Marimaca Files Technical Report on Updated Mineral Resource Estimation

27 June 2023 - 9:00PM

Marimaca Copper Corp. (“Marimaca Copper” or the “Company”)

(TSX: MARI) is pleased to announce that further to its

news release dated May 18th, 2023 it has filed a technical report

in accordance with Canadian Securities Administrator’s National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“

NI 43-101”) on the Marimaca Copper Project

titled “Updated Mineral Resource Estimation for the Marimaca Copper

Project, Antofagasta Region, Chile” (the “

Technical

Report”

or “

2023 MRE”).

The Technical Report is dated June 26th, 2023, with an effective

date of May 18th, 2023, and is available under the Company's

profile on SEDAR at www.sedar.com.

The 2023 MRE incorporates 28,374m of new

drilling data completed since the Company’s previous technical

report for the Marimaca Copper Project having an effective date of

October 13th, 2022 and filed on November 28th, 2022 (the

“2022 MRE”). The Marimaca Oxide Deposit (the

“MOD”) database now consists of 139,164m of

drilling completed since discovery in 2016. New drilling data

captured following the 2022 MRE was largely targeted at conversion

of Inferred Resources to the Measured and Indicated categories.

|

Mineral Resource Category and Type |

Quantity |

CuT |

CuS |

CuT |

CuS |

|

(kt) |

(%) |

(%) |

(t) |

(t) |

|

Total Measured |

96,954 |

0.49 |

0.28 |

473,912 |

268,628 |

|

Total Indicated |

103,358 |

0.41 |

0.21 |

425,797 |

219,690 |

|

Total Measured and Indicated |

200,312 |

0.45 |

0.24 |

899,709 |

488,319 |

|

Total Inferred |

37,289 |

0.38 |

0.15 |

141,252 |

55,802 |

Table 1. 2023 Mineral Resource Estimate

(reported at 0.15% CuT cutoff)

* Pit shell constrained resources with demonstrated

reasonable prospects for eventual economic extraction (RPEEE) are

generated using series of Lerchs-Grossmann pit shell optimizations

completed by NCL* CuT means total copper and CuS means acid soluble

copper. Technical and economic parameters include: copper price

US$4.00/lb; base mining cost of US$1.51/t with a mining cost

adjustment factor of US$0.04/t-10m bench; Heap Leach “HL”

processing cost US$5.94/t (incl. G&A); Run-of-Mine “ROM”

processing cost US$1.65/t (incl. G&A); SX-EW processing cost

and selling cost US$0.16/lb Cu; heap leach recovery 76% of CuT; ROM

recovery 40% of CuT; and 42°-52° pit slope angles* Mineral

resources which are not mineral reserves do not have demonstrated

economic viability. Due to the uncertainty which may attach to

inferred mineral resources, it cannot be assumed that all or any

part of an inferred mineral resource will be upgraded to an

indicated or measured mineral resource as a result of continued

exploration

|

Cut-off grade (% CuT) |

Measured |

Indicated |

Measured + Indicated |

Inferred |

|

|

|

|

Quantity kt |

CuT [%] |

CuS [%] |

Quantity kt |

CuT [%] |

CuS [%] |

Quantity kt |

CuT [%] |

CuS [%] |

Quantity kt |

CuT [%] |

CuS [%] |

|

|

0.40 |

44.0 |

0.77 |

0.44 |

37.5 |

0.69 |

0.38 |

81.6 |

0.73 |

0.41 |

12.1 |

0.64 |

0.24 |

|

|

0.30 |

60.2 |

0.65 |

0.38 |

55.5 |

0.58 |

0.31 |

115.7 |

0.62 |

0.35 |

18.8 |

0.54 |

0.21 |

|

|

0.22 |

77.8 |

0.56 |

0.32 |

77.0 |

0.49 |

0.26 |

154.9 |

0.53 |

0.29 |

27.2 |

0.45 |

0.18 |

|

|

0.20 |

83.0 |

0.54 |

0.31 |

83.8 |

0.47 |

0.25 |

166.8 |

0.50 |

0.28 |

30.2 |

0.43 |

0.17 |

|

|

0.18 |

88.3 |

0.52 |

0.30 |

91.3 |

0.44 |

0.23 |

179.6 |

0.48 |

0.26 |

33.0 |

0.41 |

0.16 |

|

|

0.15 |

97.0 |

0.49 |

0.28 |

103.4 |

0.41 |

0.21 |

200.3 |

0.45 |

0.24 |

37.3 |

0.38 |

0.15 |

|

|

0.10 |

113.3 |

0.44 |

0.24 |

127.6 |

0.36 |

0.18 |

241.0 |

0.39 |

0.21 |

46.6 |

0.33 |

0.13 |

|

|

0.00 |

146.1 |

0.35 |

0.19 |

178.2 |

0.27 |

0.14 |

324.3 |

0.31 |

0.16 |

72.0 |

0.24 |

0.09 |

|

Table 2. 2023 Mineral Resource

Sensitivity

* Pit shell constrained resources with demonstrated

reasonable prospects for eventual economic extraction (RPEEE) are

generated using series of Lerchs-Grossmann pit shell optimizations

completed by NCL* CuT means total copper and CuS means acid soluble

copper. Technical and economic parameters include: copper price

US$4.00/lb; base mining cost of US$1.51/t with a mining cost

adjustment factor of US$0.04/t-10m bench; Heap Leach “HL”

processing cost US$5.94/t (incl. G&A); Run-of-Mine “ROM”

processing cost US$1.65/t (incl. G&A); SX-EW processing cost

and selling cost US$0.16/lb Cu; heap leach recovery 76% of CuT; ROM

recovery 40% of CuT; and 42°-52° pit slope angles* Mineral

resources which are not mineral reserves do not have demonstrated

economic viability. Due to the uncertainty which may attach to

inferred mineral resources, it cannot be assumed that all or any

part of an inferred mineral resource will be upgraded to an

indicated or measured mineral resource as a result of continued

exploration

Qualified Person

The technical information in this news release,

including the information related to drilling, modeling and

resource estimation, and the application of technical and economic

parameters has been reviewed and approved by Luis Oviedo, P. Geo,

an independent Consulting Geologist with more than 45 years of

experience. Mr. Oviedo is a member of the Colegio de Geólogos and

the Institute of Mining Engineers of Chile and is an Independent

Qualified Person as defined by NI 43-101.

Mr. Oviedo confirms he has visited the project

area, has reviewed relevant project information, is responsible for

the information contained in this news release, and consents to its

publication.

Contact InformationFor further

information please visit www.marimaca.com or contact:

Tavistock +44 (0) 207 920

3150Emily Moss / Adam Baynes

marimaca@tavistock.co.uk

Forward Looking Statements

This news release includes certain

“forward-looking statements” under applicable Canadian securities

legislation. There can be no assurance that such statements will

prove to be accurate, and actual results and future events could

differ materially from those anticipated in such statements.

Forward-looking statements reflect the beliefs, opinions and

projections on the date the statements are made and are based upon

a number of assumptions and estimates that, while considered

reasonable by Marimaca Copper, are inherently subject to

significant business, economic, competitive, political and social

uncertainties and contingencies. Many factors, both known and

unknown, could cause actual results, performance or achievements to

be materially different from the results, performance or

achievements that are or may be expressed or implied by such

forward-looking statements and the parties have made assumptions

and estimates based on or related to many of these factors. Such

factors include, without limitation: risks related to share price

and market conditions, the inherent risks involved in the mining,

exploration and development of mineral properties, the

uncertainties involved in interpreting drilling results and other

geological data, fluctuating metal prices, the possibility of

project delays or cost overruns or unanticipated excessive

operating costs and expenses, uncertainties related to the

necessity of financing, uncertainties relating to regulatory

procedure and timing for permitting reviews, the availability of

and costs of financing needed in the future as well as those

factors disclosed in the annual information form of the Company

dated March 27, 2023 and other filings made by the Company with the

Canadian securities regulatory authorities (which may be viewed

at www.sedar.com). Accordingly, readers should not place undue

reliance on forward-looking statements. Marimaca Copper undertakes

no obligation to update publicly or otherwise revise any

forward-looking statements contained herein whether as a result of

new information or future events or otherwise, except as may be

required by law.

Neither the Toronto Stock Exchange nor the

Canadian Investment Regulatory Organization accepts

responsibility for the adequacy or accuracy of this

release.

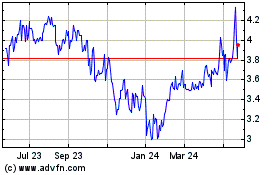

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Jan 2025 to Feb 2025

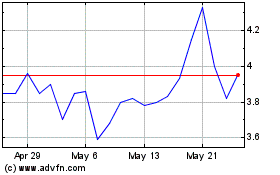

Marimaca Copper (TSX:MARI)

Historical Stock Chart

From Feb 2024 to Feb 2025