Platinum Group Metals Ltd. (PTM:TSX; PLG:NYSE

American) (“Platinum Group” “PTM” or the “Company”) is pleased to

announce as project operator that the Definitive Feasibility Study

(“DFS”) for the Waterberg Project is advancing according to plan.

The target date for the completion of the DFS is the end of

calendar Q1 2019. An updated resource model to be used in the DFS

is in the final stages of calculations and peer review.

Three-dimensional models have been provided to independent project

engineer for mine design, Stantec Consulting International LLC

(“Stantec”). The mine design involves bulk underground fully

mechanized methods. Optimization of the methods utilized for the

Company’s October 2016 Waterberg Pre-feasibility Study is in

progress. (See the technical report dated October 19, 2016 and

filed on SEDAR titled “Independent Technical Report on the

Waterberg Project Including Mineral Resource Update and

Pre-Feasibility Study”.) Stantec brings global mine design and

operating experience in these methods to the study.

Metallurgical test work and infrastructure

designs are also progressing well, led by independent project

engineer for plant design and metallurgy DRA Projects SA

(Proprietary) Limited, who are an experienced platinum and

palladium plant, engineering and construction firm. The DFS is

looking at two potential scales for the project as previously

announced, including a 600,000 tonne per month option and a 250,000

-350,000 tonne per month option.

A Mining Right Application for the Waterberg

Project, endorsed by all of the Waterberg Joint Venture partners,

including Impala Platinum Holdings Ltd. (“Implats”), Japan Oil, Gas

and Metals National Corporation (“JOGMEC”) and Mnombo Wethu

Consultants (Pty) Ltd. (“Mnombo”), was filed in early September

2018. The detailed consultation process in the area of the mine has

commenced as required under Environmental Assessment and Mining

Right regulations and specialist consultants have been engaged to

manage and document this process. Co-operation with the Capricorn

Municipality surrounding the mine has been active and positive

including work on regional water supply plans and infrastructure

under a recently signed co-operation agreement. Work on the planned

national electrical grid connection for the project is also

progressing well. Consultation on powerline servitudes and permits

are advancing on plan as part of the DFS.

Platinum Group Metals is the Waterberg project

operator and currently holds an effective 50.02% interest in the

project. Implats, the world’s second largest platinum producer,

owns a 15% interest. The project is being managed by a joint

technical committee which regularly brings together expertise from

the senior levels of all partners, including the construction and

operating experience of Implats. Mnombo, a black economic

empowerment company, holds a 26% project interest. The Company owns

a 49.9% interest in Mnombo. JOGMEC holds a 21.95% project interest

in the Waterberg Project and is in the process of transferring a

9.755% interest to Japanese conglomerate Hanwa Co., Ltd. Hosken

Consolidated Investments Limited, a South African black empowerment

investment holding company listed on the JSE with a US$1.1 billion

market capitalization, owns a 15% stake in Platinum Group. Implats

is an active participant in the joint venture and holds an option

to increase their stake to 50.01% following the completion of the

DFS.

Platinum Group Metals recently was in New York

for events and meetings of “Platinum Week”. The Waterberg Project

is dominated by palladium and there are very few deposits of this

type in the world. Palladium has been gaining market interest based

on continued demand in the auto sector, due to a growing trend

towards gasoline engines and hybrids that use palladium dominant

catalysts. Platinum Group Metals is focused on completing the DFS

for Waterberg on time and on budget with the assistance of its

project partners.

On November 23, 2017 the Company announced the

execution of binding legal agreements to sell Maseve Investments 11

Proprietary Limited (“Maseve”) to JSE listed Royal Bafokeng

Platinum Limited (“RBPlat”). The Company first reported the details

of the transaction in a news release dated September 6, 2017. The

sale later closed on April 26, 2018 after completion of regulatory

review and all conditions precedent, whereby RBPlat and its

wholly-owned subsidiary, Royal Bafokeng Resources Proprietary

Limited:

- acquired the concentrator plant and related surface assets

owned by Maseve for an aggregate consideration equal to the ZAR

equivalent of US $58 million; and

- acquired 100% of the shares in and shareholder claims owing by

Maseve for an aggregate purchase consideration equal to the ZAR

equivalent of US $12 million and the return to the Company of an

environmental bond valued at approximately US $4.0 million.

(collectively “the Maseve Transaction”).

The Company reports that it is in receipt of a

summons issued by Africa Wide Mineral Prospecting and Exploration

(Pty) Limited ("Africa Wide") whereby Africa Wide has instituted

legal proceedings in South Africa against the Company’s wholly

owned subsidiary, Platinum Group Metals (RSA) (Pty) Limited, RBPlat

and Maseve in relation to the Maseve Transaction. Africa Wide is

seeking, at this very late date, to set aside or be paid increased

value for, the closed Maseve Transaction. Africa Wide held a 17.1%

interest in Maseve prior to the Maseve Transaction. RBPlat

consulted with senior counsel, both during the negotiation of the

Maseve Transaction and in regard to the current Africa Wide legal

proceedings. The Company has also received legal advice to the

effect that the Africa Wide action, as issued, is ill-conceived and

is factually and legally defective.

Qualified Person

R. Michael Jones, P.Eng., the Company’s

President, Chief Executive Officer and a shareholder of the

Company, is a non-independent qualified person as defined in

National Instrument 43-101 Standards of Disclosure for Mineral

Projects (“NI 43-101”) and is responsible for preparing the

technical information contained in this news release. He has

verified the data by reviewing the detailed information of the

geological and engineering staff and independent qualified person

reports as well as visiting the Waterberg Project site

regularly.

About Platinum Group Metals

Ltd.

Platinum Group is focused on, and is the

operator of, the Waterberg Project, a bulk mineable underground

deposit in northern South Africa. Waterberg was discovered by the

Company. Waterberg has potential to be a low cost dominantly

palladium mine and Impala Platinum recently made a strategic

investment in the Waterberg Project.

On behalf of the Board of Platinum Group Metals

Ltd.

R. Michael JonesPresident, CEO and Director

|

|

|

| For further information contact: |

|

|

R.

Michael Jones, President |

|

|

or

Kris Begic, VP, Corporate Development |

|

|

Platinum Group Metals Ltd., Vancouver |

|

|

Tel:

(604) 899-5450 / Toll Free: (866) 899-5450 |

|

|

www.platinumgroupmetals.net |

|

|

|

Disclosure

The Toronto Stock Exchange and the NYSE American

LLC have not reviewed and do not accept responsibility for the

accuracy or adequacy of this news release, which has been prepared

by management.

This press release contains forward-looking

information within the meaning of Canadian securities laws and

forward-looking statements within the meaning of U.S. securities

laws (collectively “forward-looking

statements”). Forward-looking statements are typically

identified by words such as: believe, expect, anticipate, intend,

estimate, plans, postulate and similar expressions, or are those,

which, by their nature, refer to future events. All statements

that are not statements of historical fact are forward-looking

statements. Forward-looking statements in this press release

include, without limitation, JOGMEC’s potential transfer of a

portion of its interest in the Waterberg Project to Hanwa; the

potential for Implats to exercise its rights and fund additional

development work on the Waterberg Project; the timing and

completion of a DFS and updated resource model; the potential

production scale of the Waterberg Project; the Waterberg Project’s

potential to be a large scale, bulk mineable, fully mechanized,

low-cost dominantly palladium mine; [potential developments in the

palladium markets;] and the potential outcome of the Africa Wide

litigation. Although the Company believes the forward-looking

statements in this press release are reasonable, it can give no

assurance that the expectations and assumptions in such statements

will prove to be correct. The Company cautions investors that

any forward-looking statements by the Company are not guarantees of

future results or performance and that actual results may differ

materially from those in forward-looking statements as a result of

various factors, including additional financing requirements; the

Company’s history of losses; the Company’s inability to generate

sufficient cash flow or raise sufficient additional capital to make

payment on its indebtedness, and to comply with the terms of such

indebtedness; the LMM Facility is, and any new indebtedness may be,

secured and the Company has pledged its shares of PTM RSA, and PTM

RSA has pledged its shares of Waterberg JV Resources (Pty) Limited

(“Waterberg JV Co.”) to Liberty Metals & Mining Holdings, LLC,

a subsidiary of LMM, under the LMM Facility, which potentially

could result in the loss of the Company’s interest in PTM RSA and

the Waterberg Project in the event of a default under the LMM

Facility or any new secured indebtedness; the Company’s negative

cash flow; the Company’s ability to continue as a going concern;

completion of the definitive feasibility study for the Waterberg

Project, which is subject to resource upgrade and economic analysis

requirements; uncertainty of estimated production, development

plans and cost estimates for the Waterberg Project; discrepancies

between actual and estimated Mineral Reserves and Mineral

Resources, between actual and estimated development and operating

costs, between actual and estimated metallurgical recoveries and

between estimated and actual production; fluctuations in the

relative values of the U.S. Dollar, the Rand and the Canadian

Dollar; volatility in metals prices; the failure of the Company or

the other shareholders to fund their pro rata share of funding

obligations for the Waterberg Project; any disputes or

disagreements with the other shareholders of Waterberg JV Co. or

Mnombo Wethu Consultants (Pty) Ltd; the ability of the Company to

retain its key management employees and skilled and experienced

personnel; contractor performance and delivery of services, changes

in contractors or their scope of work or any disputes with

contractors; conflicts of interest; capital requirements may exceed

its current expectations; the uncertainty of cost, operational and

economic projections; the ability of the Company to negotiate and

complete future funding transactions and either settle or

restructure its debt as required; litigation or other

administrative proceedings brought against the Company; actual or

alleged breaches of governance processes or instances of fraud,

bribery or corruption; exploration, development and mining risks

and the inherently dangerous nature of the mining industry, and the

risk of inadequate insurance or inability to obtain insurance to

cover these risks and other risks and uncertainties; property and

mineral title risks including defective title to mineral claims or

property; changes in national and local government legislation,

taxation, controls, regulations and political or economic

developments in Canada and South Africa; equipment shortages and

the ability of the Company to acquire necessary access rights and

infrastructure for its mineral properties; environmental

regulations and the ability to obtain and maintain necessary

permits, including environmental authorizations and water use

licences; extreme competition in the mineral exploration industry;

delays in obtaining, or a failure to obtain, permits necessary for

current or future operations or failures to comply with the terms

of such permits; risks of doing business in South Africa, including

but not limited to, labour, economic and political instability and

potential changes to and failures to comply with legislation; and

other risk factors described in the Company’s most recent Form 20-F

annual report, annual information form and other filings with the

U.S. Securities and Exchange Commission (“SEC”) and Canadian

securities regulators, which may be viewed at www.sec.gov and

www.sedar.com, respectively. Proposed changes in the mineral law in

South Africa if implemented as proposed would have a material

adverse effect on the Company’s business and potential interest in

projects. Any forward-looking statement speaks only as of the

date on which it is made and, except as may be required by

applicable securities laws, the Company disclaims any intent or

obligation to update any forward-looking statement, whether as a

result of new information, future events or results or

otherwise.

Estimates of mineralization and other technical information

included herein have been prepared in accordance with National

Instrument 43-101 – Standards of Disclosure for Mineral Projects

(“NI 43-101”). The definitions of proven and probable Mineral

Reserves used in NI 43-101 differ from the definitions in SEC

Industry Guide 7. Under SEC Industry Guide 7 standards, a “final”

or “bankable” feasibility study is required to report Mineral

Reserves, the three-year historical average price is used in any

Mineral Reserve or cash flow analysis to designate Mineral Reserves

and the primary environmental analysis or report must be filed with

the appropriate governmental authority. As a result, the reserves

reported by the Company in accordance with NI 43-101 may not

qualify as “Mineral Reserves” under SEC standards. In addition, the

terms “Mineral Resource” and “measured Mineral Resource” are

defined in and required to be disclosed by NI 43-101; however,

these terms are not defined terms under SEC Industry Guide 7 and

normally are not permitted to be used in reports and registration

statements filed with the SEC. Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability.

Investors are cautioned not to assume that any part or all of the

mineral deposits in these categories will ever be converted into

reserves. Accordingly, descriptions of the Company’s mineral

deposits in this press release may not be comparable to similar

information made public by U.S. companies subject to the reporting

and disclosure requirements of United States federal securities

laws and the rules and regulations thereunder.

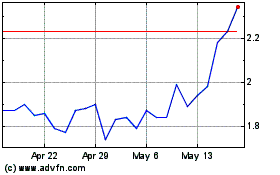

Platinum Group Metals (TSX:PTM)

Historical Stock Chart

From Jan 2025 to Feb 2025

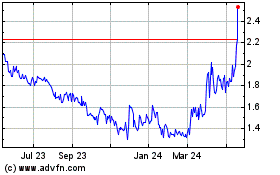

Platinum Group Metals (TSX:PTM)

Historical Stock Chart

From Feb 2024 to Feb 2025