STEP Energy Services Ltd. (the “Company” or “STEP”) is pleased to

announce its financial and operating results for the three and nine

months ended September 30, 2023. The following press release should

be read in conjunction with the management’s discussion and

analysis (“MD&A”) and unaudited condensed consolidated interim

financial statements and notes thereto as at September 30, 2023

(the “Financial Statements”). Readers should also refer to the

“Forward-looking information & statements” legal advisory and

the section regarding “Non-IFRS Measures and Ratios” at the end of

this press release. All financial amounts and measures are

expressed in Canadian dollars unless otherwise indicated.

Additional information about STEP is available on the SEDAR website

at www.sedar.com, including the Company’s Annual Information Form

for the year ended December 31, 2022 dated March 1, 2023 (the

“AIF”).

CONSOLIDATED HIGHLIGHTS

FINANCIAL REVIEW

|

($000s except percentages and per share amounts) |

Three months ended |

Nine months ended |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Consolidated revenue |

$ |

255,235 |

|

$ |

245,085 |

|

$ |

750,676 |

|

$ |

737,624 |

|

|

Net income |

$ |

20,734 |

|

$ |

30,852 |

|

$ |

55,663 |

|

$ |

78,089 |

|

|

Per share-basic |

$ |

0.29 |

|

$ |

0.45 |

|

$ |

0.77 |

|

$ |

1.14 |

|

|

Per share-diluted |

$ |

0.28 |

|

$ |

0.43 |

|

$ |

0.74 |

|

$ |

1.09 |

|

|

Adjusted EBITDA(1) |

$ |

52,286 |

|

$ |

58,050 |

|

$ |

145,142 |

|

$ |

150,290 |

|

|

Adjusted EBITDA %(1) |

|

21% |

|

|

24% |

|

|

19% |

|

|

20% |

|

|

Free Cash Flow(1) |

|

37,121 |

|

|

40,076 |

|

|

87,269 |

|

|

89,416 |

|

(1) Adjusted EBITDA and Free Cash Flow are

non-IFRS financial measures, Adjusted EBITDA % is a non-IFRS

financial ratio. These metrics are not defined and have no

standardized meaning under IFRS. See Non-IFRS Measures and

Ratios.

OPERATIONAL REVIEW

|

($000s except days, proppant, pumped, horsepower and units) |

Three months ended |

Nine months ended |

|

September 30, |

September 30, |

September 30, |

September 30, |

|

|

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Fracturing services |

|

|

|

|

|

|

|

|

|

Fracturing operating days(2) |

|

407 |

|

444 |

|

1,273 |

|

1,566 |

|

Proppant pumped (tonnes) |

|

589,000 |

|

478,000 |

|

1,693,000 |

|

1,776,000 |

|

Fracturing crews |

|

8 |

|

8 |

|

8 |

|

8 |

|

Dual fuel horsepower (“HP”), ended |

|

205,250 |

|

182,750 |

|

205,250 |

|

182,750 |

|

Total HP, ended |

|

478,750 |

|

490,000 |

|

478,750 |

|

490,000 |

|

Coiled tubing services |

|

|

|

|

|

|

|

|

|

Coiled tubing operating days(2) |

|

1,311 |

|

1,199 |

|

3,713 |

|

3,187 |

|

Active coiled tubing units, ended |

|

21 |

|

19 |

|

21 |

|

19 |

|

Total coiled tubing units, ended |

|

35 |

|

33 |

|

35 |

|

33 |

(2) An operating day is defined as any coiled

tubing or fracturing work that is performed in a 24-hour period,

exclusive of support equipment.

|

($000s except shares) |

|

September 30 |

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Cash and cash equivalents |

$ |

1,486 |

|

$ |

2,785 |

|

Working Capital (including cash and cash equivalents)(1) |

$ |

72,443 |

|

$ |

66,580 |

|

Total assets |

$ |

670,249 |

|

$ |

682,532 |

|

Total long-term financial liabilities(1) |

$ |

124,673 |

|

$ |

168,746 |

|

Net Debt(1) |

$ |

89,750 |

|

$ |

142,224 |

|

Shares outstanding |

|

72,233,064 |

|

|

71,589,626 |

(1) Working Capital, Total long-term financial

liabilities and Net Debt are non-IFRS financial measures. They are

not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.

THIRD QUARTER 2023

HIGHLIGHTS

- Consolidated

revenue for the three months ended September 30, 2023 of $255.2

million, increased 4% from $245.1 million for the three months

ended September 30, 2022 and increased 10% from $232.1 million for

the three months ended June 30, 2023.

- Net income for

the three months ended September 30, 2023 was $20.7 million ($0.28

per diluted share) compared to $30.9 million ($0.43 per diluted

share) in the same period of 2022 and $15.3 million ($0.21 per

diluted share) for the three months ended June 30, 2023.

- For the three

months ended September 30, 2023, Adjusted EBITDA was $52.3 million

or 21% of revenue compared to $58.1 million or 24% of revenue in Q3

2022 and $47.4 million or 20% of revenue in Q2 2023.

- Free Cash Flow

for the three months ended September 30, 2023 was $37.1 million

compared to $40.1 million in Q3 2022 and $34.8 million in Q2

2023.

- STEP made

significant progress on debt reduction during the quarter,

achieving its year end goal of reducing net debt to less than $100

million one quarter early, while continuing investment into the

long-term sustainability of the business.

- The Company had

Net Debt of $89.8 million at September 30, 2023, compared to $142.2

million at December 31, 2022. STEP has reduced Net Debt by nearly

$230 million from peak levels in 2018.

- The Company

invested $25.2 million into sustaining and optimization capital

equipment in the quarter. The Company completed conversion of nine

Tier 4 direct injection dual-fuel pumps in the U.S. and had sixteen

Tier 4 dual-fuel units in the field in Canada at the end of Q3,

providing diesel substitution rates of up to 85%.

THIRD QUARTER 2023 OVERVIEW The

third quarter of 2023 continued the trend of positive financial

results since the first quarter of 2022. Revenue of $255.2 million

and Adjusted EBITDA of $52.3 million were driven by solid

performance across all service lines. Despite the unstable market

environment, the Adjusted EBITDA in Q3 2023 was the best quarterly

financial results for the current year. While Adjusted EBITDA

showed a modest decline year over year, it showed a slight

improvement sequentially as a result of improved activity in the

Canadian fracturing and U.S. coiled tubing segments of our

business.

Commodity prices stabilized in the third quarter

after a volatile second quarter. West Texas Intermediate (WTI), the

benchmark U.S. oil price, rose from approximately $70 per barrel at

the start of the quarter to approximately $90 per barrel at the

close. Strong global demand coupled with cuts from the Organization

of the Petroleum Exporting Countries (“OPEC”) finally began to

impact the physical oil market, driving the price of crude oil

higher. U.S. natural gas prices rallied approximately 20% quarter

over quarter, with the benchmark Henry Hub natural gas price

responding to the drop off in drilling activity. The U.S. land rig

count continued to slide, declining 10% from Q2 to an average count

of 630 rigs in Q3 20231. The average Q3 2023 rig count in the

Permian basin, home of STEP’s three U.S. fracturing crews, was 326

rigs, down 24 rigs since Q2 20231. Rig counts in Canada increased

to 187 rigs in Q3 2023 from 116 in Q2 20231.

STEP’s Canadian fracturing service line had

another solid quarter, despite residual impacts from wildfires and

floods in Q2 that delayed operations to start the third quarter.

The Canadian fracturing service line generated $127.4 million in

revenue on 308,000 tonnes of proppant pumped, the best third

quarter in the Company’s history. Activity in the U.S. fracturing

service line was down sequentially on weak client activity at the

start of the quarter but finished strong with all three fracturing

fleets fully utilized.

U.S. coiled tubing continues to demonstrate the

advantages of scale in that business, setting another quarterly

record for operating days while generating $50.0 million in revenue

for the quarter. STEP shifted units to capitalize on the higher

demand northern regions during the quarter. Clients in these

regions have been very receptive to STEP’s technical competency and

fleet capability, laying a strong foundation for growth in these

areas in 2024. The U.S. coiled tubing division also set a depth

record of 8,253 meters (27,075 feet) for a client in the Permian

Basin. Canadian coiled tubing levels were sequentially higher in

Q3, although decisions by some clients to shift budgets from 2023

to 2024 negatively impacted the service line in the quarter. Early

in Q4 2023, the Canadian coiled tubing division also set a depth

record, reaching 8,101 meters (26,578 feet) for a client in the

Duvernay.

Net income was $20.7 million in Q3 2023 ($0.28

diluted earnings per share), sequentially higher than the $15.3

million in Q2 2023 ($0.21 diluted earnings per share) and lower

than the $30.9 million in Q3 2022 ($0.43 diluted earnings per

share). Net income included $2.9 million in finance costs (Q2 2023

‐ $2.8 million, Q3 2022 ‐ $1.3 million) and $4.0 million in

share‐based compensation expense (Q2 2023 ‐ $1.4 million, Q3 2022 ‐

$1.4 million).

Free Cash Flow was $37.1 million in Q3 2023,

sequentially higher than the $34.8 million in Q2 2023 but lower

than the $40.1 million in Q3 2022. This strong Free Cash Flow

enabled STEP to reduce Net Debt to $89.8 million at the close of Q3

2023 from $115.8 million at close of Q2 2023, achieving its

year-end target of sub-$100 million one quarter early. This debt

reduction was accomplished while investing $27.6 million into

capital expenditures during Q3 2023. STEP has now reduced debt by

nearly $230 million from peak levels in 2018. The reduction in debt

and improvement in Adjusted EBITDA resulted in a 12-month trailing

Funded Debt to Adjusted Bank EBITDA of 0.56:1.00, well under the

limit of 3.00:1 in the Company’s Credit Facilities (as defined in

Capital Management – Debt below).______________________________1

Baker Hughes North American Rotary Rig Count, September 29,

2023

MARKET OUTLOOK Oil prices are

expected to remain volatile in the near term, as recessionary

concerns over the macro economic outlook are being overshadowed by

geopolitical events in Europe and the Middle East. Notwithstanding

immediate geopolitical tensions, the tight supply demand balance is

anticipated to continue into 2024, as OPEC balances production to

maintain a target price of $80-$90 per barrel for Brent crude,

while remaining sensitive to inflationary concerns in the world’s

leading economies. This strategy provides price support for North

American producers to moderately increase their capital programs

for 2024.

Near term natural gas prices are expected to

rise with the seasonal demand for winter heating in both Canada and

the U.S. 2024 prices are expected to increase modestly relative to

2023 levels but will remain relatively range-bound until additional

liquefied natural gas (LNG) capacity under construction in Canada

and the U.S. is completed in the second half of the year. Economics

of Canadian gas production are boosted by the price for natural gas

liquids (NGL), particularly for diluent. Prices for NGLs are

correlated more closely to oil prices, creating attractive returns

for NGL-focused producers.

The long-term outlook for 2025 and onward for

oilfield services is very constructive. The recent Supreme Court of

Canada reference ruling that found the Impact Assessment Act (Bill

C-69) and the related regulations to be unconstitutional in part

may be a positive signal for Canadian energy production. While not

binding on the federal government, it may create an opportunity for

Canada to develop a policy framework that recognizes climate

concerns while supporting an energy industry that is among the most

environmentally sensitive in the world.

Creating a North American regulatory framework

to unleash the power of clean, safe and secure energy, particularly

LNG, will immediately lower emissions and improve living standards

across the world, while continuing to advance global climate goals.

STEP is proud to be part of an energy industry in Canada and the

U.S., countries that have the natural resources, the regulatory

frameworks, and the technical expertise to deliver safe and

affordable energy to the world.

Canada As with most years,

Canadian Q4 activity levels are expected to show a sequential

decline as client budget exhaustion and seasonal holiday activity

begins to slow activity in the basin. Despite stronger commodity

prices, producers are not expected to materially add to their 2023

budgets, preferring instead to maintain tight capital discipline to

support shareholder return frameworks. Fracturing job mix is

expected to see a higher mix of smaller jobs, resulting in less

efficient activity levels through the quarter. Coiled tubing

activity is anticipated to remain steady until the seasonal

slowdown begins in early to mid-December.

STEP will use the moderating of activity in Q4

2023 to complete more intensive maintenance on equipment to prepare

it for the extremely intensive utilization anticipated for Q1 2024.

STEP also has the flexibility to redeploy professionals from

operating fracturing equipment to operating sand transport trucks,

reducing the payroll burden during slower periods while also

reducing logistics costs. STEP has one of western Canada’s largest

sand hauling fleets, a critical advantage in the basin that is

often tight for sand hauling capacity.

Activity in 2024 is expected to increase, with

multiple clients signalling that their 2024 capital budgets will be

higher than 2023. The discipline in global oil markets and

anticipated completion of the Trans Mountain pipeline project and

the Coastal Gas Link pipeline/LNG Canada projects are creating an

opportunity for Canada to materially increase production in 2024.

Demand for oil and gas is projected to continue growing, creating

an opportunity for Canada to deliver among the most sustainably

produced energy in the world. STEP is similarly committed to

sustainability, introducing its first Tier 4 dual fuel fracturing

fleet in 2023. In response to strong client demand for this

equipment, which displaces up to 85% of diesel with cleaner burning

natural gas, STEP will upgrade an additional fleet with Tier 4 dual

fuel technology, with anticipated completion in Q2 2024.

The first quarter fracturing schedule is almost

fully booked, supported by an expected incremental year over year

increase in work scope following the award of a two-year fracturing

service and ancillary services agreement from a leading Montney gas

producer. First quarter sand volumes are expected to hit record

levels, making sand logistics critical to meeting client

expectations in the quarter. STEP has an industry leading sand

hauling and logistics capability, which it will continue to invest

into through 2024 to meet client demand. The demand for fracturing

equipment will likely also exceed STEP’s Canadian fleet capacity,

necessitating the transfer of some U.S. fracturing

equipment to Canada. STEP’s geographic diversity creates

flexibility to move equipment between countries to capitalize on

opportunities that deliver the highest return, a key competitive

advantage for STEP.

Demand for coiled tubing is expected to grow in

2024. Since inception, STEP pursued a differentiation strategy of

bringing the most technically capable equipment and crews to client

locations. STEP’s equipment is purpose built for the deepest, most

technically challenging wells found in the Montney and Duvernay,

which are key growth areas that underpin Canada’s LNG feedstock.

The recent competitor consolidation is expected to drive positive

change in the coiled tubing market, bringing more price discipline

and will more clearly delineate STEP’s value proposition.

United StatesU.S. land rig

counts have steadily declined from 756 at the start of 2023 to 603

at the close of Q3 2023, a decline of 20%. Fracturing spreads have

fluctuated more dramatically through the year, with intra-quarter

peak-to-trough declines of approximately 17% but only an overall

decline of 1% from the start of 2023 to the close of Q3 2023. The

tightening of the rig count to frac spread ratio has resulted in a

short-term oversupply in Q4 2023, putting pressure on pricing for

spot market opportunities. STEP has two fracturing crews committed

with longer term clients through to the close of 2023, with the

third crew likely to remain utilized until late in the quarter

before being transferred to Canada.

STEP’s 12 coiled tubing units are anticipated to

remain highly utilized for much of the quarter, although the

holiday season is likely to affect efficiencies in November and

December. STEP’s performance in the northern basins continues to

outpace many of the existing competitors that are unable to bring

the technology and equipment that comes with the STEP service

offering. The consolidation in the premium coiled tubing market has

been supportive for pricing in these regions, maintaining rates at

more consistent levels. As the Permian and Eagle Ford basins remain

under pressure due to equipment oversupply, STEP has transferred

coiled tubing units from these areas to the northern basins in

order to capitalize on the opportunities that exist in those

areas.

Sustained oil prices in the $80-$90 per barrel

range are expected to drive a modest recovery in rig counts through

the first half of the year, particularly in the Permian, home of

STEP’s fracturing crews and four of its twelve coiled tubing

fleets. The ongoing capacity constraints within the U.S. natural

gas transportation, storage and liquefaction system are not

expected to improve until the second half of the year, which may

result in uneven fracturing activity levels in the first half of

the year. The second half of the year is expected to see the

completion of additional LNG capacity on the Gulf Coast, which

should provide an additional source of demand for U.S. natural gas

oriented fracturing activity.

ConsolidatedSTEP’s focus for

the balance of 2023 and into 2024 is on the generation of Free Cash

Flow while continuing to invest in emission reducing technologies

on our asset base, including the recently deployed Tier 4 dual fuel

engines in our Canadian and U.S. fracturing fleet. The strong

results posted year to date support the Company’s goals to reduce

its balance sheet leverage and make disciplined investments that

support STEP’s goal of building a resilient company and creating

shareholder value.

CANADIAN FINANCIAL AND OPERATIONS

REVIEW

STEP has a fleet of 16 coiled tubing units in

the WCSB, all of which are designed to service the deepest wells in

the basin. STEP’s fracturing business primarily focuses on the

deeper, more technically challenging plays in Alberta and northeast

British Columbia. STEP deploys or idles coiled tubing units and

fracturing horsepower as dictated by the market’s ability to

support targeted utilization and economic returns.

|

($000’s except per day, days, units, proppant pumped and HP) |

Three months ended |

Nine months ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

Fracturing |

$ |

127,415 |

|

$ |

110,991 |

|

$ |

378,784 |

|

$ |

370,518 |

|

|

Coiled tubing |

|

30,241 |

|

|

30,100 |

|

|

89,224 |

|

|

82,494 |

|

|

|

|

157,656 |

|

|

141,091 |

|

|

468,008 |

|

|

453,012 |

|

|

Expenses |

|

125,414 |

|

|

112,213 |

|

|

375,512 |

|

|

374,536 |

|

|

Results from operating activities |

$ |

32,242 |

|

$ |

28,878 |

|

$ |

92,496 |

|

$ |

78,476 |

|

|

Adjusted EBITDA(1) |

$ |

41,235 |

|

$ |

40,895 |

|

$ |

119,401 |

|

$ |

112,473 |

|

|

Adjusted EBITDA %(1) |

|

26% |

|

|

29% |

|

|

26% |

|

|

25% |

|

|

Sales mix (% of segment revenue) |

|

|

|

|

|

|

|

|

|

Fracturing |

|

81% |

|

|

79% |

|

|

81% |

|

|

82% |

|

|

Coiled tubing |

|

19% |

|

|

21% |

|

|

19% |

|

|

18% |

|

|

Fracturing services |

|

|

|

|

|

|

|

|

|

Number of fracturing operating days(2) |

|

250 |

|

|

271 |

|

|

771 |

|

|

945 |

|

|

Proppant pumped (tonnes) |

|

308,000 |

|

|

234,000 |

|

|

914,000 |

|

|

915,000 |

|

|

Stages completed |

|

3,268 |

|

|

4,006 |

|

|

10,165 |

|

|

11,881 |

|

|

Fracturing crews |

|

5 |

|

|

5 |

|

|

5 |

|

|

5 |

|

|

Coiled tubing services |

|

|

|

|

|

|

|

|

|

Number of coiled tubing operating days(2) |

|

448 |

|

|

536 |

|

|

1,368 |

|

|

1,468 |

|

|

Active coiled tubing units, end of period |

|

9 |

|

|

8 |

|

|

9 |

|

|

8 |

|

|

Total coiled tubing units, end of period |

|

16 |

|

|

16 |

|

|

16 |

|

|

16 |

|

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % are non-IFRS financial ratios. They

are not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.(2) An operating day is defined as any

coiled tubing or fracturing work that is performed in a 24-hour

period, exclusive of support equipment.

THIRD QUARTER 2023 COMPARED TO THIRD

QUARTER 2022Revenue for the three months ended September

30, 2023 was $157.7 million compared to $141.1 million for the same

period of the prior year. Increased intensity on fracturing jobs

resulted in higher daily average revenue year-over-year despite

continued pricing pressure. This was partially offset by reduced

operating days which decreased to 250 for Q3 2023 from 271 during

the same period of 2022. Residual effects from the fire and flood

conditions during Q2 slowed drilling activity which impacted timing

for completion services. STEP remains focused on proper client

alignment which contributed to steady utilization in the coiled

tubing business during the quarter, however overall days decreased

to 448 for Q3 2023 from 536 during the comparable period of 2022.

Coiled tubing revenue was also impacted by client delays to start

the quarter however an increase in ancillary services contributed

to revenue remaining flat year-over-year.

Adjusted EBITDA for the third quarter of 2023

was $41.2 million (26% of revenue) versus $41.0 million (29% of

revenue) in the third quarter of 2022. While Adjusted EBITDA

increased slightly, year-over-year Adjusted EBITDA % fell slightly

due to the change in job mix.

NINE MONTHS ENDED SEPTEMBER 30, 2023

COMPARED TO NINE MONTHS ENDED SEPTEMBER 30, 2022Revenue

for the nine months ended September 30, 2023 was $468.0 million

compared to $453.0 million for the nine months ended September 30,

2022. Revenue increased compared to the prior year despite

decreasing activity levels as changes in client mix and work scope

has improved average daily revenue even with continued pressure on

pricing. Fracturing operating days decreased to 771 for the first

nine months of 2023 from 945 during the same period of 2022. The

general decline in market activity as a result of lower natural gas

prices combined with fire and flood conditions during Q2 and Q3

were the primary reasons for declining activity year-over-year. The

same conditions contributed to the decline in coiled tubing

operating days from 1,468 for the first nine months of 2022 to

1,368 for the comparable period of 2023. An increase in ancillary

services contributed to an increase of total coiled tubing revenue

year-over-year.

The Company’s Canadian operating expenses were

relatively flat as cost management remains a focus. Despite these

efforts, the higher inflationary environment combined with

continued supply chain disruptions, commodity price appreciation,

and strong industry activity has costs escalating across most

expense categories.

Canadian operations generated Adjusted EBITDA of

$119.4 million (26% of revenue) for the first nine months of 2023

compared to $112.5 million (25% of revenue) in the same period of

2022. Continued cost management while retaining pricing

improvements achieved since 2022 was the most significant factor in

the $6.9 million increase in Adjusted EBITDA. The margin

improvement provides the critical cash flow needed to reinvest into

the business to ensure that clients receive the best equipment on

their well sites.

UNITED STATES FINANCIAL AND OPERATIONS

REVIEW

STEP has a fleet of 19 coiled tubing units in

the Permian and Eagle Ford basins in Texas, the Bakken shale in

North Dakota, and the Uinta-Piceance and Niobrara-DJ basins in

Colorado while the U.S. fracturing business primarily operates in

the Permian basin in Texas. The Company deploys or idles coiled

tubing units and fracturing horsepower as dictated by the market’s

ability to support targeted utilization and economic returns.

|

($000’s except per day, days, units, proppant pumped and HP) |

Three months ended |

Nine months ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

Fracturing |

$ |

47,579 |

|

$ |

67,794 |

|

$ |

145,544 |

|

$ |

199,035 |

|

|

Coiled tubing |

|

50,000 |

|

|

36,200 |

|

|

137,124 |

|

|

85,577 |

|

|

|

|

97,579 |

|

|

103,994 |

|

|

282,668 |

|

|

284,612 |

|

|

Expenses |

|

94,464 |

|

|

91,034 |

|

|

280,819 |

|

|

265,788 |

|

|

Results from operating activities |

$ |

3,115 |

|

$ |

12,960 |

|

$ |

1,849 |

|

$ |

18,824 |

|

|

Adjusted EBITDA(1) |

$ |

15,356 |

|

$ |

20,814 |

|

$ |

38,504 |

|

$ |

50,958 |

|

|

Adjusted EBITDA %(1) |

|

16% |

|

|

20% |

|

|

14% |

|

|

18% |

|

|

Sales mix (% of segment revenue) |

|

|

|

|

|

|

|

|

|

Fracturing |

|

49% |

|

|

65% |

|

|

51% |

|

|

70% |

|

|

Coiled tubing |

|

51% |

|

|

35% |

|

|

49% |

|

|

30% |

|

|

Fracturing services |

|

|

|

|

|

|

|

|

|

Number of fracturing operating days(2) |

|

157 |

|

|

173 |

|

|

502 |

|

|

621 |

|

|

Proppant pumped (tonnes) |

|

281,000 |

|

|

244,000 |

|

|

779,000 |

|

|

861,000 |

|

|

Stages completed |

|

1,328 |

|

|

1,121 |

|

|

3,767 |

|

|

3,678 |

|

|

Fracturing crews |

|

3 |

|

|

3 |

|

|

3 |

|

|

3 |

|

|

Coiled tubing services |

|

|

|

|

|

|

|

|

|

Number of coiled tubing operating days(2) |

|

863 |

|

|

663 |

|

|

2,345 |

|

|

1,719 |

|

|

Active coiled tubing units, end of period |

|

12 |

|

|

11 |

|

|

12 |

|

|

11 |

|

|

Total coiled tubing units, end of period |

|

19 |

|

|

17 |

|

|

19 |

|

|

17 |

|

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % is non-IFRS financial ratios. They

are not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.(2) An operating day is defined as any

coiled tubing or fracturing work that is performed in a 24-hour

period, exclusive of support equipment.

THIRD QUARTER 2023 COMPARED TO THIRD

QUARTER 2022Revenue for the three months ended September

30, 2023 was $97.6 million compared to $104.0 million at September

30, 2022. The increase in active coiled tubing units and resultant

increase in operating days offset much of the declines in

fracturing revenue resulting from the transition to client-supplied

product. Key acquisitions in 2022 have enabled STEP to deploy

additional coiled tubing units to key basins and benefit from

strong oilfield activity levels in those regions. Proper client

alignment within the coiled tubing business has been a main driver

to our continued success in this segment as operating days

increased to 863 for Q3 2023 from 663 during the comparable period

of 2022. Fracturing activity stabilized in the third quarter

however market conditions have continued to put pressure on pricing

compared to the prior year.

U.S. operations generated Adjusted EBITDA of

$15.4 million (16% of revenue) for the third quarter 2023 versus

$20.8 million (20% of revenue) in the third quarter of 2022. While

coiled tubing rates have remained stable, the change in job mix and

downward pressure on rates for fracturing services were the primary

contributors to the drop in Adjusted EBITDA compared to the prior

year.

NINE MONTHS ENDED SEPTEMBER 30, 2023

COMPARED TO NINE MONTHS ENDED SEPTEMBER 30, 2022Revenue

for the nine months ended September 30, 2023 was $282.7 million

compared to $284.6 million for the nine months ended September 30,

2022. U.S. operations realized a 36% increase in operating days for

the coiled tubing service line reflecting the additional assets

acquired during 2022 that increased our depth capacity and allowed

us to expand our operating footprint. Operating days across the

Company’s U.S. fracturing operations were relatively flat at 3,767

for the first nine months of 2023 compared to 3,678 days during the

same period of 2022, however, the transition to client supplied

product resulted in significantly lower revenue.

The year over year increase in operating

expenses reflects increased maintenance costs from the increase in

fracturing intensity compared to the prior year and from the

intensive preventative maintenance program completed during the

first quarter of 2023. Inflationary pressures and supply chain

constraints have eased slightly during Q3 2023, but costs remain

higher on a year over year basis across most expense

categories.

U.S. operations generated Adjusted EBITDA of

$38.5 million (14% of revenue) for the nine months ended September

30, 2023, compared to an Adjusted EBITDA of $51.0 million (18% of

revenue) for the nine months ended September 30, 2022. The

transition to client supplied product and declining fracturing

rates were the primary contributors to the Adjusted EBITDA decline

and were partially offset by improved activity in coiled

tubing.

CORPORATE FINANCIAL REVIEW The

Company’s corporate activities are separated from Canadian and U.S.

operations. Corporate operating expenses include expenses related

to asset reliability and optimization teams, as well as general and

administrative costs which include costs associated with the

executive team, the Board of Directors, public company costs and

other activities that benefit the Canadian and U.S. operating

segments collectively.

|

($000’s) |

Three months ended |

Nine months ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Expenses: |

|

|

|

|

|

|

|

|

|

Operating expenses |

$ |

490 |

|

$ |

503 |

|

$ |

1,438 |

|

$ |

1,869 |

|

|

Selling, general and administrative |

|

7,259 |

|

|

4,027 |

|

|

10,656 |

|

|

24,577 |

|

|

Results from operating activities |

$ |

(7,749 |

) |

$ |

(4,530 |

) |

$ |

(12,094 |

) |

$ |

(26,446 |

) |

|

Add: |

|

|

|

|

|

|

|

|

|

Depreciation |

|

222 |

|

|

151 |

|

|

637 |

|

|

437 |

|

|

Share-based compensation expense (recovery) |

|

3,322 |

|

|

720 |

|

|

(1,306 |

) |

|

12,868 |

|

|

Adjusted EBITDA(1) |

$ |

(4,205 |

) |

$ |

(3,659 |

) |

$ |

(12,763 |

) |

$ |

(13,141 |

) |

|

Adjusted EBITDA %(1) |

|

(2% |

) |

|

(1% |

) |

|

(2% |

) |

|

(2% |

) |

(1) Adjusted EBITDA is a non-IFRS financial

measure and Adjusted EBITDA % is a non-IFRS financial ratio. They

are not defined and have no standardized meaning under IFRS. See

Non-IFRS Measures and Ratios.

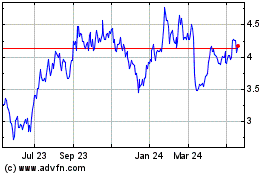

THIRD QUARTER 2023 COMPARED TO THIRD

QUARTER 2022For the three months ended September 30, 2023,

expenses from corporate activities were $7.7 million compared to

expenses of $4.5 million for the same period in 2022. The increase

in these expenses was primarily due to the mark to market

adjustment on cash settled share-based compensation in the current

period. Corporate expense were $3.2 million higher in Q3 2023

relative to Q3 2022, as the Company’s share price increased by

$0.98 from June 30, 2023 to September 30, 2023 compared to a share

price decrease of $0.21 during the same period of the prior year.

Adjusted EBITDA of $(4.2) million for the three months ended

September 30, 2023 remained aligned with Adjusted EBITDA of $(3.7)

million for the same period in 2022.

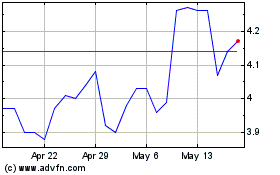

NINE MONTHS ENDED SEPTEMBER 30, 2023

COMPARED TO NINE MONTHS ENDED SEPTEMBER 30, 2022For the

nine months ended September 30, 2023 expenses from corporate

activities were $12.1 million compared to $26.4 million for the

same period in 2022. Cash settled share-based compensation expense

was lower in the first nine months of 2023 as a decrease in number

of cash settled instruments outstanding combined with the share

price decreasing $1.09 from December 31, 2022 to September 30, 2023

resulted in lower expenses from the mark to market adjustment in

the current period. Adjusted EBITDA of $(12.8) million for the nine

months ended September 30, 2023 was relatively consistent with

Adjusted EBITDA of $(13.1) million for the same period of the prior

year.

NON-IFRS MEASURES AND

RATIOSThis Press Release includes terms and performance

measures commonly used in the oilfield services industry that are

not defined under IFRS. The terms presented are intended to provide

additional information and should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS. These non-IFRS measures have no standardized meaning

under IFRS and therefore may not be comparable to similar measures

presented by other issuers. The non-IFRS measures should be read in

conjunction with the Company’s quarterly financial statements and

Annual Financial Statements and the accompanying notes thereto.

“Adjusted EBITDA” is a financial measure not

presented in accordance with IFRS and is equal to net (loss) income

before finance costs, depreciation and amortization, (gain) loss on

disposal of property and equipment, current and deferred income tax

provisions and recoveries, equity and cash settled share-based

compensation, transaction costs, foreign exchange forward contract

(gain) loss, foreign exchange (gain) loss, and impairment losses.

“Adjusted EBITDA %” is a non-IFRS ratio and is calculated as

Adjusted EBITDA divided by revenue. Adjusted EBITDA and Adjusted

EBITDA % are presented because they are widely used by the

investment community as they provide an indication of the results

generated by the Company’s normal course business activities prior

to considering how the activities are financed and the results are

taxed. The Company uses Adjusted EBITDA and Adjusted EBITDA %

internally to evaluate operating and segment performance, because

management believes they provide better comparability between

periods. The following table presents a reconciliation of the

non-IFRS financial measure of Adjusted EBITDA to the IFRS financial

measure of net income.

|

($000s except percentages) |

Three months ended |

|

Nine months ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

Net income |

$ |

20,734 |

|

$ |

30,852 |

|

$ |

55,663 |

|

$ |

78,089 |

|

|

|

Add (deduct): |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

20,743 |

|

|

19,378 |

|

|

62,614 |

|

|

63,140 |

|

|

|

Gain on disposal of equipment |

|

(417 |

) |

|

(921 |

) |

|

(1,064 |

) |

|

(2,571 |

) |

|

|

Finance costs |

|

2,850 |

|

|

1,330 |

|

|

8,557 |

|

|

7,551 |

|

|

|

Income tax expense |

|

6,936 |

|

|

6,211 |

|

|

18,318 |

|

|

20,582 |

|

|

|

Share-based compensation – Cash settled |

|

2,709 |

|

|

396 |

|

|

(3,713 |

) |

|

14,441 |

|

|

|

Share-based compensation – Equity settled |

|

1,336 |

|

|

977 |

|

|

4,020 |

|

|

1,990 |

|

|

|

Foreign exchange (gain) loss |

|

1,278 |

|

|

(173 |

) |

|

2,036 |

|

|

(224 |

) |

|

|

Unrealized gain on derivatives |

|

(3,783 |

) |

|

- |

|

|

(1,289 |

) |

|

- |

|

|

|

Impairment reversal |

|

- |

|

|

- |

|

|

- |

|

|

(32,708 |

) |

|

|

Adjusted EBITDA |

$ |

52,386 |

|

$ |

58,050 |

|

$ |

145,142 |

|

$ |

150,290 |

|

|

|

Adjusted EBITDA % |

|

21% |

|

|

24% |

|

|

19% |

|

|

20% |

|

|

“Free Cash Flow” is a financial measure not

presented in accordance with IFRS and is equal to net cash provided

by operating activities adjusted for changes in non-cash Working

Capital from operating activities, sustaining capital expenditures,

term loan principal repayments and lease payments (net of sublease

receipts). The Company may deduct or include additional items in

its calculation of Free Cash Flow that are unusual, non-recurring

or non-operating in nature. Free Cash Flow is presented as this

measure is widely used in the investment community as an indication

of the level of cash flow generated by ongoing operations.

Management uses Free Cash Flow to evaluate the adequacy of

internally generated cash flows to manage debt levels, invest in

the growth of the business or return capital to shareholders. The

following table presents a reconciliation of the non-IFRS financial

measure of Free Cash Flow to the IFRS financial measure of net cash

provided by operating activities.

|

($000s) |

Three months ended |

Nine months ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Net cash provided by (used in) operating activities |

$ |

50,736 |

|

$ |

73,048 |

|

$ |

131,876 |

|

$ |

90,265 |

|

|

Add (deduct): |

|

|

|

|

|

|

|

|

|

Changes in non-cash working capital from operating activities |

|

(2,607 |

) |

|

(19,395 |

) |

|

(8,319 |

) |

|

50,246 |

|

|

Sustaining capital |

|

(8,518 |

) |

|

(11,107 |

) |

|

(30,139 |

) |

|

(30,531 |

) |

|

Term loan principal repayments |

|

- |

|

|

- |

|

|

- |

|

|

(13,975 |

) |

|

Lease payments (net of sublease receipts) |

|

(2,490 |

) |

|

(2,470 |

) |

|

(6,149 |

) |

|

(6,589 |

) |

|

Free Cash Flow |

$ |

37,121 |

|

$ |

40,076 |

|

$ |

87,269 |

|

$ |

89,416 |

|

“Working Capital”, “Total long-term financial

liabilities” and “Net Debt” are financial measures not presented in

accordance with IFRS. “Working Capital” is equal to total current

assets less total current liabilities. “Total long-term financial

liabilities” is comprised of loans and borrowings, long-term lease

obligations and other liabilities. “Net Debt” is equal to loans and

borrowings before deferred financing charges less cash and cash

equivalents and CCS derivatives. The data presented is intended to

provide additional information about items on the statement of

financial position and should not be considered in isolation or as

a substitute for measures prepared in accordance with IFRS.

The following table represents the composition

of the non-IFRS financial measure of Working Capital (including

cash and cash equivalents).

|

($000s) |

|

|

September 30, |

|

|

December 31, |

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Current assets |

|

$ |

233,899 |

|

$ |

256,361 |

|

|

Current liabilities |

|

|

(161,456 |

) |

|

(189,781 |

) |

|

Working Capital (including cash and cash equivalents) |

|

$ |

72,443 |

|

$ |

66,580 |

|

|

|

The following table presents the composition of the non-IFRS

financial measure of Total long-term financial liabilities.

|

($000s) |

|

|

September 30, |

|

December 31, |

|

|

|

|

2023 |

|

2022 |

|

Long-term loans |

|

$ |

89,740 |

$ |

140,794 |

|

Long-term leases |

|

|

18,461 |

|

13,860 |

|

Other long-term liabilities |

|

|

16,472 |

|

14,092 |

|

Total long-term financial liabilities |

|

$ |

124,673 |

$ |

168,746 |

The following table presents the composition of

the non-IFRS financial measure of Net Debt.

|

($000s) |

|

|

September 30, |

|

|

December 31, |

|

|

|

|

|

2023 |

|

|

2022 |

|

|

Loans and borrowings |

|

$ |

89,740 |

|

$ |

140,794 |

|

|

Add back: Deferred financing costs |

|

|

1,909 |

|

|

2,704 |

|

|

Less: Cash and cash equivalents |

|

|

(1,486 |

) |

|

(2,785 |

) |

|

Less: CCS Derivatives liability (asset) |

|

|

(413 |

) |

|

1,511 |

|

|

Net Debt |

|

$ |

89,750 |

|

$ |

142,224 |

|

RISK FACTORS AND RISK

MANAGEMENTThe oilfield services industry involves many

risks, which may influence the ultimate success of the Company. The

risks and uncertainties set out are not the only ones the Company

is facing. There are additional risks and uncertainties that the

Company does not currently know about or that the Company currently

considers immaterial which may also impair the Company’s business

operations and can cause the price of the Common Shares to decline.

If any of the following risks occur, the Company’s business may be

harmed and the Company’s financial condition and results of

operations may suffer significantly:

- The Company's

business depends on the oil and natural gas industry and

particularly on the level of exploration, development and

production for North American oil and natural gas, which is

volatile;

- Difficulty in

retaining, replacing or adding personnel could adversely affect the

Company's business;

- If the Company is

unable to obtain raw materials, diesel fuel and component parts

from its current suppliers or obtain them at competitive prices, it

could have a material adverse effect on the Company's

business;

- STEP's reliance

on equipment suppliers and fabricators exposes it to risks

including timing of delivery and quality of equipment;

- Radical activism

could harm the Company's business;

- Natural disasters

and pandemics (including COVID-19) could adversely affect the

Company;

- The Company's

industry is affected by excess equipment levels;

- The Company's

industry is intensely competitive;

- The Company's

current technology may become obsolete or experience a decrease in

demand;

- Cyber-attacks and

loss of the Company's information and computer systems could

adversely affect the Company's business;

- The Company's

client base is concentrated and loss of a significant client could

cause its revenue to decline substantially.

- Fluctuations in

currency exchange rates could adversely affect the Company's

business;

- Legislation,

regulations, and court rulings could result in increased costs and

additional operating restrictions or delays;

- The Company is

subject to a number of health, safety and environmental laws and

regulations that may require it to make substantial expenditures or

cause it to incur substantial liabilities;

- Political and

social events and decisions could have an adverse effect on the

Company;

- The Company is

susceptible to seasonal volatility in its operating and financial

results due to adverse weather conditions.

- The Company may

be exposed to third-party credit risk;

- The Company's

operations are subject to hazards inherent in the oilfield services

industry, which risks may not be covered to the full extent by the

Company's insurance policies;

- Failure to

maintain the Company's safety standards and record could lead to a

decline in the demand for services.

- Access to capital

may become restricted, more expensive, or repayment could be

required;

- Actual results

may differ materially from management estimates and

assumptions;

- The Company may

become subject to legal proceedings which could have a material

adverse effect on its business, financial condition and results of

operations;

- The direct and

indirect costs of various GHG regulations, existing and proposed,

may adversely affect the Company's business, operations and

financial results;

- The Company's

internal controls may not be sufficient to ensure the Company

maintains control over its financial processes and reporting;

- Business

acquisitions involve numerous risks and the failure to realize

anticipated benefits of acquisitions and dispositions could

negatively affect the Company's results of operations;

- There can be no

assurance that the steps the Company takes to protect its

intellectual property rights will prevent misappropriation or

infringement;

- Improper access

to confidential information could adversely affect the Company's

business; and

- Some of the

Company's directors and officers have conflicts of interest as a

result of their involvement with other oilfield services

companies.

In addition, global and national risks

associated with inflation or economic contraction may adversely

affect the Company by, among other things, reducing economic

activity resulting in lower demand, and pricing, for crude oil and

natural gas products, and thereby the demand and pricing for the

Company’s services. For additional information regarding the risks

that the Company is exposed to, see the disclosure provided under

the heading “Risk Factors” in the AIF which is available on the

SEDAR website at www.sedar.com and is incorporated by reference

herein.

FORWARD-LOOKING INFORMATION &

STATEMENTS Certain statements contained in this Press

Release constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws

(collectively, “forward-looking statements”). These statements

relate to the expectations of management about future events,

results of operations and the Company’s future performance (both

operational and financial) and business prospects. All statements

other than statements of historical fact are forward-looking

statements. The use of any of the words “anticipate”, “plan”,

“contemplate”, “continue”, “estimate”, “expect”, “intend”,

“propose”, “might”, “may”, “will”, “shall”, “project”, “should”,

“could”, “would”, “believe”, “predict”, “forecast”, “pursue”,

“potential”, “objective” and “capable” and similar expressions are

intended to identify forward-looking statements. These statements

involve known and unknown risks, uncertainties and other factors

that may cause actual results or events to differ materially from

those anticipated in such forward-looking statements. While the

Company believes the expectations reflected in the forward-looking

statements included in this Press Release are reasonable, such

statements are not guarantees of future performance or outcomes and

may prove to be incorrect and should not be unduly relied upon.

In particular, but without limitation, this

Press Release contains forward-looking statements pertaining to:

2023, 2024, and 2025 industry conditions and outlook, including the

effect of European and Middle East geopolitical events, demand for

oil and gas, industry production discipline, and other

macroeconomic factors, and the effect of new LNG facilities; OPEC

production as it relates to oil prices; anticipated 2023 and 2024

utilization levels, commodity prices, and pricing for the Company’s

services; recession risk, including its effect on oil prices; the

timing of completion of the Company’s tier 4 dual fuel conversions

and anticipated substitution rates in the Company’s dual fuel

fleets; the effect of a Canadian Supreme Court reference opinion on

the federal Impact Assessment Act and related regulations, and

consequently on Canadian energy production; the effect of

under-investment in hydrocarbon production; the effect large

clients and their programs may have on the Company’s activity

levels; supply and demand for the Company’s and its competitors’

services, including the ability for the industry to respond to

demand increases; the effect of inflation and related cost

increases; the effect of natural gas transportation, storage and

liquefaction system constraints; the impact of weather and break up

on the Company’s operations; the competitive labour market; the

potential for commodity price volatility; the effect of changes in

work scope and awards on expected margins and the location of

deployed equipment; the Company’s focus on Free Cash Flow and

investment in emissions reduction technologies; the Company’s

ability to meet all financial commitments including interest

payments over the next twelve months; the Company’s plans regarding

equipment; the Company’s ability to manage its capital structure;

expected debt repayment and Funded Debt to Adjusted Bank EBITDA

ratios; expected income tax and derivative liabilities; adequacy of

resources to funds operations, financial obligations and planned

capital expenditures; the Company’s ability to retain its existing

clients; the monitoring of impairment, amount and age of balances

owing, and the Company’s financial assets and liabilities

denominated in U.S. dollars, and exchange rates; supply chain

constraints impact on new-build and refurbishment timelines; and

the Company’s expected compliance with covenants under its Credit

Facilities and its ability to satisfy its financial commitments

thereunder.

The forward-looking information and statements

contained in this Press Release reflect several material factors

and expectations and assumptions of the Company including, without

limitation: the effect of macroeconomic factors, including global

energy security concerns and levels of oil and gas inventories;

market concerns regarding economic recession; levels of oil and gas

production and the effect of OPEC related capacity and related

uncertainty on the market for the Company’s services; that the

Government of Canada will respond to a Supreme Court reference

ruling in a manner consistent with past practice; that the Company

will continue to conduct its operations in a manner consistent with

past operations; the Company will continue as a going concern; the

general continuance of current or, where applicable, assumed

industry conditions; pricing of the Company’s services; the

Company’s ability to market successfully to current and new

clients; predictability of Q4 activity levels; predictable effect

of seasonal weather and break up on the Company’s operations; the

Company’s ability to utilize its equipment; the Company’s ability

to collect on trade and other receivables; Client demand for dual

fuel fleets and emissions reduction technologies; the Company’s

ability to obtain and retain qualified staff and equipment in a

timely and cost effective manner; levels of deployable equipment;

future capital expenditures to be made by the Company; future

funding sources for the Company’s capital program; the Company’s

future debt levels; the availability of unused credit capacity on

the Company’s credit lines; the impact of competition on the

Company; the Company’s ability to obtain financing on acceptable

terms; the Company’s continued compliance with financial covenants;

the amount of available equipment in the marketplace; and client

activity levels and spending. The Company believes the material

factors, expectations and assumptions reflected in the

forward-looking information and statements are reasonable, but no

assurance can be given that these factors, expectations and

assumptions will prove correct.

Actual results could differ materially from

those anticipated in these forward‐looking statements due to the

risk factors set forth under the heading “Risk Factors” in the AIF

and under the heading Risk Factors and Risk Management in this

Press Release.

Any financial outlook or future orientated

financial information contained in this Press Release regarding

prospective financial performance, financial position or cash flows

is based on the assumptions about future events, including economic

conditions and proposed courses of action based on management’s

assessment of the relevant information that is currently available.

Projected operational information, including the Company’s capital

program, contains forward looking information and is based on a

number of material assumptions and factors, as are set out above.

These projections may also be considered to contain future oriented

financial information or a financial outlook. The actual results of

the Company’s operations will likely vary from the amounts set

forth in these projections and such variations may be material.

Readers are cautioned that any such financial outlook and future

oriented financial information contains herein should not be used

for purposes other than those for which it is disclosed herein.

The forward-looking information and statements

contained in this Press Release speak only as of the date of the

document, and none of the Company or its subsidiaries assumes any

obligation to publicly update or revise them to reflect new events

or circumstances, except as may be required pursuant to applicable

laws. The reader is cautioned not to place undue reliance on

forward-looking information.

CONDENSED CONSOLIDATED INTERIM STATEMENTS

OF FINANCIAL POSITION

|

As at |

|

|

September 30, |

|

|

December 31, |

|

|

Unaudited (in thousands of Canadian dollars) |

|

|

2023 |

|

|

2022 |

|

|

ASSETS |

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

1,486 |

|

$ |

2,785 |

|

|

Trade and other receivables |

|

|

169,313 |

|

|

199,004 |

|

|

Income tax receivable |

|

|

- |

|

|

137 |

|

|

Inventory |

|

|

51,619 |

|

|

46,410 |

|

|

Prepaid expenses and deposits |

|

|

11,068 |

|

|

8,025 |

|

|

Risk management contracts |

|

|

413 |

|

|

- |

|

|

|

|

|

233,899 |

|

|

256,361 |

|

|

Property and equipment |

|

|

404,819 |

|

|

402,482 |

|

|

Right-of-use assets |

|

|

27,227 |

|

|

23,528 |

|

|

Intangible assets |

|

|

132 |

|

|

161 |

|

|

Other assets |

|

|

4,172 |

|

|

- |

|

|

|

|

$ |

670,249 |

|

$ |

682,532 |

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

Trade and other payables |

|

$ |

137,973 |

|

$ |

165,869 |

|

|

Current portion of lease obligations |

|

|

8,302 |

|

|

8,326 |

|

|

Current portion of other liabilities |

|

|

2,654 |

|

|

6,526 |

|

|

Income tax payable |

|

|

12,527 |

|

|

9,060 |

|

|

|

|

|

161,456 |

|

|

189,781 |

|

|

Deferred tax liabilities |

|

|

18,348 |

|

|

17,972 |

|

|

Lease obligations |

|

|

18,461 |

|

|

13,860 |

|

|

Other liabilities |

|

|

16,472 |

|

|

14,092 |

|

|

Loans and borrowings |

|

|

89,740 |

|

|

140,794 |

|

|

|

|

|

304,477 |

|

|

376,499 |

|

|

Shareholders' equity |

|

|

|

|

|

|

Share capital |

|

|

455,864 |

|

|

453,702 |

|

|

Contributed surplus |

|

|

34,701 |

|

|

32,843 |

|

|

Accumulated other comprehensive income |

|

|

16,292 |

|

|

16,236 |

|

|

Deficit |

|

|

(141,085 |

) |

|

(196,748 |

) |

|

|

|

|

365,772 |

|

|

306,033 |

|

|

|

|

$ |

670,249 |

|

$ |

682,532 |

|

CONDENSED CONSOLIDATED INTERIM STATEMENTS

OF NET INCOME AND OTHER COMPREHENSIVE INCOME

|

|

|

|

For the three months endedSeptember 30, |

|

|

For the nine months endedSeptember 30, |

|

|

Unaudited(in thousands of Canadian dollars, except per share

amounts) |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

255,235 |

|

$ |

245,085 |

|

$ |

750,676 |

|

$ |

737,624 |

|

|

Operating expenses |

|

|

214,218 |

|

|

198,770 |

|

|

639,293 |

|

|

623,622 |

|

|

Gross profit |

|

|

41,017 |

|

|

46,315 |

|

|

111,383 |

|

|

114,002 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

13,409 |

|

|

9,007 |

|

|

29,132 |

|

|

43,148 |

|

|

Results from operating activities |

|

|

27,608 |

|

|

37,308 |

|

|

82,251 |

|

|

70,854 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance costs, net |

|

|

2,850 |

|

|

1,330 |

|

|

8,557 |

|

|

7,551 |

|

|

Foreign exchange loss (gain) |

|

|

1,278 |

|

|

(173 |

) |

|

2,036 |

|

|

(224 |

) |

|

Unrealized gain on derivatives |

|

|

(3,783 |

) |

|

- |

|

|

(1,289 |

) |

|

- |

|

|

Gain on disposal of property and equipment |

|

|

(417 |

) |

|

(921 |

) |

|

(1,064 |

) |

|

(2,571 |

) |

|

Amortization of intangible assets |

|

|

10 |

|

|

9 |

|

|

30 |

|

|

135 |

|

|

Impairment reversal of property and equipment |

|

|

- |

|

|

- |

|

|

- |

|

|

(32,708 |

) |

|

Income before income tax |

|

|

27,670 |

|

|

37,063 |

|

|

73,981 |

|

|

98,671 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Income tax expense |

|

|

|

|

|

|

|

|

|

|

Current |

|

|

4,878 |

|

|

5,071 |

|

|

17,948 |

|

|

8,423 |

|

|

Deferred |

|

|

2,058 |

|

|

1,140 |

|

|

370 |

|

|

12,159 |

|

|

Total income tax expense |

|

|

6,936 |

|

|

6,211 |

|

|

18,318 |

|

|

20,582 |

|

|

Net income |

|

|

20,734 |

|

|

30,852 |

|

|

55,663 |

|

|

78,089 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

Foreign currency translation gain |

|

|

6,039 |

|

|

13,956 |

|

|

56 |

|

|

17,092 |

|

|

Total comprehensive income |

|

$ |

26,773 |

|

$ |

44,808 |

|

$ |

55,719 |

|

$ |

95,181 |

|

|

Net income per share: |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.29 |

|

$ |

0.45 |

|

$ |

0.77 |

|

$ |

1.14 |

|

|

Diluted |

|

$ |

0.28 |

|

$ |

0.43 |

|

$ |

0.74 |

|

$ |

1.09 |

|

CONDENSED CONSOLIDATED INTERIM

STATEMENTS OF CASH FLOWS

|

|

|

|

For the three months endedSeptember 30, |

|

|

For the nine months endedSeptember 30, |

|

|

Unaudited(in thousands of Canadian dollars) |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating activities: |

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

20,734 |

|

$ |

30,852 |

|

$ |

55,663 |

|

$ |

78,089 |

|

|

Adjusted for the following: |

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

20,743 |

|

|

19,378 |

|

|

62,614 |

|

|

63,140 |

|

|

Share-based compensation |

|

|

4,045 |

|

|

1,373 |

|

|

307 |

|

|

16,431 |

|

|

Unrealized foreign exchange loss (gain) |

|

|

1,041 |

|

|

(837 |

) |

|

3,413 |

|

|

(812 |

) |

|

Unrealized gain on derivatives |

|

|

(3,783 |

) |

|

- |

|

|

(1,289 |

) |

|

- |

|

|

Gain on disposal of property and equipment |

|

|

(417 |

) |

|

(921 |

) |

|

(1,064 |

) |

|

(2,571 |

) |

|

Impairment reversal of property and equipment |

|

|

- |

|

|

- |

|

|

- |

|

|

(32,708 |

) |

|

Finance costs |

|

|

2,850 |

|

|

1,330 |

|

|

8,557 |

|

|

7,551 |

|

|

Income tax expense |

|

|

6,936 |

|

|

6,211 |

|

|

18,318 |

|

|

20,582 |

|

|

Income taxes paid |

|

|

(1,569 |

) |

|

(117 |

) |

|

(14,439 |

) |

|

(161 |

) |

|

Cash finance costs paid |

|

|

(2,451 |

) |

|

(3,616 |

) |

|

(8,523 |

) |

|

(9,030 |

) |

|

Changes in non-cash working capital from operating activities |

|

|

2,607 |

|

|

19,395 |

|

|

8,319 |

|

|

(50,246 |

) |

|

Net cash provided by operating activities |

|

|

50,736 |

|

|

73,048 |

|

|

131,876 |

|

|

90,265 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investing activities: |

|

|

|

|

|

|

|

|

|

|

Purchase of property and equipment |

|

|

(25,232 |

) |

|

(20,226 |

) |

|

(65,606 |

) |

|

(50,322 |

) |

|

Proceeds from disposal of equipment and vehicles |

|

|

75 |

|

|

888 |

|

|

2,023 |

|

|

5,658 |

|

|

Changes in non-cash working capital from investing activities |

|

|

2,613 |

|

|

(5,821 |

) |

|

(9,986 |

) |

|

103 |

|

|

Net cash used in investing activities |

|

|

(22,544 |

) |

|

(25,159 |

) |

|

(73,569 |

) |

|

(44,561 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Financing activities: |

|

|

|

|

|

|

|

|

|

|

(Repayment) draws of loans and borrowings |

|

|

(30,236 |

) |

|

(46,046 |

) |

|

(53,302 |

) |

|

(41,012 |

) |

|

Repayment of obligations under finance lease |

|