Progress Announces Timing of Mailing of Meeting Materials

23 July 2012 - 7:15AM

PR Newswire (Canada)

CALGARY, July 24, 2012 /CNW/ - - Progress Energy Resources Corp.

("Progress" or the "Company") is pleased to announce that on July

25, 2012 it will be mailing a notice of meeting, information

circular and proxy statement dated July 20, 2012 (the "Information

Circular") and related documents to the holders of common shares of

Progress (the "Common Shares"), the holders of 5.25% convertible

unsecured subordinated debentures of Progress due October 31, 2014

and the holders of 5.75% series B convertible unsecured

subordinated debentures of Progress due June 30, 2016 (all such

debentures collectively referred to herein as the "Debentures") in

connection with the special meeting (the "Meeting") of holders of

Common Shares and holders of Debentures to be held at 3:00 p.m.

(Calgary time) on August 28, 2012 in the McMurray Room of the

Calgary Petroleum Club, 319 - 5th Avenue S.W., Calgary, Alberta. At

the Meeting, holders of Common Shares and Debentures will be asked

to consider, and, if deemed advisable, to pass a special resolution

approving an arrangement (the "Arrangement") contemplated pursuant

to an arrangement agreement dated June 27, 2012 (the "Arrangement

Agreement"), as amended July 19, 2012, among Progress, PETRONAS

International Corporation Ltd. and PETRONAS Carigali Canada Ltd.

(the "Purchaser"). The Arrangement Agreement was amended on July

19, 2012 by replacing the original plan of arrangement with a

revised plan of arrangement. The revisions to the original plan of

arrangement were primarily to: (i) increase the consideration

payable for the Debentures under the Arrangement by including an

additional payment in an amount equal to the amount of interest

that would otherwise be payable on the Debentures from and

including the effective date of the Arrangement (the "Effective

Date") to but excluding the date which is 32 days after the

Effective Date; and (ii) include provisions relating to performance

unit awards and restricted unit awards which may be outstanding on

the Effective Date. If the holders of Common Shares approve the

Arrangement, it is anticipated that the Arrangement will be

completed on or about September 25, 2012, subject to obtaining

Court approval and the required governmental and regulatory

approvals and satisfying other usual and customary conditions

contained in the Arrangement Agreement. The approval of the holders

of Debentures is not a condition to the successful completion of

the Arrangement. If the requisite approval of the holders of a

series of Debentures is not obtained at the Meeting, the applicable

series of Debentures for which approval has not been obtained will

be excluded from the Arrangement and will remain outstanding

following closing of the Arrangement. The Information Circular and

related documents, which include further particulars of the

Arrangement and the foregoing amendments, will be available for

viewing on the Company's profile on SEDAR at www.sedar.com. If

holders of Common Shares or holders of Debentures have any

questions or need additional information, they should consult their

financial, legal, tax or other professional advisor, or contact the

information agent for the Arrangement, Laurel Hill Advisory Group,

at 416-304-0211, or at its North American toll-free number:

1-877-304-0211 or by email at assistance@laurelhill.com. About

Progress Energy Progress is a Calgary, Canada based Energy Company

focused on exploration, development and production of large,

unconventional natural gas resources in northeast British Columbia

and northwest Alberta. Progress holds the largest acreage position

in the Montney shale gas play. Throughout its history, Progress has

a solid track record of growing reserves, production and the

underlying value of the Company for its shareholders. The Common

Shares and the two series of Debentures are listed on the Toronto

Stock Exchange under the symbols PRQ, PRQ.DB.B and PRQ.DB.C,

respectively. Cautionary Statement on Forward-Looking Information

This press release contains forward-looking statements and

forward-looking information within the meaning of applicable

securities laws. The use of any of the words "expect",

"anticipate", "continue", "estimate", "objective", "ongoing",

"may", "will", "project", "should", "believe", "plans", "intends"

and similar expressions are intended to identify forward-looking

statements or information. In particular, forward looking

statements in this press release include, but are not limited to,

statements regarding the completion of the Arrangement, the timing

of the Meeting and the anticipated results therefrom. The

forward-looking statements and information are based on certain key

expectations and assumptions made by Progress and the Purchaser,

including, but not limited to, expectations and assumptions

concerning the ability of Progress and the Purchaser to obtain all

required regulatory approvals for the transaction, including, but

not limited to, shareholder, Court and regulatory approvals.

Although Progress and the Purchaser believes that the expectations

and assumptions on which such forward-looking statements and

information are based are reasonable, undue reliance should not be

placed on the forward looking statements and information because

there can be no assurance that they will prove to be correct. Since

forward-looking statements and information address future events

and conditions, by their very nature they involve inherent risks

and uncertainties. Actual results could differ materially from

those currently anticipated due to a number of factors and risks.

These include, but are not limited to, the risk that the

transaction may not close when planned or at all or on the terms

and conditions set forth in the Arrangement Agreement; the failure

of Progress and the Purchaser to obtain the necessary shareholder,

Court, regulatory and other third party approvals required in order

to proceed with the transaction; operational risks in development,

exploration and production for natural gas; delays or changes in

plans with respect to exploration or development projects or

capital expenditures; the uncertainty of reserve and resource

estimates; health, safety and environmental risks; commodity price

and exchange rate fluctuations; marketing and transportation; loss

of markets; environmental risks; competition; incorrect assessment

of the value of acquisitions; ability to access sufficient capital

from internal and external sources; and changes in legislation,

including but not limited to tax laws, royalties and environmental

regulations. Readers are cautioned that the foregoing list of

factors is not exhaustive. Management has included the above

summary of assumptions and risks related to forward-looking

statements and information provided in this press release in order

to provide securityholders with a more complete perspective on the

Arrangement and such information may not be appropriate for other

purposes. Actual results, performance or achievement could differ

materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do so, what

benefits that Progress and the Purchaser will derive there from.

The forward-looking statements and information contained in this

press release are made as of the date hereof and Progress and the

Purchaser undertake no obligation to update publicly or revise any

forward-looking statements or information, whether as a result of

new information, future events, or results or otherwise, other than

as required by applicable securities laws. Progress Energy

Resources Corp. CONTACT: Greg Kist, Vice President, Marketing,

Corporate and GovernmentRelationsProgress Energy Resources

Corp.403-539-1809 gkist@progressenergy.com.Kurtis Barrett, Analyst,

Investor Relations and MarketingProgress Energy Resources

Corp.403-539-1843 kbarrett@progressenergy.com

Copyright

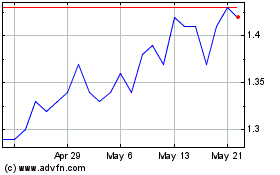

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From May 2024 to Jun 2024

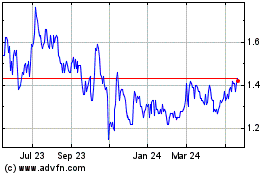

Petrus Resources (TSX:PRQ)

Historical Stock Chart

From Jun 2023 to Jun 2024