Savaria's Best Year Ever!

13 March 2014 - 7:30AM

Marketwired

Savaria's Best Year Ever!

LAVAL, QUEBEC--(Marketwired - Mar 12, 2014) - Savaria

Corporation (TSX:SIS), North America's leader in the accessibility

industry, discloses its results for its fourth quarter ended

December 31, 2013 and for fiscal 2013.

Highlights

- In the fourth quarter of 2013, revenue is up 7%, from $17.8

million in fourth quarter 2012 to $19.1 million. For fiscal 2013,

revenue is up 13.5%, from $66.7 million to $75.7 million;

- Net income for the fourth quarter of 2013 is up $173,000, from

$952,000 in 2012 to $1.1 million in 2013. For fiscal 2013, net

income amounts to $5.3 million or 23 cents per share, up from $1.6

million or 7 cents per share in 2012;

- Earnings before interest, taxes, depreciation and amortization

("EBITDA") for the fourth quarter of 2013 went from $1.8 million to

$2 million, up 13.2 %. For fiscal 2013, EBITDA is up by $5 million

or 113%, to $9.5 million or 41 cents per share, compared to $4.5

million or 19 cents per share in 2012. This is the highest yearly

EBITDA in the history of the Corporation;

- China operations doubling in size by moving to a new facility

in May 2013;

- Introduction in September 2013 of a new stairlift for curved

staircases, the Stairfriend.

A Word from the President

"Savaria realized its best year ever for both sales and EBITDA.

This was achieved through market share gains from the closure of a

major U.S. competitor in the fall of 2012 in combination with

managing sales and administrative costs and productivity

efficiencies," declared Marcel Bourassa, President and Chief

Executive Officer of Savaria.

"The successful introduction in September 2013 of

Stairfriend, a new stairlift for curved staircases,

demonstrated to dealers and consumers alike that Savaria offers a

complete portfolio of accessibility products, a unique position and

competitive advantage unmatched by another manufacturer in the

world.

"In May 2013, we doubled the size of our factory in Huizhou,

China moving to a new facility of 75,000 square feet. This

increased capacity allows the company to respond efficiently to

increased demand for both parts and finished products.

"Our strong financial position enables us to fuel our growth and

to offer a dividend highly appreciated by our shareholders,"

concluded Mr. Bourassa.

Operating Results (Comparative Analysis with Fourth Quarter and

Fiscal 2012)

- In the fourth quarter of 2013, revenue is up $1.3 million or

7%, from $17.8 million in fourth quarter 2012 to $19.1 million. For

fiscal 2013, revenue is up $9 million or 13.5%, from $66.7 million

to $75.7 million.

- Gross margin for the fourth quarter of 2013 is up $756,000, at

28.7% of revenue, compared to 26.5% in the fourth quarter of 2012.

For fiscal 2013, gross margin is up $4.2 million, at 29.4% of

revenue compared to 27.1% in 2012. This improvement is due to the

increase in revenue and to the cost savings following the

relocation of the Brampton plant in the building acquired in

2012.

- Operating income for the fourth quarter of 2013 is up $106,000,

from $1.3 million in 2012 to $1.4 million in 2013. For fiscal 2013,

operating income amounts to $7.5 million, an increase of $4.6

million or 156%.

- Net income for the fourth quarter of 2013 is up $173,000, from

$952,000 in 2012 to $1.1 million in 2013, an increase of 18.2%. For

fiscal 2013, net income amounts to $5.3 million, an increase of

$3.7 million or 236%.

- EBITDA for the fourth quarter of 2013 went from $1.8 million or

8 cents per share in 2012, to $2 million or 9 cents per share in

2013, an increase of $239,000. For fiscal 2013, EBITDA amounts to

$9.5 million or 41 cents per share, compared to $4.5 million or 19

cents per share in 2012, up by $5 million.

Dividend

The Corporation's Board of Directors has declared a dividend of

13 cents ($0.13) per share: a 2 cents ($0.02) fourth quarter

dividend plus a special 11 cents ($0.11) year-end dividend. The

dividend is payable on April 7, 2014 to shareholders of record of

the Corporation at the close of business on March 24, 2014. This is

an eligible dividend within the meaning of the Income Tax Act.

Savaria Corporation (savaria.com) is North America's leader in

the accessibility industry focused on meeting the needs of people

with mobility challenges. Savaria designs, manufactures, installs

and distributes primarily elevators for home and commercial use, as

well as stairlifts and vertical and inclined platform lifts. In

addition, it converts and adapts minivans to be wheelchair

accessible. The diversity of its product line, one of the world's

most comprehensive, enables the Corporation to stand out by

proposing an integrated and customized solution for its customers'

mobility needs. Its operations in China have substantially grown

and the collaboration with Savaria's other Canadian facilities

increases its competitive edge in the market place. The Corporation

records some 60% of its revenue outside Canada, primarily in the

United States. It has a sales network of some 600 retailers in

North America and employs some 360 people at its head office in

Laval and at its plants and sales offices in Montreal (Quebec),

Brampton and London (Ontario), Calgary (Alberta) and Huizhou

(China).

Compliance with International Financial Reporting Standards

("IFRS")

The information appearing in this press release has been

prepared in accordance with IFRS. However, the Corporation uses

EBITDA for analysis purposes to measure its financial performance.

This measure has no standardized definition in accordance with IFRS

and is therefore regarded as a non-IFRS measure. This measure may

therefore not be comparable to similar measures reported by other

companies. Reconciliation between net income for the period and

EBITDA is provided in the Financial Highlights section

below.

Cautionary Notice Regarding Forward-Looking Statements

Certain information in this press release may constitute

"forward-looking statements" regarding Savaria, including, without

being limited thereto, understanding of the elements that might

affect the Corporation's future, relating to its financial or

operating performance, the costs and schedule of future

acquisitions, supplementary capital expenditure requirements and

legislative matters. Most frequently, but not invariably,

forward-looking statements are identified by the use of such terms

as "plan", "expect", "should", "could", "budget", "expected",

"estimated" "forecast", "intend", "anticipate", "believe", variants

thereof (including negative variants) or statements that certain

events, results or shares "could", "should" or "will" occur or be

achieved. Such statements involve known and unknown risks,

uncertainties and other factors liable to cause Savaria's actual

results, performance or achievements to differ materially from

those set forth in or underlying the forward-looking statements.

Such factors notably include general, economic, competitive,

political and social uncertainties. Although Savaria has attempted

to identify the key elements liable to cause actual measures,

events or results to differ from those described in the

forward-looking statements, other factors could have an impact on

the reality and produce unexpected results. The forward-looking

statements contained herein are valid at the date of this press

release. As there can be no assurance that these forward-looking

statements will prove accurate, actual future results and events

could differ materially from those anticipated therein.

Accordingly, readers are strongly advised not to unduly rely on

these forward-looking statements.

Complete financial statements and the management's report for

fiscal 2013 will be available shortly on Savaria's website and on

SEDAR (www.sedar.com).

Financial Highlights

| (in thousands, except per-share amounts and

percentages) |

Quarters Ended December 31, (Unaudited) |

|

Years Ended December 31, |

|

|

2013 |

|

2012 |

|

Change |

|

2013 |

|

2012 |

|

Change |

|

|

Revenue |

$19,120 |

|

$17,865 |

|

7 |

% |

$75,739 |

|

$66,734 |

|

13.5 |

% |

|

Gross margin as a % of revenue |

28.7 |

% |

26.5 |

% |

n/a |

|

29.4 |

% |

27.1 |

% |

n/a |

|

|

Operating costs |

$4,110 |

|

$3,457 |

|

18.9 |

% |

$15,085 |

|

$14,135 |

|

6.7 |

% |

|

As a % of revenue |

21.5 |

% |

19.4 |

% |

n/a |

|

19.9 |

% |

21.2 |

% |

n/a |

|

|

Operating income |

$1,375 |

|

$1,269 |

|

8.4 |

% |

$7,509 |

|

$2,930 |

|

156 |

% |

|

As a % of revenue |

7.2 |

% |

7.1 |

% |

n/a |

|

9.9 |

% |

4.4 |

% |

n/a |

|

|

Gain (loss) on foreign exchange |

$236 |

|

$48 |

|

392 |

% |

$330 |

|

$(69 |

) |

578 |

% |

|

Net income |

$1,125 |

|

$952 |

|

18.2 |

% |

$5,299 |

|

$1,578 |

|

236 |

% |

|

Earnings per share - basic and diluted |

$0.05 |

|

$0.04 |

|

25 |

% |

$0.23 |

|

$0.07 |

|

229 |

% |

|

EBITDA (1) |

$2,045 |

|

$1,806 |

|

13,2 |

% |

$9,538 |

|

$4,488 |

|

113 |

% |

|

EBITDA per share - basic and diluted |

$0.09 |

|

$0.08 |

|

12,5 |

% |

$0.41 |

|

$0.19 |

|

116 |

% |

|

Dividends declared per share |

$0.02 |

|

- |

|

n/a |

|

$0.14 |

|

$0.094 |

|

n/a |

|

|

Weighted average number of common shares outstanding - diluted |

23,855 |

|

23,132 |

|

n/a |

|

23,444 |

|

23,116 |

|

n/a |

|

|

|

As at Dec. 31, 2013 |

|

As at Dec. 31, 2012 |

|

|

|

|

Total assets |

$49,013 |

|

$49,380 |

|

|

|

|

Total liabilities |

$28,780 |

|

$30,156 |

|

|

|

|

Shareholders' equity |

$20,233 |

|

$19,224 |

|

|

|

|

|

|

(1) |

Reconciliation of EBITDA with net income provided in the following

table. |

Although EBITDA is not recognized according to IFRS, it is used

by management, investors and analysts to assess the Corporation's

financial and operating performance.

Reconciliation of EBITDA with Net Income

|

(in thousands of dollars - unaudited) |

Quarters Ended December 31, |

Years Ended December 31, |

|

|

2013 |

2012 |

2013 |

2012 |

|

Net income |

$1,125 |

$952 |

$5,299 |

$1,578 |

|

Plus : |

|

|

|

|

|

Interest on long-term debt |

135 |

210 |

612 |

732 |

|

Interest expense and banking fees |

36 |

28 |

127 |

96 |

|

Income tax expense |

319 |

222 |

1,920 |

571 |

|

Depreciation of fixed assets |

230 |

201 |

831 |

789 |

|

Amortization of intangible assets |

204 |

196 |

765 |

752 |

|

Less: |

|

|

|

|

|

Interest income |

4 |

3 |

16 |

30 |

|

EBITDA |

$2,045 |

$1,806 |

$9,538 |

$4,488 |

Helene Bernier, CPA, CAVice-President, Finance1-800-931-5655,

ext. 248helene.bernier@savaria.comMarcel BourassaPresident and

Chief Executive

Officer1-800-661-5112marcel.bourassa@savaria.comwww.savaria.com

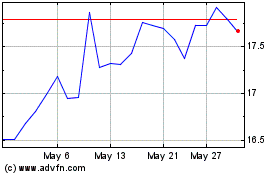

Savaria (TSX:SIS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Savaria (TSX:SIS)

Historical Stock Chart

From Nov 2023 to Nov 2024