Parex Resources Inc. (“Parex” or the “Company”) (TSX: PXT) is

pleased to announce its financial and operating results for the

three-month period ended March 31, 2024, and the declaration

of its increased Q2 2024 regular dividend of C$0.385 per share. All

amounts herein are in United States Dollars (“USD”) unless

otherwise stated.

“This year, we have made significant progress in executing our

strategy and building operational momentum,” commented Imad Mohsen,

President & Chief Executive Officer.

“The foundation is strong at our base Cabrestero and LLA-34

assets, where horizontal wells, waterflood, and polymer application

are yielding positive results. Beyond our base, the Arauca-8 well

is now among the top oil-producing wells in Colombia – and the

recently signed Llanos Foothills agreement marks a pivotal moment

for Parex, representing our expansion into the most prolific region

of the country. Our team's focus on executing the 2024 plan remains

steadfast; concurrently, we are laying the groundwork for the

future, strategically positioning the Company to realize its

step-change potential and drive long-term shareholder value.”

Key Highlights

- Generated Q1 2024

funds flow provided by operations ("FFO")(1) of $148 million and

FFO per share(2)(3) of $1.43.

- Successfully brought the Arauca-8(9)

well online in April 2024, with stable rates averaging over 4,000

bbl/d of light crude oil (gross) over the past 14 days(4).

- On track to deliver

FY 2024 average production guidance of 57,000 boe/d (midpoint);

second quarter-to-date estimated average production is

approximately 56,000 boe/d(8).

- High-graded the

exploration portfolio through the signing of definitive agreements

to explore Colombia's high-potential Llanos Foothills trend, as

previously announced April 11, 2024.

- Declared a Q2 2024

regular dividend of C$0.385 per share(7) or C$1.54 per share

annualized, representing a C$0.04 per share increase on an

annualized basis.

- Repurchased approximately 1.5 million

shares year-to-date 2024 under the Company's current normal course

issuer bid ("NCIB").

Q1 2024 Results

- Quarterly

average oil & natural gas production was 53,338 boe/d(5), an

increase of 4% from Q1 2023, and a 7% decrease from Q4 2023; the

primary driver of the decrease was the suspension of operations in

the Northern Llanos, which has since returned to normal

operations.

- Grew production per share(3)(7) by

9% compared to Q1 2023, from increased production as well as the

reduction of outstanding shares through NCIB programs.

- Realized net income

of $60 million or $0.58 per share basic(3).

- Generated quarterly

FFO(1) of $148 million, an 8% decrease from Q1 2023, and FFO per

share(2)(3) of $1.43, a 4% decrease from Q1 2023.

- Produced an

operating netback(2) of $43.55/boe and an FFO netback(2) of

$31.32/boe from an average Brent price of $81.87/bbl.

- Incurred $85

million of capital expenditures(6), primarily from activities at

Arauca, LLA-34 and LLA-122.

- Generated $63

million of free funds flow(6) that was used for return of capital

initiatives as well as $30 million of bank debt repayment; working

capital surplus(1) was $56 million and cash $61 million at quarter

end.

- Paid a C$0.375 per

share(7) regular quarterly dividend and repurchased 919,900

shares.

| (1) Capital

management measure. See “Non-GAAP and Other Financial Measures

Advisory.”(2) Non-GAAP ratio. See “Non-GAAP and Other Financial

Measures Advisory.”(3) Per share amounts (with the exception of

dividends) are based on weighted-average common shares; dividends

paid per share are based on the number of common shares outstanding

at each dividend date.(4) Short-term production rate. See "Oil

& Gas Matters Advisory."(5) See "Operational and Financial

Highlights" for a breakdown of production by product type.(6)

Non-GAAP financial measure. See “Non-GAAP and Other Financial

Measures Advisory.”(7) Supplementary financial measure. See

"Non-GAAP and Other Financial Measures Advisory."(8) Estimated

average production for April 1, 2024 to May 7, 2024.(9) Arauca:

Business Collaboration Agreement with Ecopetrol S.A. (Parex 50%

Participating Share); Ecopetrol S.A. currently holds 100% of the

working interest in the Convenio Arauca while the assignment

procedure is pending. |

|

Operational and Financial Highlights |

Three Months Ended |

|

(unaudited) |

Mar. 31, |

|

Mar. 31, |

|

Dec. 31, |

|

|

|

2024 |

|

2023 |

|

2023 |

|

|

Operational |

|

|

|

|

Average daily production |

|

|

|

|

Light Crude Oil and Medium Crude Oil (bbl/d) |

7,237 |

|

7,115 |

|

9,700 |

|

|

Heavy Crude Oil (bbl/d) |

45,543 |

|

43,435 |

|

46,760 |

|

|

Crude Oil (bbl/d) |

52,780 |

|

50,550 |

|

56,460 |

|

|

Conventional Natural Gas (mcf/d) |

3,348 |

|

4,692 |

|

5,214 |

|

|

Oil & Gas (boe/d)(1) |

53,338 |

|

51,332 |

|

57,329 |

|

|

|

|

|

|

|

Operating netback ($/boe) |

|

|

|

|

Reference price - Brent ($/bbl) |

81.87 |

|

82.16 |

|

82.90 |

|

|

Oil & gas sales(4) |

70.80 |

|

69.09 |

|

70.55 |

|

|

Royalties(4) |

(11.21 |

) |

(12.21 |

) |

(12.12 |

) |

|

Net revenue(4) |

59.59 |

|

56.88 |

|

58.43 |

|

|

Production expense(4) |

(12.64 |

) |

(8.85 |

) |

(13.67 |

) |

|

Transportation expense(4) |

(3.40 |

) |

(3.08 |

) |

(3.54 |

) |

|

Operating netback ($/boe)(2) |

43.55 |

|

44.95 |

|

41.22 |

|

|

|

|

|

|

|

Funds flow provided by operations netback

($/boe)(2) |

31.32 |

|

34.27 |

|

36.81 |

|

|

|

|

|

|

|

Financial ($000s except per share amounts) |

|

|

|

|

|

|

|

|

|

Net income |

60,093 |

|

104,375 |

|

133,783 |

|

|

Per share - basic(6) |

0.58 |

|

0.96 |

|

1.28 |

|

|

|

|

|

|

|

Funds flow provided by

operations(5) |

148,307 |

|

161,724 |

|

193,377 |

|

|

Per share - basic(2)(6) |

1.43 |

|

1.49 |

|

1.85 |

|

|

|

|

|

|

|

Capital expenditures(3) |

85,421 |

|

113,868 |

|

91,419 |

|

|

|

|

|

|

|

Free funds flow(3) |

62,886 |

|

47,856 |

|

101,958 |

|

|

|

|

|

|

|

EBITDA(3) |

192,078 |

|

178,817 |

|

110,860 |

|

|

Adjusted EBITDA(3) |

188,228 |

|

198,360 |

|

201,552 |

|

|

|

|

|

|

|

Long-term inventory expenditures |

3,843 |

|

19,767 |

|

(866 |

) |

|

|

|

|

|

|

Dividends paid |

28,531 |

|

29,831 |

|

29,505 |

|

|

Per share - Cdn$(4) |

0.375 |

|

0.375 |

|

0.375 |

|

|

|

|

|

|

|

Shares repurchased |

15,291 |

|

32,868 |

|

22,453 |

|

|

Number of shares repurchased (000s) |

920 |

|

1,909 |

|

1,220 |

|

|

|

|

|

|

|

Outstanding shares (end of period) (000s) |

|

|

|

|

Basic |

102,914 |

|

107,419 |

|

103,812 |

|

|

Weighted average basic |

103,474 |

|

108,192 |

|

104,394 |

|

|

Diluted(8) |

103,829 |

|

108,221 |

|

104,502 |

|

|

|

|

|

|

|

Working capital surplus(5) |

55,901 |

|

29,662 |

|

79,027 |

|

|

Bank debt(7) |

60,000 |

|

— |

|

90,000 |

|

|

Cash |

61,052 |

|

372,419 |

|

140,352 |

|

| (1)

Reference to crude oil or natural gas in the above table and

elsewhere in this press release refer to the light and medium crude

oil and heavy crude oil and conventional natural gas, respectively,

product types as defined in National Instrument 51-101 - Standards

of Disclosure for Oil and Gas Activities.(2) Non-GAAP ratio. See

“Non-GAAP and Other Financial Measures Advisory”.(3) Non-GAAP

financial measure. See "Non-GAAP and Other Financial Measures

Advisory".(4) Supplementary financial measure. See "Non-GAAP and

Other Financial Measures Advisory".(5) Capital management measure.

See "Non-GAAP and Other Financial Measures Advisory".(6) Per share

amounts (with the exception of dividends) are based on weighted

average common shares. Dividends paid per share are based on the

number of common shares outstanding at each dividend record

date.(7) Syndicated bank credit facility borrowing base of $200.0

million as at March 31, 2024. (8) Diluted shares as stated

include common shares and stock options outstanding at period end;

March 31, 2024 closing price was C$21.64 per share. |

Parex Resources and Ecopetrol S.A. Enter into Definitive

Agreements to Explore Colombia's High-Potential Llanos Foothills

Trend

As previously announced April 11, 2024, Parex and its strategic

partner have entered into definitive agreements to consolidate

their position along the Llanos Foothills trend in alignment with

Colombian government objectives to secure gas supply and support

energy transition initiatives.

Parex views the agreements as having high-graded its exploration

portfolio, while maintaining the Company's long-term capital

allocation framework. This positions Parex for its next growth

chapter, minimizing risk profile and maximizing reward potential as

the Company expands into Colombia's most prolific area.

To learn more, please see the "Llanos Foothills Trend"

presentation, which is available at www.parexresources.com under

Investors.

Strong Current Production with FY 2024 Guidance

Re-Confirmed

Second quarter-to-date estimated average production is

approximately 56,000 boe/d, reflecting strong base production from

Cabrestero and LLA-34, initial Arauca production, and a successful

restart of Capachos.

Parex's FY 2024 average production guidance of 54,000 to 60,000

boe/d (57,000 boe/d midpoint) and capital expenditure guidance of

$390 to $430 million ($410 million midpoint) remain unchanged.

Operational Update

Cabrestero and LLA-34(1)(2)

The Cabrestero and LLA-34 blocks continue to demonstrate strong

base production, producing approximately 44,000 bbl/d heavy crude

oil (net) combined in Q1 2024. Although new producing well

additions have slowed alongside lower capital investment,

production rates have remained strong through a combination of

positive waterflood response, successful exploitation and

optimization activities, and in the case of Cabrestero, initial

positive results from the polymer injection pilot.

At Cabrestero, average production levels have been sustained at

over 14,500 bbl/d of heavy crude oil (net) since October 2023,

despite no new wells being drilled on the block. This sustained

production is demonstrating the low decline profile of the asset

when coupled with Management's strategic focus on applying

globally-proven technology.

|

(1) Cabrestero: 100% W.I.(2) LLA-34: 55% W.I. |

Northern Llanos - Arauca Update(1)

Substantial advancements at the Arauca Block have occurred in

2024. Significant drilling improvements have been realized,

achieved through a blend of lessons learned as well as technology

application; the Arauca-81 well is drilling at a pacesetting rate,

building upon the success of the Arauca-8 drill. Initial production

has begun from the block, with the Arauca-8 well currently ranked

among the top oil-producing wells in Colombia.

Arauca-8 Well

- The Arauca-8 well came online in

April 2024 and produced roughly 3,400 bbl/d of light crude oil

(gross) during the month.

- Over the last 14 days following

wellbore cleanup, natural flow has been stable at rates over 4,000

bbl/d of light crude oil (gross), limited by gas facility

constraints.

- Facility constraints are limiting

the monetization of associated natural gas in the Gacheta and Une

reservoirs; the Company is currently working on short- and

long-term facility and infrastructure solutions, including

connecting to the bicentenario ("OBC") pipeline.

Arauca-81 Well

- Arauca-81, which is the adjacent

follow-up well to Arauca-8 that is a roughly 600 meter stepout, was

spud in early Q2 2024.

Arauca-15 Well

- The Arauca-15 sidetrack has reached

total depth and is expected to come online in Q2 2024.

- Once Arauca-15 is completed, the rig

is expected to move to the Arauca-12 follow-up location.

| (1) Arauca:

Business Collaboration Agreement with Ecopetrol S.A. (Parex 50%

Participating Share); Ecopetrol S.A. currently holds 100% of the

working interest in the Convenio Arauca while the assignment

procedure is pending. |

Near-Field Exploration - Small 'E' Targets Complementary to the

Big 'E' Exploration Strategy

The Company's 2024 near-field exploration plan is progressing,

with the first well expected to spud in Q2 2024.

Big 'E' Exploration - High-Impact Targets with Transformational

Potential

Parex continues to drill its first high-potential well in the

Colombian Foothills, Arantes at LLA-122(1), which is targeting gas

and condensate. This prospect is at roughly 10,000 feet, with a

target depth of approximately 18,000 feet. Initial results are

expected mid-year 2024.

Parex continues to progress the pre-drill work for the Hidra

well (name changed from "Hydra") at VIM-1(2), which is roughly 15

kilometers from the Company's La Belleza discovery. The well is

expected to spud mid-year 2024.

| (1)

LLA-122: 50% W.I.(2) VIM-1: 50% W.I. |

Return of Capital Update

Increased Q2 2024 Dividend

Parex’s Board of Directors have approved a Q2 2024 regular

dividend of C$0.385 per share to be paid on June 17, 2024, to

shareholders of record on June 10, 2024, representing a C$0.04 per

share increase on an annualized basis. The Company first initiated

a regular quarterly dividend at C$0.125 per share in 2021.

This quarterly dividend payment to shareholders is designated as

an “eligible dividend” for purposes of the Income Tax Act

(Canada).

Active Share Buyback Program Under Current Normal Course Issuer

Bid

As at May 7, 2024, Parex has repurchased approximately 1.5

million shares under its current NCIB at an average price of

C$22.24 per share, for total consideration of roughly C$33

million.

Q1 2024 Results - Conference Call & Video

Webcast

Parex will host a conference call and video webcast to discuss

its Q1 2024 results on Thursday, May 9, 2024, beginning at

9:30 am MT (11:30 am ET). To participate in the conference call or

video webcast, please see the access information below:

| Conference

ID: |

1 335

335 |

| Participant Toll-Free Dial-In Number: |

1-888-550-5584 |

| Participant Toll Dial-In Number: |

1-646-960-0157 |

| Webcast: |

https://events.q4inc.com/attendee/326628133 |

2024 Annual General & Special Meeting of

Shareholders

On Thursday, May 9, 2024, Parex will hold its Annual General and

Special Meeting of Shareholders at 11:00 am MT (1:00 pm ET) both

in-person and virtually. Participants may attend at the 4th Floor

Conference Center, Eight Avenue Place, East Tower, 525, 8th Ave SW,

Calgary, Alberta – and virtual participants can join through the

following link: https:meetnow.global/MFWYXAV.

Additional information regarding the Annual General and Special

Meeting, including meeting materials, can be found at

www.parexresources.com under Investors.

About Parex Resources Inc.

Parex is the largest independent oil and gas company in

Colombia, focusing on sustainable, conventional production. The

Company’s corporate headquarters are in Calgary, Canada, with an

operating office in Bogotá, Colombia. Parex shares trade on the

Toronto Stock Exchange under the symbol PXT.

For more information, please contact:

Mike KruchtenSenior Vice President, Capital

Markets & Corporate PlanningParex Resources Inc.

403-517-1733investor.relations@parexresources.com

Steven EirichInvestor Relations &

Communications AdvisorParex Resources

Inc.587-293-3286investor.relations@parexresources.com

NOT FOR DISTRIBUTION OR FOR DISSEMINATION IN THE UNITED

STATES

Non-GAAP and Other Financial Measures

Advisory

This press release uses various “non-GAAP financial measures”,

“non-GAAP ratios”, “supplementary financial measures” and “capital

management measures” (as such terms are defined in NI 52-112),

which are described in further detail below. Such measures are not

standardized financial measures under IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. Investors are cautioned that non-GAAP financial measures

should not be construed as alternatives to or more meaningful than

the most directly comparable GAAP measures as indicators of Parex's

performance.

These measures facilitate management’s comparisons to the

Company’s historical operating results in assessing its results and

strategic and operational decision-making and may be used by

financial analysts and others in the oil and natural gas industry

to evaluate the Company’s performance. Further, management believes

that such financial measures are useful supplemental information to

analyze operating performance and provide an indication of the

results generated by the Company's principal business

activities.

Set forth below is a description of the non-GAAP financial

measures, non-GAAP ratios, supplementary financial measures and

capital management measures used in this press release.

Non-GAAP Financial Measures

Capital expenditures, is a non-GAAP financial

measure which the Company uses to describe its capital costs

associated with oil and gas expenditures. The measure considers

both property, plant and equipment expenditures and exploration and

evaluation asset expenditures which are items in the Company’s

statement of cash flows for the period.

| |

For the three months ended |

| |

Mar. 31, |

|

|

Mar. 31, |

|

|

Dec. 31, |

|

|

($000s) |

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

Property, plant and equipment expenditures |

$ |

40,831 |

|

$ |

83,224 |

|

$ |

50,753 |

|

|

Exploration and evaluation expenditures |

|

44,590 |

|

|

30,644 |

|

|

40,666 |

|

|

Capital expenditures |

$ |

85,421 |

|

$ |

113,868 |

|

$ |

91,419 |

|

Free funds flow, is a non-GAAP financial

measure that is determined by funds flow provided by operations

less capital expenditures. The Company considers free funds flow to

be a key measure as it demonstrates Parex’s ability to fund return

of capital, such as the NCIB and dividends, without accessing

outside funds and is calculated as follows:

| |

For the three months ended |

| |

Mar. 31, |

|

Mar. 31, |

|

|

Dec. 31, |

|

|

($000s) |

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

Cash provided by operating activities |

$ |

97,412 |

|

$ |

131,273 |

|

$ |

194,242 |

|

|

Net change in non-cash working capital |

|

50,895 |

|

|

30,451 |

|

|

(865 |

) |

|

Funds flow provided by operations |

|

148,307 |

|

|

161,724 |

|

|

193,377 |

|

| Capital

expenditures |

|

85,421 |

|

|

113,868 |

|

|

91,419 |

|

|

Free funds flow |

$ |

62,886 |

|

$ |

47,856 |

|

$ |

101,958 |

|

EBITDA, is a non-GAAP financial measure that is

defined as net income adjusted for finance income and expenses,

income tax expense (recovery) and depletion, depreciation and

amortization.

Adjusted EBITDA, is a non-GAAP financial

measure defined as EBITDA adjusted for non-cash impairment charges,

unrealized foreign exchange gains (losses), unrealized gains

(losses) on risk management contracts and share-based compensation

expense.

The Company considers EBITDA and Adjusted EBITDA to be key

measures as they demonstrates Parex’s profitability before finance

income and expenses, taxes, depletion, depreciation and

amortization and other non-cash items. A reconciliation from net

income to EBITDA and Adjusted EBITDA is as follows:

| |

For the three months ended |

| |

|

Mar. 31, |

|

|

|

Mar. 31, |

|

|

|

Dec. 31, |

|

|

($000s) |

|

2024 |

|

|

|

2023 |

|

|

|

2023 |

|

|

Net income |

$ |

60,093 |

|

|

$ |

104,375 |

|

|

$ |

133,783 |

|

| Adjustments to reconcile net

income to EBITDA: |

|

|

|

|

|

|

Finance income |

|

(1,257 |

) |

|

|

(4,386 |

) |

|

|

(2,067 |

) |

|

Finance expense |

|

5,194 |

|

|

|

3,704 |

|

|

|

3,240 |

|

|

Income tax expense (recovery) |

|

75,817 |

|

|

|

33,172 |

|

|

|

(81,929 |

) |

|

Depletion, depreciation and amortization |

|

52,231 |

|

|

|

41,952 |

|

|

|

57,833 |

|

|

EBITDA |

$ |

192,078 |

|

|

$ |

178,817 |

|

|

$ |

110,860 |

|

|

Non-cash impairment charges |

|

— |

|

|

|

— |

|

|

|

85,330 |

|

| Share-based compensation

expense |

|

(2,463 |

) |

|

|

10,551 |

|

|

|

7,674 |

|

|

Unrealized foreign exchange (gain) loss |

|

(1,387 |

) |

|

|

8,992 |

|

|

|

(2,312 |

) |

|

Adjusted EBITDA |

$ |

188,228 |

|

|

$ |

198,360 |

|

|

$ |

201,552 |

|

Non-GAAP Ratios

Operating netback per boe, is a non-GAAP ratio

that the Company considers to be a key measure as it demonstrates

Parex’ profitability relative to current commodity prices. Parex

calculates operating netback per boe as operating netback

(calculated as oil and natural gas sales from production, less

royalties, operating, and transportation expense) divided by the

total equivalent sales volume including purchased oil volumes for

oil and natural gas sales price and transportation expense per boe

and by the total equivalent sales volume excluding purchased oil

volumes for royalties and operating expense per boe.

Funds flow provided by operations netback or FFO

netback, is a non-GAAP ratio that includes all cash

generated from operating activities and is calculated before

changes in non-cash working capital, divided by produced oil and

natural gas sales volumes. The Company considers funds flow

provided by operations netback per boe to be a key measure as it

demonstrates Parex’s profitability after all cash costs relative to

current commodity prices.

Basic funds flow provided by operations per share or FFO

per share, is a non-GAAP ratio that is calculated by

dividing funds flow provided by operations by the weighted average

number of basic shares outstanding. Parex presents basic funds flow

provided by operations per share whereby per share amounts are

calculated using weighted-average shares outstanding, consistent

with the calculation of earnings per share.The Company considers

basic and diluted funds flow provided by operations per share or

FFO per share to be a key measure as it demonstrates Parex’

profitability after all cash costs relative to the weighted average

number of basic and diluted shares outstanding.

Capital Management Measures

Funds flow provided by operations, is a capital

management measure that includes all cash generated from operating

activities and is calculated before changes in non-cash working

capital. The Company considers funds flow provided by operations to

be a key measure as it demonstrates Parex’s profitability after all

cash costs. A reconciliation from cash provided by operating

activities to funds flow provided by operations is as follows:

| |

For the three months ended |

| |

Mar. 31, |

|

Mar. 31, |

|

|

Dec. 31, |

|

|

($000s) |

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

Cash provided by operating activities |

$ |

97,412 |

|

$ |

131,273 |

|

$ |

194,242 |

|

|

Net change in non-cash working capital |

|

50,895 |

|

|

30,451 |

|

|

(865 |

) |

|

Funds flow provided by operations |

$ |

148,307 |

|

$ |

161,724 |

|

$ |

193,377 |

|

Working capital surplus, is a capital

management measure which the Company uses to describe its liquidity

position and ability to meet its short-term liabilities. Working

capital surplus is defined as current assets less current

liabilities.

| |

For the three months ended |

| |

Mar. 31, |

|

Mar. 31, |

|

|

Dec. 31, |

|

|

($000s) |

|

2024 |

|

|

2023 |

|

|

2023 |

|

|

Current assets |

$ |

276,113 |

|

$ |

528,744 |

|

$ |

337,175 |

|

| Current

liabilities |

|

220,212 |

|

|

499,082 |

|

|

258,148 |

|

|

Working capital surplus |

$ |

55,901 |

|

$ |

29,662 |

|

$ |

79,027 |

|

Supplementary Financial Measures

"Oil and natural gas sales per boe" is

determined by sales revenue excluding risk management contracts, as

determined in accordance with IFRS, divided by total equivalent

sales volume including purchased oil volumes.

"Royalties per boe" is comprised of royalties,

as determined in accordance with IFRS, divided by the total

equivalent sales volume and excludes purchased oil volumes.

"Net revenue per boe" is comprised of net

revenue, as determined in accordance with IFRS, divided by the

total equivalent sales volume and excludes purchased oil

volumes.

"Production expense per boe" is comprised of

production expense, as determined in accordance with IFRS, divided

by the total equivalent sales volume and excludes purchased oil

volumes.

"Transportation expense per boe" is comprised

of transportation expense, as determined in accordance with IFRS,

divided by the total equivalent sales volumes including purchased

oil volumes.

"Dividends paid per share" is comprised of

dividends declared, as determined in accordance with IFRS, divided

by the number of shares outstanding at the dividend record

date.

"Production per share growth" is comprised of

the Company's total oil and natural gas production volumes divided

by the weighted average number of basic shares outstanding. Parex

presents production per share whereby per share amounts are

calculated using weighted-average shares outstanding, consistent

with the calculation of earnings per share. Growth is determined in

comparison to the comparative year.

Oil & Gas Matters Advisory

The term "Boe" means a barrel of oil equivalent on the basis of

6 Mcf of natural gas to 1 barrel of oil ("bbl"). Boe’s may be

misleading, particularly if used in isolation. A boe conversation

ratio of 6 Mcf: 1 Bbl is based on an energy equivalency conversion

method primarily applicable at the burner tip and does not

represent a value equivalency at the wellhead. Given the value

ratio based on the current price of crude oil as compared to

natural gas is significantly different from the energy equivalency

of 6 Mcf: 1Bbl, utilizing a conversion ratio at 6 Mcf: 1 Bbl may be

misleading as an indication of value.

This press release contains a number of oil and gas metrics,

including, operating netbacks and FFO netbacks. These oil and gas

metrics have been prepared by management and do not have

standardized meanings or standard methods of calculation and

therefore such measures may not be comparable to similar measures

used by other companies and should not be used to make comparisons.

Such metrics have been included herein to provide readers with

additional measures to evaluate the Company's performance; however,

such measures are not reliable indicators of the future performance

of the Company and future performance may not compare to the

performance in previous periods and therefore such metrics should

not be unduly relied upon. Management uses these oil and gas

metrics for its own performance measurements and to provide

security holders with measures to compare the Company's operations

over time. Readers are cautioned that the information provided by

these metrics, or that can be derived from the metrics presented in

this news release, should not be relied upon for investment or

other purposes.

Any reference in this press release to short-term production

rates are useful in confirming the presence of hydrocarbons,

however such rates are not determination of the rates at which such

wells will continue production and decline thereafter and readers

are cautioned not to place reliance on such rates in calculating

the aggregate production of Parex.

Distribution Advisory

The Company's future shareholder distributions, including but

not limited to the payment of dividends and the acquisition by the

Company of its shares pursuant to an NCIB, if any, and the level

thereof is uncertain. Any decision to pay further dividends on the

common shares (including the actual amount, the declaration date,

the record date and the payment date in connection therewith and

any special dividends) or acquire shares of the Company will be

subject to the discretion of the Board of Directors of Parex and

may depend on a variety of factors, including, without limitation

the Company's business performance, financial condition, financial

requirements, growth plans, expected capital requirements and other

conditions existing at such future time including, without

limitation, contractual restrictions and satisfaction of the

solvency tests imposed on the Company under applicable corporate

law. Further, the actual amount, the declaration date, the record

date and the payment date of any dividend are subject to the

discretion of the Board. There can be no assurance that the Company

will pay dividends or repurchase any shares of the Company in the

future.

Advisory on Forward Looking Statements

Certain information regarding Parex set forth in this document

contains forward-looking statements that involve substantial known

and unknown risks and uncertainties. The use of any of the words

"plan", "expect", “prospective”, "project", "intend", "believe",

"should", "anticipate", "estimate", “forecast”, "guidance",

“budget” or other similar words, or statements that certain events

or conditions "may" or "will" occur are intended to identify

forward-looking statements. Such statements represent Parex's

internal projections, estimates or beliefs concerning, among other

things, future growth, results of operations, production, future

capital and other expenditures (including the amount, nature and

sources of funding thereof), competitive advantages, plans for and

results of drilling activity, environmental matters, business

prospects and opportunities. These statements are only predictions

and actual events or results may differ materially. Although the

Company’s management believes that the expectations reflected in

the forward-looking statements are reasonable, it cannot guarantee

future results, levels of activity, performance or achievement

since such expectations are inherently subject to significant

business, economic, competitive, political and social uncertainties

and contingencies. Many factors could cause Parex's actual results

to differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Parex.

In particular, forward-looking statements contained in this

document include, but are not limited to, statements with respect

to: the Company’s focus, plans, priorities and strategies; Parex's

expectations with respect to the definitive agreements entered into

with Ecopetrol S.A., including the expected benefits to be derived

therefrom; Parex's 2024 average production guidance and capital

expenditure guidance; Parex's expectations with respect to the

Arauca-8 well, including that facility installations will be

completed in the second half of 2024 and in connection therewith,

production from the well can be further optimized, and the

Company's related plans to commence natural gas sales by the end of

the year; the anticipated timing of when production will commence

at the Arauca-15 well and that once the Arauca-15 well is

completed, the rig is expected to move to the Arauca-12 well

follow-up location; expectations with respect to the low decline

profile of the Cabrestero Block and Management's related focus on

enhanced oil recovery and associated technology applications; the

expected timing for the first Small 'E' Target well to spud; the

anticipated timing of when the Arantes at Block LLA-122 well will

produce initial results; the anticipated timing of when the Hidra

well will spud; the anticipated terms of the Company's Q2 2024

regular quarterly dividend, including its expectation that it will

be designated as an "eligible dividend"; and the anticipated date

and time of Parex's conference call to discuss Q1 2024 results.

These forward-looking statements are subject to numerous risks

and uncertainties, including but not limited to, the impact of

general economic conditions in Canada and Colombia; prolonged

volatility in commodity prices; industry conditions including

changes in laws and regulations including adoption of new

environmental laws and regulations, and changes in how they are

interpreted and enforced in Canada and Colombia; determinations by

OPEC and other countries as to production levels; competition; lack

of availability of qualified personnel; the results of exploration

and development drilling and related activities; obtaining required

approvals of regulatory authorities in Canada and Colombia; the

risks associated with negotiating with foreign governments as well

as country risk associated with conducting international

activities; volatility in market prices for oil; fluctuations in

foreign exchange or interest rates; environmental risks; changes in

income tax laws or changes in tax laws and incentive programs

relating to the oil industry; changes to pipeline capacity; ability

to access sufficient capital from internal and external sources;

failure of counterparties to perform under contracts; the risk that

Brent oil prices may be lower than anticipated; the risk that

Parex's evaluation of its existing portfolio of development and

exploration opportunities may not be consistent with its

expectations; the risk that Parex may not have sufficient financial

resources in the future to provide distributions to its

shareholders; the risk that the Board may not declare dividends in

the future or that Parex's dividend policy changes; the risk that

Parex may not be responsive to changes in commodity prices; the

risk that Parex may not meet its production guidance for the year

ended December 31, 2024; the risk that Parex's 2024 capital

expenditures may be greater than anticipated; the risk that Parex

may not realize the anticipated benefits from the definitive

agreements entered into with Ecopetrol S.A.; the risk that with

respect to the Arauca-8 well, facility installations will not be

completed on the timeline expected or at all and, accordingly, that

Parex may not realize the expected benefits to be derived

therefrom; the risk that initial production does not commence at

the Arauca-15 well when expected or at all, and/or the rig does not

move to the Arauca-12 well follow-up location; the risk that the

expected low decline profile of the Cabrestero Block does not

materialize; the risk that the first Small 'E' Target well is not

spud when expected or at all; the risk that the Arantes at Block

LLA-122 well does not produce initial results when expected or at

all; the risk that the Hidra big 'E' exploration well is not spud

when expected or at all; and other factors, many of which are

beyond the control of the Company.

Readers are cautioned that the foregoing list of factors is not

exhaustive. Additional information on these and other factors that

could affect Parex's operations and financial results are included

in reports on file with Canadian securities regulatory authorities

and may be accessed through the SEDAR+ website

(www.sedarplus.ca).

Although the forward-looking statements contained in this

document are based upon assumptions which Management believes to be

reasonable, the Company cannot assure investors that actual results

will be consistent with these forward-looking statements. With

respect to forward-looking statements contained in this document,

Parex has made assumptions regarding, among other things: current

and anticipated commodity prices and royalty regimes; availability

of skilled labour; timing and amount of capital expenditures;

future exchange rates; the price of oil, including the anticipated

Brent oil price; the impact of increasing competition; conditions

in general economic and financial markets; availability of drilling

and related equipment; effects of regulation by governmental

agencies; receipt of partner, regulatory and community approvals;

royalty rates; future operating costs; uninterrupted access to

areas of Parex's operations and infrastructure; recoverability of

reserves and future production rates; the status of litigation;

timing of drilling and completion of wells; on-stream timing of

production from successful exploration wells; operational

performance of non-operated producing fields; pipeline capacity;

that Parex will have sufficient cash flow, debt or equity sources

or other financial resources required to fund its capital and

operating expenditures and requirements as needed; that Parex's

conduct and results of operations will be consistent with its

expectations; that Parex will have the ability to develop its oil

and gas properties in the manner currently contemplated; that

Parex's evaluation of its existing portfolio of development and

exploration opportunities is consistent with its expectations;

current or, where applicable, proposed industry conditions, laws

and regulations will continue in effect or as anticipated as

described herein; that the estimates of Parex's production and

reserves volumes and the assumptions related thereto (including

commodity prices and development costs) are accurate in all

material respects; that Parex will be able to obtain contract

extensions or fulfill the contractual obligations required to

retain its rights to explore, develop and exploit any of its

undeveloped properties; that Parex will have sufficient financial

resources to pay dividends and acquire shares pursuant to its NCIB

in the future; that Parex will realize the anticipated benefits

from the definitive agreements entered into with Ecopetrol S.A.;

that with respect to the Arauca-8 well, facility installations will

be completed in the second half of 2024; that at the Cabrestero

Block, Management's focus on enhanced oil recovery and associated

technology applications will result in anticipated benefits; and

other matters.

Management has included the above summary of assumptions and

risks related to forward-looking information provided in this

document in order to provide shareholders with a more complete

perspective on Parex's current and future operations and such

information may not be appropriate for other purposes. Parex's

actual results, performance or achievement could differ materially

from those expressed in, or implied by, these forward-looking

statements and, accordingly, no assurance can be given that any of

the events anticipated by the forward-looking statements will

transpire or occur, or if any of them do, what benefits Parex will

derive. These forward-looking statements are made as of the date of

this document and Parex disclaims any intent or obligation to

update publicly any forward-looking statements, whether as a result

of new information, future events or results or otherwise, other

than as required by applicable securities laws.

This press release contains information that may be considered a

financial outlook under applicable securities laws about the

Company's potential financial position, including, but not limited

to; Parex's 2024 capital expenditure guidance; and the anticipated

terms of the Company's Q2 2024 regular quarterly dividend including

its expectation that it will be designated as an "eligible

dividend", all of which are subject to numerous assumptions, risk

factors, limitations and qualifications, including those set forth

in the above paragraphs. The actual results of operations of the

Company and the resulting financial results will vary from the

amounts set forth in this press release and such variations may be

material. This information has been provided for illustration only

and with respect to future periods are based on budgets and

forecasts that are speculative and are subject to a variety of

contingencies and may not be appropriate for other purposes.

Accordingly, these estimates are not to be relied upon as

indicative of future results. Except as required by applicable

securities laws, the Company undertakes no obligation to update

such financial outlook. The financial outlook contained in this

press release was made as of the date of this press release and was

provided for the purpose of providing further information about the

Company's potential future business operations. Readers are

cautioned that the financial outlook contained in this press

release is not conclusive and is subject to change.

The following abbreviations used in this press release have the

meanings set forth below:

| bbl |

one

barrel |

| bbls |

barrels |

| bbl/d |

barrels per day |

| boe |

barrels of oil equivalent of natural gas; one barrel of oil or

natural gas liquids for six thousand cubic feet of natural gas |

| boe/d |

barrels of oil equivalent of natural gas per day |

| mcf |

thousand cubic feet |

| mcf/d |

thousand cubic feet per day |

| W.I. |

working interest |

PDF

available: http://ml.globenewswire.com/Resource/Download/16b7f92a-f989-478b-b355-bdb55030c365

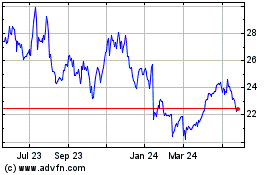

Parex Resources (TSX:PXT)

Historical Stock Chart

From Jan 2025 to Feb 2025

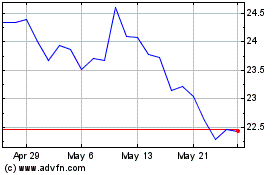

Parex Resources (TSX:PXT)

Historical Stock Chart

From Feb 2024 to Feb 2025