Torex Gold Resources Inc. (the “Company” or “Torex”) (TSX: TXG)

reports the Company’s financial and operational results for the

three- and nine-month periods ended September 30, 2023. Senior

management of Torex will host a conference call tomorrow morning at

9:00 AM (ET) to discuss the quarterly results.

Jody Kuzenko, President & CEO of Torex,

stated:

“We expect to close out 2023 on a solid note

with the fourth quarter forecast to be the strongest quarter of

production, driven by higher open pit grades now that the period of

elevated waste stripping is behind us. Our confidence in achieving

full year production guidance of 440,000 to 470,000 ounces (“oz”)

is supported by October gold production of 41,450 oz, which

included 105 hours of planned maintenance in the process plant at

the start of the month. With mining now into higher-grade benches

in the open pit, the average gold grade processed during October

averaged 4.05 grams per tonne (“gpt”) compared to 2.47 gpt during

Q3.

“Despite the lower grades processed during the

third quarter, operational and safety performance remained strong

with the mill exceeding 13,000 tonnes per day (“tpd”) for the third

quarter in a row, ELG Underground setting another record mining

rate, and consistent recoveries despite the lower grades processed.

On the safety front, there were no lost time injuries during the

quarter, and we exited the quarter with a lost time injury

frequency (“LTIF”) of 0.47 per million hours worked. In October,

the ELG Complex (excluding Media Luna) surpassed 10 million

hours lost time injury free, the third time this milestone has been

achieved since 2020.

“Full year cost guidance has been revised higher

given the ongoing strength of the Mexican peso along with the

combination of higher than budgeted mining volumes and plant

throughput with lower processed grades, which was due to the

greater reliance on lower-grade stockpiles during the period of

elevated waste stripping in Q2 and Q3. As a result, full year total

cash costs1 guidance has been revised to $840 to $870 per oz gold

sold and full year all-in sustaining costs1 revised to $1,160 to

$1,200 per oz gold sold.

“Steady progress was made at Media Luna during

the quarter with the project 49% complete at quarter-end.

Underground development and construction are well underway and

surface construction is tracking to plan. Advancement of the Guajes

Tunnel continues to impress with breakthrough expected in late

December. While the overall project timeline remains intact, some

expenditure has been pushed into 2024 and, as a result, we have

lowered our full year capital expenditure guidance for Media Luna

to $360 to $390 million. With $501 million of liquidity (including

$209 million in cash) and 15 months of ongoing free cash flow

expected from ELG during the remaining project period, we are well

positioned to fund the remaining $508 million of expenditures on

Media Luna while maintaining at least $100 million on the balance

sheet.

“With a couple of tough, low-grade quarters now

behind us, we continue to deliver the level of operational

excellence our shareholders have come to expect from us. As we

continue to make progress on the Media Luna Project, we look

forward to a solid end of the year by delivering a strong fourth

quarter and achieving annual production guidance for the fifth

straight year.”

THIRD QUARTER 2023 HIGHLIGHTS

- Strong

safety performance continues: Despite the substantial

increase in activity during the quarter with the construction of

the Media Luna Project, there were no lost-time injuries (“LTI”) in

the quarter. Exited the quarter with a LTIF rate of 0.47 per

million hours worked on a rolling 12-month basis. On October 18,

the Company reached 10 million hours worked without a LTI at its

ELG Mine Complex for the third time since 2020.

-

Hurricane Otis: In late October, the category 5

hurricane Otis made landfall near Acapulco, Mexico, approximately

300 kilometres from the ELG Mine Complex. The Company's employees

are safe and both the operations and assets are unaffected.

- Gold

production: Delivered gold production of 85,360 oz for the

quarter (YTD - 315,785 oz) driven by the processing of lower grade

and stockpiled ore during the intense stripping period associated

with the layback at the El Limón open pit, partially offset by a

record mining rate at ELG Underground of 2,321 tpd (YTD - 1,993

tpd). With mining of the higher-grade benches started in late

September and gold production of 41,450 oz in October despite an

extended planned shutdown, the Company remains on track to meet

annual production guidance of 440,000 to 470,000 oz.

- Gold

sold: Sold 81,752 oz of gold (YTD - 305,956 oz) at an

average realized gold price1 of $1,944 per oz (YTD - $1,932 per

oz), contributing to revenue of $160.1 million (YTD - $600.2

million).

- Total

cash costs1 and all-in sustaining

costs1: Total cash costs

of $1,086 per oz sold (YTD - $858) and all-in sustaining costs of

$1,450 per oz sold (YTD - $1,257). All-in sustaining costs margin1

of $494 per oz sold (YTD - $675), implying an all-in sustaining

costs margin1 of 25% (YTD - 34%). Cost of sales was $133.0 million

(YTD - $408.5 million) or $1,627 per oz sold in the quarter (YTD -

$1,335), impacted by the appreciation of the Mexican peso and the

high strip, low grade phase of the open pit mine plan resulting in

the lower average gold grade of ore processed. Given the ongoing

strength of the Mexican peso as well as the combination of higher

than budgeted mine volumes (open pit and underground) and plant

throughput with lower processed grades (greater reliance on lower

grade stockpiles during Q2 and Q3), full year total cash costs

guidance is now estimated at $840 to $870 per oz sold and full year

all-in sustaining costs guidance is now estimated at $1,160 to

$1,200 per oz sold.

- Net

income and adjusted net earnings1:

Reported net income of $10.5 million or earnings of $0.12 per share

on a basic basis and $0.09 per share on a diluted basis (YTD -

$154.0 million, or $1.79 per share on a basic basis and $1.77 per

share on a diluted basis). Adjusted net earnings of $11.1 million

or $0.13 per share on a basic basis and $0.13 per share on a

diluted basis (YTD - $99.3 million, or $1.16 per share on a basic

basis and $1.15 per share on a diluted basis). Net income includes

a net derivative gain of $18.1 million (YTD - $6.2 million gain)

related to gold forward contracts entered into to mitigate downside

price risk during the construction of the Media Luna Project. In

the third quarter of 2023, the Company entered into a series of

zero-cost collars whereby it sold call option contracts and

purchased put option contracts for $nil cash premium to hedge

against changes in foreign exchange rates of the Mexican peso

between September 2023 and December 2024 for a total notional value

of $65.9 million. In October 2023, the Company entered into an

additional series of zero-cost collars between October 2023 and

December 2024 for a total notional value of $41.4 million.

-

EBITDA1 and adjusted

EBITDA1: Generated

EBITDA of $79.4 million (YTD - $307.2 million) and adjusted EBITDA

of $61.2 million (YTD - $299.6 million).

- Cash

flow generation: Net cash generated from operating

activities totalled $44.2 million (YTD - $180.8 million) and $52.6

million (YTD - $207.3 million) before changes in non-cash operating

working capital, including income taxes paid of $12.0 million (YTD

- $104.2 million). Negative free cash flow1 of $69.7 million (YTD -

$161.1 million) net of cash outlays for capital expenditures, lease

payments and interest, including borrowing costs capitalized.

- Strong

financial liquidity: The Company extended and increased

the available credit facilities with a syndicate of international

banks in the quarter, now providing a total of $300.0 million in

available credit maturing in 2026. The quarter closed with net

cash1 of $188.3 million, including $209.4 million in cash and $21.1

million of lease-related obligations, no borrowings on the credit

facilities of $300.0 million and letters of credit outstanding of

$7.9 million, providing $501.5 million in available liquidity.

- Media

Luna Project: Media Luna Project expenditures totalled

$98.7 million during the quarter (YTD - $242.3 million), with a

remaining project spend of $507.5 million. Expenditures during this

period were primarily focused on continued development of the

Guajes Tunnel and South Portals, with development of the Guajes

Tunnel reaching 5,160 metres and South Portal Lower reaching 2,325

metres by end of the third quarter. As of September 30, 2023,

physical progress on the Project was approximately 49%, with

detailed engineering, procurement activities, underground

development, and surface construction advancing. As of

September 30, 2023, the Company had commitments in place for

$591.2 million of project expenditures (approximately 68% of total

budgeted expenditures). With $242.3 million invested year-to-date

and the level of spending expected to increase further in the

fourth quarter of 2023, the full year Media Luna Project

expenditure guidance has been lowered to $360 to $390 million

reflecting the redistribution in timing of expenditures. Quarterly

expenditures are expected to remain elevated through the third

quarter of 2024 before declining with the commissioning of the

upgraded processing plant.

-

Exploration and Drilling Activities: In September,

the Company announced initial assay results from the 2023 drilling

program at EPO2. Results from the 2023 program continue to

highlight the potential to upgrade Inferred Resources to the

Indicated category and expand Inferred Resources through step-out

drilling to the north and south of the deposit. Results from the

2023 program will be incorporated into the year-end Mineral

Resource update and will form the basis of an internal study

evaluating the feasibility of developing an economic mining front

at EPO, which could leverage the infrastructure currently being

developed for Media Luna, including the Guajes Tunnel. Overall, the

positive results from the 2023 drilling program at EPO support

ongoing resource expansion and reserve growth, which in turn

supports the Company's strategic focus on filling the mill with

higher-grade feed beyond 2027.

- These measures are Non-GAAP

Financial Performance Measures or Non-GAAP ratios (collectively,

“Non-GAAP Measures”). For a detailed reconciliation of each

Non-GAAP Measure to its most directly comparable measure in

accordance with the IFRS Accounting Standards (“IFRS”) as issued by

the International Accounting Standards Board see Tables 2 to 10 of

this press release. For additional information on these Non-GAAP

Measures, please refer to the Company’s management’s discussion and

analysis (“MD&A”) for the three- and nine-month periods ending

September 30, 2023, dated November 13, 2023. The MD&A, and the

Company’s unaudited condensed consolidated interim financial

statements for the three- and nine-month periods ended September

30, 2023, are available on Torex’s website (www.torexgold.com) and

under the Company’s SEDAR profile (www.sedar.com).

- For more information on EPO

drilling results, see the Company’s news release titled “Torex Gold

Reports Results From 2023 Drilling at EPO” issued on September 5,

2023, and filed on SEDAR (www.sedar.com) and on the Company’s

website at www.torexgold.com.

Table 1: Operating & Financial

Highlights

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

Sep

30, |

|

Jun 30, |

|

Sep

30, |

|

Sep

30, |

|

Sep

30, |

|

In millions of U.S. dollars, unless otherwise noted |

|

|

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Operating Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lost-time injury frequency1 |

|

/million hours |

|

0.47 |

|

|

0.58 |

|

|

0.10 |

|

0.47 |

|

|

0.10 |

|

Total recordable injury frequency1 |

|

/million hours |

|

1.24 |

|

|

1.66 |

|

|

1.69 |

|

1.24 |

|

|

1.69 |

|

Gold produced |

|

oz |

|

85,360 |

|

|

107,507 |

|

|

122,208 |

|

315,785 |

|

|

357,839 |

|

Gold sold |

|

oz |

|

81,752 |

|

|

105,749 |

|

|

119,834 |

|

305,956 |

|

|

351,209 |

|

Total cash costs2 |

|

$/oz |

|

1,086 |

|

|

848 |

|

|

760 |

|

858 |

|

|

736 |

|

Total cash costs margin2 |

|

$/oz |

|

858 |

|

|

1,112 |

|

|

955 |

|

1,074 |

|

|

1,081 |

|

All-in sustaining costs2 |

|

$/oz |

|

1,450 |

|

|

1,308 |

|

|

1,059 |

|

1,257 |

|

|

999 |

|

All-in sustaining costs margin2 |

|

$/oz |

|

494 |

|

|

652 |

|

|

656 |

|

675 |

|

|

818 |

|

Average realized gold price2 |

|

$/oz |

|

1,944 |

|

|

1,960 |

|

|

1,715 |

|

1,932 |

|

|

1,817 |

|

Financial Results |

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

|

160.1 |

|

|

211.3 |

|

|

209.3 |

|

600.2 |

|

|

652.0 |

|

Cost of sales |

|

$ |

|

133.0 |

|

|

138.1 |

|

|

146.2 |

|

408.5 |

|

|

418.0 |

|

Earnings from mine operations |

|

$ |

|

27.1 |

|

|

73.2 |

|

|

63.1 |

|

191.7 |

|

|

234.0 |

|

Net income |

|

$ |

|

10.5 |

|

|

75.3 |

|

|

43.9 |

|

154.0 |

|

|

154.2 |

|

Per share - Basic |

|

$/share |

|

0.12 |

|

|

0.88 |

|

|

0.51 |

|

1.79 |

|

|

1.80 |

|

Per share - Diluted |

|

$/share |

|

0.09 |

|

|

0.85 |

|

|

0.51 |

|

1.77 |

|

|

1.77 |

|

Adjusted net earnings2 |

|

$ |

|

11.1 |

|

|

37.9 |

|

|

34.6 |

|

99.3 |

|

|

128.8 |

|

Per share - Basic2 |

|

$/share |

|

0.13 |

|

|

0.44 |

|

|

0.40 |

|

1.16 |

|

|

1.50 |

|

Per share - Diluted2 |

|

$/share |

|

0.13 |

|

|

0.44 |

|

|

0.40 |

|

1.15 |

|

|

1.50 |

|

EBITDA2 |

|

$ |

|

79.4 |

|

|

125.3 |

|

|

127.8 |

|

307.2 |

|

|

386.8 |

|

Adjusted EBITDA2 |

|

$ |

|

61.2 |

|

|

105.7 |

|

|

107.8 |

|

299.6 |

|

|

355.6 |

|

Cost of sales |

|

$/oz |

|

1,627 |

|

|

1,306 |

|

|

1,220 |

|

1,335 |

|

|

1,190 |

|

Net cash generated from operating activities |

|

$ |

|

44.2 |

|

|

89.6 |

|

|

102.4 |

|

180.8 |

|

|

276.0 |

|

Net cash generated from operating activities before changes in

non-cash operating working capital |

|

$ |

|

52.6 |

|

|

92.8 |

|

|

91.3 |

|

207.3 |

|

|

271.5 |

|

Free cash flow2 |

|

$ |

|

(69.7 |

) |

|

(37.4 |

) |

|

32.0 |

|

(161.1 |

) |

|

85.4 |

|

Cash and cash equivalents |

|

$ |

|

209.4 |

|

|

285.3 |

|

|

339.2 |

|

209.4 |

|

|

339.2 |

|

Lease-related obligations |

|

$ |

|

21.1 |

|

|

11.5 |

|

|

3.1 |

|

21.1 |

|

|

3.1 |

|

Net cash2 |

|

$ |

|

188.3 |

|

|

273.8 |

|

|

336.1 |

|

188.3 |

|

|

336.1 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

- On a 12-month rolling basis, per

million hours worked.

- Total cash costs, total cash costs

margin, all-in sustaining costs, all-in sustaining costs margin,

average realized gold price, adjusted net earnings, EBITDA,

adjusted EBITDA, free cash flow and net cash are non-GAAP financial

measures with no standardized meaning under IFRS. For a detailed

reconciliation of each Non-GAAP Measure to its most directly

comparable IFRS financial measure see Tables 2 to 10 of this press

release. Refer to “Non-GAAP Financial Performance Measures” for

further information and a detailed reconciliation to the comparable

IFRS measures in the MD&A for the three- and nine-month periods

ending September 30, 2023, dated November 13, 2023.

CONFERENCE CALL AND WEBCAST DETAILS

The Company will host a conference call tomorrow

at 9:00 AM (ET) in which senior management will discuss the third

quarter operating and financial results. Please dial in or access

the webcast approximately ten minutes prior to the start of the

call:

- Toronto local or International:

1-416-915-3239

- Toll-Free (North America):

1-800-319-4610

A live webcast of the conference call will be

available on the Company’s website at

https://torexgold.com/investors/upcoming-events/. The webcast will

be archived on the Company’s website.

Table 2: Reconciliation of Total Cash

Costs and All-in Sustaining Costs to Cost of Sales

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

In millions of U.S. dollars, unless otherwise noted |

|

|

|

Sep 30, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2022 |

|

Sep 30, 2023 |

|

Sep 30, 2022 |

|

Gold sold |

|

oz |

|

81,752 |

|

|

105,749 |

|

|

119,834 |

|

|

305,956 |

|

|

351,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total cash costs per oz sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

Production costs and royalties |

|

$ |

|

91.6 |

|

|

93.1 |

|

|

94.9 |

|

|

273.1 |

|

|

272.3 |

|

|

Less: Silver sales |

|

$ |

|

(1.0 |

) |

|

(1.3 |

) |

|

(0.6 |

) |

|

(3.8 |

) |

|

(2.0 |

) |

|

Less: Copper sales |

|

$ |

|

(1.8 |

) |

|

(2.1 |

) |

|

(3.2 |

) |

|

(6.8 |

) |

|

(11.7 |

) |

|

Total cash costs |

|

$ |

|

88.8 |

|

|

89.7 |

|

|

91.1 |

|

|

262.5 |

|

|

258.6 |

|

|

Total cash costs per oz sold |

|

$/oz |

|

1,086 |

|

|

848 |

|

|

760 |

|

|

858 |

|

|

736 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All-in sustaining costs per oz sold |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total cash costs |

|

$ |

|

88.8 |

|

|

89.7 |

|

|

91.1 |

|

|

262.5 |

|

|

258.6 |

|

|

General and administrative costs1 |

|

$ |

|

6.2 |

|

|

5.9 |

|

|

5.0 |

|

|

18.7 |

|

|

17.8 |

|

|

Reclamation and remediation costs |

|

$ |

|

1.1 |

|

|

1.3 |

|

|

1.4 |

|

|

3.8 |

|

|

4.0 |

|

|

Sustaining capital expenditure |

|

$ |

|

22.4 |

|

|

41.4 |

|

|

29.4 |

|

|

99.6 |

|

|

70.6 |

|

|

Total all-in sustaining costs |

|

$ |

|

118.5 |

|

|

138.3 |

|

|

126.9 |

|

|

384.6 |

|

|

351.0 |

|

|

Total all-in sustaining costs per oz sold |

|

$/oz |

|

1,450 |

|

|

1,308 |

|

|

1,059 |

|

|

1,257 |

|

|

999 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

- This amount excludes a gain of $3.1

million, gain of $1.8 million and gain of $0.3 million for the

three months ended September 30, 2023, June 30, 2023, and September

30, 2022, respectively, and a gain of $1.3 million and gain of $2.1

million for the nine months ended September 30, 2023 and September

30, 2022, respectively, in relation to the remeasurement of

share-based payments. This amount also excludes corporate

depreciation and amortization expenses totalling $0.1 million, $nil

and $0.1 million for the three months ended September 30, 2023,

June 30, 2023, and September 30, 2022, respectively, $0.2 million

and $0.2 million for the nine months ended September 30, 2023 and

September 30, 2022, respectively, within general and administrative

costs. Included in general and administrative costs is share-based

compensation expense in the amount of $1.2 million or $15/oz for

the three months ended September 30, 2023, $1.2 million or $11/oz

for the three months ended June 30, 2023, $0.8 million or $7/oz for

the three months ended September 30, 2022, $4.3 million or $14/oz

for the nine months ended September 30, 2023 and $3.4 million or

$10/oz for the nine months ended September 30, 2022. This amount

excludes other expenses totalling $2.4 million, $1.6 million and

$nil for the three months ended September 30, 2023, June 30, 2023,

and September 30, 2022, respectively, and $4.6 million and $nil for

the nine months ended September 30, 2023 and September 30, 2022,

respectively.

Table 3: Reconciliation of Sustaining

and Non-Sustaining Costs to Capital Expenditures

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

|

Sep

30, |

|

Jun

30, |

|

Sep 30, |

|

Sep

30, |

|

Sep

30, |

|

In millions of U.S. dollars |

|

|

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

Sustaining |

|

$ |

|

16.5 |

|

|

19.5 |

|

12.8 |

|

|

50.6 |

|

|

30.0 |

|

Capitalized Stripping (Sustaining) |

|

$ |

|

5.9 |

|

|

21.9 |

|

16.6 |

|

|

49.0 |

|

|

40.6 |

|

Non-sustaining |

|

$ |

|

0.8 |

|

|

0.4 |

|

4.3 |

|

|

1.9 |

|

|

15.0 |

|

Total ELG |

|

$ |

|

23.2 |

|

|

41.8 |

|

33.7 |

|

|

101.5 |

|

|

85.6 |

|

Media Luna Project |

|

$ |

|

98.7 |

|

|

77.2 |

|

32.5 |

|

|

242.3 |

|

|

80.6 |

|

Media Luna Infill Drilling/Other |

|

$ |

|

4.2 |

|

|

4.9 |

|

5.4 |

|

|

12.2 |

|

|

17.2 |

|

Working Capital Changes & Other |

|

$ |

|

(13.7 |

) |

|

0.6 |

|

(3.0 |

) |

|

(19.4 |

) |

|

3.0 |

|

Capital expenditures1 |

|

$ |

|

112.4 |

|

|

124.5 |

|

68.6 |

|

|

336.6 |

|

|

186.4 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

- The amount of cash expended on

additions to property, plant and equipment in the period as

reported in the Condensed Consolidated Interim Statements of Cash

Flows.

Table 4: Reconciliation of Average

Realized Price and Total Cash Costs Margin Per Ounce of Gold Sold

to Revenue

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

In millions of U.S. dollars, unless otherwise noted |

|

|

|

Sep 30, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2022 |

|

Sep 30, 2023 |

|

Sep 30, 2022 |

|

Gold sold |

|

oz |

|

81,752 |

|

|

105,749 |

|

|

119,834 |

|

|

305,956 |

|

|

351,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

$ |

|

160.1 |

|

|

211.3 |

|

|

209.3 |

|

|

600.2 |

|

|

652.0 |

|

|

Less: Silver sales |

|

$ |

|

(1.0 |

) |

|

(1.3 |

) |

|

(0.6 |

) |

|

(3.8 |

) |

|

(2.0 |

) |

|

Less: Copper sales |

|

$ |

|

(1.8 |

) |

|

(2.1 |

) |

|

(3.2 |

) |

|

(6.8 |

) |

|

(11.7 |

) |

|

Add: Realized gain (loss) on gold contracts |

|

$ |

|

1.6 |

|

|

(0.6 |

) |

|

- |

|

|

1.5 |

|

|

- |

|

|

Total proceeds |

|

$ |

|

158.9 |

|

|

207.3 |

|

|

205.5 |

|

|

591.1 |

|

|

638.3 |

|

|

Total average realized gold price |

|

$/oz |

|

1,944 |

|

|

1,960 |

|

|

1,715 |

|

|

1,932 |

|

|

1,817 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Total cash costs |

|

$/oz |

|

1,086 |

|

|

848 |

|

|

760 |

|

|

858 |

|

|

736 |

|

|

Total cash costs margin |

|

$/oz |

|

858 |

|

|

1,112 |

|

|

955 |

|

|

1,074 |

|

|

1,081 |

|

|

Total cash costs margin |

|

% |

|

44 |

|

|

57 |

|

|

56 |

|

|

56 |

|

|

59 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Table 5: Reconciliation of All-in

Sustaining Costs Margin to Revenue

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

In millions of U.S. dollars, unless otherwise noted |

Sep 30, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2022 |

|

Sep 30, 2023 |

|

Sep 30, 2022 |

|

Gold sold |

oz |

|

81,752 |

|

|

105,749 |

|

|

119,834 |

|

|

305,956 |

|

|

351,209 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

|

160.1 |

|

|

211.3 |

|

|

209.3 |

|

|

600.2 |

|

|

652.0 |

|

|

Less: Silver sales |

|

$ |

|

(1.0 |

) |

|

(1.3 |

) |

|

(0.6 |

) |

|

(3.8 |

) |

|

(2.0 |

) |

|

Less: Copper sales |

|

$ |

|

(1.8 |

) |

|

(2.1 |

) |

|

(3.2 |

) |

|

(6.8 |

) |

|

(11.7 |

) |

|

Add: Realized gain (loss) on gold contracts |

|

$ |

|

1.6 |

|

|

(0.6 |

) |

|

- |

|

|

1.5 |

|

|

- |

|

|

Less: All-in sustaining costs |

|

$ |

|

(118.5 |

) |

|

(138.3 |

) |

|

(126.9 |

) |

|

(384.6 |

) |

|

(351.0 |

) |

|

All-in sustaining costs margin |

|

$ |

|

40.4 |

|

|

69.0 |

|

|

78.6 |

|

|

206.5 |

|

|

287.3 |

|

|

Total all-in sustaining costs margin |

|

$/oz |

|

494 |

|

|

652 |

|

|

656 |

|

|

675 |

|

|

818 |

|

|

Total all-in sustaining costs margin |

|

% |

|

25 |

|

|

33 |

|

|

38 |

|

|

34 |

|

|

44 |

|

Table 6: Reconciliation of Adjusted Net

Earnings to Net Income

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

In millions of U.S. dollars, unless otherwise noted |

|

|

|

Sep 30, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2022 |

|

Sep 30, 2023 |

|

Sep 30, 2022 |

|

Basic weighted average shares outstanding |

|

shares |

|

85,885,453 |

|

|

85,884,895 |

|

|

85,843,808 |

|

|

85,879,934 |

|

|

85,827,656 |

|

|

Diluted weighted average shares outstanding |

|

shares |

|

86,401,220 |

|

|

86,565,950 |

|

|

86,039,606 |

|

|

86,409,988 |

|

|

86,059,576 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income |

|

$ |

|

10.5 |

|

|

75.3 |

|

|

43.9 |

|

|

154.0 |

|

|

154.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized foreign exchange loss (gain) |

|

$ |

|

1.4 |

|

|

(2.5 |

) |

|

0.3 |

|

|

(1.6 |

) |

|

(0.3 |

) |

|

Unrealized gain on derivative contracts |

|

$ |

|

(16.5 |

) |

|

(15.3 |

) |

|

(20.0 |

) |

|

(4.7 |

) |

|

(28.8 |

) |

|

Remeasurement of share-based payments |

|

$ |

|

(3.1 |

) |

|

(1.8 |

) |

|

(0.3 |

) |

|

(1.3 |

) |

|

(2.1 |

) |

|

Derecognition of provisions for uncertain tax positions |

|

$ |

|

- |

|

|

- |

|

|

- |

|

|

(15.2 |

) |

|

- |

|

|

Tax effect of above adjustments |

|

$ |

|

5.2 |

|

|

5.9 |

|

|

6.0 |

|

|

2.1 |

|

|

9.4 |

|

|

Tax effect of currency translation on tax base |

|

$ |

|

13.6 |

|

|

(23.7 |

) |

|

4.7 |

|

|

(34.0 |

) |

|

(3.6 |

) |

|

Adjusted net earnings |

|

$ |

|

11.1 |

|

|

37.9 |

|

|

34.6 |

|

|

99.3 |

|

|

128.8 |

|

|

Per share - Basic |

|

$/share |

|

0.13 |

|

|

0.44 |

|

|

0.40 |

|

|

1.16 |

|

|

1.50 |

|

|

Per share - Diluted |

|

$/share |

|

0.13 |

|

|

0.44 |

|

|

0.40 |

|

|

1.15 |

|

|

1.50 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Table 7: Reconciliation of EBITDA and

Adjusted EBITDA to Net Income

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

In millions of U.S. dollars |

|

|

|

Sep 30, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2022 |

|

Sep 30, 2023 |

|

Sep 30, 2022 |

|

Net income |

|

$ |

|

10.5 |

|

|

75.3 |

|

|

43.9 |

|

|

154.0 |

|

|

154.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance income, net |

|

$ |

|

(2.0 |

) |

|

(3.2 |

) |

|

(0.8 |

) |

|

(8.2 |

) |

|

(0.7 |

) |

|

Depreciation and amortization1 |

|

$ |

|

41.5 |

|

|

45.0 |

|

|

51.4 |

|

|

135.6 |

|

|

145.9 |

|

|

Current income tax expense |

|

$ |

|

12.1 |

|

|

18.6 |

|

|

32.3 |

|

|

47.5 |

|

|

93.9 |

|

|

Deferred income tax expense (recovery) |

|

$ |

|

17.3 |

|

|

(10.4 |

) |

|

1.0 |

|

|

(21.7 |

) |

|

(6.5 |

) |

|

EBITDA |

|

$ |

|

79.4 |

|

|

125.3 |

|

|

127.8 |

|

|

307.2 |

|

|

386.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on derivative contracts |

|

$ |

|

(16.5 |

) |

|

(15.3 |

) |

|

(20.0 |

) |

|

(4.7 |

) |

|

(28.8 |

) |

|

Unrealized foreign exchange loss (gain) |

|

$ |

|

1.4 |

|

|

(2.5 |

) |

|

0.3 |

|

|

(1.6 |

) |

|

(0.3 |

) |

|

Remeasurement of share-based payments |

|

$ |

|

(3.1 |

) |

|

(1.8 |

) |

|

(0.3 |

) |

|

(1.3 |

) |

|

(2.1 |

) |

|

Adjusted EBITDA |

|

$ |

|

61.2 |

|

|

105.7 |

|

|

107.8 |

|

|

299.6 |

|

|

355.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

- Includes depreciation and

amortization included in cost of sales, general and administrative

expenses and exploration and evaluation expenses.

Table 8: Free Cash Flow

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

In millions of U.S. dollars |

|

|

|

Sep 30, 2023 |

|

Jun 30, 2023 |

|

Sep 30, 2022 |

|

Sep 30, 2023 |

|

Sep 30, 2022 |

|

Net cash generated from operating activities |

|

$ |

|

44.2 |

|

|

89.6 |

|

|

102.4 |

|

|

180.8 |

|

|

276.0 |

|

|

Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Additions to property, plant and equipment1 |

|

$ |

|

(112.4 |

) |

|

(124.5 |

) |

|

(68.6 |

) |

|

(336.6 |

) |

|

(186.4 |

) |

|

Lease payments |

|

$ |

|

(1.0 |

) |

|

(1.4 |

) |

|

(1.5 |

) |

|

(3.2 |

) |

|

(3.0 |

) |

|

Interest paid2 |

|

$ |

|

(0.5 |

) |

|

(1.1 |

) |

|

(0.3 |

) |

|

(2.1 |

) |

|

(1.2 |

) |

|

Free cash flow |

|

$ |

|

(69.7 |

) |

|

(37.4 |

) |

|

32.0 |

|

|

(161.1 |

) |

|

85.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

- The amount of cash expended on

additions to property, plant and equipment in the period as

reported on the Condensed Consolidated Interim Statements of Cash

Flows.

- Including borrowing costs

capitalized to property, plant and equipment.

Table 9: Net Cash

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sep 30, |

|

Jun 30, |

|

Dec 31, |

|

Sep 30, |

|

In millions of U.S. dollars |

|

|

|

2023 |

|

2023 |

|

2022 |

|

2022 |

|

Cash and cash equivalents |

|

$ |

|

209.4 |

|

|

285.3 |

|

|

376.0 |

|

|

339.2 |

|

|

Less: Lease-related obligations |

|

$ |

|

(21.1 |

) |

|

(11.5 |

) |

|

(3.9 |

) |

|

(3.1 |

) |

|

Net cash |

|

$ |

|

188.3 |

|

|

273.8 |

|

|

372.1 |

|

|

336.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

Table 10: Unit Cost

Measures

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

In millions of U.S. dollars, unless otherwise noted |

|

Sep 30, 2023 |

|

|

Jun 30, 2023 |

|

|

Sep 30, 2022 |

|

|

Sep 30, 2023 |

|

|

Sep 30, 2022 |

|

|

Gold sold (oz) |

|

81,752 |

|

|

|

105,749 |

|

|

|

119,834 |

|

|

|

305,956 |

|

|

|

351,209 |

|

|

|

Tonnes mined - open pit (kt) |

|

11,157 |

|

|

|

11,768 |

|

|

|

9,980 |

|

|

|

32,279 |

|

|

|

28,946 |

|

|

|

Tonnes mined - underground (kt) |

|

214 |

|

|

|

174 |

|

|

|

143 |

|

|

|

544 |

|

|

|

401 |

|

|

|

Tonnes processed (kt) |

|

1,206 |

|

|

|

1,210 |

|

|

|

1,199 |

|

|

|

3,592 |

|

|

|

3,457 |

|

|

|

Total cash costs: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total cash costs ($) |

|

88.8 |

|

|

|

89.7 |

|

|

|

91.1 |

|

|

|

262.5 |

|

|

|

258.6 |

|

|

|

Total cash costs per oz sold ($) |

|

1,086 |

|

|

|

848 |

|

|

|

760 |

|

|

|

858 |

|

|

|

736 |

|

|

|

Breakdown of production costs |

|

$ |

$/t |

|

$ |

$/t |

|

$ |

$/t |

|

$ |

$/t |

|

$ |

$/t |

|

Mining - open pit |

|

33.4 |

|

2.99 |

|

32.1 |

|

2.73 |

|

28.6 |

|

2.87 |

|

93.9 |

|

2.91 |

|

81.8 |

|

2.82 |

|

Mining - underground |

|

17.0 |

|

79.61 |

|

14.3 |

|

82.29 |

|

13.2 |

|

91.89 |

|

43.9 |

|

80.70 |

|

35.0 |

|

87.30 |

|

Processing |

|

39.8 |

|

32.96 |

|

43.0 |

|

35.60 |

|

38.2 |

|

31.82 |

|

122.5 |

|

34.10 |

|

113.5 |

|

32.82 |

|

Site support |

|

13.9 |

|

11.51 |

|

14.3 |

|

11.84 |

|

12.8 |

|

10.64 |

|

40.3 |

|

11.21 |

|

36.1 |

|

10.44 |

|

Mexican profit sharing (PTU) |

|

0.8 |

|

0.66 |

|

5.3 |

|

4.38 |

|

5.9 |

|

4.96 |

|

11.6 |

|

3.22 |

|

19.8 |

|

5.72 |

|

Capitalized stripping |

|

(5.9 |

) |

|

|

(21.9 |

) |

|

|

(16.6 |

) |

|

|

(49.0 |

) |

|

|

(40.6 |

) |

|

|

Inventory movement |

|

(12.1 |

) |

|

|

(0.9 |

) |

|

|

5.2 |

|

|

|

(9.5 |

) |

|

|

3.3 |

|

|

|

Other |

|

(0.1 |

) |

|

|

0.5 |

|

|

|

1.4 |

|

|

|

1.3 |

|

|

|

3.9 |

|

|

|

Production costs |

|

86.8 |

|

|

|

86.7 |

|

|

|

88.7 |

|

|

|

255.0 |

|

|

|

252.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABOUT TOREX GOLD RESOURCES

INC.Torex is an intermediate gold producer based in

Canada, engaged in the exploration, development and operation of

its 100% owned Morelos Property, an area of 29,000 hectares in the

highly prospective Guerrero Gold Belt located 180 kilometres

southwest of Mexico City. The Company’s principal asset is the

Morelos Complex, which includes the El Limón Guajes (“ELG”) Mine

Complex, the Media Luna Project, a processing plant, and related

infrastructure. Commercial production from the Morelos Complex

commenced on April 1, 2016 and an updated Technical Report for the

Morelos Complex was released in March 2022. Torex’s key strategic

objectives are to optimize and extend production from the ELG Mine

Complex, de-risk and advance Media Luna to commercial production,

build on ESG excellence, and to grow through ongoing exploration

across the entire Morelos Property.

FOR FURTHER INFORMATION, PLEASE

CONTACT:

| TOREX GOLD RESOURCES

INC. |

|

| Jody

Kuzenko |

Dan Rollins |

|

President and CEO |

Senior Vice President, Corporate Development & Investor

Relations |

|

Direct: (647) 725-9982 |

Direct: (647) 260-1503 |

|

jody.kuzenko@torexgold.com |

dan.rollins@torexgold.com |

QUALIFIED PERSONThe technical

and scientific information in this press release has been reviewed

and approved by Dave Stefanuto, P. Eng, Executive Vice President,

Technical Services and Capital Projects of the Company, and a

qualified person under National Instrument 43-101.

CAUTIONARY NOTES ON FORWARD LOOKING

STATEMENTSThis press release contains "forward-looking

statements" and "forward-looking information" within the meaning of

applicable Canadian securities legislation. Forward-looking

information includes, but is not limited to, statements that: The

Company is on track to achieve production guidance with a solid

start to Q4; the Company expects to close out 2023 on a solid note

with the fourth quarter forecast to be the strongest quarter of

production, driven by higher open pit grades now that the period of

elevated waste stripping is behind the Company; the Company remains

on track to meet annual production guidance of 440,000 to 470,000

oz.; full year total cash costs guidance has been revised to $840

to $870 per oz gold sold and full year all-in sustaining costs

revised to $1,160 to $1,200 per oz gold sold; Media Luna

underground development and construction are well underway and

surface construction is tracking to plan; advancement of the Guajes

Tunnel continues to exceed the Company’s expectations with

breakthrough expected in late December; while the overall project

timeline remains intact, some expenditure has been pushed into 2024

and, as a result, the Company has lowered full year capital

expenditure guidance for Media Luna to $360 to $390 million; with

$501 million of liquidity (including $209 million in cash) and 15

months of ongoing free cash flow expected from ELG during the

remaining project period, the Company is well positioned to fund

the remaining $508 million of expenditures on Media Luna while

maintaining at least $100 million on the balance sheet; the Company

continues to make progress on the Media Luna Project, the Company

looks forward to a solid end of the year by delivering a strong

fourth quarter and achieving annual production guidance for the

fifth straight year; results from the 2023 EPO drilling program

continue to highlight the potential to upgrade Inferred Resources

to the Indicated category and expand Inferred Resources through

step-out drilling to the north and south of the deposit; overall,

the positive results from the 2023 drilling program at EPO support

ongoing resource expansion and reserve growth, which in turn

supports the Company's strategic focus on filling the mill with

higher-grade feed beyond 2027; and Torex’s key strategic objectives

are to optimize and extend production from the ELG Mine Complex,

de-risk and advance Media Luna to commercial production, build on

ESG excellence, and to grow through ongoing exploration across the

entire Morelos Property. Generally, forward-looking information can

be identified by the use of forward-looking terminology such as

“guidance,” “expects,” “planned,” or variations of such words and

phrases or statements that certain plans, actions, events or

results are “on schedule” or “on budget,” or “is on track to” or

“will,” or “is expected to” occur. Forward-looking information is

subject to known and unknown risks, uncertainties and other factors

that may cause the actual results, level of activity, performance

or achievements of the Company to be materially different from

those expressed or implied by such forward-looking information,

including, without limitation, risks and uncertainties identified

in the Company’s technical report (the “Technical Report”) released

on March 31, 2022, entitled “NI 43-101 Technical Report ELG Mine

Complex Life of Mine Plan and Media Luna Feasibility Study”, which

has an effective date of March 16, 2022, Company’s annual

information form (“AIF”) and management’s discussion and analysis

(“MD&A”) or other unknown but potentially significant impacts.

Forward-looking information is based on the reasonable assumptions,

estimates, analyses and opinions of management made in light of its

experience and perception of trends, current conditions and

expected developments, and other factors that management believes

are relevant and reasonable in the circumstances at the date such

statements are made. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in the forward-looking information,

there may be other factors that cause results not to be as

anticipated. There can be no assurance that such information will

prove to be accurate, as actual results and future events could

differ materially from those anticipated in such information.

Accordingly, readers should not place undue reliance on

forward-looking information. The Company does not undertake to

update any forward-looking information, whether as a result of new

information or future events or otherwise, except as may be

required by applicable securities laws. The Technical Report, AIF

and MD&A are available under the Company’s profile on SEDAR at

www.sedar.com and on the Company’s website at

www.torexgold.com.

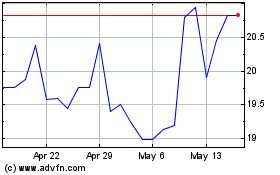

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Torex Gold Resources (TSX:TXG)

Historical Stock Chart

From Mar 2024 to Mar 2025