NOT FOR DISTRIBUTION OR FOR DISSEMINATION IN THE UNITED STATES

Parex Resources Inc. ("Parex" or the "Company") (TSX:PXT), a company focused on

Colombian oil exploration and production announces the results of its 2013

year-end independent crude oil and natural gas reserves evaluation. The

financial and operational information contained below is based on the Company's

unaudited expected results for the year ended December 31, 2013.

Highlights:

-- Total proved ("1P") reserve growth of 73 percent from the prior year,

increasing from 10.1 million barrels of oil equivalent ("MMboe") to 17.4

MMboe (net company working interest);

-- Proved plus probable ("2P") reserves double from the prior year,

increasing from 16.1 MMboe to 32.0 MMboe (net company working interest).

Over 98 percent of 2013 2P reserves are light and medium oil;

-- Replaced 2013 production 3.75 times with 2P reserve additions;

-- 2P reserve growth per share of 108 percent on a debt adjusted basic

share basis funded entirely with 2013 cash flow from operations;

-- 2P net present value of USD$832 million (CAD$915 (1) million) after tax

discounted at 10 percent compared to USD$449 million at 2012;

-- Net asset value of approximately CAD$7.70 per basic share using 2P net

present value after tax discounted at 10 percent (2);

-- Finding, developing and acquisition ("FD&A") costs for 2013 of USD$15.75

per barrel including changes in future development costs, generating a

recycle ratio of 4.0 times;

-- 2P reserve life index ("RLI") increases to 5.1 times compared to 3.4

times at 2012; and

-- Supported by strong reserves growth, Parex expects January 1 - March 31

2014 ("First Quarter") production to average approximately 18,300-18,700

barrels of oil per day ("bopd"). Q4 production averaged 17,285 bopd.

(1) At current spot rate of approximately 1.10 USD-CAD

(2) Using December 31, 2013 estimates of working capital, long-term debt and

convertible debenture face value totaling net debt of approximately

USD$70 million, 108.7 million basic shares and 2P net present value

after tax discounted at 10% of USD$832.4 million.

2013 Year-End Reserves

The following tables summarize information contained in the independent reserves

report prepared by GLJ Petroleum Consultants Ltd. ("GLJ") effective December 31,

2013 ("GLJ Report") with comparatives to the year ended December 31, 2012

contained in the report prepared by GLJ with an effective date of December 31,

2012 (the "GLJ 2012 Report"). The GLJ Report and the GLJ 2012 Report were

prepared in accordance with definitions, standards and procedures contained in

the Canadian Oil and Gas Evaluation Handbook ("COGE Handbook") and National

Instrument 51-101, Standards of Disclosure for Oil and Gas Activities ("NI

51-101"). Additional reserve information as required under NI 51-101 will be

included in the Company's Annual Information Form which will be filed on SEDAR

by March 31, 2014.

The recovery and reserve estimates of crude oil reserves provided in this news

release are estimates only, and there is no guarantee that the estimated

reserves will be recovered. Actual crude oil reserves may eventually prove to be

greater than, or less than, the estimates provided herein. All reserves

presented for the year ended December 31, 2013 are based on GLJ's forecast

pricing effective January 1, 2014 and all reserves presented for the year ended

December 31, 2012 are based on GLJ's forecast pricing effective January 1, 2013.

Consistent with the Company's reporting currency, all amounts are in United

States dollars unless otherwise noted.

Discussion of Reserves

All of Parex' crude oil reserves are located in Colombia, primarily in the

Llanos basin. Reserve additions in 2013, as evaluated by GLJ were generated from

a successful 2013 oil exploration and drilling extension program. The GLJ Report

includes 597 Mboe (3,581 MMcf) of 2P gas reserves for the La Casona field which

is less than 2 percent of total 2P reserves (1P gas reserves of 1,282 MMcf).

The net present value after tax of proved plus probable reserves approximately

doubled and on a per share basis, adjusted for the decrease in debt increased by

108 percent at December 31, 2013 compared to the prior year end.

The quality of the Company's light and medium oil reserves and a favourable

Colombian fiscal regime combine to generate a net present value before tax

discounted at 10 percent of $35.62 per barrel for proved plus probable reserves

as at December 31, 2013 compared to $35.76 per barrel for the prior period.

Five Year Crude Oil Price Forecast - GLJ Report

2014 2015 2016 2017 2018

----------------------------------------------------------------------------

ICE Brent (USD$/bbl) $107.50 $107.50 $105.00 $102.50 $102.50

----------------------------------------------------------------------------

2013 Year-End Reserves Volumes

December 31, December 31, Increase Debt Adjusted

2012 2013 year-over Per Share

Reserves Category(1) (MBbl) (Mboe)(2) year Growth(3)

----------------------------------------------------------------------------

Proved (1P) 10,063 17,368 73% 81%

Proved plus Probable

(2P) 16,100 32,021 99% 108%

Proved plus Probable

plus Possible (3P) 23,131 49,949 116% 125%

----------------------------------------------------------------------------

(1) Reserves are greater than 98% light and medium crude oil, therefore

disclosure of heavy crude oil, liquids and natural gas volumes has not

been provided. All reserves are presented as Parex working interest

before royalties

(2) Mboe is defined as thousand barrels of oil equivalent.

(3) Calculated using: basic shares of 108.7 million, December 31, 2013 share

price of $6.58, convertible debenture face value Cdn$85 million, and

unaudited estimated net working capital of $15 million as at December

31, 2013.

Reserve Life Index ("RLI") (1)

2012 2013

----------------------------------------------------------------------------

Proved Plus Probable (2P) 3.4x 5.1x

----------------------------------------------------------------------------

(1) Calculated using estimated average fourth quarter (Q4) production of

17,285 bpd annualized

2013 Year-End Reserves Net Present Summary

Net Present Value Before Tax(1)(2)

Increase year-

December 31, 2012 December 31, 2013 over

Reserves Category (USD$000s) (USD $000s) year (10%)

------------------------------------------

0% 10% 0% 10%

----------------------------------------------------------------------------

Proved (1P) $411,054 $364,463 $747,396 $635,490 74%

Proved plus

Probable (2P) $683,965 $575,756 $1,431,693 $1,140,735 98%

Proved plus

Probable plus

Possible (3P) $1,011,329 $808,475 $2,317,282 $1,723,293 113%

----------------------------------------------------------------------------

Net Present Value After Tax(1)(2)

Increase year-

December 31, 2012 December 31, 2013 over

Reserves Category (USD $000s) (USD $000s) year (10%)

------------------------------------------

0% 10% 0% 10%

----------------------------------------------------------------------------

Proved (1P) $349,672 $308,034 $591,542 $502,822 63%

Proved plus

Probable (2P) $539,362 $449,475 $1,047,004 $832,378 85%

Proved plus

Probable plus

Possible (3P) $758,786 $600,651 $1,639,187 $1,213,913 102%

----------------------------------------------------------------------------

(1) The forecast prices used in the calculation of the present value of

future net revenue are based on the GLJ January 1, 2014 price forecast

and will be included in the Company's Annual Information Form.

(2) Includes proved plus probable future development capital ("FDC") of $232

million (2012 was $125 million). Total proved FDC is $147 million (2012

was $98 million).

2013 Year-End Reserves Reconciliation Company Gross

----------------------------------------------------------------------------

Mboe Total Proved Total Proved plus Probable

----------------------------------------------------------------------------

December 31, 2012 10,063 16,100

Technical Revisions(1) 4,063 3,728

Discoveries & Extensions(2) 8,397 16,740

Acquisition 632 1,240

Production (5,787) (5,787)

----------------------------------------------------------------------------

December 31, 2013(3) 17,368 32,021

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Proved plus probable reserve revisions are primarily associated with the

evaluations of the Tua and Las Maracas fields.

(2) Proved plus probable reserve discoveries and extensions are primarily

associated with the evaluations of the Adalia, Akira, Tarotaro, Tua,

Tigana and Tigana Sur discoveries.

(3) Subject to final reconciliation adjustments.

Proved plus Probable FD&A - Company Gross(1)

----------------------------------------------------------------------------

2013 3 Year

----------------------------------------------------------------------------

$ ('000) (Unaudited) Including FDC Including FDC

Proved+Probable Proved+Probable

Capital Expenditure - Colombia $219,716 $579,866

Capital Expenditure - Trinidad $2,039 $59,220

Capital Expenditure - change in FDC $101,651 $129,143

----------------------------------------

Total (2) $323,406 $768,229

Net Acquisitions $12,489 $337,250

Net Acquisitions - change in FDC $6,050 $69,284

----------------------------------------

Total Net Acquisitions(3) $18,539 $406,534

----------------------------------------------------------------------------

Total Capital including change in $341,945 $1,174,763

FDC

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Reserve Additions 20,468 29,547

Net Acquisition Reserve Additions 1,240 8,534

----------------------------------------------------------------------------

Reserve Additions including

Acquisitions 21,708 38,081

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Company Metrics(4)

----------------------------------------------------------------------------

F&D Costs $15.80/bbl $26.00/bbl

FD&A Costs $15.75/bbl $30.85/bbl

----------------------------------------------------------------------------

Estimated Full Year Operating

Netback(5) $62.50/bbl $67.45/bbl

----------------------------------------------------------------------------

Recycle Ratio - F&D 4.0x 2.6x

Recycle Ratio - FD&A 4.0x 2.2x

----------------------------------------------------------------------------

Colombia Only Metrics (Excluding

Trinidad)

F&D Costs $15.70/bbl $24.00/bbl

FD&A Costs $15.66/bbl $29.29/bbl

Recycle Ratio - F&D 4.0x 2.8x

Recycle Ratio - FD&A 4.0x 2.3x

----------------------------------------------------------------------------

(1) Calculated using unaudited estimated capital expenditures and operating

netback as at December 31, 2013.

(2) Capital expenditures include the costs of exploration land and minor

expenditures in Canada.

(3) Acquisitions and associated reserves and FDC are all related to

Colombia. 1P acquisition 2013 FDC was $3.9 million.

(4) 2012 Company metrics for 2P including FDC were: F&D $36.92/bbl and FD&A

$39.64/bbl

(5) Recycle ratio is calculated as operating netback divided by FD&A costs

(proved plus probable). Operating netback is calculated as revenue minus

royalties, production and operating expenses and transportation

expenses. 3 Year operating netback is calculated using weighted average

volumes and annual operating netbacks.

Summary of Company

FD&A

2012 2013 3 yr Average

Per bbl 1P 2P 1P 2P 1P 2P

----------------------------------------------------------------------------

Total Company FD&A $ 42.61 $ 39.64 $ 21.66 $ 15.75 $ 39.66 $ 30.85

This news release does not constitute an offer to sell securities, nor is it a

solicitation of an offer to buy securities, in any jurisdiction.

Reserve Advisory

"Proved" reserves are those reserves that can be estimated with a high degree of

certainty to be recoverable. It is likely that the actual remaining quantities

recovered will exceed the estimated proved reserves.

"Probable" reserves are those additional reserves that are less certain to be

recovered than proved reserves. It is equally likely that the actual remaining

quantities recovered will be greater or less than the sum of the estimated

proved plus probable reserves.

"Possible" reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10 percent probability that the

quantities actually recovered will equal or exceed the sum of proved plus

probable plus possible reserves. It is unlikely that the actual remaining

quantities recovered will exceed the sum of the estimated proved plus probable

plus possible reserves.

All evaluations and reviews of future net cash flow are stated prior to any

provision for interest costs or general and administrative costs and after the

deduction of estimated future capital expenditures for wells to which reserves

have been assigned. It should not be assumed that the estimated future net cash

flow shown below is representative of the fair market value of the Company's

properties. There is no assurance that such price and cost assumptions will be

attained, and variances could be material. The recovery and reserve estimates of

crude oil reserves provided are estimates only, and there is no guarantee that

the estimated reserves will be recovered. Actual crude oil reserves may be

greater than or less than the estimates provided.

The term "Boe" means a barrel of oil equivalent on the basis of 6 Mcf of natural

gas to 1 barrel of oil ("bbl"). Boe's may be misleading, particularly if used in

isolation. A boe conversation ratio of 6 Mcf: 1 Bbl is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. Given the value ratio based

on the current price of crude oil as compared to natural gas is significantly

different from the energy equivalency of 6 Mcf: 1Bbl, utilizing a conversion

ratio at 6 Mcf: 1 Bbl may be misleading as an indication of value.

Unaudited Financial Information

Certain financial and operating results included in this news release such as

finding, development and acquisition costs, recycle ratio, net debt, capital

expenditures, production information and operating costs are based on unaudited

estimated results. These estimated results are subject to change upon completion

of the audited financial statements for the year ended December 31, 2013, and

changes could be material. Parex anticipates filing its audited financial

statements and related management's discussion and analysis for the year ended

December 31, 2013 on SEDAR on or before March 31, 2014.

Advisory on Forward Looking Statements

Certain information regarding Parex set forth in this document contains

forward-looking statements that involve substantial known and unknown risks and

uncertainties. The use of any of the words "plan", "expect", "prospective",

"project", "intend", "believe", "should", "anticipate", "estimate" or other

similar words, or statements that certain events or conditions "may" or "will"

occur are intended to identify forward-looking statements. Such statements

represent Parex's internal projections, estimates or beliefs concerning, among

other things, future growth, results of operations, production, future capital

and other expenditures (including the amount, nature and sources of funding

thereof), competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These statements

are only predictions and actual events or results may differ materially.

Although the Company's management believes that the expectations reflected in

the forward-looking statements are reasonable, it cannot guarantee future

results, levels of activity, performance or achievement since such expectations

are inherently subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could cause Parex'

actual results to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

In particular, forward-looking statements contained in this document include,

but are not limited to, statements with respect to the performance

characteristics of the Company's oil properties; supply and demand for oil;

financial and business prospects and financial outlook; results of operations;

estimated Q4 production and estimated First Quarter production; and planned

capital expenditures and the timing thereof. In addition, statements relating to

"reserves" or "resources" are by their nature forward-looking statements, as

they involve the implied assessment, based on certain estimates and assumptions

that the resources and reserves described can be profitably produced in the

future. The recovery and reserve estimates of Parex' reserves provided herein

are estimates only and there is no guarantee that the estimated reserves will be

recovered.

These forward-looking statements are subject to numerous risks and

uncertainties, including but not limited to, the impact of general economic

conditions in Canada, Colombia and Trinidad & Tobago; industry conditions

including changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are interpreted and

enforced, in Canada and Colombia; competition; lack of availability of qualified

personnel; the results of exploration and development drilling and related

activities; risks related to the ability of partners to fund capital work

programs and other matters requiring partner approval; imprecision in reserve

and resource estimates; the production and growth potential of Parex' assets;

obtaining required approvals of regulatory authorities and partners; risks

associated with negotiating with foreign governments as well as country risk

associated with conducting international activities; volatility in market prices

for oil; fluctuations in foreign exchange or interest rates; environmental

risks; changes in income tax laws or changes in tax laws and incentive programs

relating to the oil industry; ability to access sufficient capital from internal

and external sources; risk that the Company will not be able to obtain contract

extensions or fulfill the contractual obligations required to retain its rights

to explore, develop and exploit any of its undeveloped properties; the risks

discussed under "Risk Factors" in the Company's Annual Information Form for the

year ended December 31, 2012; and other factors, many of which are beyond the

control of the Company. Readers are cautioned that the foregoing list of factors

is not exhaustive. Additional information on these and other factors that could

effect Parex's operations and financial results are included in reports on file

with Canadian securities regulatory authorities and may be accessed through the

SEDAR website (www.sedar.com).

Although the forward-looking statements contained in this document are based

upon assumptions which Management believes to be reasonable, the Company cannot

assure investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking statements contained

in this document, Parex has made assumptions regarding: current commodity prices

and royalty regimes; availability of skilled labour; timing and amount of

capital expenditures; future exchange rates; the price of oil; pipeline

capacity; timing of production from successful exploration wells; operational

performance on non-operated producing fields; the impact of increasing

competition; conditions in general economic and financial markets; availability

of drilling and related equipment; effects of regulation by governmental

agencies; royalty rates, future operating costs; that the Company will have

sufficient cash flow, debt or equity sources or other financial resources

required to fund its capital and operating expenditures and requirements as

needed; that the Company's conduct and results of operations will be consistent

with its expectations; that the Company will have the ability to develop the

Company's oil properties in the manner currently contemplated; that the

estimates of the Company's reserves volumes and the assumptions related thereto

(including commodity prices and development costs) are accurate in all material

respects; that the Company will receive all required partner and regulatory

approvals; and other matters.

Management has included the above summary of assumptions and risks related to

forward-looking information provided in this document in order to provide

shareholders with a more complete perspective on Parex's current and future

operations and such information may not be appropriate for other purposes.

Parex's actual results, performance or achievement could differ materially from

those expressed in, or implied by, these forward-looking statements and,

accordingly, no assurance can be given that any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are made as of the

date of this document and Parex disclaims any intent or obligation to update

publicly any forward-looking statements, whether as a result of new information,

future events or results or otherwise, other than as required by applicable

securities laws.

Neither the TSX nor its Regulation Services Provider (as that term is defined in

the policies of the TSX) accepts responsibility for the adequacy or accuracy of

this release.

FOR FURTHER INFORMATION PLEASE CONTACT:

Parex Resources Inc.

Michael Kruchten

Vice-President Corporate Planning and Investor Relations

(403) 517-1733

Investor.relations@parexresources.com

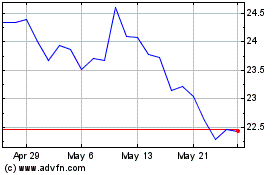

Parex Resources (TSX:PXT)

Historical Stock Chart

From May 2024 to Jun 2024

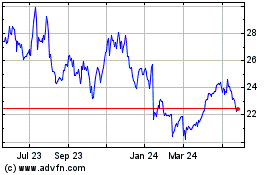

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jun 2023 to Jun 2024