Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) is

pleased to publish its 2024 budget alongside an updated three-year

outlook, announce positive test results at its Arauca-8 exploration

well (50% W.I.), and provide its estimated 2023 full-year and

fourth quarter average production.

All amounts herein are in United States Dollars

(“USD”) unless otherwise stated.

Key Highlights

- Targeting

FY 2024 average production of 57,000 boe/d, which is forecast to be

5% year-over-year growth.

- Budgeting

FY 2024 capital expenditures(2) of $410 million, which is expected

to be approximately 15% lower than 2023.

- Expecting

to generate approximately $625 million of funds flow provided by

operations (“FFO”)(3) and roughly $215 million of free funds flow

(“FFF”)(2) in 2024 at the midpoint of guidance based on $75/bbl

Brent.

- Updated

three-year outlook for 2024 through 2026, where annual average

production growth is targeted at 5% or higher, excluding

high-impact, big ‘E’ exploration potential.

- Discovery

at the Arauca-8 exploration well (50% W.I.) where two zones have

been successfully tested, with two zones still to be tested in the

coming weeks(4).

- Achieved

record FY and Q4 average production of 54,356 boe/d and 57,329

boe/d, respectively, in 2023(1).

“Our plan for the year builds on the work

completed in 2023 and is focused on increasing overall cash that

can be used to reward shareholders. This will be achieved not only

through increasing total production, but also through a reduction

in year-over-year capital expenditures and the deployment of

inventory from our balance sheet. I am optimistic about the

promising outcomes that we have seen at Arauca, which are laying

the foundation for further follow-ups in an area where we see

significant potential,” commented Imad Mohsen, President &

Chief Executive Officer.

2024 Budget

- Program

includes approximately 35 gross wells, with a targeted capital

expenditure(2) guidance range of $390 to $430 million.

-

Approximately 75% of capital expenditures(2) are focused on

investments in operated blocks.

- Average

annual production is expected to be approximately 54,000 to 60,000

boe/d, representing 5% year-over-year growth at the midpoint.

- FFF(2) is

estimated to be approximately $215 million at the midpoint guidance

based on $75/bbl Brent; after paying the Company’s current regular

dividend of C$1.50 per share annualized, which is currently

forecast to be roughly $115 million in 2024, leaves an estimated

$100 million for further returns to shareholders through regular

dividends and share repurchases; additionally, the Company expects

to deploy $30 to $50 million of long-lead material and equipment

inventory from its balance sheet during the year.

- In due

course, the Company will submit a notice of intention to make a

normal course issuer bid to the Toronto Stock Exchange for calendar

2024.

- Capital

plan includes spudding three high-impact, big ‘E’ exploration wells

(Blocks: LLA-122, LLA-38 & VIM-1 – 50% W.I.), all of which have

the potential to be transformational opportunities for the

Company.

(1) See “Production Update – 2023 Review” for a breakdown of

production by product type.(2) Non-GAAP financial measure. See

“Non-GAAP and Other Financial Measures Advisory.”(3) Capital

management measure. See “Non-GAAP and Other Financial Measures

Advisory.”(4) See “Arauca Update” for oil and gas testing

disclosure; see also “Oil & Gas Matters Advisory.”

2024 Corporate Guidance

The following table summarizes the Company’s

2024 annual guidance.

|

Category |

2024 Guidance |

|

Brent Crude Oil Average Price |

$75/bbl |

|

Average Production |

54,000-60,000 boe/d |

|

Funds Flow Provided by Operations Netback(1)(2) |

$29-31/boe |

|

Funds Flow Provided by Operations(3) |

$590-660 million |

|

Capital Expenditures(4) |

$390-430 million |

|

Free Funds Flow(4) |

$215 million (midpoint) |

(1) Non-GAAP ratio. See “Non-GAAP and Other Financial Measures

Advisory”.(2) 2024 assumptions: Vasconia differential: ~$4/bbl;

production expense: $10-12/bbl; transportation expense: ~$3.50/bbl;

G&A expense: ~$3.50/bbl; effective tax rate: 19-21%.(3) Capital

management measure. See “Non-GAAP and Other Financial Measures

Advisory”.(4) Non-GAAP financial measure. See “Non-GAAP and Other

Financial Measures Advisory”.

2024 Netback Sensitivity Estimates

|

Brent Crude Oil Price ($/bbl) |

$65 |

$75 |

$85 |

|

Effective Tax Rate |

10-12% |

19-21% |

25-27% |

|

Funds Flow Provided by Operations Netback(1) |

$25-27/boe |

$29-31/boe |

$31-33/boe |

(1) Non-GAAP ratio. See “Non-GAAP and Other Financial Measures

Advisory”.

2024 Capital Expenditure Breakdown and Activity Overview

|

Category |

Total Capital Expenditures(1)

(Midpoint) |

Notable Planned Activity |

|

Development Activities |

$210MM |

- Arauca

(50% W.I.): Sidetracking Arauca-15 and one follow-up, as well as

one follow-up for Arauca-8(2).

- Capachos

(50% W.I.): One infill well; recompletion of the Andina-3

well.

- Southern

Llanos Exploitation: One horizontal well at LLA-30 (100% W.I.) and

three follow-up wells at LLA-32 (87.5% W.I.).

-

Cabrestero (100% W.I.): Ramping up total injected volume for

pressure maintenance with facility expanded by 50% and starting

polymer flooding; multiple recompletions.

- LLA-34

(55% W.I.): 15-20 gross wells, including horizontal and vertical

producers as well as injectors; multiple recompletions.

|

|

Development Facilities |

$90MM |

- Arauca

(50% W.I.): Constructing phase one of the oil and water treatment

facility as well as building interfield flow lines.

- VIM-1

(50% W.I.): Initiating phase one expansion of the La Belleza

facility to increase gas processing capacity from 20,000 to 30,000

mmcf/d.

- LLA-34

(55% W.I.): Upgrading total fluid handling capacity by

120,000-160,000 bbl per day at the Jacana and Tigana fields;

further electrical interconnections.

|

|

Near-Field Exploration |

$40MM |

-

Approximately five higher chance of success prospects that are

complementary to the big ‘E’ exploration program: wells to be

drilled at Capachos (50% W.I.), Fortuna (50% W.I.), LLA-32 (87.5%

W.I.), and LLA-74 (100% W.I.).

|

|

Big ‘E’ Exploration |

$50MM |

- LLA-122

(50% W.I.) – Arantes well (spud in Q1 2024).

- VIM-1

(50% W.I.) – Hydra well (Q2-Q3 2024 spud).

- LLA-38

(50% W.I.) – Berilo Oeste well (Q4 2024 spud).

- Seismic

acquisition program focused on newer blocks in the Southern

Llanos.

|

|

Carry Capital |

$20MM |

- Primarily

relates to the Arauca and LLA-38 farm-in agreement with Ecopetrol

S.A., as previously announced on July 7, 2021.

|

(1) Non-GAAP financial measure. See “Non-GAAP and Other

Financial Measures Advisory”.(2) Subject to the required

approvals.

Near-Field Exploration

In 2024, Parex is planning to drill

approximately five near-field exploration targets across various

strategic blocks. By focusing on three-way closure targets

identified through 3D seismic analysis, the identified targets have

a higher chance of success and are complementary to the Company’s

unchanged big ‘E’ exploration strategy that has higher risk and

reward characteristics.

Big ‘E’ Exploration – High-Impact Targets with

Transformational Potential

- Llanos Foothills –

LLA-122 (50% W.I.): The Arantes well is targeting gas and

condensate in the high-potential Foothills trend of Colombia, where

historical pool sizes are significant, and wells can be extremely

prolific. This prospect was spud in early January 2024 with

preliminary results expected in H1 2024.

- Magdalena – VIM-1

(50% W.I.): The Hydra well is targeting gas and condensate on the

VIM-1 Block where Parex previously had the material La Belleza

discovery in 2018. Parex plans to utilize new seismic processing

technology to drill this prospect, which is expected to spud

mid-year 2024.

- Northern Llanos –

LLA-38 (50% W.I.): The Berilo Oeste well is targeting light crude

oil and gas on an adjacent trend to Arauca. This multi-zone

prospect is targeting the same zones as the Arauca-8 well where

Parex has seen positive test results. This prospect is expected to

spud in Q4 2024.

Production Update

2023 Review

|

Average Production |

For the three months ended December 31 |

For the year ended December 31 |

|

Product Type |

2023(1) |

2022 |

2023(1) |

2022 |

|

Light & Medium Crude Oil (bbl/d) |

9,700 |

10,511 |

8,417 |

7,471 |

|

Heavy Crude Oil (bbl/d) |

46,760 |

42,746 |

45,163 |

43,008 |

|

Conventional Natural Gas (mcf/d) |

5,212 |

6,000 |

4,656 |

9,420 |

|

Oil Equivalent (boe/d)(2) |

57,329 |

54,257 |

54,356 |

52,049 |

(1) Production volumes for the three months ended

December 31, 2023, and for the year-ended December 31,

2023, are estimated.(2) Reference to crude oil or natural gas in

the above table and elsewhere in this press release refer to the

light and medium crude oil and heavy crude oil and conventional

natural gas, respectively, product types as defined in National

Instrument 51-101 – Standards of Disclosure for Oil and Gas

Activities.

Parex’s Q4 2023 average production was 57,329 boe/d, which was

an increase of 6% from Q4 2022. During the quarter, the Company

experienced multiple factors that led to production being lower

than Management’s expectations, including, but not limited to,

slower onstream timing because of extended testing and operational

setbacks, as well as higher-than expected water cut on a single

high-rate well.

Arauca (Business Collaboration Agreement with

Ecopetrol S.A. (Parex 50% Participating Share)) Update(1)

“Overall, the initial results that we are seeing

from the first two wells at Arauca are promising. The Arauca-8 well

has successfully tested the first two zones with discoveries in

each, with two more zones to test where logging and pressure

measurements show the presence of oil – while the Arauca-15 well is

being sidetracked to an optimal location after having demonstrated

the presence of hydrocarbons in multiple layers. We are optimistic

and planning to proceed with follow-up wells in each area based on

the initial results that we are seeing today,” commented Eric

Furlan, Chief Operating Officer.

Arauca-8 Exploration Well

Arauca-8 was drilled to a total depth of 21,010

feet as a pacesetting well and encountered the expected Guadalupe,

Gacheta, and Une zones. Based on positive wireline logging and

modular formation dynamics tester (“MDT”) pressure measurements, a

comprehensive testing program commenced, beginning with the Une

zone that resulted in a gas discovery that tested at roughly 9.0

MMCFD and over 1,000 barrels of condensate per day(2)(3)(4).

Following the successful Une gas test, the Gacheta zone was tested

that resulted in an oil discovery that tested at over 6,000

boe/d(2)(3)(5).

In the coming weeks, the remaining zones will be

tested, and following that, a formal development and production

plan for the area will be developed by Parex and Ecopetrol S.A.

The adjacent follow-up well, Arauca-81, is

expected to spud in late Q1 2024(2).

Arauca-15 Well

Although the well came in structurally low, it

encountered hydrocarbon sands in the Barco zone and the deeper Une

zone that previously had not been penetrated in the area. However,

wellbore conditions resulted in an ineffective completion that

affected overall test results and compromised the commercial

viability of the standalone well.

Based on the vertical seismic profile (“VSP”)

from downhole data, Parex plans to sidetrack the well to a more

optimal updip location and utilize the existing wellbore to reduce

costs and overall drilling time. The sidetrack is expected to be

completed in late Q1 2024, with the well brought onstream in early

Q2 2024.

In addition to the sidetrack of Arauca-15, which

will be drilled to the originally planned Arauca-11 location, Parex

also plans to drill a follow-up well, Arauca-12(2).

(1) Ecopetrol S.A. currently holds 100% W.I. in the Convenio

Arauca while the assignment procedure is pending. (2) Subject to

the required approvals.(3) The Arauca-8 well was drilled to a total

depth of 21,010 ft in a record time of 69 days, approximately 3.15

kilometers north-east of the Arauca-3 well. The data acquisition

program at the Arauca-8 well included wireline logging and MDT

pressure measurements in the Guadalupe, Gacheta, and Une

formations, indicating the presence of hydrocarbons. (4) In the Une

formation, over a 42-hour period, the well recovered 647 barrels of

50 API condensate and 9.7 MMCF of natural gas, representing an

average test rate of 370 barrels of condensate per day and 5.5

MMCFD of gas for a combined rate of 1,293 boe/d. The peak

production was at a restricted rate due to facility constraints of

9.0 MMCFD and 1,090 barrels of condensate per day, and the watercut

was stable at 0.5% during the last 10 hours of the test. Downhole

pressure sensors indicated an average producing drawdown of 1.2%

during the flow period, and a maximum drawdown of 2.7% during the

peak production period.(5) In the Gacheta formation, over 38-hour

period, the well recovered 2,783 barrels of 28 API crude oil, 3.0

MMCF of solution gas and 406 barrels of water, representing an

average test rate of 1,758 barrels of oil per day, 1.9 MMCF of gas,

and 256 barrels of water per day, for a combined rate of 2,075

boe/d. The peak production was at a restricted rate due to facility

constraints of 5,426 barrels of oil per day and 4.7 MMCFD, for a

total of 6,209 boe/d, with the watercut steadily decreasing

throughout the test to 4% when the test was terminated due to oil

storage capacity. Downhole pressure sensors indicated an average

producing drawdown of 6% during the flow period, and a maximum

drawdown of 20% during the peak production period.(6) See “Oil

& Gas Matters Advisory”.

Updated Three-Year Outlook

Parex’s updated plan for 2024 through 2026 shows

operational sustainability as well as the ability to generate

increased FFF(1).

The plan has been updated to include 2026,

incorporate Management’s forecast of inflationary impacts, drilling

results to date, as well as additional contingency related to well

timing and overall field execution.

Highlights of the updated three-year plan, based

on a constant $75/bbl Brent oil price outlook and forecast annual

capital expenditures(1) of $375 to $450 million, include:

- Annual average

production growth of approximately 5% or higher per year;

- Reinvestment

ratio(2) of 54 to 66 percent; and

-

Cumulative FFF(1) of approximately $850 million or over C$1.1

billion at current foreign exchange rates.

The plan continues to not include any associated

capital and production from successful exploration follow-up that

may occur over the outlook period.

Please note that an updated investor

presentation has been posted to the Company’s website, which

includes additional detail in relation to the updated three-year

outlook.

(1) Non-GAAP financial measure. See "Non-GAAP and Other

Financial Measures Advisory".(2) Supplementary financial measure;

reinvestment ratio is defined as capital expenditures expressed as

a percentage of funds flow provided by operations for the

applicable period. See "Non-GAAP and Other Financial Measures

Advisory".

Q4 2023 Results - Conference Call & Video

Webcast

Parex will host a conference call and video

webcast to discuss its Q4 2023 results on Friday, March 1, 2024.

Additional details will be available on the Company’s website in

due course.

About Parex Resources Inc.

Parex is the largest independent oil and gas

company in Colombia, focusing on sustainable, conventional

production. The Company’s corporate headquarters are in Calgary,

Canada, with an operating office in Bogotá, Colombia. Parex shares

trade on the Toronto Stock Exchange under the symbol PXT.

NOT FOR DISTRIBUTION OR FOR DISSEMINATION IN THE UNITED

STATES

Non-GAAP and Other Financial Measures

Advisory

This press release uses various "non-GAAP

financial measures", "non-GAAP ratios", "supplementary financial

measures" and "capital management measures" (as such terms are

defined in National Instrument 52-112 – Non-GAAP and Other

Financial Measures Disclosure). Such measures are not standardized

financial measures under IFRS, and might not be comparable to

similar financial measures disclosed by other issuers. Such

financial measures should not be considered as alternatives to, or

more meaningful than measures determined in accordance with GAAP.

These measures facilitate management’s comparisons to the Company’s

historical operating results in assessing its results and strategic

and operational decision-making and may be used by financial

analysts and others in the oil and natural gas industry to evaluate

the Company’s performance. Further, management believes that such

financial measures are useful supplemental information to analyze

operating performance and provide an indication of the results

generated by the Company's principal business activities.

Please refer to the Company’s Management’s

Discussion and Analysis of the financial condition and results of

operations for the period ended September 30, 2023 dated

November 7, 2023, which is available at the Company’s website

at www.parexresources.com and on the Company’s profile on SEDAR+ at

www.sedarplus.ca for additional information about such financial

measures, including reconciliations to the nearest GAAP measures,

as applicable.

Set forth below is a description of the non-GAAP

financial measures, non-GAAP ratios, supplementary financial

measures and capital management measures used in this press

release.

Non-GAAP Financial Measures

Capital expenditures, is a

non-GAAP financial measure which the Company uses to describe its

capital costs associated with oil and gas expenditures. The measure

considers both property, plant and equipment expenditures and

exploration and evaluation asset expenditures which are items in

the Company’s statement of cash flows for the period. In Q3 2022,

the Company changed how it presents exploration and evaluation

expenditures, refer to note 2 of the Company's consolidated interim

financial statements for the period ended September 30, 2022.

Free funds flow, is a non-GAAP

measure that is determined by funds flow provided by operations

less capital expenditures. In Q3 2022, the Company changed how it

presents exploration and evaluation expenditures included in total

capital expenditures. Amounts have been restated for prior periods

to conform to the current year's presentation, refer to note 2 of

the Company's consolidated interim financial statements for the

period ended September 30, 2022. The Company considers free funds

flow to be a key measure as it demonstrates Parex’s ability to fund

return of capital, such as the normal course issuer bid or

dividends, without accessing outside funds.

Non-GAAP Ratios

Funds flow provided by operations

netback ("FFO netback") is a non-GAAP

ratio that includes all cash generated from operating activities

and is calculated before changes in non-cash working capital,

divided by produced oil and natural gas sales volumes. The Company

considers FFO netback to be a key measure as it demonstrates

Parex's profitability after all cash costs relative to current

commodity prices.

Capital Management Measures

Funds flow provided by

operations, is a capital management measure that includes

all cash generated from operating activities and is calculated

before changes in non-cash working capital. The Company considers

funds flow provided by operations to be a key measure as it

demonstrates Parex’s profitability after all cash costs relative to

current commodity prices.

Supplementary Financial

Measures

Dividends per share is

comprised of dividends declared as determined in accordance with

IFRS, divided by the number of shares outstanding at the applicable

dividend record date.

Reinvestment ratio is capital

expenditures expressed as a percentage of funds flow provided by

operations for the applicable period.

Oil & Gas Matters

Advisory

The term "Boe" means a barrel of oil equivalent

on the basis of 6 thousand cubic feet ("Mcf") of natural gas to 1

bbl. Boe may be misleading, particularly if used in isolation. A

boe conversion ratio of 6 Mcf: 1 Bbl is based on an energy

equivalency conversion method primarily applicable at the burner

tip and does not represent a value equivalency at the wellhead.

Given the value ratio based on the current price of crude oil as

compared to natural gas is significantly different from the energy

equivalency of 6 Mcf: 1Bbl, utilizing a conversion ratio at 6 Mcf:

1 Bbl may be misleading as an indication of value.

This press release contains a number of oil and

gas metrics, including FFO netbacks. These oil and gas metrics have

been prepared by management and do not have standardized meanings

or standard methods of calculation and therefore such measures may

not be comparable to similar measures used by other companies and

should not be used to make comparisons. Such metrics have been

included herein to provide readers with additional measures to

evaluate the Company's performance; however, such measures are not

reliable indicators of the future performance of the Company and

future performance may not compare to the performance in previous

periods and therefore such metrics should not be unduly relied

upon. Management uses these oil and gas metrics for its own

performance measurements and to provide security holders with

measures to compare the Company's operations over time. Readers are

cautioned that the information provided by these metrics, or that

can be derived from the metrics presented in this news release,

should not be relied upon for investment or other purposes. A

summary of the calculation of FFO netbacks is provided under

"Non-GAAP and Other Financial Measures Advisory".

References in this press release to initial

production test rates, initial "flow" rates, initial flow testing,

and "peak" rates are useful in confirming the presence of

hydrocarbons, however such rates are not determinative of the rates

at which such wells will commence production and decline thereafter

and are not indicative of long-term performance or of ultimate

recovery. While encouraging, investors are cautioned not to place

reliance on such rates in calculating the aggregate production for

Parex. Parex has not conducted a pressure transient analysis or

well-test interpretation on the wells referenced in this press

release. As such, all data should be considered to be preliminary

until such analysis or interpretation has been done.

Analogous Information

Certain information in this press release may

constitute "analogous information" as defined in NI 51-101. Such

information includes production estimates, reserves estimates and

other information retrieved from the continuous disclosure record

of certain industry participants from www.sedar.com or other

publicly available sources. Management of Parex believes the

information is relevant as it may help to define the reservoir

characteristics and production profile of lands in which Parex may

hold an interest. Parex is unable to confirm that the analogous

information was prepared by a qualified reserves evaluator or

auditor and is unable to confirm that the analogous information was

prepared in accordance with NI 51-101. Such information is not an

estimate of the production, reserves or resources attributable to

lands held or to be held by Parex and there is no certainty that

the production, reserves or resources data and economic information

for the lands held or to be held by Parex will be similar to the

information presented herein. The reader is cautioned that the data

relied upon by Parex may be in error and/or may not be analogous to

such lands held or to be held by Parex.

Advisory on Forward-Looking

Statements

Certain information regarding Parex set forth in

this press release contains forward-looking statements that involve

substantial known and unknown risks and uncertainties. The use of

any of the words "plan", "expect", “prospective”, "project",

"intend", "believe", "should", "anticipate", "estimate",

“forecast”, "guidance", “budget” or other similar words, or

statements that certain events or conditions "may" or "will" occur

are intended to identify forward-looking statements. Such

statements represent Parex's internal projections, estimates or

beliefs concerning, among other things, future growth, results of

operations, production, future capital and other expenditures

(including the amount, nature and sources of funding thereof),

competitive advantages, plans for and results of drilling activity,

environmental matters, business prospects and opportunities. These

statements are only predictions and actual events or results may

differ materially. Although the Company’s management believes that

the expectations reflected in the forward-looking statements are

reasonable, it cannot guarantee future results, levels of activity,

performance or achievement since such expectations are inherently

subject to significant business, economic, competitive, political

and social uncertainties and contingencies. Many factors could

cause Parex's actual results to differ materially from those

expressed or implied in any forward-looking statements made by, or

on behalf of, Parex.

In particular, forward-looking statements

contained in this press release include, but are not limited to,

statements with respect to the Company's focus, plans, priorities

and strategies and the benefits to be derived from such plans,

priorities and strategies; Parex's anticipated FY 2024 average

production (midpoint of 2024 guidance) and forecasted annual

production growth at the midpoint; budgeted FY 2024 capital

expenditures and the expected comparison back to FY 2023 capital

expenditures; expected FFO and FFF in each case at the midpoint of

2024 guidance and the underlying assumptions; Parex's 2024 budget

including, the number of gross wells, the 2024 capital expenditure

guidance range, the allocation of capital expenditures, aggregate

amount of dividends that may be paid in 2024 and estimated amount

for further returns to shareholders, plans with respect to the 2024

exploration and development program, and 2024 capital plans;

Parex's 2024 guidance, including its anticipated average

production, FFO netback, FFO, capital expenditures and FFF; Parex's

2024 netback sensitivity estimates; Parex's 2024 capital

expenditure breakdown and specific overview of planned development

activities, development facilities, near-field exploration, Big 'E'

exploration and carry capital; the timing of, and the benefits to

be derived from, the planned development activities, development

facilities, near-field exploration, Big 'E' exploration and carry

capital; the expected timing for preliminary well results; the

timing to spud wells and the timing to bring wells onstream;

utilization of new seismic processing technology; the products and

zones being targeted at certain blocks; plans to proceed with

follow-up wells in Arauca; the formal development and production

plan for Arauca to be developed by Parex and its joint venture

partner; the plan for 2024 through 2026, and the underlying

assumptions and the highlighted components of such plan; and the

anticipated timing for Parex's webcast to discuss its Q4 2023

results.

Although the forward-looking statements

contained in this press release are based upon assumptions which

Management believes to be reasonable, the Company cannot assure

investors that actual results will be consistent with these

forward-looking statements. With respect to forward-looking

statements contained in this press release, Parex has made

assumptions regarding, among other things: current and anticipated

commodity prices and royalty regimes; availability of skilled

labour; timing and amount of capital expenditures; future exchange

rates; the price of oil, including the anticipated Brent oil price;

the impact of increasing competition; conditions in general

economic and financial markets; availability of drilling and

related equipment; effects of regulation by governmental agencies;

receipt of partner, regulatory and community approvals; royalty

rates; future operating costs; uninterrupted access to areas of

Parex's operations and infrastructure; recoverability of reserves

and future production rates; the status of litigation; timing of

drilling and completion of wells; on-stream timing of production

from successful exploration wells; operational performance of

non-operated producing fields; pipeline capacity; that Parex will

have sufficient cash flow, debt or equity sources or other

financial resources required to fund its capital and operating

expenditures and requirements as needed; that Parex's conduct and

results of operations will be consistent with its expectations;

that Parex will have the ability to develop its oil and gas

properties in the manner currently contemplated; that Parex's

evaluation of its existing portfolio of development and exploration

opportunities is consistent with its expectations; current or,

where applicable, proposed industry conditions, laws and

regulations will continue in effect or as anticipated as described

herein; that the estimates of Parex's production and reserves

volumes and the assumptions related thereto (including commodity

prices and development costs) are accurate in all material

respects; that Parex will be able to obtain contract extensions or

fulfill the contractual obligations required to retain its rights

to explore, develop and exploit any of its undeveloped properties;

that Parex will have sufficient financial resources in the future

to pay a dividend in the future; that the Board will declare

dividends in the future; and other matters.

Included in this press release are additional

forward-looking statements which are estimates of Parex's 2024-2026

average annual production growth, Brent oil pricing, annual capital

expenditures, reinvestment ratio and cumulative free funds flow.

The foregoing 2025-2026 forecasts are based on various assumptions

and are provided for illustration only and are based on budgets and

forecasts that have not been finalized and are subject to a variety

of contingencies including prior years' results. In addition, the

foregoing 2025-2026 forecasts and any capital budgets underlying

such forecasts are management prepared only and have not been

approved by the Board of Directors of Parex. These forecasts are

made as of the date of this press release and except as required by

applicable securities laws, Parex undertakes no obligation to

update such forecasts.

These forward-looking statements are subject to

numerous risks and uncertainties, including but not limited to, the

impact of general economic conditions in Canada and Colombia;

prolonged volatility in commodity prices; industry conditions

including changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Canada and Colombia; determinations by

OPEC and other countries as to production levels; competition; lack

of availability of qualified personnel; the results of exploration

and development drilling and related activities; obtaining required

approvals of regulatory authorities in Canada and Colombia; risks

associated with negotiating with foreign governments as well as

country risk associated with conducting international activities;

volatility in market prices for oil; fluctuations in foreign

exchange or interest rates; environmental risks; changes in income

tax laws or changes in tax laws and incentive programs relating to

the oil industry; changes to pipeline capacity; ability to access

sufficient capital from internal and external sources; failure of

counterparties to perform under contracts; risk that Brent oil

prices are lower than anticipated; risk that Parex's evaluation of

its existing portfolio of development and exploration opportunities

is not consistent with its expectations; risk that initial test

results are not indicative of future performance or ultimate

recovery; risk that other zones to be tested do not contain the

expected hydrocarbon bearing formations; the risk that Parex's 2024

capital expenditures and planned exploration and development

programs are different than expected, including in a manner adverse

to Parex; the risk that Parex's financial and production results

may be less favorable than anticipated; the risk that Parex may not

receive its preliminary well results when anticipated, or at all;

the risk that certain of Parex's wells may not spud or come

onstream when anticipated, or at all; the risk that Parex may not

utilize new seismic processing technology or receive the benefits

anticipated; the risk that Parex may not proceed with follow-up

wells in Arauca; the risk that a formal development and production

plan for Arauca may not be developed by Parex and its joint venture

partner when anticipated, or at all; the risk that Parex's actual

results may be less favorable than those reflected in its plan for

2024 through 2026; the risk that Parex's webcast to discuss its Q4

2023 results may not occur when anticipated, or at all; the risk

that Parex may not have sufficient financial resources in the

future to pay a dividend or repurchase its shares; the risk that

the Board may not declare dividends in the future or that Parex's

dividend policy changes; and other factors, many of which are

beyond the control of the Company. Readers are cautioned that the

foregoing list of factors is not exhaustive. Additional information

on these and other factors that could affect Parex's operations and

financial results are included in reports on file with Canadian

securities regulatory authorities and may be accessed through the

SEDAR website (www.sedarplus.ca).

Management has included the above summary of

assumptions and risks related to forward-looking information

provided in this press release in order to provide shareholders

with a more complete perspective on Parex's current and future

operations and such information may not be appropriate for other

purposes. Parex's actual results, performance or achievement could

differ materially from those expressed in, or implied by, these

forward-looking statements and, accordingly, no assurance can be

given that any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

benefits Parex will derive. These forward-looking statements are

made as of the date of this press release and Parex disclaims any

intent or obligation to update publicly any forward-looking

statements, whether as a result of new information, future events

or results or otherwise, other than as required by applicable

securities laws.

This press release contains a financial outlook,

in particular: Parex's 2024 budget, including its anticipated

capital expenditures, free funds flow, forecasted aggregate

dividend payments and other shareholder returns and funds flow

provided by operations; that Parex will continue to pay its regular

quarterly dividend; Parex's 2024 guidance, including its

anticipated average production, FFO netback, FFO, capital

expenditures and FFF; Parex's three-year outlook, including its

forecasted annual capital expenditures, cumulative free funds flow

and reinvestment ratio; and Parex's 2024 netback sensitivity

estimates. Such financial outlook has been prepared by Parex's

management to provide an outlook of the Company's activities and

results. The financial outlook has been prepared based on a number

of assumptions including the assumptions discussed above and

assumptions with respect to the costs and expenditures to be

incurred by the Company, capital equipment and operating costs,

foreign exchange rates, taxation rates for the Company, general and

administrative expenses and the prices to be paid for the Company's

production.

Management does not have firm commitments for

all of the costs, expenditures, prices or other financial

assumptions used to prepare the financial outlook or assurance that

such operating results will be achieved and, accordingly, the

complete financial effects of all of those costs, expenditures,

prices and operating results are not objectively determinable. The

actual results of operations of the Company and the resulting

financial results will likely vary from the amounts set forth in

the analysis presented in this press release, and such variation

may be material. The Company and its management believe that the

financial outlook has been prepared on a reasonable basis,

reflecting the best estimates and judgments, and represent, to the

best of management's knowledge and opinion, Parex's expected

expenditures and results of operations. However, because this

information is highly subjective and subject to numerous risks

including the risks discussed above, it should not be relied on as

necessarily indicative of future results. Except as required by

applicable securities laws, Parex undertakes no obligation to

update such financial outlook.

Distribution Advisory

The proposed aggregate quarterly dividend

payments of approximately US$115 million in 2024 remain subject to

the approval of the Board of Directors of Parex and the declaration

of such dividends is subject to a number of other assumptions and

contingencies, including commodity prices. The Company's future

shareholder distributions, including but not limited to the payment

of dividends and the acquisition by the Company of its shares

pursuant to a normal course issuer bid, if any, and the level

thereof is uncertain. Any decision to pay further dividends on the

common shares (including the actual amount, the declaration date,

the record date and the payment date in connection therewith and

any special dividends) or acquire shares of the Company will be

subject to the discretion of the Board of Directors of Parex and

may depend on a variety of factors, including, without limitation

the Company's business performance, financial condition, financial

requirements, growth plans, expected capital requirements and other

conditions existing at such future time including, without

limitation, contractual restrictions and satisfaction of the

solvency tests imposed on the Company under applicable corporate

law. Any purchases of common shares pursuant to a normal course

issuer bid is subject to all required regulatory approvals. There

can be no assurance that the Company will pay dividends or

repurchase any shares of the Company in the future. The payment of

dividends to shareholders is not assured or guaranteed and

dividends may be reduced or suspended entirely. In addition to the

foregoing, the Company’s ability to pay dividends or acquire shares

now or in the future may be limited by covenants contained in the

agreements governing any indebtedness that the Company has incurred

or may incur in the future, including the terms of the credit

facilities.

Abbreviations

The following abbreviations used in this press

release have the meanings set forth below:

|

API |

American Petroleum Institute gravity |

|

bbl |

one barrel |

|

bbl/d |

barrels per day |

|

boe |

barrels of oil equivalent of natural gas; one barrel of oil or

natural gas liquids for six thousand cubic feet of natural gas |

|

boe/d |

barrels of oil equivalent of natural gas per day |

|

mcf |

thousand cubic feet |

|

mcf/d |

thousand cubic feet per day |

|

mmcf/d |

million cubic feet per day |

|

W.I. |

working interest |

PDF

available: http://ml.globenewswire.com/Resource/Download/ecea789d-3638-47d2-b752-dad7d1f81765

For more information, please contact:

Mike Kruchten

Senior Vice President, Capital Markets & Corporate Planning

Parex Resources Inc.

403-517-1733

investor.relations@parexresources.com

Steven Eirich

Investor Relations & Communications Advisor

Parex Resources Inc.

587-293-3286

investor.relations@parexresources.com

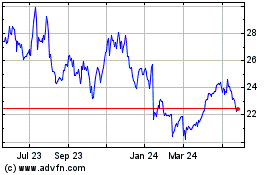

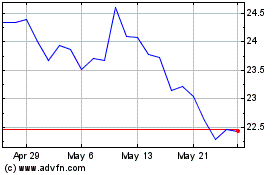

Parex Resources (TSX:PXT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Parex Resources (TSX:PXT)

Historical Stock Chart

From Dec 2023 to Dec 2024