Arias Resource Capital Fund II L.P. and Arias Resource Capital Fund

II (Mexico) L.P. (the “

Nominating Shareholders”),

together with other affiliates of Arias Resource Capital and its

principal (together with the Nominating Shareholders,

“

ARC”) today responded to the misleading and

inaccurate statements made by the board of directors (the

“

Sierra Board”) of Sierra Metals Inc.

(“

Sierra” or the “

Company”) (TSX:

SMT) following the close of business on Friday, May 12, 2023 and

earlier this morning, May 15, 2023. ARC holds approximately 27% of

the outstanding shares of Sierra.

Rather than answer to Sierra shareholders for

their woeful performance and unthinkable destruction of over 90% of

shareholder value, ARC believes that the Sierra Board has tried to

paint ARC and its principal, J. Alberto Arias, as self-interested

actors, while falsely and maliciously claiming that Mr. Arias is

somehow to blame for the situation that the Company now finds

itself in. Furthermore, the Sierra Board has blatantly

mischaracterized the discussions and engagement with respect to

Compañia Minera Kolpa S.A. (“Kolpa”). The

Nominating Shareholders urge all shareholders to hold the Sierra

Board accountable for its attempted obfuscation.

Contrary to the Company’s May 12, 2023

assertions, Mr. Arias and the other ARC representative left the

Sierra Board almost two years ago. The distribution of Sierra

shares to the limited partners of an ARC-managed fund that Sierra

now blames for its share price performance was made over two years

ago, and does not explain the over 90% loss of value to

shareholders or the disastrous operational performance of the

Company since.

Fundamentally, the Sierra Board and the

Company’s current management have no one to blame for the state of

the Company but themselves. And they owe shareholders the truth

about the Company’s 2021 strategic review process (the

“2021 Strategic Review Process”). Sierra’s press

release on Friday May 12, 2023 states that “the strategic review

process was concluded without having identified a buyer for the

Company”, which is not accurate. ARC recently learned that,

following the departure of the ARC representatives from the Sierra

Board in 2021, the Sierra Board received and rejected an all-cash

offer from a prominent, fully-financed strategic buyer. To the best

of ARC’s information and belief, the Sierra Board, following months

of due diligence and after entering into an exclusivity agreement,

received and rejected a cash offer which was in excess of US$400

million, a valuation more than eight times the Company’s market

value as of the close on May 12, 2023.

“This loss to all shareholders is

incomprehensible,” Mr. Arias stated. “We don’t see how the Sierra

Board acting reasonably with a view to the best interest of Sierra

and all its shareholders could have rejected an offer that would

have received widespread support from the Company’s stakeholders.

ARC is completely vindicated in its assessment that the Sierra

special committee could not – or would not – deliver under the 2021

Strategic Review Process. But the incumbent Sierra Board is now

following the same misguided path after destroying over 90% of

Sierra's market capitalization over the past two years,” Mr. Arias

said.

Similarly, ARC believes that the Sierra Board’s

description in its May 15, 2023 press release of its engagement

regarding a potential transaction with Kolpa is inaccurate.

Following Kolpa’s public offer, over four months passed before the

Company decided to reach out to Kolpa with respect to the proposed

transaction and concurrent financing. Despite Kolpa having provided

a second offer with enhanced terms in respect of an operational

merger, which represented, and continues to represent, a

significant premium to the prevailing market price of Sierra

shares, the Company refused to provide any counter-offer.

Notwithstanding constructive attempts by Kolpa and its financing

sources to reach common ground with Sierra regarding mutually

acceptable asset valuations, Kolpa was met with refusals to engage

in ordinary course discussions and a litany of contrived excuses to

avoid meaningful engagement. Contrary to today’s press release from

Sierra, Kolpa has provided all information in its possession that

was requested by Sierra. Finally, in the Sierra Board’s own words,

the Sierra Board’s refusal to engage further was based on ARC’s

intention to nominate directors to the Sierra Board and not as a

result of an impasse in Kolpa-related matters, which is directly

contrary to the Sierra Board’s statements earlier this morning.

In addition to providing Sierra shareholders

with the accurate description of events outlined above, ARC and Mr.

Arias plan to further consider the contents of Sierra’s May 12,

2023 and May 15, 2023 press releases and respond in due course,

including evaluating whether any further action will be taken.

In light of this new information surrounding the

fully-financed, premium offer rejected as part of the 2021

Strategic Review Process, ARC is also examining events surrounding

the failure of the 2021 Strategic Review Process and the subsequent

strategic review process announced by Sierra in October 2022. The

actions of the Sierra Board and the related outcomes appear to be

squarely at odds with the best interests of the Company and its

shareholders, while seemingly being motivated by a vindictive and

self-interested “anyone but Arias shareholders” approach.

URGENT NEED FOR CHANGE

Despite these deliberate falsehoods to distract

shareholders from the Company’s staggering and mounting losses, ARC

cautions all Sierra shareholders to remain focused on the urgent

task of protecting Sierra by taking the crucial first step of

electing a reconstituted Sierra Board. The Nominating Shareholders

have proposed five highly qualified nominees – J. Alberto Arias,

Derek White, Daniel Tellechea, Ricardo Arrarte, and Alonso Checa

(the “ARC Nominees”) – for election to the Board

at Sierra’s annual general and special meeting scheduled for June

28, 2023 (the “2023 AGM”).

A copy of ARC’s preliminary information circular

dated May 11, 2023 (the “Circular”) is available

under Sierra’s profile on SEDAR at www.sedar.com and at

www.ProtectYourSierraInvestment.com, where ARC’s press releases and

other relevant case for change documents are available.

Shareholders can also call or text Kingsdale

Advisors on 1.888.370.3955 (toll free in North America), or email

contactus@kingsdaleadvisors.com, or chat with an advisor on

www.ProtectYourSierraInvestment.com for more information.

ADVISORS

ARC has retained Kingsdale Advisors as its

strategic shareholder and communications advisor and, should ARC

commence a formal solicitation of proxies, its strategic

shareholder advisor and proxy solicitation agent. ARC has retained

Stikeman Elliott LLP as its legal advisor.

ABOUT ARC

Arias Resource Capital, founded in 2007, is a

Miami-based private equity firm in the metals sector that invests

in critical materials empowering the clean energy revolution.

CAUTIONARY NOTES AND FORWARD-LOOKING

STATEMENTS

This news release contains forward-looking

information within the meaning of applicable securities laws

(“forward-looking statements”) and are prospective

in nature. These forward-looking statements are not based on

historical facts, but rather on current expectations and may

include projections about future events and estimates and their

underlying assumptions, statements regarding plans, objectives,

intentions and expectations with respect to future financial

results, events, operations, services, product development and

potential, and statements regarding future performance.

Forward-looking statements are generally identified by the words

“expects”, “anticipates”, “believes”, “intends”, “estimates”,

“plans”, “will”, “may”, “should”, “could”, “believes”, “potential”

or “continue” and similar expressions, or the negative thereof.

Forward-looking statements in this news release include, without

limitation, statements regarding the potential benefits,

contributions and development of the ARC Nominees and the expected

impact and results of Sierra’s strategic review process and

Sierra’s corporate governance practices. There are numerous risks

and uncertainties that could cause actual results and ARC’s plans

and objectives to differ materially from those expressed in, or

implied or projected by, the forward-looking information and

statements in this news release, including, without limitation, the

risks described under the headings such as “Cautionary Statement –

Forward Looking Information” and “Risk Factors” in Sierra’s annual

information form dated March 28, 2023 for its fiscal year ended

December 31, 2022, and other risks identified in Sierra’s filings

with Canadian securities regulatory authorities which are available

under Sierra’s profile on SEDAR at www.sedar.com. The

forward-looking statements speak only as of the date hereof and,

other than as required by applicable law, ARC undertakes no duty or

obligation to update or revise any forward-looking information or

statements contained in this news release as a result of new

information, future events, changes in expectation or

otherwise.

ADDITIONAL INFORMATION

In connection with the Nominating Shareholders’

solicitation of proxies in respect of Sierra’s 2023 AGM, the

Nominating Shareholders have filed and mailed the Circular to

Sierra shareholders and intend to file and mail a form of proxy in

due course.

Any solicitation made by ARC will be made by it

and not by or on behalf of the management of Sierra. All costs

incurred for any solicitation will be borne by ARC, provided that,

subject to applicable law, ARC may seek reimbursement from Sierra

of ARC’s out-of-pocket expenses, including proxy solicitation

expenses and legal fees, incurred in connection with any successful

result at a meeting of Sierra shareholders. Proxies may be

solicited by ARC pursuant to the Circular. Solicitations may be

made by or on behalf of ARC by mail, telephone, fax, email or other

electronic means as well as by newspaper or other media

advertising, and in person by directors, officers and employees of

ARC, who will not be specifically remunerated therefor. ARC may

also solicit proxies in reliance upon the public broadcast

exemption to the solicitation requirements under applicable

Canadian corporate and securities laws, including through press

releases, speeches or publications, and by any other manner

permitted under applicable Canadian laws. ARC may engage the

services of one or more agents and authorize other persons to

assist in soliciting proxies on its behalf, which agents would

receive customary fees for such services. In particular, ARC has

engaged Kingsdale Advisors (“Kingsdale”) to act as

ARC’s shareholder and communications advisor and, should ARC

commence a formal solicitation of proxies, to act as its strategic

shareholder advisor and proxy solicitation agent to solicit proxies

in the United States and Canada. Pursuant to this engagement,

Kingsdale will receive an initial fee of C$150,000, plus a

customary fee for each call to and from shareholders. Proxies may

be revoked by instrument in writing by a shareholder giving the

proxy or by its duly authorized officer or attorney, or in any

other manner permitted by law and the articles or by-laws of

Sierra. None of ARC nor, to its knowledge, any of its associates or

affiliates, has any material interest, direct or indirect: (i) in

any transaction since the beginning of Sierra’s most recently

completed financial year or in any proposed transaction that has

materially affected or would materially affect Sierra or any of its

subsidiaries; or (ii) by way of beneficial ownership of securities

or otherwise, in any matter proposed to be acted on by Sierra at

the 2023 AGM, other than the election of directors to the board of

Sierra or as disclosed in accordance with applicable law.

See the Circular for further information

regarding the Nominating Shareholders, ARC and the ARC Nominees. A

copy is available under Sierra’s profile on SEDAR at

www.sedar.com.

Sierra trades on the Toronto Stock Exchange

under the symbol “SMT”. Sierra’s head office is located at 77 King

Street West, Suite 400, Toronto, Ontario M5K 0A1.

CONTACT

Andrew SidnellVice President, Special SituationsKingsdale

Advisors647-265-4522asidnell@kingsdaleadvisors.com

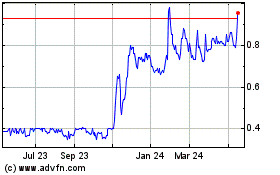

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

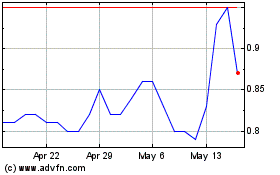

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024