Melcor Developments Ltd. (TSX:MRD), an Alberta-based real estate

development company, today reported record results for the year

ended December 31, 2012. Melcor earned net income of $105.02

million or $3.49 per share (basic), an increase of 29% from 2011.

Revenue was $274.93 million, an increase of 25% from 2011. Total

assets grew 19% to 1.45 billion with fair value gains of $59.10

million or $1.96 per share (basic) compared fair value gains of

$41.70 million or $1.39 per share (basic) in 2011.

Record fourth quarter results contributed to Melcor's strong

performance for the full year. Fourth quarter net income was $55.47

million or $1.84 per share (basic) on revenue of $141.96 million

compared to net income of $51.82 million or $1.73 per share (basic)

on revenue of $129.43 million in the fourth quarter of 2011.

Funds from operations (FFO) was $2.22 per share in 2012, an

increase of $0.42 per share or 23% from 2011. FFO per share adjusts

for all non-cash items included in income such as fair value

adjustments on investment properties and stock based compensation

expense.

Brian Baker, Melcor's President and Chief Operating Officer

commented on the year: "Top and bottom line growth in 2012 was a

result of the coordinated efforts and diligence of all operating

divisions. Our company is comprised of the most talented and

hardest working team in the industry: a reality that is reflected

in our record results for 2012. As we enter our 90th year, we are

eager to compete and win in each of our divisions. With a solid

base of assets and a strong financial position, managed by

effective leaders and dedicated employees, we are well positioned

for continued growth and success."

2012 Highlights

-- Melcor achieved several records in 2012:

-- Record consolidated revenues of $274.93 million

-- Record basic earnings per share of $3.49

-- Fair value gains of $59.10 million or $1.96 per share

-- Total assets of $1.45 billion (up 19%)

-- Revenues were higher across all divisions in 2012 as a result of

increased activity and growth.

-- The Community Development division had a record year, starting four

new residential communities and continuing to build out existing

developments. They also acquired strategic land parcels to maintain

inventory levels and support future growth.

-- The Property Development division completed 11 buildings totalling

125,000 square feet. These projects have been leased predominantly

to well-recognized national and multinational tenants. In addition,

the Property Development division broke ground on three new large-

scale projects that will provide the division with a sustained

activity pipeline. The division was also successful in advancing

several future projects through the land use and development

approvals process.

-- Leasing activity in the Investment Properties division was strong

with portfolio-wide occupancy rates rising to 89%. The division

continues its capital expenditure strategies to enhance the

efficiency and market desirability of existing assets through on-

going improvements.

-- The Recreational Properties division increased both revenue and

earnings in 2012 through effective and efficient operations

management and an increased emphasis on its food and beverage

operation. The number of rounds played at its four championship golf

courses also increased by 3.4%.

-- Melcor paid an annual dividend of $0.45 per share to shareholders. The

company has been paying dividends since 1969.

-- Subsequent to the end of the year, Melcor announced that it had

initiated a strategic process to advance its business interests through

the potential creation of a Real Estate Investment Trust (REIT).

Investing in the Future

The company continues to invest in land inventory, develop

commercial properties and improve and lease its portfolio of

income-producing properties.

-- The Community Development division added several parcels of raw land for

future development including:

-- a 50% interest in 166 acres of land in St. Albert in the first

quarter; and

-- 233 acres of land in the third quarter, strategically located near

existing land holdings in St. Albert and Red Deer.

-- The Property Development division had projects totaling over $62 million

under development in 2012, compared to projects under development of $28

million in 2011. The division completed development of 125,000 sq. ft.

(11 buildings) in 2012 compared to 69,500 sq. ft. (9 buildings) in the

same period last year.

-- The Investment Property division acquired a multi-tenant industrial

warehouse in Lethbridge in the second quarter and took over management

of approximately 70,000 square feet (including four free-standing bank

buildings) transferred from the Property Development division.

Building Capacity

-- Brian Baker was appointed to the position of President and Chief

Operating Officer on June 1, 2012. Mr. Baker was previously Executive

Vice President and Chief Operating Officer.

-- The company expanded its production capacity in 2012 by expanding its

team via the addition of 18 new staff in 2012. This resulted in an

increase in overall headcount by 21%. This positions the company to

execute on its growth strategies.

Outlook

The majority of Melcor's business operations and assets remain

focused on Alberta. Alberta economic fundamentals remain strong,

with low unemployment rates, net in-migration, higher than the

national average weekly earnings, strong capital investment,

stabilizing inflation and relative stability in the price of oil.

These fundamentals create a favorable environment for both

residential and commercial property development.

The company continues its focus on US expansion by increasing

its stable of residential rental properties, serviced lot inventory

and raw development land. These assets now comprise approximately

8.5% of the company's total assets. Management believes that the

economic indicators in its US regions provide a strong outlook for

overall business success for the foreseeable future. The US

continues its gradual economic recovery with clear signs of

strengthening in the housing market and capitalization rate

compression in the residential rental asset class.

With Melcor's inventory of raw and developed land, financial

resources and strong management group, the company is well

positioned to take advantage of market opportunities.

Annual Results

Complete financial statements, notes to the financial statements

and management's discussion and analysis will be filed on SEDAR

(www.sedar.com) on March 6, 2013 and is available at www.melcor.ca.

Melcor's information circular and other material will be mailed on

or about March 30, 2012.

Annual General Meeting

We invite shareholders to join us at Melcor's annual meeting on

April 25, 2013 at 11:00 am MDT. The meeting will be held at The

Fairmont Hotel Macdonald, Wedgewood Room, 10065 - 100 Street NW,

Edmonton, Alberta

About Melcor Developments Ltd.

Melcor is a diversified real estate development and management

company with a rich heritage of integrity and innovation in real

estate since 1923.

Through four integrated operating divisions, Melcor manages the

full life cycle of real estate development: from acquiring raw

land, to community planning, to construction and development, to

owning and managing leasable office, retail and residential sites.

Melcor develops and manages mixed-use residential communities,

business and industrial parks, office buildings, retail commercial

centres and golf courses.

Melcor's headquarters are located in Edmonton, Alberta, with

regional offices throughout Alberta and British Columbia. Company

developments span western Canada and the US. Melcor has been a

public company since 1968 and trades on the Toronto Stock Exchange

(TSX:MRD).

Forward Looking Statements

In order to provide our investors with an understanding of our

current results and future prospects, our public communications

often include written or verbal forward-looking statements.

Forward-looking statements are disclosures regarding possible

events, conditions, or results of operations that are based on

assumptions about future economic conditions, courses of action and

include future-oriented financial information.

This news release and other materials filed with the Canadian

securities regulators contain statements that are forward-looking.

These statements represent Melcor's intentions, plans,

expectations, and beliefs and are based on our experience and our

assessment of historical and future trends, and the application of

key assumptions relating to future events and circumstances.

Future-looking statements may involve, but are not limited to,

comments with respect to our strategic initiatives for 2013 and

beyond, future development plans and objectives, targets,

expectations of the real estate, financing and economic

environments, our financial condition or the results of or outlook

of our operations.

By their nature, forward-looking statements require assumptions

and involve risks and uncertainties related to the business and

general economic environment, many beyond our control. There is

significant risk that the predictions, forecasts, valuations,

conclusions or projections we make will not prove to be accurate

and that our actual results will be materially different from

targets, expectations, estimates or intentions expressed in

forward-looking statements. We caution readers of this document not

to place undue reliance on forward-looking statements. Assumptions

about the performance of the Canadian and US economies and how this

performance will affect Melcor's business are material factors we

consider in determining our forward-looking statements. For

additional information regarding material risks and assumptions,

please see the discussion under Business Environment and Risk in

our annual MD&A.

Readers should carefully consider these factors, as well as

other uncertainties and potential events, and the inherent

uncertainty of forward-looking statements. Except as may be

required by law, we do not undertake to update any forward-looking

statement, whether written or oral, made by the company or on its

behalf.

Contacts: Melcor Developments Ltd. Business Contact Brian Baker

President & COO 780-423-6931 Melcor Developments Ltd. Investor

Relations Jonathan Chia, CA CFO 780-423-6931 www.melcor.ca

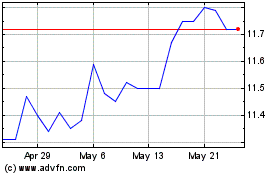

Melcor Developments (TSX:MRD)

Historical Stock Chart

From May 2024 to Jun 2024

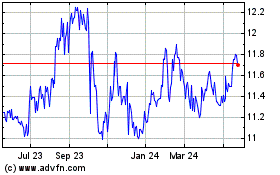

Melcor Developments (TSX:MRD)

Historical Stock Chart

From Jun 2023 to Jun 2024