ARCpoint Inc. (TSXV: ARC) (the “

Company” or

“

ARCpoint”) a leading US-based franchise system

providing drug testing, alcohol screening, DNA and direct to

consumer (“DTC”) clinical lab testing services announces that it

will host a conference call on Tuesday, August 15, 2023 at 9:30 pm

Eastern time to review the Company’s financial results for the

second quarter ended June 30, 2023, and provide an operational

update.

The dial-in number for the conference call is as follows:

Canada / USA Toll Free

1-800-319-4610International

Toll 1-604-638-5340

Callers should dial in 5 – 10 min prior to the scheduled start

time and ask to join the ARCpoint call:

ARCpoint’s President and CEO, John Constantine

commented “The second quarter was a period of great change for our

Company as we transitioned from developing our technology platforms

and processes to focus on deploying these new tools to drive more

business through our franchisee locations. This included

significant cost and headcount reductions, especially in the senior

management and executive levels and realignment of team member

responsibilities”.

As announced March 8, 2023, effective April 1,

2023, the Company enacted a headcount reduction representing

approximately 30 per cent of the company's salary costs. The

majority of these cuts took place at the upper management and

executive levels and involved $485 thousand in one time severance

costs that were accrued in Q1, 2023, but paid in Q2, 2023. As part

of the cost-cutting process, the company also undertook significant

operational cost-saving measures representing approximately 20 per

cent of the then current operating costs. Concurrently, the Company

also incurred additional software expenditures to refine the new

technology platforms in preparation for full roll

out.

Mr. Constantine concluded “As difficult as the

cuts and changes were, in the second quarter we added new

leadership for our franchise group in Bob Mann and launched our

MyARCpointLabs technology platform. With these new tools, combined

with Bob’s expertise in implementing growth strategies, we believe

that we have taken huge steps forward to help increase our revenue

per store as well as dramatically expand our distribution

network”.

On May 15, 2023 the Company announced that it

had appointed Bob Mann as President of Arcpoint Franchise Group LLC

(AFG), a wholly owned U.S. subsidiary of the company that operates

Arcpoint's franchise business. The Company commented that it

believed Mr. Mann’s 15 years in the US diagnostics services space

and track record of successfully developing and implementing

programs and processes to drive revenue in the health care

diagnostics industry would be critical given his responsibility for

driving both top-line growth at all franchisee locations and

growing the company's distribution network from the then current

134 locations.

On July 10, 2023, the Company announced that it

had fully launched its new consumer e-commerce platform

MyARCpointLabs, (“MAPL”) which was developed to make it easier for

the Company’s franchisees to attract and better serve individual

healthcare consumers and to make it easier for consumers to

purchase the Company’s products and services. On August 10, 2023,

the Company further updated that 90 of the Company’s 135 locations

had completed MyARCpointLabs onboarding and training processes, and

that 36 of those locations had begun using and integrating the

platform into their daily business. The Company also noted that in

addition, 105 affiliate businesses had signed up through 21

different franchise locations to use the MyARCpointLabs platform on

a SaaS basis, giving the Company 240 physical locations where

consumers could potentially purchase its tests and services.

Business Updates

Average Unit Volume (“AUV”)As

at June 30, 2023 AUV stood at $265K on a trailing three months and

annualized basis. The Company defines AUV as the average revenue of

reporting physical franchise locations open more than 24 months,

which is the length of time the Company believes it takes for a new

franchisee location to reach normalized operations after start up.

For the purposes of calculating AUV, as at June 30, 2023, the

Company had 134 total physical locations, with 89 locations open

greater than 24 months. 4 locations open greater than 24 months

were excluded from the calculation because of delays in their data

reporting. Accordingly, for the second quarter, the Company based

its AUV calculation on 85 locations. The Company has another 45

locations that have been open less than 24 months, which are

excluded from the AUV calculation. As of June 30, 2023, when

considering the total 134 locations, the average revenue per

location was $185K. The Company earns a 7% royalty and 2% brand

fund contribution on its franchisee’s revenues. AUV is a non-IFRS

measure that is used to evaluate the performance of its

business.

Physical LocationsIn the second

quarter of 2023, the Company sold 6 new franchisee agreements,

awarded 2 transfers of ownership and opened 2 new locations. As of

the current date, the Company now has a total of 135 locations open

and operating and 19 more locations in various stages of preparing

to open. During the second quarter 2 locations closed. The Company

has the ability to use its technology platforms to continue

operating virtually in the geographies related to the closed

locations.

Vertical Treatment Centers

(“VTC”)The Company’s opiate addiction therapy business,

VTC, which currently operates only in the state of South Carolina,

has recently transitioned its business model given industry

changes. The most significant changes for VTC are the closing of

stand-alone VTC locations, with clients being served at specific

ARCpoint franchisee locations. By moving from VTC-only locations to

utilizing existing ARCpoint franchisee locations to treat clients,

the VTC business unit is able to reduce costs. Of note, Blue Cross

Blue Shield, which provides insurance reimbursement for opiate

addiction therapy in South Carolina, has recently increased

reimbursement rates that the insurer pays opiate addiction therapy

practices like VTC. Currently, VTC does not comprise a materially

financial portion of ARCpoint’s overall business, but the Company

is investigating ways it could grow the business in South Carolina

and other US states.

As at June 30, 2023, the Company had total cash

on hand of approximately US$3.3 million, comprised of US$2.6

million in unrestricted cash and cash equivalents and US$733

thousand in Brand Fund restricted cash. Use of Brand Fund

restricted cash is at the Company’s discretion and is used to

increase sales and the brand presence of the Company’s entities and

franchisees.

Summary of

2023 Q2

Financial Results All results below are reported

under International Financial Reporting Standards and in US

dollars.

- Total revenue for the three months

ended June 30, 2023 was $1.5 million compared to $2.3 million for

the three months ended June 30, 2022 and $1.7 million for the three

months ended March 31, 2023. During Q2 2022, high complexity PCR

testing and low complexity rapid tests volumes were significantly

higher due to the COVID pandemic.

- Net loss for the three months ended

June 30, 2023 was $2.4 million compared to a net loss of $1.1

million for the three months ended June 30, 2022 and negative $2.1

million for the three months ended December 31, 2022. The increase

in loss for Q2 2023 versus Q2 2022 was due to lower revenues and

higher operating costs, including software development and sales

and marketing costs for the period.

- Operating cash flow for the three

months ended June 30, 2023 was negative $1.9 million compared to

negative $400 thousand for the three months ended June 30, 2022 and

negative $1.2 million for the three months ended March 31, 2023.

During the quarter, the Company paid $485 thousand in one-time

severance costs due to headcount reductions enacted on April 1,

2023.

- EBITDA for the three months ended

June 30, 2023 was negative $2.0 million compared to negative $1.1

million for the three months ended June 30, 2022 and negative $1.8

million for the three months ended March 31, 2023.

- Adjusted EBITDA for the three

months ended June 30, 2023 was negative $1.8 million compared to

negative $0.3 million for the three months ended June 30, 2022 and

negative $1.1 million for the three months ended March 31, 2023.

For the current period ended, the difference between EBITDA and

Adjusted EBITDA is primarily due to an adjustment related to the

timing difference between Brand fund revenues and

expenditures.

DEFINITION AND RECONCILIATION OF

NON-IFRS FINANCIAL MEASURESThe Company reports certain

non-IFRS measures that are used to evaluate the performance of its

businesses and the performance of their respective segments.

Securities regulators require such measures to be clearly defined

and reconciled with their most comparable IFRS measures.

As non-IFRS measures generally do not have a

standardized meaning, they may not be comparable to similar

measures presented by other issuers. Rather, these are provided as

additional information to complement those IFRS measures by

providing further understanding of the results of the operations of

the Company from management’s perspective. Accordingly, these

measures should not be considered in isolation, nor as a substitute

for analysis of the Company’s financial information reported under

IFRS. Non-IFRS measures used to analyze the performance of the

Company’s businesses include “EBITDA”, “Adjusted EBITDA” and

“Average Unit Volume”.

The Company believes that these non-IFRS

financial measures provide meaningful supplemental information

regarding the Company’s performances and may be useful to investors

because they allow for greater transparency with respect to key

metrics used by management in its financial and operational

decision-making. These financial measures are intended to provide

investors with supplemental measures of the Company’s operating

performances and thus highlight trends in the Company’s core

businesses that may not otherwise be apparent when solely relying

on the IFRS measures. These non-IFRS measures are calculated as

follows:

“EBITDA” is comprised as income (loss) less interest, income tax

and depreciation and amortization. Management believes that EBITDA

is a useful indicator for investors, and is used by management, in

evaluating the operating performance of the Company. See “Unaudited

Interim Condensed Consolidated EBITDA and Adjusted EBITDA

Reconciliation” appended to this press release for a quantitative

reconciliation of EBITDA to the most directly comparable financial

measure.

“Adjusted EBITDA” is comprised as income (loss)

less interest, income tax, depreciation, amortization, share-based

compensation, Brand Fund revenue and expense timing difference,

change in fair value of warrant liability, foreign exchange gain

(loss) and other income / expenses not attributable to the

operations of the Company. Management believes that EBITDA is a

useful indicator for investors, and is used by management, in

evaluating the operating performance of the Company. See “Unaudited

Interim Condensed Consolidated EBITDA and Adjusted EBITDA

Reconciliation” appended to this press release for a quantitative

reconciliation of Adjusted EBITDA to the most directly comparable

financial measure.

“Average Unit Volume” is defined as the average

revenue of a reporting physical franchise location open more than

24 months, which is the length of time the Company believe it takes

for a new franchisee location to reach normalized operations after

start up. AUV cannot be distinguished from totals, subtotals and

items disclosed in the primary financial statements of the

Company.

A reconciliation of how the Company calculates

EBITDA and Adjusted EBITDA is provide in the table appended to this

press release.

For more information, please see

the interim

Financial

Statements

(the “Financial Statements”)

and the interim

Management Discussion & Analysis of the

Company (MD&A”) for the

three-month period ended June

30, 2023

under the Company’s profile at

www.sedar.com.

About

ARCpoint

Inc.ARCpoint is a leading US-based franchise system that

leverages technology along with brick-and-mortar locations to give

businesses and individual consumers access to convenient,

cost-effective healthcare information and solutions with

transparent, up-front pricing, so that they can be proactive and

preventative with their health and well-being. ARCpoint is based in

Greenville, South Carolina, USA. ARCpoint Franchise Group LLC,

formed under the laws of the state of South Carolina in February

2005, is the franchisor of ARCpoint Labs and supports over 130

independently owned locations. ARCpoint sells franchises to

individuals throughout the United States and provides support in

the form of marketing, technology and training to new franchisees.

ARCpoint Corporate Labs LLC develops corporate-owned labs committed

to providing accurate, cost-effective solutions for customers,

businesses and physicians. AFG Services LLC serves as the

innovation center of the ARCpoint group of companies as it builds a

proprietary technology platform and a physician network to equip

all ARCpoint labs with best-in-class tools and solutions to better

serve their customers. The platform also digitalizes and

streamlines administrative functions such as materials purchasing,

compliance, billing and physician services for ARCpoint franchise

labs and other clients.

For more information, please contact:

ARCpoint Inc.Jason Tong, Chief Financial

OfficerPhone: (604) 889-7827E-mail: invest@arcpointlabs.com

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION:

Forward-Looking

Information – this news

release contains

“forward-looking

information” within

the meaning of applicable

Canadian securities laws

which are based

on ARCpoint’s

current internal

expectations, estimates,

projections, assumptions

and beliefs and

views of future

events.

Forward-looking

information can be

identified by the use of

forward-looking terminology

such as

“expect”,

“likely”,

“may”,

“will”,

“should”,

“intend”,

“anticipate”,

“potential”,

“proposed”,

“estimate” and

other similar

words, including

negative and grammatical

variations thereof, or

statements that

certain events or

conditions “may”,

“would” or

“will”

happen, or by discussions of

strategy.

The

forward-looking information in

this news release

is based upon

the expectations,

estimates, projections,

assumptions and

views of future

events which

management believes

to be reasonable

in the

circumstances.

Forward-looking information

includes estimates,

plans, expectations, opinions,

forecasts, projections,

targets, guidance or

other statements

that are not

statements of

fact.

Froward-looking information

necessarily involve

known and

unknown risks,

including,

without limitation,

risks associated

with general

economic conditions; adverse

industry events;

loss of

markets; future

legislative and

regulatory

developments;

inability to

access sufficient

capital from

internal and

external sources, and/or

inability to

access sufficient capital

on favourable

terms; the

ability of the

Company to

implement its

business strategies, the

COVID-19 pandemic;

competition and

other risks.

Any

forward-looking information

speaks only as of the

date on which it

is made, and

except as

required by

law, the Company

does not

undertake any obligation

to update or revise any

forward-looking information,

whether as a

result of new information, future

events or

otherwise. New

factors emerge

from time to time, and

it is not possible for

the Company to

predict all such

factors. When

considering the

forward-looking information

contained

herein, readers

should keep in

mind the risk

factors and

other cautionary

statements in the

Company’s disclosure

documents filed

with the applicable Canadian

securities regulatory

authorities on SEDAR at www.sedar.com.

The risk factors

and other

factors noted in

the disclosure documents

could cause

actual events or

results to

differ materially

from those

described in any

forward-looking information.

Neither the

TSX Venture Exchange

nor its

Regulation Services Provider (as

that term is

defined in the

policies of the Exchange)

accepts responsibility

for the adequacy

or accuracy of

this Press

release.

ARCpoint Inc.Unaudited

Interim Condensed Consolidated EBITDA and Adjusted EBITDA

Reconciliation(Expressed in United States

Dollars)

(a) Finance

expense comprised of interest on bank loans, notes payable and

lease liabilities (see Financial Statements).

(b) Share-based compensation expense comprised of

non-cash compensation (see Financial Statements).

(c) One-time legal and professional fees

refer to expenses and other transactional costs incurred for

financings and restructuring completed in 2022 and one-time legal

fees in 2023 (see Financial Statements).

(d) The Group operates a Brand Fund

established to collect and administer funds contributed for use in

advertising and promotional programs designed to increase sales and

enhance the reputation of the Group and its franchisees. The Group

reports contributions and expenditures on a gross basis on the

Group’s statement of profit and loss. Brand Fund contributions are

recognized as revenue when invoiced, as the Group has full

discretion on how and when the Brand Fund revenues are spent. Brand

Fund revenue received may not equal advertising expenditures for

the period due to timing of promotions and this difference is

recognized to earnings. This adjustment is made to normalize for

the timing difference of the Brand Fund revenues and Brand Fund

expenditures.

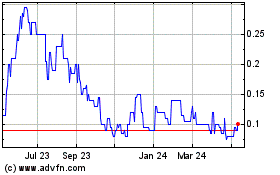

ARCpoint (TSXV:ARC)

Historical Stock Chart

From Nov 2024 to Dec 2024

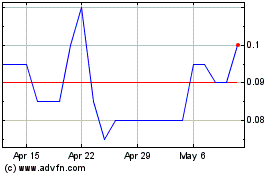

ARCpoint (TSXV:ARC)

Historical Stock Chart

From Dec 2023 to Dec 2024