Copper Lake Announces Closing of Second and Final Tranche of Private Placement

14 October 2022 - 11:00PM

Copper Lake Resources Ltd. (TSX-V: CPL, Frankfurt: W0I) ("Copper

Lake" or the "Company") announces that it has closed the second,

and final, tranche of the non-brokered private placement (the

“Offering”) described in the Company’s news release dated September

6, 2022.

Under the final tranche closing of the Offering,

the Company issued 300,000 flow-through units (“FT Units”) at a

price of $0.10 per FT Unit and 2,106,765 non flow-through units

(“NFT Units”) at a price of $0.09 per NFT Unit for gross proceeds

of $219,609. Each FT Unit consists of one flow-through common share

and one-half of a common share purchase warrant (a “FT Warrant”),

with each Warrant being exercisable at $0.15 for 36 months. Each

NFT Unit consists of one common share and one Warrant, with each

Warrant being exercisable at $0.15 for 36 months. The Company paid

no finders’ fees in connection with this final tranche of the

Offering.

The Company has raised a total of $1,563,859 and

issued 10,820,655 NFT Units and 5,900,000 FT Units in connection

with both tranches of the Offering, and paid total finders’ fees of

$57,137 in cash, and issued 616,195 non-transferable finders’

warrants exercisable at $0.15 for a period of 36 months from the

closing date.

The Warrants are subject to an accelerated

expiry date clause whereby at any time following the expiry of the

four-months and one day hold period, should the weighted average

closing price of the Common Shares on the TSX Venture Exchange (the

“TSX-V”) be more than $0.25 for a period of 15 consecutive trading

days, the Company shall be entitled to accelerate the expiry date

of the warrants to a date which is 30 days following the date on

which the Company announces the accelerated expiry of the Warrants

by press release.

The proceeds from the issuance of the FT Units

will be used to incur qualified Canadian exploration expenses for

planned exploration work on the Marshall Lake

copper-zinc-silver-gold property. Net proceeds from the issuance of

the NFT Units will be used for general corporate purposes, as well

as supporting work on the Marshall Lake property. All securities

issuable are subject to a four-month hold period from the closing

date.

Certain insiders of the company purchased

250,000 FT Units under the second tranche of the Private Placement

and such participation is considered to be a “related party

transaction” pursuant to Multilateral Instrument 61-101

(“MI 61-101”). The Company intends to rely on the

exemptions from the formal valuation and minority shareholder

approval requirements of MI 61-101 contained in Section 5.5(a) and

Section 5.7(1)(a) of MI 61-101 in respect of such insider

participation.

The Private Placement has been conditionally

approved by the TSX Venture Exchange but remains subject to final

exchange approval.

ABOUT COPPER LAKE RESOURCES

Copper Lake Resources Ltd. is a publicly traded

Canadian mineral exploration and development company with interests

in two projects both located in Ontario.

www.copperlakeresources.com

The Marshall Lake high-grade

VMS copper, zinc, silver and gold project comprises an area of

approximately 220 square km, located 120 km north of Geraldton,

Ontario and is accessible by all-season road from the Trans-Canada

Highway and just 22 km north of the main CNR rail line. Copper Lake

has a 79.45% interest in the joint ventured property, which

consists of 233 claims and 52 mining leases. The project also

includes 148 claim cells staked in 2018 and 2020 that are 100%

owned and not subject to any royalties, which add approximately 30

square km to the original property.

In addition to the original Marshall Lake

property above, Marshall Lake also includes the Sollas Lake and

Summit Lake properties, wholly owned by the Company and not subject

to any royalties. The Sollas Lake property consists of 20 claim

cells comprising an area of 4 square km on the east side of the

Marshall Lake property where historical EM airborne geophysical

surveys have outlined strong conductors on the property hosted

within the same favorable felsic volcanic units. The Summit Lake

property currently consists of 100 claim cells comprising an area

of 20.5 square km, is accessible year-round, and is located

immediately west of the original Marshall Lake property. The

Marshall Lake project is located in the traditional territories of

the Aroland and Animbiigoo Zaagi igan Anishinaabek (“AZA”) First

Nations.

Copper Lake also has a 69.79% joint venture

interest in the Norton Lake nickel, copper,

cobalt, and palladium PGM property, located in the southern Ring of

Fire area, is approximately 100 km north of the Marshall Lake

Property. The Norton Lake property has a NI 43-101 compliant

Measured and Indicated resource of 2.26 million tonnes @ 0.67% Ni,

0.61% Cu, 0.03% Co and 0.46 g/t Pd. The Norton Lake property is

located in the traditional territories of the Eabametoong (“Fort

Hope”) and Neskantaga First Nations.

On behalf of the Board of

Directors,

Copper Lake Resources Ltd.Terry

MacDonald, CEO(416) 561-3626tmacdonald@copperlakeresources.com

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

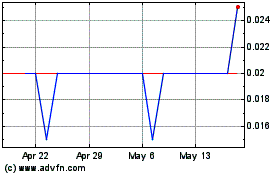

Copper Lake Resources (TSXV:CPL)

Historical Stock Chart

From Nov 2024 to Dec 2024

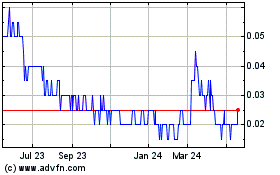

Copper Lake Resources (TSXV:CPL)

Historical Stock Chart

From Dec 2023 to Dec 2024