mdf commerce inc. (the “Corporation”) (TSX:MDF), a

SaaS leader in digital commerce technologies, reported Q3 FY2022

financial results for the three-month and nine-month periods ended

December 31, 2021. Financial references are expressed in Canadian

dollars unless otherwise indicated.

“Q3 FY2022 marks the inclusion of the first full

quarter of Periscope results, the US-based eprocurement entity that

was acquired in August 2021. For the quarter, Periscope contributed

$7.7 million of revenue, after the acquisition accounting fair

value adjustment on deferred revenue which had the impact of

reducing revenue by $2.6 million in the quarter. Periscope’s growth

trajectory is solid” said Luc Filiatreault, CEO of mdf commerce.

“$30.7 million is the highest revenue reported in a single quarter

for mdf commerce, and this would have been $2.6 million higher had

it not been for the acquisition accounting adjustment on Periscope

deferred revenues. Our focus for the quarter was the integration of

Periscope and we’re happy to report that efforts are on track: the

combined leadership team is in place, early product integration has

generated quick wins and the longer-term product roadmap is now

confirmed. This performance was achieved despite considerable

macro-economic challenges, including those caused by the Omicron

wave of the COVID-19 pandemic.”

Third Quarter Fiscal 2022 Financial

Results

Total revenues for the third quarter of fiscal

2022 reached $30.7 million, an increase of $9.2 million or 43.2%

compared to $21.4 million for the third quarter of fiscal 2021. On

a constant currency (1) basis, total revenue increased by $9.7

million or 46.3% compared to the third quarter of fiscal 2021.

Total Q3 FY2022 revenues were impacted by a fair value adjustment

on deferred revenues at the closing date of the Periscope

acquisition, and resulted in a $2.6 million reduction of revenue

for the quarter.

Recurring revenue(2) represents $26.7 million or

80% (MRR)(2) of total revenues for Q3 FY2022 and grew by $10.7

million compared to $16.0 million or 75% (MRR)(2) of total revenues

for Q3 FY2021.

Our two core platforms, eprocurement and Unified

Commerce contributed to revenue growth for the third quarter as

follows:

Overall, the eprocurement platform generated

revenues of $16.9 million, an increase of $8.6 million or 104.7%

compared to $8.2 million in Q3 FY2021. Excluding Periscope

revenues, the platform grew organically by $0.9 million or by 11%

compared to Q3 of the previous fiscal year. The US-based

eprocurement network, which includes revenues from Periscope,

contributed $8.2 million to revenue growth, compared to Q3 FY2021.

Revenues for Periscope for the quarter were $7.7 million, after the

acquisition accounting fair value adjustment of $2.6 million on

Periscope deferred revenues at the closing date of the acquisition.

Recurring revenue (MRR)(2) for the eprocurement platform

represented 92% of platform revenues for Q3 FY2022, remaining

unchanged compared to Q3 FY2021. We achieved $7.7 million, despite

the $2.6 million fair value adjustment on deferred revenue, even as

implementation activities for existing customer contracts were

slower than expected due mainly to the Omicron virus and its

impacts on personnel at our clients and within our teams.

The Unified Commerce platform, which includes

both ecommerce and Supply Chain Collaboration solutions, generated

revenues of $9.8 million for Q3 FY2022, an increase of

$0.4 million or 3.8% compared to revenues of $9.4 million for

Q3 FY2021. Recurring revenue (MRR)(2) for the Unified Commerce

platform represented 59% of platform revenues for Q3 FY2022

compared to 57% for Q3 FY2021.

The emarketplaces platform generated revenues of

$4.0 million for Q3 FY 2022, an increase of $0.2 million or 6.6%

compared to revenues of $3.7 million for Q3 FY2021.

Gross margin for Q3 FY2022 was

$17.2 million or 56.1% compared to $13.4 million or 62.7% for

Q3 FY2021. The decrease in the gross margin percentage is due to

the increased cost of revenues mainly from increased headcount,

higher salaries and increased professional fees to support customer

implementations and deployments which have lower margins than right

of use revenues, and higher hosting and licenses costs directly

related to the Corporation’s transition to a cloud-based

strategy.

For Q3 FY2022, total operating expenses were

$22.7 million, an increase of 41% compared to $16.1 million in

Q3 FY2021.

General and administrative expenses totalled

$6.2 million in Q3 FY2022, selling and marketing expenses were $8.4

million and technology expenses were $8.1 million, compared to $5.2

million, $4.8 million and $6.1 million respectively for Q3

FY2021.

The Corporation recorded an operating loss of

$5.5 million during Q3 FY2022, compared to operating loss of $2.7

million in Q3 FY2021.

Higher operating expenses are mainly due to

4-months of Periscope operations, an increase in headcount, salary

and related expenses, to additional amortization expense related to

the Periscope acquisition and to an increase in hosting fees

related to the Corporation’s transition to a cloud-based strategy.

Operating expenses for the third quarter of the previous year

included a federal wage subsidy in the context of COVID-19 of $0.6

million.

Net loss was $4.7 million or $0.11 net loss per

share basic and diluted in Q3 FY2022, compared to a net loss of

$2.9 million or $0.14 net loss per share basic and diluted in Q3

FY2021.

Adjusted EBITDA(3) was $0.7 million for Q3

FY2022 compared to Adjusted EBITDA(3) of $1.0 million reported for

Q3 FY2021.

The acquisition accounting adjustment to the

fair value of deferred revenues as of the acquisition date, which

resulted in a reduction of revenue of $2.6 million in Q3 FY2022,

also had an unfavorable impact on gross margin, operating loss, net

loss, Adjusted EBITDA(3) and loss per share (basic and diluted) for

Q3 FY2022.

“We are excited about the acquisition of

Periscope, in particular how the eprocurement solutions and the

business model can be leveraged across our entire eprocurement

platform with the goal of maximizing earnings potential,” remarked

CFO Deborah Dumoulin.

“As we progress with the integration and sales

efforts, an opportunity lies in expanding the transactional model

which has the potential to generate high-margin recurring revenue.

Our focus is on operational efficiency and cost optimization.”

Summary of consolidated results the three and

nine-months ended December 31:

| |

Three-month periods ended |

Nine-month periods ended |

|

|

Dec.312021 |

Sep. 312021 |

Dec. 312020 |

Dec. 312021 |

Dec. 31 2020 |

| In thousands of Canadian

dollars, except per share amounts |

$ |

$ |

$ |

$ |

$ |

|

Revenues |

30,652 |

25,080 |

21,403 |

78,305 |

62,689 |

| Operating loss |

(5,465) |

(8,822) |

(2,716) |

(18,576) |

(3,507) |

| Net loss |

(4,673) |

(6,308) |

(2,853) |

(15,266) |

(4,733) |

| |

|

|

|

|

|

| Adjusted EBITDA (loss)

(3) |

739 |

(402) |

1,021 |

(1,174) |

5,525 |

| Adjusted loss(4) |

(4,673) |

(6,308) |

(2,853) |

(15,266) |

(4,733) |

| |

|

|

|

|

|

| Loss per share (basic and

diluted) |

(0.11) |

(0.19) |

(0.14) |

(0.43) |

(0.26) |

|

Adjusted loss per share(4) (basic and diluted) |

(0.11) |

(0.19) |

(0.14) |

(0.43) |

(0.26) |

| Basic and diluted weighted

average number of shares outstanding (in thousands) |

43,971 |

33,536 |

20,844 |

35,335 |

18,407 |

Reconciliation of net loss and Adjusted

EBITDA

| |

Three-month periods ended |

Nine-month periods ended |

|

|

|

|

|

|

|

| |

Dec. 31 2021 |

Sep. 302021 |

Dec. 31 2020 |

Dec. 31 2021 |

Dec. 31 2020 |

| In thousands of Canadian

dollars, except per share amounts |

$ |

$ |

$ |

$ |

$ |

|

Net loss |

(4,673) |

(6,308) |

(2,853) |

(15,266) |

(4,733) |

| Income tax recovery |

(1,496) |

(1,371) |

(625) |

(3,693) |

(914) |

| Depreciation of property and

equipment and amortization of intangible assets |

1,083 |

1,019 |

1,121 |

3,002 |

3,064 |

| |

|

|

|

|

|

| Amortization of acquired

intangible assets |

2,920 |

1,337 |

885 |

5,139 |

2,799 |

| Amortization of right-of-use

assets |

602 |

506 |

415 |

1,597 |

1,298 |

| Amortization of deferred

financing costs |

69 |

158 |

58 |

284 |

78 |

| Interest on lease

liability |

93 |

173 |

93 |

357 |

290 |

|

Interest on long-term debt |

211 |

135 |

106 |

360 |

527 |

| Other finance costs

(income) |

24 |

131 |

- |

155 |

- |

| Interest income |

- |

(343) |

(11) |

(510) |

(11) |

| EBITDA |

(1,167) |

(4,563) |

(811) |

(8,575) |

2,398 |

| Foreign exchange loss

(gain) |

(1) |

(1,397) |

516 |

(571) |

1,256 |

| Stock-based compensation

expense |

306 |

319 |

156 |

825 |

343 |

| Restructuring costs |

1,552 |

611 |

932 |

2,391 |

1,243 |

| Acquisition-related costs |

49 |

4,628 |

228 |

4,756 |

285 |

|

|

|

|

|

|

|

| Adjusted EBITDA

(loss)3 |

739 |

(402) |

1,021 |

(1,174) |

5,525 |

Reconciliation of net loss and Adjusted

loss

| |

Three-month periods ended |

Nine-month periods ended |

|

|

Dec. 312021 |

Sep.302021 |

Dec. 312020 |

Dec. 312021 |

Dec. 312020 |

| In thousands of Canadian

dollars, except per share amounts |

$ |

$ |

$ |

$ |

$ |

|

Net loss |

(4,673) |

(6,308) |

(2,853) |

(15,266) |

(4,733) |

| Adjusted

loss4 |

(4,673) |

(6,308) |

(2,853) |

(15,266) |

(4,733) |

| Loss per share (basic

and diluted) |

(0.11) |

(0.19) |

(0.14) |

(0.43) |

(0.26) |

| Adjusted loss per

share4 (basic and diluted) |

(0.11) |

(0.19) |

(0.14) |

(0.43) |

(0.26) |

Reconciliation of revenues on a constant currency

basis1

Q3 FY2021 versus Q3 FY2021

|

In thousands ofCanadian dollars |

Three-monthperiod endedDecember 31,2021 |

Three- monthperiod endedDecember 31,2020 |

Variance $ |

Variance % |

|

Revenues |

30,652 |

21,403 |

9,249 |

43.2% |

|

Constant Currency Impact |

- |

(454) |

- |

- |

|

Revenues in Constant Currency1 |

30,652 |

20,949 |

9,703 |

46.3% |

Q3 FY2021 versus Q2 FY2021

|

In thousands ofCanadian dollars |

Three-monthperiod endedDecember 31,2021 |

Three-monthperiod endedSeptember 30,2021 |

Variance $ |

Variance % |

|

Revenues |

30,652 |

25,080 |

5,572 |

22.2% |

|

Constant Currency Impact |

- |

(212) |

- |

- |

|

Revenues in Constant Currency1 |

30,652 |

24,868 |

5,784 |

23.3% |

Nine-month period ended December 31, 2021 versus nine-month

period ended December 31, 2020

|

In thousands of Canadian dollars |

Nine-monthperiod endedDecember 31,2021 |

Nine-monthperiod endedDecember 31,2020 |

Variance $ |

Variance % |

|

Revenues |

78,305 |

62,689 |

15,616 |

24.9% |

|

Constant Currency Impact |

- |

(1,344) |

- |

- |

|

Revenues in Constant Currency1 |

78,305 |

61,345 |

16,960 |

27.6% |

1 Certain revenue figures and changes from prior

period are analyzed and presented on a constant currency basis and

are obtained by translating revenues from the comparable period of

the prior year denominated in foreign currencies at the foreign

exchange rates of the current period. The Company believes that

this Non-IFRS financial measure is useful to compare its

performance that excludes certain elements prone to volatility.

Refer to the “Non-IFRS Financial Measures and Key Performance

Indicators” section.

2 Recurring revenue and Monthly Recurring

Revenue (“MRR”) are a key performance indicators. Refer to the

“Non-IFRS Financial Measures and Key Performance Indicators”

section.

3 Adjusted EBITDA and adjusted EBITDA margin are

non-IFRS measure. In the fourth quarter of fiscal 2021, the

definition of adjusted EBITDA was amended, and certain comparative

figures have been restated to conform with the current

presentation. Refer to the “Non-IFRS Financial Measures and Key

Performance Indicators” section.

4 Adjusted loss and Adjusted loss per share

(basic and diluted) are non-IFRS financial measures. Refer to the

“Non-IFRS Financial Measures and Key Performance Indicators”

section.

Board changes

The Honourable Clément Gignac was appointed to

the Senate of Canada on July 29, 2021. As a result of his

appointment as a Senator, the Honourable Clément Gignac has decided

to resign as a member of the Board of Directors of mdf commerce,

effective as of February 9, 2022, to focus on his responsibilities

as a Senator. The Honourable Clément Gignac will be a member of

three of the Senate committees, namely the National Finance

Committee, the Banking, Trade and Commerce Committee as well as the

Energy, the Environment and National Resources Committee.

Mr. Gilles Laporte, Chair of the Board, has

also announced that, after serving on the mdf commerce Board of

Directors for 11 years, he will not stand for re-election at the

next annual meeting of the Corporation, unless at such time no new

director has been selected.

mdf commerce has initiated a recruiting process

to replace Messrs. Gignac and Laporte on the Board. The Board has

formed a Search Committee headed by Mary-Ann Bell, an independent

Board member, to hire an executive search firm, to conduct the

search and to make recommendations of candidates to the full

Board.

About mdf commerce inc.

mdf commerce inc. (TSX:MDF)

enables the flow of commerce by providing a broad set of SaaS

solutions that optimize and accelerate commercial interactions

between buyers and sellers. Our platforms and services empower

businesses around the world, allowing them to generate

billions of dollars in transactions on an annual basis. Our

eprocurement, Unified Commerce and emarketplace platforms are

supported by a strong and dedicated team of approximately 800

employees based in Canada, the United States, Denmark, Ukraine and

China. For more information, please visit us

at mdfcommerce.com, follow us on LinkedIn or call at

1-877-677-9088.

Forward-Looking Statements

In this press release, “mdf commerce”, the

“Corporation” or the words “we”, “our” and “us” refer, depending on

the context, either to mdf commerce inc. or to mdf commerce inc.

together with its subsidiaries and entities in which it has an

economic interest. All dollar amounts refer to Canadian dollars,

unless otherwise expressly stated.

This press release is dated February 9, 2022

and, unless specifically stated otherwise, all information

disclosed herein is provided as at December 31, 2021, the end of

the most recent quarter of the Corporation.

Certain statements in this press release and in

the documents incorporated by reference herein constitute

forward-looking statements. These statements relate to future

events or our future financial performance and involve known and

unknown risks, uncertainties and other factors that may cause mdf

commerce’s, or the Corporation’s industry’s actual results, levels

of activity, performance or achievements to be materially different

from those expressed or implied by any of the Corporation’s

statements. Such factors may include, but are not limited to, risks

and uncertainties that are discussed in greater detail in the “Risk

Factors and Uncertainties” section of the Corporation’s Annual

Information Form as at March 31, 2021, as well as in the “Risk

Factors and Uncertainties” section of the Management’s Discussion

and Analysis for the third quarter ended December 31, 2021 and

elsewhere in the Corporation’s filings with the Canadian securities

regulators, as applicable. Forward-looking statements generally can

be identified by the use of forward-looking terminology such as

“may”, “will”, “should”, “could”, “expects”, “plans”,

“anticipates”, “intends”, “believes”, “estimates”, “predicts”,

“potential” or “continue” or the negatives of these terms or other

comparable terminology. These statements are only predictions.

Forward-looking statements are based on management’s current

estimates, expectations and assumptions, which management believes

are reasonable as of the date hereof, and are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and are accordingly

subject to changes after such date. Undue importance should not be

placed on forward-looking statements, and the information contained

in such forward-looking statements should not be relied upon as of

any other date. Actual events or results may differ materially. We

cannot guarantee future results, levels of activity, performance or

achievement. We disclaim any intention, and assume no obligation,

to update these forward-looking statements, except as required by

applicable securities laws.

Additional information about mdf commerce,

including the Corporation’s interim condensed consolidated

financial statements as at December 31, 2021 and 2020 and for the

three and nine-month periods then ended, Management’s Discussion

and Analysis for the third quarter ended December 31, 2021 and its

latest Annual Information Form as at March 31, 2021 are available

on the Corporation’s website www.mdfcommerce.com and have been

filed with SEDAR at www.sedar.com.

Non-IFRS Financial Measures and Key

Performance Indicators

The Corporation’s interim condensed consolidated

financial statements for the three and nine-month periods ended

December 31, 2021 and December 31, 2020 have been prepared in

accordance with International Accounting Standard (IAS) 34, Interim

Financial Reporting, through the application of accounting

principles that are compliant with International Financial

Reporting Standards (IFRS). The interim condensed consolidated

financial statements do not include all of the information required

for complete financial statements under IFRS, including the

notes.

The Corporation presents non-IFRS financial

performance measures and key performance indicators to assess

operating performance. The Corporation presents Adjusted profit

(loss), Adjusted profit (loss) per share, net profit (loss) before

interest, taxes, depreciation and amortization (“EBITDA”), Adjusted

EBITDA, Adjusted EBITDA margin, and certain Revenues presented on a

constant currency basis as a non-IFRS measures and Recurring

Revenue and Monthly Recurring Revenues as key performance

indicators. These non-IFRS measures and key performance indicators

do not have standardized meanings under IFRS standards and are not

likely to be comparable to similarly designated measures reported

by other corporations. The reader is cautioned that these measures

are being reported in order to complement, and not replace, the

analysis of financial results in accordance with IFRS standards.

Management uses both measures that comply with IFRS standards and

non-IFRS measures, in planning, overseeing and assessing the

Corporation’s performance.

Certain additional disclosures including the

definitions associated with non-IFRS measures as well as a

reconciliation to the most comparable IFRS measures, and key

performance indicators have been incorporated by reference and can

be found in Management’s Discussion and Analysis (MD&A) for the

third quarter ended December 31, 2021, as presented in the section

“Non-IFRS Financial Measures and Key Performance Indicators”. The

MD&A for the third quarter ended December 31, is available on

SEDAR at www.sedar.com and on the Corporation’s website

mdfcommerce.com under the Investors section.

In Q4 FY2021, the Corporation amended the

definition of Adjusted EBITDA to adjust for acquisition related

costs and restructuring costs. Comparative figures prior to March

31, 2021 have been restated to be consistent with the current

presentation. Adjusted EBITDA is calculated as profit (loss) before

interest, taxes, depreciation and amortization (“EBITDA”), adjusted

for foreign exchange gain (loss), gain (loss) on the sale of a

subsidiary, share-based compensation, acquisition-related costs and

restructuring costs Refer to the “Non-IFRS Financial Measures and

Key Performance Indicators” in Management’s Discussion and Analysis

for the third quarter ended December 31, 2021.

Conference call for third quarter of

fiscal 2022 financial results

Date: Thursday, February 10, 2022Time: 10:00

a.m. Eastern Standard TimeDial-in: (833) 732-1201 (toll-free) or

(720) 405-2161 (international)Live webcast: register here

A replay of the webcast will be available until

February 10, 2023, at midnight Eastern Time through the same link

following the conference call. Please visit the Investor Relations

section on our website on February 9, 2022, to view the earnings

release prior to the conference call.

For further information:

mdf commerce inc.Luc

Filiatreault, President & CEOToll free: 1-877-677-9088, ext.

2004Email: luc.filiatreault@mdfcommerce.com

Deborah Dumoulin, Chief Financial OfficerToll

free: 1-877-677-9088, ext. 2134Email:

deborah.dumoulin@mdfcommerce.com

André Leblanc, Vice President, Marketing and

Public AffairsToll Free: 1 877 677-9088, ext. 8220Email:

andre.leblanc@mdfcommerce.com

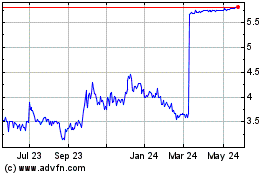

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Dec 2024 to Jan 2025

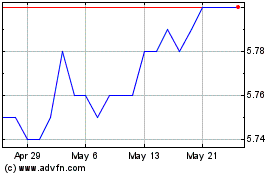

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Jan 2024 to Jan 2025