Macusani Yellowcake and Azincourt Uranium Sign Letter of Intent to Consolidate Properties Creating Pre-eminent Uranium Develo...

18 April 2014 - 1:05AM

Marketwired Canada

Macusani Yellowcake Inc. (TSX VENTURE:YEL) (FRANKFURT:QG1) ("Macusani") and

Azincourt Uranium Inc. (TSX VENTURE:AAZ) ("Azincourt") are pleased to announce

that they have signed a non-binding letter of intent which contemplates the

acquisition by Macusani of all of Azincourt's adjacent uranium properties

located on the Macusani Plateau in south-eastern Peru in exchange for 68,350,000

common shares of Macusani (the "Transaction").

Synergies and Transaction Rationale

Completion of the Transaction is expected to result in substantial synergies,

creating significant value for both Macusani and Azincourt shareholders,

including:

-- On a pro-forma basis, after the acquisition, Macusani would control one

of the largest undeveloped uranium projects in the world containing very

large measured, indicated and inferred uranium resources, comprising the

following:

-- Macusani's 31.47 M lbs of measured and indicated (M&I) contained

U3O8 and 30.09 M lbs of inferred contained U3O8 (refer to Macusani

preliminary economic assessment filed on SEDAR on January 15, 2014

for details, including tonnage and grade, Footnote 1 and Table,

below) and

-- Azincourt's historical 18.2 M lbs of M&I contained U3O8 and 17.4 M

lbs of inferred contained U3O8 (refer to Azincourt News Release

November 22, 2013 filed on SEDAR for details including tonnage and

grade, Footnote 2 and Table, below)

-- For a total combined resource of 49.67 M lbs of M&I contained U3O8

and 47.49 M lbs of inferred contained U3O8.

-- Macusani expects that Azincourt's adjacent uranium resources can be

easily incorporated into its existing mine plan as contemplated in its

January 15, 2014 Preliminary Economic Assessment completed by GBM

Minerals Engineering Consultants (the "PEA"), which could result in

substantial development and operating efficiencies and economies of

scale. See Map below.

-- The PEA's base case evaluation shows attractive project economics,

including a Pre-Tax Net Present Value of US $708 million ($417 million

Post-Tax), a Pre-Tax IRR of 47.5% (32.4% Post-Tax) using an 8% discount

rate and $65lb uranium price. Following the closing of the Transaction,

it is anticipated that a new Preliminary Economic Assessment will be

undertaken on the combined property portfolio, and Macusani and

Azincourt currently believe that economic returns will be even stronger

as a result of the operational synergies noted above.1

-- By combining adjacent mineral property claims totalling over 949 km2 in

one of the largest, most highly prospective uranium districts in the

world, Macusani's position as the dominant landholder in the region

would be further solidified. Macusani believes that the district offers

exceptional exploration prospects.

-- Combined Management team and Board of Directors following completion of

the Transaction would be complementary, providing Macusani with deep

expertise across key competencies including local operations management

in Peru, uranium project development and exploration, relationship

management with strategic investors and end-users as well as global

finance and capital markets.

-- The proposed Macusani Board will be closely aligned with shareholders

through substantial equity ownership.

-- Positions Azincourt shareholders to own two distinct uranium investments

with different risk/return characteristics: Macusani, a pure-play,

dominant uranium development company focused in Peru; and Azincourt, an

Athabasca-focused uranium exploration company.

1. Readers are cautioned that a PEA should not be considered to be a

pre-feasibility or feasibility study. The PEA is preliminary in nature and uses

inferred resources which are considered too speculative geologically to have

economic considerations applied to them that would enable them to be categorized

as mineral reserves. Mineral resources that are not mineral reserves do not have

demonstrated economic viability. There is no certainty that the results

predicted by this PEA will be realized. The mineral resource estimates, upon

which the PEA is based, could be materially affected by environmental,

geotechnical, permitting, legal, title, taxation, socio-political, marketing or

other relevant factors.

2. The historical estimate was prepared and reported under NI 43-101 by Henkle &

Associates entitled "Updated Technical Report of the Macusani Uranium

Exploration Project", dated October 25, 2011. The resource estimate was prepared

using polygon-area method cross-checked by inverse distance squared method, both

current industry standard methods. Azincourt will be filing an updated 43-101

report on the Minergia projects in May 2014. A qualified person has not done

sufficient work to classify the historical estimate as current mineral resources

or mineral reserves and neither Azincourt nor Macusani is treating the

historical estimate as current mineral resources or mineral reserves.

To view the Map of the Macusani Plateau, please visit the following link:

http://media3.marketwire.com/docs/940352a.pdf

Dr. Laurence Stefan, President and CEO of Macusani, stated: "This transaction is

a natural step in Macusani's evolution of becoming a developer of one of the

largest and most prospective uranium projects in the world. The synergies from

this transaction are obvious and offer the potential for substantial value

creation for both Macusani and Azincourt shareholders. Macusani over the years

has developed an exceptional uranium project and this transaction enhances our

project in a very significant manner. I look forward to the completion of this

transaction and working with Ted O'Connor in not only advancing our world-class

uranium project through feasibility and ultimately into production, but also in

raising the market's awareness about this unique and valuable asset."

Mr. Ted O'Connor, current President and CEO of Azincourt, stated: "From our

initial approach to Macusani it has been my opinion that this transaction

represents an inflection point for both Macusani and Azincourt from which a

pre-eminent uranium development company will emerge. As a former Director with

Cameco, I've had the opportunity to evaluate uranium projects all over the world

and I believe that the investment community will be very hard-pressed to

identify an investment opportunity in the uranium sector that is more attractive

in the context of the current market than Macusani. Once combined, Macusani will

offer one of the largest contiguous uranium resource bases, the potential for

substantial synergies from a combined mine plan and exploration upside which is

very rare to find. I look forward to joining the Macusani team and helping them

realize the value of this unique project in the marketplace over time."

Proposed Transaction Details

Under the proposed Transaction, it is currently contemplated that Macusani would

acquire 100% of Azincourt's subsidiary Minergia SAC in consideration for the

issuance to Azincourt of 68,350,000 common shares (the "Acquisition Shares"),

representing approximately 30% of the outstanding shares of Macusani

post-Transaction. The final structure of the Transaction is still to be

determined. It is expected that Azincourt would distribute the Acquisition

Shares to its shareholders on a tax efficient, pro rata basis (the

"Distribution") following the receipt of all necessary regulatory and

shareholder approvals and within five months of the closing of the proposed

Transaction. The Acquisition Shares would be restricted to exercising no more

than 19.9% of the voting rights attached to all common shares of Macusani until

the Distribution is completed.

The letter of intent contemplates that Ted O'Connor, current President and CEO

of Azincourt, would be appointed as Chief Executive Officer of Macusani

following completion of the Transaction, and Laurence Stefan, current President

and CEO of Macusani, would serve as President and Chief Operating Officer. Mr.

O'Connor and Ian Stalker, Chairman of Azincourt, would also join a six member

board of directors of Macusani.

Pursuant to the letter of intent, each party has granted the other an

exclusivity period until May 30, 2014 in which to complete due diligence and has

agreed not to solicit other proposals subject to the exercise by its board of

the board's fiduciary duties. The letter of intent permits either party to

terminate the letter of intent and enter into or pursue another transaction with

a third party that is deemed superior (after providing the other party with an

opportunity to match), upon payment of an expense reimbursement fee of $100,000.

The exclusivity period and expense reimbursement fee provisions in the letter of

intent are binding on the parties.

The companies have agreed to work towards the signing of definitive

documentation by May 30, 2014, and the proposed Transaction is expected to be

completed in June 2014, following all necessary approvals.

The proposed Transaction remains subject to satisfactory due diligence

investigations by both parties, the entering into of a definitive agreement and

the satisfaction of customary closing conditions, including any necessary

regulatory approvals. There is no assurance that the proposed Transaction will

be completed, or if completed, that the terms may not change.

Cantor Fitzgerald Canada Corporation is acting as financial advisor to Macusani

and its board of directors and Haywood Securities Inc. is acting as financial

advisor to Azincourt and its board of directors.

Qualified Person

Mr. David Young, B.Sc. (Hons), FGSSA, FSAIMM, FAusIMM, Pr Sci Nat (No 400989/83)

of The Mineral Corporation, South Africa, an independent geological consulting

firm, is a Qualified Person as defined under National Instrument 43-101, and has

reviewed and approved the scientific and technical data contained in this press

release relating to Macusani.

Mr. Ted O'Connor, P.Geo., President and CEO of Azincourt and a qualified person

as defined by National Instrument 43-101, has reviewed and approved Azincourt's

scientific and technical information contained in this press release.

About Macusani Yellowcake Inc.

Macusani Yellowcake Inc. is a Canadian uranium exploration and development

company focused on the exploration of its properties on the Macusani Plateau in

southeastern Peru. The company owns a 99.5% interest in concessions that cover

over 90,000 hectares (900 km2) and are situated near significant infrastructure.

Macusani is listed on the TSX Venture Exchange under the symbol 'YEL' and the

Frankfurt Exchange under the symbol 'QG1'. The company has 159,473,613 shares

outstanding. For more information please visit www.macyel.com.

About Azincourt Uranium Inc.

Azincourt Uranium Inc. is a Canadian based resource company specializing in the

strategic acquisition, exploration and development of uranium properties and is

headquartered in Vancouver, British Columbia. Azincourt has advanced exploration

projects and compliant uranium resources in southeastern Peru and the PLN

exploration project joint venture with Fission 3.0 in northern Saskatchewan.

Cautionary Statements

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

Forward Looking Information

This news release includes certain forward-looking statements concerning the

future performance of Macusani's and Azincourt' business, operations and

financial performance and condition, as well as management's objectives,

strategies, beliefs and intentions. Forward-looking statements are frequently

identified by such words as "would", "may", "will", "plan", "expect",

"anticipate", "estimate", "intend" and similar words referring to future events

and results. Forward-looking statements are based on the current opinions and

expectations of management. All forward-looking information is inherently

uncertain and subject to a variety of assumptions, risks and uncertainties,

including the speculative nature of mineral exploration and development,

fluctuating commodity prices, competitive risks and the availability of

financing, as described in more detail in the both companies recent securities

filings available at www.sedar.com. Actual events or results may differ

materially from those projected in the forward-looking statements and Macusani

and Azincourt caution against placing undue reliance thereon. Specifically,

there is no assurance that (i) the proposed Transaction between Macusani and

Azincourt will be completed on the terms outlined, or at all; (ii) that any of

the anticipated synergies pertaining to combining their respective Peruvian

properties will be realized in the manner outlined above, or at all; or (iii)

the values forecasted in the PEA will be realized. Neither the companies nor

their management assume any obligation to revise or update these forward-looking

statements.

To view the Resource Estimate tables associated with this release, please visit

the following link: http://media3.marketwire.com/docs/940352_T1-2.pdf

FOR FURTHER INFORMATION PLEASE CONTACT:

Macusani Yellowcake Inc.

Laurence Stefan, President & CEO

416-628-9600

laurence@macyel.com

www.macyel.com / Facebook: www.macyel.com/facebook/

Twitter: www.twitter.com/macusani/

Azincourt Uranium Inc.

Ted O'Connor

President & CEO

604-662-4955

ted@azincourturanium.com

Azincourt Uranium Inc.

Mario Vetro

Corporate Development and Investor Relations

604-662-4955

mario@azincourturanium.com

www.azincourturanium.com

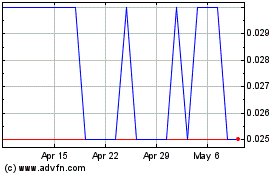

Azincourt Energy (TSXV:AAZ)

Historical Stock Chart

From Apr 2024 to May 2024

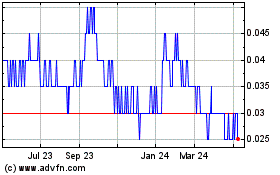

Azincourt Energy (TSXV:AAZ)

Historical Stock Chart

From May 2023 to May 2024