Viemed Healthcare, Inc. (the “Company” or “Viemed”) (NASDAQ:VMD and

TSX:VMD.TO), a national leader in respiratory care and

technology-enabled home medical equipment services, announced that

it has entered into a definitive agreement to acquire Tennessee

based Home Medical Products, Inc. (“HMP”), a large regional

provider of respiratory focused home medical solutions.

“We are incredibly excited to complement our

strong history of organic growth by combining great teams through

accretive transactions” said Viemed Chief Executive Officer Casey

Hoyt. “The purchase of HMP will launch our acquisition growth

initiatives with a stellar organization that has an extraordinary

reputation with patients, payors, and physicians. Above all, the

team at HMP shares our same driving passion for innovative

patient-focused care.”

Home Medical Products, Inc. was founded in

September 2004 seeking to offer residents of local communities

quality solutions for medical equipment in the home – solutions

that would help people live life better. HMP has expanded its

programs and services to partner more effectively with physicians,

hospitals, and other healthcare partners in order to facilitate

quality care plans for patients in their homes that lead to

innovative solutions and improved health outcomes. The organization

currently manages numerous medical equipment offices throughout

Tennessee and in Alabama and Mississippi. Founder David Steele,

Chief Executive Officer Jason Shiflet, and the HMP team are

expected to join Viemed upon the completion of the transaction.

“We are exceptionally proud of the work that we

have done to build HMP into the patient-centered organization that

it is today” said Steele. “We are now thrilled to become part of

the Viemed family, allowing even greater expansion of care. We have

a tremendous amount of respect for the management team and culture

at Viemed and we are very excited to leverage the talent and

resources of the combined companies.”

In 2022, HMP generated net revenues of

approximately $28 million and HMP Adjusted EBITDA of approximately

$6.8 million. See “Non-GAAP Financial Measures” for a discussion of

HMP Adjusted EBITDA. The transaction is expected to close in June

2023 with a purchase price of approximately $31.75 million,

adjusted for net working capital and other customary closing

adjustments. Viemed expects to fund the acquisition through a

combination of cash on hand and borrowings from its existing

undrawn credit facilities.

ABOUT VIEMED HEALTHCARE, INC.

Viemed is a provider of in-home medical

equipment and post-acute respiratory healthcare services in the

United States. Viemed’s service offerings are focused on effective

in-home treatment with clinical practitioners providing therapy and

counseling to patients in their homes using cutting-edge

technology. Visit our website at www.viemed.com.

For further information, please contact:

Glen AkselrodBristol

Capital905-326-1888glen@bristolir.com

Todd ZehnderChief Operating OfficerViemed

Healthcare, Inc.337-504-3802investorinfo@viemed.com

Forward-Looking Statements

Certain statements contained in this press

release may constitute “forward-looking statements” within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 or “forward-looking information” as such term is defined in

applicable Canadian securities legislation (collectively,

“forward-looking statements”). Often, but not always,

forward-looking statements can be identified by the use of words

such as “plans”, “expects”, “is expected”, “budget”, “potential”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”,

“believes”, or “projects”, or the negatives thereof or variations

of such words and phrases or statements that certain actions,

events or results “will”, “should”, “may”, “could”, “would”,

“might” or “will be taken”, “occur” or “be achieved” or the

negative of these terms or comparable terminology. All statements

other than statements of historical fact, including those that

express, or involve discussions as to, expectations, beliefs,

plans, objectives, assumptions or future events or performance,

including the Company’s expectations about its pending acquisition

of Home Medical Products, Inc., such as expected purchase price,

closing date, funding sources, and anticipated synergies and other

benefits, as well as future expected inorganic growth strategies.

Such statements reflect the Company's current views and intentions

with respect to future events, and current information available to

the Company, and are subject to certain risks, uncertainties and

assumptions. Many factors could cause the actual results,

performance or achievements that may be expressed or implied by

such forward-looking statements to vary from those described herein

should one or more of these risks or uncertainties materialize.

These factors include, without limitation: the general business,

market and economic conditions in the regions in which the Company

operates; the impact of the COVID-19 pandemic and the actions taken

by governmental authorities, individuals and companies in response

to the pandemic on our business, financial condition and results of

operations, including on the Company's patient base, revenues,

employees, and equipment and supplies; significant capital

requirements and operating risks that the Company may be subject

to; the ability of the Company to implement business strategies and

pursue business opportunities; volatility in the market price of

the Company's common shares; the Company’s novel business model;

the state of the capital markets; the availability of funds and

resources to pursue operations; reductions in reimbursement rates

and audits of reimbursement claims by various governmental and

private payor entities; dependence on few payors; possible new drug

discoveries; dependence on key suppliers; granting of permits and

licenses in a highly regulated business; competition; disruptions

in or attacks (including cyber-attacks) on the Company's

information technology, internet, network access or other voice or

data communications systems or services; the evolution of various

types of fraud or other criminal behavior to which the Company is

exposed; difficulty integrating newly acquired businesses; the

impact of new and changes to, or application of, current laws and

regulations; the overall difficult litigation and regulatory

environment; increased competition; increased funding costs and

market volatility due to market illiquidity and competition for

funding; critical accounting estimates and changes to accounting

standards, policies, and methods used by the Company; the Company’s

status as an emerging growth company and a smaller reporting

company; and the occurrence of natural and unnatural catastrophic

events or health epidemics or concerns, such as the COVID-19

pandemic, and claims resulting from such events or concerns; as

well as those risk factors discussed or referred to in the

Company’s disclosure documents filed with the U.S. Securities and

Exchange Commission (the “SEC”) available on the SEC’s website at

www.sec.gov, including the Company’s most recent Annual Report on

Form 10-K, and with the securities regulatory authorities in

certain provinces of Canada available at www.sedar.com. Should any

factor affect the Company in an unexpected manner, or should

assumptions underlying the forward-looking statements prove

incorrect, the actual results or events may differ materially from

the results or events predicted. Any such forward-looking

statements are expressly qualified in their entirety by this

cautionary statement. Moreover, the Company does not assume

responsibility for the accuracy or completeness of such

forward-looking statements. The forward-looking statements included

in this press release are made as of the date of this press release

and the Company undertakes no obligation to publicly update or

revise any forward-looking statements, other than as required by

applicable law.

Non-GAAP Financial Measures

This press release refers to “HMP Adjusted

EBITDA” which is a non-GAAP financial measure that does not have a

standardized meaning prescribed by U.S. GAAP. The Company's

presentation of HMP Adjusted EBITDA may not be comparable to

similarly titled measures used by other companies and includes

adjustments that have not been previously made in connection with

the Company’s historical presentation of Adjusted EBITDA. HMP

Adjusted EBITDA is defined as net income (loss) before interest

expense, income tax expense (benefit), depreciation and

amortization, and other adjustments, including adjustments relating

to the proposed acquisition of HMP. Company management believes HMP

Adjusted EBITDA provides helpful information to analyze HMP’s

operating performance, including a view of HMP’s business that is

not dependent on the impact of HMP’s capitalization structure and

the exclusion of items that are not part of HMP’s recurring

operations, including the impacts of the Company’s proposed

acquisition of HMP. Accordingly, Company management believes that

HMP Adjusted EBITDA provides useful information in understanding

and evaluating HMP’s historical operating performance in the same

manner as it analyzes the Company’s operating performance.

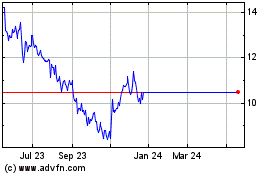

Viemed Healthcare (TSX:VMD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Viemed Healthcare (TSX:VMD)

Historical Stock Chart

From Nov 2023 to Nov 2024