Teck Resources Limited (TSX: TECK.A and TECK.B, NYSE: TECK) (Teck)

today announced its unaudited third quarter results for 2024.

"The third quarter marked a new era for Teck as we successfully

transformed into a pure-play energy transition metals company with

leading copper growth," said Jonathan Price, President and CEO. "We

closed the sale of our remaining interest in the steelmaking coal

business and have returned over $1.3 billion to shareholders so far

this year, while also reducing debt and ramping-up copper

production."

Highlights

- Adjusted EBITDA1 of $986 million in Q3 2024 was driven by

record copper production as Quebrada Blanca (QB) continues to

ramp-up operations, as well as strong base metals pricing and zinc

sales volumes from Red Dog. Our loss from continuing operations

before taxes was $759 million in Q3 2024, primarily due to an

impairment charge at our Trail Operations.

- Adjusted profit from continuing operations attributable to

shareholders1 was $314 million, or $0.61 per share, in Q3 2024. Our

loss from continuing operations attributable to shareholders was

$748 million, $1.45 per share, in Q3 2024, primarily due to an

impairment charge at our Trail Operations.

- We completed the sale of the remaining 77% interest in our

steelmaking coal business, Elk Valley Resources (EVR) and received

cash proceeds of US$7.3 billion on July 11, 2024. We commenced

deployment of these proceeds through shareholder returns and debt

reductions in Q3.

- We returned a total of $720 million to shareholders in the

third quarter through the purchase of $398 million of Class B

subordinate voting shares pursuant to our normal course issuer bid,

and $322 million in dividends, reflecting our regular base

quarterly dividend and a supplemental dividend of $0.50 per share,

or $257 million.

- From January 1 to October 23, 2024, we have returned over $1.3

billion to shareholders through share buybacks and dividends.

- We reduced our debt by US$1.5 billion through a bond tender

offer for our public notes in July and the repayment of short-term

loans at Carmen de Andacollo.

- Our liquidity as at October 23, 2024 is $11.9

billion, including $7.8 billion of cash. We generated cash flows

from operations of $134 million in Q3 and had a net cash position

of $1.8 billion at September 30, 2024.

- We achieved another consecutive record quarter of copper

production with 114,500 tonnes in the third quarter, of which

52,500 tonnes were from QB. Production at QB continues to ramp-up

and we expect to be operating at full throughput rates by the end

of 2024.

- Copper prices (LME) remain strong, averaging US$4.18 per pound

in the third quarter and closing the quarter at US$4.43 per pound,

contributing to $103 million of positive pricing adjustments in the

third quarter.

- Red Dog's performance was strong in the third quarter with zinc

production increasing by 14% to 142,500 tonnes compared to the same

period last year. Red Dog's zinc net cash unit costs1 have improved

and our 2024 annual unit cost guidance for zinc has been updated

accordingly.

Note:

- This is a non-GAAP financial measure or ratio. See “Use of

Non-GAAP Financial Measures and Ratios” for further

information.

Financial Summary Q3 2024

|

Financial Metrics(CAD$ in millions, except per

share data) |

Q3 2024 |

Q3 2023 |

|

Revenue |

$ |

2,858 |

$ |

1,989 |

| Gross profit |

$ |

478 |

$ |

261 |

| Gross profit before

depreciation and amortization1 |

$ |

962 |

$ |

533 |

| Profit (loss) from continuing

operations before taxes |

$ |

(759) |

$ |

48 |

| Adjusted EBITDA1 |

$ |

986 |

$ |

417 |

| Loss from continuing

operations attributable to shareholders |

$ |

(748) |

$ |

(48) |

| Adjusted profit from

continuing operations attributable to shareholders1 |

$ |

314 |

$ |

85 |

| Basic loss per share from

continuing operations |

$ |

(1.45) |

$ |

(0.09) |

| Diluted loss per share from

continuing operations |

$ |

(1.45) |

$ |

(0.09) |

| Adjusted basic earnings per

share from continuing operations1 |

$ |

0.61 |

$ |

0.16 |

|

Adjusted diluted earnings per share from continuing

operations1 |

$ |

0.60 |

$ |

0.16 |

Key Updates

Executing on Our Copper Growth Strategy

- QB copper production of 52,500 tonnes in the third quarter

increased compared to 51,300 tonnes in the second quarter of 2024,

as quarter over quarter production ramp-up continues.

- Mill throughput rates increased quarter over quarter confirming

plant design is robust. We continue to expect to be at design mill

throughput rates by the end of 2024.

- The localized geotechnical issue identified and disclosed in Q2

2024 has now stabilized with controls in place and we are advancing

the mine plan.

- Grades in Q3 were lower, consistent with our previously

disclosed guidance, and we continue to expect higher grades in Q4.

Normal grade variability is expected within any given period, as

considered in our mine plans.

- Based on current production levels and expected throughput and

recoveries, the upper end of our 2024 annual QB copper production

guidance range has been updated and our guidance range is now

200,000 to 210,000 tonnes. In addition, as a result of our lower

than expected molybdenum production levels, we have updated our

previously disclosed annual QB molybdenum production guidance to

0.8 to 1.2 thousand tonnes.

- We continue to expect QB's total and net cash unit costs1 for

2024 to be within our previously disclosed guidance, despite the

reduction in annual molybdenum production guidance.

- Due to the ongoing work to improve copper recovery and

equipment reliability extending into the first half of 2025, we

have updated our previously disclosed 2025 QB annual copper

production guidance to 240,000 to 280,000 tonnes and molybdenum

production to 4.0 to 5.5 thousand tonnes.

- Mill optimization work to push performance past nameplate by

improving throughput is currently underway with plans for

debottlenecking efforts being advanced.

- In the third quarter, we continued to make progress in

advancing Teck’s copper growth strategy, reinforcing our commitment

to long-term value creation through a balanced approach of growth

investments and shareholder returns. While maintaining a strong

balance sheet, Teck’s prudent investment plans are designed to

de-risk the development of our assets, including navigating the

permitting process. As previously disclosed, Teck does not

anticipate sanctioning any growth projects in 2024. The focus

remains on advancing our near-term projects for potential

sanctioning in 2025. All growth projects must meet stringent

criteria, delivering attractive risk-adjusted returns and competing

for capital in alignment with Teck’s capital allocation

framework.

Note:

- This is a non-GAAP financial measure or ratio. See “Use of

Non-GAAP Financial Measures and Ratios” for further

information.

New Business Structure to Support Transition to

Pure-Play Energy Transition Metals Company

- In August, we announced a new business structure to support our

shift to a pure-play energy transition metals company focused on

growth. The new business structure organizes Teck around two

regional business units for North America and Latin America

(LATAM), and a dedicated Projects group to develop and execute

brownfield and greenfield projects.

- This structure simplifies Teck with a streamlined executive

leadership team and regional structure to deliver on our strategy

of copper growth balanced with shareholder returns and long-term

resiliency. It positions Teck to drive improved operational

performance, while efficiently and responsibly capitalizing on

profitable growth opportunities to enhance value for all

stakeholders.

- Our reported segmented financial results and summary

information contained in our Management Discussion and Analysis

will continue to be disclosed on a commodity basis for our copper

and zinc operations in addition to our corporate segment.

Deployment of Transaction Proceeds from Sale of

Steelmaking Coal Business

- We completed the sale of our remaining 77% interest in our

steelmaking coal business, EVR, to Glencore and received

transaction proceeds of US$7.3 billion on July 11, 2024.

- On closing of the transaction, we announced our intention to

allocate the transaction proceeds consistent with Teck's Capital

Allocation Framework. This included the repurchase of up to $2.75

billion of Class B subordinate voting shares, a one-time

supplemental dividend of $0.50 per share, a debt reduction program

of up to $2.75 billion, funding retained for our value-accretive

copper growth projects, and approximately $1.0 billion for final

taxes and transaction costs.

- Combined with the $500 million share buyback announced in

February, total cash returns to shareholders of $3.5 billion from

the sale of the steelmaking coal business have been

authorized.

- In Q3, we commenced deployment of the proceeds through

shareholder returns and debt reduction. We returned a total of $720

million to shareholders in the third quarter through the purchase

of $398 million of Class B subordinate voting shares pursuant to

our normal course issuer bid, and $322 million in dividends,

reflecting our regular base quarterly dividend and a supplemental

dividend of $0.50 per share, or $257 million. We reduced our debt

by US$1.5 billion through a bond tender offer for our public notes

in July and the repayment of short-term loans at Carmen de

Andacollo.

- From January 1 to October 23, 2024, we have returned over $1.3

billion to shareholders through share buybacks and dividends.

- In our third quarter News Release, Management's Discussion and

Analysis, and Condensed Interim Consolidated Financial Statements,

EVR's results have been presented as discontinued operations for

all periods reported.

Safety and Sustainability Leadership

- We were saddened to report a fatality on July 24 at the

Antamina Mine, our joint venture with BHP, Glencore and Mitsubishi.

Antamina has conducted a full investigation and learnings will be

shared across our company and industry.

- We continued to focus on driving health and safety at our

sites, with our High-Potential Incident (HPI) Frequency rate

remaining steady at 0.10 in Q3 2024, a 33% reduction compared to

the same period last year.

- On October 9, 2024, Teck was named to the Forbes list of the

World’s Best Employers 2024, an employee-driven ranking of

multinational companies and institutions from over 50 countries

around the world.

Guidance

- We have updated our previously disclosed 2024 annual guidance

for zinc net cash unit costs1, and copper, molybdenum and refined

zinc production. The remainder of our previously disclosed guidance

for 2024 is unchanged. We have updated our previously disclosed

2025 annual copper and molybdenum production guidance for QB, as

outlined above.

- Continued strong performance at Red Dog has resulted in an

improvement in net cash unit costs1 and accordingly, our 2024

annual zinc net cash unit costs1 are now expected to be US$0.45 to

$0.55 per pound, compared to our previously disclosed guidance

range of US$0.55 to $0.65 per pound.

- Our 2024 annual copper production guidance has been

updated to a range of 420,000 to 455,000 tonnes, a reduction from

our previously disclosed guidance of 435,000 to 500,000 tonnes. The

reduction relates to Highland Valley Copper, as well as a reduction

to the upper end of QB's production guidance range. Highland Valley

Copper's guidance reduction was a result of a delay in mining in

the Lornex pit due to challenges with labour availability and the

autonomous systems of our new haul trucks. This has been largely

resolved and we expect to process more ore from the Lornex pit in

the fourth quarter.

- Molybdenum production for 2024 has been reduced by 1.3 to 1.5

thousand tonnes to 3.0 to 4.0 thousand tonnes due to lower

production at Highland Valley Copper and QB.

- Refined zinc production at Trail for 2024 has been reduced to a

range of 240,000 to 250,000 tonnes as a result of a localized fire

in the electrolytic zinc plant on September 24, 2024.

- Our guidance is outlined in summary below and our usual

guidance tables, including three-year production guidance, can be

found on pages 26–29 of Teck’s third quarter results for 2024

at the link below.

|

2024 Guidance – Summary |

Current |

|

| Production

Guidance |

|

|

|

Copper (000’s tonnes) |

420 - 455 |

|

|

Zinc (000’s tonnes) |

565 - 630 |

|

|

Refined zinc (000’s tonnes) |

240 - 250 |

|

| Sales Guidance –

Q4 2024 |

|

|

|

Red Dog zinc in concentrate sales (000’s tonnes) |

155 - 185 |

|

| Unit Cost

Guidance |

|

|

|

Copper net cash unit costs (US$/lb.)1 |

1.90 - 2.30 |

|

|

Zinc net cash unit costs (US$/lb.)1 |

0.45 - 0.55 |

|

Note:

- This is a non-GAAP financial measure or ratio. See “Use of

Non-GAAP Financial Measures and Ratios” for further

information.

Click here to view Teck’s full third quarter results for

2024.

WEBCAST

Teck will host an Investor Conference Call to discuss its

Q3/2024 financial results at 11:00 AM Eastern time, 8:00 AM Pacific

time, on October 24, 2024. A live audio

webcast of the conference call, together with supporting

presentation slides, will be available at our website at

www.teck.com. The webcast will be archived at www.teck.com.

REFERENCE

Fraser Phillips, Senior Vice President, Investor Relations and

Strategic Analysis: 604.699.4621Dale Steeves, Director, Stakeholder

Relations: 236.987.7405

USE OF NON-GAAP FINANCIAL MEASURES AND

RATIOS

Our annual financial statements are prepared in accordance with

IFRS® Accounting Standards as issued by the International

Accounting Standards Board (IASB). Our interim financial results

are prepared in accordance with IAS 34, Interim Financial Reporting

(IAS 34). This document refers to a number of non-GAAP financial

measures and non-GAAP ratios, which are not measures recognized

under IFRS Accounting Standards and do not have a standardized

meaning prescribed by IFRS Accounting Standards or by Generally

Accepted Accounting Principles (GAAP) in the United States.

The non-GAAP financial measures and non-GAAP ratios described

below do not have standardized meanings under IFRS Accounting

Standards, may differ from those used by other issuers, and may not

be comparable to similar financial measures and ratios reported by

other issuers. These financial measures and ratios have been

derived from our financial statements and applied on a consistent

basis as appropriate. We disclose these financial measures and

ratios because we believe they assist readers in understanding the

results of our operations and financial position and provide

further information about our financial results to investors. These

measures should not be considered in isolation or used as a

substitute for other measures of performance prepared in accordance

with IFRS Accounting Standards.

Adjusted profit from continuing operations attributable

to shareholders – For adjusted profit from continuing

operations attributable to shareholders, we adjust profit from

continuing operations attributable to shareholders as reported to

remove the after-tax effect of certain types of transactions that

reflect measurement changes on our balance sheet or are not

indicative of our normal operating activities.

EBITDA – EBITDA is profit before net finance

expense, provision for income taxes, and depreciation and

amortization.

Adjusted EBITDA – Adjusted EBITDA is EBITDA

before the pre-tax effect of the adjustments that we make to

adjusted profit from continuing operations attributable to

shareholders as described above.

Adjusted profit from continuing operations attributable to

shareholders, EBITDA and Adjusted EBITDA highlight items and allow

us and readers to analyze the rest of our results more clearly. We

believe that disclosing these measures assists readers in

understanding the ongoing cash-generating potential of our business

in order to provide liquidity to fund working capital needs,

service outstanding debt, fund future capital expenditures and

investment opportunities, and pay dividends.

Adjusted basic earnings per share from continuing

operations – Adjusted basic earnings per share from

continuing operations is adjusted profit from continuing operations

attributable to shareholders divided by average number of shares

outstanding in the period.

Adjusted diluted earnings per share from continuing

operations – Adjusted diluted earnings per share from

continuing operations is adjusted profit from continuing operations

attributable to shareholders divided by average number of fully

diluted shares in a period.

Gross profit before depreciation and

amortization – Gross profit before depreciation and

amortization is gross profit with depreciation and amortization

expense added back. We believe this measure assists us and readers

to assess our ability to generate cash flow from our reportable

segments or overall operations.

Total cash unit costs – Total cash unit costs

for our copper and zinc operations includes adjusted cash costs of

sales, as described below, plus the smelter and refining charges

added back in determining adjusted revenue. This presentation

allows a comparison of total cash unit costs, including smelter

charges, to the underlying price of copper or zinc in order to

assess the margin for the mine on a per unit basis.

Net cash unit costs – Net cash unit costs of

principal product, after deducting co-product and by-product

margins, are also a common industry measure. By deducting the co-

and by-product margin per unit of the principal product, the margin

for the mine on a per unit basis may be presented in a single

metric for comparison to other operations.

Adjusted cash cost of sales – Adjusted cash

cost of sales for our copper and zinc operations is defined as the

cost of the product delivered to the port of shipment, excluding

depreciation and amortization charges, any one-time collective

agreement charges or inventory write-down provisions and by-product

cost of sales. It is common practice in the industry to exclude

depreciation and amortization, as these costs are non-cash, and

discounted cash flow valuation models used in the industry

substitute expectations of future capital spending for these

amounts.

Profit from Continuing Operations Attributable to

Shareholders and Adjusted Profit from Continuing Operations

Attributable to Shareholders

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(CAD$ in millions) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profit (loss) from

continuing operations attributable to shareholders |

$ |

(748) |

|

$ |

(48) |

|

$ |

(852) |

|

$ |

49 |

| Add (deduct) on an after-tax

basis: |

|

|

|

|

|

Asset impairment |

|

828 |

|

|

— |

|

|

828 |

|

|

— |

|

QB variable consideration to IMSA and Codelco |

|

(33) |

|

|

(45) |

|

|

9 |

|

|

26 |

|

Environmental costs |

|

15 |

|

|

(16) |

|

|

9 |

|

|

4 |

|

Share-based compensation |

|

26 |

|

|

19 |

|

|

67 |

|

|

76 |

|

Commodity derivatives |

|

(9) |

|

|

10 |

|

|

(36) |

|

|

29 |

|

Loss (gain) on disposal or contribution of assets |

|

— |

|

|

3 |

|

|

(10) |

|

|

(144) |

|

Tax items |

|

203 |

|

|

69 |

|

|

229 |

|

|

69 |

|

Other |

|

32 |

|

|

93 |

|

|

129 |

|

|

157 |

| |

|

|

|

|

| Adjusted profit from

continuing operations attributable to shareholders |

$ |

314 |

|

$ |

85 |

|

$ |

373 |

|

$ |

266 |

| |

|

|

|

|

| Basic earnings (loss)

per share from continuing operations |

$ |

(1.45) |

|

$ |

(0.09) |

|

$ |

(1.64) |

|

$ |

0.09 |

| Diluted earnings

(loss) per share from continuing operations |

$ |

(1.45) |

|

$ |

(0.09) |

|

$ |

(1.64) |

|

$ |

0.09 |

| Adjusted basic

earnings per share from continuing operations |

$ |

0.61 |

|

$ |

0.16 |

|

$ |

0.72 |

|

$ |

0.51 |

| Adjusted diluted

earnings per share from continuing operations |

$ |

0.60 |

|

$ |

0.16 |

|

$ |

0.71 |

|

$ |

0.51 |

| |

|

|

|

|

Reconciliation of Basic Earnings per share from

Continuing Operations to Adjusted Basic Earnings per share from

Continuing Operations

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(Per share amounts) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| |

|

|

|

|

| Basic earnings (loss)

per share from continuing operations |

$ |

(1.45) |

|

$ |

(0.09) |

|

$ |

(1.64) |

|

$ |

0.09 |

| Add (deduct): |

|

|

|

|

|

Asset impairment |

|

1.60 |

|

|

— |

|

|

1.60 |

|

|

— |

|

QB variable consideration to IMSA and Codelco |

|

(0.06) |

|

|

(0.09) |

|

|

0.01 |

|

|

0.05 |

|

Environmental costs |

|

0.03 |

|

|

(0.03) |

|

|

0.02 |

|

|

0.01 |

|

Share-based compensation |

|

0.05 |

|

|

0.04 |

|

|

0.13 |

|

|

0.15 |

|

Commodity derivatives |

|

(0.02) |

|

|

0.02 |

|

|

(0.07) |

|

|

0.06 |

|

Loss (gain) on disposal or contribution of assets |

|

— |

|

|

0.01 |

|

|

(0.02) |

|

|

(0.28) |

|

Tax items |

|

0.39 |

|

|

0.13 |

|

|

0.44 |

|

|

0.13 |

|

Other |

|

0.07 |

|

|

0.17 |

|

|

0.25 |

|

|

0.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted basic

earnings per share from continuing operations |

$ |

0.61 |

|

$ |

0.16 |

|

$ |

0.72 |

|

$ |

0.51 |

| |

|

|

|

|

Reconciliation of Diluted Earnings per share from

Continuing Operations to Adjusted Diluted Earnings per share from

Continuing Operations

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(Per share amounts) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| |

|

|

|

|

| Diluted earnings

(loss) per share from continuing operations |

$ |

(1.45) |

|

$ |

(0.09) |

|

$ |

(1.64) |

|

$ |

0.09 |

| Add (deduct): |

|

|

|

|

|

Asset impairment |

|

1.59 |

|

|

— |

|

|

1.58 |

|

|

— |

|

QB variable consideration to IMSA and Codelco |

|

(0.06) |

|

|

(0.09) |

|

|

0.02 |

|

|

0.05 |

|

Environmental costs |

|

0.03 |

|

|

(0.03) |

|

|

0.02 |

|

|

0.01 |

|

Share-based compensation |

|

0.05 |

|

|

0.04 |

|

|

0.13 |

|

|

0.14 |

|

Commodity derivatives |

|

(0.02) |

|

|

0.02 |

|

|

(0.07) |

|

|

0.06 |

|

Loss (gain) on disposal or contribution of assets |

|

— |

|

|

0.01 |

|

|

(0.02) |

|

|

(0.27) |

|

Tax items |

|

0.39 |

|

|

0.13 |

|

|

0.44 |

|

|

0.13 |

|

Other |

|

0.07 |

|

|

0.17 |

|

|

0.25 |

|

|

0.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted diluted

earnings per share from continuing operations |

$ |

0.60 |

|

$ |

0.16 |

|

$ |

0.71 |

|

$ |

0.51 |

| |

|

|

|

|

Reconciliation of EBITDA and Adjusted

EBITDA

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(CAD$ in millions) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| |

|

|

|

|

| Profit (loss) from continuing

operations before taxes |

$ |

(759) |

|

$ |

48 |

|

$ |

(974) |

|

$ |

249 |

| Finance expense net of finance

income |

|

153 |

|

|

10 |

|

|

578 |

|

|

25 |

|

Depreciation and amortization |

|

498 |

|

|

290 |

|

|

1,203 |

|

|

633 |

|

|

|

|

|

|

| EBITDA |

|

(108) |

|

|

348 |

|

|

807 |

|

|

907 |

| |

|

|

|

|

| Add (deduct): |

|

|

|

|

|

Asset impairment |

|

1,053 |

|

|

— |

|

|

1,053 |

|

|

— |

|

QB variable consideration to IMSA and Codelco |

|

(55) |

|

|

(75) |

|

|

14 |

|

|

41 |

|

Environmental costs |

|

20 |

|

|

(22) |

|

|

8 |

|

|

4 |

|

Share-based compensation |

|

34 |

|

|

24 |

|

|

86 |

|

|

96 |

|

Commodity derivatives |

|

(13) |

|

|

15 |

|

|

(50) |

|

|

39 |

|

Loss (gain) on disposal or contribution of assets |

|

— |

|

|

4 |

|

|

(14) |

|

|

(194) |

|

Other |

|

55 |

|

|

123 |

|

|

194 |

|

|

222 |

|

|

|

|

|

|

|

Adjusted EBITDA |

$ |

986 |

|

$ |

417 |

|

$ |

2,098 |

|

$ |

1,115 |

Reconciliation of Gross Profit Before Depreciation and

Amortization

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

(CAD$ in millions) |

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

| |

|

|

|

|

| Gross profit |

$ |

478 |

|

$ |

261 |

|

$ |

1,065 |

|

$ |

960 |

|

Depreciation and amortization |

|

484 |

|

|

272 |

|

|

1,155 |

|

|

581 |

|

|

|

|

|

|

| Gross

profit before depreciation and amortization |

$ |

962 |

|

$ |

533 |

|

$ |

2,220 |

|

$ |

1,541 |

|

|

|

|

|

|

| Reported as: |

|

|

|

|

| Copper |

|

|

|

|

|

Quebrada Blanca |

$ |

178 |

|

$ |

19 |

|

$ |

462 |

|

$ |

18 |

|

Highland Valley Copper |

|

89 |

|

|

57 |

|

|

371 |

|

|

290 |

|

Antamina |

|

287 |

|

|

215 |

|

|

763 |

|

|

671 |

|

Carmen de Andacollo |

|

48 |

|

|

1 |

|

|

69 |

|

|

10 |

|

Other |

|

2 |

|

|

1 |

|

|

4 |

|

|

(5) |

|

|

|

|

|

|

| |

|

604 |

|

|

293 |

|

|

1,669 |

|

|

984 |

| |

|

|

|

|

| Zinc |

|

|

|

|

|

Trail Operations |

|

26 |

|

|

22 |

|

|

(3) |

|

|

91 |

|

Red Dog |

|

333 |

|

|

220 |

|

|

548 |

|

|

470 |

|

Other |

|

(1) |

|

|

(2) |

|

|

6 |

|

|

(4) |

|

|

|

|

|

|

|

|

|

358 |

|

|

240 |

|

|

551 |

|

|

557 |

|

|

|

|

|

|

| Gross profit before

depreciation and amortization |

$ |

962 |

|

$ |

533 |

|

$ |

2,220 |

|

$ |

1,541 |

CAUTIONARY STATEMENT ON FORWARD-LOOKING

STATEMENTS

This news release contains certain forward-looking information

and forward-looking statements as defined in applicable securities

laws (collectively referred to as forward-looking statements).

These statements relate to future events or our future performance.

All statements other than statements of historical fact are

forward-looking statements. The use of any of the words

“anticipate”, “plan”, “continue”, “estimate”, “expect”, “may”,

“will”, “project”, “predict”, “potential”, “should”, “believe” and

similar expressions is intended to identify forward-looking

statements. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to differ materially from those anticipated in such

forward-looking statements. These statements speak only as of the

date of this news release.

These forward-looking statements include, but are not limited

to, statements concerning: our focus and strategy, including being

a pure-play energy transition metals company; anticipated global

and regional supply, demand and market outlook for our commodities;

our business, assets, and strategy going forward, including with

respect to future and ongoing project development; the potential

benefits of our new business structure; the expected use of

proceeds from the sale of our steelmaking coal business, including

the timing and format of any cash returns to shareholders; the

anticipated benefits of the sale of our steelmaking coal business,

including deployment of proceeds; our expectations regarding the

continuing ramp-up of QB2, including the expectation that QB will

be operating at design mill throughput rates by year end and our

ability to improve mine equipment reliability, molybdenum plant

stability, and copper recovery; expectations regarding haul truck

and labour availability at Highland Valley Copper and the ability

to process more ore from the Lornex pit in the fourth quarter;

expectations regarding inflationary pressures and our ability to

manage controllable operating expenditures; expectations with

respect to execution of our copper growth strategy, including the

timing and occurrence of any sanction decisions and prioritization

of growth capital; expectations regarding advancement and potential

sanction decisions related to our copper growth portfolio,

including advancement of study, permitting, execution planning, and

engineering work, community and Indigenous engagement, completion

of updated cost estimates, and timing for receipt of permits

related to QB debottlenecking, the HVC Mine Life Extension, San

Nicolás, and Zafranal projects, as applicable; expectation

regarding potential pricing adjustments related to our

sustainability performance in the context of our revolving credit

facility; expectations regarding timing and amount of income tax

payments and our effective tax rate; liquidity and availability of

borrowings under our credit facilities; requirements to post and

our ability to obtain additional credit for posting security for

reclamation at our sites; all guidance appearing in this document

including but not limited to the production, sales, cost, unit

cost, capital expenditure, capitalized stripping, and other

guidance under the headings “Guidance” and "Outlook" and as

discussed elsewhere in the various reportable segment sections; our

expectations regarding inflationary pressures and increased key

input costs; and expectations regarding the adoption of new

accounting standards and the impact of new accounting

developments.

These statements are based on a number of assumptions,

including, but not limited to, assumptions disclosed elsewhere in

this document and assumptions regarding general business and

economic conditions, interest rates, commodity and power prices;

acts of foreign or domestic governments and the outcome of legal

proceedings; the continued ramp-up of QB2 in accordance with our

expectations; our ability to improve haul truck availability at

Highland Valley Copper; the possibility that the anticipated

benefits from the sale of our steelmaking coal business are not

realized in the time frame anticipated or at all as a result of

changes in general economic and market conditions, including

credit, market, currency, operational, commodity, liquidity and

funding risks generally and relating specifically to the

transaction; the possibility that our business may not perform as

expected or in a manner consistent with historical performance; the

supply and demand for, deliveries of, and the level and volatility

of prices of copper and zinc and our other metals and minerals, as

well as steel, crude oil, natural gas and other petroleum products;

the timing of the receipt of permits and other regulatory and

governmental approvals for our development projects and other

operations, including mine extensions; positive results from the

studies on our expansion and development projects; our ability to

secure adequate transportation, including rail and port services,

for our products; our costs of production and our production and

productivity levels, as well as those of our competitors;

continuing availability of water and power resources for our

operations; changes in credit market conditions and conditions in

financial markets generally; the availability of funding to

refinance our borrowings as they become due or to finance our

development projects on reasonable terms; availability of letters

of credit and other forms of financial assurance acceptable to

regulators for reclamation and other bonding requirements; our

ability to procure equipment and operating supplies in sufficient

quantities and on a timely basis; the availability of qualified

employees and contractors for our operations, including our new

developments and our ability to attract and retain skilled

employees; the satisfactory negotiation of collective agreements

with unionized employees; the impact of changes in Canadian-U.S.

dollar, Canadian dollar-Chilean Peso and other foreign exchange

rates on our costs and results; engineering and construction

timetables and capital costs for our development and expansion

projects; our ability to develop technology and obtain the benefits

of technology for our operations and development projects; closure

costs; environmental compliance costs; market competition; the

accuracy of our mineral reserve and resource estimates (including

with respect to size, grade and recoverability) and the geological,

operational and price assumptions on which these are based; tax

benefits and statutory and effective tax rates; the outcome of our

copper, zinc and lead concentrate treatment and refining charge

negotiations with customers; the resolution of environmental and

other proceedings or disputes; our ability to obtain, comply with

and renew permits, licenses and leases in a timely manner; and our

ongoing relations with our employees and with our business and

joint venture partners.

Statements regarding the availability of our credit facilities

are based on assumptions that we will be able to satisfy the

conditions for borrowing at the time of a borrowing request and

that the facilities are not otherwise terminated or accelerated due

to an event of default. Assumptions regarding the costs and

benefits of our projects include assumptions that the relevant

project is constructed, commissioned and operated in accordance

with current expectations. Expectations regarding our operations

are based on numerous assumptions regarding the operations. Our

Guidance tables include disclosure and footnotes with further

assumptions relating to our guidance, and assumptions for certain

other forward-looking statements accompany those statements within

the document. Statements concerning future production costs or

volumes are based on numerous assumptions regarding operating

matters and on assumptions that demand for products develops as

anticipated, that customers and other counterparties perform their

contractual obligations, that operating and capital plans will not

be disrupted by issues such as mechanical failure, unavailability

of parts and supplies, labour disturbances, interruption in

transportation or utilities, or adverse weather conditions, and

that there are no material unanticipated variations in the cost of

energy or supplies. The foregoing list of assumptions is not

exhaustive. Events or circumstances could cause actual results to

vary materially.

Factors that may cause actual results to vary materially

include, but are not limited to, changes in commodity and power

prices; changes in market demand for our products; changes in

interest and currency exchange rates; acts of governments and the

outcome of legal proceedings; inaccurate geological and

metallurgical assumptions (including with respect to the size,

grade and recoverability of mineral reserves and resources);

operational difficulties (including failure of plant, equipment or

processes to operate in accordance with specifications or

expectations, cost escalation, unavailability of labour, materials

and equipment); government action or delays in the receipt of

government approvals; changes in royalty or tax rates; industrial

disturbances or other job action; adverse weather conditions;

unanticipated events related to health, safety and environmental

matters; union labour disputes; any resurgence of COVID-19 and

related mitigation protocols; political risk; social unrest;

failure of customers or counterparties (including logistics

suppliers) to perform their contractual obligations; changes in our

credit ratings; unanticipated increases in costs to construct our

development projects; difficulty in obtaining permits; inability to

address concerns regarding permits or environmental impact

assessments; and changes or further deterioration in general

economic conditions. The amount and timing of capital expenditures

is depending upon, among other matters, being able to secure

permits, equipment, supplies, materials and labour on a timely

basis and at expected costs. Certain operations and projects are

not controlled by us; schedules and costs may be adjusted by our

partners, and timing of spending and operation of the operation or

project is not in our control. Certain of our other operations and

projects are operated through joint arrangements where we may not

have control over all decisions, which may cause outcomes to differ

from current expectations. Ongoing monitoring may reveal unexpected

environmental conditions at our operations and projects that could

require additional remedial measures. QB2 costs and ramp-up are

dependent on, among other matters, our continued ability to advance

ramp-up as currently anticipated. Production at our Red Dog

Operations may also be impacted by water levels at site. Sales to

China may be impacted by general and specific port restrictions,

Chinese regulation and policies, and normal production and

operating risks. We assume no obligation to update forward-looking

statements except as required under securities laws. Further

information concerning risks, assumptions and uncertainties

associated with these forward-looking statements and our business

can be found in our Annual Information Form for the year ended

December 31, 2023 filed under our profile on SEDAR+

(www.sedarplus.ca) and on EDGAR (www.sec.gov) under cover of Form

40-F, as well as subsequent filings that can also be found under

our profile.

Scientific and technical information in this quarterly report

regarding our material properties was reviewed, approved and

verified by Rodrigo Alves Marinho, P.Geo., an employee of Teck and

a Qualified Person as defined under National Instrument 43-101.

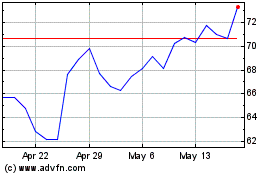

Teck Resources (TSX:TECK.B)

Historical Stock Chart

From Oct 2024 to Nov 2024

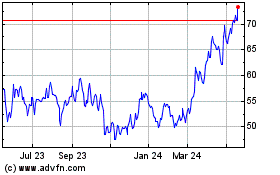

Teck Resources (TSX:TECK.B)

Historical Stock Chart

From Nov 2023 to Nov 2024