Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX:

ORAAF) (“

Aura” or the

“

Company”) is pleased to announce that it has

filed its audited consolidated financial statements and management

discussion and analysis (together, “

Financial and

Operational Results”) for the year ended December 31,

2023, which also contains the Annual Guidance (“

2024

Guidance”). The full version of the Financial and

Operational Results can be viewed on the Company’s website at

www.auraminerals.com or on SEDAR+ at www.sedarplus.ca. All amounts

are in thousands of U.S. dollars unless stated otherwise.

Rodrigo Barbosa, CEO of Aura, commented, “The

year 2023 showcased our unwavering commitment to growth under the

highest Environmental, Social, and Governance (ESG) standards. We

achieved remarkable milestones, including zero lost time incidents

across all operations. Our greenfield implementation set new

benchmarks, as we completed the construction of Almas in just 16

months and rapidly ramped up operations in less than 5 months. We

published a new feasibility study, raised the capital, and

commenced construction of Borborema, which is on schedule to begin

operations in early 2025. Our exploration program continued to

expand our Resources & Reserves, with an update to be released

soon. In all, despite temporary challenges in operations, we

generated US$88 MM in recurring free cash flow, enabling us to fund

our growth while paying one of the highest dividend yield in the

sector (6%p.a.) for the third consecutive year. We are confident

that 2024 will bring further achievements, with an increase in GEO

production, development of greenfield projects like Borborema, and

growth in Resources and Reserves.”

Q4 2023 and 2023 Financial and

Operational Highlights:

(US$ thousand):

|

|

For the three months ended December 31, 2023 |

For the three months ended December 31, 2022 |

For the twelvemonths

endedDecember 31, 2023 |

For the twelvemonths endedDecember 31, 2022 |

|

Total Production1 (GEO) |

69,194 |

67,663 |

235,856 |

241,421 |

|

Sales2 (GEO) |

68,571 |

68,077 |

233,923 |

247,215 |

|

Net Revenue |

124,322 |

105,850 |

416,894 |

392,699 |

|

Adjusted EBITDA |

40,893 |

36,584 |

134,107 |

133,779 |

|

AISC per GEO sold |

1,311 |

1,005 |

1,324 |

1,118 |

|

Ending Cash balance |

237,295 |

127,901 |

237,295 |

127,901 |

|

Net Debt |

85,165 |

77,422 |

85,165 |

77,422 |

(1) Considers capitalized production (2) Does not consider

capitalized production

- Aura reached

ZERO lost time incidents (“LTIs”) across all its operating business

units and projects by the end of 2023 and credits its strong safety

culture and robust management systems under its Aura 360

values.

- The Company was

recognized with the socially responsible company seal by the

Honduran Foundation for Social Responsibility (Funhdarse),

reflecting its commitment to good operational management and

communication practices.

- In Q4 2023,

production reached 69,194 GEO, a notable increase of 7% compared to

Q3 2023 and the best quarterly production for the year. The

increase was a result of improved operating performance at Apoena

(EPP), Minosa (San Andrés) and Almas. When compared to the same

period last year, production increased by 2% mainly due to Almas

achieving commercial production in August 2023. Total production

for 2023 reached 235,856 GEO at current prices, within the range of

the Q3 2023 MD&A Consolidated Production Guidance of between

231,000 – 253,000 GEO for 2023.

- Aranzazu:

Production of 26,532 GEO, was 2% lower compared to Q3 2023 and 1%

above Q4 2022 at constant prices, due to mine sequencing. In 2023,

Aranzazu produced 106,119 GEO, 2% below 2022 at constant prices and

in line with the Company`s Guidance.

- Apoena (EPP):

Production of 15,217 GEO, was 36% higher in Q4 2023 compared to the

previous quarter as the high-grade Ernesto pit was accessed and a

lower volume of existing low-grade stockpiles were processed.

Despite this increase, production was still influenced by the

adverse impact of rains during Q3 2023. Aura anticipates mining to

continue in Ernesto during Q1 2024 with improving production rates.

Compared to Q4 2022, production decreased 43% when record

production was achieved as a result of initial access to phase II

in the Ernesto pit. Considering this result, Apoena produced 46,006

GEO in 2023.

- Minosa (San

Andres): Production of 17,854 GEO for the quarter, representing

aNOTHER 2% increase compared to the previous quarter and an

increase of 47% over Q4 2022. This represents the fourth quarterly

increase in production in a row, due to the higher stacked tonnage

resulting from the upgrade in the stacking system in Q3 2023. In

2023, Minosa produced 65,927 GEO, 7.3% above 2022.Almas: Production

of 9,591 GEO, representing the first full quarter of production.

Despite lower volume than expected in the quarter, mine performance

improved by 93% between October and December, with 584 thousand

tons moved in October, 731 thousand tons in November and 1,128

thousand tons in December, achieving stable performance levels as

expected in 2024. In 2023, Almas produced 17,805 GEO.

- Sales volumes

were 8% higher than Q3 2023, mainly due to higher production in

Apoena, Minosa, and Almas. Compared to same period last year, sales

volumes were 1% higher, mainly due to higher production in Minosa

and the commencement of commercial production in Almas, despite

Apoena’s decrease. In 2023, Sales volumes decreased 5% when

compared to the previous year. During the year, sales volumes

fluctuated, and consistently increased as a result of higher

production.

- Revenues were

$124,322 in Q4 2023, representing an increase of 12% compared to Q3

2023 and 17% compared to the same period in 2022. Compared to

same period last year sales volumes were 1% higher, mainly due to

higher production in Minosa and the commencement of commercial

production in Almas, despite Apoena’s decrease. In 2023, revenues

reached $416,894, a 6% increase compared to 2022. Revenues improved

significantly in the second semester, reflecting a recovery in

production and the commencement of operations in Almas.

- Adjusted EBITDA

was $40,893 in Q4 2023, an improvement of 37% compared to $30,020

in Q3 2023, as a result of higher production and sales volume from

Apoena, Minosa and Almas. Compared to Q4 2022, adjusted EBITDA

showed an improvement of 13%, also mainly due to higher production,

and sales volumes. In 2023, Adjusted EBITDA reached $134,107,

stable when compared to 2022. This was mainly due to the decrease

in Apoena´s production in 2023, and partially offset by an increase

in Minosa and the ramp-up of Almas.

- AISC during Q4

2023 of $1,311/GEO, represented a decrease of $126/GEO when

compared to Q3 2023 ($1,437/GEO) mainly due to higher volumes in

Minosa and Almas and higher-grade production from the Ernesto pit

and lower processing stockpile inventory at Apoena. In 2023, AISC

of $1,324, was in line with guidance and 18% above 2022 AISC,

partially due to metal prices and the appreciation of the US Dollar

against the Brazilian Real and the Mexican Peso, and lower grades

at Apoena mines. At constant metal prices and FX rates, AISC would

have increased 11% in 2023 vs. 2022.

- By the end of Q4

2023, the Company’s Net Debt position was $85,165, a reduction

compared to $112,110 reported in the previous quarter. Recurring

Free Cash Flow to Firm was strong and about $38,000, of which

$9,000 was invested in growth activities and $18,000 was returned

to shareholders through a dividend payment.

-

Strategic Investment in Altamira Gold: In

November, Aura made a strategic investment in Altamira Gold through

a non-brokered private placement. This investment resulted in Aura

owning approximately 11.35% of Altamira's issued and outstanding

shares (non-diluted) and around 17.00% on a fully diluted basis.

The decision to invest was motivated by Altamira's exploration

potential and the recent success at the Maria Bonita gold discovery

within the Cajueiro gold project in Mato Grosso and Para,

Brazil.

-

Achievement of Commercial Production at Almas: In

April 2023, Aura successfully completed construction and began the

ramp-up phase of the Almas project, achieving this milestone on

time and mostly within budget over a remarkably quick 16-month

period. By August 2023, Almas had reached commercial production,

processing about 8,214 ounces by the end of Q3 2023 and producing

17,805 gold equivalent ounces (GEO) in its first five months, from

August to December, marking significant month-to-month performance

improvements. By the end of 2023, Almas was not only operating

above its nominal capacity but also embarked on an expansion to

increase its capacity from 1.3 to 1.5 million tons, aiming for a

15% increase in annual gold production by the end of 2024, setting

a new industry standard for rapid development and production

scaling.

-

Construction Underway at the Borborema Project:

The Borborema project experienced significant progress in 2023,

marking a pivotal year with key milestones. In August, Dundee

exchanged its 20% interest in Borborema for a net smelter royalty,

allowing Aura to acquire full ownership. Concurrently, Aura

announced the completion of the Borborema Feasibility Study under

NI 43-101, projecting 748,000 ounces of gold production over an

initial life of mine of 11.3 years, with robust economics

indicating a net present value (NPV) of US$182 million and an

internal rate of return (IRR) of 21.9% at a gold price of

US$1,712/oz. The study outlined competitive life of mine average

AISC of $949/oz, a CAPEX of US$188 million, and an expected payback

within 3.2 years. Following this, the Board of Directors green-lit

the project's construction, with Aura securing over US$145 million

in funding through a combination of financing strategies.

Construction is well underway with 17% completed to date, aiming

for a start in early 2025. The project's advancement includes

completed earthworks and ongoing civil mobilizations, alongside

efforts to relocate a road to access additional resources, with

engineering, procurement, and construction management (EPCM)

services provided by POYRY, ensuring the project remains on

schedule.

2024 Guidance:

The Company’s updated gold equivalent production, AISC and cash

operating cost per gold equivalent ounce sold, and CAPEX guidance

for 2024 is detailed below.

| |

Gold equivalent thousand ounces ('000 GEO)

production - 2024 |

Cash Cost per equivalent ounce of gold produced -

2024 |

AISC per equivalent ounce of gold produced -

2024 |

|

|

Low |

High |

Low |

High |

Low |

High |

| Aranzazu |

94 |

108 |

826 |

1,009 |

1,089 |

1,331 |

| Apoena (EPP) |

46 |

56 |

1,182 |

1,300 |

1,588 |

1,747 |

| Minosa (San Andres) |

60 |

75 |

1,120 |

1,288 |

1,216 |

1,398 |

| Almas |

45 |

53 |

932 |

1,025 |

1,179 |

1,297 |

|

Total |

244 |

292 |

984 |

1,140 |

1,290 |

1,459 |

| |

|

|

|

|

|

|

| |

Capex (US$ million) - 2024 |

|

|

|

|

| |

Low |

High |

|

|

|

|

| Manutenção |

37 |

43 |

|

|

|

|

| Exploração |

7 |

8 |

|

|

|

|

| Novos projetos + Expansão |

144 |

169 |

|

|

|

|

|

Total |

188 |

219 |

|

|

|

|

| |

|

|

|

|

|

|

In 2024, Aura is set to achieve significant

progress across its portfolio, with production guidance indicating

a promising increase in gold equivalent ounces (GEO) ranging from

244-292 kGEO, marking an 8k – 56k GEO increase (3% to 24%) compared

to 2023, primarily due to the full-scale production at Almas.

Highlights include operational advancements at Minosa (San Andres)

with an expected production volume increase, strategic expansions

at Apoena (EPP) and Almas to enhance plant capacity and

productivity, and steady production at Aranzazu.

On the financial front, Aura anticipates varied

cash cost and all-in sustaining cost (AISC) adjustments across

projects, with notable cost reductions at Almas due to increased

mine productivity and plant enhancements. The year also focuses on

the Borborema Project's construction, reflecting a significant

portion of the year's capital expenditures, alongside continued

investments in exploration and development to bolster the life of

mine (LOM) across Aura's operations. For a detailed breakdown of

the 2024 guidance including production volumes, cash costs, AISC,

and insights into new projects and expansions, review the MD&A

and Earnings Release documents for comprehensive information.

Q4 2023 Earnings Call

The Company will hold an earnings conference

call on Wednesday, February 21, 2024 at 8 AM (Eastern Time). To

register and participate, please click the link below.

Date: February 21, 2024

Time: 8 AM (New York and

Toronto) | 10 AM (Brasília)

Access Link: Click here

Key Factors

The Company’s future profitability, operating

cash flows, and financial position will be closely related to the

prevailing prices of gold and copper. Key factors influencing the

price of gold and copper include, but are not limited to, the

supply of and demand for gold and copper, the relative strength of

currencies (particularly the United States dollar), and

macroeconomic factors such as current and future expectations for

inflation and interest rates. Management believes that the

short-to-medium term economic environment is likely to remain

relatively supportive for commodity prices but with continued

volatility.

To decrease risks associated with commodity

prices and currency volatility, the Company will continue to

evaluate and implement available protection programs. For

additional information on this, please refer to the AIF.

Other key factors influencing profitability and

operating cash flows are production levels (impacted by grades, ore

quantities, process recoveries, labor, country stability, plant,

and equipment availabilities), production and processing costs

(impacted by production levels, prices, and usage of key

consumables, labor, inflation, and exchange rates), among other

factors.

Non-GAAP Measures

In this press release, the Company has included

Adjusted EBITDA, cash operating costs per gold equivalent ounce

sold, AISC and net debt which are non-GAAP measures. These non-GAAP

measures do not have any standardized meaning within IFRS and

therefore may not be comparable to similar measures presented by

other companies. The Company believes that these measures provide

investors with additional information which is useful in evaluating

the Company’s performance and should not be considered in isolation

or as a substitute for measures of performance prepared in

accordance with IFRS. The below tables provide a reconciliation of

the non-GAAP measures presented:

Reconciliation from Income for the Quarter for EBITDA

and Adjusted EBITDA (US$

thousand):

|

|

For the three months ended December 31, 2023 |

|

For the three months ended December 31, 2022 |

|

For the twelve months ended

December 31, 2023 |

|

For the twelve months ended December 31, 2022 |

|

|

Profit (loss) from continued and discontinued operation |

(5,908 |

) |

12,313 |

|

31,880 |

|

56,247 |

|

|

Income tax (expense) recovery |

1,598 |

|

3,748 |

|

18,798 |

|

26,832 |

|

|

Deferred income tax (expense) recovery |

(6,049 |

) |

(826 |

) |

(12,372 |

) |

(1,088 |

) |

|

Finance costs |

34,980 |

|

1,771 |

|

49,379 |

|

7,397 |

|

|

Other gains (losses) |

6,971 |

|

1,098 |

|

(659 |

) |

(1,157 |

) |

|

Depreciation |

9,301 |

|

18,480 |

|

47,082 |

|

45,548 |

|

|

EBITDA |

40,893 |

|

36,584 |

|

134,107 |

|

133,779 |

|

|

Impairment |

- |

|

- |

|

- |

|

- |

|

|

ARO Change |

- |

|

- |

|

- |

|

- |

|

|

Adjusted EBITDA |

40,893 |

|

36,584 |

|

134,107 |

|

133,779 |

|

| |

|

|

|

|

|

|

|

|

Reconciliation from the consolidated

financial statements to cash operating costs per gold equivalent

ounce sold (US$

thousand):

| |

For the three months ended December 31, 2023 |

|

For the three months ended December 31, 2022 |

|

For the twelvemonths

endedDecember 31, 2023 |

|

For the twelvemonths endedDecember 31, 2022 |

|

| Cost of goods sold |

(84,186 |

) |

(74,671 |

) |

(290,877 |

) |

(267,006 |

) |

| Depreciation |

9,844 |

|

18,437 |

|

46,816 |

|

45,187 |

|

| COGS w/o

Depreciation |

(74,342 |

) |

(56,234 |

) |

(244,061 |

) |

(221,819 |

) |

| Gold

Equivalent Ounces sold |

68,571 |

|

68,077 |

|

233,923 |

|

247,215 |

|

| Cash costs per gold

equivalent ounce sold |

1,084 |

|

826 |

|

1,043 |

|

897 |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation from the consolidated

financial statements to all in sustaining costs per gold equivalent

ounce sold (US$

thousand):

|

|

For the three months ended December 31, 2023 |

|

For the three months ended December 31, 2022 |

|

For the twelvemonths

endedDecember 31, 2023 |

|

For the twelvemonths endedDecember 31, 2022 |

|

| Cost of goods sold |

(84,186 |

) |

(74,671 |

) |

(290,877 |

) |

(267,006 |

) |

| Depreciation |

9,844 |

|

18,437 |

|

46,816 |

|

45,187 |

|

| COGS w/o

Depreciation |

(74,342 |

) |

(56,234 |

) |

(244,061 |

) |

(221,819 |

) |

| Capex w/o Expansion |

10,378 |

|

6,855 |

|

44,481 |

|

38,900 |

|

| Site G&A |

1,687 |

|

1,658 |

|

8,217 |

|

8,181 |

|

| Lease Payments |

3,473 |

|

3,644 |

|

13,109 |

|

7,658 |

|

| Gold

Equivalent Ounces sold |

68,571 |

|

68,077 |

|

233,923 |

|

247,215 |

|

| All In Sustaining

costs per ounce sold |

1,311 |

|

1,005 |

|

1,324 |

|

1,118 |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation Net Debt

(US$ thousand):

|

|

For the three months ended December 31, 2023 |

|

For the three months ended December 31, 2022 |

|

For the twelve months ended

December 31, 2023 |

|

For the twelve months ended December 31, 2022 |

|

| Short Term Loans |

82,865 |

|

73,215 |

|

82,865 |

|

73,215 |

|

|

Long-Term Loans |

250,724 |

|

140,827 |

|

250,724 |

|

140,827 |

|

|

Plus / (Less): Derivative Financial Instrument for Debentures |

(11,129 |

) |

(8,119 |

) |

(11,129 |

) |

(8,119 |

) |

| Less: Cash and Cash

Equivalents |

(237,295 |

) |

(127,901 |

) |

(237,295 |

) |

(127,901 |

) |

| Less: Restricted cash |

- |

|

(600 |

) |

- |

|

(600 |

) |

| Less: Short term

investments |

- |

|

- |

|

- |

|

- |

|

|

Net Debt |

85,165 |

|

77,422 |

|

85,165 |

|

77,422 |

|

|

|

|

|

|

|

|

|

|

|

Qualified Person

Farshid Ghazanfari, P.Geo. Mineral resources and

Geology Director for Aura Minerals Inc., has reviewed and confirmed

the scientific and technical information contained within this news

release and serve as the Qualified Person as defined in NI 43-101.

All technical information related to Aura’s properties and the

Company’s mineral reserves and resources is available on SEDAR+ at

sedarplus.ca.

About Aura 360° Mining

Aura is focused on mining in complete terms –

thinking holistically about how its business impacts and benefits

every one of our stakeholders: our company, our shareholders, our

employees, and the countries and communities we serve. We call this

360° Mining.

Aura is a mid-tier gold and copper production

company focused on operating and developing gold and base metal

projects in the Americas. The Company has 4 operating mines

including the Aranzazu copper-gold-silver mine in Mexico, the

Apoena (EPP) and Almas gold mines in Brazil, and the Minosa (San

Andres) gold mine in Honduras. The Company’s development projects

include Borborema and Matupá both in Brazil. Aura has unmatched

exploration potential owning over 630,000 hectares of mineral

rights and is currently advancing multiple near-mine and regional

targets along with the Serra da Estrela copper project in the

prolific Carajás region of Brazil.

Forward-Looking Information

This press release contains “forward-looking

information” and “forward-looking statements”, as defined in

applicable securities laws (collectively, “forward-looking

statements”) which may include, but is not limited to, statements

with respect to the activities, events or developments that the

Company expects or anticipates will or may occur in the future.

Often, but not always, forward-looking statements can be identified

by the use of words and phrases such as “plans,” “expects,” “is

expected,” “budget,” “scheduled,” “estimates,” “forecasts,”

“intends,” “anticipates,” or “believes” or variations (including

negative variations) of such words and phrases, or state that

certain actions, events or results “may,” “could,” “would,” “might”

or “will” be taken, occur or be achieved.

Known and unknown risks, uncertainties and other

factors, many of which are beyond the Company’s ability to predict

or control, could cause actual results to differ materially from

those contained in the forward-looking statements. Specific

reference is made to the most recent Annual Information Form on

file with certain Canadian provincial securities regulatory

authorities for a discussion of some of the factors underlying

forward-looking statements, which include, without limitation,

volatility in the prices of gold, copper and certain other

commodities, changes in debt and equity markets, the uncertainties

involved in interpreting geological data, increases in costs,

environmental compliance and changes in environmental legislation

and regulation, interest rate and exchange rate fluctuations,

general economic conditions and other risks involved in the mineral

exploration and development industry. Readers are cautioned that

the foregoing list of factors is not exhaustive of the factors that

may affect the forward-looking statements.

All forward-looking statements herein are

qualified by this cautionary statement. Accordingly, readers should

not place undue reliance on forward-looking statements. The Company

undertakes no obligation to update publicly or otherwise revise any

forward-looking statements whether as a result of new information

or future events or otherwise, except as may be required by law. If

the Company does update one or more forward-looking statements, no

inference should be drawn that it will make additional updates with

respect to those or other forward-looking statements.

Financial Outlook and Future-Oriented Financial

Information

To the extent any forward-looking statements in

this press release constitute “financial outlooks” within the

meaning of applicable Canadian securities legislation, such

information is being provided as certain estimated financial

metrics and the reader is cautioned that this information may not

be appropriate for any other purpose and the reader should not

place undue reliance on such financial outlooks. Such information

was approved by the company’s Board of Directors on February 20,

2024. Financial outlooks, as with forward-looking statements

generally, are, without limitation, based on the assumptions and

subject to various risks as set out herein. The Company’s actual

financial position and results of operations may differ materially

from management’s current expectations and, as a result, may differ

materially from values provided in this press release.

For more information, please contact:

Investor Relations

ir@auraminerals.com

www.auraminerals.com

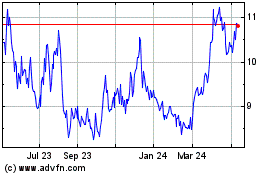

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Dec 2024 to Jan 2025

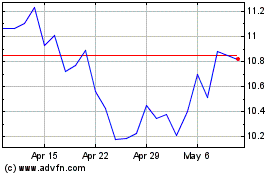

Aura Minerals (TSX:ORA)

Historical Stock Chart

From Jan 2024 to Jan 2025