NuVista Energy Ltd. ("

NuVista" or the

"

Company") (TSX:

NVA) is pleased

to announce strong financial and operating results for the three

and nine months ended September 30, 2024, and to provide an update

on our operational performance. The quality and composition of our

asset base consistently enables us to generate strong returns

across commodity price cycles. Subsequent to the third quarter, our

daily production has reached new record levels, as we continue to

invest in new high-return wells and infrastructure projects to

support our development plans. We also added LNG market access to

our diversified natural gas portfolio and made significant progress

on our return of capital to shareholders program through our normal

course issuer bid (the “2024 NCIB”), while maintaining a financial

position with low debt.

Financial Highlights

During the third quarter of 2024, NuVista:

- Delivered adjusted

funds flow(1) of $139.5 million ($0.68/share, basic(3)), and free

adjusted funds flow(2) of $19.4 million. Adjusted funds flow and

free adjusted funds flow remained strong relative to the second

quarter, supported by condensate rich production and lower cash

costs, despite softer commodity prices;

- Generated net

earnings of $59.8 million ($0.29/share, basic), resulting in

year-to-date net earnings of $206.6 million ($1.00/share,

basic);

- Completed a

well-executed capital expenditures(2) program, investing $118.4

million in well and facility activities including the drilling of

14 wells and completion of 12 wells in our condensate rich Wapiti

Montney asset base. Year-to-date, the capital expenditures program

has totaled $427.8 million, with 34 wells drilled and 38 wells

completed, in addition to completing several infrastructure

projects;

- Added LNG sales to

our natural gas diversification portfolio by gaining exposure to

the Japan/Korea marker (“JKM”) through a netback agreement with

Trafigura based on 21,000 MMbtu/d of LNG for a period of up to

thirteen years commencing January 1, 2027;

- Exited the quarter

with $37.5 million drawn on our $450 million credit facility and

net debt(1) of $261.9 million, maintaining a favorable net debt to

annualized third quarter adjusted funds flow(1) ratio of 0.5x;

-

Repurchased and subsequently cancelled 816,800 common shares under

its 2024 NCIB program at a weighted average price of $13.81 per

share for a total cost of $11.3 million. Since the inception of our

NCIB programs in 2022, NuVista has repurchased and subsequently

cancelled 33.2 million common shares for an aggregate cost of

$394.6 million or $11.89 per share; and

- Recognized as

part of the TSX30 for the third consecutive year. The TSX30

recognizes the thirty top-performing companies on the Toronto Stock

Exchange (“TSX”) over the prior three-year period

(see www.tsx.com/tsx30). NuVista ranked a notable sixth place

overall.

Notes:(1) Each of "adjusted funds flow", "net

debt", "net debt to annualized third quarter adjusted funds flow"

are capital management measures. Reference should be made to the

section entitled "Non-GAAP and Other Financial Measures" in this

press release. (2) “Free adjusted funds flow” and "capital

expenditures" are non-GAAP financial measures that do not have

standardized meanings under IFRS Accounting Standards and therefore

may not be comparable to similar measures presented by other

companies where similar terminology is used. Reference should be

made to the section entitled "Non-GAAP and Other Financial

Measures" in this press release.(3) "Adjusted funds flow per share"

is a supplementary financial measure. Reference should be made to

the section entitled "Non-GAAP and Other Financial Measures" in

this press release.

Operational Excellence

During the third quarter of 2024, NuVista:

- Produced an average

of 83,475 Boe/d, within the third quarter guidance range of 83,000

– 86,000 Boe/d, and consistent with the second quarter production

despite unplanned downtime at third-party facilities, which

negatively impacted the quarter by approximately 5,000 Boe/d. All

impacted production has since been brought back online, with daily

production levels in late October reaching record levels above

90,000 Boe/d. It is expected that production will stabilize around

this new level throughout much of the fourth quarter;

- Production for the

third quarter comprised 31% condensate, 9% NGLs and 60% natural

gas, a favorable outcome despite the fact that the production

outage occurred in our richest condensate area. This was mainly due

to outperformance of the most recent pad brought online at

Pipestone;

- Realized strong

production milestones for both pads brought online during the

second quarter in the Pipestone area. A 4-well pad at Pipestone

South has reached its IP90 at average rates per well of 1,300 Boe/d

including 40% condensate, in line with historic averages for the

area despite flowing at restricted rates since coming on production

due to infrastructure capacity. In addition, the most southerly pad

drilled at Pipestone North to-date has reached its IP60 milestone,

producing 1,650 Boe/d including 50% condensate over the period.

This pad included co-development of the Lower Montney and is

important as it illustrates the continued repeatability in

condensate yields as we progress development to the south.

Completion operations in Pipestone will resume in the new year

where we will begin on the 14-well pad that is scheduled to come on

production at the end of the first quarter;

- Commenced the

production ramp-up of two new pads in the Wapiti area, as planned

during the third quarter, following the completion of our

infrastructure expansion projects in the first half of the year.

With firm transportation capacity in place, area production has

reached record levels. Both the 6-well pad in Elmworth and a 4-well

pad in Gold Creek have reached IP90 milestones and with facilities

very recently expanded, they have now been able to produce

consistently. The pad on the southern end of Elmworth co-developed

the entire stack including one well in the Lower Montney which

averaged 1,675 Boe/d including 15% condensate over the period and

reflects over 25% more production than the other 5 wells on the pad

which averaged 1,300 Boe/d per well including 26% condensate. The

4-well pad on the western side of Gold Creek also has reached IP90

averaging 1,500 Boe/d per well including 35% condensate over the

period. This pad was also co-developed in the Lower and Middle

Montney and exhibited exceptional consistency in deliverability

across the zones which reinforces our view on inventory expansion

in Gold Creek area; and

- Brought on

production a 6-well pad between Gold Creek and Elmworth. Notably,

this pad was co-developed across the entire stack of 4 zones, and

included one Lower Montney pilot. The pad has reached its IP30

milestone producing on average 1,725 Boe/d per well including 40%

condensate. Importantly, the Lower Montney well exhibited robust

productivity compared to the other benches, producing 1,850 Boe/d

including 38% condensate.

Balance Sheet Strength and Return of

Capital to Shareholders

At the end of the third quarter, our net debt

was $261.9 million, resulting in a net debt to annualized third

quarter adjusted funds flow ratio of 0.5x, which supports our

strong financial position. The net debt level is also well below

the $350 million limit set by management, to ensure that our net

debt to adjusted funds flow ratio remains comfortably below 1.0x in

a stress test price environment of US$45/Bbl WTI oil and

US$2.00/MMBtu NYMEX natural gas.

We remain focused on our disciplined

value-adding growth strategy, balanced with providing significant

shareholder returns. We continue to believe the best way to return

capital to shareholders is through the repurchase of shares,

although we will continue to consider other options in tandem with

our longer term, high return growth plans. This evaluation will

consider commodity prices, the economic and tax environment, and

will include all options including share repurchases and dividend

payments.

Presently, our Board has set a target of

returning approximately 75% of free adjusted funds flow to

shareholders through the repurchase of the NuVista’s common shares

pursuant to our NCIB programs.

2024 Guidance Reaffirmed

We are extremely well-positioned with top-tier

assets and highly favorable economics. Our disciplined execution

has enabled us to achieve growth in production and adjusted funds

flow, while also generating positive free adjusted funds flow. This

has allowed us to continue to return capital to our shareholders

through the repurchase of shares. Our high condensate weighting,

for which pricing has remained supportive, continues to drive

superior economics despite the weakness in natural gas prices

experienced for much of 2024. We continue to execute according to

our plans, with well and facility outperformance in several areas.

As such, we reaffirm our 2024 capital expenditure guidance target

of approximately $500 million, allowing us to maintain the

efficiencies of a steady 2-drill-rig execution.

Recent average weekly production has reached a

record level above 90,000 Boe/d and our guidance for the fourth

quarter of 2024 is 89,000 – 91,000 Boe/d. This includes the minor

impact associated with our decision to temporarily shut in the very

small amount of our production which was exposed to AECO when those

prices reached historically low levels at the start of the fourth

quarter. We are pleased that despite the unplanned impacts of

third-party downtime in the third quarter, we are able to reaffirm

our previously announced full-year 2024 guidance range of 83,500 –

86,000 Boe/d.

2025 Budget Further Enhances Priority of Return of

Capital to Shareholders

With well outperformance continuing to drive

strong capital efficiencies, and with commodity prices retreating

from the highs of 2022, we have taken this as a market signal to

moderate capital spending and production growth in order to

increase the priority of at least triple-digit return of cash to

shareholders via share buybacks. We are fortunate that our business

has the flexibility and superior asset quality to afford this. We

have set our 2025 capital expenditure guidance at approximately

$450 million to grow production volumes by 7% to a 2025 annual

average of approximately 90,000 Boe/d. This includes a planned

six-week turnaround for maintenance and expansion of major third

party facilities in Wapiti which will impact the second and third

quarters. Production volumes are expected to approach 100,000 Boe/d

in the second half of the year. Our budget is based on commodity

price assumptions of $65/Bbl WTI oil and $3/MMBtu Nymex natural

gas. In this base scenario we would expect to generate

approximately $175 million of free adjusted funds flow, of which we

will target at least 75% for return to shareholders. This capital

budget is approximately $125 million lower than our previous

outlook with only a modest tempering of our production growth from

10% to 7%. Superior ongoing execution and new well performance are

the main drivers that provide us the flexibility to exercise this

discipline and reduce capital substantially with only a modest

growth impact.

Substantially all of our production growth in

2025 will come from the Pipestone North area, beginning with the

startup of the CSV Midstream Albright gas plant which is

anticipated to be commissioned during the first quarter. 14 wells

will be completed in Pipestone to ramp into this additional

capacity of 8,000 to 10,000 Boe/d by the second quarter. Looking

further ahead, Gold Creek area production growth will be a high

focus for 2026 and 2027.

We will monitor the economic environment, and if

commodity prices are averaging higher than our base assumptions, we

have the ability and intention to increase returns to shareholders

and 2025 capital expenditures for future growth concurrently to

maximize long term value per share. If in an environment where

commodity prices soften, we have the flexibility to further

moderate production growth and reduce 2025 capital expenditures to

act counter-cyclically and ensure our return of capital to

shareholders remains intact. Underlying our commitment to

shareholder returns is a pristine balance sheet. We expect to enter

2025 with approximately $250 million of net debt.

We intend to continue our track record of

carefully directing free adjusted funds flow towards a prudent

balance of capital return to shareholders and debt reduction, while

investing in high return growth projects. NuVista's top quality

asset base, deep inventory, and management's relentless focus on

value maximization supports our medium-term plans for value-adding

growth to the plateau level of 125,000 Boe/d. We will continue to

closely monitor and adjust to the environment in order to maximize

the value of our asset base and ensure the long-term sustainability

of our business. We would like to thank our staff, contractors, and

suppliers for their continued dedication and delivery, and we thank

our Board of Directors and our shareholders for their continued

guidance and support.

Please note that our corporate presentation will

be available at www.nuvistaenergy.com on November 8, 2024.

NuVista's management's discussion and analysis, condensed

consolidated interim financial statements for the three and nine

months ended September 30, 2024 and notes thereto, will be filed on

SEDAR+ (www.sedarplus.ca) on November 8, 2024 and can also be

obtained at www.nuvistaenergy.com.

| FINANCIAL AND

OPERATING HIGHLIGHTS |

|

|

|

|

|

|

Three months ended September 30 |

Nine months ended September 30 |

|

($ thousands, except otherwise stated) |

|

2024 |

|

|

2023 |

|

% Change |

|

2024 |

|

|

2023 |

|

% Change |

|

FINANCIAL |

|

|

|

|

|

|

|

Petroleum and natural gas revenues |

|

301,406 |

|

|

360,373 |

|

|

(16 |

) |

|

933,780 |

|

|

1,032,600 |

|

|

(10 |

) |

| Cash provided by operating

activities |

|

150,249 |

|

|

160,194 |

|

|

(6 |

) |

|

464,422 |

|

|

509,581 |

|

|

(9 |

) |

| Adjusted funds flow(3) |

|

139,478 |

|

|

202,010 |

|

|

(31 |

) |

|

415,137 |

|

|

554,956 |

|

|

(25 |

) |

|

Per share, basic(6) |

|

0.68 |

|

|

0.94 |

|

|

(28 |

) |

|

2.01 |

|

|

2.55 |

|

|

(21 |

) |

|

Per share, diluted(6) |

|

0.67 |

|

|

0.91 |

|

|

(26 |

) |

|

1.98 |

|

|

2.47 |

|

|

(20 |

) |

| Net earnings |

|

59,823 |

|

|

110,323 |

|

|

(46 |

) |

|

206,566 |

|

|

278,165 |

|

|

(26 |

) |

|

Per share, basic |

|

0.29 |

|

|

0.51 |

|

|

(43 |

) |

|

1.00 |

|

|

1.28 |

|

|

(22 |

) |

|

Per share, diluted |

|

0.29 |

|

|

0.50 |

|

|

(42 |

) |

|

0.99 |

|

|

1.24 |

|

|

(20 |

) |

| Total assets |

|

|

|

|

3,339,971 |

|

|

3,009,291 |

|

|

11 |

|

| Net capital

expenditures(1) |

|

118,433 |

|

|

110,036 |

|

|

8 |

|

|

427,786 |

|

|

405,036 |

|

|

6 |

|

| Net debt(3) |

|

|

|

|

261,898 |

|

|

150,158 |

|

|

74 |

|

|

OPERATING |

|

|

|

|

|

|

| Daily Production |

|

|

|

|

|

|

| Natural gas (MMcf/d) |

|

297.2 |

|

|

283.1 |

|

|

5 |

|

|

296.6 |

|

|

264.4 |

|

|

12 |

|

| Condensate (Bbls/d) |

|

26,204 |

|

|

26,704 |

|

|

(2 |

) |

|

25,398 |

|

|

23,873 |

|

|

6 |

|

| NGLs (Bbls/d) |

|

7,735 |

|

|

6,491 |

|

|

19 |

|

|

7,395 |

|

|

6,295 |

|

|

17 |

|

| Total (Boe/d) |

|

83,475 |

|

|

80,382 |

|

|

4 |

|

|

82,228 |

|

|

74,240 |

|

|

11 |

|

| Condensate & NGLs

weighting |

|

41 |

% |

|

41 |

% |

|

|

40 |

% |

|

41 |

% |

|

| Condensate weighting |

|

31 |

% |

|

33 |

% |

|

|

31 |

% |

|

32 |

% |

|

| Average realized selling

prices(5) |

|

|

|

|

|

|

| Natural gas ($/Mcf) |

|

1.92 |

|

|

3.36 |

|

|

(43 |

) |

|

2.41 |

|

|

4.49 |

|

|

(46 |

) |

| Condensate ($/Bbl) |

|

95.51 |

|

|

103.92 |

|

|

(8 |

) |

|

98.20 |

|

|

100.33 |

|

|

(2 |

) |

| NGLs ($/Bbl)(4) |

|

26.09 |

|

|

29.19 |

|

|

(11 |

) |

|

26.90 |

|

|

31.54 |

|

|

(15 |

) |

| Netbacks ($/Boe) |

|

|

|

|

|

|

| Petroleum and natural gas

revenues |

|

39.25 |

|

|

48.73 |

|

|

(19 |

) |

|

41.45 |

|

|

50.95 |

|

|

(19 |

) |

| Realized gain (loss) on

financial derivatives |

|

1.53 |

|

|

1.30 |

|

|

18 |

|

|

0.55 |

|

|

0.39 |

|

|

41 |

|

| Other income |

|

0.34 |

|

|

— |

|

|

— |

|

|

0.14 |

|

|

— |

|

|

— |

|

| Royalties |

|

(4.64 |

) |

|

(3.64 |

) |

|

27 |

|

|

(4.71 |

) |

|

(4.92 |

) |

|

(4 |

) |

| Transportation expense |

|

(5.13 |

) |

|

(4.91 |

) |

|

4 |

|

|

(4.85 |

) |

|

(4.86 |

) |

|

— |

|

| Net operating expense(2) |

|

(11.43 |

) |

|

(11.49 |

) |

|

(1 |

) |

|

(11.47 |

) |

|

(11.69 |

) |

|

(2 |

) |

| Operating netback(2) |

|

19.92 |

|

|

29.99 |

|

|

(34 |

) |

|

21.11 |

|

|

29.87 |

|

|

(29 |

) |

|

Corporate netback(2) |

|

18.17 |

|

|

27.30 |

|

|

(33 |

) |

|

18.44 |

|

|

27.37 |

|

|

(33 |

) |

|

SHARE TRADING STATISTICS |

|

|

|

|

|

|

| High ($/share) |

|

14.86 |

|

|

13.55 |

|

|

10 |

|

|

14.86 |

|

|

13.55 |

|

|

10 |

|

| Low ($/share) |

|

10.70 |

|

|

10.34 |

|

|

3 |

|

|

9.59 |

|

|

9.93 |

|

|

(3 |

) |

| Close ($/share) |

|

11.12 |

|

|

13.00 |

|

|

(14 |

) |

|

11.12 |

|

|

13.00 |

|

|

(14 |

) |

| Common

shares outstanding (thousands of shares) |

|

|

|

|

205,381 |

|

|

213,209 |

|

|

(4 |

) |

(1) Non-GAAP financial measure that does not

have any standardized meaning under IFRS Accounting Standards and

therefore may not be comparable to similar measures presented by

other companies where similar terminology is used. Reference should

be made to the section entitled “Non-GAAP and other financial

measures”. (2) Non-GAAP ratio that does not have any standardized

meaning under IFRS Accounting Standards and therefore may not be

comparable to similar measures presented by other companies where

similar terminology is used. Reference should be made to the

section entitled “Non-GAAP and other financial measures”. (3)

Capital management measure. Reference should be made to the section

entitled “Non-GAAP and other financial measures”. (4) Natural gas

liquids (“NGLs”) include butane, propane and ethane revenue and

sales volumes, and sulphur revenue. (5) Product prices exclude

realized gains/losses on financial derivatives.(6) Supplementary

financial measure. Reference should be made to the section entitled

“Non-GAAP and other financial measures”.

Advisories Regarding Oil and Gas

Information

BOEs may be misleading, particularly if

used in isolation. A BOE conversion ratio of 6 Mcf: 1 Bbl is based

on an energy equivalency conversion method primarily applicable at

the burner tip and does not represent a value equivalency at the

wellhead. As the value ratio between natural gas and crude oil

based on the current prices of natural gas and crude oil is

significantly different from the energy equivalency of 6:1,

utilizing a conversion on a 6:1 basis may be misleading as an

indication of value.

Any references in this press release to initial

production rates are useful in confirming the presence of

hydrocarbons, however, such rates are not determinative of the

rates at which such wells will continue production and decline

thereafter and are not indicative of long-term performance or

ultimate recovery. While encouraging, readers are cautioned not to

place reliance on such rates in calculating the aggregate

production for NuVista.

This press release contains certain oil and gas

metrics, which do not have standardized meanings or standard

methods of calculation and therefore such measures may not be

comparable to similar measures used by other companies and should

not be used to make comparisons. Such metrics have been included

herein to provide readers with additional measures to evaluate

NuVista's performance; however, such measures are not reliable

indicators of NuVista's future performance and future performance

may not compare to NuVista's performance in previous periods and

therefore such metrics should not be unduly relied upon. Management

uses these oil and gas metrics for its own performance measurements

and to provide security holders with measures to compare the

NuVista's operations over time. Readers are cautioned that the

information provided by these metrics, or that can be derived from

the metrics presented in this presentation, should not be relied

upon for investment or other purposes.

NuVista has presented certain well economics

based on type curves for the Pipestone development block. The type

curves are based on historical production in respect of NuVista's

Pipestone assets as well as drilling results from analogous

development located in close proximity to such area. Such type

curves and well economics are useful in understanding management's

assumptions of well performance in making investment decisions in

relation to development drilling in the Montney area and for

determining the success of the performance of development wells;

however, such type curves and well economics are not necessarily

determinative of the production rates and performance of existing

and future wells and such type curves do not reflect the type

curves used by our independent qualified reserves evaluator in

estimating our reserves volumes.

Basis of presentation

Unless otherwise noted, the financial data

presented in this news release has been prepared in accordance with

Canadian generally accepted accounting principles ("GAAP") also

known as International Financial Reporting Standards ("IFRS").

Natural gas liquids are defined by National

Instrument 51-101 – Standards of Disclosure for Oil and Gas

Activities" to include ethane, butane, propane, pentanes plus and

condensate. Unless explicitly stated in this press release,

references to "NGL" refers only to ethane, butane and propane and

references to "condensate" refers to only to condensate and

pentanes plus. NuVista has disclosed condensate and pentanes plus

values separately from ethane, butane and propane values as NuVista

believes it provides a more accurate description of NuVista's

operations and results therefrom.

Production split for Boe/d amounts referenced in

the news release are as follows:

|

Reference |

Total Boe/d |

Natural Gas% |

Condensate% |

NGLs% |

|

|

|

|

|

|

|

Q3 2024 production - actual |

83,475 |

60 |

% |

31 |

% |

9 |

% |

|

Q3 2024 production guidance |

83,000 – 86,000 |

61 |

% |

30 |

% |

9 |

% |

|

Q4 2024 production guidance |

89,000 – 91,000 |

61 |

% |

30 |

% |

9 |

% |

|

2024 annual production guidance |

83,500 – 86,000 |

61 |

% |

30 |

% |

9 |

% |

|

2025 annual production guidance |

~90,000 |

61 |

% |

30 |

% |

9 |

% |

Advisory regarding forward-looking

information and statements

This press release contains forward-looking

statements and forward-looking information (collectively,

"forward-looking statements") within the meaning of applicable

securities laws. The use of any of the words "will", "expects",

"believe", "plans", "potential" and similar expressions are

intended to identify forward-looking statements. More particularly

and without limitation, this press release contains forward looking

statements, including but not limited to:

- our expectations that production

will stabilize around 90,000 Boe/d for much of the fourth

quarter;

- our assumption that completion

operations in Pipestone will resume in 2025 beginning with a

14-well pad scheduled to come on production at the end of the first

quarter;

- the expectation that recent lower

Montney results at Pipestone will be an important indicator for

future development plans;

- our expectations regarding the

consistency in deliverability of inventory in the Gold Creek

area;

- that our soft ceiling net debt will

allow our current production levels to be sustainable and maintain

an adjusted funds flow ratio below 1.0x in a stress test price

environment of US$45/Bbl WTI oil and US$2.00/MMBtu NYMEX natural

gas;

- NuVista's ability to continue

directing free adjusted funds flow towards a prudent balance of

return of capital to shareholders and debt reduction, while

investing in high return growth projects;

- the anticipated allocation of free

adjusted funds flow;

- that 75% of NuVista's free adjusted

funds flow will be put towards the repurchase of the Company's

common shares pursuant to the 2024 NCIB;

- our 2024 full year production and

capital expenditures guidance ranges;

- our plan to continue to maintain an

efficient drilling program by employing 2-drill-rig execution;

- guidance with respect to our

updated 2024 full year production mix;

- guidance with respect to fourth

quarter 2024 production and production mix;

- future commodity prices;

- our expectation with respect to our

2025 capital expenditures, free adjusted funds flow and average

annual production guidance;

- expectations that the Company will

exit 2024 with net debt significantly below $300 million;

- our expectation that growth in 2025

will be largely supported by Pipestone North;

- the expected timing of start-up of

a third-party gas plant in the Pipestone area and the anticipated

benefits thereof;

- that production volumes in the

second half of 2025 will approach approximately 100,000 Boe/d;

- that production during the second

and third quarters of 2025 will be impacted due to planned

turnaround activity at third-party facilities which is expected to

be at least six weeks in duration;

- the exception that more detailed

quarterly production guidance will be released throughout 2025,

once more detailed information in known;

- our expectation that the Gold Creek

area will be an important area of development focus in 2026 and

2027;

- our expectation that our

value-adding growth plateau level will be approximately 125,000

Boe/d;

- our future focus, strategy, plans,

opportunities and operations; and

- other such similar statements.

The future acquisition of our common shares

pursuant to a share buyback (including through our normal course

issuer bid), if any, and the level thereof is uncertain. Any

decision to acquire common shares pursuant to a share buyback will

be subject to the discretion of the Board of Directors and may

depend on a variety of factors, including, without limitation, the

Company's business performance, financial condition, financial

requirements, growth plans, expected capital requirements and other

conditions existing at such future time including, without

limitation, contractual restrictions and satisfaction of the

solvency tests imposed on the Company under applicable corporate

law. There can be no assurance of the number of common shares that

the Company will acquire pursuant to a share buyback, if any, in

the future.

By their nature, forward-looking statements are

based upon certain assumptions and are subject to numerous risks

and uncertainties, some of which are beyond NuVista's control,

including the impact of general economic conditions, industry

conditions, current and future commodity prices and inflation

rates; the impact of ongoing global events, including Middle East

and European tensions, with respect to commodity prices, currency

and interest rates, anticipated production rates, borrowing,

operating and other costs and adjusted funds flow; the timing,

allocation and amount of capital expenditures and the results

therefrom; anticipated reserves and the imprecision of reserve

estimates; the performance of existing wells; the success obtained

in drilling new wells; the sufficiency of budgeted capital

expenditures in carrying out planned activities; access to

infrastructure and markets; competition from other industry

participants; availability of qualified personnel or services and

drilling and related equipment; stock market volatility; effects of

regulation by governmental agencies including changes in

environmental regulations, tax laws and royalties; the ability to

access sufficient capital from internal sources and bank and equity

markets; that we will be able to execute our 2024 drilling plans as

expected; our ability to carry out our 2024 production and capital

guidance as expected and including, without limitation, those risks

considered under "Risk Factors" in our Annual Information Form.

Readers are cautioned that the assumptions used

in the preparation of such information, although considered

reasonable at the time of preparation, may prove to be imprecise

and, as such, undue reliance should not be placed on

forward-looking statements. NuVista's actual results, performance

or achievement could differ materially from those expressed in, or

implied by, these forward-looking statements, or if any of them do

so, what benefits NuVista will derive therefrom. NuVista has

included the forward-looking statements in this press release in

order to provide readers with a more complete perspective on

NuVista's future operations and such information may not be

appropriate for other purposes. NuVista disclaims any intention or

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

This press release also contains financial

outlook and future oriented financial information (together,

"FOFI") relating to NuVista including, without limitation, capital

expenditures in 2024, capital expenditures in 2025, net debt, free

adjusted funds flow and production which are based on, among other

things, the various assumptions disclosed in this press release

including under "Advisory regarding forward-looking information and

statements" and including assumptions regarding benchmark pricing

as it relates to free adjusted funds flow and the 2024 and 2025

capital allocation framework. Readers are cautioned that the

assumptions used in the preparation of such information, although

considered reasonable at the time of preparation, may prove to be

imprecise and, as such, undue reliance should not be placed on

FOFI. NuVista's actual results, performance or achievement could

differ materially from those expressed in, or implied by, these

FOFI, or if any of them do so, what benefits NuVista will derive

therefrom. NuVista has included the FOFI in order to provide

readers with a more complete perspective on NuVista's future

operations and such information may not be appropriate for other

purposes.

These forward-looking statements and FOFI are

made as of the date of this press release and NuVista disclaims any

intent or obligation to update any forward-looking statements and

FOFI, whether as a result of new information, future events or

results or otherwise, other than as required by applicable

securities law.

Non-GAAP and other financial

measures

This press release uses various specified

financial measures (as such terms are defined in National

Instrument 52-112 – Non-GAAP Disclosure and Other Financial

Measures Disclosure ("NI 52-112")) including

"non-GAAP financial measures", "non-GAAP ratios", "capital

management measures" and "supplementary financial measures" (as

such terms are defined in NI 52-112), which are described in

further detail below. Management believes that the presentation of

these non-GAAP measures provides useful information to investors

and shareholders as the measures provide increased transparency and

the ability to better analyze performance against prior periods on

a comparable basis.

(1) Non-GAAP financial

measures

NI 52-112 defines a non-GAAP financial measure

as a financial measure that: (i) depicts the historical or expected

future financial performance, financial position or cash flow of an

entity; (ii) with respect to its composition, excludes an amount

that is included in, or includes an amount that is excluded from,

the composition of the most directly comparable financial measure

disclosed in the primary financial statements of the entity; (iii)

is not disclosed in the financial statements of the entity; and

(iv) is not a ratio, fraction, percentage or similar

representation.

These non-GAAP financial measures are not

standardized financial measures under IFRS Accounting Standards and

might not be comparable to similar measures presented by other

companies where similar terminology is used. Investors are

cautioned that these measures should not be construed as

alternatives to or more meaningful than the most directly

comparable GAAP measures as indicators of NuVista's performance.

Set forth below are descriptions of the non-GAAP financial measures

used in this press release.

Free adjusted funds flow is adjusted funds flow

less net capital expenditures, power generation expenditures, and

asset retirement expenditures. Each of the components of free

adjusted funds flow are non-GAAP financial measures. Management

uses free adjusted funds flow as a measure of the efficiency and

liquidity of its business, measuring its funds available for

additional capital allocation to manage debt levels and return

capital to shareholders through its NCIB program and/or dividend

payments. By removing the impact of current period net capital and

asset retirement expenditures, management believes this measure

provides an indication of the funds NuVista has available for

future capital allocation decisions.

The following table sets out our free adjusted

funds flow compared to the most directly comparable GAAP measure of

cash provided by operating activities less cash used in investing

activities for the applicable periods:

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

($ thousands) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Cash provided by operating activities |

150,249 |

|

160,194 |

|

464,422 |

|

509,581 |

|

| Cash

used in investing activities |

(124,352 |

) |

(120,713 |

) |

(428,489 |

) |

(398,940 |

) |

|

Excess (deficit) cash provided by operating activities over cash

used in investing activities |

25,897 |

|

39,481 |

|

35,933 |

|

110,641 |

|

|

|

|

|

|

|

| Adjusted funds flow |

139,478 |

|

202,010 |

|

415,137 |

|

554,956 |

|

| Net capital expenditures |

(118,433 |

) |

(110,036 |

) |

(427,786 |

) |

(405,036 |

) |

| Power generation

expenditures |

— |

|

— |

|

(1,680 |

) |

— |

|

| Asset

retirement expenditures |

(1,636 |

) |

(773 |

) |

(8,478 |

) |

(9,987 |

) |

|

Free adjusted funds flow |

19,409 |

|

91,201 |

|

(22,807 |

) |

139,933 |

|

Capital expenditures are equal to cash used in

investing activities, excluding changes in non-cash working

capital, other asset expenditures, power generation expenditures,

proceeds on property dispositions and costs of acquisitions.

NuVista considers capital expenditures to represent its organic

capital program and a useful measure of cash flow used for capital

reinvestment.

The following table provides a reconciliation

between the non-GAAP measure of capital expenditures to the most

directly comparable GAAP measure of cash used in investing

activities for the applicable periods:

|

|

Three months ended September 30 |

Nine months ended September 30 |

|

($ thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Cash used in investing activities |

|

(124,352 |

) |

|

(120,713 |

) |

|

(428,489 |

) |

|

(398,940 |

) |

| Changes in non-cash working

capital |

|

5,919 |

|

|

10,677 |

|

|

(977 |

) |

|

(15,596 |

) |

| Other asset expenditures |

|

— |

|

|

— |

|

|

— |

|

|

9,500 |

|

| Power generation

expenditures |

|

— |

|

|

— |

|

|

1,680 |

|

|

— |

|

|

Proceeds on property disposition |

|

— |

|

|

— |

|

|

— |

|

|

(26,000 |

) |

|

Capital expenditures |

|

(118,433 |

) |

|

(110,036 |

) |

|

(427,786 |

) |

|

(431,036 |

) |

Net capital expenditures are equal to cash used

in investing activities, excluding changes in non-cash working

capital, other asset expenditures, and power generation

expenditures. The Company includes funds used for property

acquisitions or proceeds from property dispositions within net

capital expenditures as these transactions are part of its

development plans. NuVista considers net capital expenditures to

represent its organic capital program inclusive of capital spending

for acquisition and disposition proposes and a useful measure of

cash flow used for capital reinvestment.

The following table provides a reconciliation

between the non-GAAP measure of net capital expenditures to the

most directly comparable GAAP measure of cash used in investing

activities for the applicable periods:

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

($ thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Cash used in investing activities |

|

(124,352 |

) |

|

(120,713 |

) |

|

(428,489 |

) |

|

(398,940 |

) |

| Changes in non-cash working

capital |

|

5,919 |

|

|

10,677 |

|

|

(977 |

) |

|

(15,596 |

) |

| Other asset expenditures |

|

— |

|

|

— |

|

|

— |

|

|

9,500 |

|

| Power

generation expenditures |

|

— |

|

|

— |

|

|

1,680 |

|

|

— |

|

|

Net capital expenditures |

|

(118,433 |

) |

|

(110,036 |

) |

|

(427,786 |

) |

|

(405,036 |

) |

NuVista considers that any incremental gross

costs incurred to process third party volumes at its facilities are

offset by the applicable fees charged to such third parties.

However, under IFRS Accounting Standards, NuVista is required to

reflect operating costs and processing fee income separately on its

statements of earnings. Management believes that net operating

expense, calculated as gross operating expense less processing

income and other recoveries, is a meaningful measure for investors

to understand the net impact of the NuVista’s operating

activities.

The following table sets out net operating

expense compared to the most directly comparable GAAP measure of

operating expenses for the applicable periods:

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

($ thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Operating expense |

|

90,091 |

|

|

85,952 |

|

|

265,899 |

|

|

238,989 |

|

| Other

income(1) |

|

(2,293 |

) |

|

(1,003 |

) |

|

(7,496 |

) |

|

(2,020 |

) |

|

Net operating expense |

|

87,798 |

|

|

84,949 |

|

|

258,403 |

|

|

236,969 |

|

(1) Processing income and other recoveries,

included within Other Income as presented in the table below:

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

($ thousands) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Other income |

|

2,642 |

|

|

— |

|

|

3,178 |

|

|

— |

|

|

Processing income and other recoveries |

|

2,293 |

|

|

1,003 |

|

|

7,496 |

|

|

2,020 |

|

|

Other Income |

|

4,935 |

|

|

1,003 |

|

|

10,674 |

|

|

2,020 |

|

Non-GAAP ratios

NI 52-112 defines a non-GAAP ratio as a

financial measure that: (i) is in the form of a ratio, fraction,

percentage or similar representation; (ii) has a non-GAAP financial

measure as one or more of its components; and (iii) is not

disclosed in the financial statements of the entity. Set forth

below is a description of the non-GAAP ratios used in this press

release.

These non-GAAP ratios are not standardized

financial measures under IFRS Accounting Standards and might not be

comparable to similar measures presented by other companies where

similar terminology is used. Investors are cautioned that these

ratios should not be construed as alternatives to or more

meaningful than the most directly comparable GAAP measures as

indicators of NuVista's performance.

Per Boe disclosures for petroleum and natural

gas revenues, realized gains/losses on financial derivatives,

royalties, transportation expense, G&A expense, financing

costs, and DD&A expense are non-GAAP ratios that are calculated

by dividing each of these respective GAAP measures by NuVista's

total production volumes for the period.

Non-GAAP ratios presented on a "per Boe" basis

may also be considered to be supplementary financial measures (as

such term is defined in NI 52-112).

- Operating

netback and corporate netback ("netbacks"), per Boe

NuVista calculated netbacks per Boe by dividing

the netbacks by total production volumes sold in the period. Each

of operating netback and corporate netback are non-GAAP financial

measures. Operating netback is calculated as petroleum and natural

gas revenues including realized financial derivative gains/losses,

less royalties, transportation expense and net operating expense.

Corporate netback is operating netback less general and

administrative expense, cash share-based compensation expense,

financing costs excluding accretion expense, and current income tax

expense (recovery).

Management believes both operating and corporate

netbacks are key industry benchmarks and measures of operating

performance for NuVista that assists management and investors in

assessing NuVista's profitability, and are commonly used by other

petroleum and natural gas producers. The measurement on a Boe basis

assists management and investors with evaluating NuVista's

operating performance on a comparable basis.

- Net operating expense, per

Boe

NuVista has calculated net operating expense per

Boe by dividing net operating expense by NuVista's production

volumes for the period.

Management believes that net operating expense,

calculated as gross operating expense less processing income and

other recoveries, which are included in other income on the

statement of income and comprehensive income, is a meaningful

measure for investors to understand the net impact of the Company's

operating activities. The measurement on a Boe basis assists

management and investors with evaluating NuVista's operating

performance on a comparable basis.

(2) Capital

management measures

NI 52-112 defines a capital management measure

as a financial measure that: (i) is intended to enable an

individual to evaluate an entity's objectives, policies and

processes for managing the entity's capital; (ii) is not a

component of a line item disclosed in the primary financial

statements of the entity; (iii) is disclosed in the notes to the

financial statements of the entity; and (iv) is not disclosed in

the primary financial statements of the entity.

NuVista has defined net debt, adjusted funds

flow, and net debt to annualized third quarter adjusted funds flow

ratio as capital management measures used by the Company in this

press release.

NuVista considers adjusted funds flow to be a

key measure that provides a more complete understanding of the

Company's ability to generate cash flow necessary to finance

capital expenditures, expenditures on asset retirement obligations,

and meet its financial obligations. NuVista has calculated adjusted

funds flow based on cash flow provided by operating activities,

excluding changes in non-cash working capital and asset retirement

expenditures, as management believes the timing of collection,

payment, and occurrence is variable and by excluding them from the

calculation, management is able to provide a more meaningful

performance measure of NuVista's operations on a continuing basis.

More specifically, expenditures on asset retirement obligations may

vary from period to period depending on the Company's capital

programs and the maturity of its operating areas, while

environmental remediation recovery relates to an incident that

management doesn't expect to occur on a regular basis. The

settlement of asset retirement obligations is managed through

NuVista's capital budgeting process which considers its available

adjusted funds flow.

A reconciliation of adjusted funds flow is

presented in the following table:

|

|

Three months ended September 30 |

|

Nine months ended September 30 |

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Cash provided by operating activities |

$ |

150,249 |

|

$ |

160,194 |

|

$ |

464,422 |

|

$ |

509,581 |

|

| Asset retirement

expenditures |

|

1,636 |

|

|

773 |

|

|

8,478 |

|

|

9,987 |

|

| Change

in non-cash working capital |

|

(12,407 |

) |

|

41,043 |

|

|

(57,763 |

) |

|

35,388 |

|

|

Adjusted funds flow |

$ |

139,478 |

|

$ |

202,010 |

|

$ |

415,137 |

|

$ |

554,956 |

|

- Net debt

and Net debt to annualized current quarter adjusted funds

flow

Net debt is used by management to provide a more

complete understanding of NuVista's capital structure and provides

a key measure to assess the Company's liquidity. NuVista has

calculated net debt based on accounts receivable and prepaid

expenses, other receivable, accounts payable and accrued

liabilities, long-term debt (credit facility) and senior unsecured

notes and other liabilities. NuVista calculated annualized current

quarter adjusted funds flow ratio by dividing net debt by the

annualized adjusted funds flow for the current quarter.

The following is a summary of total market

capitalization, net debt, annualized current quarter adjusted funds

flow, and net debt to annualized current quarter adjusted funds

flow:

|

|

September 30, 2024 |

|

December 31, 2023 |

|

|

Basic common shares outstanding (thousands of shares) |

|

205,381 |

|

|

207,584 |

|

| Share

price(1) |

$ |

11.12 |

|

$ |

11.04 |

|

|

Total market capitalization |

$ |

2,283,837 |

|

$ |

2,291,727 |

|

|

Accounts receivable and prepaid expenses |

|

(133,904 |

) |

|

(163,987 |

) |

| Inventory |

|

(12,080 |

) |

|

(20,705 |

) |

| Accounts payable and accrued

liabilities |

|

176,123 |

|

|

157,711 |

|

| Current portion of other

liabilities |

|

14,805 |

|

|

14,082 |

|

| Long-term debt (credit

facility) |

|

37,529 |

|

|

16,897 |

|

| Senior unsecured notes |

|

163,080 |

|

|

162,195 |

|

| Other

liabilities |

|

16,345 |

|

|

17,358 |

|

|

Net debt |

$ |

261,898 |

|

$ |

183,551 |

|

| Annualized current quarter

adjusted funds flow |

$ |

557,912 |

|

$ |

807,948 |

|

| Net

debt to annualized current quarter adjusted funds flow |

|

0.5 |

|

|

0.2 |

|

(3) Supplementary

financial measures

This press release may contain certain

supplementary financial measures. NI 52-112 defines a supplementary

financial measure as a financial measure that: (i) is intended to

be disclosed on a periodic basis to depict the historical or

expected future financial performance, financial position or cash

flow of an entity; (ii) is not disclosed in the financial

statements of the entity; (iii) is not a non-GAAP financial

measure; and (iv) is not a non-GAAP ratio.

NuVista calculates "adjusted funds flow per

share" by dividing adjusted funds flow for a period by the number

of weighted average common shares of NuVista for the specified

period.

| FOR FURTHER INFORMATION

CONTACT: |

| |

|

|

| Jonathan A. Wright |

Mike J. Lawford |

Ivan J. Condic |

| CEO |

President and COO |

VP, Finance and CFO |

| (403) 538-8501 |

(403) 538-1936 |

(403) 538-1945 |

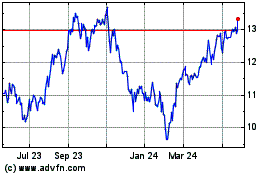

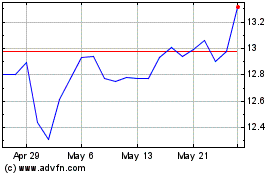

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Feb 2025 to Mar 2025

NuVista Energy (TSX:NVA)

Historical Stock Chart

From Mar 2024 to Mar 2025