Copper Fox Commences Drilling Program at Van Dyke and Announces the

2014 Schaft Creek Joint Venture Program

VANCOUVER, BRITISH COLUMBIA--(Marketwired - Mar 19, 2014) -

Copper Fox Metals Inc. ("Copper Fox" or the "Company")

(TSX-VENTURE:CUU) is pleased announce the 2014 program for the

Schaft Creek Joint Venture as well as Desert Fox Copper Inc.'s

("Desert Fox") plans for the verification diamond drilling program

on the Van Dyke oxide copper deposit along with an update on other

activities of Desert Fox.

Highlights:

- Layne Christensen Company has been contracted to complete the 7

hole; 5,100 meter ("m") diamond drilling program on the Van Dyke

oxide copper deposit. The drilling will commence immediately,

- The recently completed analytical results for the original Van

Dyke pulps show that:

- the 2014 weighted averages for total copper range from 93% to

97.5% of the original weighted averages based on the historical

data of Occidental Minerals,

- the 2014 weighted averages for soluble copper range from 94% to

150% of the historical weighted averages,

- The recently completed analytical results for the re-sampling

of the core from DDH-OXY-27 show that;

- the 2014 weighted average for total copper is the same as the

historical weighted average,

- the 2014 weighted average for soluble copper is 107% of the

historical weighted average, and

- The permit to complete the proposed Titan-24 survey over the

Sombrero Butte copper-molybdenum project has been received.

Mr. Stewart,

President of Copper Fox stated, "We are pleased with the direction

and look forward to the results of the 2014 Schaft Creek program.

The Van Dyke oxide copper deposit verification drilling program is

designed to confirm the historical data in advance of completing a

resource estimation; the first step in working toward completion of

a Preliminary Economic Assessment ("PEA"). The positive correlation

between the 2014 analytical results from the original pulps and

re-sampling of the core strongly support the copper grades stated

in the historical estimate."

Schaft Creek Joint

Venture:

Teck Resources

Limited ("Teck") as operator of the Schaft Creek Joint Venture has

recommended a comprehensive series of studies to review all aspects

(including metallurgical, pit slope design, geological modelling

and environmental) of the Schaft Creek project. The objective is to

review all data collected on the Schaft Creek project to the end of

2013 to update and optimize various parameters of the project. The

studies will be conducted internally by Teck and outside

consultants will be retained if and when necessary.

The 2014 program

also has a field program planned of mapping and re-logging core to

obtain a better structural understanding of the Schaft Creek

deposit for pit slope design purposes. Environmental monitoring

studies will continue through 2014. The 2014 program is estimated

to cost approximately $2.5 million.

Van Dyke

Project:

The results from the

previously mentioned re-assay of selected intervals from certain

diamond drill holes have been received (see news release dated

January 9, 2014). A comparison of the historical and 2014 assays is

shown below:

|

Van Dyke |

From |

To |

Interval |

Total Copper |

Soluble Copper |

|

Drillhole ID |

(m) |

(m) |

(m) |

2014 Pulp |

Original |

2014 Pulp |

Original |

|

OXY-6 |

376.12 |

460.25 |

84.13 |

0.444 |

0.456 |

0.418 |

0.390 |

|

and |

463.30 |

583.69 |

120.39 |

0.670 |

0.706 |

0.556 |

0.546 |

|

OXY-8 |

313.94 |

404.77 |

90.83 |

0.533 |

0.563 |

0.334 |

0.222 |

|

and |

406.30 |

439.22 |

32.92 |

0.861 |

0.883 |

0.704 |

0.544 |

|

OXY-15 |

402.64 |

455.07 |

52.43 |

0.503 |

0.537 |

0.458 |

0.489 |

|

OXY-17B |

324.61 |

396.85 |

72.24 |

0.662 |

0.699 |

0.482 |

0.427 |

|

VD-73-6 |

359.97 |

497.13 |

137.16 |

0.341 |

0.367 |

0.299 |

0.278 |

|

|

|

|

|

2014 Core |

Original |

2014 Core |

Original |

|

OXY-27 |

527.40 |

620.70 |

93.30 |

0.408 |

0.407 |

0.329 |

0.308 |

| Note: The core intervals listed in the above tables do not

represent true widths. |

The historical

estimate for the Van Dyke oxide copper deposit is quoted as 119.2

million tons that averaged 0.52% copper using a 0.20% copper cutoff

(estimated to contain 1.2 billion pounds of copper - see news

release dated April 12, 2013). To verify a portion of the reported

historical copper grades; in January, 2014, 406 of the original

pulp samples from five DDH and 67 splits of the core from

DDH-OXY-27 were submitted to ALS Minerals for analysis. The

original copper grades and the 2014 results show a strong positive

correlation. The analysis performed in 2014 did not detect any

appreciable concentrations of gold-silver-molybdenum.

Van Dyke PEA:

Moose Mountain

Technical Services has been selected as the primary contractor for

the PEA. Knight Piésold Ltd. will provide certain engineering and

hydrogeological design inputs and Greenwood Environmental Inc. will

provide the environmental design inputs for the PEA. Greenwood

Environmental has also been retained to help the Company with

longer item studies related to environmental monitoring, assessment

and permitting. In addition to the 2014 verification drilling

program, additional metallurgical studies, environmental baseline

and surface water hydrology monitoring, geochemical

characterization of the lithologies surrounding the deposit and

scoping level engineering studies are also planned. The resource

estimate is to be completed based on the verification drilling

program and the results from the above work program will form the

basis of the PEA to be completed in 2014.

Sombrero Butte

Project:

The permit to

complete the three line Titan-24 DCIP & MT survey over two

targets (over a 4 kilometer ("km") strike length) outlined in 2013

has been received.

The first target

area is located in the northwest part of the 4km long zone and

measures 1,000m by 1,200m and shows copper values (associated with

malachite, a copper oxide mineral) ranging from 76 parts per

million ("ppm") to greater than 2,450ppm with molybdenum values

ranging from 7ppm up to 252ppm and is open to the west.

The second target

area, located in the southeast portion of the 4km long zone

measures 1,600m by 2,800m and shows copper values (associated with

malachite and chalcopyrite, a copper sulphide mineral) ranging from

76ppm to greater than 2,450ppm with molybdenum values ranging from

7ppm up to 489ppm and is open to the south.

Within this 4km long

trend, three phases of cross-cutting porphyry dikes and at least 15

new mineralized breccia pipes carrying abundant copper veinlets and

extensive dickite (a hypogene clay mineral related to acid

alteration under advanced argillic conditions in porphyry copper

environments) alteration occurs in a number of breccia pipes that

appear to form a halo surrounding Area #2.

Sampling

Procedures:

Sample preparation

was conducted by ALS Minerals located in Reno, Nevada with the

analyses being completed by ALS Minerals in Vancouver, British

Columbia.

Copper

concentrations were determined using aqua regia ICPMS-MEMS41, AA

and 08Q packages. Lower detection limits are as follows: copper 0.2

ppm, molybdenum 0.05 ppm, silver 0.01g/t. Gold is being determined

by AA-23 on a 30-gram sample followed by ICP-ES finish; with a

lower detection limit of 0.005 g/t. ALS has a 9001:2008

International Standard Organization rating.

Quality Control:

Desert Fox follows a

rigorous Quality Assurance/Quality Control program consisting of

inserting standards, blanks and duplicates at regular intervals

into the sample stream submitted to the laboratory for

analysis.

Elmer B. Stewart,

MSc. P. Geol., President of Copper Fox, is the Corporation's

nominated Qualified Person pursuant to National Instrument 43-101,

Standards for Disclosure for Mineral Projects, has reviewed the

technical information disclosed in this news release.

About Copper Fox

Copper Fox is a

Canadian resource development company listed on the TSX-Venture

Exchange (TSX-VENTURE:CUU) with offices in Calgary, Alberta and

through its wholly owned subsidiary Desert Fox, an office in Miami,

Arizona.

Copper Fox holds a 25% interest in the Schaft Creek Joint

Venture with Teck on the Schaft Creek project in northwestern

British Columbia. On January 23, 2013, a National Instrument 43-101

technical report (feasibility study) was completed on the Schaft

Creek copper-gold-molybdenum-silver project that recommended a

130,000 tonne per day open pit mine with proven and probable

reserves of 940.8 million tonnes grading 0.27% copper, 0.19 g/t

gold, 0.018% molybdenum and 1.72 g/t silver with a 21 year mine

life. The proven and probable reserves are estimated to contain 5.6

billion pounds of copper, 5.8 million ounces of gold, 363.5 million

pounds of molybdenum and 51.7 million ounces of silver.

In addition to its

interest in the Schaft Creek Joint Venture, Copper Fox holds,

through Desert Fox and its wholly-owned subsidiaries, the Sombrero

Butte copper project located in the Bunker Hill District, Pinal

County, Arizona and the Van Dyke copper project located in the

Globe-Miami District, Gila County, Arizona immediately adjacent to

the mining operations of BHP Billiton and Freeport McMoRan copper

mining operations. The Sombrero Butte copper project is located 9

miles east of the San Manuel Mine (14 billion lbs of Cu), and 2

miles south of Redhawk Resources' Copper Creek project (7 billion

lbs of Cu).

On behalf of the

Board of Directors

Elmer B. Stewart,

President and Chief Executive Officer

Neither TSX

Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts

responsibility for the adequacy or accuracy of this

release.

Cautionary Note

Regarding Forward-Looking Information

This news release

contains "forward-looking information" within the meaning of the

Canadian securities laws. Forward-looking information is generally

identifiable by use of the words "believes," "may," "plans,"

"will," "anticipates," "intends," "budgets", "could", "estimates",

"expects", "forecasts", "projects" and similar expressions, and the

negative of such expressions. Forward-looking information in this

news release includes statements about work towards completion of a

Preliminary Economic Assessment; the 2014 program for the Schaft

Creek Joint Venture; the expected commencement of drilling on the

Van Dyke oxide copper deposit; the objectives of the 2014 program

at the Van Dyke copper deposit; proposed diamond drilling; and

statements about Copper Fox's strategy, future operations,

prospects and the plans of management.

In connection with

the forward-looking information contained in this news release,

Copper Fox has made numerous assumptions. While Copper Fox

considers these assumptions to be reasonable, these assumptions are

inherently subject to significant uncertainties and contingencies.

Additionally, there are known and unknown risk factors which could

cause Copper Fox's actual results, performance or achievements to

be materially different from any future results, performance or

achievements expressed or implied by the forward-looking

information contained herein. Known risk factors include, among

others: the proposed Titan-24 survey planned for the Sombrero Butte

project maybe delayed or not completed at all; the proposed diamond

drilling in the Van Dyke Deposit may not contain any mineralization

or mineralization as favorable as suggested by the original pulps

and re-sampling results and historical estimates; the original

pulps and re-sampling results and historical estimates may not be

reliable or indicative of any commercial benefit to Copper Fox;

Copper Fox may not be able to comply with its ongoing obligations

regarding the Van Dyke Deposit; a Preliminary Economic Assessment

may not be prepared for the Van Dyke Deposit as currently

contemplated, or at all; fluctuations in copper prices and demand;

currency exchange rates; conditions in the financial markets and

the overall economy may continue to deteriorate; uncertainties

relating to interpretation of the previous drill results and the

geology, continuity and grade of Van Dyke Deposit; the previous

metallurgical test work and metal recovery rates; the need to

obtain additional financing and uncertainty of meeting anticipated

program milestones; uncertainty as to timely availability of

permits and other governmental approvals.

A more complete

discussion of the risks and uncertainties facing Copper Fox is

disclosed in Copper Fox's continuous disclosure filings with

Canadian securities regulatory authorities at www.sedar.com. All

forward-looking information herein is qualified in its entirety by

this cautionary statement, and Copper Fox disclaims any obligation

to revise or update any such forward-looking information or to

publicly announce the result of any revisions to any of the

forward-looking information contained herein to reflect future

results, events or developments, except as required by law.

Copper Fox Metals Inc.Investor line1-866-913-1910Copper Fox

Metals Inc.Lynn Ball1-403-264-2820

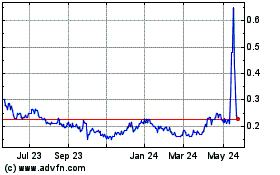

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From Apr 2024 to May 2024

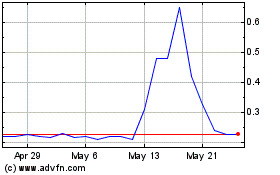

Copper Fox Metals (TSXV:CUU)

Historical Stock Chart

From May 2023 to May 2024