pre-existing rights to participate on a pro rata basis in equity

financings by the Company.

RBC Capital Markets is acting as financial

advisor to the Company in connection with the Strategic

Investment.

About MarimacaMarimaca Copper is a

Canadian exploration and development company focused on developing

the Marimaca Project, an oxide, open-pit, heap leach copper project

located in the Antofagasta region of northern Chile. The Company’s

shares trade on the TSX under the symbol “MARI” and on the OTCQX

under the symbol “MARIF”.

Contact InformationFor further

information please visit www.marimaca.com or contact:

Tavistock +44 (0) 207 920

3150Emily Moss / Adam Baynesmarimaca@tavistock.co.uk

Forward Looking Statements

This news release includes certain

“forward-looking statements” under applicable Canadian securities

legislation, including statements related to the Strategic

Investment and the terms thereof, the anticipated closing date, the

intended use of proceeds and the receipt of regulatory approvals

including the approval of the TSX. There can be no assurance that

such statements will prove to be accurate, and actual results and

future events could differ materially from those anticipated in

such statements. Forward-looking statements reflect the beliefs,

opinions and projections on the date the statements are made and

are based upon a number of assumptions and estimates that, while

considered reasonable by Marimaca Copper, are inherently subject to

significant business, economic, competitive, political and social

uncertainties and contingencies. Many factors, both known and

unknown, could cause actual results, performance or achievements to

be materially different from the results, performance or

achievements that are or may be expressed or implied by such

forward-looking statements and the parties have made assumptions

and estimates based on or related to many of these factors. Such

factors include, without limitation: risks related to share price

and market conditions, the inherent risks involved in the mining,

exploration and development of mineral properties, the

uncertainties involved in interpreting drilling results and other

geological data, fluctuating metal prices, the possibility of

project delays or cost overruns or unanticipated excessive

operating costs and expenses, uncertainties related to the

necessity of financing, uncertainties relating to regulatory

procedure and timing for permitting reviews, the availability of

and costs of financing needed in the future as well as those

factors disclosed in the annual information form of the Company

dated March 27, 2023 and other filings made by the Company with the

Canadian securities regulatory authorities (which may be viewed at

www.sedar.com). Statements regarding the Company’s planned DFS on

the Project are forward-looking information and may not be

realized. Accordingly, readers should not place undue reliance on

forward-looking statements. Marimaca Copper undertakes no

obligation to update publicly or otherwise revise any

forward-looking statements contained herein whether as a result of

new information or future events or otherwise, except as may be

required by law.

Neither the TSX nor the Canadian Investment

Regulatory Organization accepts responsibility for the adequacy or

accuracy of this release.

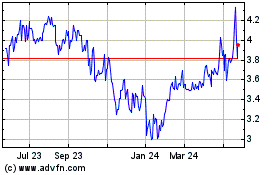

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jan 2025 to Feb 2025

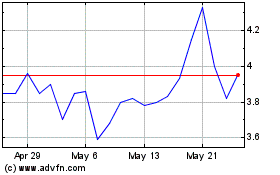

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Feb 2024 to Feb 2025