Skeena Resources Limited (TSX: SKE; NYSE: SKE) (“Skeena” or the

“Company”) announced today that it has entered into an agreement

with a syndicate of underwriters led by Raymond James Ltd. (the

“Underwriters”), pursuant to which the Underwriters have agreed to

purchase, on a bought deal basis, 4,958,678 common shares of the

Company (the “Common Shares”) at a price of C$6.05 per Common

Share, for total gross proceeds of approximately C$30 million (the

“Offering”). The Company will also grant to the Underwriters an

over-allotment option (the “Over-Allotment Option”) to purchase up

to 743,801 additional Common Shares (the “Over-Allotment Shares”).

The Over-Allotment Option will be exercisable for a period of 30

days following closing.

The Common Shares will be offered by way of a

prospectus supplement (the “Supplement”) to the Company’s base

shelf prospectus in all of the provinces of Canada, except the

province of Québec. The Supplement will also be filed with the U.S.

Securities and Exchange Commission (the “SEC”) as part of the

Company’s registration statement on Form F-10 (File No. 333-267434)

in the United States under the multi-jurisdictional disclosure

system adopted by the United States and Canada. Such documents

contain important information about the Offering.

The net proceeds of the Offering will be used by

the Company to exercise their right (subject to the terms and

conditions of the Company’s buy-back rights) to buy down a 0.5% NSR

royalty currently held by Barrick Gold Corporation, for a payment

of C$17.5mm, as well as general administration and corporate

purposes.

The Offering is expected to close on or about

September 22, 2022, subject to customary closing conditions

including, but not limited to, the receipt of all necessary

approvals including the approval of the Toronto Stock Exchange and

the New York Stock Exchange and the applicable securities

regulatory authorities.

The Company has filed a registration statement

on Form F-10 with the SEC for the Offering to which this

communication relates. Before you invest, you should read the

registration statement and other documents the Company has filed

with the SEC, and the Supplement, when available, for more complete

information about the Company and this Offering. You may get these

documents for free by visiting EDGAR on the SEC website at

www.sec.gov or on the SEDAR website at www.sedar.com.

Alternatively, the Company, any Underwriter or any dealer

participating in the Offering will arrange to send you the

Supplement or you may request it from the Corporate Secretary of

Skeena Resources Limited. at Suite 650, 1021 West Hastings St,

Vancouver, BC, V6E 0C3 Canada telephone (604) 684-8725.

No securities regulatory authority has either

approved or disapproved of the contents of this news release. This

news release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities in any province, state or jurisdiction in which

such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

province, state or jurisdiction.

About Skeena

Skeena Resources Limited is a Canadian mining

exploration and development company focused on revitalizing the

past-producing Eskay Creek gold-silver mine located in Tahltan

Territory in the Golden Triangle of northwest British Columbia,

Canada. The Company released a Feasibility Study for Eskay Creek in

September 2022 which highlights an open-pit average grade of 4.00

g/t AuEq, an after-tax NPV5% of C$1.4B, 50% IRR, and a 1-year

payback at US$1,700/oz Au and US$19/oz Ag. Skeena is currently

continuing exploration drilling at Eskay Creek.

On behalf of the Board of Directors of Skeena

Resources Limited,

Walter Coles Jr.

CEO & Director

Contact Information

Investor Inquiries: info@skeenaresources.com

Office Phone: +1 604 684 8725

Qualified Persons

In accordance with NI 43-101, Paul Geddes,

P.Geo., Senior Vice President Exploration and Resource Development,

is the Qualified Person for the Company and has reviewed and

approved the technical and scientific content of this news release.

The Company strictly adheres to CIM Best Practices Guidelines in

conducting, documenting, and reporting the exploration activities

on its projects.

Cautionary note regarding

forward-looking statements

Certain statements and information contained or

incorporated by reference in this news release constitute

“forward-looking information” and “forward-looking statements”

within the meaning of applicable Canadian and United States

securities legislation (collectively, “forward-looking

statements”). These statements relate to future events or our

future performance. The use of words such as “anticipates”,

“believes”, “proposes”, “contemplates”, “generates”, “targets”, “is

projected”, “is planned”, “considers”, “estimates”, “expects”, “is

expected”, “potential” and similar expressions, or statements that

certain actions, events or results “may”, “might”, “will”, “could”,

or “would” be taken, achieved, or occur, may identify

forward-looking statements. All statements other than statements of

historical fact are forward-looking statements. Specific

forward-looking statements contained herein include, but are not

limited to, statements regarding the intended use of proceeds,

over-allotment option, timing with respect to the filing of the

prospectus and closing of the Offering, revitaization of Eskay

Creek and results of the Feasibility Study. . Such forward-looking

statements are based on material factors and/or assumptions which

include, but are not limited to, the estimation of mineral

resources and reserves, the realization of resource and reserve

estimates, metal prices, taxation, the estimation, timing and

amount of future exploration and development, capital and operating

costs, the availability of financing, the receipt of regulatory

approvals, environmental risks, title disputes and the assumptions

set forth herein and in the Company’s MD&A for the year ended

December 31, 2021, its most recently filed interim MD&A, and

the Company’s Annual Information Form (“AIF”) dated March 31, 2022.

Such forward-looking statements represent the Company’s management

expectations, estimates and projections regarding future events or

circumstances on the date the statements are made, and are

necessarily based on several estimates and assumptions that, while

considered reasonable by the Company as of the date hereof, are not

guarantees of future performance. Actual events and results may

differ materially from those described herein, and are subject to

significant operational, business, economic, and regulatory risks

and uncertainties. The risks and uncertainties that may affect the

forward-looking statements in this news release include, among

others: the inherent risks involved in exploration and development

of mineral properties, including permitting and other government

approvals; changes in economic conditions, including changes in the

price of gold and other key variables; changes in mine plans and

other factors, including accidents, equipment breakdown, bad

weather and other project execution delays, many of which are

beyond the control of the Company; environmental risks and

unanticipated reclamation expenses; and other risk factors

identified in the Company’s MD&A for the year ended December

31, 2021, its most recently filed interim MD&A, the AIF dated

March 31, 2022, and in the Company’s other periodic filings with

securities and regulatory authorities in Canada and the United

States that are available on SEDAR at www.sedar.com or on EDGAR at

www.sec.gov.

Readers should not place undue reliance on such

forward-looking statements. Any forward-looking statement speaks

only as of the date on which it is made and Company does not

undertake any obligations to update and/or revise any

forward-looking statements except as required by applicable

securities laws.

Cautionary note to U.S. Investors

concerning estimates of mineral reserves and mineral

resources

Skeena’s mineral reserves and mineral resources

included or incorporated by reference herein have been estimated in

accordance with National Instrument 43-101 – Standards of

Disclosure for Mineral Projects (“NI 43-101”) as required by

Canadian securities regulatory authorities, which differ from the

requirements of U.S. securities laws. The terms “mineral reserve”,

“proven mineral reserve”, “probable mineral reserve”, “mineral

resource”, “measured mineral resource”, “indicated mineral

resource” and “inferred mineral resource” are Canadian mining terms

as defined in accordance with NI 43-101 and the Canadian Institute

of Mining, Metallurgy and Petroleum (“CIM”) “CIM Definition

Standards – For Mineral Resources and Mineral Reserves” adopted by

the CIM Council (as amended, the “CIM Definition Standards”). These

standards differ significantly from the mineral property disclosure

requirements of the U.S. Securities and Exchange Commission in

Regulation S-K Subpart 1300 (the “SEC Modernization Rules”). Skeena

is not currently subject to the SEC Modernization Rules.

Accordingly, Skeena’s disclosure of mineralization and other

technical information may differ significantly from the information

that would be disclosed had Skeena prepared the information under

the standards adopted under the SEC Modernization Rules.

In addition, investors are cautioned not to

assume that any part or all of Skeena’s mineral resources

constitute or will be converted into reserves. These terms have a

great amount of uncertainty as to their economic and legal

feasibility. Accordingly, investors are cautioned not to assume

that any “measured”, “indicated”, or “inferred” mineral resources

that Skeena reports are or will be economically or legally

mineable. Further, “inferred mineral resources” have a great amount

of uncertainty as to their existence, and great uncertainty as to

their economic and legal feasibility. It cannot be assumed that all

or any part of an “inferred mineral resource” will ever be upgraded

to a higher category. Under Canadian securities laws, estimates of

“inferred mineral resources” may not form the basis of feasibility

or prefeasibility studies, except in rare cases where permitted

under NI 43-101.

For these reasons, the mineral reserve and

mineral resource estimates and related information presented herein

may not be comparable to similar information made public by U.S.

companies subject to the reporting and disclosure requirements

under the U.S. federal securities laws and the rules and

regulations thereunder.

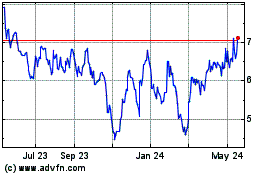

Skeena Resources (TSX:SKE)

Historical Stock Chart

From Dec 2024 to Jan 2025

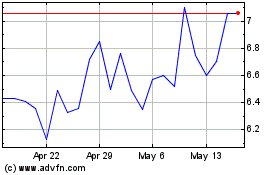

Skeena Resources (TSX:SKE)

Historical Stock Chart

From Jan 2024 to Jan 2025