Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX:

TXG) reports the Company’s financial and operational results

for the three months ended March 31, 2023. Senior management of

Torex will host a conference call tomorrow morning at 9:00 AM (ET)

to discuss the quarterly results.

Jody Kuzenko, President & CEO of Torex,

stated:

“The consistent operational and cost performance

that investors have come to expect of Torex continued in the first

quarter of 2023, placing the Company in an excellent position to

deliver on full year operational guidance for a fifth year in a

row. During the quarter, the team produced 122,918 ounces of gold

at an all-in sustaining cost1 of $1,079 per ounce, implying an

all-in sustaining costs margin1 of 42%. Our solid production and

disciplined cost management, combined with the higher gold price,

resulted in adjusted EBITDA1 of $132.7 million and net cash

generation from operating activities of $47.0 million. Per usual

course of business for first quarters, cash flow was impacted by

tax and royalty payments of $85.9 million.

“Development of the Media Luna Project is

tracking to schedule and budget, with the project approximately 24%

complete at quarter end. Through the end of March, approximately

34% of project expenditures had been committed, including 22%

incurred. As disclosed previously, the Guajes Tunnel has advanced

more than four kilometres with breakthrough on track for early Q1

2024, if not before. During the quarter, the contract was finalized

for the hybrid battery electric and diesel underground mining

fleet, with fabrication dates established and first deliveries

anticipated later this year. The level of spending on Media Luna is

expected to increase through the remainder of 2023 as surface

construction and underground development activities continue to

gain momentum.

“In terms of the forward look, production during

Q2 and Q3 will be closer to the bottom end of the quarterly

run-rate implied by full year guidance. Our mine plan for the next

two quarters sees the conclusion of mining in the Guajes pit, a

heavy focus on waste stripping in the El Limón pit and draw down of

stockpiled material. Given the mine plan, total cash costs and

all-in sustaining costs during Q2 and Q3 are expected to be above

the upper end of the annual guided range for those quarters only.

Production and costs are expected to return to usual levels in Q4,

with higher processed grades and the increased level of ore

production. Notwithstanding these planned quarter on quarter

movements, we are well on track to achieve annual guidance.

“2023 is an important year for Torex and we are

off to an excellent start. With $564 million of available liquidity

at quarter-end, strong cash flow from ELG, and continued momentum

on production and cost management, we are well-positioned to fund

the remaining $683 million of capital on the Media Luna Project

while delivering on our commitments and generating solid value for

shareholders.”

FIRST QUARTER 2023 HIGHLIGHTS

- Strong

safety performance continues: Exited the quarter with no

fatalities and a lost-time injury frequency (“LTIF”) rate of 0.53

per million hours worked on a rolling 12-month basis. There were

three lost-time injuries in the quarter at the Media Luna Project,

with three contractors suffering hand-related injuries.

- Gold

production: Delivered gold production of 122,918 ounces

(“oz”) for the quarter driven by a record milling rate of 13,073

tonnes per day (“tpd”) and a record mining rate at ELG Underground

of 1,738 tpd. This represents a strong start to the year and puts

the Company on track to meet annual production guidance of 440,000

to 470,000 ounces.

- Gold

sold: Sold 118,455 oz of gold at an average realized gold

price1 of $1,899 per oz, contributing to revenue of $228.8

million.

- Total

cash costs1 and all-in sustaining

costs1: Total cash costs

of $709 per oz sold and all-in sustaining costs of $1,079 per oz

sold. All-in sustaining costs margin1 of $820 per oz sold, implying

an all-in sustaining costs margin1 of 42%. Cost of sales was $137.4

million or $1,160 per oz sold in the quarter, benefitting from the

record milling throughput, partially offset by the appreciation of

the Mexican peso. Given the strong cost performance during the

quarter, the Company is on track to achieve full year total cash

costs guidance of $740 to $780 per oz and all-in sustaining costs

guidance of $1,080 to $1,130 per ounce.

- Net

income and adjusted net

earnings1: Reported net

income of $68.2 million or earnings of $0.79 per share on both a

basic and diluted basis. Adjusted net earnings of $50.3 million or

$0.59 per share on a basic and $0.58 per share on a diluted basis.

Net income includes a net derivative loss of $26.6 million related

to gold forward contracts entered into to mitigate downside price

risk during the construction of the Media Luna Project.

-

EBITDA1 and adjusted

EBITDA1: Generated

EBITDA of $102.5 million and adjusted EBITDA of $132.7

million.

- Cash

flow generation: Net cash generated from operating

activities totalled $47.0 million and $61.9 million before changes

in non-cash operating working capital, including income tax and

royalty payments of $85.9 million, primarily related to fiscal

2022. Negative free cash flow1 of $54.0 million net of cash outlays

for capital expenditures, lease payments and interest.

- Strong

financial liquidity: The quarter closed with net cash1 of

$318.4 million, including $321.9 million in cash and $3.5 million

of lease obligations, no borrowings on the credit facilities of

$250.0 million and letters of credit outstanding of $7.9 million,

providing $564.0 million in available liquidity.

- Media

Luna Project: Media Luna Project expenditures totalled

$66.4 million during the quarter, with a remaining project spend of

$683.4 million. Expenditures during this period were primarily

focused on continued development of the Guajes Tunnel and South

Portals, with development of the Guajes Tunnel reaching 3,870

metres and South Portal Lower reaching 1,725 metres by end of the

first quarter. As of March 31, 2023, physical progress on the

Project was approximately 24%, with detailed engineering,

procurement activities underground development, and surface

construction advancing. As of March 31, 2023, the Company had

commitments in place for $298.9 million of project expenditures

(approximately 34% of total budgeted expenditures). The pace of

investment is expected to increase into the second half of 2023 and

remain relatively consistent through the first half of 2024, before

declining as development activities wind down ahead of commercial

production, which is anticipated in early-2025. The project

continues to track to overall schedule and budget.

- Year-end

Mineral Reserves &

Resources2: Drilling

success in the ELG Open Pits and ELG Underground resulted in more

than 60% of Proven & Probable gold reserves processed in 2022

being replaced. Drilling both north and south of the Balsas River

was successful in increasing gold equivalent Measured &

Indicated resources by 1,078 koz prior to depletion (+16%) or 567

koz after depletion (+8%). Measured & Indicated resource growth

was driven by ELG Underground, Media Luna, and EPO, where an

inaugural gold equivalent Indicated resource of 671 koz was

declared.

- These measures are Non-GAAP

Financial Performance Measures or Non-GAAP ratios (collectively,

“Non-GAAP Measures”). For a detailed reconciliation of each

Non-GAAP Measure to its most directly comparable IFRS financial

measure see Tables 2 to 10 of this press release. For additional

information on these Non-GAAP Measures, please refer to the

Company’s management’s discussion and analysis (“MD&A”) for the

three months ended March 31, 2023, dated May 9, 2023. The MD&A,

and the Company’s unaudited condensed consolidated interim

financial statements for the three months ended March 31, 2023, are

available on Torex’s website (www.torexgold.com) and under the

Company’s SEDAR profile (www.sedar.com).

- Mineral Reserve and Mineral

Resource estimates for Morelos Complex can be found in Tables 11

and 12 of this press release. Gold equivalent values account for

underlying metal prices and metallurgical recoveries used in

reserve and resource estimates. For additional information on the

Mineral Reserve and Mineral Resource estimates for Morelos Complex,

please see the Company’s annual information form for the year ended

December 31, 2022, or the Company’s news release titled “Torex Gold

Reports Year-end 2022 Reserves & Resources” issued on March 28,

2023, both available on Torex’s website (www.torexgold.com) and

under the Company’s SEDAR profile (www.sedar.com).

Table 1: Operating & Financial

Highlights

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Mar 31, |

|

|

Dec 31, |

|

Mar 31, |

|

|

In millions of U.S. dollars, unless otherwise noted |

|

|

|

2023 |

|

|

2022 |

|

2022 |

|

|

Operating Results |

|

|

|

|

|

|

|

|

|

Lost-time injury frequency1 |

|

/million hours |

|

0.53 |

|

|

0.28 |

|

0.12 |

|

|

Total recordable injury frequency1 |

|

/million hours |

|

1.87 |

|

|

1.58 |

|

1.69 |

|

|

Gold produced |

|

oz |

|

122,918 |

|

|

116,196 |

|

112,446 |

|

|

Gold sold |

|

oz |

|

118,455 |

|

|

121,913 |

|

108,012 |

|

|

Total cash costs2 |

|

$/oz |

|

709 |

|

|

711 |

|

748 |

|

|

Total cash costs margin2 |

|

$/oz |

|

1,190 |

|

|

1,073 |

|

1,128 |

|

|

All-in sustaining costs2 |

|

$/oz |

|

1,079 |

|

|

1,034 |

|

1,034 |

|

|

All-in sustaining costs margin2 |

|

$/oz |

|

820 |

|

|

750 |

|

841 |

|

|

Average realized gold price2 |

|

$/oz |

|

1,899 |

|

|

1,784 |

|

1,876 |

|

|

Financial Results |

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

|

228.8 |

|

|

216.5 |

|

207.7 |

|

|

Cost of sales |

|

$ |

|

137.4 |

|

|

146.6 |

|

132.2 |

|

|

Earnings from mine operations |

|

$ |

|

91.4 |

|

|

69.9 |

|

75.5 |

|

|

Net income |

|

$ |

|

68.2 |

|

|

34.6 |

|

40.0 |

|

|

Per share - Basic |

|

$/share |

|

0.79 |

|

|

0.40 |

|

0.47 |

|

|

Per share - Diluted |

|

$/share |

|

0.79 |

|

|

0.40 |

|

0.46 |

|

|

Adjusted net earnings2 |

|

$ |

|

50.3 |

|

|

38.3 |

|

37.2 |

|

|

Per share - Basic2 |

|

$/share |

|

0.59 |

|

|

0.45 |

|

0.43 |

|

|

Per share - Diluted2 |

|

$/share |

|

0.58 |

|

|

0.44 |

|

0.43 |

|

|

EBITDA2 |

|

$ |

|

102.5 |

|

|

96.0 |

|

103.1 |

|

|

Adjusted EBITDA2 |

|

$ |

|

132.7 |

|

|

122.9 |

|

110.7 |

|

|

Cost of sales |

|

$/oz |

|

1,160 |

|

|

1,202 |

|

1,224 |

|

|

Net cash generated from operating activities |

|

$ |

|

47.0 |

|

|

132.1 |

|

46.7 |

|

|

Net cash generated from operating activities before changes in

non-cash operating working capital |

|

$ |

|

61.9 |

|

|

110.8 |

|

60.8 |

|

|

Free cash flow2 |

|

$ |

|

(54.0 |

) |

|

40.5 |

|

(19.7 |

) |

|

Cash and cash equivalents |

|

$ |

|

321.9 |

|

|

376.0 |

|

237.0 |

|

|

Net cash2 |

|

$ |

|

318.4 |

|

|

372.1 |

|

233.4 |

|

| |

|

|

|

|

|

|

|

|

- On a 12-month rolling basis, per

million hours worked.

- Total cash costs, total cash costs

margin, all-in sustaining costs, all-in sustaining costs margin,

average realized gold price, adjusted net earnings, EBITDA,

adjusted EBITDA, free cash flow and net cash are non-GAAP financial

measures with no standardized meaning under International Financial

Reporting Standards (“IFRS”). Refer to “Non-GAAP Financial

Performance Measures” for further information and a detailed

reconciliation to the comparable IFRS measures in the Company’s

MD&A for the three months ended March 31, 2023, dated May 9,

2023, available on Torex Gold’s website (www.torexgold.com) and

under the Company’s SEDAR profile (www.sedar.com).

CONFERENCE CALL AND WEBCAST DETAILS

The Company will host a conference call tomorrow

at 9:00 AM (ET) in which senior management will discuss the first

quarter operating and financial results. Please dial in or access

the webcast approximately ten minutes prior to the start of the

call:

- Toronto local or International:

1-416-915-3239

- Toll-Free (North America):

1-800-319-4610

A live webcast of the conference call will be

available on the Company’s website at

https://torexgold.com/investors/upcoming-events/. The webcast will

be archived on the Company’s website.

Table 2: Reconciliation of Total Cash

Costs and All-in Sustaining Costs to Cost of Sales

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Mar 31, |

|

|

Dec 31, |

|

|

Mar 31, |

|

|

In millions of U.S. dollars, unless otherwise noted |

|

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

Gold sold |

|

oz |

|

118,455 |

|

|

121,913 |

|

|

108,012 |

|

|

|

|

|

|

|

|

|

|

|

|

Total cash costs per oz sold |

|

|

|

|

|

|

|

|

|

Production costs and royalties |

|

$ |

|

88.4 |

|

|

91.0 |

|

|

85.8 |

|

|

Less: Silver sales |

|

$ |

|

(1.5 |

) |

|

(1.4 |

) |

|

(0.7 |

) |

|

Less: Copper sales |

|

$ |

|

(2.9 |

) |

|

(2.9 |

) |

|

(4.3 |

) |

|

Total cash costs |

|

$ |

|

84.0 |

|

|

86.7 |

|

|

80.8 |

|

|

Total cash costs per oz sold |

|

$/oz |

|

709 |

|

|

711 |

|

|

748 |

|

|

|

|

|

|

|

|

|

|

|

|

All-in sustaining costs per oz sold |

|

|

|

|

|

|

|

|

|

Total cash costs |

|

$ |

|

84.0 |

|

|

86.7 |

|

|

80.8 |

|

|

General and administrative costs1 |

|

$ |

|

6.6 |

|

|

5.7 |

|

|

7.8 |

|

|

Reclamation and remediation costs |

|

$ |

|

1.4 |

|

|

1.4 |

|

|

1.4 |

|

|

Sustaining capital expenditure |

|

$ |

|

35.8 |

|

|

32.3 |

|

|

21.7 |

|

|

Total all-in sustaining costs |

|

$ |

|

127.8 |

|

|

126.1 |

|

|

111.7 |

|

|

Total all-in sustaining costs per oz sold |

|

$/oz |

|

1,079 |

|

|

1,034 |

|

|

1,034 |

|

| |

|

|

|

|

|

|

|

|

- This amount excludes a loss of $3.6

million, loss of $2.5 million and loss of $0.4 million for the

three months ended March 31, 2023, December 31, 2022, and March 31,

2022, respectively, in relation to the remeasurement of share-based

payments. This amount also excludes corporate depreciation and

amortization expenses totalling $0.1 million, nil and $0.1 million

for the three months ended March 31, 2023, December 31, 2022, and

March 31, 2022, respectively, recorded within general and

administrative costs. Included in general and administrative costs

is share-based compensation expense in the amount of $1.9 million

or $16/oz for the three months ended March 31, 2023, $0.8 million

or $7/oz for the three months ended December 31, 2022 and $1.8

million or $16/oz for the three months ended March 31, 2022. This

amount excludes other expenses totalling $0.6 million, nil and nil

for the three months ended March 31, 2023, December 31, 2022, and

March 31, 2022, respectively.

Table 3: Reconciliation of Sustaining

and Non-Sustaining Costs to Capital Expenditures

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Mar 31, |

|

|

Dec 31, |

|

|

Mar 31, |

|

In millions of U.S. dollars |

|

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

Sustaining |

|

$ |

|

14.6 |

|

|

14.8 |

|

|

5.6 |

|

Capitalized Stripping |

|

$ |

|

21.2 |

|

|

17.5 |

|

|

16.1 |

|

Non-sustaining |

|

$ |

|

0.7 |

|

|

6.6 |

|

|

5.3 |

|

Total ELG |

|

$ |

|

36.5 |

|

|

38.9 |

|

|

27.0 |

|

Media Luna Project |

|

$ |

|

66.4 |

|

|

62.6 |

|

|

20.8 |

|

Media Luna Infill Drilling/Other |

|

$ |

|

3.1 |

|

|

4.1 |

|

|

3.9 |

|

Working Capital Changes & Other |

|

$ |

|

(6.3 |

) |

|

(14.8 |

) |

|

13.5 |

|

Capital expenditures1 |

|

$ |

|

99.7 |

|

|

90.8 |

|

|

65.3 |

| |

|

|

|

|

|

|

|

|

- The amount of cash expended on

additions to property, plant and equipment in the period as

reported in the condensed consolidated interim statements of cash

flows.

Table 4: Reconciliation of Average

Realized Price and Total Cash Costs Margin Per Ounce of Gold Sold

to Revenue

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Mar 31, |

|

|

Dec 31, |

|

|

Mar 31, |

|

|

In millions of U.S. dollars, unless otherwise noted |

|

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

Gold sold |

|

oz |

|

118,455 |

|

|

121,913 |

|

|

108,012 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

|

228.8 |

|

|

216.5 |

|

|

207.7 |

|

|

Less: Silver sales |

|

$ |

|

(1.5 |

) |

|

(1.4 |

) |

|

(0.7 |

) |

|

Less: Copper sales |

|

$ |

|

(2.9 |

) |

|

(2.9 |

) |

|

(4.3 |

) |

|

Add: Realized gain on gold contracts |

|

$ |

|

0.5 |

|

|

5.3 |

|

|

- |

|

|

Total proceeds |

|

$ |

|

224.9 |

|

|

217.5 |

|

|

202.7 |

|

|

Total average realized gold price |

|

$/oz |

|

1,899 |

|

|

1,784 |

|

|

1,876 |

|

|

|

|

|

|

|

|

|

|

|

|

Less: Total cash costs |

|

$/oz |

|

709 |

|

|

711 |

|

|

748 |

|

|

Total cash costs margin |

|

$/oz |

|

1,190 |

|

|

1,073 |

|

|

1,128 |

|

|

Total cash costs margin |

|

% |

|

63 |

|

|

60 |

|

|

60 |

|

| |

|

|

|

|

|

|

|

|

Table 5: Reconciliation of All-in

Sustaining Costs Margin to Revenue

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Mar 31, |

|

|

Dec 31, |

|

|

Mar 31, |

|

|

In millions of U.S. dollars, unless otherwise noted |

|

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

Gold sold |

|

oz |

|

118,455 |

|

|

121,913 |

|

|

108,012 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

|

228.8 |

|

|

216.5 |

|

|

207.7 |

|

|

Less: Silver sales |

|

$ |

|

(1.5 |

) |

|

(1.4 |

) |

|

(0.7 |

) |

|

Less: Copper sales |

|

$ |

|

(2.9 |

) |

|

(2.9 |

) |

|

(4.3 |

) |

|

Add: Realized gain on gold contracts |

|

$ |

|

0.5 |

|

|

5.3 |

|

|

- |

|

|

Less: All-in sustaining costs |

|

$ |

|

(127.8 |

) |

|

(126.1 |

) |

|

(111.7 |

) |

|

All-in sustaining costs margin |

|

$ |

|

97.1 |

|

|

91.4 |

|

|

91.0 |

|

|

Total all-in sustaining costs margin |

|

$/oz |

|

820 |

|

|

750 |

|

|

841 |

|

|

Total all-in sustaining costs margin |

|

% |

|

42 |

|

|

42 |

|

|

44 |

|

| |

|

|

|

|

|

|

|

|

Table 6: Reconciliation of Adjusted Net

Earnings to Net Income

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Mar 31, |

|

|

Dec 31, |

|

|

Mar 31, |

|

|

In millions of U.S. dollars, unless otherwise noted |

|

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

Basic weighted average shares outstanding |

|

shares |

|

85,869,276 |

|

|

85,843,808 |

|

|

85,797,699 |

|

|

Diluted weighted average shares outstanding |

|

shares |

|

86,398,732 |

|

|

86,166,019 |

|

|

86,091,564 |

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

|

68.2 |

|

|

34.6 |

|

|

40.0 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Unrealized foreign exchange gain |

|

$ |

|

(0.5 |

) |

|

(0.9 |

) |

|

(1.0 |

) |

|

Change in unrealized gains and losses on derivative contracts |

|

$ |

|

27.1 |

|

|

25.3 |

|

|

8.2 |

|

|

Remeasurement of share-based payments |

|

$ |

|

3.6 |

|

|

2.5 |

|

|

0.4 |

|

|

Derecognition of provisions for uncertain tax provisions |

|

$ |

|

(15.2 |

) |

|

- |

|

|

- |

|

|

Tax effect of above adjustments |

|

$ |

|

(9.0 |

) |

|

(8.1 |

) |

|

(2.3 |

) |

|

Tax effect of currency translation on tax base |

|

$ |

|

(23.9 |

) |

|

(15.1 |

) |

|

(8.1 |

) |

|

Adjusted net earnings |

|

$ |

|

50.3 |

|

|

38.3 |

|

|

37.2 |

|

|

Per share - Basic |

|

$/share |

|

0.59 |

|

|

0.45 |

|

|

0.43 |

|

|

Per share - Diluted |

|

$/share |

|

0.58 |

|

|

0.44 |

|

|

0.43 |

|

| |

|

|

|

|

|

|

|

|

Table 7: Reconciliation of EBITDA and

Adjusted EBITDA to Net Income

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Mar 31, |

|

|

Dec 31, |

|

|

Mar 31, |

|

|

In millions of U.S. dollars |

|

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

Net income |

|

$ |

|

68.2 |

|

|

34.6 |

|

|

40.0 |

|

|

|

|

|

|

|

|

|

|

|

|

Finance (income) costs, net |

|

$ |

|

(3.0 |

) |

|

(4.5 |

) |

|

0.4 |

|

|

Depreciation and amortization1 |

|

$ |

|

49.1 |

|

|

55.6 |

|

|

46.4 |

|

|

Current income tax expense |

|

$ |

|

16.8 |

|

|

50.7 |

|

|

24.6 |

|

|

Deferred income tax recovery |

|

$ |

|

(28.6 |

) |

|

(40.4 |

) |

|

(8.3 |

) |

|

EBITDA |

|

$ |

|

102.5 |

|

|

96.0 |

|

|

103.1 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

Change in unrealized gains and losses on derivative contracts |

|

$ |

|

27.1 |

|

|

25.3 |

|

|

8.2 |

|

|

Unrealized foreign exchange gain |

|

$ |

|

(0.5 |

) |

|

(0.9 |

) |

|

(1.0 |

) |

|

Remeasurement of share-based payments |

|

$ |

|

3.6 |

|

|

2.5 |

|

|

0.4 |

|

|

Adjusted EBITDA |

|

$ |

|

132.7 |

|

|

122.9 |

|

|

110.7 |

|

| |

|

|

|

|

|

|

|

|

- Includes depreciation and

amortization included in cost of sales, general and administrative

and exploration and evaluation expenses.

Table 8: Free Cash Flow

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

Mar 31, |

|

|

Dec 31, |

|

|

Mar 31, |

|

|

In millions of U.S. dollars |

|

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

Net cash generated from operating activities |

|

$ |

|

47.0 |

|

|

132.1 |

|

|

46.7 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

Additions to property, plant and equipment1 |

|

$ |

|

(99.7 |

) |

|

(90.8 |

) |

|

(65.3 |

) |

|

Lease payments |

|

$ |

|

(0.8 |

) |

|

(0.9 |

) |

|

(0.6 |

) |

|

Interest paid |

|

$ |

|

(0.5 |

) |

|

0.1 |

|

|

(0.5 |

) |

|

Free cash flow |

|

$ |

|

(54.0 |

) |

|

40.5 |

|

|

(19.7 |

) |

| |

|

|

|

|

|

|

|

|

- The amount of cash expended on

additions to property, plant and equipment in the year as reported

on the condensed consolidated interim statements of cash

flows.

Table 9: Net Cash

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Mar 31, |

|

|

Dec 31, |

|

|

Mar 31, |

|

|

In millions of U.S. dollars |

|

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

Cash and cash equivalents |

|

$ |

|

321.9 |

|

|

376.0 |

|

|

237.0 |

|

|

Less: Lease obligations |

|

$ |

|

(3.5 |

) |

|

(3.9 |

) |

|

(3.6 |

) |

|

Net cash |

|

$ |

|

318.4 |

|

|

372.1 |

|

|

233.4 |

|

| |

|

|

|

|

|

|

|

|

Table 10: Unit Cost

Measures

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

Mar 31, |

|

|

|

Dec 31, |

|

|

|

Mar 31, |

|

|

|

In millions of U.S. dollars, unless otherwise noted |

|

2023 |

|

|

|

2022 |

|

|

|

2022 |

|

|

|

Gold sold (oz) |

|

118,455 |

|

|

|

121,913 |

|

|

|

108,012 |

|

|

|

Tonnes mined - open pit (kt) |

|

9,354 |

|

|

|

9,505 |

|

|

|

10,019 |

|

|

|

Tonnes mined - underground (kt) |

|

156 |

|

|

|

155 |

|

|

|

114 |

|

|

|

Tonnes processed (kt) |

|

1,177 |

|

|

|

1,141 |

|

|

|

1,134 |

|

|

|

Total cash costs: |

|

|

|

|

|

|

|

|

|

|

Total cash costs ($) |

|

84.0 |

|

|

|

86.7 |

|

|

|

80.8 |

|

|

|

Total cash costs per oz sold ($) |

|

709 |

|

|

|

711 |

|

|

|

748 |

|

|

|

Breakdown of production costs |

|

$ |

$/t |

|

$ |

$/t |

|

$ |

$/t |

|

Mining - open pit |

|

28.4 |

|

3.03 |

|

28.6 |

|

3.01 |

|

25.7 |

|

2.57 |

|

Mining - underground |

|

12.6 |

|

80.42 |

|

10.9 |

|

70.19 |

|

9.8 |

|

86.14 |

|

Processing |

|

39.7 |

|

33.72 |

|

38.2 |

|

33.43 |

|

37.2 |

|

32.77 |

|

Site support |

|

12.1 |

|

10.25 |

|

13.2 |

|

11.54 |

|

11.0 |

|

9.66 |

|

Mexican profit sharing (PTU) |

|

5.5 |

|

4.64 |

|

3.9 |

|

3.43 |

|

8.1 |

|

7.16 |

|

Capitalized stripping |

|

(21.2 |

) |

|

|

(17.5 |

) |

|

|

(16.1 |

) |

|

|

Inventory movement |

|

3.5 |

|

|

|

6.2 |

|

|

|

2.7 |

|

|

|

Other |

|

0.9 |

|

|

|

0.8 |

|

|

|

1.2 |

|

|

|

Production costs |

|

81.5 |

|

|

|

84.3 |

|

|

|

79.6 |

|

|

| |

|

|

|

|

|

|

|

|

|

Table 11: Mineral Reserves for the Morelos

Complex

|

|

Tonnes |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

AuEq |

AuEq |

|

|

(kt) |

(gpt) |

(gpt) |

(%) |

(koz) |

(koz) |

(Mlb) |

(gpt) |

(koz) |

|

Media Luna Underground |

|

|

|

|

|

|

|

|

|

|

Proven |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Probable |

23,017 |

2.81 |

25.6 |

0.88 |

2,077 |

18,944 |

444 |

4.54 |

3,360 |

|

Proven & Probable |

23,017 |

2.81 |

25.6 |

0.88 |

2,077 |

18,944 |

444 |

4.54 |

3,360 |

|

ELG Open Pit |

|

|

|

|

|

|

|

|

|

|

Proven |

2,821 |

4.65 |

5.5 |

0.15 |

421 |

495 |

9 |

4.73 |

429 |

|

Probable |

5,582 |

2.46 |

3.9 |

0.15 |

442 |

699 |

18 |

2.54 |

456 |

|

Proven & Probable |

8,403 |

3.20 |

4.4 |

0.15 |

863 |

1,195 |

27 |

3.27 |

885 |

|

ELG Underground |

|

|

|

|

|

|

|

|

|

|

Proven |

829 |

6.22 |

7.7 |

0.28 |

166 |

204 |

5 |

6.60 |

176 |

|

Probable |

1,734 |

5.64 |

7.1 |

0.24 |

314 |

393 |

9 |

5.96 |

332 |

|

Proven & Probable |

2,563 |

5.83 |

7.3 |

0.25 |

480 |

598 |

14 |

6.17 |

508 |

|

Surface Stockpiles |

|

|

|

|

|

|

|

|

|

|

Proven |

4,655 |

1.26 |

3.1 |

0.07 |

188 |

470 |

7 |

1.30 |

195 |

|

Probable |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Proven & Probable |

4,655 |

1.26 |

3.1 |

0.07 |

188 |

470 |

7 |

1.30 |

195 |

|

Total Morelos Complex |

|

|

|

|

|

|

|

|

|

|

Proven |

8,306 |

2.90 |

4.4 |

0.12 |

776 |

1,170 |

22 |

2.99 |

800 |

|

Probable |

30,332 |

2.91 |

20.5 |

0.70 |

2,833 |

20,037 |

471 |

4.25 |

4,148 |

|

Proven & Probable |

38,638 |

2.91 |

17.1 |

0.58 |

3,609 |

21,206 |

493 |

3.98 |

4,947 |

Notes to accompany Mineral Reserve table:

1. Mineral Reserves were developed in accordance with CIM (2014)

guidelines.2. Rounding may result in apparent summation differences

between tonnes, grade, and contained metal content. Surface

Stockpile Mineral Reserves are estimated using production and

survey data and apply the same gold equivalent (“AuEq”) formula as

ELG Open Pits.3. AuEq of Total Reserves is established from

combined contributions of the various deposits.4. The qualified

person for the Mineral Reserve estimate is Johannes (Gertjan)

Bekkers, P. Eng., VP of Mines Technical Services.5. The qualified

person is not aware of mining, metallurgical, infrastructure,

permitting, or other factors that materially affect the Mineral

Reserve estimates.

Notes to accompany the Media Luna Underground Mineral

Reserves:6. Mineral Reserves are based on Media Luna Indicated

Mineral Resources with an effective date of October 31, 2021.7.

Media Luna Underground Mineral Reserves are reported above a

diluted ore cut-off grade of 2.2 g/t AuEq.8. Media Luna Underground

cut-off grades and mining shapes are considered appropriate for a

metal price of $1,400/oz gold (“Au”), $17/oz silver (“Ag”) and

$3.25/lb copper (“Cu”) and metal recoveries of 85% Au, 79% Ag, and

91% Cu.9. Mineral Reserves within designed mine shapes assume

long-hole open stoping, supplemented with mechanized cut-and-fill

mining and includes estimates for dilution and mining losses.10.

Media Luna Underground AuEq = Au (g/t) + Ag (g/t) * (0.0112) + Cu

(%) * (1.6946), accounting for metal prices and metallurgical

recoveries. Notes to

accompany the ELG Open Pit Mineral Reserves:11. Mineral Reserves

are founded on Measured and Indicated Mineral Resources, with an

effective date of December 31, 2022, for ELG Open Pits (including

El Limón, El Limón Sur and Guajes deposits).12. ELG Open Pit

Mineral Reserves are reported above an in-situ cut-off grade of 1.2

g/t Au.13. ELG Low Grade Mineral Reserves are reported above an

in-situ cut-off grade of 0.88 g/t Au.14. It is planned that ELG Low

Grade Mineral Reserves within the designed pits will be stockpiled

during pit operation and processed during pit closure.15. Mineral

Reserves within the designed pits include assumed estimates for

dilution and ore losses.16. Cut-off grades and designed pits are

considered appropriate for a metal price of $1,400/oz Au and metal

recovery of 89% Au.17. Mineral Reserves are reported using a Au

price of US$1,400/oz, Ag price of US$17/oz, and Cu price of

US$3.25/lb.18. Average metallurgical recoveries of 89% for Au, 30%

for Ag, and 23% for Cu.19. ELG Open Pit (including surface

stockpiles) AuEq = Au (g/t) + Ag (g/t) * (0.0041) + Cu (%) *

(0.4114), accounting for metal prices and metallurgical

recoveries.Notes to accompany the ELG Underground Mineral

Reserves:20. Mineral Reserves are founded on Measured and Indicated

Mineral Resources, with an effective date of December 31, 2022, for

ELG Underground (including Sub-Sill, ELD, Sub-Sill South and El

Limón Sur Deep deposits).21. Mineral Reserves were developed in

accordance with CIM guidelines.22. El Limón Underground Mineral

Reserves are reported above an in-situ ore cut-off grade of 3.2 g/t

AuEq and an in-situ incremental cut-off grade of 1.05 g/t Au.23.

Cut-off grades and mining shapes are considered appropriate for a

metal price of $1,400/oz Au and metal recovery of 90% Au.24.

Mineral Reserves within designed mine shapes assume mechanized cut

and fill mining method and include estimates for dilution and

mining losses.25. Mineral Reserves are reported using a Au price of

US$1,400/oz, Ag price of US$17/oz, and Cu price of US$3.25/lb.26.

Average metallurgical recoveries of 90% for Au, 62% for Ag, and 63%

for Cu, accounting for the planned copper concentrator.27. ELG

Underground AuEq = Au (g/t) + Ag (g/t) * (0.0083) + Cu (%) *

(1.1202), accounting for metal prices and metallurgical

recoveries.

Table 12: Mineral Resources for the Morelos

Complex

|

|

Tonnes |

Au |

Ag |

Cu |

Au |

Ag |

Cu |

AuEq |

AuEq |

|

|

(kt) |

(gpt) |

(gpt) |

(%) |

(koz) |

(koz) |

(Mlb) |

(gpt) |

(koz) |

|

Media Luna Underground |

|

|

|

|

|

|

|

|

|

|

Measured |

1,823 |

5.29 |

42.0 |

1.38 |

310 |

2,460 |

55 |

8.06 |

473 |

|

Indicated |

25,567 |

3.02 |

30.1 |

1.05 |

2,486 |

24,708 |

589 |

5.11 |

4,196 |

|

Measured & Indicated |

27,390 |

3.17 |

30.9 |

1.07 |

2,796 |

27,168 |

645 |

5.30 |

4,669 |

|

Inferred |

7,322 |

2.54 |

23.0 |

0.88 |

598 |

5,422 |

143 |

4.27 |

1,006 |

|

ELG Open Pit |

|

|

|

|

|

|

|

|

|

|

Measured |

3,161 |

4.67 |

5.7 |

0.16 |

475 |

576 |

11 |

4.76 |

484 |

|

Indicated |

8,143 |

2.35 |

4.1 |

0.15 |

615 |

1,073 |

26 |

2.42 |

635 |

|

Measured & Indicated |

11,304 |

3.00 |

4.5 |

0.15 |

1,090 |

1,650 |

37 |

3.08 |

1,119 |

|

Inferred |

1,385 |

1.92 |

2.2 |

0.06 |

85 |

100 |

2 |

1.95 |

87 |

|

ELG Underground |

|

|

|

|

|

|

|

|

|

|

Measured |

1,741 |

5.94 |

8.0 |

0.34 |

332 |

450 |

13 |

6.58 |

369 |

|

Indicated |

3,274 |

5.54 |

8.1 |

0.28 |

583 |

854 |

20 |

6.08 |

640 |

|

Measured & Indicated |

5,016 |

5.68 |

8.1 |

0.30 |

916 |

1,304 |

33 |

6.26 |

1,009 |

|

Inferred |

1,480 |

5.45 |

10.2 |

0.30 |

259 |

485 |

10 |

6.05 |

288 |

|

EPO Underground |

|

|

|

|

|

|

|

|

|

|

Measured |

- |

- |

- |

- |

- |

- |

- |

- |

- |

|

Indicated |

4,050 |

2.37 |

34.8 |

1.48 |

308 |

4,528 |

132 |

5.16 |

671 |

|

Measured & Indicated |

4,050 |

2.37 |

34.8 |

1.48 |

308 |

4,528 |

132 |

5.16 |

671 |

|

Inferred |

5,634 |

1.79 |

31.3 |

1.17 |

324 |

5,668 |

145 |

4.04 |

732 |

|

Total Morelos Complex |

|

|

|

|

|

|

|

|

|

|

Measured |

6,725 |

5.17 |

16.1 |

0.54 |

1,117 |

3,486 |

80 |

6.13 |

1,325 |

|

Indicated |

41,035 |

3.03 |

23.6 |

0.85 |

3,992 |

31,164 |

767 |

4.66 |

6,143 |

|

Measured & Indicated |

47,760 |

3.33 |

22.6 |

0.80 |

5,110 |

34,650 |

847 |

4.86 |

7,468 |

|

Inferred |

15,821 |

2.49 |

23.0 |

0.86 |

1,267 |

11,675 |

299 |

4.15 |

2,112 |

Notes to accompany the Mineral Resource Table:1.

CIM (2014) definitions were followed for Mineral Resources.2.

Mineral Resources are depleted above a mining surface or to the

as-mined solids as of December 31, 2022.3. Mineral Resources are

reported using a gold (“Au”) price of US$1,550/oz, silver (“Ag”)

price of US$20/oz, and copper (“Cu”) price of US$3.50/lb.4. Gold

equivalent (“AuEq”) of Total Mineral Resources is established from

combined contributions of the various deposits.5. Mineral Resources

are inclusive of Mineral Reserves.6. Mineral Resources that are not

Mineral Reserves do not have demonstrated economic viability.7.

Numbers may not add due to rounding.8. The estimate was prepared by

Ms. Carolina Milla, P.Eng. (Alberta), Principal, Mineral Resources

Notes to accompany Media Luna Underground Mineral Resources:9. The

effective date of the estimate is December 31, 2022.10. Mineral

Resources are reported above a 2.0 g/t AuEq cut-off grade.11.

Metallurgical recoveries at Media Luna average 85% for Au, 79% for

Ag, and 91% for Cu.12. Media Luna Underground AuEq = Au (g/t) + (Ag

(g/t) * 0.0119) + (Cu (%) * 1.6483). AuEq calculations consider

both metal prices and metallurgical recoveries.13. The assumed

mining method is from underground methods, using a combination of

long hole stoping and cut and fill.Notes to accompany the ELG Open

Pit Mineral Resources:14. The effective date of the estimate is

December 31, 2022.15. Average metallurgical recoveries are 89% for

Au, 30% for Ag and 23% for Cu.16. ELG Open Pit AuEq = Au (g/t) +

(Ag (g/t) * 0.0043) + (Cu (%) * 0.4001). AuEq calculations consider

both metal prices and metallurgical recoveries.17. Mineral

Resources are reported above an in-situ cut-off grade of 0.78 g/t

Au.18. Mineral Resources are reported inside an optimized pit

shell. Underground Mineral Reserves at ELD within the El Limón

shell have been excluded from the open pit Mineral Resources.Notes

to accompany ELG Underground Mineral Resources:19. The effective

date of the estimate is December 31, 2022.20. Average metallurgical

recoveries are 90% for Au, 86% for Ag and 93% for Cu, accounting

for the planned copper concentrator.21. ELG Underground AuEq = Au

(g/t) + (Ag (g/t) * 0.0123) + (Cu (%) * 1.600). AuEq calculations

consider both metal prices and metallurgical recoveries.22. Mineral

Resources are reported above a cut-off grade of 3.0 g/t AuEq.23.

The assumed mining method is underground cut and fill.Notes to

accompany EPO Underground Mineral Resources:24. The effective date

of the estimate is December 31, 2022.25. Mineral Resources are

reported above a 2.0 g/t AuEq cut-off grade.26. Metallurgical

recoveries at EPO average 85% for Au, 75% for Ag, and 89% for

Cu.27. EPO Underground AuEq = Au (g/t) + Ag (g/t) * (0.0114) + Cu %

* (1.6212). AuEq calculations consider both metal prices and

metallurgical recoveries.28. The assumed mining method is from

underground methods using a long hole

stoping.

ABOUT TOREX GOLD RESOURCES

INC.Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development, and operation of

its 100% owned Morelos Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal asset is the

Morelos Complex, which includes the El Limón Guajes (“ELG”) Mine

Complex, the Media Luna Project, a processing plant and related

infrastructure. Commercial production from the Morelos Complex

commenced on April 1, 2016 and an updated Technical Report for the

Morelos Complex was released in March 2022. Torex’s key strategic

objectives are to optimize and extend production from the ELG Mine

Complex, de-risk and advance Media Luna to commercial production,

build on ESG excellence, and to grow through ongoing exploration

across the entire Morelos Property.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

| TOREX GOLD RESOURCES INC. |

|

| Jody

Kuzenko |

Dan Rollins |

|

President and CEO |

Senior Vice President, Corporate Development & Investor

Relations |

|

Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

| jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

QUALIFIED PERSONS

The scientific and technical information

contained in this press release pertaining to Mineral Reserves has

been reviewed and approved by Johannes (Gertjan) Bekkers, P.Eng.,

Vice President, Mine Technical Services of Torex Gold Resources

Inc. and a Qualified Person under NI 43-101.

The scientific and technical information

contained in this press release pertaining to Mineral Resources has

been reviewed and approved by Carolina Milla, P.Eng., Principal,

Mineral Resources of Torex Gold Resources Inc. and a Qualified

Person under NI 43-101.

CAUTIONARY NOTES

Forward Looking Information

This press release contains "forward-looking

statements" and "forward-looking information" within the meaning of

applicable Canadian securities legislation. Forward-looking

information also includes, but is not limited to, statements that:

the Company is placed in an excellent position to deliver on full

year operational guidance; development of the Media Luna Project is

tracking to schedule and budget; the Guajes Tunnel breakthrough on

track for early Q1 2024, if not before; the level of spending on

Media Luna is expected to increase through the remainder of 2023;

production during Q2 and Q3 will be closer to the bottom end of the

quarterly run-rate implied by full year guidance; the mine plan for

the next two quarters sees the conclusion of mining in the Guajes

pit, a heavy focus on waste stripping in the El Limón pit and draw

down of stockpiled material; total cash costs and all-in sustaining

costs during Q2 and Q3 are expected to be above the upper end of

the annual guided range for those quarters only; production and

costs are expected to return to usual levels in Q4, with higher

processed grades and the increased level of ore production; net

income includes a net derivative loss of $26.6 million related

to gold forward contracts entered into to mitigate downside price

risk during the construction of the Media Luna Project; the pace of

investment is expected to increase into the second half of 2023 and

remain relatively consistent through the first half of 2024, before

declining as development activities wind down ahead of commercial

production, which is anticipated in early-2025; the Company on

track to meet annual production guidance and full year total cash

costs guidance and all-in sustaining costs guidance; and the

Company’s key strategic objectives are to optimize and extend

production from the ELG Mine Complex, de-risk and advance Media

Luna to commercial production, build on ESG excellence, and to grow

through ongoing exploration across the entire Morelos Property.

Generally, forward-looking information and statements can be

identified by the use of forward-looking terminology such as

“plans,” “expects,” or “does not expect,” “is expected,” or

variations of such words and phrases or statements that certain

actions, events or results “will”, “may,” “could,” “would,”

“might,” or “on track,” or “well positioned to” occur.

Forward-looking information is subject to known and unknown risks,

uncertainties and other factors that may cause the actual results,

level of activity, performance or achievements of the Company to be

materially different from those expressed or implied by such

forward-looking information, including, without limitation, risks

and uncertainties identified in the technical report (the

“Technical Report”) released on March 31, 2022, entitled “NI 43-101

Technical Report ELG Mine Complex Life of Mine Plan and Media Luna

Feasibility Study”, which has an effective date of March 16, 2022,

and the Company’s annual information form and management’s

discussion and analysis or other unknown but potentially

significant impacts. Forward-looking information and statements are

based on the assumptions discussed in the Technical Report and such

other reasonable assumptions, estimates, analysis and opinions of

management made in light of its experience and perception of

trends, current conditions and expected developments, and other

factors that management believes are relevant and reasonable in the

circumstances at the date such statements are made. Although the

Company has attempted to identify important factors that could

cause actual results to differ materially from those contained in

the forward-looking information, there may be other factors that

cause results not to be as anticipated. There can be no assurance

that such information will prove to be accurate, as actual results

and future events could differ materially from those anticipated in

such information. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, whether as a

result of new information or future events or otherwise, except as

may be required by applicable securities laws.

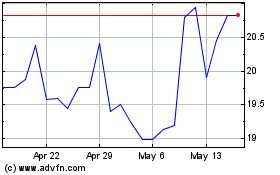

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Mar 2024 to Mar 2025