Atlas One Capital Corporation (TSXV: ACAP.P) (the

"

Corporation") is pleased to announce that it has

successfully completed its initial public offering of 2,660,000

common shares (the "

Common Shares") at a price of

$0.10 per share for gross proceeds of $266,000 (the

"

Offering"). As a result of this issuance, the

Corporation has 5,320,000 Common Shares issued and outstanding of

which 2,660,000 Common Shares are subject to escrow restrictions as

disclosed in the Corporation's final prospectus dated April 5,

2022, a copy of which may be obtained on the Corporation’s System

for Electronic Document Analysis and Retrieval

("

SEDAR") profile at www.sedar.com. M Partners

Inc. (the "

Agent") acted as agent for the

Offering. In connection with the Offering, the Agent and other

sub-agents received an aggregate cash commission of $26,600,

representing 10% of the gross proceeds of the Offering. In

addition, the Agent received a corporate finance fee of $20,000,

and a non-transferrable warrant entitling the Agent to acquire

266,000 Common Shares at a price per Common Share of $0.10,

exercisable until close of business on June 8, 2024.

The Corporation is a capital pool company

pursuant to Policy 2.4 (the "CPC Policy") of the

TSX Venture Exchange (the "Exchange"). Except as

specifically contemplated in the CPC Policy, until the completion

of its "Qualifying Transaction" (as defined in the

CPC Policy), the Corporation will not carry on business, other than

the identification and evaluation of companies, business or assets

with a view to completing a proposed Qualifying Transaction.

The net proceeds from the Offering, together

with net proceeds raised prior to the Offering, will be used to

identify and evaluate assets and businesses with a view to

completing a Qualifying Transaction.

The Common Shares were listed on the Exchange on

June 8, 2022 at 5:01 p.m. and are expected to commence trading

under the symbol "ACAP.P" at the opening this morning.

Investors are cautioned that trading in the

securities of a capital pool company is considered highly

speculative.

Early Warning Report

In connection with the Offering, David

Rosenkrantz, an officer and director of the Corporation, has

announced, in accordance with the requirements of National

Instrument 62-103 - The Early Warning System and Related Take-Over

Bid and Insider Reporting Issues and applicable Canadian securities

legislation (collectively, "NI 62-103"), that he

and those acting jointly or in concert with him now hold a total of

1,426,000 Common Shares, inclusive of the stock options (the

"Options") he has been granted on an as-converted

basis, representing 25.8% of the Company’s issued and outstanding

Common Shares on a partially diluted basis. Prior to the Offering,

Mr. Rosenkrantz beneficially owned 1,000,000 Common Shares,

representing approximately 37.6% of the Corporation's issued and

outstanding Common Shares. On June 9, 2022, Mr. Rosenkrantz and

those acting jointly or in concert with him acquired beneficial

ownership of an additional 226,500 Common Shares and 199,500

Options, thereby triggering the requirement to file an early

warning report under NI 62-103.

In connection with the Offering, Ilana Prussky,

an officer and director of the Corporation, has announced, in

accordance with the requirements of NI 62-103, that she now holds

1,199,500 Common Shares, inclusive of the Options she has been

granted on an as-converted basis, representing 21.73% of the

Company’s issued and outstanding Common Shares on a partially

diluted basis. Prior to the Offering, Ms. Prussky beneficially

owned 1,000,000 Common Shares, representing approximately 37.6% of

the Corporation's issued and outstanding Common Shares. On June 9,

2022, Ms. Prussky acquired beneficial ownership of an additional

199,500 Options, thereby triggering the requirement to file an

early warning report under NI 62-103.

While Mr. Rosenkrantz and Ms. Prussky currently

have no plans or intentions with respect to their Common Shares,

depending on market conditions, general economic and industry

conditions, trading prices of the Common Shares, the Company's

business, financial condition and prospects and/or other relevant

factors they may develop such plans or intentions in the future

and, at such time, subject to any applicable escrow arrangements or

other restrictions under the policies of the Exchange, may from

time to time acquire additional Common Shares, dispose of some or

all of the existing or additional Common Shares or may continue to

hold the Common Shares of the Company.

Copies of the early warning reports filed by Mr.

Rosenkrantz and Ms. Prussky will be available on the Company's

SEDAR profile at www.sedar.com or may be obtained by contacting

David Rosenkrantz at (416) 865-0123. The Company's head office is

located 20 Holly Street, Suite 300, Toronto, Ontario, M4S 3B1.

For further information, please contact:

David Rosenkrantz, President, Chief Executive

Officer, Chief Financial Officer, and Director at (416)

865-0123.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

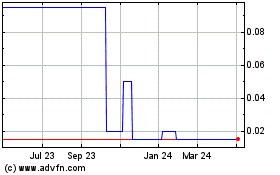

Atlas One Capital (TSXV:ACAP.P)

Historical Stock Chart

From Jan 2025 to Feb 2025

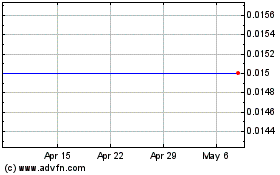

Atlas One Capital (TSXV:ACAP.P)

Historical Stock Chart

From Feb 2024 to Feb 2025