Chinook Energy Inc. ("Chinook" or the "Company") (TSX:CKE) is pleased to

announce its financial and operating results for the three and twelve months

ended December 31, 2010.

2010 was a very active year at Chinook and its predecessor Storm Ventures

International Inc. ("SVI"). Undoubtedly, it was also challenging, and sometimes

confusing, for our shareholders to follow the many changes we underwent while

strengthening our platform to deliver growth, liquidity and ultimately, a better

valuation. We started the year with a strong portfolio of oil prone exploration

licenses and undeveloped discoveries in Tunisia and a capital intensive natural

gas weighted development portfolio and operatorship of the Victoria natural gas

field in the southern natural gas basin of the UK sector of the North Sea. By

early summer, we had completed a number of transactions and by year end we had

assembled a 62.5 million barrel proved plus probable oil equivalent asset base,

49 percent of which are liquids. The majority of the scalable opportunities in

Canada are targeting natural gas despite roughly 30 percent of the production

volumes and 58 percent of the revenue coming from liquids projects. The scalable

development inventory on the oil side comes from our onshore Tunisian position,

in particular the Bir Ben Tartar (TT) discovery at Sud Remada, where we have an

independent resource assessment that quantifies a Discovered Petroleum

Initially-In- Place ("DPIIP") resource of 297 million barrels of oil (gross).

With 57 percent of our Canadian reserves (42 percent of the total reserves)

being classified as proved developed producing and an 11 year reserve life index

(based on average fourth quarter production and proved plus probable reserves)

we believe the $3.55 net asset value per fully diluted share, on an after tax

basis discounted at 10 percent ($4.91 net asset value per fully diluted share on

a before tax basis discounted at 10 percent), is a conservative estimate of the

value of the Company. Over 2010 we completed the following transactions:

-- On March 1, the acquisition of West Central Alberta assets from

Provident Energy Ltd. for $175 million, after adjustments, through the

issuance of 42.9 million shares at $3.50 per share. In connection with

the transaction, we established and drew down a portion of a $55 million

credit facility. This was a reasonably priced, stable cash flow stream

from mature assets that supported a re -focus in Canada. The acquisition

was intended to improve our access to debt, equity and cash flow and was

successful in two out of three of those objectives. The year end 2010

proved plus probable reserves, net of 2010 production and non-core

property dispositions totaling $13 million, were 12.4 million barrels of

oil equivalent with a present value before tax discounted at ten percent

for these assets of $156 million.

-- On March 11, the acquisition of a Tunisian producing company with a five

percent non-operated interest in the prolific Acacus oil fairway that

brought 600 barrels of oil equivalent per day of production, in- country

cash flow and marketing experience, 1.7 million barrels of oil

equivalent of reserves, continued exploration upside to expansions in

the play fairway, exposure to strategic facilities and infrastructure,

and a good technical window on a play where we have similar prospects on

other high interest operated lands. This acquisition was completed for

USD $18 million and financed in large part through the January 2010

issuance of 4.52 million shares at $3.00 per share. The year end 2010

proved plus probable reserves, net of 2010 production, were 2.4 million

barrels of oil equivalent with a present value before tax discounted at

ten percent for these assets of $34.9 million. We expect this asset to

continue to appreciate in value for a number of years.

-- On March 26, the merger of our indirect wholly-owned UK subsidiary

Silverstone Energy Limited with Bridge Energy Norge AS in exchange for

28.8 million shares of Bridge Energy ASA ("Bridge Energy") that

represented at closing 80 percent of the then issued and outstanding

shares. Concurrent with that transaction Bridge Energy raised USD $54.1

million in new equity through the issuance of 16.2 million shares at 20

Norwegian Kroner per share (equivalent to USD $3.33 per share) and

listed on the Norwegian Borse. These shares were distributed to our

shareholders on the basis of 0.23398 of a Bridge Energy share for each

common share of SVI held. We believed it was necessary to diversify the

portfolio of assets in our North Sea business and improve our access to

capital in an attempt to mitigate risk associated with our debt exposure

to The Royal Bank of Scotland and 100 percent exposure to natural gas.

The initial value assigned to the shares received and distributed was

approximately 60 percent of the equity contributed to that business

since it was started in 2004. Two members of our board are directors of

Bridge Energy. The company is pursuing a strategy of oil exploration in

Norway and natural gas development/oil acquisition in the UK.

-- On June 29, the acquisition of Iteration Energy Ltd. ("Iteration") for

total consideration of $555 million (including fees and severance). This

acquisition was financed with the sale at closing of $150 million of

assets representing approximately 25 percent of the acquired assets,

52.1 million shares issued to Iteration shareholders (valued at $141.8

million at closing), the assumption of $175 million of Iteration debt,

and a portion of the proceeds of a $125 million financing through the

issuance of 38.5 million shares at $3.25 per share. Through the

Iteration acquisition we have attempted to acquire a strong undeveloped

land position and a natural gas growth asset focused along the western

corridor of the province from Grande Prairie through the Fort St John

area. The year end 2010 reserves, net of 2010 production and asset

sales, were 29.1 million barrels of oil equivalent with a present value

before tax discounted at ten percent for these assets of $480.0 million.

-- On June 30, the purchase of assets in our core area of Gilby, Alberta

for consideration of $44.6 million, including adjustments, which was

financed through non-core asset sales and utilization of a portion of a

newly expanded $240 million syndicated revolving credit facility with a

consortium of six banks. The year end 2010 proved plus probable

reserves, net of 2010 production, were 3.8 million barrels of oil

equivalent with a present value before tax discounted at ten percent for

these assets of $57.9 million.

-- On July 6, the listing of the common shares of the combined entity as

Chinook on the TSX. Over the fourth quarter of 2010, we traded

approximately 310,000 shares per day within a range from $1.76 to $2.43

per share, closing the year at $2.14 per share.

Our full time staff in Calgary and Tunis increased to 113 full-time employees in

2010 from 30 at the end of 2009 as we staffed up the Canadian operation and

undertook the integration of the assets, systems and new staff. We began and

completed the design and testing of the internal controls over financial

reporting, as required of new Canadian public companies, and prepared for the

transition to International Financial Reporting Standards.

OPERATIONS SUMMARY

The key commodity price benchmarks for Chinook are the AECO natural gas price

for incremental natural gas and Brent crude oil prices for incremental oil

volumes. At March 21st prices the revenue equivalency is 31:1 and looking to the

2012 forward curve it averages 26:1. Based on this huge price disparity in

comparison to heating equivalency of 6 mcf:1 bbl and resulting recycle rates, we

intend to dedicate a minimum of 75 percent of capital expenditures to oil

projects in 2011.

Our recycle ratio in Canada, excluding acquisitions was 0.74 times on a proved

plus probable basis, based on netbacks of $16.69 per barrel of oil equivalent,

28 percent liquids contribution and a natural gas price of $3.62 per thousand

cubic feet. We require both a higher natural gas price and better drilling

results to generate competitive returns from investments in our natural gas

assets. Capital spent on natural gas projects will be focused on proving up

resource play concepts in our core areas and on locations supported by secondary

oil objectives at Gilby and Grande Prairie. We are not confident at calling the

timing of a turn on natural gas prices but generally believe that accelerated

decline rates and a drop in rig activity could support AECO prices rising to

$5.00-$6.00 per thousand cubic feet possibly as early as 2012. With an increase

in price to that level, we anticipate producers will aggressively hedge,

activity will ramp up, supply will increase and natural gas prices will have a

difficult time narrowing the unusually wide discount to oil prices without a

step change in consumption.

We have had interesting initial drilling success on our light oil prospects at

Winmore, Gilby and Valhalla that will be developed over the balance of 2011 and

may increase our domestic liquids weighting to 35 percent and 45 percent on a

corporate basis by 2012. We are also evaluating the shale potential of our lands

on the liquids-rich portions of both the Muskwa and Nordegg play fairways. We

also have heavy oil mineral rights on three bitumen accumulations, two of which

are being actively evaluated with pilot steam-assisted gravity drainage projects

that we will follow the results of and use to assist in assessing the commercial

viability of our acreage.

Three months ended Year ended

December 31 December 31

($ thousands, except per

unit amounts) 2010 2009 2010 2009

--------------------------------------------------------------------------

Sales and prices (3)

--------------------------------------------------------------------------

Oil sales (bbl/d) 4,125 93 2,225 68

Natural gas liquids sales

(bbl/d) 1,410 - 899 -

Natural gas sales (mcf/d) 62,346 - 40,282 -

Average daily sales 6:1

(boe/d) 15,927 93 9,839 68

Average oil price ($/bbl) 76.49 72.71 73.13 70.23

Average natural gas

liquids price ($/bbl) 55.93 - 53.33 -

Average natural gas price

($/mcf) 3.47 - 3.75 -

--------------------------------------------------------------------------

Production (4)

--------------------------------------------------------------------------

Oil (bbl/d) 3,552 93 2,181 68

Natural gas liquids

(bbl/d) 1,410 - 899 -

Natural gas (mcf/d) 62,346 - 40,282 -

Average daily production

(boe/d) 15,354 93 9,795 68

--------------------------------------------------------------------------

Financial operations

--------------------------------------------------------------------------

Oil, gas and natural gas

liquids revenue, net of

royalties (3) 47,227 620 114,620 1,735

Cash flow (1) 22,576 (784) 51,729 (1,236)

Per share-basic and

diluted (1) $ 0.11 $ (0.01) $ 0.32 $ (0.02)

Net loss from continuing

operations (12,893) (1,332) (31,952) (5,999)

Per share-basic and

diluted $ (0.06) $ (0.02) $ (0.20) $ (0.09)

Net loss (12,893) (16,327) (45,492) (19,617)

Per share-basic and

diluted $ (0.06) $ (0.23) $ (0.28) $ (0.27)

Capital expenditures (2)

(3) 25,454 3,692 761,059 7,983

Net debt (5) 170,526 (2,165) 170,526 (2,165)

Total assets 805,732 394,200 805,732 394,200

--------------------------------------------------------------------------

Common shares (thousands)

--------------------------------------------------------------------------

Weighted average during

period

- basic 214,188 73,839 162,003 73,681

- diluted 214,188 73,839 162,003 73,681

Outstanding at period end

- basic 214,188 75,224 214,188 75,224

- diluted 227,603 79,164 227,603 79,164

--------------------------------------------------------------------------

1. Cash flow is a non-GAAP measurement and is defined under the Non-GAAP

Measures section of this MD&A.

2. Includes asset retirement obligations incurred during the period and

other non-cash acquisition alloctions.

3. Excludes discontinued operations.

4. Production volumes differ from sales volumes in Tunisia where volumes of

oil are stored as inventory until title, responsibility and risk of the

oil transfer to a third party occurs.

5. Net debt includes bank debt, both current and long-term, and working

capital deficit (surplus).

Our recycle ratio in Tunisia, excluding acquisitions, was 2.92 times on a proved

plus probable basis and supports expanded commitments of capital as soon as the

initial appraisal results can be incorporated into the Plan of Development and

we receive regulatory approval. We are planning a five to six vertical

development well program before year end 2011.

The TT discovery on the Sud Remada permit in the Ghadames Basin represents our

near term oil development focus and the key catalyst to unlocking the

considerable remaining exploration potential of the 1.2 million acre permit.

When we acquired our interest in the block in 2003, it was considered a natural

gas prone, lightly explored, shallow extension of a prolific oil province. Our

Ordovician light oil discovery confirms a new zone and material extension to the

recognized oil window. An independent resource assessment by InSite Petroleum

Consultants Ltd. confirmed gross DPIIP of 297 million barrels of oil and

forecast reserves and a best case contingent resource of 36.8 million barrels of

oil (12 percent primary recovery) was attributable to three of the four

recognized pay zones mapped over the 16,000 acre TT structure (65 square

kilometres) on the 90,000 acre TT concession. Our contractor share of 38 percent

totals 14.1 million barrels of oil of which 3.6 million barrels of oil are

currently booked as proven and probable. Net pay in the four zones present in

the three wells drilled to date averages 52 feet with porosities of over 11

percent and permeability between 0.1 and 100 millidarcy. Approximately

two-thirds of these net pays will need to be fracture stimulated to produce at

commercial rates and we are in the process of mobilizing the service rig and

frac spread to complete an eight frac campaign beginning in April. We expect the

results of the frac campaign and first stage drilling of five to six wells later

this year will give us the experience we need to successfully land and complete

multi-stage frac'd horizontal wells as a preferred option in exploiting the

field. The approval of the development concession, which we anticipate to

receive in the second quarter of 2011, will create a single cost centre for cost

recovery purposes and will allow us to develop and produce from the field, and

any other discoveries on the concession, for up to 30 years. Our 2011 exit

target rate for Sud Remada is 2,500 barrels of oil per day (gross). Our goal for

2012 is to have a continuous drilling and completion operation employing

fit-for-purpose equipment and having a sales pipeline connected central facility

in place by year end. Early stage cash flow from Sud Remada will support

acceleration of the exploration activity on the balance of the concession and

development of the first offshore field at Cosmos. As we approach full cost

recovery on the Sud Remada permit, exploration costs incurred on the next

operation on other permits at Jenein and the Hammamet offshore permit can be

used to extend the payout calculation on the TT concession in much the same way

as tax pools are used to shelter income from multiple properties in different

provinces in Canada.

Exploration in sparsely drilled regions (Sud Remada averages one well per four

townships!) usually begins with drilling of seismically defined structural

closures with recognition of stratigraphically trapped accumulations and more

subtle play types developing as more data is generated. We have a five to ten

kilometre grid of 2D seismic data over the balance of the permit on which we

have identified eight additional structures which we will begin to test

immediately after entering the first of two possible three year renewal periods

beginning in the fall of this year. There are eleven wells drilled to date on

the block and based on the petrophysical understanding gained in our TT

appraisal work, we now have conventional targets in three prospective zones and

interpret wells on two of the structures to have by-passed pay. The Tannezuft

hot shale is the source rock for the oil at Sud Remada, and for most of the oil

in the Ghadames Basin. It has been cored and completed in at least four wells in

southern Tunisia in 2010. The information regarding whether the early stage work

supports a commercial shale play for natural gas and/or liquids is not currently

public. However, we cored our TT-3 appraisal well, the interpreted data from

which will be available by mid-year, and we intend to exchange that data with

other operators in an attempt to answer that question by the end of this year.

Based on the maturity information from TT, we know that at least 750,000 acres

of our block is in the oil generation window in the Tannezuft formation.

On our Adam project we continue to see oil production curtailed as gas oil

ratios increase and work towards the sanctioning of the Southern Tunisia Gas

Pipeline ("STGP") project continues. The STGP is expected on stream by early

2014 facilitating increased oil production, conservation and sale of solution

gas and commencement of production of non-associated natural gas from the Acacus

and the Ordovician. We drilled an exploration well on the Bochra prospect on the

Borj El Khadra block in March 2011 that has resulted in a discovery in the

Acacus and Ordovician. We expect the operator to submit a concession application

on a large portion of the 730,000 acre permit before the end of 2011. The

Tannezuft hot shale was cored in this well and a completion decision will be

made following a full petrophysical and core evaluation.

At Jenein, we plan to propose a workover of the Acacus and completion of the

Ordovician zones for late 2011 or early 2012 dependent on service rig

availability.

On our Hammamet offshore permit, we are shooting two 3D seismic surveys during

2011 and plan to move into the first four year renewal period with a new well

commitment made prior to year end.

TUNISIAN SECURITY SITUATION

Tunisia was the initial catalyst to a wave of civil unrest across the Middle

East and North Africa region that has caused the collapse of autocratic regimes

in Tunisia, Egypt and threatens civil war in Libya. The president of 23 years

resigned and left the country in the face of increasing dissent over youth

underemployment, police brutality and corruption. In comparison to other actions

in the region, the Tunisian Jasmine Revolution was quick, relatively peaceful

and the country appears to be moving towards a society with greater personal

freedoms and expression and a more representative political system. The short

term effects on our business were minimal in that our production has not been

interrupted and our operational delays to date have been predominantly

associated with equipment availability as opposed to security issues. Our staff

have been able to continue to manage our business, albeit with reduced

effectiveness due in large part to curfews, personal security restrictions and

the government shutting down for a period.

The longer term effect on our business is still to be determined but we are

optimistic and attribute a high probability to the outcome being neutral to our

interests. Legislative elections have been set for July 24 and more than 30

political parties have been registered. Expectations of the population are very

high with respect to the government's ability to increase employment and there

are periodic demonstrations demanding unrealistically high increases in staff

levels of public enterprises that threaten to spill over to demands on private

companies. Stability from a policy standpoint, maintaining a stable environment

for continued foreign investment, and the intent to honor the government's

obligations under existing contracts have been clearly articulated as policies

of the interim government. Chinook received a tangible indication of the

government's support in these areas with written notification of Entreprise

Tunisienne D'Activites Petrolieres's support for the joint concession request at

Sud Remada submitted to the General Directorate for Energy in Tunisia in late

March. Increased employment, increased revenue and stability will be key to the

success of any government and are benefits our project can begin to deliver

immediately. Energy will be a key aspect of any new budget balance and foreign

investment is critical in maintaining the domestic supply of energy at close to

a balanced level. From a timing perspective, it is our view that it is unlikely

that any clear direction from a new government will occur prior to the end of

2011. Several opinions we respect suggest a broad secular-based coalition is

very likely. The requirements in our existing contracts that we support the

development of Tunisian-based businesses will become even more critical in the

current environment.

During 2011, we hope to demonstrate commerciality of our onshore Tunisian assets

and have increasing oil volumes from the TT discovery drive increasing volumes

and higher barrels of oil equivalent revenue corporately. We will work to

improve the profitability and growth projections from our Canadian activities

through an increased focus on oil projects and activity in our core project

areas and will evaluate the key resource concepts that are prospective on our

540,000 undeveloped acre land base.

The Company has filed its audited consolidated financial statements and related

management's discussion and analysis ("MD&A") for the year ended December 31,

2010 on www.sedar.com and www.chinookenergyinc.com. Certain selected financial

and operational information for the three and twelve month periods ended

December 31, 2010 and 2009 comparatives contained in this news release should be

read in conjunction with Chinook's audited consolidated financial statements for

the year ended December 31, 2010 and related MD&A.

About Chinook Energy Inc.

Chinook is a Calgary-based public oil and natural gas exploration and

development company that combines high quality gas-weighted assets in Western

Canada with an exciting high growth oil business onshore and offshore Tunisia in

North Africa.

Reader Advisory

Certain information regarding Chinook in this news release including

management's assessment of the future plans and operations of Chinook and the

timing thereof constitute forward-looking statements under applicable securities

laws. In addition, statements relating to "reserves" and "resources" are deemed

to be forward-looking statements as they involve the implied assessment, based

on certain estimates and assumptions, that the reserves described exist in the

quantities predicted or estimated and be profitably produced in the future. In

particular, this news release contains, without limitation, forward-looking

statements pertaining to the following: management's assessment of the future

plans and operations of Chinook and the timing thereof and future production

volumes of oil and natural gas.

With respect to the forward-looking statements contained in this news release,

Chinook has made assumptions regarding, among other things: the ability of

Chinook to continue to operate in Tunisia with limited logistical issues, future

capital expenditure levels, future oil and natural gas prices, future oil and

natural gas production levels, Chinook's ability to obtain equipment in a timely

manner to carry out development activities, the impact of increasing

competition, the ability of Chinook to add production and reserves through

development and exploitation activities. Although Chinook believes that the

expectations reflected in the forward-looking statements contained in this news

release, and the assumptions on which such forward-looking statements are made,

are reasonable, there can be no assurance that such expectations will prove to

be correct. Readers are cautioned not to place undue reliance on forward-looking

statements included in this news release, as there can be no assurance that the

plans, intentions or expectations upon which the forward-looking statements are

based will occur. By their nature, forward-looking statements involve numerous

assumptions, known and unknown risks and uncertainties that contribute to the

possibility that predictions, forecasts, projections and other forward-looking

statements will not occur, which may cause Chinook's actual performance and

financial results in future periods to differ materially from any estimates or

projections of future performance or results expressed or implied by such

forward-looking statements. These risks and uncertainties include, without

limitation, political risk associated with Chinook's Tunisian operations, risks

associated with oil and gas exploration, development, exploitation, production,

marketing and transportation, loss of markets, volatility of commodity prices,

currency fluctuations, imprecision of reserve and resource estimates,

environmental risks, competition from other producers, inability to retain

drilling rigs and other services, capital expenditure costs, including drilling,

completion and facilities costs, unexpected decline rates in wells, delays in

projects and/or operations resulting from surface conditions, wells not

performing as expected, delays resulting from or inability to obtain the

required regulatory approvals and ability to access sufficient capital from

internal and external sources. As a consequence, actual results may differ

materially from those anticipated in the forward-looking statements. Readers are

cautioned that the forgoing list of factors is not exhaustive. Additional

information on these and other factors that could effect Chinook's operations

and financial results are included in reports on file with Canadian securities

regulatory authorities and may be accessed through the SEDAR website

(www.sedar.com) and at Chinook's website (www.chinookenergyinc.com).

Furthermore, the forward-looking statements contained in this news release are

made as at the date of this news release and Chinook does not undertake any

obligation to update publicly or to revise any of the forward-looking

statements, whether as a result of new information, future events or otherwise,

except as may be required by applicable securities laws.

Barrels of Oil Equivalent

Barrels of oil equivalent (boe) is calculated using the conversion factor of 6

mcf (thousand cubic feet) of natural gas being equivalent to one barrel of oil.

Boe may be misleading, particularly if used in isolation. A boe conversion ratio

of 6 mcf:1 bbl (barrel) is based on an energy equivalency conversion method

primarily applicable at the burner tip and does not represent a value

equivalency at the wellhead.

Reserve Life Index

The reader is also cautioned that this news release contains the term reserve

life index ("RLI"), which is not a recognized measure under GAAP. Management

believes that this measure is a useful supplemental measure of the length of

time the reserves would be produced over at the rate used in the calculation.

Readers are cautioned, however, that this measure should not be construed as an

alternative to other terms such as net income determined in accordance with GAAP

as a measure of performance. Chinook's method of calculating this measure may

differ from other companies, and accordingly, they may not be comparable to

measures used by other companies.

Discovered Petroleum Initially-In-Place

DPIIP (equivalent to discovered resources) is defined in the Canadian Oil and

Gas Evaluation Handbook as that quantity of petroleum that is estimated, as of a

given date, to be contained in known accumulations prior to production. The

recoverable portion of discovered petroleum initially-in-place includes

production, reserves, and contingent resources; the remainder is unrecoverable.

"Contingent Resources" are defined in the COGE Handbook as those quantities of

petroleum estimated to be potentially recoverable from known accumulations using

established technology or technology under development, but which are not

currently considered to be commercially recoverable due to one or more

contingencies. Contingencies include factors such as economic, legal,

environmental, political, and regulatory matters, or a lack of markets. It is

also appropriate to classify as contingent resources the estimated discovered

recoverable quantities associated with a project in the early evaluation stage.

The Contingent Resources estimates and the DPIIP estimates are estimates only

and the actual results may be greater than or less than the estimates provided

herein. There is no certainty that it will be commercially viable to produce any

portion of the resources except to the extent identified as proved or probable

reserves. Best Case Estimate: This is considered to be the best estimate of the

quantity that will actually be recovered. It is equally likely that the actual

remaining quantities recovered will be greater or less than the best estimate.

If probabilistic methods are used, there should be at least a 50% probability

(P50) that the quantities actually recovered will equal or exceed the best

estimate.

Possible reserves are those additional reserves that are less certain to be

recovered than probable reserves. There is a 10% probability that the quantities

actually recovered will equal or exceed the sum of proved plus probable plus

possible reserves.

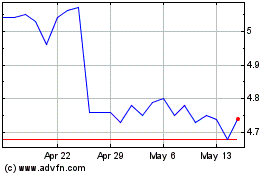

StorageVault Canada (TSX:SVI)

Historical Stock Chart

From Apr 2024 to May 2024

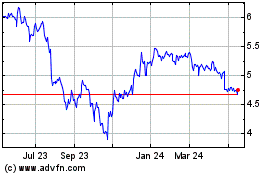

StorageVault Canada (TSX:SVI)

Historical Stock Chart

From May 2023 to May 2024