TSX VENTURE COMPANIES

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Companies

A Cease Trade Order has been issued by the British Columbia Securities

Commission on November 5, 2009, against the following Companies for

failing to file the documents indicated within the required time period:

Period Ending

Symbol Company Failure to File (Y/M/D)

("ARW") Aroway Minerals Inc. comparative financial 09/06/30

statement

management's discussion 09/06/30

& analysis

("OTL") Oriental Minerals Inc. comparative financial 09/06/30

statement

management's discussion 09/06/30

& analysis

Upon revocation of the Cease Trade Order, the Company's shares will

remain suspended until the Company meets TSX Venture Exchange

requirements. Members are prohibited from trading in the securities of

the company during the period of the suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

49 NORTH RESOURCES INC. ("FNR")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 6, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

a Share Purchase Agreement (the "Agreement"), dated November 2, 2009,

between 49 North Resources Inc. (the "Company"), and The Halabura Family

Trust (the "Vendor"), whereby the Company has agreed to purchase 750,000

Class "A" common shares of North Rim Exploration Ltd. ("NREL") - a

private Saskatchewan based geological consulting company specializing in

the filed of subsurface geology pertaining to petroleum, potash and

industrial mineral resources.

In consideration for the NREL shares, the Company has agreed to pay an

aggregate of $750,000 (at a deemed value of $1.00 per share) to the

Vendor.

For further details, please refer to the Company's news release dated

November 6, 2009.

TSX-X

---------------------------------------------------------------------------

ABITIBI MINING CORP. ("ABB")

BULLETIN TYPE: Property-Asset or Share Purchase Agreements

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation in connection

with the following Option Agreements:

1. Agreement dated September 15, 2009 between the Company and Larry

Gervais whereby the Company has been granted an option to acquire a 100%

interest in the Armstrong Lake Property that is located in the Keith and

Penhorwood Townships, Porcupine Mining Division. The aggregate

consideration is $105,000, 400,000 common shares and $155,200 in

exploration expenditure over a four year period. The property is subject

to a 3% Net Smelter Return Royalty of which the Company may purchase a

third for $1,000,000 subject to further Exchange review and acceptance.

An additional 100,000 common shares will be issued upon completion of a

positive feasibility study.

2. Agreement dated September 15, 2009 between Larry Gervais (as to 50%)

and Clayon Larche (as to 50%) and the Company whereby the Company has

been granted an option to acquire a 100% interest in the Foleyet Property

that is located in the Foleyet Township, Porcupine Mining Division. The

aggregate consideration is $140,000, 400,000 common shares and $180,000

in exploration expenditure over a four year period. The property is

subject to a 3% Net Smelter Return Royalty of which the Company may

purchase a third for $1,000,000 subject to further Exchange review and

acceptance. An additional 100,000 common shares will be issued upon

completion of a positive feasibility study.

3. Agreement dated September 15, 2009 between Larry Gervais (as to 50%)

and Clayon Larche (as to 50%) and the Company whereby the Company has

been granted an option to acquire a 100% interest in the Ivanhoe Property

that is located in the Ivanhoe Township, Porcupine Mining Division. The

aggregate consideration is $180,000, 400,000 common shares and $371,200

in exploration expenditure over a four year period. The property is

subject to a 3% Net Smelter Return Royalty of which the Company may

purchase a third for $1,000,000 subject to further Exchange review and

acceptance. An additional 100,000 common shares will be issued upon

completion of a positive feasibility study.

4. Agreement dated September 15, 2009 between the Company and Larry

Gervais whereby the Company has been granted an option to acquire a 100%

interest in the Muskego Property that is located in the MuskegoTownship,

Porcupine Mining Division. The aggregate consideration is $140,000,

400,000 common shares and $129,600 in exploration expenditure over a four

year period. The property is subject to a 3% Net Smelter Return Royalty

of which the Company may purchase a third for $1,000,000 subject to

further Exchange review and acceptance. An additional 100,000 common

shares will be issued upon completion of a positive feasibility study.

TSX-X

---------------------------------------------------------------------------

ACRO ENERGY TECHNOLOGIES CORP. ("ART")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pertaining to

a Stock Purchase Agreement (the "Agreement"), dated October 28, 2009,

between Acro Energy Technologies Corp. (the "Company"), Energy Efficiency

Solar, Inc. ("EESI") and William Korthof (the "Vendor"), whereby the

Company has agreed to purchase all of the issued and outstanding shares

EESI - a private California based solar energy corporation that installs

residential and commercial solar systems.

Under the terms of the Agreement, the Company will acquire all of the

issued and outstanding shares of EESI for a purchase price of

US$1,500,000, consisting of US$250,000 in cash, a promissory note in the

amount of US$750,000, and 2,216,250 common shares of Company at a deemed

value of CDN$0.24 per share.

For further details, please refer to the Company's news release dated

October 28, 2009.

TSX-X

---------------------------------------------------------------------------

ALLANA RESOURCES INC. ("AAA")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 4, 2009:

Number of Shares: 8,000,000 shares

Purchase Price: $0.25 per share

Number of Placees: 1 placee

Finder's Fee: an aggregate of $120,000 payable to Blair

Krueger and Li Feng

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

ALITA RESOURCES LTD. ("AL.P")

BULLETIN TYPE: New Listing-CPC-Shares

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

This Capital Pool Company's ('CPC') Prospectus dated September 23, 2009

has been filed with and accepted by TSX Venture Exchange and the British

Columbia, Alberta and Ontario Securities Commissions effective September

25, 2009, pursuant to the provisions of the British Columbia, Alberta and

Ontario Securities Acts. The Common Shares of the Company will be listed

on TSX Venture Exchange on the effective date stated below.

The Company has completed its initial distribution of securities to the

public. The gross proceeds received by the Company for the Offering were

$502,000 (5,020,000 common shares at $0.10 per share).

Commence Date: At the opening Monday, November 9, 2009, the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: British Columbia

Capitalization: unlimited common shares with no par value of

which 7,170,000 common shares are issued and

outstanding

Escrowed Shares: 2,150,000 common shares

Transfer Agent: Valiant Trust Company

Trading Symbol: AL.P

CUSIP Number: 016423105

Sponsoring Member: Leede Financial Markets Inc.

Agent's Options: 502,000 non-transferable stock options. One

option to purchase one share at $0.10 per

share up to 24 months.

For further information, please refer to the Company's Prospectus dated

September 23, 2009.

Company Contact: Carl R. Jonsson

Company Address: 9131 Jaskow Gate

Richmond, BC V7E 5H6

Company Phone Number: (604) 640-6357

Company Fax Number: (604) 681-0139

Company Email Address: jonsson@securitieslaw.bc.ca

Seeking QT primarily

in these sectors: natural resources, oil and gas

TSX-X

---------------------------------------------------------------------------

ANDOVER VENTURES INC. ("AOX")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 14, 2009:

Number of Shares: 9,000,000 shares

Purchase Price: $0.25 per share

Warrants: 9,000,000 share purchase warrants to purchase

9,000,000 shares

Warrant Exercise Price: $0.40 for a two year period

Number of Placees: 38 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Gordon Blankstein Y 960,000

Sunwest Ventures Ltd.

(Gordon Blankstein) Y 320,000

Finders' Fees: Cannacord Capital Corp. - $21,525

Leede Financial Markets Inc. - $22,225

Union Securities Ltd. - $4,375

Northern Securities Inc. - $5,425

Bolder Investment Partners - $33,500

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

ARGEX SILVER CAPITAL INC. ("RGX")

(formerly Argex Silver Capital Inc. ("RGX.P"))

BULLETIN TYPE: Qualifying Transaction-Completed/New Symbol, Resume

Trading, Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

Qualifying Transaction:

TSX Venture Exchange has accepted for filing the Company's Qualifying

Transaction described in its Filing Statement dated March 31, 2009. As a

result, at the opening Monday, November 9, 2009, the Company will no

longer be considered as a Capital Pool Company.

The Qualifying Transaction consists of the arm's length acquisition of

100% of the assets of 7013833 Canada Corp. (the "Vendor"), consisting of

the Mouchalagane and Lake La Blache properties (the "Properties") in

consideration of $580,000 in cash, and the issuance of 17,000,000 common

shares at a deemed issued price $0.25 per share, for a deemed acquisition

price of $8,250,000, as well as the issuance of 8,000,000 Milestone

Warrants, exchangeable into 8,000,000 common shares with no further

consideration, upon achievement of a first milestone, and a subsequent

issuance of 8,000,000 Milestone Warrants, also exchangeable into

8,000,000 common shares at no additional consideration, upon achievement

of a second milestone.

The first milestone requires that a Regulation 43-101 technical report be

completed demonstrating at least 80 million tonnes of measured resources

(as defined under CIM standards) averaging 30% Fe and 10 %Ti. The second

milestone requires the completion of a Regulation 43-101 compliant

technical report demonstrating at least 300 million tonnes of measured

resources (also as defined under CIM standards) averaging 30% Fe and 10%

Ti in the properties.

The company will assume various obligations initially undertaken by the

Vendor in its own original purchase agreements. These obligations include

Net Smelter Return ("NSR") royalties of between 2 and 4% as well as a

total cash payments of $300,000 per year in each of the first two years,

and additional annual cash payment of $200,000 per year, as of the third

year, as advance royalty payments.

Gemme Manicougan Inc. will receive a finder's fee of $352,250 in cash

($252,250 at the closing and $100,000 at the first milestone).

A total of 21,046,154 common shares, and 16,000,000 Milestone Warrants

issued pursuant to the Qualifying Transaction and the concurrent

financing are escrowed pursuant to an Exchange Tier 2 Value Escrow

Agreement.

The Company is classified as an "Iron Ore Mining" issuer (NAICS Number:

21221).

For further information, please refer to the Company's Filing Statement

dated March 31, 2009, available on SEDAR.

Resume Trading:

Further to TSX Venture Exchange's Bulletin dated November 11, 2008,

trading in the securities of the Resulting Issuer will resume at the

opening Monday, November 9, 2009.

Private Placement- Brokered:

TSX Venture Exchange has accepted for filing the documentation with

respect to a Non-Brokered Private Placement announced on November 18,

2008:

Number of Shares: 20,284,000 common shares (16,280,000

flow-through common shares, and 4,004,000

common shares)

Purchase Price: $0.25 per share

Warrants: 20,284,000 warrants to purchase 20,284,000

common shares

Warrants Exercise Price: $0.40 per share during a period of 24

months following the closing of the Private

Placement

Number of Placees: 25 placees

Insider / Pro Group

Participation: N/A

Finders: Limited Market Dealer Inc. ("LMD"), IBK

Capital Corp. ("IBK"), CEDC Inc. ("CEDC") and

Confederation Capital Corp. ("CCC")

Finder's Compensation: LMD, IBK, CEDC and CCC received $190,000 (50%

of which represents a due diligence fee),

$40,000, $110,000 and $100,000 in cash,

respectively. Further, LMD and IBK received

760,000 and 200,000 in finder's warrants,

respectively. Each finder's warrant entitles

the holder to purchase one unit of the Private

Placement over a period of 24 months following

the closing at an exercise price of $0.25 per

unit. Each unit is composed of one share and

one share purchase warrant. Each warrant

entitles the holder to purchase one share at a

price of $0.40 per share for a period of 24

months following the closing.

The Company has confirmed the closing of the Private Placement pursuant

to a news release dated October 30, 2009.

Capitalization: Unlimited common shares with no par value of

which 50,633,000 shares will be issued and

outstanding.

Escrow: 31,046,154 common shares and 16,000,000

Milestone Warrants, of which 3,104,615 common

shares and 1,600,000 Milestone Warrants are

released at the date of this bulletin.

Transfer Agent: CIBC Mellon Trust Company - Montreal

Trading Symbol: RGX (new)

CUSIP Number: 04013R 10 7 (unchanged)

The Exchange has been advised that the above transactions have been

completed.

Company Contact: Mr. Mark Billings

Company Address: 2020 University Street, Suite 2000

Montreal, Quebec H3A 2A5

Company Phone Number: (514) 296-1641

Company Fax Number: (514) 843-9208

E-mail Address: mark@atwaterfin.com

Company Web Site: N/A

CAPITAL ARGEX ARGENT INC. ("RGX")

(anciennement Capital Argex Argent Inc. ("RGX.P"))

TYPE DE BULLETIN : Operation admissible - completee/Changement de

symbole, Reprise de la negociation, Placement prive sans l'entremise d'un

courtier

DATE DU BULLETIN : Le 6 novembre 2009

Societe du groupe 2 de TSX Croissance

Operation admissible :

Bourse de croissance TSX a accepte le depot des documents de la societe

relativement a son operation admissible decrite dans la declaration de

changement a l'inscription datee du 31 mars 2009. Consequemment, a

l'ouverture des marches, lundi le 9 novembre 2009, la societe ne sera

plus consideree comme une societe de capital de demarrage.

L'operation admissible consiste en l'acquisition, aupres de parties

transigeant a distance avec la societe, d'un interet de 100 % dans les

proprietes detenues par 7013833 Canada Corp., comprenant les proprietes

Mouchalagane et Lac La Bache (les "proprietes") en contrepartie de 580

000 $ en especes et de l'emission de 17 000 000 d'actions ordinaires au

prix repute de 0,25 $ l'action, pour un prix d'acquisition repute de 8

250 000 $, ainsi que l'emission de 8 000 000 de bons de souscriptions de

performance, echangeable pour 8 000 000 d'actions ordinaires sans

consideration additionnelle, lors de la rencontre du premier jalon, et de

l'emission de 8 000 000 de bons de souscriptions de performance

additionnelles, echangeable pour 8 000 000 d'actions ordinaires sans

consideration additionnelle, suite a la rencontre du deuxieme jalon.

Le premier jalon comprend l'etablissement d'un rapport technique

conformement au Reglement 43-101 et demontrant que les proprietes

renferment au moins 80 millions de tonnes de ressources mesurees (selon

les normes de l'ICM) titrant en moyenne 30 % de Fe et 10 % de Ti. Le

deuxieme jalon comprend l'etablissement d'un rapport technique

conformement au Reglement 43-101 et demontrant que les proprietes

renferment au moins 300 millions de tonnes de ressources mesurees (selon

les normes de l'ICM) titrant en moyenne 30 % de Fe et 10 % de Ti.

La societe assumera plusieurs obligations initialement engagees par le

vendeur en vertu de leurs ententes originales d'acquisition (les

"ententes") des proprietes. Ces obligations incluent quelques redevances

"NSR" variant entre 2 % et 4 % ainsi que des paiements en especes de 300

000 $ par annee pendant les deux premieres annees et des paiements

annuels additionnels de 200 000 $ par annee, a partir de la troisieme

annee en avances de paiements de NSR.

Gemme Manicougan Inc. recevra des honoraires d'intermediation de 352 250

$ en especes (252 250 $ a la cloture et 100 000 $ suite a la satisfaction

du premier jalon).

Un total de 21 046 154 actions ordinaires ainsi que 16 000 000 de bons de

souscriptions de performance, emis dans le cadre de l'operation

admissible et du financement concomitant, sont entierces en vertu d'une

convention de titres de valeur du groupe 2 de la Bourse.

La societe est categorisee dans le secteur "Extraction de minerais de fer

" (numero de SCIAN : 21221).

Pour de plus amples renseignements, veuillez vous referer a la

declaration de changement a l'inscription datee du 31 mars 2009,

disponible sur SEDAR.

Reprise de la negociation :

Suite au bulletin de la Bourse de croissance TSX date du 11 novembre

2008, la negociation des titres de l'emetteur resultant sera reprise a

l'ouverture des marches lundi, le 9 novembre 2009.

Placement prive sans l'entremise d'un courtier :

Bourse de croissance TSX a accepte le depot de la documentation en vertu

d'un placement prive par l'entremise d'un courtier, tel qu'annonce le 18

novembre 2008 :

Nombre d'actions : 20 284 000 actions ordinaires (16 280 000

actions ordinaires accreditives ainsi que

4 004 000 actions ordinaires)

Prix : 0,25 $ par action

Bons de souscription : 20 284 000 bons permettant d'acquerir

20 284 000 actions ordinaires

Prix d'exercice des bons : 0,40 $ par action ordinaire pendant une

periode de 24 mois suivant la cloture du

placement prive

Nombre de souscripteurs : 25 souscripteurs

Participation

Initie / Groupe Pro : N/A

Intermediaires : Limited Market Dealer Inc. ("LMD"), IBK

Capital Corp. ("IBK"), CEDC Inc. ("CEDC") et

Confederation Capital Corp. ("CCC")

Remuneration de l'agent : LMD, IBK, CEDC et CCC ont recu respectivement

des montants en especes de 190 000 $ (dont

50 % represente des frais de verification

diligente), 40 000 $, 110 000 $ et 100 000 $.

De plus, LMD et IBK ont recu respectivement

760 000 et 200 000 bons de souscriptions

d'intermediation. Chaque bon de souscription

d'intermediation permet au titulaire

d'acquerir une unite du placement prive au

prix de 0,25 $ par unite pendant une periode

de 24 mois suivant la cloture de l'operation.

Chaque unite est composee d'une action

ordinaire et d'un bon de souscription. Chaque

bon de souscription permet au titulaire

d'acquerir une action ordinaire au prix de

0,40 $ l'action pour une periode de 24 mois

suivant la cloture du placement prive.

La societe a confirme la cloture du placement prive dans le cadre d'un

communique de presse date du 30 octobre 2009.

Capitalisation : Un nombre illimite d'actions ordinaires sans

valeur nominale, dont 50 633 000 actions

seront emises et en circulation.

Actions entiercees : 31 046 154 actions ordinaires et 16 000 000 de

bons de souscription de performance dont

3 104 615 actions ordinaires et 1 600 000 bons

de souscriptions sont liberees a la date de ce

bulletin.

Agent des transferts : Compagnie Trust CIBC Mellon. - Montreal

Symbole au telescripteur : RGX (nouveau)

Numero de CUSIP : 04013R 10 7 (inchange)

La Bourse a ete avisee que les operations precitees ont ete completees.

Contact de la societe : M. Mark Billings

Adresse de la societe : 2020, rue University

Montreal (Quebec) H3A 2A5

Telephone de la societe : (514) 296-1641

Telecopieur de la societe : (514) 843-9208

Courriel : mark@atwaterfin.com

Site Web de la societe N/A

TSX-X

---------------------------------------------------------------------------

AURION RESOURCES LTD. ("AU")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 16, 2009 and

October 9, 2009:

Number of Shares: 6,999,000 shares

Purchase Price: $0.15 per share

Warrants: 6,999,000 share purchase warrants to purchase

6,999,000 shares

Warrant Exercise Price: $0.25 for a 36-month period. The warrants are

subject to an accelerated exercise provision

in the event the closing price of the

Company's shares is trading at or above $0.40

per share for 30 consecutive trading days.

Number of Placees: 52 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Michael Basha Y 250,000

Andrew Williams P 100,000

Batell Investments Ltd.

(Ken Bates/David Elliott) P 25,000

David Shepherd P 50,000

David Elliott P 200,000

Finders' Fees: Global Resources Investments, Ltd. - 90,930

units

Haywood Securities Inc. - 98,000 units

Ionic Securities Ltd. - 91,000 units

Dundee Securities Corp. - 105,000 units

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

BLUE SKY URANIUM CORP. ("BSK")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 23, 2009:

Number of Shares: 5,500,000 shares

Purchase Price: $0.22 per share

Warrants: 5,500,000 share purchase warrants to purchase

5,500,000 shares

Warrant Exercise Price: $0.30 for a two year period

Number of Placees: 19 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Ronald McMillan Y 90,000

Finders' Fees: Salman Partners Inc. - 296,296 common shares

and 363,636 Compensation Warrants that are

exercisable into common shares at $0.30 per

share for a two year term.

Dundee Securities Corporation - 14,797 common

shares and 18,160 Compensation Warrants that

are exercisable into common shares at $0.30

per share for a two year term.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

BRAVO VENTURE GROUP INC. ("BVG")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to the second and final tranche of a Non-Brokered Private Placement

announced October 6, 2009 and October 14, 2009:

Number of Shares: 5,915,000 flow-through shares

Purchase Price: $0.50 per share

Warrants: 2,957,500 share purchase warrants to purchase

2,957,500 shares

Warrant Exercise Price: $0.60 for a two year period

Number of Placees: 7 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Robert Swenarchuk Y 15,000

Finders' Fees: Dundee Securities Corporation - $120,000 and

240,000 Broker Warrants that are exercisable

into common shares at $0.45 per share for a

two year period.

Haywood Securities Inc. - $15,000 and 30,000

Broker Warrants that are exercisable into

common shares at $0.45 per share for a two

year period.

Limited Market Dealer Inc. - $12,000 and

24,000 Broker Warrants that are exercisable

into common shares at $0.45 per share for a

two year period.

Strand Securities Corporation - $30,000 and

60,000 Broker Warrants that are exercisable

into common shares at $0.45 per share for a

two year period.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

BRAZAURO RESOURCES CORPORATION ("BZO")

BULLETIN TYPE: Private Placement-Non-Brokered, Amendment

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

Further to the bulletin dated November 2, 2009 with respect to a private

placement of 7,659,699 units at a price of $0.65 per unit, TSX Venture

Exchange has been advised that each of the Agents:

- M Partners Inc. and Industrial alliance Securities Inc. - will also

receive a work fee of $15,000.00 plus GST.

TSX-X

---------------------------------------------------------------------------

CANADIAN PHOENIX RESOURCES CORP. ("CPH")

BULLETIN TYPE: Halt

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

Effective at 9:30 a.m. PST, November 6, 2009, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

---------------------------------------------------------------------------

CANADREAM CORPORATION ("CDN")

BULLETIN TYPE: Normal Course Issuer Bid

BULLETIN DATE: November 6, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has been advised by the Company that pursuant to a

Notice of Intention to make a Normal Course Issuer Bid dated October 30,

2009, it may repurchase for cancellation, up to 987,907 shares in its own

capital stock. The purchases are to be made through the facilities of TSX

Venture Exchange during the period commencing today to November 2, 2010.

Purchases pursuant to the bid will be made by Raymond James Ltd. on

behalf of the Company.

TSX-X

---------------------------------------------------------------------------

ENSSOLUTIONS GROUP INC. ("ENV")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced September 23, 2009:

Number of Shares: 6,786,959 shares

Purchase Price: $0.10 per share

Number of Placees: 6 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

David C. Lincoln Y 5,406,090

Patrice Merrin Y 100,000

Michael Cone Y 21,200

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

has issued a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s).

TSX-X

---------------------------------------------------------------------------

GENOIL INC. ("GNO")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 1 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 21, 2009:

Number of Shares: 1,399,884 Units

(Each Unit consists of one common share and

one share purchase warrant.)

Purchase Price: US$0.13 per Unit

Warrants: 1,399,884 share purchase warrants to purchase

1,399,884 shares

Warrant Exercise Price: US$0.20 for a period of two years from the

date of issuance

Number of Placees: 3 placees

No Insider / Pro Group Participation

No Finder's Fee

TSX-X

---------------------------------------------------------------------------

GFE CAPITAL CORP. ("GFC")

(formerly GFE Capital Corp. ("GFE"))

BULLETIN TYPE: Consolidation, Symbol Change

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

Pursuant to a special resolution passed by shareholders on October 1,

2009, the Company has consolidated its capital on a three (3) old for one

(1) new basis and has subsequently increased its authorized capital. The

name of the Company has not been changed.

Effective at the opening Monday, November 9, 2009, the common shares of

GFE Capital Corp. will commence trading on TSX Venture Exchange on a

consolidated basis. The Company is classified as a 'Mineral

Exploration/Development' company.

Post - Consolidation

Capitalization: Unlimited shares with no par value of which

3,466,667 shares are issued and outstanding

Escrow 720,000 shares are subject to escrow

Transfer Agent: Computershare Investor Services Inc.

Trading Symbol: GFC (new)

CUSIP Number: 36161U 110 (new)

TSX-X

---------------------------------------------------------------------------

GLAMIS RESOURCES LTD. ("GLM.A")

BULLETIN TYPE: Property-Asset or Share Purchase Agreement

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation pursuant to a

Purchase and Sale Agreement dated October 19, 2009 between Glamis

Resources Ltd. (the 'Company') and an arm's-length private company (the

'Vendor') wherein the Company has agreed to acquire certain partnership

interests from the Vendor. In consideration, the Company agreed to pay

the Vendor $47,600,000 in cash and issue 5,000,000 Class A shares at a

deemed price of $1.68 per share.

This transaction was announced in the Company's news releases dated

October 20 and November 4, 2009.

TSX-X

---------------------------------------------------------------------------

METALEX VENTURES LTD. ("MTX")

BULLETIN TYPE: Shares for Services

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposed

issuance of 7,426 shares at a deemed price of $1.01 per share, in

consideration of certain services provided to the Company up to October

31, 2009, pursuant to an Amended Deferred Share Unit Plan for Glenn Nolan

dated March 13, 2009 and effective November 14, 2008.

The Company shall issue a news release when the shares are issued.

TSX-X

---------------------------------------------------------------------------

METALEX VENTURES LTD. ("MTX")

BULLETIN TYPE: Shares for Services

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing the Company's proposed

issuance of 7,426 shares at a deemed price of $1.01 per share, in

consideration of certain services provided to the Company up to October

31, 2009, pursuant to an Amended Deferred Share Unit Plan for Deferred

Share Unit Plan for Lorie Waisberg dated March 13, 2009 and effective May

1, 2004.

The Company shall issue a news release when the shares are issued.

TSX-X

---------------------------------------------------------------------------

MKM RESOURCES LTD. ("MKM.P")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated October 30, 2009,

effective at the opening, November 6, 2009 trading in the shares of the

Company will remain halted pending receipt and review of acceptable

documentation regarding the Qualifying Transaction pursuant to Listings

Policy 2.4.

TSX-X

---------------------------------------------------------------------------

NITINAT MINERALS CORPORATION ("NZZ")

BULLETIN TYPE: New Listing-IPO-Shares

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

The Company's Amended and Restated Initial Public Offering ('IPO')

Prospectus dated September 4, 2009, has been filed with and accepted by

TSX Venture Exchange, and filed with and receipted by the British

Columbia, Alberta and Ontario Securities Commissions on September 9,

2009, pursuant to the provisions of the British Columbia, Alberta and

Ontario Securities Acts.

The gross proceeds received by the Company for the Offering were

$2,025,380 (4,950,200 units at $0.40 per unit and 75,500 flow through

shares at $0.60 per share). Each unit consists of one common share and

one half of one common share purchase warrant. Each whole warrant

entitles the holder to purchase one additional common share of the

Company at $0.60 per share up to November 2, 2010. The Company is

classified as a 'mining' company.

The Company also completed a non-brokered private placement of an

aggregate of 25,000 units at the price of $0.40 per unit for total gross

proceeds of $10,000 to two (2) non arm's length parties. Each unit is

comprised of one common share of the Company and one-half of one common

share purchase warrant. Each whole warrant will entitle the holder to

purchase one additional common share of the Company at $0.60 per share

until November 5, 2010.

Commence Date: At the opening Monday, November 9, 2009, the

Common shares will commence trading on TSX

Venture Exchange.

Corporate Jurisdiction: Ontario

Capitalization: unlimited common shares with no par value of

which 26,720,656 common shares are issued and

outstanding

Escrowed Shares: 16,645,599 common shares

127,695 warrants

Transfer Agent: Olympia Transfer Services Inc.

Trading Symbol: NZZ

CUSIP Number: 65477B 10 2

Agent(s)/Underwriter(s): First Canada Capital Partners Inc.

Agent's/Underwriter's

Warrants: 304,542 non-transferable unit purchase

warrants.

One warrant to purchase one unit at $0.40 per

share up to November 2, 2010. Each unit will

have the same terms as the units of the

Offering.

For further information, please refer to the Company's Amended and

Restated Prospectus dated September 4, 2009.

Company Contact: Wayne Isaacs

Company Address: 56 Temperance St., 10th Floor

Toronto, ON M5H 3V5

Company Phone Number: (416) 363-3582

Company Fax Number: (866) 288-3582

Company Email Address: wisaacs@deltauranium.com

TSX-X

---------------------------------------------------------------------------

PROSYS TECH CORPORATION ("POZ")

BULLETIN TYPE: Property-Asset or Share Disposition Agreement, Remain

Suspended

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

Property-Asset or Share Disposition Agreement

TSX Venture Exchange has accepted for filing the documentation of the

Company relating to the non-arm's length sale of 75% of the shares of

Chris Danielle Micro Solutions (CDMS) Inc., in consideration of $277,000

paid at the closing.

For further information, please refer to the Company's press release

dated December 16, 2008.

Remain Suspended

As mentioned in the TSX Venture Exchange Bulletin dated November 3, 2009,

a Cease Trade Order has been issued by the Autorite des marches

financiers on November 3, 2009, against the Company for failing to file

its Annual Financial Statements for the period ending on June 30, 2009,

within the required time period.

Upon revocation of the Cease Trade Order, the Company's shares will

remain suspended until the Company meets TSX Venture Exchange

requirements.

Members are prohibited from trading in the securities of the Company

during the period of the suspension or until further notice.

CORPORATION PROSYS TECH ("POZ")

TYPE DE BULLETIN: Vente d'actif ou convention de vente d'actions,

Suspension maintenue

DATE DU BULLETIN: Le 6 novembre 2009

Societe du groupe 2 de TSX Croissance

Vente d'actif ou convention de vente d'actions

Bourse de croissance TSX a accepte le depot de documents de la societe en

vertu de la vente de 75 % des actions de Chris Danielle Micro Solutions

(CDMS) Inc. dans le cadre d'une operation aupres de personnes ayant un

lien de dependance, en consideration de 277 000 $.

Pour de plus amples renseignements, veuillez vous referer au communique

de presse date du 16 decembre 2008.

Suspension maintenue

Tel que mentionne au bulletin de Bourse de croissance TSX date du 3

novembre 2009, une interdiction d'operations sur valeurs a ete emise le 3

novembre 2009 par l'Autorite des marches financiers envers la societe

pour defaut de deposer les etats financiers annuels pour la periode se

terminant le 30 juin 2009, durant la periode prescrite.

Suite a l'interdiction d'operations sur valeurs, la negociation des

titres de la societe demeurera suspendue jusqu'a ce que la societe

reponde aux normes de Bourse de croissance TSX.

Il est interdit aux membres de transiger les titres de la societe durant

la periode de suspension ou jusqu'a avis ulterieur.

TSX-X

---------------------------------------------------------------------------

PUGET VENTURES INC. ("PVS")

BULLETIN TYPE: Warrant Term Extension

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has consented to the extension in the expiry date of

the following warrants:

Private Placement:

# of Warrants: 750,000

Original Expiry Date of Warrants: November 14, 2009

New Expiry Date of Warrants: November 14, 2010

Exercise Price of Warrants: $0.75

These warrants were issued pursuant to a private placement of 1,500,000

flow through shares with 750,000 share purchase warrants attached, which

was accepted for filing by the Exchange effective May 15, 2008.

TSX-X

---------------------------------------------------------------------------

RANDSBURG INTERNATIONAL GOLD CORP. ("RGZ")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced October 27, 2009:

Number of Shares: 1,000,000 non flow-through shares and

1,489,000 flow-through shares

Purchase Price: $0.10 per non flow-through share and $0.15 per

flow-through share

Warrants: 1,489,000 share purchase warrants to purchase

1,489,000 shares

Warrant Exercise Price: $0.20 for a two year period. If the closing

price of the Company's shares is $0.40 or

greater for a period of ten consecutive

trading days, the Company may, upon notice to

the warrant holder, reduce the exercise period

of the warrants to 30 days from the date of

notice.

Number of Placees: 9 placees

Finder's Fee: 148,900 Broker's Warrants exercisable at $0.20

for two years payable to Anchor Securities

Ltd.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly. Note that in certain circumstances the Exchange may later

extend the expiry date of the warrants, if they are less than the maximum

permitted term.

TSX-X

---------------------------------------------------------------------------

RESULT ENERGY INC. ("RTE")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 6, 2009

TSX Venture Tier 1 Company

Effective at the opening, November 6, 2009, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

---------------------------------------------------------------------------

ROSS RIVER MINERALS INC. ("RRM")

BULLETIN TYPE: Reinstated for Trading

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

Further to TSX Venture Exchange Bulletin dated May 11, 2009, the Exchange

has been advised that the Cease Trade Orders issued by the British

Columbia Securities Commission on May 11, 2009 has been revoked.

Effective at the opening Monday, November 9, 2009 trading will be

reinstated in the securities of the Company (CUSIP 77829P 10 1).

TSX-X

---------------------------------------------------------------------------

STRATIC ENERGY CORPORATION ("SE")

BULLETIN TYPE: Resume Trading

BULLETIN DATE: November 6, 2009

TSX Venture Tier 1 Company

Effective at the opening, November 6, 2009, shares of the Company resumed

trading, an announcement having been made over StockWatch.

TSX-X

---------------------------------------------------------------------------

SUMMUS CAPITAL CORP. ("SS.P")

BULLETIN TYPE: Halt

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

Effective at 8:30 a.m. PST, November 6, 2009, trading in the shares of

the Company was halted at the request of the Company, pending an

announcement; this regulatory halt is imposed by Investment Industry

Regulatory Organization of Canada, the Market Regulator of the Exchange

pursuant to the provisions of Section 10.9(1) of the Universal Market

Integrity Rules.

TSX-X

---------------------------------------------------------------------------

SWIFT RESOURCES INC. ("SWR")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 3, 2009:

Number of Shares: 1,785,713 flow-through shares

Purchase Price: $0.28 per flow-through share

Warrants: 892,856 share purchase warrants to purchase

892,856 shares

Warrant Exercise Price: $0.35 for a one year period

$0.45 in the second year

If the Company's common shares close at a price above $0.50 per share or

higher during the first year of the exercise period and at a price of

$0.65 per share or higher during the second year of the exercise period

over 20 consecutive trading days, then the Company will have the right to

reduce the exercise period of the warrants.

Number of Placees: 3 placees

Finder's Fee: $30,000 payable to Limited Market Dealer Inc.

Pursuant to Corporate Finance Policy 4.1, Section 1.11(d), the Company

must issue a news release announcing the closing of the private placement

and setting out the expiry dates of the hold period(s). The Company must

also issue a news release if the private placement does not close

promptly.

TSX-X

---------------------------------------------------------------------------

TENTH POWER TECHNOLOGIES CORP. ("TPI")

BULLETIN TYPE: Private Placement-Non-Brokered

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

TSX Venture Exchange has accepted for filing documentation with respect

to a Non-Brokered Private Placement announced November 2, 2009:

Number of Shares: 4,626,668 shares

Purchase Price: $0.15 per share

Warrants: 2,313,334 share purchase warrants to purchase

2,313,334 shares

Warrant Exercise Price: $0.20 for a one year period

Number of Placees: 10 placees

Insider / Pro Group Participation:

Insider=Y /

Name ProGroup=P / # of Shares

Winco Corporation Y 1,166,667

(Winifred Burry)

Dennis Bernhard Y 166,667

Note that in certain circumstances the Exchange may later extend the

expiry date of the warrants, if they are less than the maximum permitted

term.

For further details, please refer to the Company's news release dated

November 2, 2009.

TSX-X

---------------------------------------------------------------------------

VENDOME CAPITAL II CORP. ("VCT.P")

BULLETIN TYPE: Miscellaneous, Remain Halted

BULLETIN DATE: November 6, 2009

TSX Venture Tier 2 Company

Further to the Exchange's Bulletins of November 3, 2008 and March 6, 2009

and the Company's press release of April 24, 2009, the Company which is a

Capital Pool Company ('CPC') is required to complete a Qualifying

Transaction ('QT') by December 8, 2009.

The records of the Exchange indicate that the Company has not yet

completed a QT. If the Company fails to complete a QT by December 8,

2009, the Company's trading status may be changed to a suspension without

further notice, in accordance with Exchange Policy 2.4 Section 14.6.

TSX-X

---------------------------------------------------------------------------

NEX COMPANIES

BULLETIN TYPE: Cease Trade Order

BULLETIN DATE: November 6, 2009

NEX Company

A Cease Trade Order has been issued by the British Columbia Securities

Commission on November 5, 2009, against the following Company for failing

to file the documents indicated within the required time period:

Period Ending

Symbol Company Failure to File (Y/M/D)

("GHA.H") Golden Hat Resources Inc. comparative financial 09/06/30

statement

management's discussion 09/06/30

& analysis

Upon revocation of the Cease Trade Order, the Company's shares will

remain suspended until the Company meets TSX Venture Exchange

requirements. Members are prohibited from trading in the securities of

the company during the period of the suspension or until further notice.

TSX-X

---------------------------------------------------------------------------

BLUE VISTA TECHNOLOGIES INC. ("BV.H")

BULLETIN TYPE: Remain Halted

BULLETIN DATE: November 6, 2009

NEX Company

Further to TSX Venture Exchange Bulletin dated November 5, 2009,

effective at the opening, November 6, 2009 trading in the shares of the

Company will remain halted pending receipt and review of acceptable

documentation regarding the Change of Business and/or Reverse Takeover

pursuant to Listings Policy 5.2.

TSX-X

---------------------------------------------------------------------------

CHALLENGER DEVELOPMENT CORP. ("CDQ")

(formerly Challenger Development Corp. ("CDQ.H"))

BULLETIN TYPE: Graduation from NEX to TSX Venture, Symbol Change

BULLETIN DATE: November 6, 2009

NEX Company

The Company has met the requirements to be listed as a TSX Venture Tier 2

Company. Therefore, effective on opening Monday, November 9, 2009, the

Company's listing will transfer from NEX to TSX Venture, the Company's

Tier classification will change from NEX to Tier 2 and the Filing and

Service Office will change from NEX to Vancouver.

Effective at the opening Monday, November 9, 2009 the trading symbol for

the Company will change from CDQ.H to CDQ.

For further information, please see the Company's Filing Statement dated

October 16, 2009 available under the Company's profile on SEDAR.

TSX-X

---------------------------------------------------------------------------

FMX VENTURES INC. ("FXX.H")

(formerly FMX Ventures Inc. ("FMX.H"))

BULLETIN TYPE: Consolidation, Symbol Change

BULLETIN DATE: November 6, 2009

NEX Company

Pursuant to a special resolution passed by shareholders July 13, 2009,

the Company has consolidated its capital on a 10 old for 1 new basis. The

name of the Company has not been changed.

Effective at the opening Monday, November 9, 2009, shares of FMX Ventures

Inc. will commence trading on TSX Venture Exchange on a consolidated

basis. The Company is a 'Temporarily Unclassified' company.

Post - Consolidation

Capitalization: Unlimited shares with no par value of which

3,934,289 shares are issued and outstanding

Escrow 0 shares are subject to escrow

Transfer Agent: Equity Transfer & Trust

Trading Symbol: FXX.H (new)

CUSIP Number: 30252A 20 8 (new)

TSX-X

---------------------------------------------------------------------------

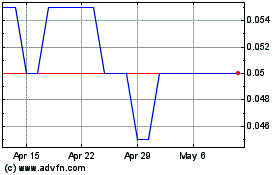

Arht Media (TSXV:ART)

Historical Stock Chart

From Apr 2024 to May 2024

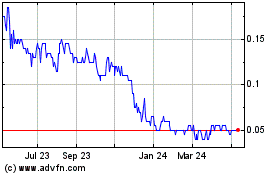

Arht Media (TSXV:ART)

Historical Stock Chart

From May 2023 to May 2024