Q1 2024 Highlights:

- Revenues of $63.1 million, 65% higher than in Q1 2023

- Adjusted EBITDA(1) of $17.9 million, higher than the Adjusted

EBITDA of $15.5 in Q1 2023

- Continue to generate positive Operating cash flows of $16.5

million, 28% higher than Q1 2023

- Higher copper, silver, gold and lead production than in Q1

2023

- Record metal production at Bolivar

- Development below the 1120 level at Yauricocha is on-track and

expected to reach full capacity in Q4 2024, which is a 40% increase

in production from current levels.

- Q1 2024 production and financial performance reaffirms 2024

production and cost guidance

Management will host a conference call and webcast at 11:00

am EST on May 13, 2024.

All dollar figures are in USD.

(1) This is a non-IFRS performance measure, see non-IFRS

Performance Measures section of this press release

Sierra Metals Inc. (TSX:SMT | OTCQX:SMTSF) (“Sierra

Metals” or the “Company”) reports consolidated financial results

for the three months ending March 31, 2024 (“Q1 2024”). The

information provided below are excerpts from the Company’s Q1 2024

financial statements and Management’s Discussion and Analysis

(“MD&A”), which are available on the Company's website

(www.SierraMetals.com) and on SEDAR+ (www.sedarplus.ca) under the

Company’s profile. Consolidated results include results from the

Company’s Yauricocha Mine (“Yauricocha”) in Peru and the Bolivar

Mine (“Bolivar”) in Mexico.

Ernesto Balarezo, Sierra Metals’ CEO, comments, “We are pleased

to deliver another strong quarter of operating and financial

performance. Operationally, Bolivar had a record quarter of metal

production, while at Yauricocha the mine maximized production above

the 1120 level as development at depth is progressing on track,

which will allow us to reach full capacity in the fourth quarter of

2024. This was the Company’s best financial quarter since early

2021 as both mines continue to produce positive cash flow from

operations, and we continue to improve our balance sheet. Overall,

2024 has gotten off to a tremendous start.”

Conference Call & Webcast

Management will host a conference call and webcast at 11:00 am

EST on May 13, 2024 to discuss Q1 2024 consolidated operating and

financial results. Participate on the telephone at 1-844-763-8276

(North America) or +1-647-484-8814 (rest of world) or register for

the webcast HERE.

Q1 2024 Consolidated Operating and Financial

Highlights

(In thousands of dollars, except per share and cash cost amounts,

consolidated figures unless noted otherwise)

Q1 2024 Q4

2023 Q1 2023 Operating Ore Processed / Tonnes

Milled

638,916

673,846

518,162

Copper Pounds Produced (000's)

11,247

12,096

8,285

Zinc Pounds Produced (000's)

10,132

9,629

10,579

Silver Ounces Produced (000's)

427

468

389

Gold Ounces Produced

4,505

4,708

3,791

Lead Pounds Produced (000's)

3,049

2,481

2,778

Copper Equivalent Pounds Produced (000's)1

19,973

20,902

16,465

Cash Cost per CuEqLb (Yauricocha)2,3

$

3.27

$

2.88

$

3.00

AISC per CuEqLb (Yauricocha)2,3

$

3.69

$

3.47

$

3.12

Cash Cost per CuEqLb (Bolivar)2,3

$

2.44

$

2.63

$

2.58

AISC per CuEqLb (Bolivar)2,3

$

3.12

$

3.47

$

3.10

Financial Revenues

$

63,140

$

60,632

$

53,537

Net income (loss) - Continuing operations

$

1,630

$

(11,266

)

$

3,709

- Discontinued Operations

$

(865

)

$

(1,907

)

$

(1,570

)

Net income (loss) attributable to shareholders, including

discontinued operations

$

1,159

$

(13,724

)

$

2,053

Adjusted EBITDA2 from continuing operations

$

17,913

$

12,233

$

15,482

Operating cash flows before movements in working capital

$

16,486

$

12,845

$

12,851

Adjusted net income (loss) attributable to shareholders2 -

Continuing operations

$

5,174

$

(8,470

)

$

5,688

- Discontinued Operations

$

(865

)

$

(1,829

)

$

(942

)

Cash and cash equivalents

$

11,220

$

9,122

$

3,864

(1)

Copper equivalent pounds were calculated

using the following weighted average realized prices for Q1 2024 -

$3.84/lb Cu, $1.12/lb Zn, $23.41/oz Ag, $2,069/oz Au, $0.94/lb Pb.

Copper equivalent production for Q4 2023 and Q1 2023 have been

recalculated at the same prices for proper comparison.

(2)

This is a non-IFRS performance measure,

see Non-IFRS Performance Measures section of this press

release.

(3)

Copper equivalent payable pounds used for

the cash cost and AISC calculations were calculated at the

following prices:

Q1 2024 - $3.84/lb Cu, $1.12/lb Zn,

$23.41/oz Ag, $0.94/lb Pb, $2,069/oz Au.

Q4 2023 - $3.70/lb Cu, $1.13/lb Zn,

$23.22/oz Ag, $0.96/lb Pb, $1,976/oz Au.

Q1 2023 - $4.06/lb Cu, $1.42/lb Zn,

$22.57/oz Ag, $0.97/lb Pb, $1,891/oz Au.

Q1 2024 Consolidated Operating Highlights

- Consolidated quarterly throughput during Q1 2024 was 638,916

tonnes, a 23% increase from the same quarter of 2023, as both mines

registered increases in throughput during Q1 2024 compared to Q1

2023.

- Grades from the Bolivar Mine during Q1 2024 were higher than Q1

2023 and Q4 2023, while Yauricocha experienced declines in copper

grades during Q1 2024 compared to Q4 2023, as well as decreases in

grades for precious metals compared to both Q1 2023 and Q4 2023.

These lower grades from the Yauricocha Mine were primarily due to

the limited available ore above the 1120 level. However, the

Company expects that grades will improve as the development below

1120 level progresses.

- Consolidated production for all metals increased in Q1 2024

compared to Q1 2023, excluding zinc. When compared to Q4 2023,

consolidated production for copper, silver, and gold were lower by

7%, 9% and 4%, respectively.

- Yauricocha’s cash cost per copper equivalent payable pound was

$3.27 (Q1 2023 - $3.00), and AISC per copper equivalent payable

pound of $3.69 (Q1 2023 - $3.12). The increase in cash costs was

higher treatment and refining costs, and lower grades, resulting in

a 4% decline in copper equivalent payable pounds. Higher AISC was a

combined result of higher cash costs and the increase in sustaining

capital focused on developing below the 1120 level during Q1

2024.

- Bolivar’s cash cost per copper equivalent payable pound was

$2.44 (Q1 2023 - $2.58), and AISC per copper equivalent payable

pound was $3.12 (Q1 2023 - $3.10) for Q1 2024. Cash costs improved

during Q1 2024 versus Q1 2023, mainly driven by the 59% increase in

copper equivalent payable pounds. AISC for Q1 2024 was slightly

higher than Q1 2023, driven by the increase in sustaining capital

due to the intensive efforts in mine development meters.

Q1 2024 Consolidated Financial Highlights

- Consolidated revenue from metals payable amounted to $63.1

million in Q1 2024, marking an 18% increase from the $53.5 million

recorded in Q1 2023, mainly attributed to enhanced metal sales at

Bolivar, driven by higher grades and increased production volumes

when compared to Q1 2023.

- Adjusted EBITDA(1) of $17.9 million for Q1 2024 increased 16%

compared to $15.5 million in Q1 2023.

- Adjusted net income attributable to shareholders(1) of $4.3, or

$0.02 per share, for Q1 2024 as compared to the adjusted net income

of $4.7 million, or $0.03 per share for Q1 2023.

- Cash flow generated from operations before movements in working

capital of $16.5 million for Q1 2024 increased compared to $12.9

million in Q1 2023; and

- Cash and cash equivalents of $11.2 million as at March 31, 2024

compared to the $9.1 million and the $5.0 million, at the end of

2023 and March 31, 2023 respectively. Cash and cash equivalents

increased during Q1 2024 as a result of cash generated from

operating activities of $16.5 million offset by cash used in

investing activities of $11.4 million and cash used in financing

activities of $2.9 million.

(1) This is a non-IFRS performance

measure, see non-IFRS Performance Measures section of this press

release

Subsequent to Quarter-end

Identifying additional mineral resources at the Company’s core

operating mines, Yauricocha and Bolivar, is a key priority for

Sierra Metals. Accordingly, on May 7, 2024, the Company announced

the results of the revised reserves and resources under National

Instrument 43-101 (“NI 43-101”) for both its mines. The updated

technical report indicates the following implied LOMs in terms of

mineral resources and reserves:

Yauricocha 2,3 Bolivar 2,4 Measured &

Indicated Resources 10.4 Mt 18.4 Mt Tonnes 8 years 10 years

Life-of-mine

Proven & Probable Reserves 6.4 Mt 5.6 Mt

Tonnes 5 years 3 years Life-of-mine

(1)

Mineral resources are inclusive

of mineral reserves. Mineral resources that are not mineral

reserves do not have demonstrated economic viability. Mineral

resources require further technical works and studies to determine

their viability to be converted into mineral reserves.

(2)

Assumes 347 operating days per

year at full plant capacity, assuming 1.5 days per month of

maintenance works

(3)

Assumes throughput rates of 3,600

tpd

(4)

Assumes throughput rates of 5,000

tpd

The Company will file the corresponding NI 43-101 technical

reports within 45 days of this announcement, which will be

available on SEDAR+ and the Company’s website.

2024 Outlook

Management expects 2024 to be the year to consolidate the

optimization efforts that started in 2023 and to establish the

platform for growth. In 2023, under the guidance of the new

management team, the Company began a process of stabilization and

optimization.

Prioritizing safety, employee engagement and streamlining

operations have helped restore production levels, while strategic

debt refinancing has stabilized the Company’s financial position.

The refinancing process remains on track and is expected to lead to

a formal contract with the lenders before the end of Q2 2024.

In February 2024, the Company obtained the environmental permit

to develop and mine below the 1120 level at the Yauricocha mine.

This permit provides several significant catalysts for Sierra

Metals, such as operational enhancements, maximized operating

capacity and cost efficiencies. Using a modest development capital

investment, the Company anticipates ramping up to full production

levels of 3,600 tonnes per day (40% higher than current levels) by

Q4 2024.

At Bolivar, the Company will continue the construction of the

new tailings dam, which is expected to be completed over the next

three years, allowing the mine to increase its production capacity

to 7,500 tpd in the future.

After the robust Q1 2024 results at the Bolivar Mine and with

the development activities below the 1120 level at Yauricocha

progressing as planned, the Company remains on track to achieve

previously announced production, costs, and capital expenditure

guidance for 2024. The tables below summarize the 2024 production

guidance from the Yauricocha and the Bolivar mines.

Production Guidance

2024 Guidance Low High Copper (000 lbs)

37,500

43,300

Zinc (000 lbs)

38,600

44,500

Silver (000 oz)

1,500

1,750

Gold (oz)

10,100

11,600

Lead (000 lbs)

10,200

11,800

By Mine

Yauricocha 2024 Guidance Low High

Copper (000 lbs)

13,600

15,700

Zinc (000 lbs)

38,600

44,500

Silver (000 oz)

850

1,000

Gold (oz)

2,100

2,400

Lead (000 lbs)

10,200

11,800

Bolivar 2024 Guidance Low High

Copper (000 lbs)

23,900

27,600

Silver (000 oz)

650

750

Gold (oz)

8,000

9,200

2024 Cost Guidance

A mine by mine breakdown of 2024 production guidance, cash costs

and all-in sustaining costs (“AISC”) are included in the table

below. Starting 2024, the Company is modifying its definition of

cash cost to include treatment and refining charges, selling costs

and site G&A costs. AISC includes cash costs and sustaining

capital expenditure.

Cash costs(1) range AISC(1) range Mine per

CuEqLb per CuEqLb Yauricocha $3.31 - $3.41 $3.75

- $3.86 Bolivar $2.56 - $2.72 $3.28 - $3.36

(1) This is a non-IFRS performance

measure, see Non-IFRS Performance Measures section of this press

release. Cash Cost comprise of: operating costs, selling expenses,

administrative expenses, commercial terms and discounts. All In

Sustaining Costs (AISC) comprise of Cash Costs and sustaining

capex

2024 Capex Guidance

A breakdown by mine of the throughput and planned capital

investments is shown in the following table:

Yauricocha Bolivar Consolidated (Amounts in

$M) Low High Low High Low

High Sustaining

12.5

15.6

17.4

21.8

29.9

37.4

Growth

1.9

2.3

7.4

9.3

9.3

11.6

Total

14.4

17.9

24.8

31.1

39.2

49.0

Total capital for 2024 is expected to range between $39.2

million to $49.0 million, with Management retaining the option to

adjust the capital expenditure plan depending on the business

conditions. Sustaining capital mainly comprises of mine development

of up to $14.7 million ($8.9 million in Bolivar and $5.8 million in

Yauricocha) mainly targeted towards building mine infrastructure

needed to access and develop future mining zones. The remaining

sustaining capital expenditure consists of infill drilling and

replacement of equipment at the mines.

Growth capital for 2024 is expected to range between $9.3

million to $11.6 million, focusing on the new tailings dam at

Bolivar.

NON-IFRS PERFORMANCE MEASURES

The non-IFRS performance measures presented do not have any

standardized meaning prescribed by IFRS and are therefore unlikely

to be directly comparable to similar measures presented by other

issuers.

Non-IFRS reconciliation of adjusted EBITDA

EBITDA is a non-IFRS measure that represents an indication of

the Company’s continuing capacity to generate earnings from

operations before taking into account management’s financing

decisions and costs of consuming capital assets, which vary

according to their vintage, technological currency, and

management’s estimate of their useful life. EBITDA comprises

revenue less operating expenses before interest expense (income),

property, plant and equipment amortization and depletion, and

income taxes. Adjusted EBITDA has been included in this document.

Under IFRS, entities must reflect in compensation expense the cost

of share-based payments. In the Company’s circumstances,

share-based payments involve a significant accrual of amounts that

will not be settled in cash but are settled by the issuance of

shares in exchange for cash. As such, the Company has made an

entity specific adjustment to EBITDA for these expenses. The

Company has also made an entity-specific adjustment to the foreign

currency exchange (gain)/loss. The Company considers cash flow

before movements in working capital to be the IFRS performance

measure that is most closely comparable to adjusted EBITDA.

The following table provides a reconciliation of adjusted EBITDA

to the condensed interim consolidated financial statements for the

three months ended March 31, 2024 and 2023:

Three months ended March 31,

2024

2023

Net income

$

765

$

2,139

Adjusted for: Depletion and depreciation

9,634

7,543

Interest expense and other finance costs

2,405

2,199

NRV adjustments on inventory

-

476

Share-based payments

634

102

Foreign currency exchange and other provisions

2,164

1,372

Income taxes

1,446

1,374

Adjusted EBITDA

$

17,048

$

15,205

Less: Adjusted EBITDA from discontinued operations

(865

)

(277

)

Adjusted EBITDA from continuing operations

17,913

15,482

Non-IFRS reconciliation of adjusted net income

The Company has included the non-IFRS financial performance

measure of adjusted net income, defined by management as the net

income attributable to shareholders shown in the statement of

earnings plus the non-cash depletion charge due to the acquisition

of Corona and the corresponding deferred tax recovery and certain

non-recurring or non-cash items such as share-based compensation

and foreign currency exchange (gains) losses. The Company believes

that, in addition to conventional measures prepared in accordance

with IFRS, certain investors may want to use this information to

evaluate the Company’s performance and ability to generate cash

flows. Accordingly, it is intended to provide additional

information and should not be considered in isolation or as a

substitute for measures of performance in accordance with IFRS.

The following table provides a reconciliation of adjusted net

income to the condensed interim consolidated financial statements

for the three months ended March 31, 2024 and 2022:

Three months ended March 31, (In thousands of United States

dollars)

2024

2023

Net loss attributable to shareholders

$

1,159

$

2,053

Non-cash depletion charge on Corona's acquisition

1,045

1,070

Deferred tax recovery on Corona's acquisition depletion charge

(693

)

(327

)

NRV adjustments on inventory

-

476

Share-based compensation

634

102

Foreign currency exchange loss (gain)

2,164

1,372

Impairment charges

-

-

Adjusted net income (loss) attributable to shareholders

$

4,309

$

4,746

Less: Adjusted net loss from discontinued operations

(865

)

(942

)

Adjusted net income (loss) from continuing operations

5,174

5,688

Cash cost per copper equivalent payable pound

The Company uses the non-IFRS measure of cash cost per copper

equivalent payable pound to manage and evaluate operating

performance. The Company believes that, in addition to conventional

measures prepared in accordance with IFRS, certain investors use

this information to evaluate the Company’s performance and ability

to generate cash flows. Accordingly, it is intended to provide

additional information and should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS. The Company considers cost of sales per copper

equivalent payable pound to be the most comparable IFRS measure to

cash cost per copper equivalent payable pound and has included

calculations of this metric in the reconciliations within the

applicable tables to follow.

All-in sustaining cost per copper equivalent payable

pound

All‐In Sustaining Cost (“AISC”) is a non‐IFRS measure and is

calculated based on guidance provided by the World Gold Council

(“WGC”). WGC is not a regulatory industry organization and does not

have the authority to develop accounting standards for disclosure

requirements. Other mining companies may calculate AISC differently

as a result of differences in underlying accounting principles and

policies applied, as well as differences in definitions of

sustaining versus development capital expenditures.

AISC is a more comprehensive measure than cash cost per pound

for the Company’s consolidated operating performance by providing

greater visibility, comparability and representation of the total

costs associated with producing copper from its current

operations.

The Company defines sustaining capital expenditures as, “costs

incurred to sustain and maintain existing assets at current

productive capacity and constant planned levels of productive

output without resulting in an increase in the life of assets,

future earnings, or improvements in recovery or grade. Sustaining

capital includes costs required to improve/enhance assets to

minimum standards for reliability, environmental or safety

requirements. Sustaining capital expenditures excludes all

expenditures at the Company’s new projects and certain expenditures

at current operations which are deemed expansionary in nature.”

Consolidated AISC includes total production cash costs incurred

at the Company’s mining operations, including treatment and

refining charges and selling costs, which forms the basis of the

Company’s total cash costs. Additionally, the Company includes

sustaining capital expenditures and corporate general and

administrative expenses. AISC by mine does not include certain

corporate and non‐cash items such as general and administrative

expense and share-based payments. The Company believes that this

measure represents the total sustainable costs of producing silver

and copper from current operations and provides the Company and

other stakeholders of the Company with additional information of

the Company’s operational performance and ability to generate cash

flows. As the measure seeks to reflect the full cost of silver and

copper production from current operations, new project capital and

expansionary capital at current operations are not included.

Certain other cash expenditures, including tax payments, dividends

and financing costs are also not included.

The following table provides a reconciliation of cash costs to

cost of sales, as reported in the Company’s condensed interim

consolidated statement of income for the three months ended March

31, 2024 and 2023:

Three months ended Three months ended (In thousand of

US dollars, unless stated)

March 31, 2024 March 31,

2023 Yauricocha Bolivar Yauricocha

Bolivar Cash Cost per Tonne

of Processed Ore Cost of Sales

23,385

24,215

21,892

14,932

Reverse: Workers Profit Sharing

-

392

-

-

Reverse: D&A/Other adjustments

(5,513

)

(6,168

)

(5,123

)

(2,301

)

Reverse: Variation in Inventory

306

326

408

524

Total Cash Cost

18,178

18,765

17,177

13,155

Tonnes Processed

240,686

398,230

219,145

299,017

Cash Cost per Tonne Processed US$

75.53

47.12

78.38

43.99

The following table provides detailed information on

Yauricocha’s cash cost and all-in sustaining cost per copper

equivalent payable pound for the three months ended March 31, 2024

and 2023:

YAURICOCHA Three months ended (In thousand of US

dollars, unless stated)

March 31, 2024 March 31, 2023

Cash Cost per zinc equivalent

payable pound Total Cash Cost

18,178

17,177

Variation in Finished inventory

(306

)

(408

)

Treatment and Refining Charges

5,625

4,741

Selling Costs

640

616

G&A Costs(1)

1,520

1,640

Total Cash Cost of Sales

25,657

23,766

Sustaining Capital Expenditures

3,318

1,044

All-In Sustaining Cash Costs

28,975

24,810

Copper Equivalent Payable Pounds (000's)(2)

7,856

8,197

Cash Cost per Copper Equivalent Payable Pound (US$)

3.27

2.90

All-In Sustaining Cash Cost per Copper Equivalent Payable

Pound (US$)

3.69

3.03

(1)

G&A Costs for the quarter ended March

31, 2023 have been adjusted to include site G&A only.

Allocation of corporate G&A costs have been excluded for

consistency with the G&A costs for the quarter ended March 31,

2024 and those used in the 2024 guidance cash costs and AISC.

(2)

Copper equivalent payable pounds were

calculated using the following realized prices:

Q1 2024 - $3.84/lb Cu, $1.12/lb Zn,

$23.41/oz Ag, $0.94/lb Pb, $2,069/oz Au.

Q4 2023 - $3.70/lb Cu, $1.13/lb Zn,

$23.22/oz Ag, $0.96/lb Pb, $1,976/oz Au.

Q1 2023 - $4.06/lb Cu, $1.42/lb Zn,

$22.57/oz Ag, $0.97/lb Pb, $1,891/oz Au.

The following table provides detailed information on Bolivar’s

cash cost, and all-in sustaining cost per copper equivalent payable

pound for the three months ended March 31, 2024 and 2023:

BOLIVAR Three months ended (In thousand of US

dollars, unless stated)

March 31, 2024 March 31, 2023

Cash Cost per copper equivalent

payable pound Total Cash Cost

18,765

13,155

Variation in Finished inventory

(326

)

(524

)

Treatment and Refining Charges

2,854

2,165

Selling Costs

2,639

1,537

Copper Equivalent Payable Pounds (000's)(2)

2,579

1,240

Total Cash Cost of Sales

26,511

17,573

Sustaining Capital Expenditures

7,383

3,548

All-In Sustaining Cash Costs

33,894

21,121

Copper Equivalent Payable Pounds (000's)

10,880

6,843

Cash Cost per Copper Equivalent Payable Pound (US$)

2.44

2.57

All-In Sustaining Cash Cost per Copper Equivalent Payable

Pound (US$)

3.12

3.09

(1)

G&A Costs for the quarter ended March

31, 2023 have been adjusted to include site G&A only.

Allocation of corporate G&A costs have been excluded for

consistency with the G&A costs for the quarter ended March 31,

2024 and those used in the 2024 guidance cash costs and AISC.

(2)

Copper equivalent payable pounds were

calculated using the following realized prices:

Q1 2024 - $3.84/lb Cu, $1.12/lb Zn,

$23.41/oz Ag, $0.94/lb Pb, $2,069/oz Au.

Q4 2023 - $3.70/lb Cu, $1.13/lb Zn,

$23.22/oz Ag, $0.96/lb Pb, $1,976/oz Au.

Q1 2023 - $4.06/lb Cu, $1.42/lb Zn,

$22.57/oz Ag, $0.97/lb Pb, $1,891/oz Au.

Additional non-IFRS measures

The Company uses other financial measures, the presentation of

which is not meant to be a substitute for other subtotals or totals

presented in accordance with IFRS, but rather should be evaluated

in conjunction with such IFRS measures. The following other

financial measures are used:

- Operating cash flows before movements in working capital -

excludes the movement from period-to-period in working capital

items including trade and other receivables, prepaid expenses,

deposits, inventories, trade and other payables and the effects of

foreign exchange rates on these items.

The terms described above do not have a standardized meaning

prescribed by IFRS, and therefore the Company’s definitions are

unlikely to be comparable to similar measures presented by other

companies. The Company’s management believes that their

presentation provides useful information to investors because cash

flows generated from operations before changes in working capital

excludes the movement in working capital items. This, in

management’s view, provides useful information of the Company’s

cash flows from operations and are considered to be meaningful in

evaluating the Company’s past financial performance or its future

prospects. The most comparable IFRS measure is cash flows from

operating activities.

About Sierra Metals

Sierra Metals is a Canadian mining company focused on copper

production with additional base and precious metals by-product

credits at its Yauricocha Mine in Peru and Bolivar Mine in Mexico.

The Company is intent on safely increasing production volume and

growing mineral resources. Sierra Metals has recently had several

new key discoveries and still has many more exciting brownfield

exploration opportunities in Peru and Mexico that are within close

proximity to the existing mines. Additionally, the Company has

large land packages at each of its mines with several prospective

regional targets providing longer-term exploration upside and

mineral resource growth potential.

For further information regarding Sierra Metals, please visit

www.sierrametals.com.

Forward-Looking Statements

This press release contains forward-looking information within

the meaning of Canadian securities legislation. Forward-looking

information relates to future events or the anticipated performance

of Sierra and reflect management's expectations or beliefs

regarding such future events and anticipated performance based on

an assumed set of economic conditions and courses of action. In

certain cases, statements that contain forward-looking information

can be identified by the use of words such as "plans", "expects",

"is expected", "budget", "scheduled", "estimates", "forecasts",

"intends", "anticipates", "believes" or variations of such words

and phrases or statements that certain actions, events or results

"may", "could", "would", "might", or "will be taken", "occur" or

"be achieved" or the negative of these words or comparable

terminology. By its very nature forward-looking information

involves known and unknown risks, uncertainties and other factors

that may cause actual performance of Sierra to be materially

different from any anticipated performance expressed or implied by

such forward-looking information.

Forward-looking information is subject to a variety of risks and

uncertainties, which could cause actual events or results to differ

from those reflected in the forward-looking information, including,

without limitation, the risks described under the heading "Risk

Factors" in the Company's annual information form dated March 15,

2024 for its fiscal year ended December 31, 2023 and other risks

identified in the Company's filings with Canadian securities

regulators, which are available at www.sedarplus.ca.

The risk factors referred to above are not an exhaustive list of

the factors that may affect any of the Company's forward-looking

information. Forward-looking information includes statements about

the future and is inherently uncertain, and the Company's actual

achievements or other future events or conditions may differ

materially from those reflected in the forward-looking information

due to a variety of risks, uncertainties and other factors. The

Company's statements containing forward-looking information are

based on the beliefs, expectations, and opinions of management on

the date the statements are made, and the Company does not assume

any obligation to update such forward-looking information if

circumstances or management's beliefs, expectations or opinions

should change, other than as required by applicable law. For the

reasons set forth above, one should not place undue reliance on

forward-looking information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509729031/en/

Investor Relations Sierra Metals Inc. +1 (866) 721-7437

info@sierrametals.com

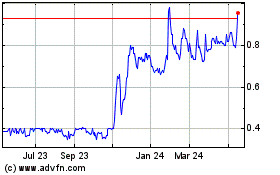

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

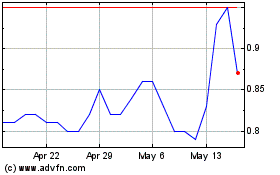

Sierra Metals (TSX:SMT)

Historical Stock Chart

From Dec 2023 to Dec 2024