mdf commerce inc. (the “Corporation”) (TSX:MDF), a

SaaS leader in digital commerce technologies, reported third

quarter financial results for the three-month period ended December

31, 2023 (“Q3 FY2024”). All dollar amounts are expressed in

Canadian dollars unless otherwise indicated.

“We’ve seen a clear shift in public sector focus

on digital transformation, with procurement process digitalization

listed among the top priorities of state and local governments”,

said Luc Filiatreault, President and Chief Executive Officer of mdf

commerce. “Our innovative suite of eprocurement solutions

purpose-fit for state and local governments, provide efficiencies

critical to government agencies who are ultimately seeking to

generate taxpayer value. We are excited that we’ve seen

year-over-year growth in our eprocurement products, implying broad

strength across our product suite. We are well-positioned for

strong growth as this digital transformation is primed to

accelerate over the next few years.”

During the third quarter we welcomed new

mid-market customers to our eprocurement community, closing several

multi-year contracts for our eprocurement solutions, mainly focused

on our Source, Contract and Connect offerings. Our full-suite of

end-to-end procurement solutions offered in modules Source,

Contract, Procure, Connect and Shop, are tailored for public sector

procurement and provide a strong competitive advantage.

New customer wins in the 2024 fiscal year,

including the State of Hawaii which was announced last quarter, and

new agency customers in the eprocurement mid-market strategy, are

starting to show in our financial results as customer deployments

ramp up. “The eprocurement platform revenue grew by 4.5% and 7.4%

in Q3 FY2024 and in the nine-month period ended December 31, 2023

(“YTD Q3 FY2024”) respectively compared to the same periods of

prior year, and eprocurement Recurring Revenue4 continues to trend

at 88% of total platform revenues”, said Deborah Dumoulin, Chief

Financial Officer of mdf commerce. “We reported a sixth sequential

quarter of positive Adjusted EBITDA1 at $2.5 million, a significant

improvement from $0.9 million in Q3 prior year, with notable

improvements in profitability over the last year and positive cash

flow from operations for the quarter. We reported positive net cash

generated from operating activities of $6.4 million for Q3 FY2024,

compared to net cash used in operating activities of $2.8 million

in the third quarter last year and ended the third quarter with

over $5.0 million in cash and cash equivalents and with $1.5

million drawn on the Revolving Facility available under the Credit

Agreement. We are pleased that our results show a notable

improvement in cash flows from operations.”

Third Quarter

Fiscal 2024

Financial Results

Revenues for Q3 FY2024 were $30.2 million

compared to $31.7 million in Q3 FY2023, a decrease of $1.5 million

or 4.6%. Q3 year-over-year revenue decreased by $0.2 million or

0.6% when excluding InterTrade5, a subsidiary that was sold on

October 4, 2022 and contributed $0.4 million of revenue in Q3

FY2023 and other revenue from post-closing transition services of

$0.9 million. On a Constant Currency3 basis, revenues decreased by

$1.6 million or 4.9% compared to $31.8 million in Q3 FY2023.

Recurring Revenue4 was $24.8 million or 82.2% of

revenues in Q3 FY2024 compared to $24.7 million or 77.8% in Q3

FY2023. Recurring Revenue4 in Q3 FY2023 included $0.3 million from

InterTrade5.

Net loss was $4.2 million for Q3 FY2024 compared

to net earnings of $15.1 million which included a $22.9 million

gain on the disposal of InterTrade.

Adjusted net loss2 was $4.2 million for Q3

FY2024, a significant improvement of $3.6 million compared to $7.8

million for Q3 FY2023.

Adjusted EBITDA1 was $2.5 million in Q3 FY2024

marking the sixth sequential quarter with positive Adjusted

EBITDA1, a significant improvement of $1.6 million from $0.9

million in Q3 FY2023.

Profitability and cash flows from operations

have improved significantly in Q3 FY2024 compared to the third

quarter of the prior year from new sales, mainly for eprocurement

solutions, and as a result of the various right-sizing measures,

including a focus on operational efficiency. The US state

transaction model agreements (TRX) in eprocurement, for which we

collect fees based on a percentage of our customers’ spend on

eligible goods and services, have contributed positively to cash

flows both for Q3 FY2024 and YTD Q3 FY2024 as compared to the same

periods in the prior year. We reported net cash generated by

operating activities of $6.4 million for the third quarter this

year, compared to net cash used in operating activities of $2.8

million in the third quarter last year. The net cash generated by

operating activities has been used to reduce long-term debt during

Q3 FY2024.

As at December 31, 2023, cash and cash

equivalents was $5.0 million and the amount drawn on the Revolving

Facility was $1.5 million, compared to cash and cash equivalents of

$4.0 million and $7.4 million drawn on the Revolving Facility at

March 31, 2023.

Revenue

- The

eprocurement platform revenues were $20.7 million

in Q3 FY2024, an increase of $0.9 million or 4.5% compared to

$19.8 million in Q3 FY2023, driven by higher right of use

revenues. The Corporation’s US-based eprocurement platform revenues

were $15.5 million for Q3 FY2024, an increase of $0.4 million

compared to $15.1 million for Q3 FY2023.Recurring Revenue4 for the

eprocurement platform was $18.2 million for Q3 FY2024, an increase

from $17.7 million in Q3 FY2023 and representing 88.0% and 88.6% of

platform revenues respectively.The year-to-date Q3 FY2024 revenues

from the eprocurement platform were $61.2 million, an increase of

$4.2 million or 7.4% in comparison to $57.0 million for the same

period of FY2023. The increase is mainly attributable to a $4.8

million increase in right of use revenues, partially offset by

decreases in maintenance and hosting revenue of $0.3 million, and

professional services revenue of $0.2 million.The eprocurement

platform represents 69% of total consolidated revenues in Q3

FY2024. Our fully integrated end-to-end suite of eprocurement

products are offered in modules: Source, Contract, Procure, Connect

and Shop. Our full suite of products uniquely supports digital

transformation in the public sector, bringing efficiency,

transparency and modernization to customer procurement processes,

and positions us well for increased market penetration.Our

solutions and the services that we provide to customers are

tailored for public sector procurement and provide a strong

competitive advantage for both state, large cities and for

mid-market agency customers, as well as the supplier network.Our

supplier network in North America includes over 650,000 suppliers

and over 6,500 buying organizations. This large customer base and a

strong presence in US states position us well for market

growth.During the third quarter of FY2024 we welcomed new

mid-market customers to our eprocurement community, including

several with multi-year contracts for our eprocurement solutions,

mainly for our Source, Contract and Connect offerings. There is a

large addressable market for mid-market offerings. Demand for

eprocurement digitalization in the mid-market is strong and we

expect to see continued acceleration as the mid-market offering

gains traction with customers, pipeline conversion is a focus area

to generate revenue growth.

- The

ecommerce6 platform revenues were $5.4 million for

Q3 FY2024, compared to $5.5 million for Q3 FY2023, when excluding

Q3 FY2023 revenues from InterTrade5 and the related post-closing

transition revenues recognized in Q3 FY2023 which represented a

decrease of $0.4 million and $0.9 million respectively. Total

Unified Commerce6 platform revenues were $6.8 million for Q3

FY2023.Recurring Revenue4 for the Unified Commerce platform, which

included only ecommerce for Q3 FY2024 was $3.0 million and

represented 55.0% of platform revenues compared to $2.9 million or

43.5% in Q3 FY2023 which also included InterTrade5 with Recurring

Revenue4 of $0.3 million.

- The

emarketplaces platform revenues were $4.1 million

in Q3 FY2024, a decrease of $0.9 million compared to $5.0 million

in Q3 FY2023. Certain emarketplaces solutions such as The Broker

Forum and Jobboom benefited from the macro-economic conditions of

recent years. As the worldwide supply chain issues experienced over

the past few years subside, revenues from The Broker Forum, an

electronic components marketplace, decreased by $0.7 million in Q3

FY2024 compared to Q3 FY2023. A softer labour market in FY2024 has

impacted Jobboom which had a $0.2 million decrease in revenue in Q3

year-over-year. The closure of Reseau Contact and Power Source

Online in Q3 FY2024 resulted in a $0.1 million decrease in

revenues. Revenues from the other emarketplaces solutions were

stable compared to Q3 FY2023. Recurring Revenue4 for the

emarketplaces platform represented $3.6 million or 88.9% in Q3

FY2024 compared to $4.1 million or 81.0% in Q3 FY2023.

Gross margin for Q3 FY2024 was

$17.7 million or 58.5% compared to $17.8 million or 56.3% for Q3

FY2023. The gross margin percentage increased by 2.2% compared to

Q3 of prior year.

Revenues decreased by $1.5 million while cost of

revenues improved by $1.3 million compared to Q3 FY2023, mostly due

to lower salaries expenses of $0.8 million from workforce reduction

initiatives implemented across the Corporation in FY2023 and in

early Q1 FY2024, and from lower professional services expenses of

$0.4 million due to a decrease in the use of contractual

consultants.

Operating expenses in Q3 FY2024

were $20.7 million, a significant decrease of $2.9 million or 12.3%

compared to $23.6 million in Q3 FY2023.

General and administrative expenses totalled

$6.2 million in Q3 FY2024, selling and marketing expenses were $6.8

million and technology expenses were $7.7 million, compared to $6.4

million, $8.5 million, and $8.7 million respectively for Q3 FY2023.

The reduction in operating expenses is mainly from $1.2 million of

salary savings from workforce reductions and from the sale of

InterTrade, a decrease of $0.9 million in restructuring costs

mainly related to termination benefits, a decrease of $0.4 million

in professional services expenses and a decrease of $0.3 million in

amortization and depreciation expenses. This was partially offset

by lower capitalized internally developed software of $0.2

million.

Operating loss The Corporation

significantly improved its operating loss by $2.7 million or 47.2%,

from $5.8 million in Q3 FY2023 to $3.1 million in Q3 FY2024. This

is mainly due to the decrease in operating expenses of $2.9

million.

Net loss was $4.2 million, or

$0.10 net loss per share (basic and diluted) for Q3 FY2024,

compared to net earnings of $15.1 million for Q3

FY2023, which included a $22.9 million gain on

disposal of InterTrade, or $0.34 net earnings per share (basic and

diluted) for Q3 FY2023.

Adjusted net

loss2 was equal to Net loss of $4.2

million, or $0.10 Adjusted net loss2 per share (basic and diluted)

for Q3 FY2024. Adjusted net loss2 for Q3 FY2023 was $7.8 million or

$0.18 Adjusted net loss2 per share (basic and diluted).

As a result of the operational efficiencies and

cost saving initiatives in FY2023 and in early Q1 FY2024 to improve

profitability, there was a significant improvement of $3.6 million

in Adjusted net loss2 and $0.08 in Adjusted net loss2 per share

(basic and diluted) in Q3 FY2024 compared to Q3 FY2023.

Adjusted

EBITDA1 was $2.5 million for Q3 FY2024, a

significant improvement of $1.6 million compared to $0.9 million

for Q3 FY2023. This significant improvement in Adjusted EBITDA1 is

mainly due to decreases in operating expenses, following workforce

reductions and other cost savings initiatives, partially offset by

the reduction in total revenues.

Our Q3 FY2024 financial results show the

positive impacts of our focus on operational efficiency,

profitability and cash flows, with significant Q3 year-over-year

improvements in net loss, Adjusted net loss2, and Adjusted

EBITDA1.

Summary of

consolidated results

|

Financial HighlightsIn thousands of Canadian

dollars, except number of shares and per share data |

|

Q3FY2024 |

|

Q2FY2024 |

|

Q3FY2023 |

|

YTD Q3FY2024 |

|

YTD Q3FY2023 |

|

|

Revenues |

|

30,189 |

|

30,749 |

|

31,652 |

|

91,942 |

|

97,064 |

|

|

Recurring Revenue4 |

|

24,822 |

|

24,360 |

|

24,728 |

|

73,739 |

|

77,233 |

|

|

Gross margin |

|

17,653 |

|

18,457 |

|

17,832 |

|

53,823 |

|

55,693 |

|

|

Operating loss |

|

(3,053 |

) |

(2,031 |

) |

(5,787 |

) |

(8,138 |

) |

(16,708 |

) |

|

Net earnings (loss) |

|

(4,179 |

) |

(784 |

) |

15,082 |

|

(10,078 |

) |

(81,010 |

) |

|

Adjusted net loss2 |

|

(4,179 |

) |

(784 |

) |

(7,804 |

) |

(10,078 |

) |

(18,896 |

) |

|

Adjusted EBITDA1 |

|

2,501 |

|

3,998 |

|

898 |

|

9,139 |

|

1,168 |

|

|

Net earning (loss) per share (basic and diluted) |

|

(0.10 |

) |

(0.02 |

) |

0.34 |

|

(0.23 |

) |

(1.84 |

) |

|

Adjusted net loss2 per share (basic and diluted) |

|

(0.10 |

) |

(0.02 |

) |

(0.18 |

) |

(0.23 |

) |

(0.43 |

) |

|

Weighted average number of shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted (in thousands) |

|

43,971 |

|

43,971 |

|

43,971 |

|

43,971 |

|

43,971 |

|

Reconciliation

of net earnings

(loss), EBITDA1

(loss) and

Adjusted

EBITDA1

|

In thousands of Canadian dollars |

|

Q3FY2024 |

|

Q2FY2024 |

|

Q3FY2023 |

|

YTD Q3FY2024 |

|

YTD Q3FY2023 |

|

|

Net earnings (loss) |

|

(4,179 |

) |

(784 |

) |

15,082 |

|

(10,078 |

) |

(81,010 |

) |

| Income tax expense

(recovery) |

|

(493 |

) |

(202 |

) |

1,194 |

|

(979 |

) |

818 |

|

|

Depreciation of property and equipment and amortization of

intangible assets |

|

767 |

|

802 |

|

1,018 |

|

2,416 |

|

3,104 |

|

| Amortization of acquired

intangible assets |

|

3,136 |

|

3,095 |

|

3,128 |

|

9,329 |

|

9,119 |

|

| Depreciation of right-of-use

assets |

|

496 |

|

706 |

|

566 |

|

2,015 |

|

1,716 |

|

| Finance

expenses |

|

125 |

|

300 |

|

228 |

|

681 |

|

1,911 |

|

|

EBITDA1

(loss) |

|

(148 |

) |

3,917 |

|

21,216 |

|

3,384 |

|

(64,342 |

) |

|

Gain on disposal of a subsidiary |

|

- |

|

- |

|

(22,886 |

) |

- |

|

(22,886 |

) |

| Goodwill impairment loss |

|

- |

|

- |

|

- |

|

- |

|

85,000 |

|

| Foreign exchange loss

(gain) |

|

1,494 |

|

(1,345 |

) |

594 |

|

1,577 |

|

(1,793 |

) |

| Share-based compensation |

|

132 |

|

181 |

|

47 |

|

454 |

|

470 |

|

| Restructuring costs |

|

382 |

|

422 |

|

1,418 |

|

2,225 |

|

2,498 |

|

|

Transaction-related costs |

|

641 |

|

823 |

|

509 |

|

1,499 |

|

2,221 |

|

|

Adjusted EBITDA1 |

|

2,501 |

|

3,998 |

|

898 |

|

9,139 |

|

1,168 |

|

Reconciliation of net earnings (loss) and Adjusted net

loss2

|

In thousands of Canadian dollars, except number of shares and per

share data |

|

Q3FY2024 |

|

Q2FY2024 |

|

Q3FY2023 |

|

YTD Q3FY2024 |

|

YTD Q3FY2023 |

|

|

Net earnings (loss) |

|

(4,179 |

) |

(784 |

) |

15,082 |

|

(10,078 |

) |

(81,010 |

) |

|

Gain on disposal of a subsidiary |

|

- |

|

- |

|

(22,886 |

) |

- |

|

(22,886 |

) |

| Goodwill impairment loss |

|

- |

|

- |

|

- |

|

- |

|

85,000 |

|

|

Adjusted net loss2 |

|

(4,179 |

) |

(784 |

) |

(7,804 |

) |

(10,078 |

) |

(18,896 |

) |

|

Weighted average number of shares outstanding |

|

|

|

|

|

|

|

Basic and diluted (in thousands) |

|

43,971 |

|

43,971 |

|

43,971 |

|

43,971 |

|

43,971 |

|

|

Net earnings (loss) per share – basic

and diluted |

|

(0.10 |

) |

(0.02 |

) |

0.34 |

|

(0.23 |

) |

(1.84 |

) |

|

Adjusted net loss2 per

share – basic

and diluted |

|

(0.10 |

) |

(0.02 |

) |

(0.18 |

) |

(0.23 |

) |

(0.43 |

) |

Reconciliation

of revenues on

a Constant

Currency

basis3

|

In thousands of Canadian dollars, unless otherwise noted |

|

Q3 FY2024 |

|

Q3 FY2023 |

|

Var. $ |

|

Var. % |

|

Q3 FY2024 |

|

Q2 FY2024 |

|

Var. $ |

|

Var. % |

|

YTD Q3 FY2024 |

YTD Q3 FY2023 |

Var. $ |

|

Var.% |

|

|

Revenues |

|

30,189 |

|

31,652 |

|

(1,463 |

) |

(4.6 |

) |

30,189 |

|

30,749 |

|

(560 |

) |

(1.8 |

) |

91,942 |

97,064 |

(5,122 |

) |

(5.3 |

) |

|

Constant Currency impact |

|

- |

|

106 |

|

(106 |

) |

- |

|

- |

|

297 |

|

(297 |

) |

- |

|

- |

1,778 |

(1,778 |

) |

- |

|

|

Revenues in Constant Currency |

|

30,189 |

|

31,758 |

|

(1,569 |

) |

(4.9 |

) |

30,189 |

|

31,046 |

|

(857 |

) |

(2.8 |

) |

91,942 |

98,842 |

(6,900 |

) |

(7.0 |

) |

1 EBITDA, Adjusted EBITDA (loss) and Adjusted

EBITDA margin are non-IFRS financial measures. Refer to section 10

“Non-IFRS Financial Measures and Key Performance Indicators” of the

MD&A for the third quarter ended December 31, 2023.

2 Adjusted net earnings (loss) and Adjusted net

earnings (loss) per share (basic and diluted) are non-IFRS

financial measures. Refer to section 10 “Non-IFRS Financial

Measures and Key Performance Indicators” of the MD&A for the

third quarter ended December 31, 2023.

3 Certain revenue figures and changes from prior

period are analyzed and presented on a Constant Currency basis and

are obtained by translating revenues from the comparable period of

the prior year denominated in foreign currencies at the foreign

exchange rates of the current period. Refer to section 10 “Non-IFRS

Financial Measures and Key Performance Indicators” of the MD&A

for the third quarter ended December 31, 2023.

4 Recurring Revenue and Monthly Recurring

Revenue (“MRR”) are key performance indicators. Refer to section 10

“Non-IFRS Financial Measures and Key Performance Indicators” of the

MD&A for the third quarter ended December 31, 2023.

5 InterTrade Systems Inc. (“InterTrade”), a

wholly-owned subsidiary of the Corporation, our Supply Chain

Collaboration solution was sold on October 4, 2022. For comparative

purposes, the Corporation has provided information on the disposed

entity prior to the sale, by excluding Q3 FY2023 and YTD Q3 FY2023

revenue for InterTrade which was $0.4 million and $7.2 million

respectively, by excluding post-closing transition services

revenues which totalled $0.9 million for both Q3 FY2023 and YTD Q3

2023, and by excluding Q3 FY2023 and YTD Q3 FY2023 Recurring

Revenue4 of $0.3 million and $6.7 million respectively.

6 The Unified Commerce platform, which included

both ecommerce and Supply Chain Collaboration solutions, was

renamed ecommerce following the sale of InterTrade.

About mdf

commerce inc.

mdf commerce inc. (TSX:MDF)

enables the flow of commerce by providing a broad set of software

as a service (SaaS) solutions that optimize and accelerate

commercial interactions between buyers and sellers. Our platforms

and services empower businesses around the world, allowing them to

generate billions of dollars in transactions on an annual basis.

Our eprocurement, ecommerce and emarketplace solutions are

supported by a strong and dedicated team of approximately 650

employees based in Canada, the United States, Ukraine and China.

For more information, please visit us at mdfcommerce.com, follow us

on LinkedIn or call at 1-877-677-9088.

Forward-Looking

Statements

In this press release, “mdf commerce”, the

“Corporation” or the words “we”, “our” and “us” refer, depending on

the context, either to mdf commerce inc. or to mdf commerce inc.

together with its subsidiaries and entities in which it has an

economic interest.

This press release is dated February 13, 2024,

and unless specifically stated otherwise, all information disclosed

herein is provided as at December 31, 2023 and for the third

quarter of fiscal 2024.

Certain statements in this press release and in

the documents incorporated by reference herein constitute

forward-looking statements. These statements relate to future

events or our future financial performance and involve known and

unknown risks, uncertainties and other factors that may cause mdf

commerce’s, or the Corporation’s industry’s actual results, levels

of activity, performance or achievements to be materially different

from those expressed or implied by any of the Corporation’s

statements. Such factors may include, but are not limited to, risks

and uncertainties that are discussed in greater detail in the “Risk

Factors and Uncertainties” section of the Corporation’s Annual

Information Form as at March 31, 2023, as well as in the “Risk

Factors and Uncertainties” section of the MD&A for the third

quarter ended December 31, 2023 and elsewhere in the Corporation’s

filings with the Canadian securities regulators, as applicable.

Forward-looking statements generally can be

identified by the use of forward-looking terminology such as “may”,

“will”, “should”, “could”, “expects”, “plans”, “anticipates”,

“intends”, “believes”, “estimates”, “predicts”, “potential” or

“continue” or the negatives of these terms or other comparable

terminology. These statements are only predictions. Forward-looking

statements are based on management’s current estimates,

expectations and assumptions, which management believes are

reasonable as of the date hereof, and are inherently subject to

significant business, economic, competitive and other uncertainties

and contingencies regarding future events and are accordingly

subject to changes after such date. Undue importance should not be

placed on forward looking statements, and the information contained

in such forward-looking statements should not be relied upon as of

any other date. Actual events or results may differ materially. We

cannot guarantee future results, levels of activity, performance or

achievement. We disclaim any intention, and assume no obligation,

to update these forward-looking statements, except as required by

applicable securities laws.

Additional information about mdf commerce,

including the Corporation’s interim condensed consolidated

financial statements as at December 31, 2023 and 2022, the MD&A

for the third quarter ended December 31, 2023 and its latest Annual

Information Form as at March 31, 2023 are available on the

Corporation’s website www.mdfcommerce.com and have been filed with

SEDAR+ at www.sedarplus.com.

Non-IFRS Financial Measures and Key

Performance Indicators

The Corporation’s unaudited interim condensed

consolidated financial statements for the three-month and

nine-month periods ended December 31, 2023 and 2022 have been

prepared in accordance with International Accounting Standard

(“IAS”) 34, Interim Financial Reporting, through the application of

accounting principles that are compliant with International

Financial Reporting Standards (“IFRS”). The unaudited interim

condensed consolidated financial statements do not include all of

the information required for complete financial statements under

IFRS, including the notes.

The Corporation presents non-IFRS financial

measures and key performance indicators to assess operating

performance. The Corporation presents Adjusted net earnings

(loss)2, Adjusted net earnings (loss)2 per share, net earnings

(loss) before interest, taxes, depreciation and amortization

(“EBITDA”)1, Adjusted EBITDA (loss)1, Adjusted EBITDA margin1, and

certain Revenues presented on a Constant Currency basis3 as a

non-IFRS financial measures and Recurring Revenue4 and Monthly

Recurring Revenues (“MRR”)4 as key performance indicators.

These non-IFRS measures and key performance

indicators do not have standardized meanings under IFRS and are not

likely to be comparable to similarly designated measures reported

by other corporations. The reader is cautioned that these measures

are being reported in order to complement, and not replace, the

analysis of financial results in accordance with IFRS. Management

uses both measures that comply with IFRS and non-IFRS measures, in

planning, overseeing and assessing the Corporation’s performance.

Certain additional disclosures including the definitions associated

with non-IFRS financial measures as well as a reconciliation to the

most comparable IFRS measures, and key performance indicators have

been incorporated by reference and can be found in the MD&A for

the third quarter ended December 31, 2023, as presented in the

section 10 “Non-IFRS Financial Measures and Key Performance

Indicators”. The MD&A for the third quarter ended December 31,

2023, is available on SEDAR+ at www.sedarplus.com and on the

Corporation’s website at www.mdfcommerce.com under the Investors

section.

Conference

call for Third

quarter fiscal

2024 financial

results

Date: Wednesday, February 14, 2024Time: 9:00

a.m. Eastern Standard Time

To dial-in: 1 833 630-1956 or 412 317-1837 (for

international)Live webcast: Click here to register

For further

information:

mdf commerce

inc.Luc Filiatreault, President & CEO Toll

free: 1-877-677-9088, ext. 2004Email:

luc.filiatreault@mdfcommerce.com

Deborah Dumoulin, Chief Financial Officer Toll

free: 1-877-677-9088, ext. 2134Email:

deborah.dumoulin@mdfcommerce.com

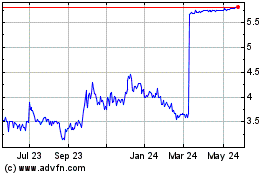

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Dec 2024 to Jan 2025

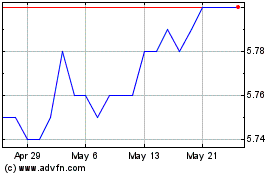

MDF Commerce (TSX:MDF)

Historical Stock Chart

From Jan 2024 to Jan 2025