Andean American Reports that ISS Recommends that Shareholders Vote In Favour of Business Combination with Lupaka Gold

13 September 2012 - 10:00PM

Marketwired Canada

Andean American Gold Corp. ("Andean" or the "Company") (TSX

VENTURE:AAG)(FRANKFURT:AQN) is pleased to report that Institutional Shareholder

Services Inc. ("ISS") has recommended that shareholders of Andean American and

Lupaka Gold Corp. ("Lupaka") vote for the plan of arrangement pursuant to which

Lupaka will acquire all of the issued and outstanding shares of Andean in

consideration for the issue of Lupaka shares on the basis of 0.245 Lupaka shares

for each Andean share.

ISS is a leading independent international corporate governance and proxy

advisory service firm which provides analysis and recommendations to assist

shareholders in making decisions regarding proxy voting.

ISS has made its recommendation based on its findings that the board of Andean

undertook a public auction process for the deal and entered into confidentiality

agreements with eight parties. Following the above process, Lupaka is the best

suited party identified to be merged with Andean and it is noted that the offer

term of Lupaka has improved once as the negotiation between the two parties went

forward.

In their report dated September 5, 2012, ISS concluded that, "The merger of two

small cap companies in the same sector makes strategic sense as the resulting

company is expected to benefit from synergies of a more diversified asset base.

The negotiations are stated to be arm's length and supported by an independent

fairness opinion. There is some uncertainty about the existence of voting

support agreements. While market reaction is not favourable, taking an overall

view, a vote FOR the acquisition is warranted."

The arrangement will be considered at Andean American's Annual and Special

Meeting of Shareholders to be held on September 21, 2012 at 10:00 am EST at the

offices of Fogler Rubinoff, 95 Wellington Street West, Suite 1200, TD Centre,

Toronto, Ontario M5J 2Z9. If the required shareholder, court and regulatory

approvals are obtained and the other conditions to completion of the transaction

are satisfied, the transaction is expected to close on or about October 1, 2012.

Andean American shareholders are encouraged to read the Andean American

information circular dated August 22, 2012 for additional details.

Shareholders are reminded that completed proxy forms are required by no later

than 10:00 am EST on September 19, 2012.

Shareholders who require assistance in voting their proxy may direct their

inquiry to Andean's proxy solicitation agent, CST Phoenix Advisors, toll-free in

North America at 1-800- 311-0721 or by email at

inquiries@phoenixadvisorscst.com.

Permission to use quotations from the ISS report was neither sought nor obtained.

About Andean American

Andean is a Canadian based exploration and development company that has

concentrated its operations and exploration activities in Peru, a country with a

long and successful history in mining and the necessary infrastructure and

mining skills to support the growth of its mining industry. The Company's key

asset is its 31,600 hectare Invicta gold-silver-copper advanced exploration

stage project located in the Huaura Province. Andean also owns approximately 17%

of Southern Legacy Minerals Inc. ("Southern Legacy"), formerly called Sinchao

Metals Corp ("Sinchao"), a company listed on the TSX-V trading under the symbol

'LCY', which has properties in Peru and Chile.

On behalf of Andean American Gold Corp.,

David Rae, President and CEO

This news release may contain forward-looking information within the meaning of

the Securities Act (Ontario) ("forward-looking statements"). Such

forward-looking statements may include the Company's plans for its mineral

projects, the overall economic potential of its properties, the availability of

adequate financing and involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or achievements

expressed or implied by such forward-looking statements to be materially

different. Such factors include, among others, risks and uncertainties relating

to potential political risks involving the Company's operations in a foreign

jurisdiction, uncertainty of production and costs estimates and the potential

for unexpected costs and expenses, physical risks inherent in mining operations,

currency fluctuations, fluctuations in the price of gold and other metals,

completion of economic evaluations, changes in project parameters as plans

continue to be refined, the inability or failure to obtain adequate financing on

a timely basis, and other risks and uncertainties, including those described in

the Company's Financial Statements, Management Discussion and Analysis and

Material Change Reports filed with the Canadian Securities Administrators and

available at www.sedar.com.

This press release is not an offer to sell or the solicitation of an offer to

buy the securities, nor shall there be any sale of the securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior

to qualification or registration under the securities laws of such jurisdiction.

The securities being offered have not been, nor will they be, registered under

the United States Securities Act of 1933, as amended and such securities may not

be offered or sold within the United States absent an applicable exemption from

U.S. registration requirements.

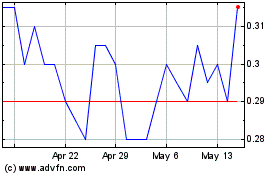

Aftermath Silver (TSXV:AAG)

Historical Stock Chart

From Apr 2024 to May 2024

Aftermath Silver (TSXV:AAG)

Historical Stock Chart

From May 2023 to May 2024