PowerSchool Holdings, Inc. (NYSE: PWSC) (“PowerSchool” or “the

Company”), a leading provider of cloud-based software for K-12

education, announced today that it has entered into a definitive

agreement to be acquired by Bain Capital in a transaction valuing

the Company at $5.6 billion.

Under the terms of the agreement, PowerSchool stockholders will

receive $22.80 per share in cash upon completion of the proposed

transaction. The per share purchase price represents a premium of

37 percent over PowerSchool’s unaffected share price of $16.64 as

of May 7, 2024, the last trading day prior to media reports

regarding a potential transaction.

PowerSchool is a global education technology company supporting

over 55 million students and over 17,000 customers in more than 90

countries. The Company brings together the best of K-12 educational

and operational technology to support every step of the learning

journey. PowerSchool will remain a standalone company, and its

business operations and customer service will continue without

interruption.

“PowerSchool is a leader in K-12 SaaS technology in North

America and is uniquely positioned to provide differentiated,

mission-critical solutions that drive better education outcomes,

empower educators, and help district operations run more

efficiently,” said Hardeep Gulati, Chief Executive Officer of

PowerSchool. “With Bain Capital’s support, PowerSchool will have

access to additional resources and the flexibility to deliver even

more growth and innovation, particularly with PowerBuddy, our

generative AI platform, and scale our global reach in helping

schools personalize education for every student journey.”

“PowerSchool’s innovative software solutions in and out of the

classroom provide a strong foundation for K-12 academic success.

Their products are highly respected by administrators, educators,

students, and parents because they foster active collaboration and

offer actionable insights needed to support positive learning

outcomes,” said David Humphrey, a Partner at Bain Capital. “As

demand for K-12 educational technology grows, we believe there are

significant opportunities to expand access to PowerSchool’s

best-in-class product suite around the world. We look forward to

working with PowerSchool to accelerate the Company’s growth while

strengthening its commitment to help educators and students realize

their full potential,” added Max de Groen, a Partner at Bain

Capital.

Vista Equity Partners and Onex Partners will continue to have

minority investments in PowerSchool.

“Vista’s continued investment in PowerSchool reflects our

conviction that software will remain a fundamental component of a

future educational ecosystem being dramatically reshaped by digital

transformation,” said Monti Saroya, Co-Chairman of PowerSchool’s

Board of Directors, Co-Head of Vista’s Flagship Fund and Senior

Managing Director. “From helping to meet the unprecedented

challenges of remote learning to being a leader in developing

responsible, personalized approaches to AI-assisted learning tools,

we are proud of the innovation and growth achieved during our

partnership with PowerSchool.”

“Since the beginning of our partnership, we have been proud to

support Hardeep and PowerSchool on the mission to drive digital

transformation in K-12 education, enhancing the experience and

outcomes for students, educators, administrators and parents,” said

Laurence Goldberg, Co-Chairman of PowerSchool’s Board of Directors

and Managing Director at Onex Partners. “We are committed to and

excited about fueling the next phase of PowerSchool’s technology

leadership and global impact.”

Certain Terms, Approvals and Timing

Following the recommendation of a Special Committee composed

entirely of independent and disinterested directors, the

PowerSchool Board of Directors approved the merger agreement. In

addition to approval by the PowerSchool Board of Directors,

PowerSchool stockholders holding a majority of the outstanding

voting securities of PowerSchool have approved the transaction by

written consent. No further action by other PowerSchool

stockholders is required to approve the transaction. In connection

with the transaction, PowerSchool’s tax receivable agreement was

amended to provide that no payments will be made in respect of or

following the transaction; these payments would have had an

estimated value of approximately $450 million, which corresponds to

an estimated per share value in excess of $2.00 per share. The

transaction is expected to close in the second half of 2024,

subject to customary closing conditions, including receipt of

regulatory approvals.

Upon completion of the transaction, PowerSchool’s common stock

will no longer be publicly listed on the New York Stock Exchange,

and PowerSchool will become a privately held company.

The foregoing description of the merger agreement and the

transactions contemplated thereby is subject to, and is qualified

in its entirety by reference to, the full terms of the merger

agreement, for which PowerSchool will file a Form 8-K.

Advisors

Goldman Sachs & Co. LLC is acting as the exclusive financial

advisor, and Kirkland & Ellis LLP is serving as legal advisor

to PowerSchool. Centerview Partners LLC is acting as the exclusive

financial advisor, and Freshfields Bruckhaus Deringer LLP is

serving as legal advisor to the Special Committee of the

PowerSchool Board of Directors. Ropes & Gray LLP is acting as

legal advisor to Bain Capital.

Debt financing for the transaction will be provided by Ares

Capital Management, HPS Investment Partners, Blackstone Alternative

Credit Advisors, Blue Owl Credit Advisors, Sixth Street Partners,

and Golub Capital.

About PowerSchool

PowerSchool (NYSE: PWSC) is a leading provider of cloud-based

software for K-12 education in North America. Its mission is to

empower educators, administrators, and families to ensure

personalized education for every student journey. PowerSchool

offers end-to-end product clouds that connect the central office to

the classroom to the home with award-winning products including

Schoology Learning and Naviance CCLR, so school districts can

securely manage student data, enrollment, attendance, grades,

instruction, assessments, human resources, talent, professional

development, special education, data analytics and insights,

communications, and college and career readiness. PowerSchool

supports over 55 million students and over 17,000 customers in more

than 90 countries, including more than 90 of the top 100 districts

by student enrollment in the United States. Learn more at

www.powerschool.com.

© PowerSchool. PowerSchool and other PowerSchool marks are

trademarks of PowerSchool Holdings, Inc. or its subsidiaries. Other

names and brands may be claimed as the property of others.

About Bain Capital

Bain Capital, LP is one of the world’s leading private

multi-asset alternative investment firms that creates lasting

impact for our investors, teams, businesses, and the communities in

which we live. Since our founding in 1984, we’ve applied our

insight and experience to organically expand into numerous asset

classes including private equity, credit, public equity, venture

capital, real estate, life sciences, insurance and other strategic

areas of focus. The firm has offices on four continents, more than

1,750 employees and approximately $185 billion in assets under

management. To learn more, visit www.baincapital.com.

About Vista Equity Partners

Vista is a leading global investment firm with more than $100

billion in assets under management as of December 31, 2023. The

firm exclusively invests in enterprise software, data and

technology-enabled organizations across private equity, permanent

capital, credit and public equity strategies, bringing an approach

that prioritizes creating enduring market value for the benefit of

its global ecosystem of investors, companies, customers and

employees. Vista's investments are anchored by a sizable long-term

capital base, experience in structuring technology-oriented

transactions and proven, flexible management techniques that drive

sustainable growth. Vista believes the transformative power of

technology is the key to an even better future – a healthier

planet, a smarter economy, a diverse and inclusive community and a

broader path to prosperity. Further information is available at

vistaequitypartners.com. Follow Vista on LinkedIn, @Vista Equity

Partners, and on X, @Vista_Equity.

About Onex Corporation

Onex is an investor and asset manager that invests capital on

behalf of Onex shareholders and clients across the globe. Formed in

1984, we have a long track record of creating value for our clients

and shareholders. Our investors include a broad range of global

clients, including public and private pension plans, sovereign

wealth funds, insurance companies, family offices, and high

net-worth individuals. In total, Onex has US$50.9 billion in assets

under management, of which US$8.4 billion is Onex’ own investing

capital. With offices in Toronto, New York, New Jersey, Boston and

London, Onex and its experienced management teams are collectively

the largest investors across Onex’ platforms.

Onex is listed on the Toronto Stock Exchange under the symbol

ONEX. For more information on Onex, visit its website at

www.onex.com. Onex’ security filings can also be accessed at

www.sedarplus.ca.

Forward-Looking Statements

This press release contains “forward-looking statements.” Any

statements made in this press release that are not statements of

historical fact, including statements about the proposed

acquisition of PowerSchool by Bain Capital, our beliefs and

expectations, are forward-looking statements and should be

evaluated as such. Forward-looking statements are not assurances of

future performance and may include information concerning possible

or assumed future results of operations, including our financial

outlook and descriptions of our business plan and strategies.

Forward-looking statements are based on PowerSchool management’s

beliefs, as well as assumptions made by, and information currently

available to, them. You can identify forward-looking statements by

the fact that they do not relate strictly to historical or current

facts. These statements may include words such as “anticipate,”

“estimate,” “expect,” “project,” “plan,” “intend,” “believe,”

“may,” “will,” “should,” “can have,” “likely,” and other words and

terms of similar meaning in connection with any discussion of the

timing or nature of future operating or financial performance or

other events. Because such statements are based on expectations as

to future financial and operating results and are not statements of

fact, actual results may differ materially from those projected.

Factors which may cause actual results to differ materially from

current expectations include, but are not limited to: uncertainties

associated with the proposed acquisition of PowerSchool by Bain

Capital; the occurrence of any event, change or other circumstances

that could give rise to the termination of the related merger

agreement; the inability to complete the proposed acquisition due

to the failure to satisfy conditions to completion of the proposed

acquisition, including the receipt of applicable approvals and

clearances by government authorities; risks related to disruption

of management’s attention from our ongoing business operations due

to the proposed acquisition; the effect of the announcement of the

proposed acquisition on our relationships with our customers,

operating results and business generally; the risk that the

proposed acquisition will not be consummated in a timely manner or

at all; the costs of the proposed acquisition if the proposed

acquisition is not consummated; restrictions imposed on our

business during the pendency of the proposed acquisition; our

ability to recruit, retain and develop key employees and management

personnel, including in light of the proposed acquisition; our

history of cumulative losses; competition; our ability to attract

new customers on a cost-effective basis and the extent to which

existing customers renew and upgrade their subscriptions; our

ability to sustain and expand revenues, maintain profitability, and

to effectively manage our anticipated growth; our ability to

retain, hire, and integrate skilled personnel including our senior

management team; our ability to identify acquisition targets and to

successfully integrate and operate acquired businesses; our ability

to maintain and expand our strategic relationships with third

parties, including with state and local government entities; the

seasonality of our sales and customer growth; our reliance on

third-party software and intellectual property licenses; our

ability to obtain, maintain, protect, and enforce intellectual

property protection for our current and future solutions; the

impact of potential information technology or data security

breaches or other cyber-attacks or other disruptions; and the other

factors described under the heading “Risk Factors” in PowerSchool’s

Annual Report on Form 10-K for the year ended December 31, 2023

(the "Annual Report"), filed with the Securities Exchange

Commission (“SEC”). Copies of the Annual Report may be obtained

from PowerSchool or the SEC. We caution you that the factors

referenced above may not contain all of the factors that are

important to you. In addition, we cannot assure you that we will

realize the results or developments we expect or anticipate or,

even if substantially realized, that they will result in the

consequences or affect us or our operations in the way we expect.

All forward-looking statements reflect our beliefs and assumptions

only as of the date of this press release. We undertake no

obligation to publicly update forward-looking statements, whether

written or oral, to reflect future events, future developments or

circumstances, or new information.

Additional Information and Where to Find It

This communication is being made in respect of the pending

merger involving PowerSchool and Bain Capital. PowerSchool will

file with the SEC an information statement on Schedule 14C and may

file or furnish other documents with the SEC regarding the pending

merger. When completed, a definitive information statement will be

mailed to PowerSchool’s stockholders. INVESTORS ARE URGED TO

CAREFULLY READ THE INFORMATION STATEMENT REGARDING THE PENDING

MERGER AND ANY OTHER RELEVANT DOCUMENTS IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE PENDING MERGER.

PowerSchool’s stockholders may obtain free copies of the

documents PowerSchool files with the SEC from the SEC’s website at

www.sec.gov or through the Investors portion of PowerSchool’s

website at investors.powerschool.com under the link “Financials”

and then under the link “SEC Filings” or by contacting

PowerSchool’s Investor Relations by e-mail at

investor.relations@PowerSchool.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240607770171/en/

For PowerSchool:

Investor Relations Shane Harrison

investor.relations@PowerSchool.com 855-707-5100

Media Relations Beth Keebler public.relations@powerschool.com

503-702-4230

For Bain Capital: Charlyn

Lusk/Scott Lessne 646-502-3549/646-502-3569

clusk@stantonprm.com/slessne@stantonprm.com

For Vista Equity Partners: Brian W.

Steel media@vistaequitypartners.com 212-804-9170

For Onex Corporation: Jill Homenuk

shareholderrelations@onex.com 416-362-7711

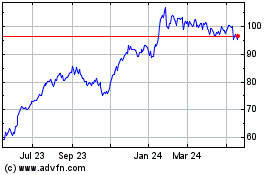

Onex (TSX:ONEX)

Historical Stock Chart

From Feb 2025 to Mar 2025

Onex (TSX:ONEX)

Historical Stock Chart

From Mar 2024 to Mar 2025