Melcor Real Estate Investment Trust (“

Melcor REIT”

or the “

REIT”) is reiterating its support for the

previously announced plan of arrangement (the

“

Arrangement”) with Melcor Developments Ltd.

(“

MRD”), whereby, among other steps, the

outstanding trust units of the REIT will be redeemed in exchange

for $4.95 per unit held in cash (the

“

Consideration”), through a series of steps

outlined in the management information circular

(“

Circular”) mailed to unitholders of the REIT

(“

Unitholders”), filed under the REIT’s profile on

SEDAR+ (http://sedarplus.com) and on the REIT’s website at

https://melcorreit.ca/special-meeting/.

THE ARRANGEMENT IS IN THE BEST INTERESTS

OF UNITHOLDERS AND SUPPORTED BY BOTH LEADING PROXY ADVISORY FIRMS

REVIEWING THE TRANSACTION

The Independent Committee reiterates its

recommendation that the Arrangement is the best outcome for

Unitholders. In coming to this recommendation, the independent

committee of trustees of the REIT (the “Independent

Committee”), together with its experienced and qualified

financial and legal advisors, considered various alternatives

reasonably available to the REIT, including the continued execution

of the REIT’s strategic business plan, sales of assets and

soliciting other potential buyers of the REIT and/or of the REIT’s

assets.

|

In addition to the Independent Committee’s recommendation, BOTH

leading independent proxy advisory firms – Institutional

Shareholder Services Inc. (“ISS”) and Glass Lewis

& Co. (“Glass Lewis”) – have

recommended that Unitholders vote FOR the Arrangement. |

| |

UNITHOLDERS HAVE A CLEAR CHOICE;

DERISKING AT A SIGNIFICANT PREMIUM OR UNCERTAIN FUTURE,

SIGNIFICANT HEADWINDS, AND NO VISIBLE PATH TO DISTRIBUTION

RESUMPTION

If the Arrangement is approved, the outcome is

clear; Unitholders will receive the all-cash consideration at a

significant premium to recent trading levels, providing Unitholders

with certainty of value, immediate liquidity, and removes the

risks associated with the REIT remaining an independent public

entity, to which there is no certainty the REIT’s trading price

will be able to get to, remain at or exceed $4.95 over any

reasonable period.

If the dissidents are successful in having the

Arrangement resolution voted down at the special meeting of

Unitholders (the “Meeting”), the outcome is less

clear. The Independent Committee warns Unitholders that

non-approval comes with significant risks, including:

- Impact

on Trading Price of the Units: The trading price of the

REIT’s Units will be uncertain and could return to trading levels

prior to when the Arrangement was announced. The trading price of

the REIT’s Units could be further impacted due to the REIT’s

diminished liquidity and the risk that further value-maximizing

transactions could be prevented by dissident Unitholders.

-

Viability of the REIT: The REIT faces significant

risks to its viability as a publicly traded real estate investment

trust as a result of the REIT’s operating environment, increased

costs of tenant inducements and capital expenditures, limited

existing liquidity profile, mortgage maturities, credit facility

constraints, and headwinds associated with accessing additional

debt and equity capital. The REIT will continue to face these risks

should the Arrangement not be completed.

- No

Prospect of Resuming Distributions: Should the Arrangement

not be completed, it is unlikely the REIT will be in a financial

position to reinstitute distributions in the near to medium term,

as a result of the ongoing liquidity and capital constraints.

- Risks

and Implications Associated with Individual Asset Sales:

The dissidents have suggested that selling the REIT’s assets on an

asset-by-asset basis would result in a higher ultimate price to be

received by Unitholders, as opposed to the cash consideration under

the Arrangement. However, the strategy to liquidate the REIT’s

assets was carefully reviewed during the strategic review process

and was deemed not to be a viable path. Not only has the REIT had

limited success in selling assets listed for sale to date, the

Independent Committee’s advisors have suggested that it could take

years to fully liquidate the REIT’s portfolio for after tax

proceeds to Unitholders that are unknown and subject to market and

liquidity risk and material transaction costs. Even were it

possible for the assets to be immediately sold for IFRS values,

the tax implications and costs of such sales must be

factored into any comparison to the $4.95 cash per unit

transaction price.Importantly, the cost of these

properties for tax purposes would need to be taken into account if

assessing the dissidents’ proposed liquidation strategy. The chart

below includes an aggregated summary of the REIT assets’ estimated

and unaudited tax attributes as of the date of this release:

|

LandsTax

Cost(1) |

BuildingsTax

Cost(1) |

BuildingsTax Depreciation

Claimed(1) |

BuildingsUndepreciated Tax

Cost(1) |

|

$132,000,000 |

$373,000,000 |

$148,000,000 |

$225,000,000 |

|

(1) Figures are rounded to the nearest million. |

| |

Given these tax

attributes, the REIT expects that an asset sale strategy would

materially reduce many Unitholders’ proceeds on an after-tax

basis.

The above risks are only some of the reasons the

Independent Committee recommends you vote FOR the Arrangement. The

Independent Committee urges all Unitholders to also refer to the

more extensive list of reasons contained in the Circular.

VOTING IS FAST AND EASY - VOTE

FOR THE ARRANGEMENT TODAY

|

|

Unitholders are urged to vote their Units TODAY in advance

of the Meeting. Even if you have never voted before, every

vote will count no matter how many Units you own. Unitholders can

switch their vote at any time to vote FOR the Arrangement.

Only the latest-dated proxy counts. |

|

| |

|

|

The Independent Committee and the Board (with

cross-trustees abstaining) continue to recommend Unitholders vote

FOR the Arrangement at the Meeting. The Meeting will be held at the

Windsor Room, Third Floor, Manulife Place, 10180 101st Street,

Edmonton, Alberta, T5J 3V5 on November 26, 2024 at 9:30 a.m.

(Mountain Time).

Unitholders are encouraged to vote well

in advance of the proxy cut-off which is at 9:30 a.m. (Mountain

Time) on November 22, 2024.

QUESTIONS AND VOTING

ASSISTANCE

Voting Unitholders who have questions or need

assistance in voting should contact Melcor REIT’s strategic

unitholder advisor and proxy solicitation agent, Laurel Hill

Advisory Group, by telephone at 1-877-452-7184 (North American Toll

Free) or 1-416-304-0211 (Outside North America), or by email at

assistance@laurelhill.com.

About Melcor REIT

Melcor REIT is an unincorporated, open-ended

real estate investment trust. Melcor REIT owns, acquires, manages

and leases quality retail, office and industrial income-generating

properties in western Canadian markets. Its portfolio is currently

made up of interests in 36 properties representing approximately

3.072 million square feet of gross leasable area located across

Alberta and in Regina, Saskatchewan.

Forward Looking Statement Cautions and

Disclaimers:

This news release includes forward-looking

information within the meaning of applicable Canadian securities

laws. In some cases, forward-looking information can be identified

by the use of words such as “may”, “will”, “should”, “expect”,

“intend”, “plan”, “anticipate”, “believe”, “estimate”, “predict”,

“potential”, “continue”, and by discussions of strategies that

involve risks and uncertainties, certain of which are beyond the

REIT’s control. In this news release, forward-looking information

includes, among other things, statements relating to the Meeting

proceeding as described herein or at all, expectations with respect

to the timing and outcome of the Arrangement, the anticipated

benefits of the Arrangement, the timing of the Meeting and the

results thereof, the risks associated with non-completion of the

Arrangement, the potential impact on the REIT’s trading price,

ability to resume distributions and viability as a publicly traded

real estate investment trust if the Arrangement does not proceed,

risks and implications associated with the REIT conducting

individual asset sales, including tax implications on Unitholders,

anticipated net proceeds to be received by Unitholders in various

alternatives, tax implications on the REIT and Unitholders of asset

sales in the future, the time required to liquidate the REIT’s

portfolio or the success thereof, and ability of the REIT to sell

assets in the future and the price of any such sales. The

forward-looking information is based on certain key expectations

and assumptions made by the REIT, including with respect to the

structure of the Arrangement and all other statements that are not

historical facts. The timing and completion of the Arrangement is

subject to customary closing conditions, termination rights and

other risks and uncertainties including, without limitation,

required regulatory, court, and Unitholder approvals. Although

management of the REIT believes that the expectations reflected in

the forward-looking information are reasonable, there can be no

assurance that any transaction, including the Arrangement, will

occur or that it will occur on the timetable or on the terms and

conditions contemplated in this news release. The Arrangement could

be modified, restructured or terminated. Readers are cautioned not

to place undue reliance on forward-looking information. Additional

information on these and other factors that could affect the REIT

are included in reports on file with Canadian securities regulatory

authorities and may be accessed through the SEDAR+ website

(www.sedarplus.ca).

By its nature, such forward-looking information

necessarily involves known and unknown risks and uncertainties that

may cause actual results, performance, prospects and opportunities

in future periods of the REIT to differ materially from those

expressed or implied by such forward-looking statements.

Furthermore, the forward-looking statements contained in this news

release are made as of the date of this news release and neither

the REIT nor any other person assumes responsibility for the

accuracy and completeness of any forward-looking information, and

no one has any obligation to update or revise any forward-looking

information, whether as a result of new information, future events

or such other factors which affect this information, except as

required by law.

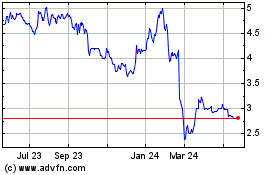

Melcor Real Estate Inves... (TSX:MR.UN)

Historical Stock Chart

From Oct 2024 to Nov 2024

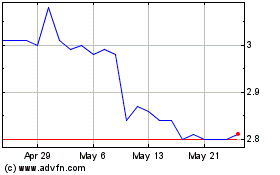

Melcor Real Estate Inves... (TSX:MR.UN)

Historical Stock Chart

From Nov 2023 to Nov 2024